C2. Taxpayers

-

Upload

casey-ibasco -

Category

Documents

-

view

239 -

download

0

Transcript of C2. Taxpayers

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 1/48

1

Fin?

Pg Topic Case Title

1 Aliens Garrison v CA, July 19, 19904 Domestic Corporations CIR v British Overseas Airways, April 30, 198

!" Ree#eri$ %A&ster#a&' an# Royal Intero(ean )ines v CIR, June *3, 198810 +arueni Corp v CIR, -ept 14, 198914 A((enture v Cir, July 11, *01*

*0 Partnerships Gat(halian v CIR*4 .as(ual v CIR*8 CIR v -C Johnson an# -on, June */, 1999

34 Reyes v CIR3 van2elista v CIR

Royal Intero(ean )ines v CIR, June *3, 198840 Oa v CIR, +ay */, 19*

G.R. Nos. L-44501-05 July 19 1990

J!"N L. G#RR$%!N FR#N& R!'(RT%!N R!'(RT ". C#T"() J#*(% +. R!'(RT%!N F(L$C$T#% ,(G*#N an/ (,+#R, *cGR& petitioners,

vs C!RT !F #PP(#L% an/ R(P'L$C !F T"( P"$L$PP$N(% respon#ents

N#R#%# J.:

-ou2ht to e overturne# in these appeals is the $u#2&ent o5 the Court o5 Appeals, 1 whi(h a55ir&e# the #e(ision o5

the Court o5 6irst Instan(e o5 7a&ales at Olon2apo City (onvi(tin2 the petitioners o5 violation o5 -e(tion 4/ a:

1: : o5 the !ational Internal Revenue Co#e, as a&en#e#, y not 5ilin2 their respe(tive in(o&e ta; returns 5or the

year 199 an# senten(in2 ea(h o5 the& to pay a 5ine o5 <wo <housan# .*,00000: .esos, with susi#iary

i&prison&ent in (ase o5 insolven(y, an# to pay the (osts proportionately

<he petitioners have a#opte# the 5a(tual 5in#in2s o5 the Court o5 Appeals, 2 viz =

1 JO>! ) GARRI-O! was orn in the .hilippines an# live# in this (ountry sin(e irth up to

194/, when he was repatriate# an# returne# to the ?nite# -tates >e staye# in the ?nite# -tates5or the 5ollowin2 twenty years until +ay /, 19/, when he entere# the .hilippines throu2h the Clar@

Air Base <he sai# a((use# live# in the .hilippines sin(e his return on +ay , 19/ >e lives with his

6ilipino wi5e an# their (hil#ren at !o 4 Corpus -treet, est <apina(, Olon2apo City, an# they own

the house an# lot on whi(h they are presently resi#in2 >is wi5e a(uire# y inheritan(e si;

he(tares o5 a2ri(ultural lan# in ueDon .rovin(e

* JA+- ROBR<-O! was orn on Ee(e&er **, 191/ in Olon2apo, 7a&ales an# he 2rew up

in this (ountry >e an# his 5a&ily were repatriate# to the ?nite# -tates in 194/ <hey staye# in

)on2 Bea(h, Cali5ornia until the latter part o5 194 or the early part o5 194, when he was reF

assi2ne# overseas, parti(ularly to the .a(i5i( area with ho&e ase in Gua& >is ne;t arrival in the

.hilippines was in 19/8 an# he staye# in this (ountry 5ro& that ti&e up to the present >e is

presently resi#in2 at !o */ li(ao, -treet, ast Ba$a(FBa$a(, Olon2apo City, an# his house an# lotare #e(lare# in his na&e 5or ta; purposes

3 6RA! ROBR<-O! was orn in the .hilippines an# he live# in this (ountry up to 194/, when

he was repatriate# to the ?nite# -tates alon2 with his rother, his (oFa((use# Ja&es Roertson

>e staye# in the ?nite# -tates 5or aout one year, #urin2 whi(h ti&e he resi#e# in +a2nolia

Avenue, )on2 Bea(h, Cali5ornia -o&eti&e in 194 or early 194, he was assi2ne# to wor@ in the

.a(i5i( Area, parti(ularly >awaii At that ti&e he ha# een visitin2 the .hilippines o55 an# on in

(onne(tion with his wor@ In 19*, he returne# on(e &ore to the .hilippines an# he has een

resi#in2 here ever sin(e >e is &arrie# to a 6ilipino (itiDen na&e# Generosa Jui(o an# they live at

!o 3 !ational Roa#, )ower ala@lan, Olon2apo City <he resi#ential lot on whi(h they are presently

resi#in2 is #e(lare# in his wi5eHs na&e 5or ta; purposes, while the house (onstru(te# thereon was

ori2inally #e(lare# in his na&e an# the sa&e was trans5erre# in his wi5eHs na&e only in 6eruary,191

4 ROBR< > CA<> was orn in <ennessee, ?nite# -tates, on April 8, 191 his 5irst arrival in the

.hilippines, as a &e&er o5 the lieration 5or(es o5 the ?nite# -tates, was in 1944 >e staye# in the

.hilippines until April, 19/0, when he returne# to the ?nite# -tates, an# he (a&e a(@ to the

.hilippines in 19/1 >e staye# in the .hilippines sin(e 19/1 up to the present

/ 6)ICI<A- E G?7+A! was orn in the .hilippines in 193/ an# her 5ather was a naturaliDe#

A&eri(an (itiDen hile she was stu#yin2 at the ?niversity o5 -to <o&as, +anila, she was re(ruite#

