Caledon Coal - CHDC Coal • Queensland ... for underground coal mines •Collaborative style ......

Transcript of Caledon Coal - CHDC Coal • Queensland ... for underground coal mines •Collaborative style ......

Caledon Coal

• Queensland coking coal producer operating and expanding the Cook underground mine

• Developing Minyango Project • Foundation shareholder in the Wiggins Island Coal

Export Terminal (WICET) • Acquired by Guangdong Rising Assets Management

(GRAM) in August 2011

2

GRAM

• Incorporated in 1999, GRAM is a State‐owned investment group

• Regulated by the Guangdong Provincial Government’s arm of the State‐Owned Assets Supervision and Administration Commission (SASAC).

• Caledon is a foundation shareholder of the new port at Gladstone and is represented on the Board

• Successful in securing 4Mt of the 27Mt first phase development

• Fundraising of A$4b completed in September 2011

• Construction started in September 2011 and is on track for commissioning Q1 2015

6

Wiggins Island Coal Terminal

TERMINAL MASTER PLAN

7. WICET potential coal export capacity of ~114Mtpa

Comprising: • four rail receival facilities; • stockyards on Golding Point;

and Reclamation Area B; • four berths; and • four shiploaders.

Rail Receival Stations

Bridge Stackers

Stacker Reclaimers

Shiploaders Berths Indicative Throughput

Capacity Stage 1 1 1 0 1 1 27 Mtpa WEXP1 2 1 3 2 3 61 Mtpa WEXP2 3 1 6 3 4 91 Mtpa WEXP3 4 1 7 4 4 114 Mtpa

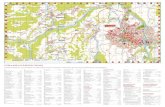

Cook Colliery

Argo seam workings in North and South

Surface area covered by grazing land, good access throughout if required

Site unaffected directly by flooding in recent years

Cook Colliery

Argo seam workings in North and South

Surface area covered by grazing land, good access throughout if required

Site unaffected directly by flooding in recent years

Modernisation Strategy

• Upgrade our Roadway Development Equipment – 4x continuous miner sections (1 of which is spare) – 3 x have been built, 4th Machine will be re-built in

2015

• Upgrade of the Mines Infrastructure – Replace the Conveyor Belt System – Electrical Power – Compressed Air – Clean Water System – Waste water pumping and storage system All jobs are in progress and expected to be completed during August 2014

Modernisation Strategy

• Establish an In-House Mine Atmosphere Inertisation Capability – Cook purchased a Nitrogen generator in 2013 so that

this function is permanently available – Cook maintains all old workings in a stable inert state

• Upgrade the Mines Atmospheric Monitoring System – completed in 2013

• Upgrade the Ventilation Modelling Capability – Long term mine plan – Emergency Scenario Planning in conjunction with

Queensland Mines Rescue

17

Cook Mine Expansion – Great Wall Project

19

• Introduce longwall mining to Cook Colliery in 2014

• Initial production of 3.5 MTPA (ROM) • Target longwall output 2.5 MTPA • Utilise existing equipment to produce

1.0 MTPA • Upgrade the colliery infrastructure

• conveyor belts, electricity supply • coal handling and processing

capability

A Modern Longwall for Cook

• Recent changes in equipment design have resulted in more effective ground support

• Change in accepted application of longwall mining in Australia

• A modern longwall delivers significant productivity

gains at a more than acceptable level of risk

The Great Wall Project

• Technical evaluation has been primarily focussed on major risks to the project: – Reserves / Geological model – Mine plan and operations – Geotechnical analysis – Infrastructure – Human resources – Financial model

• Robust and profitable project

Longwall Equipment Supplier

• Proven track record of equipment supply • Proven track record of product support • Products must have current statutory approvals

for underground coal mines

• Collaborative style – Smaller company, greater exposure – Risks must be controlled – Working for the best solution for the Customer

22

Cook Longwall

23

• Contract awarded July 2013 • Project management – Nepean Longwall

Component Origin Supplier

Roof Supports China BMJ

Electro-hydraulic Controls

Germany Tiefenbach

AFC / BSL / Crusher China Nepean / Anhui Yingliu

Shearer Germany Eickhoff

Monorail USA / Australia Longwall Hydraulics

Pump Station Germany / Australia

Longwall Hydraulics

Electrical Australian Nepean Power

Stakeholder Participation

• Caledon invited key industry Stakeholders to inspect manufacturing facilities in China and the mini-build at Rutherford, NSW – GRAM Board – State Coal Mining Inspectors – Insurance agents – Other coal mining companies

33

Coal Handling and Preparation Plant (CHPP)

• Existing plant 35+ years old

• Sub-lease from Glencore • Dedicated Rail Balloon

Loop

• Upgrade to CHPP – 500 t/hr, 3.5 Mt /yr Capacity – Dense Medium Process – Raw Coal Feed to be sized – Fine Coal Recovery Circuit

Introduced – Reject Material to be dried

Minyango

• 1.2 billion tonne resource • Updated JORC standard

resource statement imminent • Exploration has been slowed

due to GWP • 5 Mtpa ROM • EIS has been completed &

accepted by Qld Government • Mining lease anticipated

2014 – 2015 • Development will be Market

Driven

Conclusion

• The Sino-Aussie opportunities are there. • Caledon was forced into rapidly re-visiting our options in

regard to WICET due to – Australian Government process – Typical supply schedules from traditional suppliers

• The modernisation of Cook Colliery is a great example the influence Chinese stakeholders can have on Australian Projects

• Australian Suppliers can reap tremendous gains if they are willing to develop a market share in collaboration with overseas suppliers (sharing of risk with customer)

• Australia needs to quicken the pace both at Government and Corporate level or miss out !!

42