central excise

-

Upload

lakshmi811 -

Category

Documents

-

view

73 -

download

3

description

Transcript of central excise

-

1 | P a g e

C E N T R A L E X C I S E

INTRODUCTION TO CENTRAL EXCISE:

The Constitution of India (COI) has given power to levy tax to central and

State Government under seventh schedule. The taxation in India is either

charged by the State Governments or by the Central Government. In the

basic scheme of taxation in India, it is conceived that Central Government

will levy and collect tax revenue from Income Tax (exception Agricultural

Income), Excise (except on alcoholic drinks, Etc.) and Customs while State

Government will get tax revenue from Local Sales Tax, Excise on liquor and

tax on Agricultural Income and the Municipalities will get tax revenue from

Octroi and Property Tax.

Taxes are of two types viz. Direct Taxes and Indirect Taxes.

Direct Tax is the tax, which is paid directly by people to the government,

while indirect tax is paid indirectly by people to the government through

registered government representatives.

Income Tax is paid directly to the government therefore it is a direct tax

while excise duty is paid by people to the manufacturer who pays it to the

government, therefore it is an indirect tax.

Direct Tax:

'Mr. X' a proprietor of ABC trading company, earns profit of Rs. 8, 50,000/-.

He is liable to pay income tax on profit earned by him. He himself will be

responsible for payment of income tax. That is means it is direct payment by

the assessee to the Government, hence it is called direct tax.

Indirect Tax:

'Mr. Y' purchases a mobile phone for his personal use from ABC Ltd..

He has been charged MVAT (i.e. Local Sales Tax) Extra in addition to basic

price of Mobile Phone by ABC Ltd In short; he needs to pay basic price plus

MVAT (i.e. Local Sales Tax) to the ABC Ltd. Now liability of paying the tax

collected from consumer is on ABC Ltd. This example clearly indicates that

tax is actually deposited by ABC LTD but indirectly paid to the government

by Mr. Y. That is why MVAT (Local Sales Tax is an example of indirect tax)

-

2 | P a g e

The following diagrammatic representation shows the prevailing tax structure in India of Direct and Indirect Tax in Brief.

MEANING OF CENTRAL EXCISE ::

Central Excise is an indirect tax; which is levied and collected on the goods/commodities manufactured in India. Generally, manufacturer of commodities is responsible to pay duty to the Government. This indirect taxation is administered through an enactment of the Central Government viz., The Central Excise Act, 1944 and other connected rules- which provide for levy, collection and connected procedures. The rates at which the excise duty is to be collected are stipulated in the Central Excise Tariff Act, 1985. It is mandatory to pay Central Excise duty payable on the goods manufactured, unless exempted e.g., duty is not payable on the goods exported out of India. Further various other exemptions are also notified by the Government from the payment of duty by the manufacturers.

-

3 | P a g e

This act is applied to whole of India except Jammu & Kashmir. Central Excise Law is a combined study of:

Central Excise Act (CEA), 1944; Central Excise Tariff Act (CETA), 1985; Central Excise Rules, 2002; and CENVAT Credit Rules, 2004

HOW TO DECIDE DUTIABILITY?

As per section 3 of Central Excise Act (CEA) excise duty is levied only if the following all conditions are satisfied: -

PREREQUISITES FOR DUTIABILITY

There should be goods. Goods must be moveable Goods are marketable Goods are mentioned in the Central Excise Tariff Act (CETA). Goods are manufactured in India.

I. MEANING OF GOODS UNDER CENTRAL EXCISE: "Goods" have not been defined in Central Excise Act.

-

4 | P a g e

As per Article 366(12) of Constitution of India: Goods include all material commodities and articles.

Sale of Goods Act defines Goods means: II.

"every kind of movable property other than actionable claims and money; and includes stocks and shares, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale.In addition to this definition, under central excise the goods to become "excisable goods" have to pass following acid tests: Goods must be: 1) Movable2) Marketable

II. WHAT IS MOVABILITY?

Moveable means goods, which can be shifted from one place to another place, e.g., motor car, mobile phone, computer etc. The goods attached to earth are immovable goods, such as, Dams, Roads, and Buildings etc. Moveable Goods are manufactured or produced but immoveable goods are constructed.Due to this Movable aspect under central excise, although flat is manufactured by builder it is not an excisable commodity.

III. WHAT IS MARKETABILITY?

Marketable means goods which are capable of being sold, there should be at least one buyer for the commodity in the market is sufficient to call the good as marketable.e.g., Molten iron ore at 1300 degree to 1400 degree Celsius is not marketable, therefore not a good. Similarly, flour produced in own factory for use as raw material in own factory for further production

-

5 | P a g e

of bread is a good because it is marketable. Actual sales are not relevant for calling any item as goods. Sale is not relevant. Goods produced for free distribution, as sample, gifts, or replacement during warranty period is also liable of excise duty. Excisable Goods are those goods, which are mentioned in the items of tariff in CETA. Sec 2(d) defines Excisable Goods as goods specified in the schedule of CETA 1985 as being subject to a duty of excise and includes salt.Goods produced for free distribution, as sample, gifts, or replacement during warranty period is also liable of excise duty.

IV. GOODS MUST BE MENTIONED IN CENTRAL EXCISE TARIFF ACT (CETA)?

Goods specified in the Schedule to Central Excise Tariff Act, 1985 as being subject to a duty of excise and include salt. Thus, unless the item is specified in the Central Excise Tariff Act as subject to duty, no duty is leviable. Some goods like wheat, rice, cut flowers, horses, soya beans etc. are not mentioned in Central Excise Tariff at all and hence they are not excisable goods, though they may be goods.

V. GOODS MUST BE MANUFACTURED "IN INDIA"

Last operative word of section 3 of Central Excise Act is that excisable goods must be manufactured or produced in India. Thus, excise levy cannot be imposed on imported goods or goods manufactured in Nepal.

Once all above conditions are satisfied the person has to get himself registered under the Central Excise.

SPECIFIC EXEMPTIONS UNDER CENTRA EXCISE:

If production or manufacture is in special economic zone then no excise duty is levied.

Excise Duty is not levied on:

-

6 | P a g e

1. Services such as doctors treating the patients, accountants preparing the accounts, in these cases service tax are levied.

2. Immovable goods such as roads, bridges and buildings.

3. Non-Marketable goods, i.e., goods for which no market exists, e.g., melted iron ore at 1600 degree Celsius.

4. Goods that are not mentioned in CETA; and

5. Goods manufactured or produced out of India.

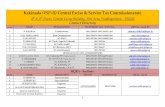

PERSONS REQUIRING TO GET REGISTERED UNDER CENTRAL EXCISE

The persons satisfying all the above conditions have to pay the excise duty. Mainly we can categories them in following manner

1. Every Manufacturer of dutiable excisable goods

2. First & Second Stage Dealer (Including Manufacturers depots& imports) desiring to issue Cenvatble invoices.

3. Persons holding warehouses for storing non duty paid goods

4. Persons who obtain excisable goods for availing end-use based exemption

5. Exporter manufacturers under rebate bond procedure, EOUs & EPZ units which have interaction with the domestic economy (Through DTA sales or procurement of duty free inputs)

-

7 | P a g e

1. Manufacturer is a person who actually manufacturing or producing the excisable goods.

2. Also a person who gets the production of other and sell it after putting its own brand then he will not be called manufacturer, e.g., if X Ltd gets the fans made from some person and sell it after putting their brand name, the X Ltd will not be called as manufacturer. The person actually making the fans will be called manufacturer.

