Chap 1 Accounting

-

Upload

minh-nguyen -

Category

Documents

-

view

226 -

download

0

Transcript of Chap 1 Accounting

-

7/24/2019 Chap 1 Accounting

1/37

McGraw-Hill/Irwin 2008 The McGraw-Hill Companies, Inc. All rights resere!.

1

Intercorporate Acquisitions and Investments in Other Entities

-

7/24/2019 Chap 1 Accounting

2/37

1-2

Intercorporate Acquisitions and

Investments in Other EntitiesThis chapter provides an overview of complex

organizational arrangements or structures!"

# $omplex organization structures often result fromcomplex %usiness strategies such as&

# Extending operations into foreign countries"

# Initiating new product lines"

# 'eparating activities that fall under regulator(controls"

# )educing taxes %( separating certain t(pes ofoperations"

-

7/24/2019 Chap 1 Accounting

3/37

1-*

Intercorporate Acquisitions and

Investments in Other Entities# 'everal accounting transactions ma( %e required

to initiate a complex organization structure"

# There is a need to anal(ze multiple transactions formultiple companies simultaneousl(+not ,ust onetransaction for one compan("

-

7/24/2019 Chap 1 Accounting

4/37

1-

Intercorporate Acquisitions and

Investments in Other Entities The accounting procedures in this chapter

are driven %( such questions as&

# .id the compan( acquire the common stoc/ ofanother compan( or the assets of anothercompan( 0

# as the compan( dissolved i"e" liquidated! ordid the compan( continue to exist0

# as a new compan( formed0

# as there a change in ownership control0

# Is the acquired compan( wholl(-owned0

-

7/24/2019 Chap 1 Accounting

5/37

1-

3orms of 4usiness $om%inations

# There are three primar( forms of %usinesscom%inations&

# 'tatutor( 5erger

#'tatutor( $onsolidation

# 'toc/ Acquisition

-

7/24/2019 Chap 1 Accounting

6/37

1-6

'tatutor( 5erger

# A statutor( merger occurs when one compan(acquires another compan( and the assets and

lia%ilities of the acquired compan( are transferred tothe acquiring compan("

# In a statutor( merger7 the acquired compan( is

liquidated and the acquiring compan( continues toexist"

-

7/24/2019 Chap 1 Accounting

7/37

1-8

'tatutor( $onsolidation

# A statutor( consolidation occurs when a newcompan( is formed to acquire the assets and

lia%ilities of two com%ining compan("

# In a statutor( consolidation7 the com%iningcompanies are dissolved and the new compan( is

the onl( surviving entit("

-

7/24/2019 Chap 1 Accounting

8/37

1-9

'toc/ Acquisition

# A stoc/ acquisition occurs when one compan(acquires a ma,orit( of the common stoc/ of another

compan( and the acquired compan( is notliquidated"

# In a stoc/ acquisition7 %oth companies continue to

operate as separate %ut related corporations i"e"7affiliated corporations!"

-

7/24/2019 Chap 1 Accounting

9/37

1-:

'toc/ Acquisition&;arent-'u%sidiar( )elationship

# A su%sidiar( is a corporation that is controlledthrough common stoc/ ownership! %( anothercorporation7 that is7 the parent corporation"

# $ontrolling Interest& The parent owns ama,orit( of the common stoc/ of thesu%sidiar("

# holl(-Owned 'u%sidiar(& The parent ownsall of the common stoc/ of the su%sidiar("

#

-

7/24/2019 Chap 1 Accounting

10/37

1-1>

5ethods of Effecting 4usiness $om%inations

# 4usiness com%inations can %e either friendl( orunfriendl("

? 3riendl( com%inations involve %oth managementteams and recommend approval %( thestoc/holders

? @nfriendl( com%inations are /nown as hostile

ta/eovers= where the acquiring compan( ma/es adirect tender offer to the stoc/holders"

-

7/24/2019 Chap 1 Accounting

11/37

1-11

Baluation of 4usiness Entities

# Assessing the overall value of a compan( oftenincludes&

# Baluation of Individual Assets and Cia%ilities

# Baluation of ;otential Earnings

# Baluation of $onsideration Exchanged

1 12

-

7/24/2019 Chap 1 Accounting

12/37

1-12

Baluation of Individual

Assets and Cia%ilities

# The value of a compan(=s individual assets is

usuall( determined %( appraisal"# $urrent lia%ilities are often viewed as having fair

values equal to their %oo/ values %ecause the( will%e paid at face amount within a short time"

# Cong-term lia%ilities must %e valued %ased oncurrent interest rates if different from the effectiverates at the issue dates of the lia%ilities"