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 2/48

2

to wor@ in the ?nite# -tates !aval Base, -ui( Bay, .hilippines A5terwar#s, she le5t the .hilippines

to wor@ in the ?nite# -tates !aval Base, >onolulu, >awaii, an# she returne# to the .hilippines on or

aout April *1, 19 <he sai# a((use# has not le5t the .hilippines sin(e then -he is &arrie# to

Jose #e GuD&an, a 6ilipino (itiDen, an# they an# their (hil#ren live at !o 9 6en#ler -treet, ast

<apina(, Olon2apo City >er husan# is e&ploye# in the ?nite# -tates !aval Base, Olon2apo City,

an# he also wor@s as an insuran(e &ana2er o5 the <ravellerHs )i5e

EARE +(G?R (a&e to the .hilippines on July 11, 19 an# he staye# in this (ountry

(ontinuously up to the present ti&e

A)) <> .<I<IO!R- are ?nite# -tates (itiDens, entere# this (ountry un#er -e(tion 9 a: o5 the .hilippine

I&&i2ration A(t o5 1940, as a&en#e#, an# presently e&ploye# in the ?nite# -tates !aval Base, Olon2apo City 6or

the year 199 John ) Garrison earne# K1/,*8800 6ran@ Roertson, K1*,04/84 Roert > Cathey, K9,8//*0

Ja&es Roertson, K14,98//4 6eli(itas #e GuD&an, K 8,/0*40 an# #war# +(Gur@ K1*,4099

A)) -AIE .<I<IO!R- re(eive# separate noti(es 5ro& )a#islao 6ir&a(ion, Eistri(t Revenue O55i(er, statione# at

Olon2apo City, in5or&in2 the& that they ha# not 5ile# their respe(tive in(o&e ta; returns 5or the year 199, as

reuire# y -e(tion 4/ o5 the !ational Internal Revenue Co#e, an# #ire(tin2 the& to 5ile the sai# returns within ten

#ays 5ro& re(eipt o5 the noti(e But the a((use# re5use# to 5ile their in(o&e ta; returns, (lai&in2 that they are not

resi#ent aliens ut only spe(ial te&porary visitors, havin2 entere# this (ountry un#er -e(tion 9 a: o5 the .hilippine

I&&i2ration A(t o5 1940, as a&en#e# <he a((use# also (lai&e# e;e&ption 5ro& 5ilin2 the return in the .hilippines

y virtue o5 the provisions o5 Arti(le LII, para2raph * o5 the ?-FR. +ilitary Bases A2ree&ent

<he petitioners (onten# that 2iven these 5a(ts, they &ay not un#er the law e #ee&e# resi#ent aliens reuire# to

5ile in(o&e ta; returns >en(e, they ar2ue, it was error 5or the Court o5 Appeals M

1: to (onsi#er their physi(al or o#ily presen(e in the (ountry as su55i(ient y itsel5 to uali5y the&: as

resi#ent aliens #espite the 5a(t that they were not Hresi#entsH o5 the .hilippines i&&e#iately e5ore their

e&ploy&ent y the ?- Govern&ent at -ui( !aval Base an# their presen(e here #urin2 the perio# (on(erne# was

#i(tate# y their respe(tive wor@ as e&ployees o5 the ?nite# -tates !aval Base in the .hilippines, an#

*: to re5use to re(o2niDe their ta;Fe;e&pt status un#er the pertinent provisions o5 the R.F?- +ilitary Bases

A2ree&ent

<he provision alle2e# to have een violate# y the petitioners, -e(tion 4/ o5 the !ational Internal Revenue Co#e, as

a&en#e#, rea#s as 5ollows=

-C 4/ M In#ivi#ual returns a: Reuire&ents 1: <he 5ollowin2 in#ivi#uals are reuire# to 5ile

an in(o&e ta; return, i5 they have a 2ross in(o&e o5 at least One <housan# i2ht >un#re# .esos 5or

the ta;ale

year

: I5 alien resi#in2 in the .hilippines, re2ar#less o5 whether the 2ross in(o&e was #erive# 5ro&sour(es within or outsi#e the .hilippines

<he san(tion 5or rea(h thereo5 is pres(rie# y -e(tion 3 o5 the sa&e (o#e, to wit=

-C 3 .enalty 5or 5ailure to 5ile return nor to pay ta; M Anyone liale to pay the ta;, to &a@e a

return or to supply in5or&ation reuire# un#er this (o#e, who re5uses or ne2le(ts to pay su(h ta;,

to &a@e su(h return or to supply su(h in5or&ation at the ti&e or ti&es herein spe(i5ie# ea(h year,

shall e punishe# y a 5ine o5 not &ore than <wo <housan# .esos or y i&prison&ent 5or not &ore

than si; &onths, or

oth

<he provision un#er whi(h the petitioners (lai& e;e&ption, on the other han#, is (ontaine# in the +ilitary BasesA2ree&ent etween the .hilippines an# the ?nite# -tates, 4 rea#in2 as 5ollows=

* !o national o5 the ?nite# -tates servin2 in or e&ploye# in the .hilippines in (onne(tion with

(onstru(tion, &aintenan(e, operation or #e5ense o5 the ases an# resi#e in the .hilippines y

reason only o5 su(h e&ploy&ent, or his spouse an# &inor (hil#ren an# #epen#ents, parents or her

spouse, shall e liale to pay in(o&e ta; in the .hilippines e;(ept in re2ar# to in(o&e #erive# 5ro&

