Chap 007

description

Transcript of Chap 007

Consolidated Financial Statements – Ownership Patterns and Income Taxes

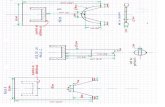

Assume three companies form a business combination:

Top Company owns 70% of Midway Company, which owns 60% of Bottom

Company. Top controls both subsidiaries, although the parent’s Relationship with Bottom is only of an indirect nature.

When a parent controls a subsidiary which in turn controls other firms, a “pyramid”or “father-son-grandson” relationship exists. To consolidate: start from the bottom of the “pyramid” and work upwards.

1. Recognize realized income of “grandson(s)”

2. Use this to consolidate the “son” and “grandson(s)” financial information (take care to calculate any noncontrolling interest)

3. Finally, consolidate the “son(s)” and parent in the same manner.

Using the income from the previous calculations, determine noncontrolling interest. (Bottom and Midway’s individual incomes as calculated). Use the standard consolidation entries to complete the father-son-grandson combination. The entries are essentially duplicated for each relationship.

A connecting affiliation exists when two or more companies within a business combination own an interest in another member of the organization.

Both High company and Side Company own Low Company’s stock, a connecting affiliation. Neither owns enough stock to establish direct control over Low’s operations, but they hold a total of 75% of the outstanding shares. Control lies within the single consolidated entity and Low’s financial information must be included in the consolidated statements. Assume High, Side, and Low have separate internal operating incomes of $300,000, $200,000, and $100,000, respectively. Each has a $30,000 net intra-entity gain in its current income. Annual amortization expense is $10,000 for acquisition-date excess fair value over book value for each subsidiary.

Basic Consolidation Rules Still Hold:

Eliminate effects of intra-entity transfers.

Adjust parent’s beginning R/E to recognize prior period ownership.Eliminate sub’s beginning equity balances.Adjust for unamortized FV adjustments.Record Amortization Expense.Remove intra-entity income and dividends.

Compute and record noncontrolling interest in subsidiaries’ net income.

The combination of the parent’s DIRECT ownership and INDIRECT ownership results in control of the subsidiary.

Although neither of the individual companies possesses enough voting stock to establish direct control over Low’s operations, the combination’s members hold a total of 75 percent of the outstanding shares.

Accrual-based income figures for the three companies in this combination are derived as seen on the following slide.

Mutual ownership occurs when two companies within a business combination hold an equity interest in each other.

GAAP recommends that “shares of the parent held by the subsidiary should be eliminated in consolidated financial statements.”

The shares are not “outstanding” because they are not held by parties outside the combination.

The Treasury Stock Approach is used to account for the mutually owned shares.

There is no accounting distinction between a parent owning stock of a subsidiary, or a subsidiary owning stock of a parent – they are both intra-entity stock ownership.

The cost of the parent shares held by the subsidiary is reclassified on the worksheet into Treasury Stock.

Intra-entity dividends on shares of the parent owned by the subsidiary are eliminated as an intra- entity cash transfer.

Pop Co owns 70% of Sun Co.

Sun owns 10% of Pop Co, purchased for $120,000, and records the investment under the Fair Value Method. Pop pays dividends of $8,000 to Sun, who records dividend income.

The following consolidation entries are recorded.

Treasury Stock . . . . . . . . . . . . . . . . . . $120,000

Investment . . . . . . . . . . . . . . . . . . . . . . . . $120,000

Dividends Paid . . . . . . . . . . . . . . . . . . . .$8,000

Dividends Income . . . . . . . . . . . . . . . . . . . . .$8,000

Business combinations may elect to file a consolidated federal tax return for all companies of an affiliated group.

The affiliated group (as defined by the IRS) will likely exclude some members of the business combination.

Affiliated Group

= The parent company

+ Any domestic subsidiary where the parent owns 80% or more of the voting stock AND 80% of each class of nonvoting stock.

All others must file separately (including any foreign subsidiaries.)

Tax consequences are often dependent on whether separate or consolidated returns are filed. Transactions affected include intra-entity dividends, goodwill, and unrealized intra-entity gains.

Intra-entity Dividends

For accounting purposes, all intra-entity dividends are eliminated.