While understanding manufacturer we need to understand what manufacturing means: - I. WHAT IS MEAN BY MANUFACTIRING: - The term manufacturing includes: -

Manufacturing Deemed Manufacturing Production Assembling

-

8 | P a g e

a. Manufacturing According to Section 2(f) of Central Excise Act manufacture includes any process:

1. Incidental or ancillary to the completion of manufactured product or

2. Which is specified in relation to any goods in the Section or Chapter notes of the Schedule to the Central Excise Tariff Act, 1985 as amounting to manufacture, or

3. Which are specified in third schedule to the CETA, involves packing or repacking of such goods in a unit container or labeling or re-labeling of containers or declaration or alteration of retail sale price or any other treatment to make product available in the marketable to the consumer. Clause (ii) and (iii) are called deemed manufacture. Thus, definition of manufacture is inclusive and not exhaustive. The word Manufacture as specified in various Court decisions shall be called only when a new and identifiable goods emerge having a different name, character, or use; e.g., manufacture has taken place when table is made from wood or of pulp is converted into base paper, or sugar is made from sugarcane.

b. Deemed Manufacture Deemed manufacture is of two types: -

1. CETA specifies some processes as amounting to manufacture. If any of these processes are carried out, goods will be said to be manufactured, even if as per Court decisions, the process may not amount to manufacture [Section 2(f) (ii)].

2. In respect of goods specified in third schedule of Central Excise Act, repacking, re-labeling, putting or altering retail sale price etc. will be manufacture. The goods included in Third Schedule of Central Excise Act are same as those on which excise duty is payable u/s 4A on basis of MRP printed on the package. [Section 2(f) (iii)].

-

9 | P a g e

c. Production Production has also not been defined in CEA but production is used to cover items like coffee, tea, tobacco, etc. which are called to have been manufactured nut produced. d. Assembling Assembly of various parts and components amount to manufacture provided it result in movable goods which have distinctive identity, use, character, name etc. e.g., assembly of computer is manufacture. Assembly of air conditioner in a car is not manufacture as no new identifiable product emerges.

FIRST & SECOND STAGE DEALER DESIRING TO ISSUE CENVATBLE INVOICES

First Stage Dealer is one who purchases goods directly from any of the following:

The manufacturer under the cover of any invoice issued in terms of the provision of Central Excise Rules, 2002 or from the depot of the said manufacturer.

Goods purchased from the premises of the consignment agent of the said manufacturer.

Goods purchased from any other premises from where the goods are sold by or on behalf of the said manufacturer.

Goods purchased from an importer or from the depot of an importer.

Goods Purchased from the premises of the consignment agent of the importer.

Procedural requirement for the first & second stage dealer

Registration :- They have to get themselves registered with the excise authorities

Maintenance of stock register: Every dealer has to maintain register for receipts and issue of inputs. This register is to be maintained on daily basis

Invoice Requirements : - CENVAT credit in respect of the inputs and capital goods purchased from a dealer shall be allowed if : - 1)The dealer maintains records indicating that inputs and capital goods were supplied from the stock on which duty was paid by the manufacturer / producer of such goods; and2)Only an amount of such duty on pro-rata basis has been indicated in the invoice issued by the dealers

Filing of the return : - Dealers are required to submit to the superintendent of central excise, a return in prescribed from within days from the close of each quarter of the year

-

10 | P a g e

Flowchart for first stage excise dealer

The categorization of a dealer as first stage or second stage is not predefined. It is decided during the purchase. Therefore, a dealer may be a first stage dealer or a second stage dealer depending on the type of purchase. Let us assume we are a First Stage Dealer and you buy the goods from the importer or Manufacturer.

Second Stage Dealer A registered dealer who purchases goods from the First Stage Dealer is called a Second Stage Dealer. Flowchart for Second stage excise dealer Let us assume we are a First Stage Dealer and you buy the goods from the importer or Manufacturer.

PERSONS HOLDING WAREHOUSES FOR STORING NON DUTY PAID GOODS

Rule 20 of CE Rules permit warehousing of certain goods in warehouses without payment of duty. These goods are coffee, petroleum products, benzene, etc. In such cases, the duty liability is on the person who stores the goods.

-

11 | P a g e

PERSONS EXEMPTED FROM REGISTRATION UNDER CENRAL EXCISE

The following persons have exempted specified categories of persons/premises from obtaining registration, as follows: -

1. Persons who manufacture the excisable goods, which are chargeable to nil rate of excise duty or are fully exempt from duty by a notification.

2. Small scale units availing the slab exemption based on value of clearances under a notification. However, such units will be required to give a declaration (Annexure-1) once the value of their clearances touches Rs.90 lakhs.

3. In respect of ready-made garments, the job-worker need not get registered if the principal manufacturer undertakes to discharge the duty liability.

4. Persons manufacturing excisable goods by following the warehousing procedure under the Customs Act, 1962 subject to the following conditions a. The said excisable goods and any intermediary or by-product including the waste and refuse arising during the process of manufacture of the said goods under the Customs Bond are either destroyed or exported out of the country to the satisfaction of the Assistant Commissioner of Customs or the Deputy Commissioner of Customs, in-charge of the Customs Bonded Warehouse; b. The manufacturer shall file a declaration in the specified form annexed hereto in triplicate for claiming exemption under this notification; c. No drawback or rebate of duty of excise paid on the raw materials or components used in the manufacture of the said goods, shall be admissible

5. The person who carries on wholesale trade or deals in excisable goods (except first and second stage dealer, as defined in CENVAT Credit Rules, 2001).

6. A Hundred per cent Export Oriented Undertaking (EOU) or a unit in Free Trade Zone or Special Economic Zone licensed or appointed, as the case may be, under the provisions of the Customs Act, 1962.

7. Persons who use excisable goods for any purpose other than for processing or manufacture of goods availing benefit of concessional duty exemption notification.

-

12 | P a g e

PROCEDURE OF REGISTRATION UNDER CENTRAL EXCISE INCLUDING RELEVANT SPECIMEN

Application for registration is given in prescribed format to the Assistant Commissioner or Deputy Commissioner in duplicate. (Form A - 1 for all persona except certain textile processors/ Cheroot manufacturers) Separate From A - 2 is prescribed for registration of power loom weavers/Hand Processors/ dealers of yarns and fabric and manufacturer of readymade garments. From A - 3 is the application for the registration specified for manufacture=r of hand-rolled cheroots of tobacco

Application should be accompanied by : - A self-attested copy of Permanent Account number (PAN) allotted by income tax department

Copy of the registration Certificate obtained under local Sales Tax (E.g. In Maharashtra MVAT Registration Certificate )

Copy of the registration certificate obtained under interstate sales tax (viz. Central Sales Tax Registration Number)

Copy of the Shop Act license / NOC from the Grampanchayat or from competent local authority

Copy of the Factory Registration certificate under factory Act.

Balance Sheet of last three years (not applicable In Case of assesses starting new business

Statement Of turnover for current financial year till date of registration

The applicant or by his authorised agent having general "Power of Attorney (POA)". The Range Officer shall have power to call the original documents to verify power of attorney. Such document shall not be retained by the Range Officer but be returned immediately after verification

Memorandum of association and article of association in case of company / in case of partnership Partnership deed / in case of co operative society by laws etc.