.hilippine sour(es or sour(es other than the ?- sour(es

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 3/48

3

<he petitioners (lai& that they are (overe# y this e;e&ptin2 provision o5 the Bases A2ree&ent sin(e, as is

a#&itte# on all si#es, they are all ?- nationals, all e&ploye# in the A&eri(an !aval Base at -ui( Bay involve# in

so&e way or other in (onstru(tion, &aintenan(e, operation or #e5ense thereo5:, an# re(eive salary there5ro&

e;(lusively an# 5ro& no other sour(e in the .hilippines an# it is their intention, as is shown y the unreutte#

evi#en(e, to return to the ?nite# -tates on ter&ination o5 their e&ploy&ent

<hat (lai& ha# een re$e(te# y the Court o5 Appeals with the terse state&ent that the Bases A2ree&ent spea@s

o5 e;e&ption 5ro& the payment o5 in(o&e ta;, not 5ro& the filing o5 the in(o&e ta; returns 5

<o e sure, the Bases A2ree&ent very plainly I#enti5ies the persons !O< liale to pay in(o&e ta; in the .hilippines

e;(ept in re2ar# to in(o&e #erive# 5ro& .hilippine sour(es or sour(es other than the ?- sour(es <hey are the

persons in who& (on(ur the 5ollowin2 reuisites, to wit=

1: nationals o5 the ?nite# -tates servin2 in or e&ploye# in the .hilippines

*: their servi(e or e&ploy&ent is in (onne(tion with (onstru(tion, &aintenan(e, operation or #e5ense o5 the

ases

3: they resi#e in the .hilippines y reason only o5 su(h e&ploy&ent an#

4: their in(o&e is #erive# e;(lusively 5ro& ?- sour(es

!ow, there is no uestion 1: that the petitioners are ?- nationals servin2 or e&ploye# in the .hilippines *: that

their e&ploy&ent is in (onne(tion with (onstru(tion, &aintenan(e, operation or #e5ense o5 a ase, -ui( Bay

!aval Base 3: they resi#e in the .hilippines y reason only o5 su(h e&ploy&ent sin(e, as is un#ispute#, they all

inten# to #epart 5ro& the (ountry on ter&ination o5 their e&ploy&ent an# 4: they earn no in(o&e 5ro& .hilippine

sour(es or sour(es other than the ?- sour(es <here5ore, y the e;pli(it ter&s o5 the Bases A2ree&ent, none o5

the& shall e liale to pay in(o&e ta; in the .hilippines In#ee#, the petitionersH (lai& 5or e;e&ption pursuant

to this A2ree&ent ha# een sustaine# y the Court o5 <a; Appeals whi(h set asi#e an# (an(elle# the assess&ents

&a#e a2ainst sai# petitioners y the BIR 5or #e5i(ien(y in(o&e ta;es 5or the ta;ale years 199F19* 3 <he

#e(ision o5 the Court o5 <a; Appeals to this e55e(t was (onteste# in this Court y the Co&&issioner o5 InternalRevenue, ut the sa&e was nonetheless a55ir&e# on Au2ust 1*, 198

But even i5 e;e&pt 5ro& paying income tax , sai# petitioners were, it is (onten#e# y the respon#ents, not e;(use#

5ro& 5ilin2 in(o&e ta; returns 6or the Internal Revenue Co#e -e( 4/, supra: reuires the 5ilin2 o5 an in(o&e ta;

return also y any alien resi#in2 in the .hilippines, re2ar#less o5 whether the 2ross in(o&e was #erive# 5ro&

sour(es within or outsi#e the .hilippines an# sin(e the petitioners, althou2h aliens resi#in2 within the .hilippines,

ha# 5aile# to #o so, they ha# een properly prose(ute# an# (onvi(te# 5or havin2 thus violate# the Co#e

hat the law reuires, states the (hallen2e# $u#2&ent o5 the Court o5 Appeals, is &erely physi(al or o#ily

presen(e in a 2iven pla(e 5or a perio# o5 ti&e, not the intention to &a@e it a per&anent pla(e o5 ao#e It is on this

proposition, ta@en in the li2ht o5 the estalishe# 5a(ts on re(or# to the e55e(t that al&ost all o5 the appellants were

orn here, repatriate# to the ?- an# to (o&e a(@, in the latest in 19, an# to stay in the .hilippines up to thepresent ti&e, that &a@es appellants resi#ent aliens not &erely transients or so$ourners whi(h resi#en(e 5or uite a

lon2 perio# o5 ti&e, (ouple# with the a&ount an# sour(e o5 in(o&e within the .hilippines, ren#ers i&&aterial, 5or

purposes o5 5ilin2 the in(o&e ta; returns as (ontraF#istin2uishe# 5ro& the pay&ent o5 in(o&e ta;, their intention to

2o a(@ to the ?nite# -tates

a(h o5 the petitioners #oes in#ee# 5all within the letter o5 the (o#al pre(ept that an alien resi#in2 in the

.hilippines is oli2e# to 5ile an in(o&e ta; return !one o5 the& &ay e (onsi#ere# a nonFresi#ent alien, a &ere

transient or so$ourner, who is not un#er any le2al #uty to 5ile an in(o&e ta; return un#er the .hilippine <a; Co#e

<his is &a#e (lear y Revenue Relations !o * o5 the Eepart&ent o5 6inan(e o5 6eruary 10, 1940, 9 whi(h lays

#own the relevant stan#ar#s on the &atter=

An alien a(tually present in the .hilippines who is not a &ere transient or so$ourner is a resi#ent o5the .hilippines 5or purposes o5 in(o&e ta; hether he is a transient or not is #eter&ine# y his

intentions with re2ar#s to the len2th an# nature o5 his stay A &ere 5loatin2 intention in#e5inite as

to ti&e, to return to another (ountry is not su55i(ient to (onstitute hi& as transient I5 he lives in the