# Tax aspects must also %e considered"

1 1*

-

7/24/2019 Chap 1 Accounting

13/37

1-1*

Baluation of ;otential Earnings

# '(nerg( occurs when assets operated together have avalue that exceeds the sum of their individual values"

# This Dvalue ma/es it desira%le to operate assets,ointl( rather than sell them individuall("

# ;ossi%le approaches to measuring the value of acompan(=s future earnings include&

# 5ultiples of current earnings"

# ;resent value of anticipated future newcash flows generated %( the compan("

# 'ophisticated financial models"

1 1

-

7/24/2019 Chap 1 Accounting

14/37

1-1

Baluation of $onsideration Exchanged

# hen one compan( acquires another7 a value must%e placed on the consideration given in theexchange"

# Cittle difficult( is encountered when cash is used inan acquisition7 %ut valuation ma( %e more difficultwhen securities are exchange7 particularl( illiquid orprivatel( held securities or securities with unusualfeatures e"g"7 converti%le or calla%le securities!"

1 1

-

7/24/2019 Chap 1 Accounting

15/37

1-1

;urchase 5ethod $urrent

-

7/24/2019 Chap 1 Accounting

16/37

1-16

;ooling 5ethod Fot $urrent

-

7/24/2019 Chap 1 Accounting

17/37

1-18

$hapter 1 Important Terms

? $ost of Investment ;urchase ;rice!

?

-

7/24/2019 Chap 1 Accounting

18/37

1-19

$ost of Investment ;urchase ;rice!

# The value of the consideration given to the ownersof the acquired compan( normall( constitutes the

largest part of the total cost"

# There are three t(pes of other costs that ma( %eincurred in effecting a %usiness com%ination&

# .irect costs

# $osts of issuing securities

# Indirect and general costs

1 1:

-

7/24/2019 Chap 1 Accounting

19/37

1-1:

;urchase ;rice--.irect $osts

# All direct costs associated with purchasing anothercompan( are capitalized as part of the total cost of

the acquired compan("# Examples&

# 3inders= fees

#Accounting fees

# Cegal fees

#Appraisal fees

1 2>

-

7/24/2019 Chap 1 Accounting

20/37

1-2>

;urchase ;rice--$osts of Issuing 'ecurities

# $osts incurred in issuing equit( securities inconnection with the purchase of a compan( should%e treated as a reduction in Additional-;aid-In$apital" Examples include& Cisting feesH Audit andlegal fees related to the registrationH and7 4ro/ers=commissions"

# $osts incurred in issuing %onds pa(a%le inconnection with the purchase of a compan( should%e accounted for as %ond issue costs and amortizedover the term of the %onds"

1-21

-

7/24/2019 Chap 1 Accounting

21/37

1-21

;urchase ;rice--Indirect and

-

7/24/2019 Chap 1 Accounting

22/37

1-22

-

7/24/2019 Chap 1 Accounting

23/37

1 2*

Example of $alculating

-

7/24/2019 Chap 1 Accounting

24/37

1 2

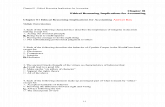

IMPLIED GOODWILL AL!LA"IO#

$!%&$ E$"IMA"ED A##!AL EA'#I#G$ ()*+,---

LE$$. #O'MAL /O' I#D!$"'0 2*,---

*3*,---

P'E$E#" 4AL!E /A"O' +516-+*

78 0EA'$, 19, O'DI#A'0 A##!I"0:

IMPLIED GOODWILL (1,*1+,)+2

1-2

-

7/24/2019 Chap 1 Accounting

25/37

1 2

'u%sequent Accounting for

-

7/24/2019 Chap 1 Accounting

26/37

1 26

4argain ;urchase ;rice

a"/"a" Fegative

-

7/24/2019 Chap 1 Accounting

27/37

Additional Thoughts

# The selling compan( would have recorded aD

-

7/24/2019 Chap 1 Accounting

28/37

Example& $om%ination Effectedthrough ;urchase of Fet Assets

# ;oint acquires the all of the common stoc/ of 'harpissuing the shareholders of 'harp 1>7>>> shares of 1>par common stoc/" The shares have a total mar/etvalue of 6>>7>>>"

# 'harp continues to operate as a separate entit( after the%usiness com%ination transaction"

# ;oint incurs >7>>> in legal and appraisal fees and27>>> in stoc/ issuance costs"

# 35B of net assets are 1>7>>> 4ro/en down as follows&AK) L& Inv 8L& ;;E 2>L ;atent 9>L&Cia% 11>L!

1-2:

-

7/24/2019 Chap 1 Accounting

29/37

Example& $om%ination Effectedthrough ;urchase of Fet Assets $ont=d"!