Copy of registration number obtained under Customs (Viz. Customs Registration No. (BIN No.)) If Applicable

Import Export Code Registration Number copy obtained from Directorate General Foreign Trades If Applicable

-

13 | P a g e

The details of the three major excisable goods / inputs likely to be manufactured / used / traded should be mentioned

One Cancelled cheque along with the letter from the banker verifying account details

Current / Saving Bank Account statements of last few months of company and directors respectively

A copy of the Ground plan

Flow chart showing exact process of manufacturing (In case of manufacturer)

Copy of the board resolution in favor of registration under central excise in case of company

Two address proof of applicant who want to get register 1) In Case of let out property a) Copy of valid registered rent agreement. b) Copy Electricity Bill /Telephone bill / Property Tax assessment order or rent receipt of the owner. (Any Two) Date of the document should not be older that 6 month c) No Objection Certificate from the owner of the property as to registration under Central Excise Act. 2) In Case of property owned by applicant

Copy Electricity Bill /Telephone bill / Property Tax assessment order or rent receipt (Any Two) Name shown on the abovementioned document should be matched with the name of the applicant mentioned in the application form - Date of the document should not be older that 6 month

Address & identity proof of directors in case of company (Documents must be given of the director who is signing the application (Two documents for Address proof & One for Identity Proof (Having Photo Identity)) / the word director to be changed to the partner in case of partnership firm. a) Copy photocopy of Passport / Driving License / Bank Account / Voters identity card / Ration Card / Maintenance Bill / Electricity Bill - for Residence Proof Name shown on the above mentioned document should be matched with the name shown of the director in the application form - Date of the document should not be older

-

14 | P a g e

that 6 month b) Self Attested Pan Card Copy of the director / Partner

All other NOCs & documents according to the nature of the business.

The registration certificate mentions the Excise Control Code (ECC), the ECC is a 15 digit number which has first 10 digits of PAN, next two digits are either XM for manufacturer or XD for dealer and the last three digits are number like 001,002 etc.

When a manufacturer who is exempt from the registration is required to file a declaration, the same will be filed with the Assistant Commissioner of the jurisdictional Central Excise Division.

The Verification By department: The verification shall be made by the Inspector or Superintendent of Central Excise having jurisdiction over the premises (Range Officer) in respect of which the applicant has sought registration, within 5 working days of the receipt of application. As per the rules/notification, the registration certificate shall be issued within 7 working days. The Range Officer (Superintendent) either himself or through the Sector Officer (Inspector) shall verify whether the declared address and operations (intended) are genuine and the declarations made in the application are correct. If found in order, he will endorse the correctness of the same and append his dated signature on the office copies of the Registration application and the copy of the application with the registrant. If any deviations or variations are noticed during the verification, the same should be got corrected. Any major discrepancy, such as fake address, non-existence of any factory etc. shall be reported in writing to the Divisional Officer within 3 working days and the Range Officer shall initiate action to safeguard revenue.

Issue of Registration Certificate: All Registrations of each type should be numbered in a single series for the Range as a whole, commencing with serial no. 1 for each calendar year. The issuing authority should make every effort to complete all formalities and grant the Registration Certificate within 7 days of receipt of application in his office. Every Registration Certificate granted / issued by the registering authority shall be under his signature. He should also countersign the ground plan accompanying the Registration Certificate. The Registration Certificate and the duplicate copy of the plan should be returned to the registered person who shall exhibit his Registration Certificate or a certified copy thereof in a conspicuous

-

15 | P a g e

part of the registered premises. The Registering authority in a permanent file shall keep the application as well as the ground plan

Registration is not transferable.

If manufacturer cease to produce i.e., stops the production permanently then he should apply for de-registration.

SPECIMEN OF GROUND PLAN

-

16 | P a g e

PROFARMA OR SPECIMEN REGISTRATION FROM UNDER CENTRAL EXCISE

-

17 | P a g e

-

18 | P a g e

-

19 | P a g e

-

20 | P a g e

-

21 | P a g e

-

22 | P a g e

CHARGEABILITY OF EXCISE DUTY & RELEVANT RECORDS

Excise duty is levied on production of goods but the liability of excise duty arises only on removal of goods from the place of storage, i.e., factory (where any part of the excisable goods other than salt are manufactured or any manufacturing process is carried out.) or warehouse (the place at which the goods are stored after their production in factory) Excise duty is levied if goods are marketable. Actual sale is not relevant. Therefore, goods, which are given for free replacement during warranty period, are also liable for excise duty. As Excise duty is levied at the time of removal of goods. Hence the date of its actual production is not relevant. The date of removal is relevant and the rate of excise duty applicable on the date of removal shall be actual rate of excise duty to be paid. Clearance means taking goods out of factory. Thus, finished goods can be stored not removed in the place of manufacture (factory) without payment of duty. There is no time limit for removal of gods from place of manufacture i.e., factory. The records have to be maintained by manufacturer indicating particulars regarding:

1. Description of goods manufactured or produced

2. Opening Balance of goods manufactured or produced

3. Quantity produced or manufactured

4. Stock of goods

5. Quantity of goods removed

6. Assessable Value

7. Amount of duty payable; and

8. Amount of duty actually paid

The record should be preserved for 5 years. If the records are not maintained then penalty up to duty payable can be imposed and goods can be confiscated. If goods are stored at any other place other than factory, then goods can be cleared from factory without payment of duty, if commissioner permits. Goods can be cleared out of factory without payment of duty for carrying out tests and omission per unit.

-

23 | P a g e

TYPES & RATES OF EXCISE DUTIES

RATES OF EXCISE DUTY The basic rate of excise duty is 14% while in some cases there is a special duty if 8% which makes the excise duty in those cases at 22%. There is at present a cess for education called education cess, which is 2% of the excise duty; therefore, the effective excise duty comes out as 14.42% or 22.66%. DUTIES UNDER CENTRAL EXCISE ACT Basic duty and special duty of excise are levied under Central Excise Act.

BASIC EXCISE DUTY TO BE TERMED AS CENVAT - Basic excise duty (also termed as Cenvat as per section 2A of CEA added w.e.f. 12-5-2000) is levied at the rates specified in First Schedule to Central Excise Tariff Act, read with exemption notification, if any. [section 3(1)(a) of CEA]. The present general rate is 14% w.e.f. 1-3.2008. There is partial exemption to a few products.

SPECIAL DUTY OF EXCISE It is leviable under second schedule to the CETA, 1985. At present, all excisable goods are exempt from this duty

EDUCATION CESS ON EXCISE DUTY - In case of excise duty, calculation of cess is easy. If excise duty rate is 14%, education cess will be 0.28%. it is levied as a duty of excise under section 91 read with Section 93 of Finance (No. 2) Act, 2004 states that education cess is duty of excise, to be calculated on aggregate of all duties of excise including special excise duty or any other duty of excise, but excluding education cess on excisable goods). As per section 93(3) of Finance (No. 2) Act, 2004, all provisions of Central Excise Act, including those relating to refunds, exemptions and penalties will apply to education cess.

SECONDARY AND HIGHER EDUCATION CESS It is levied under section 136 read with section 138 of the finance Act, 207 as a duty of excise @1% on aggregate of all the duties of excise (Excluding education cess and secondary & higher education cess)

EXCISE DUTY IN CASE OF CLEARANCES BY EOU The EOU units are expected to export all their production. However, if they clear their final product in DTA (domestic tariff area), the rate of excise duty will be equal to customs duty on like article if imported in India. [Proviso to section 3(1)]. Note that even if rate of customs duty is considered for payment of duty, actually the duty paid by them is Central Excise Duty. The rate of customs duty is taken only as a measure. The EOU units can sale part of their final products in India at 50% of customs duty or normal excise

-

24 | P a g e

duty in certain cases.

NATIONAL CALAMITY CONTINGENT DUTY A National Calamity Contingent Duty (NCCD) has been imposed vide section 136 of Finance Act, 2001 [clause 129 of Finance Bill, 2001, w.e.f. 1.3.2001]. This duty is imposed on pan masala, chewing tobacco and cigarettes. It varies from 10% to 45%.