.hilippines an# has no #e5inite intention as to his stay, he is a resi#ent One who (o&es to the

.hilippines 5or a #e5inite purpose whi(h in its nature &ay e pro&ptly a((o&plishe# is a transient

But i5 his purpose is o5 su(h a nature that an e;ten#e# stay &ay e ne(essary to its

a((o&plish&ent, an# to that en# the alien &a@es his ho&e te&porarily in the .hilippines, he

e(o&es a resi#ent, thou2h it &ay e his intention at all ti&es to return to his #o&i(ile aroa#

when the purpose 5or whi(h he (a&e has een (onsu&&ate# or aan#one#

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 4/48

4

<he petitioners (on(e#e that the 5ore2oin2 stan#ar#s have een a 2oo# yar#sti(@, an# are in 5a(t not at

sustantial varian(e 5ro& A&eri(an $urispru#en(e 10 <hey a(@nowle#2e, too, that their e;e&ption un#er the Bases

A2ree&ent relates si&ply to nonFliaility 5or the pay&ent o5 in(o&e ta;, not to the 5ilin2 o5 a return: But,

they ar2ue 11M

a5ter havin2 e;pressly re(o2niDe# that petitioners nee# not pay in(o&e ta; here, there appears

to e no lo2i( in reuirin2 the& to 5ile in(o&e ta; returns whi(h anyhow woul# serve no pra(ti(al

purpose sin(e their liaility on the a&ounts state# thereon (an har#ly e e;a(te# <he &ore

pra(ti(al view, ta@in2 into a((ount poli(y (onsi#erations that pro&pte# the Govern&ent o5 the

Repuli( o5 the .hilippines to e;e&pt the petitioners, as well as other A&eri(an (itiDens si&ilarly

situate#, 5ro& the pay&ent o5 in(o&e ta; here, is to re(o2niDe the lesser a(t o5 5ilin2 within the

e;e&ption 2rante# <his is si&ply ein2 (onsistent with the reason ehin# the 2rant o5 ta;Fe;e&pt

status to petitioners

.ointin2 out 5urther to what they (onsi#er the a#&inistrative i&ple&entation o5 that ta;Fe;e&ption:

provision o5 the Bases A2ree&ent: y oth 2overn&ents 5or aout ** years whi(h #i# not reuire the

5ilin2 o5 in(o&e ta; returns y A&eri(an (itiDenFe&ployees hol#in2 9FA spe(ial visas li@e petitioners:, an# to

the hi2her plane o5 politi(al realities whi(h pro&pte# the .hilippine Govern&ent to partially surren#er its

inherent ri2ht to ta;, petitioners su&it that the parti(ular prole& involve# in these (ases is a &atter

that has to 5in# solution an# ou2ht to e #ealt with in (on5eren(e tales rather than e5ore the (ourt o5 law

1

uite apart 5ro& the evi#ently #istin(t an# #i55erent (hara(ter o5 the reuire&ent to pay in(o&e ta; in (ontrast to

the reuire&ent to 5ile a ta; return, it appears that the e;e&ption 2rante# to the petitioners y the Bases

A2ree&ent 5ro& pay&ent o5 in(o&e ta; is not asolute By the e;pli(it ter&s o5 the Bases A2ree&ent, it e;ists only

as re2ar#s in(o&e #erive# 5ro& their e&ploy&ent in the .hilippines in (onne(tion with (onstru(tion, &aintenan(e,

operation or #e5ense o5 the ases it #oes not e;ist in respe(t o5 other in(o&e, ie, in(o&e #erive# 5ro&

.hilippine sour(es or sour(es other than the ?- sour(es Oviously, with respe(t to the latter 5or& o5 in(o&e, ie,

that otaine# or pro(ee#in2 5ro& .hilippine sour(es or sour(es other than the ?- sour(es, the petitioners, an# all

other A&eri(an nationals who are resi#ents o5 the .hilippines, are le2ally oun# to pay ta; thereon In other wor#s,

so that A&eri(an nationals resi#in2 in the (ountry &ay e relieve# o5 the #uty to pay in(o&e ta; 5or any 2iven year,

it is in(u&ent on the& to show the Bureau o5 Internal Revenue that in that year they ha# #erive# in(oⅇ(lusively 5ro& their e&ploy&ent in (onne(tion with the ?- ases, an# none whatever 5ro& .hilippine sour(es

or sour(es other than the ?- sour(es <hey have to &a@e this @nown to the Govern&ent authorities It is not in

the 5irst instan(e the latterHs #uty or ur#en to &a@e unai#e# veri5i(ation o5 the sour(es o5 in(o&e o5 A&eri(an

resi#ents <he #uty rests on the ?- nationals (on(erne# to invo@e an# prima facie estalish their ta;Fe;e&pt

status It (annot si&ply e presu&e# that they earne# no in(o&e 5ro& any other sour(es than their e&ploy&ent in

the A&eri(an ases an# are there5ore totally e;e&pt 5ro& in(o&e ta; <he situation is no #i55erent 5ro& that o5

6ilipino an# other resi#ent in(o&eFearners in the .hilippines who, y reason o5 the personal e;e&ptions an#

per&issile #e#u(tions un#er the <a; Co#e, &ay not e liale to pay in(o&e ta; year 5or any parti(ular year that

they are not liale to pay in(o&e ta;, no &atter how plain or irre5utale su(h a proposition &i2ht e, #oes not

e;e&pt the& 5ro& the #uty to 5ile an in(o&e ta; return

<hese (onsi#erations i&pel a55ir&an(e o5 the $u#2&ents o5 the Court o5 Appeals an# the <rial Court

