Chap 1+2

-

Upload

sayeed-ahmad -

Category

Documents

-

view

163 -

download

6

description

Transcript of Chap 1+2

-

Chapter 1: Introduction to Accounting 1-1

wnmvewevb mwKZ KwZcq cv_wgK aviYv

wnmvewevb (Accounting)t

wnmvewevbi AvwfavwbK A_ njv wnmve mwKZ wekl vb; hv Kvb ew ev cwZvbi wnmve msiYi

KjvKkj mK wkv `q| evcK A_, ew ev cwZvbi jb`bjv mykLjfve wnmvei eBZ msiY, Avw_K djvdj

wbYq I evLv-weklY Kivi cwqvK wnmvewevb ej|

NUbv (Event)t

mvaviYfve gvbyli Rxeb hv wKQz NU ZvKB NUbv ej| NUbv `yB cKvit A_ mKxq NUbv Ges A_ mKnxb

NUbv| A_i mv_ mKhy NUbv _K jb`bi Drcw|

jb`b (Transaction)t

jb`b kwUi AvwfavwbK A_ njv MnY I `vb A_vr- Av`vb-c`vb| Kvb NUbv viv hw` Kvb ew ev

cwZvbi Avw_K Ae vi (= mw, `vq I ^ZvwaKvii) cwieZb NU, Ze ZvK jb`b ej| cwZwU jb`b `ywU c

_vKe| GK c myweav MnYKvix ev MnxZv (WweU); Acic myweav c`vbKvix ev `vZv (wWU)| jb`bi G ewkK ejv

nq Zmv|

y`Zidv `vwLjv cwZ (Double Entry System)t

h cwZZ cwZwU jb`bi mv_ RwoZ `ywU c weklY Ki GK cK WweU Ges AcicK mgcwigvY UvKv

viv wWU Kiv nq ZvK y`Zidv `vwLjv cwZ ejv nq| 1494 mvj Luca Pacioli y`Zidv `vwLjv cwZ Dveb Kib|

wnmve (Account)t

wnmve njv jb`bjvK kYxwebvm Ki c_K c_K wkivbvgi Aaxb cZKZ msw weeiYx| wbP wnmvei

bgybv QK (AvaywbK wZbNiv QK) `Lvbv njvt

Cash No. 101

Date Explanation Ref. Debit Credit Bal

2012

June 1

6

10

Capital

Equipment

Rent Expenses

J1

J1

J1

10,000

5,000

400

10,000

5,000

4,600

wnmve mgxKib (Accounting Equation)t

jb`bi Zmvi Dci wbfi Ki AvaywbK wnmvekvwe`MY wnmvemg~ni ga GKwU MvwYwZK mK vcb KiQb

hv wnmve mgxKiY (Accounting Equation) bvg cwiwPZ| wnmve mgxKiY Abyhvqx, Kvb cwZvbi gvU mw gvU `vqi

mgvb ne| Kvb jb`bi gvag mw I `vqi cwieZb njI G mgxKiYi Kvb nidi ne bv| gvU mw me`vB

gvU `vqi mgvb _vKe|

Basic Equation = +

Expanded Equation

= + [ + ]

-

1-2 mvC` Avng`, cfvlK (ee vcbv wefvM), miKvwi AvkK gvngy` KjR, Rvgvjcyi| 01917542290