For tax purposes, dividends are removed from income if at least 80 percent of the subsidiary’s stock is held. (20% is taxable.)

If less than 80 percent of a subsidiary’s stock is held, tax recognition is necessary.

A deferred tax liability is created for any of sub’s income not paid currently as a dividend.

Amortization of Goodwill

Current tax law permits the amortization of Goodwill and other purchased Intangible Assets over 15 years.

GAAP does not systematically amortize Goodwill for financial reporting purposes, but instead reviews it annually for impairment.

Timing differences between the amortization and write-off creates a temporary difference that results in deferred income taxes.

If consolidated returns are filed, intra-entity gains are deferred until realized and no timing difference is created.

If separate returns are filed, taxable gains must be reported in the period of transfer.

The “prepayment” of taxes on the unrealized gains creates a deferred income tax asset.

Consolidated tax returns require allocation of tax expense between the parties.

Important for the subsidiary if separate financial statements are needed for loans or equity issues.

Used as a basis for calculating noncontrolling interest’s share of consolidated income.

Consolidated tax returns require allocation of tax expense between the parties.

Important for the subsidiary if separate financial statements are needed for loans or equity issues.

Used as a basis for calculating noncontrolling interest’s share of consolidated income.

Consolidated tax returns require allocation of tax expense between the parties.

Important for the subsidiary if separate financial statements are needed for loans or equity issues.

Used as a basis for calculating noncontrolling interest’s share of consolidated income.

Two Methods may be used to allocate Income Tax Expense:

Percentage Allocation Method – Tax Expense is assigned based on relative net incomes of the companies.

Separate Return Method – Tax Expense is assigned based on relative tax expense IF they

had filed separate returns.

Great owns 90 percent of Small’s outstanding stock.

Based on filing a consolidated return, total income tax expense of $48,600 was recognized.

Total taxable income on the consolidated return was $162,000.

$130,000 applied to the parent (operating income after deferral of $30,000 unrealized gain)

$32,000 came from the subsidiary (after deferral of $8,000 unrealized gain).

A business combination can create temporary differences due to differences in tax bases and book value stemming from the takeover.

In most purchases, resulting book values of acquired company’s assets and liabilities differ from their tax bases because:

Subsidiary’s cost is retained for tax purposes (in tax-free exchanges)

Allocations for tax purposes vary from those used for financial reporting (found in taxable transactions).

Net operating losses for companies may be carried back for two years and/or forward for twenty years

Because some acquisitions appeared to be done primarily to take advantage of this situation, US law has been changed to require operating loss carryforwards to be used only by the company incurring the loss (in most situations.)

FASB ASC Topic 740 requires deferred tax assets to be recorded for any net operating loss carryforwards

Valuation allowances are recorded if it is more likely than not (based on available evidence) that some or all of the deferred tax asset will not be realized.

Assume a parent purchased a company (sub) for $640,000. The sub has one asset, a building, worth $500,000.

Due to recent losses, the sub has a $200,000 NOL carryforward. The assumed tax rate is 30 % so the parent can derive a $60,000 benefit if it earns future profits.

The parent anticipates the sub will utilize some or all of the NOL carryforward.

If it is more likely than not that the benefit will be realized, goodwill of $80,000 results.

If chances are 50% or less that the sub will use the NOL carryforward, the parent recognizes a valuation allowance and $140,000 of consolidated goodwill.

U.S. GAAP prohibits the recognition of unrealized intra-entity profits; therefore, the selling firm defers any related current tax effects until the asset is sold to a third party.

International Accounting Standard (IAS) 12 requires taxes paid by a selling firm on intra-entity profits to be recognized as incurred and allows tax deferral on differences between the tax bases of assets transferred across entities that remain within the consolidated group.

Control may be direct or indirect.

Consolidation of father-son-grandson business structures requires a systematic bottom-to-top approach.

For mutual affiliation, treasury stock or conventional approach may be used for consolidated information.

Affiliated groups are permitted to file consolidated returns.

If a sub’s assets and liabilities have a tax basis that differs from their assigned values, a deferred tax asset or liability must be recognized at the time of acquisition to reflect the tax effect of these differences.