>R6OR, the petition 5or review on certiorari is E!IE, an# the (hallen2e# #e(ision o5 the Court o5 Appeals is

A66IR+E Costs a2ainst petitioners -O ORERE

G.R. No. L-352-4 #p6il 20 19

C!**$%%$!N(R !F $NT(RN#L R((N( petitioner,

vs 'R$T$%" !(R%(#% #$R+#)% C!RP!R#T$!N an/ C!RT !F T#7 #PP(#L% respon#ents

*(L(NC$!-"(RR(R# J.:

.etitioner Co&&issioner o5 Internal Revenue CIR: see@s a review on (ertiorari o5 the $oint Ee(ision o5 the Court o5

<a; Appeals C<A: in C<A Cases !os *33 an# */1, #ate# * January 1983, whi(h set asi#e petitionerHs

assess&ent o5 #e5i(ien(y in(o&e ta;es a2ainst respon#ent British Overseas Airways Corporation BOAC: 5or the

5is(al years 19/9 to 19, 198F9 to 190F1, respe(tively, as well as its Resolution o5 18 !ove&er, 1983

#enyin2 re(onsi#eration

BOAC is a 100N British Govern&entFowne# (orporation or2aniDe# an# e;istin2 un#er the laws o5 the ?nite#

in2#o& It is en2a2e# in the international airline usiness an# is a &e&erFsi2natory o5 the Interline Air <ransport

Asso(iation IA<A: As su(h it operates air transportation servi(e an# sells transportation ti(@ets over the routes o5

the other airline &e&ers Eurin2 the perio#s (overe# y the #ispute# assess&ents, it is a#&itte# that BOAC ha#

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 5/48

5

no lan#in2 ri2hts 5or tra55i( purposes in the .hilippines, an# was not 2rante# a Certi5i(ate o5 puli( (onvenien(e an#

ne(essity to operate in the .hilippines y the Civil Aeronauti(s Boar# CAB:, e;(ept 5or a nineF&onth perio#, partly

in 191 an# partly in 19*, when it was 2rante# a te&porary lan#in2 per&it y the CAB Conseuently, it #i# not

(arry passen2ers an#or (ar2o to or 5ro& the .hilippines, althou2h #urin2 the perio# (overe# y the assess&ents, it

&aintaine# a 2eneral sales a2ent in the .hilippines M a&er Barnes an# Co&pany, )t#, an# later antas Airways

M whi(h was responsile 5or sellin2 BOAC ti(@ets (overin2 passen2ers an# (ar2oes 1

G.R. No. 65! C<A Case !o *33, the 6irst Case:

On +ay 198, petitioner Co&&issioner o5 Internal Revenue CIR, 5or revity: assesse# BOAC the a22re2ate

a&ount o5 .*,498,3/8/ 5or #e5i(ien(y in(o&e ta;es (overin2 the years 19/9 to 193 <his was proteste# y

BOAC -useuent investi2ation resulte# in the issuan(e o5 a new assess&ent, #ate# 1 January 190 5or the years

19/9 to 19 in the a&ount o5 .8/8,309 BOAC pai# this new assess&ent un#er protest

On O(toer 190, BOAC 5ile# a (lai& 5or re5un# o5 the a&ount o5 .8/8,309, whi(h (lai& was #enie# y the

CIR on 1 6eruary 19* But e5ore sai# #enial, BOAC ha# alrea#y 5ile# a petition 5or review with the <a; Court on

* January 19*, assailin2 the assess&ent an# prayin2 5or the re5un# o5 the a&ount pai#

G.R. No. 65" C<A Case !o */1, the -e(on# Case:

On 1 !ove&er 191, BOAC was assesse# #e5i(ien(y in(o&e ta;es, interests, an# penalty 5or the 5is(al years

198F199 to 190F191 in the a22re2ate a&ount o5 ./49,3*43, an# the a##itional a&ounts o5 .1,00000 an#

.1,80000 as (o&pro&ise penalties 5or violation o5 -e(tion 4 reuirin2 the 5ilin2 o5 (orporation returns: penaliDe#

un#er -e(tion 4 o5 the !ational Internal Revenue Co#e !IRC:

On */ !ove&er 191, BOAC reueste# that the assess&ent e (ounter&an#e# an# set asi#e In a letter, #ate# 1

6eruary 19*, however, the CIR not only #enie# the BOAC reuest 5or re5un# in the 6irst Case ut also reFissue# in

the -e(on# Case the #e5i(ien(y in(o&e ta; assess&ent 5or ./34,13*08 5or the years 199 to 190F1 plus

.1,00000 as (o&pro&ise penalty un#er -e(tion 4 o5 the <a; Co#e BOACHs reuest 5or re(onsi#eration was #enie#

y the CIR on *4 Au2ust 193 <his pro&pte# BOAC to 5ile the -e(on# Case e5ore the <a; Court prayin2 that it e

asolve# o5 liaility 5or #e5i(ien(y in(o&e ta; 5or the years 199 to 191

<his (ase was suseuently trie# $ointly with the 6irst Case

On * January 1983, the <a; Court ren#ere# the assaile# $oint Ee(ision reversin2 the CIR <he <a; Court hel# that

the pro(ee#s o5 sales o5 BOAC passa2e ti(@ets in the .hilippines y arner Barnes an# Co&pany, )t#, an# later y

antas Airways, #urin2 the perio# in uestion, #o not (onstitute BOAC in(o&e 5ro& .hilippine sour(es sin(e no

servi(e o5 (arria2e o5 passen2ers or 5rei2ht was per5or&e# y BOAC within the .hilippines an#, there5ore, sai#

in(o&e is not su$e(t to .hilippine in(o&e ta; <he C<A position was that in(o&e 5ro& transportation is in(o&e

