CATALYST EQUITY RESEARCH REPORT - Catalyst...CATALYST EQUITY RESEARCH REPORT CTPartners Executive...

Transcript of CATALYST EQUITY RESEARCH REPORT - Catalyst...CATALYST EQUITY RESEARCH REPORT CTPartners Executive...

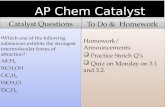

CATALYST EQUITY RESEARCH REPORT ™ Weekly Research Highlighting Activist Investments

Subscribe to receive this FREE Report emailed weekly.

www.hedgerelations.com/research.html

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

HIGHLIGHTING ACTIVIST INVESTMENTS Week Ending February 27, 2015

SYMBOL COMPANY INVESTOR

ADK AdCare Health Systems Park City Capital AEC Associated Estates Realty Land and Buildings APRI Apricus Bioscience Sarissa Capital ARIA Ariad Pharmaceuticals Sarissa Capital CAS AM Castle & Co Huber Capital CBR Ciber, Inc. Lone Star Value CCG Campus Crest Communities Clinton; Campus Evolution CSC Computer Sciences Corporation Jana Partners CTP CT Partners DHR International DAVE Famous Dave’s of America LionEye Capital ESSX Essex Rental Corp Casey Capital FRM Furmanite Corporation Mustang Capital HLSS Home Loan Servicing Solutions Kingstown Capital JNPR Juniper Networks Elliott Associates MEA Metalico Inc Adam Weitsman PBSK Poage Bankshares Joseph Stilwell PICO PICO Holdings River Rod Asset Management PKT Procera Networks Cannell Capital; Castle Union RIT LMP Real Estate Income Fund Bulldog Investors RWC Relm WirelessCorp Fundamental Global Partners SFLY Shutterfly Inc. Marathon Partners STC Stewart Information Services Bulldog Investors TRS TriMas Corporation Engaged Capital USAK USA Truck Baker Street; Stone House Capital WAIR Wesco Aircraft Holdings Makaira Partners YUME YuMe, Inc. AVI Partners

HEDGE FUND SOLUTIONS (HFS) provides investment research, strategy and stakeholder communications consulting to companies and investors interested in, or involved with, shareholder activist campaigns. Since 2001 HFS has become the trusted advisor to numerous institutional investors, CEOs and board members worldwide. HFS also administers The Official Activist Investing Blog™, the definitive source for activist shareholder information.

Catalyst Investment Research™ is a portfolio of activist investing research products that combine company-specific shareholder activism research with deep value investment analysis and access to industry insiders.

To Learn More: Download a brochure http://www.hedgerelations.com/CIR/CIR%20Brochure.pdf

Hedge Fund Solutions, LLC © 2003 – 2015 Page 2 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

AdCare Health Systems Inc (ADK) Activist Investor: Park City Capital

Investor Info Catalyst Info Shares 1,198,390 Catalyst:

Park City purchased warrants increasing its ownership from 5.3% to 6.2% Comment: We initially covered ADK on April 4 when Park City Capital disclosed a 5.1% “active” ownership stake in announced it was holding discussions with existing board members about board representation. On July 16 Park City sent a letter to the Chairman of ADK with a sum-of-the-parts analysis suggesting the stock should be trading around $13/share (currently $4). Park City also requested a board seat. A copy of Park City’s letter is available here: http://www.sec.gov/Archives/edgar/data/1004724/000121478213000297/parkcitycap-adcare13da1.htm On August 26 Park City sent a follow up letter to ADK after meeting with the Chairman. In this letter Park City introduces a REIT conversion scenario which suggests the REIT worth $5.28/sh + $0.28 annual dividend and the operating company worth $6.43/sh. A copy of Park City’s August 26 letter is available at the bottom of this SEC filing: http://www.sec.gov/Archives/edgar/data/1004724/000139834413004080/fp0008104_sc13da.htm

% Outstanding 6.2% Cost Basis 4.13 Company Info Share Price 4.50 Revenue 225M Market Cap 65M Enterprise Value 219M Net Cash -153M EBITDA 7M 52 wk. range 3.66 – 6.26 EV/EBITDA 30.7

Associated Estates Realty (AEC)

Activist Investor: Land and Buildings

Investor Info Catalyst Info Shares 1,671,885 Catalyst:

On February 24 AEC issued a presentation to “set the Record Straight” http://www.sec.gov/Archives/edgar/data/911635/000091163515000049/defa14afeb252015presentation.pdf On February 27 Land and Buildings issued a press release calling for real change and highlighting the potential upside for shareholders under a reconstituted board. http://www.sec.gov/Archives/edgar/data/911635/000090266415001434/p15-0844dfan14a.htm Comment: We initially covered AEC on November 17, 2014 when Land and Buildings announced plans to nominate 7 people to the board. http://www.sec.gov/Archives/edgar/data/911635/000090266414004418/p14-2227exhibit_1.htm On January 28 Land and Buildings held a conference call with 2 of its 7 director nominees to discuss its path to value improvement On January 28 Land and Buildings issued a presentation highlighting opportunities to unlock value at AEC http://www.sec.gov/Archives/edgar/data/911635/000090266415000340/p15-0222dfan14a.htm Land and Buildings sent a letter to the Chair and CEO of AEC commenting on its recent meeting http://www.sec.gov/Archives/edgar/data/911635/000090266415000510/p15-0376dfan14a.htm