Modern Accounting Terms-1

SL Traditional Terms Modern Terms evsjv A_

1 Bills Payable Notes Payable c`q bvU

2 Bills Receivable Notes Receivable cvc bvU

3 Sundry Debtors A/C Receivable cvc wnmve

4 Sundry Creditors A/C Payable c`q wnmve

5 Debenture Bonds Payable e

6 Share Stock K

7 Ordinary Share Common Stock mvaviY K

8 Shareholder Stockholder K gvwjK

9 Capital Owners equity gvwjKvbv Z^

10 Preliminary expenses Organization cost mvsMVwbK LiP

11 Write off Amortization gkva

12 Salary Salary expenses, Payroll eZb LiP

13 Interest on loan Interest expenses my` LiP

14 Insurance Insurance expenses exgv LiP

15 Income Revenue Avq

16 Interest income Interest revenue my` Avq

17 Rent allowed Rent expenses fvov LiP

18 Rent received Rent Revenue fvov Avq

19 Advance expenses Prepaid expenses AwMg/ AbyxY LiP

20 Advance rent Prepaid rent AwMg c` fvov

21 Advance Insurance Prepaid Insurance AwMg exgv

22 Accrued interest on investment Interest receivable cvc my`

23 Outstanding/Arrear expenses Expenses payable c`q LiP

24 Advance Income Unearned Revenue AbycvwRZ Avq

25 Accrued/Arrear Income Revenue Receivable cvc Avq

26 Proper Journal General Journal (cKZ) mvaviY Rve`v

27 Purchase Journal Purchase Day Book q Rve`v

28 Sales Journal Sales Day Book weq Rve`v

29 Cash Book Cash Receipt Journal bM` cvw Rve`v

Cash Payment Journal bM` c`vb Rve`v

30 Trading & Profit & Loss A/C Income Statement Avq weeiYx

31 Profit & Loss Appropriation A/C

Retained Earnings Statement msiwZ Avq weeiYx

32 Final Accounts Financial Statement Avw_K weeiYx

33 Gross Profit Gross margin/ Profit gvU Avq

34 Net Profit Net Income wbU Avq

-

Chapter 1: Introduction to Accounting 1-3

Modern Accounting Terms-2

SL Traditional Terms Modern Terms evsjv A_

35 Credit Sales Sales on account avi q

36 Credit Purchase Purchase on account avi weq

37 Return outward Purchase return q diZ

38 Return inward Sales return weq diZ

39 Carriage inward Freight in q cwienb

Transportation in

40

Carriage outward Freight out, Delivery expenses weq cwienb

Transportation out

41 Discount received Purchase discount q evv

42 Discount allowed Sales discount weq evv

43 Sales Sales Revenue weq Avq

44 Stock Inventory gRy`

45 Opening Stock Beginning inventory cviwK gRy`

46 Closing Stock Ending inventory mgvcbx gRy`

47 Goods Merchandise cY

48 Stock of goods Merchandise inventory gRy` cY

49 Trading organization Merchandising organization cY q-weqKvix cwZvb

50 Stationary Supplies mvi/gwbnvwi

51 Factory expenses Store supplies expenses KviLvbv `evw` (LiP)

52 Office expenses Office supplies expenses Awdm `evw` (LiP)

--- Utilities expenses DchvM LiP (cvwb, we y`Z, Mvm)

53 Bad debts Uncollectible expenses Abv`vqx cvIbv

54

Provision for bad debt Allowance for uncollectible/doutbtful expenses

Abv`vqx `bv mwwZ

Bad debt reserve

55 Provision for depreciation Accumulated Depreciation cyxf~Z AePq

56 Debit note Debit memorandum

57 Credit note Credit memorandum

58 Cheque Check PK

59 Accounting Concepts and Convention

Accounting Principles wnmvewevbi bxwZgvjv

-

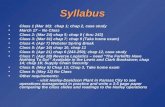

Chapter 2: Financial Accounting Process 1-1

cki aiY h mvji cixvq GmQ

1. Determine Assets/Net Income/ Owners Equity 2012,

2. Prepare Balance Sheet 2010

3. Prepare Income Statement

4. Prepare Owners Equity Statement

5. Transaction Summary 06, 08, 09, 2011

6. Proof Accounting Equation 06, 08, 09, 2011

EXERCISE : Part B and C

Problem-1 [Kieso 9e: DO IT 1-2] Classify the following items as investment by owner (I), owners drawings (D),

revenues (R), or expenses (E). Then indicate whether each item increases or decreases owners equity:

(1) Drawings (3) Advertising Expense

(2) Rent Revenue (4) Owner puts personal assets into the business.

Solution: Problem-1

1. Drawings is owners drawings (D); it decreases owners equity.

2. Rent Revenue is revenue (R); it increases owners equity.

3. Advertising Expense is an expense (E); it decreases owners equity.

4. When the owner puts personal assets into the business, it is investment by owner (I); it increases owners equity.

Problem-2 [Kieso 9e: DO IT 1-4] Presented below is selected information related to Broadway Company at December

31, 2010. Broadway reports financial information monthly

Accounts Payable 3000 Salaries Expenses 16500

Cash 7000 Notes Payable 25000

Advertising Expenses 6000 Rent Expenses 10500

Service Revenue 54000 Accounts Receivable 13500

Equipment 29000 Drawings 7500

(a) Determine the total assets of Broadway Company at December 31, 2010.