5ro& servi(es so that the pla(e where servi(es are ren#ere# #eter&ines the sour(e <hus, in the #ispositive portion

o5 its Ee(ision, the <a; Court or#ere# petitioner to (re#it BOAC with the su& o5 .8/8,309, an# to (an(el the

#e5i(ien(y in(o&e ta; assess&ents a2ainst BOAC in the a&ount o5 ./34,13*08 5or the 5is(al years 198F9 to

190F1

>en(e, this .etition 5or Review on (ertiorari o5 the Ee(ision o5 the <a; Court

<he -oli(itor General, in representation o5 the CIR, has aptly #e5ine# the issues, thus=

1 hether or not the revenue #erive# y private respon#ent British Overseas Airways Corporation

BOAC: 5ro& sales o5 ti(@ets in the .hilippines 5or air transportation, while havin2 no lan#in2 ri2hts

here, (onstitute in(o&e o5 BOAC 5ro& .hilippine sour(es, an#, a((or#in2ly, ta;ale

* hether or not #urin2 the 5is(al years in uestion BOAC s a resi#ent 5orei2n (orporation #oin2

usiness in the .hilippines or has an o55i(e or pla(e o5 usiness in the .hilippines

3 In the alternative that private respon#ent &ay not e (onsi#ere# a resi#ent 5orei2n (orporation

ut a nonFresi#ent 5orei2n (orporation, then it is liale to .hilippine in(o&e ta; at the rate o5 thirtyF

5ive per (ent 3/N: o5 its 2ross in(o&e re(eive# 5ro& all sour(es within the .hilippines

?n#er -e(tion *0 o5 the 19 <a; Co#e=

h: the ter& resi#ent 5orei2n (orporation en2a2e# in tra#e or usiness within the .hilippines or

havin2 an o55i(e or pla(e o5 usiness therein

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 6/48

6

i: <he ter& nonFresi#ent 5orei2n (orporation applies to a 5orei2n (orporation not en2a2e# in tra#e

or usiness within the .hilippines an# not havin2 any o55i(e or pla(e o5 usiness therein

It is our (onsi#ere# opinion that BOAC is a resi#ent 5orei2n (orporation <here is no spe(i5i( (riterion as to what

(onstitutes #oin2 or en2a2in2 in or transa(tin2 usiness a(h (ase &ust e $u#2e# in the li2ht o5 its pe(uliar

environ&ental (ir(u&stan(es <he ter& i&plies a (ontinuity o5 (o&&er(ial #ealin2s an# arran2e&ents, an#

(onte&plates, to that e;tent, the per5or&an(e o5 a(ts or wor@s or the e;er(ise o5 so&e o5 the 5un(tions nor&ally

in(i#ent to, an# in pro2ressive prose(ution o5 (o&&er(ial 2ain or 5or the purpose an# o$e(t o5 the usiness

or2aniDation In or#er that a 5orei2n (orporation &ay e re2ar#e# as #oin2 usiness within a -tate, there &ust

e (ontinuity o5 (on#u(t an# intention to estalish a (ontinuous usiness, su(h as the appoint&ent o5 a lo(al a2ent,

an# not one o5 a te&porary (hara(ter 2

BOAC, #urin2 the perio#s (overe# y the su$e(t F assess&ents, &aintaine# a 2eneral sales a2ent in the

.hilippines, <hat 2eneral sales a2ent, 5ro& 19/9 to 191, was en2a2e# in 1: sellin2 an# issuin2 ti(@ets *:

rea@in2 #own the whole trip into series o5 trips M ea(h trip in the series (orrespon#in2 to a #i55erent airline

(o&pany 3: re(eivin2 the 5are 5ro& the whole trip an# 4: (onseuently allo(atin2 to the various airline

(o&panies on the asis o5 their parti(ipation in the servi(es ren#ere# throu2h the &o#e o5 interline settle&ent as

pres(rie# y Arti(le "I o5 the Resolution !o 8/0 o5 the IA<A A2ree&ent 4 <hose a(tivities were in e;er(ise o5 the

5un(tions whi(h are nor&ally in(i#ent to, an# are in pro2ressive pursuit o5, the purpose an# o$e(t o5 its

or2aniDation as an international air (arrier In 5a(t, the re2ular sale o5 ti(@ets, its &ain a(tivity, is the very li5eloo#

o5 the airline usiness, the 2eneration o5 sales ein2 the para&ount o$e(tive <here shoul# e no #out then that

BOAC was en2a2e# in usiness in the .hilippines throu2h a lo(al a2ent #urin2 the perio# (overe# y the

assess&ents A((or#in2ly, it is a resi#ent 5orei2n (orporation su$e(t to ta; upon its total net in(o&e re(eive# in the

pre(e#in2 ta;ale year 5ro& all sour(es within the .hilippines 5

-e( *4 Rates o5 ta; on (orporations M

: <a; on 5orei2n (orporations M

*: Resi#ent (orporations M A (orporation or2aniDe#, authoriDe#, or e;istin2 un#er the laws o5 any

5orei2n (ountry, e;(ept a 5orei2n 5i5e insuran(e (o&pany, en2a2e# in tra#e or usiness within the

.hilippines, shall e ta;ale as provi#e# in suse(tion a: o5 this se(tion upon the total net in(o&e

re(eive# in the pre(e#in2 ta;ale year 5ro& all sources #ithin the Philippines. &phasis supplie#:

!e;t, we a##ress ourselves to the issue o5 whether or not the revenue 5ro& sales o5 ti(@ets y BOAC in the