Proxy Solicitor to Land and Buildings

% Outstanding 2.9% Cost Basis Not Avail Company Info Share Price 23.55 Revenue 195M Market Cap 1.4B Enterprise Value 2.2B Net Cash -745M EBITDA 102M 52 wk. range 116.37 – 26.22 EV/EBITDA 21.2

Hedge Fund Solutions, LLC © 2003 – 2015 Page 3 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Apricus Biosciences, Inc. (APRI) Activist Investor: Sarissa Capital

Investor Info Catalyst Info Shares 9,271,757 Catalyst:

Sarissa purchased 17.6% (through stock and warrants) as part of a subscription agreement with APRI. In exchange, Sarissa has the right to appoint 1 board member

% Outstanding 17.64 Cost Basis Not Avail Company Info Share Price 2.34 Revenue 8M Market Cap 96M Enterprise Value 81M Net Cash 16M EBITDA -11M 52 wk. range 0.92 – 2.75 EV/EBITDA Negative

Ariad Pharmaceuticals (ARIA) Activist Investor: Sarissa Capital

Investor Info Catalyst Info Shares 12,850,000 Catalyst:

On February 24 Sarissa added a third nominee to its slate Comment: On October 29, 2013 Sarissa Capital disclosed a 6.22% “active” stake in ARIA and disclosed plans to seek board representation. On February 21, 2014 ARIA agreed to appoint 1 rep from Sarissa to the board immediately and 1 additional director in the future approved by Sarissa Sarissa requested a waiver relating to the company's NOL Poison Pill in order to increase its ownership to 9.9%. The request was denied and ARIA claims the public request is a breach under the Feb 2014 standstill agreement. On February 13 we reported that there were rumors that Sarissa will launch a proxy contest before the Feb 25th deadline to nominate directors Sarissa nominated two candidates to the board and demanded any settlement include the CEO's retirement

% Outstanding 6.87% Cost Basis 3.75 Company Info Share Price 8.17 Revenue 105M Market Cap 1.5B Enterprise Value 1.4B Net Cash 118M EBITDA -155M 52 wk. range 4.90 – 8.85 EV/EBITDA Negative

Continue to Next Page

Hedge Fund Solutions, LLC © 2003 – 2015 Page 4 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

A.M. Castle & Co (CAS) Activist Investor: Huber Capital Management

Investor Info Catalyst Info Shares 2,573,142 Catalyst:

Huber increased its ownership from 8.1% to 10.9% Comment: We initially covered CAS on August 3, 2012 when CAS announced the adoption of a poison pill with a 10% trigger. On November 3, 2012 Huber changed investment from "passive" to "active" and disclosed an 8.2% ownership. On May 6, 2013 Huber announced its disappointment that CAS chose not put its poison pill up for a shareholder vote at the 2013 annual meeting. On September 20, 2013 Huber increased its "active" stake from 8.2% to 9.0% and said it is disappointed the board renewed the poison pill and revised the bylaws to classify the board. Huber currently owns 6.5% On January 5, 2015 Raging Capital disclosed a 14.5% "active" stake (avg. $7.32/sh) and announced its intention to nominate Kenneth Traub to be a director if Raging nominates one or more candidates for election to the board. In addition to RC’s 14.5% equity ownership, Raging owns $21.5M of the Company’s 12.75% senior notes. On January 26 Raging Capital nominated 3 to the board On February 2 Huber increased its ownership from 6.5% to 8.1%

Legal counsel to Raging Capital

% Outstanding 10.9% Cost Basis Not Avail Company Info Share Price 5.03 Revenue 982M Market Cap 143M Enterprise Value 407M Net Cash -264M EBITDA -8M 52 wk. range 5.52 – 15.64 EV/EBITDA Negative

Ciber, Inc. (CBR) Activist Investor: Lone Star Value Fund

Investor Info Catalyst Info Shares 2,792,374 Catalyst:

Lone Star nominated three director candidates to the board and issued a press release criticizing the board’s poor performance, corporate governance and compensation practices. http://www.sec.gov/Archives/edgar/data/918581/000092189515000515/dfan14a09482005_02272015.htm

Legal counsel to Lone Star Value

% Outstanding 3.6% Cost Basis Not Avail Company Info Share Price 3.92 Revenue 864M Market Cap 308M Enterprise Value 274M Net Cash 35M EBITDA 22M 52 wk. range 2.84 – 5.09 EV/EBITDA 12.4

