Capital Budgeting Decisions Chapter 26. Capital Budgeting Budgeting for the acquisition of...

-

Upload

annice-wiggins -

Category

Documents

-

view

395 -

download

8

Transcript of Capital Budgeting Decisions Chapter 26. Capital Budgeting Budgeting for the acquisition of...

Capital Budgeting DecisionsCapital Budgeting DecisionsCapital Budgeting DecisionsCapital Budgeting Decisions

Chapter 26

Capital BudgetingCapital BudgetingCapital BudgetingCapital Budgeting

Budgeting for the acquisition of “capital assets”

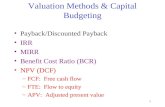

Capital budgeting techniques

(a) Payback period

(b) Accounting Rate of Return

(c) Net Present Value

(d) Internal Rate of Return

Analyzing alternative long-term investments and deciding which assets to acquire or sell.

Outcomeis uncertain.

Large amounts ofmoney involved.

Investment involveslong-term commitment.

Decision may bedifficult or impossible

to reverse.

Capital BudgetingCapital BudgetingCapital BudgetingCapital Budgeting

ExampleExampleExampleExampleCasey Co. is considering an investment of $130,000 in

new equipment. The new equipment is expected to last 10 years. It will have zero salvage value at the end of its useful life. The straight-line method of depreciation is used for accounting purposes. The expected annual revenues and costs of the new product that will be produced from the investment are:

Sales $200,000Cost of goods sold $145,000Depreciation expense 13,000Selling & Admin expense 22,000 180,000Income before income tax $20,000Income tax expense 7,000Net Income $13,000

Payback PeriodPayback PeriodPayback PeriodPayback Period

Time period required to recover the cost of the investment from the annual cash inflow produced by the investment.

Amount investedExpected annual net cash inflow

Computation of Annual Cash Computation of Annual Cash InflowInflow

Computation of Annual Cash Computation of Annual Cash InflowInflow

Expected annual net cash inflow =

Net income $13,000

Depreciation expense 13,000

$26,000

Cash Payback PeriodCash Payback PeriodCash Payback PeriodCash Payback Period

$130,000 $26,000 5 years/ =

Casey Co. wants to install a machine that costs $16,000 and has an 8-year useful life with zero salvage value. Annual net cash flows are:

YearAnnual Net Cash Flows

Cumulative Net Cash

Flows0 (16,000)$ (16,000)$ 1 3,000 (13,000) 2 4,000 (9,000) 3 4,000 (5,000) 4 4,000 (1,000) 5 5,000 6 3,000 7 2,000 8 2,000

Payback Period –Payback Period –Uneven Cash FlowsUneven Cash Flows

Payback Period –Payback Period –Uneven Cash FlowsUneven Cash Flows

YearAnnual Net Cash Flows

Cumulative Net Cash

Flows0 (16,000)$ (16,000)$ 1 3,000 (13,000) 2 4,000 (9,000) 3 4,000 (5,000) 4 4,000 (1,000) 5 5,000 6 3,000 7 2,000 8 2,000

4.2

Payback Period –Payback Period –Uneven Cash FlowsUneven Cash Flows

Payback Period –Payback Period –Uneven Cash FlowsUneven Cash Flows

We recover the $16,000purchase price between

years 4 and 5, about4.2 years for the payback period.

Consider two projects, each with a 5-year life and each costing $6,000.

Project One Project TwoNet Cash Net Cash

Year Inflows Inflows

1 2,000$ 1,000$ 2 2,000 1,000 3 2,000 1,000 4 2,000 1,000 5 2,000 1,000,000

Would you invest in Project One just because it has a shorter payback period?

Using the Payback PeriodUsing the Payback PeriodUsing the Payback PeriodUsing the Payback PeriodPayback = 3 years

Payback = 5 years

Accounting Rate of ReturnAccounting Rate of ReturnAccounting Rate of ReturnAccounting Rate of Return

Compare accounting rate of return to company’s required minimum rate of return for investments of similar risk.

The minimum return is based on the company’s cost of capital.

Average annual operating income from assetAverage amount invested in asset

Accounting Rate of ReturnAccounting Rate of Return

For Casey, average investment =

($130,000 + $0)/ 2 = $65,000

Average Investment =

Original Investment + Residual Value2

Solution to Accounting Rate of Solution to Accounting Rate of Return ProblemReturn Problem

Solution to Accounting Rate of Solution to Accounting Rate of Return ProblemReturn Problem

$13,000 / $65,000 = 20%

Average annual operating income from assetAverage amount invested in asset

Accounting Rate of ReturnAccounting Rate of ReturnAccounting Rate of ReturnAccounting Rate of Return

The decision rule is: A project is acceptable if its rate of return is

greater than management’s minimum rate of return.