.hilippines (onstitutes in(o&e 5ro& .hilippine sour(es an#, a((or#in2ly, ta;ale un#er our in(o&e ta; laws

<he <a; Co#e #e5ines 2ross in(o&e thus=

Gross in(o&e in(lu#es 2ains, pro5its, an# in(o&e #erive# 5ro& salaries, wa2es or (o&pensation

5or personal servi(e o5 whatever @in# an# in whatever 5or& pai#, or 5ro& pro5ession, vo(ations,

tra#es,$usiness% commerce, sales, or #ealin2s in property, whether real or personal, 2rowin2 out o5

the ownership or use o5 or interest in su(h property also 5ro& interests, rents, #ivi#en#s,

se(urities, or the transactions of any $usiness carrie& on for gain or profile% or 2ains, pro5its,

an# income &erive& from any source #hatever -e( *9P3Q &phasis supplie#:

<he #e5inition is roa# an# (o&prehensive to in(lu#e pro(ee#s 5ro& sales o5 transport #o(u&ents <he wor#s

Hin(o&e 5ro& any sour(e whateverH #is(lose a le2islative poli(y to in(lu#e all in(o&e not e;pressly e;e&pte# within

the (lass o5 ta;ale in(o&e un#er our laws In(o&e &eans (ash re(eive# or its euivalent it is the a&ount o5

&oney (o&in2 to a person within a spe(i5i( ti&e it &eans soðin2 #istin(t 5ro& prin(ipal or (apital 6or, while

(apital is a 5un#, in(o&e is a 5low As use# in our in(o&e ta; law, in(o&e re5ers to the 5low o5 wealth 3

<he re(or#s show that the .hilippine 2ross in(o&e o5 BOAC 5or the 5is(al years 198F9 to 190F1 a&ounte# to

.10,4*8,38 00

Ei# su(h 5low o5 wealth (o&e 5ro& sour(es within the .hilippines,

<he sour(e o5 an in(o&e is the property, a(tivity or servi(e that pro#u(e# the in(o&e 6or the sour(e o5 in(o&e to

e (onsi#ere# as (o&in2 5ro& the .hilippines, it is su55i(ient that the in(o&e is #erive# 5ro& a(tivity within the

.hilippines In BOACHs (ase, the sale o5 ti(@ets in the .hilippines is the a(tivity that pro#u(es the in(o&e <he

ti(@ets e;(han2e# han#s here an# pay&ents 5or 5ares were also &a#e here in .hilippine (urren(y <he site o5 the

sour(e o5 pay&ents is the .hilippines <he 5low o5 wealth pro(ee#e# 5ro&, an# o((urre# within, .hilippine territory,

en$oyin2 the prote(tion a((or#e# y the .hilippine 2overn&ent In (onsi#eration o5 su(h prote(tion, the 5low o5

wealth shoul# share the ur#en o5 supportin2 the 2overn&ent

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 7/48

7

A transportation ti(@et is not a &ere pie(e o5 paper hen issue# y a (o&&on (arrier, it (onstitutes the (ontra(t

etween the ti(@etFhol#er an# the (arrier It 2ives rise to the oli2ation o5 the pur(haser o5 the ti(@et to pay the

5are an# the (orrespon#in2 oli2ation o5 the (arrier to transport the passen2er upon the ter&s an# (on#itions set

5orth thereon <he or#inary ti(@et issue# to &e&ers o5 the travelin2 puli( in 2eneral e&ra(es within its ter&s all

the ele&ents to (onstitute it a vali# (ontra(t, in#in2 upon the parties enterin2 into the relationship 9

<rue, -e(tion 3a: o5 the <a; Co#e, whi(h enu&erates ite&s o5 2ross in(o&e 5ro& sour(es within the .hilippines,

na&ely= 1: interest, *1: #ivi#en#s, 3: servi(e, 4: rentals an# royalties, /: sale o5 real property, an# : sale o5

personal property, #oes not &ention in(o&e 5ro& the sale o5 ti(@ets 5or international transportation >owever, that

#oes not ren#er it less an in(o&e 5ro& sour(es within the .hilippines -e(tion 3, y its lan2ua2e, #oes not inten#

the enu&eration to e e;(lusive It &erely #ire(ts that the types o5 in(o&e liste# therein e treate# as in(o&e 5ro&

sour(es within the .hilippines A (ursory rea#in2 o5 the se(tion will show that it #oes not state that it is an allF

in(lusive enu&eration, an# that no other @in# o5 in(o&e &ay e so (onsi#ere# 10

BOAC, however, woul# i&press upon this Court that in(o&e #erive# 5ro& transportation is in(o&e 5or servi(es, with

the result that the pla(e where the servi(es are ren#ere# #eter&ines the sour(e an# sin(e BOACHs servi(e o5

transportation is per5or&e# outsi#e the .hilippines, the in(o&e #erive# is 5ro& sour(es without the .hilippines an#,

there5ore, not ta;ale un#er our in(o&e ta; laws <he <a; Court uphol#s that stan# in the $oint Ee(ision un#er

review

<he asen(e o5 5li2ht operations to an# 5ro& the .hilippines is not #eter&inative o5 the sour(e o5 in(o&e or the site

o5 in(o&e ta;ation A#&itte#ly, BOAC was an o55Fline international airline at the ti&e pertinent to this (ase <he test

o5 ta;aility is the sour(e an# the sour(e o5 an in(o&e is that a(tivity whi(h pro#u(e# the

in(o&e 11?nuestionaly, the passa2e #o(u&entations in these (ases were sol# in the .hilippines an# the revenue