Continue to Next Page

Hedge Fund Solutions, LLC © 2003 – 2015 Page 5 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Campus Crest Communities, Inc. (CCG) Activist Investor: Clinton Group/Campus Evolution Villages (CEV)

Investor Info Catalyst Info Shares Not Avail Catalyst:

On February 23 Clinton/CEV announced plans to file preliminary proxy materials and supported a process to evaluate strategic alternatives. http://www.sec.gov/Archives/edgar/data/1134119/000090266415001348/exhibit_1.htm On February 27 Clinton/CEV sent a letter to CCG shareholders highlighting why new directors are needed at the company. http://www.sec.gov/Archives/edgar/data/1134119/000090266415001452/p15-0846dfan14a.htm Comment: We initially covered CCG on February 16 when Clinton/CEV announced plans to run a proxy contest at CCG http://finance.yahoo.com/news/clinton-group-partners-campus-evolution-014800864.html CCG announced it is exploring strategic alternatives http://finance.yahoo.com/news/ccg-announces-exploration-strategic-alternatives-231900338.html

Legal counsel to Clinton Group

% Outstanding Not Avail Cost Basis Not Avail Company Info Share Price 7.69 Revenue 146M Market Cap 504M Enterprise Value 1.1B Net Cash -603M EBITDA 40M 52 wk. range 6.00 – 9.19 EV/EBITDA 27.6

Computer Sciences Corporation (CSC) Activist Investor: Jana Partners

Investor Info Catalyst Info Shares 8,371,757 Catalyst:

Jana increased its stake in CSC from 1.95% to 5.9%

Legal counsel to Jana Partners

% Outstanding 5.9% Cost Basis Not Avail Company Info Share Price 70.86 Revenue 12.6B Market Cap 10.0B Enterprise Value 10.3B Net Cash -330M EBITDA 1.3B 52 wk. range 54.23 – 73.29 EV/EBITDA 7.8

Continue to Next Page

Hedge Fund Solutions, LLC © 2003 – 2015 Page 6 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

CTPartners Executive Search (CTP) Activist Investor: DHR International

Investor Info Catalyst Info Shares 553,441 Catalyst:

On February 23 DHR disclosed a 5.1% "active" stake. http://www.sec.gov/Archives/edgar/data/1439199/000119312515058517/d879127dex994.htm On February 26 DHR increased its stake to 6.3% Comment: We initially covered CTP on February 13 when DHR’s offer for $7/share in cash was rejected by the board.

% Outstanding 6.3% Cost Basis 6.55 Company Info Share Price 6.96 Revenue 165M Market Cap 50M Enterprise Value 66M Net Cash -15M EBITDA 15M 52 wk. range 3.01 – 23.75 EV/EBITDA 4.4

Famous Dave’s of America (DAVE) Activist Investor: LionEye Capital

Investor Info Catalyst Info Shares 802,900 Catalyst:

LionEye increased its "active" stake from 9.8% to 11.2% Comment: We initially covered DAVE on March 1, 2013 when DAVE entered into a Nomination Agreement with PW Capital (at the time a 10.3% shareholder) in which the Company agreed to nominate one individual from PW Capital to its 6-member board. On May 21, 2013 Blue Clay increased its ownership to 7.6% after disclosing a 5.85% “active” stake on May 7. On June 24 Farnam Street Partners disclosed a 5.2% “active” stake and stated that shareholders would benefit from expense reduction and a share buyback On November 27, 2013 DAVE increased the size of its board from 6 to 7 and added one representative from Blue Clay Capital. In addition, DAVE reported a new agreement with PW Capital which effectively extended PW’s representation on its board. On January 14, 2014 DAVE added the former CEO of McDonald's USA to the board. Blue Clay and PW Partners amended their settlement agreements to allow for the expansion of the board from 7 to 8 members to accommodate the new director. On May 22, 2014 two incumbent directors resigned from DAVE's board and two new directors joined the board, including one individual from Pleasant Lake Capital (12.8%) On January 12 LionEye changed its filing status from "passive" to "active" and disclosed a 9.8% stake in DAVE

Legal counsel to LionEye

Strategy & Communications for DAVE

Legal counsel to PW Capital

% Outstanding 11.2% Cost Basis 29.25 Company Info Share Price 30.66 Revenue 149M Market Cap 220M Enterprise Value 223M Net Cash -3M EBITDA 16M 52 wk. range 23.00 – 34.72 EV/EBITDA 13.9

Hedge Fund Solutions, LLC © 2003 – 2015 Page 7 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Essex Rental Corp (ESSX) Activist Investor: Casey Capital

Investor Info Catalyst Info Shares 1,461,634 Catalyst:

Casey Capital disclosed a 5.9% "active" stake and sent a letter to the board requesting they examine strategic alternatives and add one representative from Casey to the board.

