Can Abbott Labs Continue to Impress (1)

-

Upload

the-motley-fool -

Category

Healthcare

-

view

1.716 -

download

7

description

Transcript of Can Abbott Labs Continue to Impress (1)

Can Abbott Labs Continue to Impress?

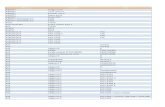

Abbott Labs: Second-Quarter ResultsAt a glance:• Sales growth of 3%

(1.9% after currency adjustment)

• Non-GAAP EPS grew 17.4% to $0.54

• GAAP EPS of $0.30 in line with same period a year ago

Abbott Labs: Second-Quarter Results

Raising full year guidance midpoints:• Non-Gaap EPS from

$2.21 to $2.24• GAAP EPS from $1.18

to $1.21

Abbott Labs: Established DrugsLatin America • Acquired CFR Pharmaceuticals

for $2.9 billion• Doubles branded generic

presence in the region• Expected addition of $900

million to 2015 sales• Latin American pharmaceutical

market forecast to increase from $73 billion in 2014 to $124 billion in 2018

Abbott Labs: Established DrugsLeaving difficult developed regions

• Selling developed markets branded generics pharmaceutical business to Mylan

• Abbott receives 21% stake in new entity to be composed of Mylan’s existing business and Abbott’s divested unit

• Intent to fuel emerging market growth with eventual sale of new entity

Abbott Labs: Medical Devices

Optics• Increased 12.2%• Recently launched

intraocular lenses gaining share

• Offsetting steep losses in diabetes and drug eluting stents

Abbott Labs: Medical Devices

New Glucose Monitor

• EU approval likely before end of year

• Wearable sensor makes finger pricks unnecessary

Abbott Labs: NutritionReturning to growth

• Supplier recall in August 2013 sent international pediatric nutrition into tailspin

• Segment up 0.5% on year-to-year operational basis

Abbott Labs: NutritionReducing risk of repeat• Developing dairy farm

hub in China through alliance with Fonterra

• Opened new Chinese plant to manufacture baby formula for local market

Abbott Labs: Look Out ForBoosting profitability● loss of

pharmaceuticals following AbbVie split exposed lackluster margins

● Improvement already visible

● Still plenty of opportunity to boost earnings

Smart investors know dividend stocks like Abbott Labs crush their non-dividend paying counterparts over the long term. Our top analysts put together a report on a group of high-yielding stocks that should be in any income investor’s portfolio.