DUTIES UNDER OTHER ACTS - Some duties and cesses are levied on manufactured products under other Acts. The administrative machinery of central excise is used to collect those taxes. Provisions of Central Excise Act and Rules have been made applicable for levy and collection of these duties / cesses.

ADDITIONAL DUTY ON GOODS OF SPECIAL IMPORTANCE - Some goods of special importance are levied Additional Excise under Additional Duties of Excise (Goods of Special Importance) Act, 1957.

DUTY ON MEDICAL AND TOILET PREPARATIONS - A duty of excise is imposed on medical preparations under Medical and Toilet Preparations (Excise Duties) Act, 1955.

ADDITIONAL DUTY ON MINERAL PRODUCTS - Additional duty on mineral products (like motor spirit, kerosene, diesel and furnace oil) is payable under Mineral Products (Additional Duties of Excise and Customs) Act, 1958.

-

25 | P a g e

VALUATION OF GOODS:

Excise duty is payable on the basis of: 1. Specific duty based on measurement like weight, volume, length etc. 2. Percentage of Tariff value. 3. Maximum Retail Price. 4. Compounded levy Scheme 5. Percentage of Assessable Value (Ad-velour duty) The entire concept of Basis of Valuation can be explained with the help of the following flow diagram.

-

26 | P a g e

SPECIFIED EXCISE DUTY IS THE DUTY ON UNITS LIKE WEIGHT, LENGTH, VOLUME, ETC

Items Basic of specific Excise Duty

Cigarettes Length of Cigarette

Matches Per 100 Boxes

Sugar Per Quintal

Marble slab & Tiles Square meter

Color TV Screen size in cm

Cement Per Tonne

Illustration

Items Basic Excise Duty

Cement If retail price is up to Rs.190 per 50 Kg then CED is Rs.350 per MT If retail sale price is above Rs.190 but up to Rs.250, per 50 Kg then CED is 12 % of retail sale price In other cases CED is Rs.600 per MT

Cement Clinker

Rs. 350 per metric tonne

EXCISE DUTY ON TARIFF VALUE

Tariff Value is the value fixed by government from time to time. Government can fix different tariff value for different classes. Tariff Value is fixed for Pan Masala, Ready Made Garments. Illustration

Pan Masala in retail packages,- Amount (Rs.)

1) If retail sale price is not printed on the retail pack, -

Containing not exceeding tow gram per pack

Rs.1.50 per unit pack

Containing more than 2 grams but not exceeding 4 grams per pack

Rs.3.00 per unit pack

Containing more than 4 grams but not exceeding 10 grams per pack

Rs.3.00 + Rs. 1.25 per gram or part thereof exceeding 4 grams

2)If retail sale price (RSP) is printed on the retail pack

-

27 | P a g e

I) Goods fall under tariff item 21069020-

a) Having betel nut content not exceeding 15 %

78 % of printed RSP

b) Other than those specified in (a) above

56 % of printed RSP

II) Goods fall under heading 2403 50 % of printed RSP

EXCISE DUTY ON MRP

Government can specify the goods on which excise duty will be based on MRP. MRP shall be the maximum price at which excisable goods shall be sold to the final consumers. It includes taxes, freight and transport charges, commission to dealers etc. In case multiple MRPs are printed on product, the maximum MRP among all will be considered for valuation purposes. Excise duty on MRP is applicable on products on which quoting of MRP is necessary under the Weights and Measurements Act, e.g., Chocolates, Biscuits, Wafers, Ice Creams, Camera, Refrigerators, Fans, Footwear, Toothpaste etc. E.g.: - MRP declared on package of shaving cream is Rs.100, notified abetment is 30 % and the rate of excise duty is 14.42 %, then , the assessable value of such package of shaving cream = 100 -30 % of 100 = Rs.70 and the excise duty leviable on such package = 70 *14.42% = Rs.10.09. Few commodities and their respective abatement notified by the government are as under: -

Description Abatement as a percentage of retail sale price

Sharbat 28%

Toothpaste 33%

Thinners 38%

Electric Fans 38%

Aerated waters 40.50%

Computer parts / accessories, laptops and set top boxes , printers, monitors, modem have been brought under RSP based excise duty

-

28 | P a g e

EXCISE DUTY ON ASSESSABLE VALUE

Assessable Value is the value of transaction i.e., the value at which transaction takes place, in other words it is the price actually paid or payable for the goods on sales. It is also called transaction value. It includes freight and transportation charges, commissions to dealer etc. EXCISE DUTY IS PAID ON TRANSACTION VALUE OR ASSESSABLE VALUE IF:

1. Goods are sold at the time and place of removal. 2. Buyer and assessee (Manufacturer/seller) are not related. 3. Price is the only consideration for sale, i.e., money or some valuable item is received on sale.

INCLUSIONS AND EXCLUSIONS FROM ASSESSABLE VALUE INCLUSIONS TO ASSESSABLE VALUE: -

1. Primary packing or main packing or necessary packing. 2. Royalty charges. 3. Commission to sales agent. 4. Packing charges (except durable and returnable package) 5. Loading and unloading charges within the factory 6. Design and Engineering Charges 7. Royalty charged in Franchise agreement 8. Advertising, marketing etc incurred by the buyer on behalf of Assessee (not on principal to principal basis)

9. Parts used for repair, replacement during the warranty period 10. Storage

EXCLUSIONS FROM ASSESSABLE VALUE: -

1. Durable and returnable packing. 2. Excise Duty. 3. Sales Tax Sales tax, turnover tax, additional sales tax, surcharge on sale tax, Octroi Etc.

4. Returnable primary packing like cold drinks bottles, LPG cylinders.

5. Trade discount given at the time of sales. 6. Freight and insurance.

Assessable Value = (Sales Price less Deductions)/(1+rate of duty)

-

29 | P a g e

Illustration 1 Computation of transaction value when sale price includes excise and sales tax: - The-cum-duty price of the product is RS.5, 94,984/-. It includes sales tax @4% and excise duty @14% (Plus3% education cess and SHEC). Find out the assessable value and excise duty and sales tax? Solution: - Let the assessable value of the goods be Rs. X Since excise duty is14.42 % of X, the price of the goods for levy of sales tax is A + 0.1442X = 1.1442X Sales tax @ 4% of Rs. 1.1442 X = Rs. 0.045768X Total Price inclusive of excise duty and sales tax is equal to Rs.5,94,984 /- i.e. X+ 0.1442 X + 0.045768X = Rs.5,94,984 i.e. 1.189968 X = Rs.5, 94,984 i.e. X = Rs. 5, 94,984 / 1.189968 Therefore, X = Rs. 5, 00,000 i. Hence the assessable value of the product is Rs. 5,00,000/- ii. Excise duty @ 14.42% is Rs.72, 100/- . iii. Sales Tax @ 4% =(5,00,000+72,100) *4% = Rs. 22,884 Illustration 2 Compute the assessable value of the excisable goods, for levy of duty of excise on the basis of the information given below: -

Particulars Amuont(Rs)

Cum Duty wholesale price including sales tax Rs. 2500/-

15,000/-

Normal secondary packing cost 1,000/-

Cost of special secondary packing 1,500/-

Cost of durable ad returnable packing 1,500/-

Freight 1,250/-

Insurance on freight 200/-

Trade Discount (Normal Practice) 1,500/-

Rate of central Excise duty (including EC & SHEC)

14.42%

-

30 | P a g e

SOLUTIONS: Particulars Amuont(Rs) Amuont(Rs)

Cum - Duty Price 15,000

Deduction:

Sales Tax 2,500

Durable & Returnable packing 1,500

Freight 1,250

Insurance 200

Trade Discount 1,500

Total 8,050

Less : - Excise duty thereon @ 14.42% (8,050 *14.42 / 114.42 )

1,050

Assessable Value 7,035

% OF ASSESSABLE VALUE (AD-VALOREM DUTY)

When duty of central excise or customs is levied by applying the given

percentage of value of the goods, then, it is known as AD-VALOREM rate. In

other words, ad-valorem rates are based on value of goods. Ad-valorem rates

have inbuilt elasticity and quantum of duty levied automatically varies as

the value of the goods vary

E.g. : - If Excise duty rate is 14.42% and ad-valorem and the assessable

value of the goods is Rs. 1,00,000 then, the excise duty works out to be

Rs.14420

CENVAT UNDER CENTRAL EXCISE

The CENVAT Credit system is based on the Value Added Tax concept to

reduce the cascading effect hence we will first understand the concept of the

value added tax & cascading effect. And then we will move to CENVAT credit

system.