(b) Determine the net income that Broadway Company reported for December 2010.

(c) Determine the owners equity of Broadway Company at December 31, 2010

[Ans: (a) Total Assets 49,500; (b) Net Income 21,000; (c) Owners Equity 21,500]

Problem-3 [Kieso 9e: BE1-2] Given the accounting equation, answer each of the following questions.

(a) The liabilities of McGlone Company are Tk.120,000 and the owners equity is Tk.232,000. What is the amount of McGlone Companys total assets?

(b) The total assets of Company are Tk.190,000 and its owners equity is Tk.80,000. What is the amount of its total liabilities?

(c) The total assets of McGlone Co. are Tk.800,000 and its liabilities are equal to one half of its total assets . What is the amount of McGlone Co.s owners equity?

[Ans: (a) Total Assets 3,52,000; (b) Total Liabilites 1,10,,000; (c) Owners Equity 4,00,000]

CHAPTER: 2 Financial Accounting Process

-

1-2 mvC` Avng`, cfvlK (ee vcbv wefvM), miKvwi AvkK gvngy` KjR, Rvgvjcyi| 01917 542290 Problem-4 [Kieso 9e: BE1-3] At the beginning of the year, Hernandez Company had total assets of Tk.800,000 and

total liabilities of Tk.500,000. Answer the following questions.

(a) If total assets increased Tk.150,000 during the year and total liabilities decreased Tk.80,000, what is the amount of owners equity at the end of the year?

(b) During the year, total liabilities increased Tk.100,000 and owners equity decreased Tk.70,000. What is the amount of total assets at the end of the year?

(c) If total assets decreased Tk.80,000 and owners equity increased Tk.120,000 during the year, what is the amount of total liabilities at the end of the year?

[Ans: (a) Owners Equity 5,30,000; (b) Total Assets 8,30,000; (c) Total Liabilities 3,00,000]

Problem-5 [Kieso 9e: BE1-4] Use the expanded accounting equation to answer each of the following questions:

(a) The liabilities of Lara Company are Tk.90,000. Brian Laras capital account is Tk.150,000; drawings are Tk.40,000; revenues, Tk.450,000; and expenses, Tk.320,000. What is the amount of Lara Companys total assets?

(b) The total assets of Pereira Company are Tk.57,000. Karen Perrys capital account is Tk.25,000; drawings are Tk.7,000; revenues , Tk.50,000; and expenses, Tk.35,000. What is the amount of the companys total liabilities?

(c) The total assets of Yap Co. are Tk.600,000 and its liabilities are equal to two-thirds of its total assets. What is the amount of Yap Co.s owners equity?

[Ans: (a) Total Assets 3,30,000; (b) Total Liabilites 24,000; (c) Owners Equity 2,00,000]

Problem-6 [Kieso 9e: E1-10; same as NU-2012] Lily Company had the following assets and liabilities on the dates

indicated.

December 31 Total Assets Total Liabilities 2009 Tk.400,000 Tk.250,000 2010 Tk.460,000 Tk.300,000 2011 Tk.590,000 Tk.400,000

Lily began business on January 1, 2009, with an investment of Tk.100,000.

Instructions

From an analysis of the change in owners equity during the year, compute the net income (or loss) for:

(a) 2009, assuming Lilys drawings were Tk.15,000 for the year. (b) 2010, assuming Lily made an additional investment of Tk.50,000 and had no drawings in 2010. (c) 2011, assuming Lily made an additional investment of Tk.15,000 and had drawings of Tk.30,000 in 2011.