% Outstanding 5.9% Cost Basis 1.26 Company Info Share Price 0.75 Revenue 98M Market Cap 19M Enterprise Value 234M Net Cash -215M EBITDA 15M 52 wk. range 0.72 – 3.47 EV/EBITDA 15.5

Furmanite Corporation (FRM) Activist Investor: Mustang Capital

Investor Info Catalyst Info Shares 1,622,282 Catalyst:

Mustang issued a press release announcing it has modified its slate of four nominees. http://www.sec.gov/Archives/edgar/data/54441/000090266415001421/p15-0839exhibit_1.htm Comment: We initially covered FRM on December 4, 2014 when Mustang nominated four candidates to the board http://finance.yahoo.com/news/mustang-capital-announces-proxy-contest-143100251.html

% Outstanding 4.3% Cost Basis Not Avail Company Info Share Price 7.02 Revenue 526M Market Cap 264M Enterprise Value 284M Net Cash -22M EBITDA 30M 52 wk. range 5.75 – 12.70 EV/EBITDA 9.4

Home Loan Servicing Solutions (HLSS)

Activist Investor: Kingstown Capital

Investor Info Catalyst Info Shares 3,600,000 Catalyst:

Kingstown Capital disclosed a 5.1% "active" stake in HLSS and opposes the recently announced transaction with New Residential Investment, saying that book value should be valued $7 higher than it is Comment: We initially covered HLSS on February 9 when Mangrove (2.3%) sent a letter to the board urging the termination of HLSS's relationship with Ocwen Loan Servicing and announced plans to nominate directors to the board. http://finance.yahoo.com/news/mangrove-partners-delivers-letter-board-150000661.html On February 12 Mangrove nominated a full slate of 5 directors for election to the board http://www.sec.gov/Archives/edgar/data/1513161/000101359415000050/homeloandfan14a-021215.htm On February 22 New Residential (NRZ) agreed to buy HLSS for $18.25/share cash

Legal counsel to Kingstown Capital

% Outstanding 5.1% Cost Basis 13.80 Company Info Share Price 18.56 Revenue 185M Market Cap 1.3B Enterprise Value 7.8B Net Cash -6.5B EBITDA N/A 52 wk. range 9.73 – 23.38 EV/EBITDA N/A

Hedge Fund Solutions, LLC © 2003 – 2015 Page 8 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Juniper Networks, Inc. (JNPR) Activist Investor: Elliott Associates

39,241,000

Investor Info Catalyst Info Shares 25,899,060 Catalyst:

JNPR and Elliott revised the terms of their settlement agreement to include two board representatives on an 11-person board http://www.sec.gov/Archives/edgar/data/1043604/000119312515059289/d877879dex992.htm Comment: On January 17 Elliott disclosed a 6.2% “active” stake in JNPR comprised mostly of options and issued a presentation highlighting 3 courses of action the Company can take to improve value, including, (i) 200M cost reduction, (ii) $3.5B share repurchase, and (iii) optimize the product portfolio to focus on the greatest risk-adjusted return on investment. A copy of Elliott’s presentation is available here: http://www.sec.gov/Archives/edgar/data/904495/000101359414000026/juniper13dppt.htm Jana Partners (2.6%) disclosed in its Q4 investor letter that it has taken an ownership stake in JNPR and that the Company has an unfocused product line up and a lazy balance sheet and share price underperformance. Jana also believes the board would benefit from the addition of new directors with a fresh perspective. On February 24 JNPR entered into a settlement agreement with Elliott adding two Elliott representatives to a Board not to exceed 12 members. On March 12, 2014 Elliott increased its ownership from 6.2% to 7.4% and said it remains in active dialogue with the Company and believes the shares are significantly undervalued

Legal counsel to Jana Partners

% Outstanding 9.6% Cost Basis Not Avail Company Info Share Price 24.01 Revenue 4.6B Market Cap 9.7B Enterprise Value 9.1B Net Cash 600M EBITDA 817M 52 wk. range 18.41 – 26.88 EV/EBITDA 11.1

Metalico Inc. (MEA) Activist Investor: Adam Weitsman

Investor Info Catalyst Info Shares 6,816,136 Catalyst:

On February 23 Weitsman sent a letter to MEA offering to purchase the company for $0.78/share in cash. http://www.sec.gov/Archives/edgar/data/1048685/000092189515000494/ex991to3da310331002_02232015.htm MEA announced later that it has hired an investment bank to advise the board on its strategic alternatives https://finance.yahoo.com/news/metalico-hires-gordian-strategic-review-214802037.html Comment: We initially covered MEA on January 21 when Weitsman disclosed a 9.95% "active" stake in MEA and said he may discuss a going private transaction with the Board On February 4 MEA implemented a poison pill with a 15% trigger Weitsman increased his ownership to 11.69% and said he may nominate directors to the board