BASIC CONCEPT OF VALUE ADDED TAX (VAT)

Value Added Tax means on tax on value addition. Value addition means the value of output as reduced by value of inputs. Under value added tax all taxes borne in respect of inputs is allowed to be set off against the taxes paid on final product in order to subject only value addition, at each stage to taxation. The system of VAT avoids the cascading effect

-

31 | P a g e

Cascading effect:

The literal meaning of cascade is overlapping. Cascading effect in Taxation, in simple terms means Tax on Tax. It is the fundamental of any Tax structure in India that, no tax should be charged on the Tax. When a raw material passes through various stages of manufacture, before it is made available to the ultimate consumers as finished good, the manufacturing cost of the finished good includes raw material cost and Tax on the same. When consumer buys these finished goods the tax is levied on above mentioned cost of manufacture which results in cascading effect of the tax. The following example elaborates this in simple way: For simplifying the tax calculation we will assume, rate applicable is 10%

Transaction without VAT

Type of the Dealer

Cost Tax Amount @ 10%

Invoice value

Tax Payable

Remarks

For Raw material supplier

Sales for RM supplier

10,000 1,000 11,000 1,000

Tax To Be paid by Raw Martial Supplier, which will be collected from Manufacturer

For Manufacturer

Purchase

10,000 1,000 11,000

Sales 21,000 (10000+1000+10000)

2,100 (21,000*10%)

23,100 (21,000+2100)

2,100

While Selling goods manufacturer has added Profit + Cost of Rs.10,000

Total Excise Duty Paid 3,100

-

32 | P a g e

Summary: - Cost of the product in hands of final consumer : - Rs. 23100 Total Tax Paid to the government : - Rs. 3,100 (1,000+2,100) Tax to be paid by manufacturer : - Rs. 2,100

Transaction with VAT

Type of the Dealer

Cost Tax Amount @ 10%

Invoice value Tax Payable

Remarks

For Raw material supplier

Sales for RM supplier

10,000 1,000 11,000 1,000

Tax To Be paid by Raw Martial Supplier, which will be collected from Manufacturer

For Manufacturer

Purchase10,000 1,000 11,000

Sales 20,000 (10000+10000)

2,000 (20,000*10%)

22.000 (20,000+2000)

1,000

While Selling goods manufacturer has added Profit + Cost of Rs.10,000

Total Excise Duty Paid 2,000

Summary: - Cost of the product in hands of final consumer : - Rs. 22000 Total Tax Paid to the government : - Rs. 2,000 (1,000+1,000) Tax to be paid by manufacturer : - Rs. 1,000

Analysis of the Above Computation

Particulars without CENVAT

with CENVAT

Diff Reasons for Diff.

Cost of the product in hands of final consumer

23,100 22,000 1,100

The cascading effect i.e. Tax on Tax is

-

33 | P a g e

Total Tax paid to the government

3,100 2,000 1,100 resulted in to this difference. (The same point is elaborated below)

Tax to be paid by manufacturer

2,100 1,000 1,100

1) Transaction without VAT

Supplier supplies his output to manufacturer at Rs. 10,000. Thus, manufacturer gets the material at Rs. 11,000 inclusive of tax @ 10%. He carries out further processing and sells his output at Rs. 23,100. While calculating his cost, manufacturer has considered his purchase cost of materials as Rs. 11,000 and added Rs. 10,000 as his conversion charges plus profit. While selling product, manufacturer will charge tax again @ 10%. Thus final consumer / customer will get the item at Rs. 23,100 (21,000+10% tax). As stages of production and/or sales continue, each subsequent purchaser has to pay tax again and again on the material which has already suffered tax. This is called cascading effect.

2) Transaction with VAT

VAT was developed to avoid cascading effect of taxes. In the aforesaid example, value added by manufacturer is only Rs. 10,000 (20,00010,000), tax on which would have been only Rs. 1,000, while the tax paid was Rs. 2,000. In VAT, the idea is that manufacturer will pay tax on only Rs 10,000 i.e. value added by him. Then, it makes no difference whether a product passes through 5 or 10 stages or even 100 stages, as every person will pay tax only on value added by him to the product and not on total selling price.

-

34 | P a g e

CENVAT CREDIT SYSTEM

CENVAT Credit scheme before 1.4.2000 was known as MODVAT credit scheme. MODVAT means modified value added Tax now it has been changed to CENVAT. CENVAT stands for "Central Value Added Tax". This scheme is introduced with a view to remove the effect of the double taxation how this is being achieved can be understood with the help of the following example ABC Ltd is a manufacturer and it purchases certain components from PQR Ltd for use in manufacturing. PQR Ltd has to pay excise duty on components manufactured by it and it would have been recovered from ABC Ltd. Now, ABC Ltd has to pay excise duty on toys manufactured by it as well as bear the excise duty paid by its supplier, PQR Ltd. This results in multiple taxation. CENVAT is a scheme where ABC Ltd can take credit for excise duty paid by PQR Ltd so that lower excise duty is payable by ABC Ltd. Under this scheme, a manufacturer can take credit of excise duty paid on raw materials and components used by him in his manufacture. Accordingly, every intermediate manufacturer can take credit for the excise element on raw materials and components used by him in his manufacture. Since it amounts to excise duty only on additions in value by each manufacturer at each stage, it is called value-added-tax (VAT) The CENVAT credit can be utilized towards payment of excise duty on the final product. Advantages of CENVAT It reduces the effects of taxation at multiple stages of manufacture. It facilitates duty free exports. It increases the tax base. Disadvantages of CENVAT It increases paper work and leads to multiplicity of records. It leads to corruption. It leads to litigation.

-

35 | P a g e

GENERAL HIGHLIGHTS OF CENVAT SCHEME

Credit of inputs Input may be used directly or Indirectly: - The input may be used directly or indirectly in or in relation to manufacture. The input need not be present in the final product.

Inputs eligible for Cenvat to service provider / Manufacturer. No input credit if final product/output service exempt from

duty/ service tax: Credit on basis of specified documents: - Credit is to be availed only on the basis of specified documents as proof of payment of duty on inputs or tax on input services.

Cenvat on inputs (Capital Goods):- Credit of duty paid on machinery, plant, spare parts of machinery, tools, dies, etc., is available. However, up to 50% credit is available in current year and balance in subsequent financial year or years The new terms used in the above highlights are

CENVATABLE INPUTS INCLUDES FOLLOWING

1. Input credit on Raw Materials 2. Input credit on Consumables Stores 3. Input credit on Capital goods 4. Input credit on services

1. INPUT CREDIT (CENVAT) ON GOODS& CONSUMABLES:-

All goods, used in or in relation to the manufacture of final products whether directly or indirectly and whether contained in the final product or not

'Input' includes lubricating oils, greases, cutting oils, coolants,

-

36 | P a g e

accessories of the final products cleared along with the final product, goods used as paint, or as packing material, or as fuel, or for generation of electricity or steam used in or in relation to manufacture of final products or for any other purpose, within the factory of production

Input also includes goods used in manufacture of capital goods which are further used in the factory of manufacturer

Inputs used for test quality control check An input becomes a waste and is sold as scrap Inputs contained in waste Final product cleared in durable and returnable packing

2. INPUT CREDIT (CENVAT) ON CAPITAL GOODS: -

Tools, hand tools, knives etc. falling under chapter 82 * Machinery covered under chapter 84 * Electrical machinery under chapter 85 * Measuring, checking and testing machines etc. falling under chapter 90 * Grinding wheels and the like goods falling under sub-heading No 6801.10 * Abrasive powder or grain on a base of textile material, falling under chapter heading 68.02.