The higher the rate of return for a given risk, the more attractive the investment.

Discounted Cash FlowsDiscounted Cash FlowsDiscounted Cash FlowsDiscounted Cash Flows

Considers both the estimated total cash inflows and the time value of money.

Two methods

1) net present value

2) internal rate of return

Net Present Value MethodNet Present Value MethodNet Present Value MethodNet Present Value Method

Find PV of future cash flows and compare with capital outlay

Interest rate used = required minimum rate of return

Proposal is acceptable when NPV is zero or positive.

The higher the positive NPV, the more attractive the investment.

Net Present ValueNet Present ValueNet Present ValueNet Present Value

We will assume that Casey Co’s annual cash inflows of $26,000 are uniform over the asset’s useful life.

The present value of the annual cash inflows can be computed by using the present value of an annuity of 1 for 10 periods. Assume the company requires a minimum return of 12%.

Net Present ValueNet Present ValueNet Present ValueNet Present Value

Cash Flow

When? Type of cash flow

Present value factor

Present value of

cash flows

(130,000) Now ($130,000)

NPV

26,000 Yrs 1-10 Annuity 5.650 146,900

$16,900

Analysis of the proposal: The proposed capital expenditure is acceptable at a required rate of return of 12% because the net present value is positive

Net Present ValueNet Present ValueNet Present ValueNet Present Value

When annual cash inflows are unequal, use present value of one tables.

Net Present ValueNet Present ValueNet Present ValueNet Present ValueCash Flow

When? Type of cash flow

PV factor Present value

(130,000) Now ($130,000)

36,000 1 Lump sum .893 32,148

32,000 2 “ .797 25,504

29,000 3 “ .712 20,648

27,000 4 “ .636 17,172

26,000 5 “ .567 14,742

24,000 6 “ .507 12,168

23,000 7 “ .452 10,396

22,000 8 “ .404 8,888

21,000 9 “ .361 7,581

20,000 10 “ .322 6,440

NPV $25,687

,,

Internal Rate of ReturnInternal Rate of ReturnInternal Rate of ReturnInternal Rate of Return

Interest yield of the potential investment

The interest rate that will cause the present value of the proposed capital expenditure to equal the present value of the expected annual cash inflows.

Internal Rate of ReturnInternal Rate of ReturnInternal Rate of ReturnInternal Rate of Return

STEP 1.Compute the internal rate of return factor using this formula:

Capital InvestmentAnnual Cash Inflows

$130,000 / $26,000 = 5.0

Internal Rate of Return MethodInternal Rate of Return MethodInternal Rate of Return MethodInternal Rate of Return MethodSTEP 2. Use the factor and the

present value of an annuity of 1 table to find the internal rate of return.

Locate the discount factor that is closest to 5.0 on the line for 10 periods.

Internal Rate of Return Internal Rate of Return Decision CriteriaDecision Criteria

The decision rule is:

Accept when internal rate of return is equal to or greater than the required rate of return

Reject when internal rate of return is less than required rate

Internal Rate of Return –Internal Rate of Return –Uneven Cash FlowsUneven Cash Flows

Internal Rate of Return –Internal Rate of Return –Uneven Cash FlowsUneven Cash Flows

If cash inflows are unequal, trial and error solution will result if present value tablesare used.

Use business calculators and electronic spreadsheets

Payback Accounting Net present Internal rateperiod rate of return value of return

Basis of Cash Accrual Cash flows Cash flowsmeasurement flows income Profitability Profitability

Measure Number Percent Dollar Percentexpressed as of years Amount

Easy to Easy to Considers time Considers timeUnderstand Understand value of money value of money

Strengths Allows Allows Accommodates Allowscomparison comparison different risk comparisons

across projects across projects levels over of dissimilara project's life projects

Doesn't Doesn't Difficult to Doesn't reflectconsider time consider time compare varying risk

value of money value of money dissimilar levels over theLimitations projects project's life

Doesn't Doesn't giveconsider cash annual rates

flows after over the lifepayback period of a project

Comparing MethodsComparing MethodsComparing MethodsComparing Methods