Strategy & Communications for Adam Weitsman

Legal counsel to Adam Weitsman

% Outstanding 11.69% Cost Basis 0.47 Company Info Share Price 0.63 Revenue 555M Market Cap 57M Enterprise Value 144M Net Cash -78M EBITDA 23M 52 wk. range 0.26 – 2.10 EV/EBITDA 6.8

Hedge Fund Solutions, LLC © 2003 – 2015 Page 9 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Poage Bankshares (PBSK) Activist Investor: Joseph Stilwell

Investor Info Catalyst Info Shares 374,708 Catalyst:

On February 27 Stilwell nominated one candidate to the board Comment: We initially covered PBSK in our September 23, 2011 Catalyst Research Reports, highlighting Stilwell’s 7.1% “active” ownership stake (currently 9.9%) and his statement that the Company’s value is not adequately reflected in the share price. On December 30, 2011 we reported that Stilwell had increased his ownership stake from 7.1% to 8.3% On February 25, 2013 Stilwell sent a letter to PBSK stating the Company is overcapitalized and that share repurchases are a simple, low-risk way to build shareholder value. To that end, Stilwell suggested the Company repurchase at least 10% of its shares every year while the stock is trading below book value. On October 21 Stilwell announced plans to seek board representation. Sandler O'Neill (8.08% shareholder) sent a letter to PBSK expressing its belief that the Company should not move forward with its announced acquisition of Town Square Financial and that the Company should not contest the request for board representation by Joseph Stilwell. On February 21 Stilwell nominated one person to the board of PBSK and announced his belief that the Company should be sold. On April 14 Stilwell sent a letter to shareholders examining the value of a potential sale. A copy of Stilwell’s letter is available here: http://www.sec.gov/Archives/edgar/data/1113303/000114420414022468/v374780_dfan14a.htm On May 1, 2014 Stilwell sent a letter to PBSK shareholders seeking support for his 1 board nominee. http://www.sec.gov/Archives/edgar/data/1113303/000114420414029972/v378465_dfan14a.htm

% Outstanding 9.7% Cost Basis Not Avail Company Info Share Price 15.04 Revenue 15M Market Cap 54M Enterprise Value 61M Net Cash -6M EBITDA N/A 52 wk. range 13.85 – 16.60 EV/EBITDA N/A

PICO Holdings Inc. (PICO) Activist Investor: Central Square

Investor Info Catalyst Info Shares 1,715,674 Catalyst:

River Road Asset Management sent a letter to the board suggesting they explore a sale of non-core assets and conduct a strategic review of its core business Comment: We initially covered PICO on February 9 when Central Square disclosed a 5% "active" stake for $20.34

Legal counsel to Central Square

% Outstanding 7.5% Cost Basis 19.74 Company Info Share Price 17.14 Revenue 355M Market Cap 391M Enterprise Value 483M Net Cash -92M EBITDA -12M 52 wk. range 15.66 – 26.36 EV/EBITDA Negative

Hedge Fund Solutions, LLC © 2003 – 2015 Page 10 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Procera Networks, Inc. (PKT) Activist Investor: Castle Union LLC; Cannell Capital

Investor Info Catalyst Info Shares 1,360,735 Catalyst:

On February 25 Cannell announced four candidates for election to the board. http://www.sec.gov/Archives/edgar/data/1058854/000121390015001371/dfan14a0215can_procera.htm On February 26 Castle Union nominated five candidates to the board. Comment: On October 20 Ronald Chez issued a press release demanding PKT's board examine strategic alternatives http://finance.yahoo.com/news/ronald-l-chez-requests-procera-110000764.html On October 28 Castle Union disclosed a 5.0% "active" stake in PKT and said it may engage with the board to discuss a sale of the business On December 5 Castle Union increased its ownership from 5% to 6.6% for $6.80/share On January 15 Cannell formed a group of investors owning 1.5% of PKT and announced plans to nominate new directors

Legal counsel to Castle Union

% Outstanding 6.6% Cost Basis 6.80 Company Info Share Price 9.01 Revenue 75M Market Cap 191M Enterprise Value 88M Net Cash 102M EBITDA -8M 52 wk. range 5.60 – 12.31 EV/EBITDA Negative

LMP Real Estate Income Fund (RIT) Activist Investor: Bulldog Investors

Investor Info Catalyst Info Shares 990,137 Catalyst:

Bulldog announced plans to nominate three to the board and present a proposal to authorize a self-tender at NAV http://www.sec.gov/Archives/edgar/data/1173557/000150430415000015/EX-99.pdf Comment: We initially covered RIT on January 15, 2015 when Bulldog disclosed a 6.01% "active" stake and stated that since the closed-end fund has been trading at a double digit discount to NAV for over a year shareholders should be afforded the opportunity to realize liquidity at NAV via a self-tender offer, open-ending or liquidation. Bulldog also said it may nominate directors or conduct a tender offer Bulldog increased its ownership from 6.01% to 7.26%