Pollution control equipment. Components, spares and accessories of the goods specified above. Moulds and dies. Refractories and refractory material. Tubes, pipes and fittings thereof, used in the factory. Storage Tank. Air- Conditioners, refrigerating equipments and computers would be eligible to CENVAT credit as capital goods (Should not be used in the offices)

If the truck purchased by the assessee in relation to bring the raw material, consumable & capital goods at premises then CENVAT credit in respect of duty paid on purchases of truck will be allowed as input credit on capital goods. The CENVAT scheme can be explained in short with the help of the following example.

3. INPUT CREDIT (CENVAT) ON SERVICES

Any Service used by a provider of taxable service for providing an output service; or

Any Service used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products from the place of removal;

And includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of provider of output service or an office relating to such factory or premises, advertisement or sales promotion, market research, storage up to the place of removal, procurement of inputs, activities relating to business, such as accounting, auditing,

-

37 | P a g e

financing, recruitment and quality control, coaching and training, computer networking, credit rating, share registry and security, inward transportation of inputs or capital goods and outward transportation up to the place of removal

CENVAT credit in respect of service tax paid on mobile phones (If used in relation to output service or in relation final manufacturing of the finished goods)

YOU CAN NOT TAKE CENVAT / INPUT CREDIT ON THE FOLLOWING (SPECIFICALLY DISALLOWED)

Light diesel oil, high speed diesel oil and motor spirit, commonly known as petrol.

Inputs destroyed before use / pilfered from store room Air- Conditioners, refrigerating equipments and computers would not be eligible to CENVAT credit as capital goods if it is used in the offices

Anything which is not used in the factory of the manufacturer will not be eligible for the CENVAT credit

The inputs used for construction and foundation of the machinery are not qualify for input credit. Similarly material used for maintaining factory building are not inputs (Except in case of Storage tank as it is specifically included in the capital goods) 1) The foundation made of cement, being immovable property is not capital goods; and 2) Cement was not used directly or indirectly in the manufacture of the final product

Inputs used in generation of the electricity, which is consumed by residential colony of the factory workers families, schools, etc will not be eligible for the CENVAT credit

Material used for repair do not qualify as inputs because repairs of final product or of the final goods does not amount to manufacturer

If the truck is purchased for delivery of the finished product then the excise duty paid on such truck will not be allowed as CENVAT credit

The CENVAT credit shall not be allowed on such quantity of inputs/ input service that are used in the manufacture of exempted goods / exempted services

CREDIT ON BASIS OF SPECIFIED DOCUMENTS

Invoice of manufacturer from factory Invoice of manufacturer from his depot or premises of consignment agent

Invoice issued by registered importer Invoice issued by importer from his premises or consignment registered with Central Excise

Invoice issued by registered first stage or second stage dealer

-

38 | P a g e

Supplementary Invoice Bill of Entry Certificate issued by an appraiser of customs in respect of goods imported through foreign post office

Challan of payment of tax where service tax is payable by other than input service provider

Invoice, bill or Challan issued by provider of input service on or after 10-9-2004

MEANING OF CENVAT CREDIT It means aggregation of following duties and taxes: -

Basic excise duty on indigenous inputs. Special excise duty. Additional Customs Duty paid u/s 3(5) of Customs Tariff Act w.e.f. 1-3-2005. This credit will not be available to service providers

Additional Excise Duty paid under Additional Duties of Excise (Goods of Special Importance) Act [AED(GSI)].

Education cess on manufactured excisable goods. This credit can be utilised only for payment of education cess on final product or output services.

National Calamity Contingent Duty (NCCD) leviable under section 136 of Finance Act, 2001 and corresponding CVD paid on imported goods. This credit can be used for payment of NCD on outputs only and not for any other duty.

Service tax on input services. Education cess paid on service tax. This credit can be utilised only for payment of education cess on final product or output services.

If all the above duties & cesses paid in case of imported inputs & capital goods , corresponding CVD paid is also eligible for CENVAT credit.

-

39 | P a g e

Illustration 1 : - Amount of the CENVAT Credit admissible Based on the following information, determine the CENVAT Credit available for use in the current year under CENVAT Credit Rules, 2004.

Goods Excise Duty paid at the time of purchases of the goods (Rs.)

Pollution Control Equipments 25,000

Spares for pollution Control Equipments

5,000

Equipments used in office 12,000

Storage Tank 10,000

Paints used for painting machinery used

6,000

Packaging Material 4,000

Lubricating oils 8,000

High Speed Diesel oil 7,000

-

40 | P a g e

Solutions:

Goods Amount (Rs.) Reasons for admissibility / in admissibility

Pollution Control Equipments

12,500 It is capital goods 50 % credit in current year.

Spares for pollution Control Equipments

2,500 It is capital goods 50 % credit in current year.

Equipments used in office

NIL Specifically Excluded from capital goods.

Storage Tank 5,000 It is capital goods 50 % credit in current year.

Paints used for painting machinery used

6,000 It is inputs, Hence, credit fully admissible.

Packaging Material 4,000 It is inputs, Hence, credit fully admissible.

Lubricating oils 8,000 It is inputs, Hence, credit fully admissible.

High Speed Diesel oil Nil Specifically excluded from input.

Total CENVAT Credit Available

38,000

Illustration 2: - An Assessee purchased inputs weighing 1,000 Kgs, The duty paid on inputs was Rs. 10,000 during transit, and 500 Kg. inputs were destroyed. Solution: - Here, 500 Kg goods were destroyed in transit and thus, they could not be used in or in relation to manufacture of excisable goods. Thus, the destroyed quantity of inputs doesnt qualify to be inputs within meaning of CENVAT Credit rules, 2004. Therefore, the CENVAT Credit admissible to the assessee will be Rs. 5,000 (10,000 *500 Kg /1000 Kg) in respect of the goods received by the assessee and used in or in relation to manufacture or production of excisable goods

-

41 | P a g e

JOB WORK & CENVAT WITH RELEVANT RECORDS

"Job work means processing or working on raw materials or semi finished goods supplied to job worker. So as to complete a part or whole of the process resulting in to manufacture or finishing of an article or any operation; which is essential for the aforesaid process" Large industries always get some processing done from outside on job work basis. This is called job work or sub contracting in engineering industry and processing in chemical or textile industry Following are the provision regarding the job work under Central Excise Act: -

When job workers contribute his own raw material to articles supplied by customers and manufactures different goods, it does not amount to job work But, addition of minor items by job worker should not distract it being job work

If an item is only repaired of reconciled, no duty liability arises as no new product emerges

If goods are manufactured during job work, excise liability will arise, as duty is on manufacture and who has supplied the raw material is immaterial

The job worker, who is engaged in manufacturing of readymade garments on job work basis, is exempt from duty. Exemption has been made in this case

DUTY PAYMENT PROVISIONS

Goods cleared from factory are cleared under an invoice. Duty is payable on monthly basis by 5th of the next month in which duty payment becomes due, i.e., the month in which goods are cleared from the factory. Duty is paid through current account called PLA and /or Central Value Added Tax Credit, i.e., CENVAT Credit. Small Scale Industry (SSI) is required to pay the duty by 15th of the next month. However, the duty for the month of March is paid by 31st March itself not on 5th of next month i.e., 5th of April because government accounts closes on 31st March. If the due date is Sunday or holiday, the duty can be paid on next working day. If duty is not paid then assessee is liable to pay the interest also on outstanding amount. If duty and interest is not paid for 30 days after due date, then the facility to pay duty on monthly basis will be withdrawn till the time interest and duty is paid or 2 months, whichever later. Thus, the facility of monthly payment of excise duty is withdrawn at least for 2 months. During this period duty will be paid on removal basis.