[Ans: (a) Net Income 65,000; (b) Net Loss 40,000; (c) Net Income 45,000]

Problem-7 [NU-2010] Presented below are the balances of the assets and liabilities of Khandoker Delivery Service as

at 30 June, 2010. Also include are the revenue and expense figures of the business for June:

Delivery Service Revenue 4,100 Delivery Equipment 15,500 Accounts Receivable 900 Supplies 600 Accounts Payable 750 Notes Payable 8,000 Kayum Khandoker, Capital ? Rent Expenses 500 Salaries Expenses 2,000 Cash 650

Instructions: Prepare the Balance Sheet of Khandoker Delivery Service as at 30 June, 2010

[Hints: Total Assets 17,650]

-

Chapter 2: Financial Accounting Process 1-3 Problem-8 [Kieso 9e: E1-16] Presented below is information related to the sole proprietorship of Kevin Johnson,

attorney

Legal service revenue2010 Tk.350,000 Total expenses2010 211,000 Assets, January 1, 2010 85,000 Liabilities, January 1, 2010 62,000 Assets, December 31, 2010 168,000 Liabilities, December 31, 2010 85,000 Drawings2010 ?

Instructions: Prepare the 2010 owners equity statement for Kevin Johnsons legal practice.

[Hints: Begining Capital 23,000; Net Income 1,39,000; Ending Capital 83,000] Problem-9 [Kieso 9e: E1-12] The following information relates to Linda Stanley Co. for the year 2010:

Linda Stanley , Capital, January 1, 2010 48,000 Advertising expense 1,800

Linda Stanley , Drawing during 2010 6,000 Rent expense 10,400

Service revenue 62,500 Utilities expense 3,100

Salaries expense 30,000

Instructions: After analyzing the data, prepare an income statement and an owners equity statement for the year ending December 31, 2010.

Solution: Problem- 9

Linda Stanley Company

Income Statement

For the Year Ended December 31, 2010

Revenues

Service Revenues 62,500

A. Total revenues 62500

Expenses

Salaries expenses 30000

Advertisement expenses 1800

Rent expenses 10400

Utilities expense 3100

B. Total expenses 45300

( ) 17200

Linda Stanley Company Owners Equity Statement

For the Year Ended December 31, 2010 Linda Stanley, Capital, January 1 48,000

(+) Net Income (a) 17200

65200

(-) Drawings 6000

Linda Stanley, Capital, December 31 83000

-

1-4 mvC` Avng`, cfvlK (ee vcbv wefvM), miKvwi AvkK gvngy` KjR, Rvgvjcyi| 01917 542290 Problem-10 [Kieso 9e: P1-4A; same as NU BBS (Hons) 2009, 2006] Mark Miller started his own delivery service, Miller Deliveries, on June 1, 2010. The following transactions occurred during the month of June

June 1 Mark invested Tk.10,000 cash in the business.

2 Purchased a used van for deliveries for Tk.12,000. Mark paid Tk.2,000 cash and signed a note payable for the remaining balance.

3 Paid Tk.500 for office rent for the month.

5 Performed Tk.4,400 of services on account.

9 Withdrew Tk.200 cash for personal use .

12 Purchased supplies for Tk.150 on account.

15 Received a cash payment of Tk.1,250 for services provided on June 5.

17 Purchased gasoline for Tk.100 on account.

20 Received a cash payment of Tk.1,500 for services provided.

23 Made a cash payment of Tk.500 on the note payable.

26 Paid Tk.250 for utilities.

29 Paid for the gasoline purchased on account on June 17.

30 Paid Tk.1,000 for employee salaries.

Instructions: (i) Show the effect of above transactions on the accounting equation;

(ii) Prove the Accounting equation.

[Hints: Cash 8,200; A/R 3,150; Supplies 150; Delivery Van 12,000; N/P 9,500; A/P 150; Capital 13,850]

Problem-11 [NU-2011, 2008 ] Mahmod Enterprise completed the following transactions in July, 201l.

Jul 1 The owner sold his personal investment for Tk. 1, 50,000 and brought in as capital.

3 Paid rent Tk. 4,000

4 Purchase merchandise for cash Tk. 60,000'

8 Purchase merchandise from Aziz Tk. 90,000 on account.

10 Borrowed Tk. 60,000 from Dhaka Bank and sign a note payable

15 Sold merchandise for cash Tk. 75,000 (Cost Tk. 60,000).

20 Sold merchandise to Imran Tk. 1,00,000 (Cost Tk. 80,000)

25 Return merchandise sold on July 20, Tk. 5,000 (Cost Tk. 4,000)

30 Payment received from Accounts receivable Tk. 50,000

31 Paid advertising bill for Tk. 5,000.

Required: (i) Show the effect of above transactions on the accounting equation;

(ii) Prove the Accounting equation.