% Outstanding 8.65% Cost Basis Not Avail Company Info Share Price 12.99 Revenue Not Avail Market Cap Not Avail Enterprise Value Not Avail Net Cash Not Avail EBITDA Not Avail 52 wk. range 10.58 – 13.61 EV/EBITDA Not Avail

Continue to Next Page

Hedge Fund Solutions, LLC © 2003 – 2015 Page 11 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

RELM Wireless Corp. (RWC) Activist Investor: Fundamental Global Partners

Investor Info Catalyst Info Shares 1,645,231 Catalyst:

Fundamental GP increased its "active" ownership from 10.8% to 12% Comment: On May 8, 2013 we reported that Privet had disclosed a 6.3% “active” stake which was subsequently increased to 8.5% on May 17 and again to 9.9% on June 11. On August 1 Privet disclosed it had increased its “active” ownership stake from 9.9% to 12.7%. On September 12 RWC increased the size of its board from 6 to 8 and added two representatives from Privet to the open positions. January 7, 2014 Privet announced it will recommend the nominating committee refrain from re-nominating the company's chairman to the board at the 2014 annual meeting. On March 17 Privet said it was in discussions with RWC regarding its board composition On March 25, 2014 RWC entered into a settlement agreement with Privet (currently 15.8% at 2.77/sh) to appoint one additional Privet representative to the board. A copy of the settlement agreement is available here: http://www.sec.gov/Archives/edgar/data/2186/000135448814001416/rwc_ex101.htm On September 3, 2014 Fundamental Global disclosed a 6% "active" stake On October 8, 2014 Fundamental increased its stake to 8.4% On December 17, 2014 Fundamental increased its ownership to 10.8%

% Outstanding 12.0% Cost Basis 4.38 Company Info Share Price 6.21 Revenue 27M Market Cap 32M Enterprise Value 74M Net Cash 11M EBITDA 3M 52 wk. range 2.80 – 6.27 EV/EBITDA 23.8

Shutterfly Inc. (SFLY) Activist Investor: Marathon Partners

Investor Info Catalyst Info Shares 2,051,700 Catalyst:

Marathon nominated three candidates to the board. http://www.sec.gov/Archives/edgar/data/1125920/000092189515000510/dfan14a08009003_02262015.htm Comment: On July 2 SFLY announced it had hired an investment bank to examine a sale. On July 18 Marathon disclosed a 5.07% "active" stake in SFLY. Marathon sent a letter to SFLY stating that they would be willing to support the sale of SFLY, but only at a price that fairly compensates the shareholders for the upside they would forgo. They also indicated that the first quarter 2014 share repurchases at approximately $52 were viewed or should have been viewed by fiduciaries as having been made at well below fair value. This implies that the Board believes the current fair value of the common shares is significantly above $52 per share. On November 5, 2014 Marathon announced it had sent SFLY a letter recommending new strategies to enhance shareholder value in light of the Board's decision to remain independent

Legal counsel to Marathon Partners

% Outstanding 5.4% Cost Basis 34.67 Company Info Share Price 47.36 Revenue 921M Market Cap 1.8B Enterprise Value 1.7B Net Cash 110M EBITDA 90M 52 wk. range 36.30 – 54.79 EV/EBITDA 18.9

Hedge Fund Solutions, LLC © 2003 – 2015 Page 12 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

Stewart Information Services (STC) Activist Investor: Foundation Asset Management/ Engine Capital

Investor Info Catalyst Info Shares 1,154,289 Catalyst:

Bulldog disclosed a 5% "active" stake in STC and says the company should eliminate the class B stock, elect new directors and sell the business; Bulldog also nominated five candidates to the board. http://www.sec.gov/Archives/edgar/data/94344/000150430415000017/EX-99.pdf Comment: We initially covered STC in on December 4 when Foundation Asset Management changed its filing status from “passive” to “active” with a 5.7% ownership On January 21 Foundation AM formed an investment group with Engine Capital and announced plans to seek board representation. On February 12 STC entered into a settlement agreement with Foundation AM and Engine Capital (together owning 8.5% for $28.49/sh). Under the terms of the agreement STC nominated two new directors. STC also announced plans for $25M in cost reductions and a $70M share repurchase.