-

42 | P a g e

Duty is paid by assessee through current account known as PLA (Personal Ledger Account). The PLA is credited when duty is paid i.e., deposited in the bank by filling a Challan called TR-6 on monthly basis. Only excise duty paid comes in PLA the items like fine, penalty, interest does not appear in PLA.

A PLA contains:

1. Serial number and date 2. Details of G.A.R.-7 Challan number 3. Balance duty etc.

The PLA is maintained in triplicate using both sided carbon.

ACCOUNTING ENTRIES IN CASE OF MANUFACTURER - CUM SERVICE PROVIDOR

Accounting groups and accounting heads

The accounting groups and accounting heads are discussed hereunder:

(I) GROUPS OF ACCOUNTS

Sr. No.

Sides of Account

Particulars Remarks

(a) Income side

Sales All the sales which is covered under CENVAT to be booked under this group.

(b) Expenses side

Expenses

Net effect of all excise account will be transferred to excise expenses account which will be created under this group & other any other expenses head can be created under this group.

(c) Liabilities side

Duties of Taxes

All heads concerning to excise should be created under this head.

(d) Asset side Current Assets, Loans and Advances

CENVAT Credit which is available for utilization in the next year will be booked under this group.

(e) Fixed Asset

Fixed Asset Asset purchased has to be recorded under this group.

-

43 | P a g e

(II) ACCOUNTING HEADS

Sr. No.

Accounting Heads Under Group Remarks

(a) Sales of Excisable goods

Sales

At the time of removable of the excisable goods from the premises

CENVAT payable Duties & Taxes

CENVAT payable - EC Duties & Taxes

CENVAT payable - SHEC

Duties & Taxes

(b) Excisable Purchases Inputs

Purchases

At the time of goods are entered & received in premises

CENVAT Receivable (Inputs )

Duties & Taxes

CENVAT Receivable (Inputs ) - EC

Duties & Taxes

CENVAT Receivable (Inputs ) - SHEC

Duties & Taxes

(c) Excisable Purchases Capital Goods

Fixed Assets

At the time of Capital Goods are entered & received in premises (Respective Asset head need to be given instead of this account E.g. Machinery.)

CENVAT Receivable (Capital Goods)07-08

Duties & Taxes

CENVAT Receivable (Capital Goods)08-09

Current Assets, Loans & Advances

CENVAT Receivable (Capital Goods) EC 07-08

Duties & Taxes

CENVAT Receivable (Capital Goods) EC 08-09

Current Assets, Loans & Advances

CENVAT Receivable (Capital Goods) SHEC 07-08

Duties & Taxes receivable

CENVAT Receivable (Capital Goods) - SHEC 08-09

Current Assets, Loans & Advances

(d) Sales of Services Chargeable To ST

CENVAT Sales

When bill of service is raised on customer.

CENVAT Payable Duties &

-

44 | P a g e

(Output Services) Taxes

CENVAT Payable (Output Services) EC

Duties & Taxes

CENVAT Payable (Output Services) SHEC

Duties & Taxes

(e) CENVAT Payable (Output Services) Due

Duties & Taxes

When payment is received from customer

CENVAT Payable (Output Services) EC Due

Duties & Taxes

CENVAT Payable (Output Services) SHEC Due

Duties & Taxes

(f) Service Taxable Expenses

Expenses

When service taxable bill is received from vendor.

CENVAT Receivable (Input Services)

Duties & Taxes

CENVAT Receivable (Input Services) EC

Duties & Taxes

CENVAT Receivable (Input Services) SHEC

Duties & Taxes

(g) CENVAT Receivable (Input Services) Due

Duties & Taxes

When payment is done to vendor

CENVAT Receivable (Input Services) EC Due

Duties & Taxes

CENVAT Receivable (Input Services)SHEC Due

Duties & Taxes

(h) Excise Duty Expenses Expenses Net Effect of the all excise accounting transferred to this account.

(i)

Other accounting heads to be opened as normally opened in books of account.

(II) ACCOUNTING ENTRIES NOW ACCOUNTING ENTRIES ARE TO BE PASSED IN FOLLOWING MANNER: We will see the accounting entries of the following Illustration: - XYZ Ltd. Furnishes you the following details for the period ending April 2007

Plant & Machinery purchased on 01/04/2007 (inclusive of excise duty

-

45 | P a g e

@ 14.42%) from PQR Ltd. Of Rs. 11,44,200/-

Raw material purchased on 01/04/2007 (inclusive of excise duty @14.42 %) of Rs. 28,60,500/-

Input Services availed of during the month (Taxable value) amount fully paid for (Rate @12.36%) Rs. 1,00,000/-

Finished goods cleared on 30/04/2007(Assessable Value) (Rate @ 14.42%) of Rs. 40,00,000/-

Solution with relevant documentation: -

Invoice Showing Purchase of Fixed Asset

-

46 | P a g e

Accounting Entry For the invoice of Fixed Asset

Sr. No.

Accounting Heads Debit Amount

Credit Amount

Remarks

1. Excisable Purchases Capital Goods / Plant and Machinery A/c Dr.

100.00 As capital Goods half credit can be utilised in this year & half credit will be carried forward as it will be available in next year.

2. CENVAT Receivable (Capital Goods) 07-08 Dr.

7.00

3. CENVAT Receivable (Capital Goods)EC 07-08 Dr.

0.14

4. CENVAT Receivable (Capital Goods)SHEC 07-08 Dr.

0.07

5. CENVAT Receivable (Capital Goods) 08-09 Dr.

7.00

6. CENVAT Receivable (Capital Goods)EC 08-09 Dr.

0.14

7. CENVAT Receivable (Capital Goods)SHEC 08-09 Dr.

0.07

8. PQR Ltd. Cr. 114.42

9. Excisable Purchases Capital Goods / Plant and Machinery A/c Dr.

10,00,000 Based On the above proportion following entry can be passed.

10.CENVAT Receivable (Capital Goods) 07-08 Dr.

70,000

11. CENVAT Receivable (Capital Goods)EC 07-08 Dr.

1,400

12.CENVAT Receivable (Capital Goods)SHEC 07-08 Dr.

700

-

47 | P a g e

13. CENVAT Receivable (Capital Goods) 08-09 Dr.

70,000

14.CENVAT Receivable (Capital Goods)EC 08-09 Dr.

1,400

15. CENVAT Receivable (Capital Goods)SHEC 08-09 Dr.

700

16.XYZ Ltd. (Sundry Creditor) Cr. 1144200

RG23C Part-I is register of capital goods

The from RG 23C Part I is required to be maintained for the purpose recording the Duty credit taken on Capital Inputs and subsequently the credits can be set off against the Duty payable by the manufacturer. RG23C Part-II is register of cenvat credit on capital goods.

RG23C Part-II is the register maintained to record Cenvat credit on all Capital Goods and duty from cenvat credit account is debited.