Entries )ecorded 4( Acquiring $ompan( ;oint!

.eferred 5erger $osts >7>>>

.eferred stoc/ Issue $osts 27>>>

$ash 67>>>

1-*>

-

7/24/2019 Chap 1 Accounting

30/37

Example& $om%ination Effectedthrough ;urchase of Fet Assets $ont=d"!

# Entries 'ecorded %= Acquirin; ompan= 7Point:5

ash and 'eceivables (+,--- >

Inventor= 8,--- >Land, %uildin;s and Equipment +*-,--- >Patent )-,--- >Good

ommon $toc@ 1--,--- Additional PaidIn apital +8,--- DeBerred Mer;er osts +-,--- ?? DeBerred $toc@ Issue osts *,--- ??? $ee next slide5 ??$ee previous t /air Mar@et 4alue

1-*1

-

7/24/2019 Chap 1 Accounting

31/37

Example& $om%ination Effectedthrough ;urchase of Fet Assets $ont=d"!

# $alculation of >7>>>

;C@'& Other acquisition costs >7>>>

Total purchase price 6>7>>>

# CE''&

4oo/ value of net assets 1>7>>>

# .ifferential 1*>7>>>

In this case the differential all relates to goodwill since 4B M 3B for all the assets"

1-*2

-

7/24/2019 Chap 1 Accounting

32/37

Example& $om%ination Effectedthrough ;urchase of Fet Assets $ont=d"!

Entries )ecorded 4( Acquired $ompan( 'harp!"

Investment in ;oint 'toc/ 6>>7>>>$urrent Cia%ilities 1>>7>>>

Accumulated .epreciation 1>7>>>

$ash and )eceiva%les 7>>>

Inventor( 67>>> Cand >7>>>

4uildings and Equipment >>7>>>

>7>>>

1-**

-

7/24/2019 Chap 1 Accounting

33/37

Example& $om%ination Effectedthrough ;urchase of 'toc/

# ;oint acquires the all of the common stoc/ of 'harpissuing the shareholders of 'harp 1>7>>> shares of 1>par common stoc/" The shares have a total mar/etvalue of 6>>7>>>"

# 'harp continues to operate as a separate entit( after the%usiness com%ination transaction"

# ;oint incurs >7>>> in legal and appraisal fees and27>>> in stoc/ issuance costs"

# 35B of net assets are 1>7>>> 4ro/en down as follows&AK) L& Inv 8L& ;;E 2>L ;atent 9>L&Cia% 11>L!

1-*

-

7/24/2019 Chap 1 Accounting

34/37

Example& $om%ination Effectedthrough ;urchase of 'toc/

# Entries )ecorded 4( Acquiring $ompan(

;oint!

.eferred 5erger $osts >7>>>

.eferred 'toc/ Issue $osts 27>>>

$ash 67>>>

1-*

-

7/24/2019 Chap 1 Accounting

35/37

Example& $om%ination Effectedthrough ;urchase of 'toc/ $ont=d"!

# Entries )ecorded 4( Acquiring $ompan( ;oint!

Investment in 'harp 'toc/ 6>7>>> N $ommon 'toc/ 1>>7>>>

Additional ;aid-In $apital 87>>>

.eferred 5erger $osts >7>>>.eferred 'toc/ Issue $osts 27>>>

6>7>>> M 6>>7>>> 3air Balue >7>>> 5erger $osts

87>>> M >N1>7>>> shares! - 27>>> 'toc/ Issue $osts

1>>7>>> M 1> par N1>7>>> shares!

1-*6

-

7/24/2019 Chap 1 Accounting

36/37

3inancial )eporting'u%sequent to a ;urchase

# hen a com%ination occurs during a fiscal (ear7income earned %( the acquired compan( prior to the

com%ination is not reported in the income statementof the com%ined entit("

# If the com%ined entit( reports comparative financialstatements that include statements for periods

%efore the com%ination7 those statements includeonl( the activities and financial statements of theacquiring compan( and not those of the acquiredcompan("

1-*8

-

7/24/2019 Chap 1 Accounting

37/37

.isclosure )equirementsa"/"a" Fotes to the 3inancial 'tatements!

# A num%er of disclosures are required to provide financialstatement readers with information a%out the com%ination&

# A description of the acquired entit("

# The percentage voting interests acquired"

# The primar( reason for the acquisition"

# A description of the factors that contri%utedto the recognition of goodwill"

# $ontingent pa(ments7 options7 or commitments"

# ;urchased research and development assets acquiredand written off"