[Hints: Cash 2,66,000; M.Inv 14,000 A/R 45,000; N/P 60,000; A/P 90,000; Capital 1,75,000]

-

Chapter 2: Financial Accounting Process 1-5 Problem-12 [Kieso 9e: P1-1A] Barones Repair Shop was started on May 1 by Nancy Barone. A summary of May transactions is presented below:

1. Invested Tk.10,000 cash to start the repair shop. 2. Purchased equipment for Tk.5,000 cash. 3. Paid Tk.400 cash for May office rent. 4. Paid Tk.500 cash for supplies. 5. Incurred Tk.250 of advertising costs in the Beacon News on account. 6. Received Tk.5,100 in cash from customers for repair service. 7. Withdrew Tk.1,000 cash for personal use . 8. Paid part-time employee salaries Tk.2,000. 9. Paid utility bills Tk.140. 10. Provided repair service on account to customers Tk.750. 11. Collected cash of Tk.120 for services billed in transaction (10).

Instructions

(a) Prepare a tabular analysis of the transactions; (b) From an analysis of the owners equity columns, compute the net income or net loss for May.

[Hints: Cash 6,180; Equipment 5,000; Supplies 500; A/R 630; A/P 250; Capital 12,060; Net Income 3,060]

Problem-13 [Kieso 9e: P1-2A] Maria Gonzalez opened a veterinary business in Nashville, Tennessee, on August 1. On August 31, the balance sheet showed Cash Tk.9,000, Accounts Receivable Tk.1,700, Supplies Tk.600, Office Equipment Tk.6,000, Accounts Payable Tk.3,600, and M. Gonzalez, Capital Tk.13,700. During September the following transactions occurred.

1. Paid Tk.2,900 cash on accounts payable. 2. Collected Tk.1,300 of accounts receivable. 3. Purchased additional office equipment for Tk.2,100, paying Tk.800 in cash and the balance on account. 4. Earned revenue of Tk.8,000, of which Tk.2,500 is paid in cash and the balance is due in October. 5. Withdrew Tk.1,000 cash for personal use . 6. Paid salaries Tk.1,700, rent for September Tk.900, and advertising expense Tk.300. 7. Incurred utilities expense for month on account Tk.170. 8. Received Tk.10,000 from Capital Bankmoney borrowed on a note payable.

Instructions (a) Prepare a tabular analysis of the September transactions beginning with August 31 balances. (b) Prepare an income statement for September, an owners equity statement for September, and a balance sheet at

September 30.

[Hints: Cash 15,200; A/R 5,900; Supplies 600; Equipment 8,100; N/P 10,000; A/P 2,170; Capital 17,630]

Problem-14 [Kieso 9e: P1-1B] On April 1, Vinnie Venuchi established Vinnies T ravel Agency. The following

transactions were completed during the month

1. Invested Tk.15,000 cash to start the agency.

2. Paid Tk.600 cash for April office rent.

3. Purchased office equipment for Tk.3,000 cash.

4. Incurred Tk.700 of advertising costs in the Chicago Tribune, on account.

5. Paid Tk.800 cash for office supplies.

6. Earned Tk.11,000 for services rendered: Tk.3,000 cash is received from customers, and the balance of

Tk.8,000 is billed to customers on account.

7. Withdrew Tk.500 cash for personal use .

8. Paid Chicago Tribune amount due in transaction (4).

9. Paid employees salaries Tk.2,200.

10. Received Tk.4,000 in cash from customers who have previously been billed in transaction (6).

Instructions

(a) Prepare a tabular analysis of the transactions

(b) From an analysis of the owners equity columns , compute the net income or net loss for April.