Legal counsel to Foundation Asset/Engine Capital

% Outstanding 5.01% Cost Basis Not Avail Company Info Share Price 37.63 Revenue 1.9B Market Cap 903M Enterprise Value 743M Net Cash 160M EBITDA 76M 52 wk. range 27.02 – 39.08 EV/EBITDA 9.7

TriMas Corporation (TRS) Activist Investor: Engaged Capital

Investor Info Catalyst Info Shares 451,488 Catalyst:

TRS agreed to appoint one representative recommended by Engaged Capital to the board and further agreed to provide the right for one additional Engaged representative in 2016 http://www.sec.gov/Archives/edgar/data/842633/000084263315000014/ex101_settlementagreementx.htm

Legal counsel to Engaged Capital

% Outstanding ~1.0% Cost Basis Not Avail Company Info Share Price 30.05 Revenue 1.5B Market Cap 1.4B Enterprise Value 1.9B Net Cash -615M EBITDA 199M 52 wk. range 23.68 – 39.16 EV/EBITDA 9.9

Continue to Next Page

Hedge Fund Solutions, LLC © 2003 – 2015 Page 13 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

USA Truck (USAK) Activist Investor: Baker Street; Stone House Capital

Investor Info Catalyst Info Shares 2,950,000 Catalyst:

On February 25 USAK entered into a new cooperation agreement with Baker Street and Stone House agreeing to register 2M shares owned by the investors and appoint 3 members to the board. http://www.sec.gov/Archives/edgar/data/883945/000092189515000504/ex991to13da307950017_022115.htm Comment: We initially covered USAK on September 26 when Knight Transportation’s offer to acquire USAK for $9 per share was rejected by the board. On September 30 Knight increased its stake from 7.9% to 11.3% and issued a press release commenting on USAK's rejection of its $9/share buyout offer. A copy of Knight’s press release is available here: http://www.sec.gov/Archives/edgar/data/883945/000089534513000235/pr13da3x99-4.htm On November 7 Baker Street disclosed a 13.3% "active" ownership stake in USAK at an avg. cost of $12.93/sh. On January 28 Stone House Capital changed its filing status from "passive" and disclosed a 14.7% "active" position at $12.63/share. (Note: Bill Ackman from Pershing Square is Stone House's largest investor). USAK and Knight Transportation entered into a settlement agreement to end litigation. Under the terms of the agreement Knight agreed not to acquire any additional shares and will not vote its shares at the annual meeting. On February 20 Stone House disclosed it has engaged in communications with USAK about operations, strategy and strategic direction On May 5 Baker Street and Stone House joined to form a 28% investment group called the "United Shareholders for the Benefit of USAK" On May 27 USAK entered into a cooperation agreement to appoint 1 representative from Baker Street and one representative from Stone House to the board.

Legal counsel to Baker Street

% Outstanding 28.0% Cost Basis 12.77 Company Info Share Price 30.74 Revenue 602M Market Cap 316M Enterprise Value 430M Net Cash -114M EBITDA 60M 52 wk. range 13.90 – 32.14 EV/EBITDA 7.1

Wesco Aircraft Holdings (WAIR) Activist Investor: Makaira Partners

Investor Info Catalyst Info Shares 7,389,142 Catalyst:

WAIR appointed one representative from Makaira to the board http://www.sec.gov/Archives/edgar/data/1378718/000110465915012839/a15-5141_1ex99d1.htm

% Outstanding 7.6% Cost Basis 16.41 Company Info Share Price 14.98 Revenue 1.5B Market Cap 1.5B Enterprise Value 2.5B Net Cash -900M EBITDA 209M 52 wk. range 11.98 – 23.10 EV/EBITDA 11.7

Hedge Fund Solutions, LLC © 2003 – 2015 Page 14 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

YuMe, Inc. (YUME)

Activist Investor: AVI Partners

Investor Info Catalyst Info Shares 2,683,632 Catalyst:

AVI increased its stake from 5.5% to 8.1% and said it is disappointed the company does not provide full financial transparency re its international and domestic business units. Comment: We initially covered YUME on January 15 AVI disclosed a 5.5% "active" stake in YUME

Legal counsel to AVI Partners

% Outstanding 8.1% Cost Basis 5.18 Company Info Share Price 5.65 Revenue 178M Market Cap 184M Enterprise Value 120M Net Cash 64M EBITDA -3M 52 wk. range 4.20 – 7.95 EV/EBITDA Negative

Hedge Fund Solutions, LLC © 2003 – 2015 Page 15 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

CONTACT INFORMATION: Hedge Fund Solutions, LLC Damien J. Park Tel. +1 215.325.0514 [email protected] FREE Subscription to the weekly report: http://www.hedgerelations.com/research.html or Email: [email protected]

The Catalyst Equity Research Report™ is a general circulation weekly. Hedge Fund Solutions and/or its affiliates (the “Firm”) may have a consulting relationship with the companies featured in this report (the “Companies”). The Firm may also actively trade in the securities of the Companies for its own account. At any time, the Firm, funds it manages and/or its employees or their family members may have a long or short position in registered or non-registered securities or in options on any such security of any company mentioned in this report. The information contained in this report is not a complete analysis of every material fact with respect to the company, industry, or security and is not an offer or solicitation to buy or sell any security. Although opinions and estimates expressed in this report reflect the current judgment of the Firm, the information upon which such opinions and estimates are based is not necessarily updated on a regular basis. In addition, opinions are subject to change without notice. The Firm from time to time may perform consulting services for companies mentioned in this report and may occasionally possess material, nonpublic information regarding such companies. This information is not used in the preparation of this report. Facts and other information contained in this report have been obtained from the public sources considered reliable but are not guaranteed in any way.