Invoice Showing Purchase of Raw Material

-

48 | P a g e

Accounting Entry For the invoice of raw material purchases

Sr. No.

Accounting Heads Debit Amount

Credit Amount

Remarks

1 Excisable Purchases Inputs Dr. 100.00

2 CENVAT Receivable (Input) Dr. 14.00

3 CENVAT Receivable (Input) - EC Dr.

0.28

4 CENVAT Receivable (Input)SHEC Dr.

0.14

5 Supplier A/c (Sundry Creditor) Cr.

114.42

6 Excisable Purchases Inputs Dr. 25,00,000

7 CENVAT Receivable (Input) Dr. 3,50,000

8 CENVAT Receivable (Input)EC Dr.

7,000

-

49 | P a g e

9 CENVAT Receivable (Input)SHEC Dr.

3,500

10 Supplier A/c (Sundry Creditor) Cr.

28,60,500

An account in form of RG 23A - Part I : - This is a record of inputs The from RG 23A Part I is required to be maintained for the purpose recording the Duty credit taken on Material Inputs used in manufacturing process and subsequently the credits can be set off against the Duty payable by the manufacturer.

An account in form of RG 23A - Part II : - This is a record of CENVAT credit on inputs RG23A Part-II is the register for Cenvat Credit. Cenvat credit on all raw material is taken in part - II and duty from cenvat credit account is debited. Invoice Showing Purchase of Services

-

50 | P a g e

Accounting Entry For the invoice of purchases of services.

Sr. No.

Accounting Heads Debit Amount

Credit Amount

Remarks

1. Service Taxable Expenses Dr. 100.00

2. CENVAT Receivable (Input Services) Dr.

12.00

3. CENVAT Receivable (Input Services) EC Dr.

0.24

4. CENVAT Receivable (Input Services) SHEC Dr.

0.12

5. Input Service Provider (Sundry Creditor) Cr.

112.36

6. Service Taxable Expenses Dr. 1,00,000

-

51 | P a g e

7. CENVAT Receivable (Input Services) Dr.

12,000

8. CENVAT Receivable (Input Services) EC Dr.

2400

9. CENVAT Receivable (Input Services) SHEC Dr.

1200

10.Input Service Provider (Sundry Creditor) Cr.

112360

Sales Invoice rose on account of sales of finished goods.

-

52 | P a g e

Accounting entry for sales

Sr. No.

Accounting Heads Debit Amount

Credit Amount

Remarks

1. Sundry Debtors (Sundry Debtor) Dr.

114.42

2. Sales of Excisable Goods Cr. 100.00

3. CENVAT Payable Cr. 14.00

4. CENVAT Payable EC Cr. 0.28

5. CENVAT Payable SHEC Cr. 0.14

6. Sundry Debtors (Sundry Debtor) Dr.

45,76,800

7. Sales of Excisable Goods Cr. 40,00,000

8. CENVAT Payable Cr. 5,60,000

9. CENVAT Payable EC Cr. 11,200

10. CENVAT Payable SHEC Cr. 5,600

Daily Stock Account (D.S.A.)

Every assessee requires maintain records of stock on daily basis known as Daily Stock Account. It was earlier known as RG 1 Register. The DSA is to be kept in the factory and should be preserved for period of 5 years immediately after the financial year to which it pertains. The assessee shall duly authenticate the first & last page of such accounts / records.

-

53 | P a g e

Adjustment / Set off Entries

A. Towards CENVAT Credit (Basic)

1. CENVAT Payable Dr. 4,32,000

2. CENVAT Receivable (Capital Goods) 07-08 Cr.

70,000

3. CENVAT Receivable (Inputs ) Cr. 3,50,000

4. CENVAT Receivable (Input Services) Cr.

12,000

B. Towards Education Cess

1. CENVAT Payable EC Dr. 8,640

2. CENVAT Receivable (Capital Goods)-EC 07-08 Cr.

1,400

3. CENVAT Receivable (Inputs )-EC Cr.

7,000

4. CENVAT Receivable (Input Services)-EC Cr.

240

C. Towards Secondary & Higher Secondary Education Cess

1. CENVAT Payable SHEC Dr. 4,320

2. CENVAT Receivable (Capital Goods)-ESHC 07-08 Cr.

700

3. CENVAT Receivable (Inputs )-SHEC Cr.

3,500

4. CENVAT Receivable (Input Services)-SHEC Cr.

120

Account Current / Personal Ledger Account The account current, also called PLA i.e. personal ledger account, is an account current with the central government, which is utilized for payment of duties of excise. The account current is credited when the sum is deposited into the treasury and debited on payment of the excise duty. Each credit and debit entry should be made on separate lines and assigned a running serial number for the financial year. The PLA must be prepared in triplicate by writing with indelible pencil and using double sided carbon. Original and duplicate copies of PLA should be detached by the manufacturer and sent to the central excise officer along with monthly / quarterly periodical return in form E.R. -1 / E.R.-3

-

54 | P a g e

Payment of final amount Due

1. CENVAT Payable Dr. 1,28,000

2. CENVAT Payable EC Dr. 2,560

3. CENVAT Payable SHEC Dr. 1,280

4. Bank Account Cr. 1,31,840

Performa of Payment Challan in form No G.A.R. 7

Extract of the profit & Loss and Balance sheet after passing the above mention entries (except Final payment Entry through G.A.R. - 7)

SINEWAVE COMPUTER SERVICES PVT. LTD.(scspl)

Profit & Loss account for the period of 1st April 2007 to 30th April 2007

-

55 | P a g e

Particulars

Amount(Rs.)

Amount(Rs.)

Particulars

Amount(Rs.)

Amount(Rs.)

Purchase Accounts

25,00,000 Sales Accounts

40,00,000.00

Excise Purchase Inputs

25,00,000 Sales of Excisable goods

40,00,000

Direct expenses

1,00,000

Service Taxable Expenses

1,00,000

Gross profit c/o

14,00,000

40,00,000 40,00,000.00

Gross profit b/f

14,00,000.00

Net Profit 14,00,000

Total 14,00,000 Total 14,00,000.00

SINEWAVE COMPUTER SERVICES PVT. LTD.(scspl)

Balance Sheet as on 30th April 2007

LiabilitiesAmount(Rs.)Amount(Rs.) Assets Amount(Rs.) Amount(Rs.)

Capital Accounts

Fixed Assets

Loans (Liability)

Current Assets

4648900.00

Current Liabilities

3248900.00 Closing stock

(See Note 1)

Duties & Taxes (see Note 2)

131840.00 Loans & advances (Asset)

72100.00

Sundry creditors

3117060.00 Sundry Debtors

4576800.00

Profit & Loss A/c

1400000.00

Opening Balance

0

-

56 | P a g e

Current Period

1400000

Total 4648900.00 Total 4648900.00

Note 1 : Closing stock valuation has to be done & required to be shown in the books same adjustment entry not passed in this relevant extract

Note 2 : The payment entry against final liability of excise is not yet passed as it is required to show where the amount due against the excise liability appears in the balance sheet..

MONTHLY RETURN FOR PRODUCTION AND REMOVAL OF GOODS AND OTHER RELEVANT PARTICULARS AND CENVAT CREDIT

Every Assessee shall submit to the superintendent of central excise a monthly return of production, removal of the goods and other relevant particulars in E.R. 1 form within 10 days after the close of the month to which it relates. It is to be filed in duplicates

The return shall be accompanied by treasury receipted Challan for deposits of duty, original and duplicate copies of the PLA and extracts of CENVAT register and other documents as required by the commissioner it is to be filed in duplicate

Excise return is submitted to the excise department with the two copies of PLA and GAR-7 Challan. The excise return is prepared in form ER-1 and ER-3.