[Hints: Cash 14,200; Equipment 3,000; Supplies 800; A/R 4,000; A/P 00; Capital 22,000; Net Income 7,500]

-

1-6 mvC` Avng`, cfvlK (ee vcbv wefvM), miKvwi AvkK gvngy` KjR, Rvgvjcyi| 01917 542290 Problem-15[Kieso 9e: P1-2B]

Jenny Brown opened a law office, on July 1, 2010. On July 31, the balance sheet showed Cash Tk.5,000, Accounts

Receivable Tk.1,500, Supplies Tk.500, Office Equipment Tk.6,000, Accounts Payable Tk.4,200, and Jenny Brown,

Capital Tk.8,800. During August the following transactions occurred.

1. Collected Tk.1,200 of accounts receivable.

2. Paid Tk.2,800 cash on accounts payable.

3. Earned revenue of Tk.8,000 of which Tk.3,000 is collected in cash and the balance is due in September.

4. Purchased additional office equipment for Tk.2,000, paying Tk.400 in cash and the balance on account.

5. Paid salaries Tk.2,500, rent for August Tk.900, and advertising expenses Tk.400.

6. Withdrew Tk.700 in cash for personal use.

7. Received Tk.1,500 from Standard Federal Bankmoney borrowed on a note payable.

8. Incurred utility expenses for month on account Tk.220.

Instructions

(a) Prepare a tabular analysis of the August transactions beginning with July 31 balances.

(b) Prepare an income statement for August, an owners equity statement for August, and a balance sheet at

August 31

[Hints: Cash 3,000; A/R 5,300; Supplies 500; Equipment 8,000; N/P 1,500; A/P 3,220; Capital 12,080]

Problem-16 [Kieso 9e: P1-4B] Michelle Rodriguez started her own consulting firm, Rodriguez Consulting, on May 1, 2010. The following transactions occurred during the month of May .

May 1 Michelle invested Tk.7,000 cash in the business.

2 Paid Tk.900 for office rent for the month.

3 Purchased Tk.600 of supplies on account.

5 Paid Tk.125 to advertise in the County News.

9 Received Tk.4,000 cash for services provided.

12 Withdrew Tk.1,000 cash for personal use .

15 Performed Tk.6,400 of services on account.

17 Paid Tk.2,500 for employee salaries.

20 Paid for the supplies purchased on account on May 3.

23 Received a cash payment of Tk.4,000 for services provided on account on May 15.

26 Borrowed Tk.5,000 from the bank on a note payable.

29 Purchased office equipment for Tk.3,100 on account.

30 Paid Tk.175 for utilities.

Instructions

(a) Show the effects of the previous transactions on the accounting equation (b) Prepare an income statement for the month of May. (c) Prepare a balance sheet at May 31, 2010.

-

Chapter 2: Financial Accounting Process 1-7 Solution: Problem- 16 (i)

Rodriguez Consulting Summary of Transactions For the month of May 2010

Date/ Trans

Assets = Liabilities+ Owners Equity

Remarks Cash A/C Receivable

Supplies Office Equipment

= Notes Payable

A/C Payable

Rodriguez, Capital

May 1 7000 7000 Investment

2 (900) (900) Rent expense

3 600 600

5 (125) (125) Advert. expense

9 4000 4000 Service revenue

12 (1000) (1000) Drawings

15 6400 6400 Service revenue

17 (2500) (2500) Salaries expenses

20 (600) (600)

23 4000 (4000)

26 5000 5000

29 3100 3100

30 (175) (175) Utilities expenses

14700 2400 600 3100 5000 3100 12700

Total =20800 Total= 20800

(ii) Income Statement

For the month of May 2010 Revenues Service Revenues (4000+6400) 10400

A. Total revenues 10400 Expenses Rent expenses 900 Advertisement expenses 125 Salaries expenses 2500 Utility expenses 175

B. Total expenses 3700 ( ) 6700

(iii) Balance Sheet

May 31, 2010 Assets

Cash Tk. 14700 Accounts receivable 2400 Supplies 600 Office Equipment 3100 Total Assets Tk. 20,800

Liabilities & Owners Equity

Liabilities Notes payable Tk. 5,000 Accounts payable 3,100 Total liabilities 8,100 Owners Equity M. Rodriguez, Capital 12700 Total Liabilities & Owners Equity Tk. 20,800

Ch 1 Acc Basic.docxCh 2 Financial Acc Process.docx