Hedge Fund Solutions’ Portfolio of Activist Investing Products

Catalyst Investment Research™

Download a Brochure

http://www.hedgerelations.com/CIR/CIR%20Brochure.pdf

Daily: Email Alerts Weekly: Catalyst Equity Research Report™

Special Reports

Quarterly Buying Analysis Top 50 Activist Investors

Shareholder Activism Report & Resource Portal

Specific Activist Target Catalyst Investment Research™

Hedge Fund Solutions, LLC © 2003 – 2015 Page 16 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

PLATINUM SPONSORS – Legal Advisers

Olshan Frome Wolosky LLP is a law firm dedicated to providing personal service tailored to the specific requirements and concerns of the firm’s clients. Olshan is widely recognized as a preeminent law firm in the activist strategy area, and represents experienced activist investors, funds new to the activist area, as well as other investment and hedge funds. Olshan has extensive experience advising clients in a wide range of activist strategies, from private negotiations with management to public, high profile proxy contests, including expertly and efficiently handling litigation relating to activist matters. We also specialize in mergers and acquisitions and hostile takeovers, with extensive expertise in these matters. Olshan’s highly regarded attorneys provide a full range of legal services and are uniquely positioned to provide expert advice regarding the complicated and nuanced legal issues facing activist investors today. Contact: Steve Wolosky, Partner Email: [email protected] Tel: +1 212.451.2333

Schulte Roth and Zabel LLP, one of the leading law firms in the activist investing area, has been involved in some of the highest-profile campaigns facing the business world in recent years. Serving both activist-only and occasional activists, the firm advises on federal securities law, state corporate law, Hart-Scott-Rodino, proxy rules and related matters, as well as handling investigations and litigations arising out of clients' activist activity. The firm, with over 375 lawyers in offices in New York, Washington, D.C., and London, has a long history of serving private equity and hedge fund clients. Contact: Marc Weingarten, Partner Email: [email protected] Tel: +1 212.756.2280 David Rosewater, Partner Email: [email protected] Tel: +1 212.756.2208

Hedge Fund Solutions, LLC © 2003 – 2015 Page 17 of 18

HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™

PLATINUM SPONSORS – Proxy Advisors

Alliance Advisors LLC is a multi-faceted shareholder communications firm specializing in proxy solicitation, corporate governance consulting, and information agent services. Our in-depth view of the investor communities and governance environment allows us to prepare for successful outcomes. Alliance Advisors’ “fight team” has built a distinguished reputation by successfully completing countless contested assignments. The team will complete a comprehensive analysis of the shareholder base and build a calculated battle plan accordingly. We will assist in the crafting and delivery of your message to the target audience, ensuring the message is heard and understood. Alliance Advisors consistently delivers successful outcomes to our clients. Contact: Peter Casey, Executive Vice President Email: [email protected] Tel: +1 973.873.7710

Innisfree M&A Incorporated is a full service proxy solicitation/investor relations firm providing clients with sound tactical and strategic advice and results-oriented implementation in proxy and consent solicitations (whether friendly or contested), tender and exchange offers, mergers, rights offerings, strategic restructurings and other domestic and cross-border transactions requiring action by public security-holders. We provide expert consulting services on a wide range of matters, including executive compensation proposals, corporate governance issues and investor relations. Innisfree’s reputation derives from our success in complex and/or contested situations. Key to that success is our ability to track, identify and understand the shifting dynamics of a company’s security-holder base and provide battle-tested advice based on that information. We are convinced, and our unrivaled record demonstrates, that this refined, analytical based approach enables us to deliver the extraordinary results our clients expect. Contact: Arthur Crozier, Co-Chairman Email: [email protected] Tel: +1 212.750.5837

MacKenzie Partners, Inc. is a full-service proxy solicitation, investor relations and corporate governance consulting firm specializing in mergers-and-acquisitions related transactions. The firm has offices in New York City, Los Angeles, Palo Alto and London. MacKenzie's services include corporate governance consulting, security holder solicitations, information agent services for tender and exchange offers, beneficial ownership identification, market surveillance and associated financial, investor and media relations services. We work in close partnership with our client's attorneys, investment bankers and other consultants, providing advice and counsel at each stage of the transaction. Contact: Mark Harnett, President Email: [email protected] Tel: +1 212.929.5877

Hedge Fund Solutions, LLC © 2003 – 2015 Page 18 of 18