there5ro& was #erive# 5ro& a a(tivity re2ularly pursue# within the .hilippines usiness a An# even i5 the BOAC

ti(@ets sol# (overe# the transport o5 passen2ers an# (ar2o to an# 5ro& 5orei2n (ities, 1it (annot alter the 5a(t

that in(o&e 5ro& the sale o5 ti(@ets was #erive# 5ro& the .hilippines <he wor# sour(e (onveys one essential

i#ea, that o5 ori2in, an# the ori2in o5 the in(o&e herein is the .hilippines 12

It shoul# e pointe# out, however, that the assess&ents uphel# herein apply only to the 5is(al years (overe# y the

uestione# #e5i(ien(y in(o&e ta; assess&ents in these (ases, or, 5ro& 19/9 to 19, 198F9 to 190F1 6or,

pursuant to .resi#ential Ee(ree !o 9, pro&ul2ate# on *4 !ove&er, 19*, international (arriers are now ta;e# as

5ollows=

.rovi#e#, however, <hat international (arriers shall pay a ta; o5 *F per (ent on their (ross

.hilippine illin2s -e( *4PQ P*1, <a; Co#e:

.resi#ential Ee(ree !o 13//, pro&ul2ate# on *1 April, 198, provi#e# a statutory #e5inition o5 the ter& 2ross

.hilippine illin2s, thus=

Gross .hilippine illin2s in(lu#es 2ross revenue realiDe# 5ro& upli5ts anywhere in the worl# y

any international (arrier #oin2 usiness in the .hilippines o5 passa2e #o(u&ents sol# therein,

whether 5or passen2er, e;(ess a22a2e or &ail provi#e# the (ar2o or &ail ori2inates 5ro& the

.hilippines

<he 5ore2oin2 provision ensures that international airlines are ta;e# on their in(o&e 5ro& .hilippine sour(es <he *F

N ta; on 2ross .hilippine illin2s is an in(o&e ta; I5 it ha# een inten#e# as an e;(ise or per(enta2e ta; it

woul# have een pla(e un#er <itle " o5 the <a; Co#e (overin2 <a;es on Business

)astly, we 5in# as untenale the BOAC ar2u&ent that the #is&issal 5or la(@ o5 &erit y this Court o5 the appeal

in 'A( vs. Commissioner of )nternal Revenue GR !o )F30041: on 6eruary 3, 199, is res *u&icata to the present

(ase <he rulin2 y the <a; Court in that (ase was to the e55e(t that the &ere sale o5 ti(@ets, una((o&panie# y the

physi(al a(t o5 (arria2e o5 transportation, #oes not ren#er the ta;payer therein su$e(t to the (o&&on (arrierHs ta;

As elu(i#ate# y the <a; Court, however, the (o&&on (arrierHs ta; is an e;(ise ta;, ein2 a ta; on the a(tivity o5

transportin2, (onveyin2 or re&ovin2 passen2ers an# (ar2o 5ro& one pla(e to another It purports to ta; the

usiness o5 transportation 14 Bein2 an e;(ise ta;, the sa&e (an e levie# y the -tate only when the a(ts,

privile2es or usinesses are #one or per5or&e# within the $uris#i(tion o5 the .hilippines <he su$e(t &atter o5 the

(ase un#er (onsi#eration is in(o&e ta;, a #ire(t ta; on the in(o&e o5 persons an# other entities o5 whatever @in#

an# in whatever 5or& #erive# 5ro& any sour(e -in(e the two (ases treat o5 a #i55erent su$e(t &atter, the #e(ision

in one (annot e res *u&icata to the other

>R6OR, the appeale# $oint Ee(ision o5 the Court o5 <a; Appeals is herey -< A-IE .rivate respon#ent, the

British Overseas Airways Corporation BOAC:, is herey or#ere# to pay the a&ount o5 ./34,13*08 as #e5i(ien(y

in(o&e ta; 5or the 5is(al years 198F9 to 190F1 plus /N sur(har2e, an# 1N &onthly interest 5ro& April 1,

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 8/48

8

19* 5or a perio# not to e;(ee# three 3: years in a((or#an(e with the <a; Co#e <he BOAC (lai& 5or re5un# in the

a&ount o5 .8/8,309 is herey #enie# ithout (osts -O ORERE

G.R. No. L-4309 June 2 19

N.. R((,(R$J 8#*%T(R,#*8 an/ R!)#L $NT(R!C(#N L$N(% petitioners,

vs C!**$%%$!N(R !F $NT(RN#L R((N( respon#ent

G#NC#)C! J.:

<he issue pose# in this petition is the in(o&e ta; liaility o5 a 5orei2n shippin2 (orporation whi(h (alle# on .hilippine

ports to loa# (ar2oes 5or 5orei2n #estination on two o((asions in 193 an# 194, respe(tively, an# whi(h (olle(te#

5rei2ht 5ees on these transa(tions

6ro& +ar(h * to April 30, 193, +" A&stel&eer an# 5ro& -epte&er *4 to O(toer *8, 194, +" A&stel@roon,

oth o5 whi(h are vessels o5 petitioner !B Ree#eri$ A+-<REA+, (alle# on .hilippine ports to loa# (ar2oes 5or

5orei2n #estination <he 5rei2ht 5ees 5or these transa(tions were pai# aroa# in the a&ount o5 ?- K98,1/00 in

193 an# ?- K13,19300 in 194 In these two instan(es, petitioner Royal Intero(ean )ines a(te# as husan#in2

a2ent 5or a 5ee or (o&&ission on sai# vessels !o in(o&e ta; appears to have een pai# y petitioner !" Ree#eri$

A+-<REA+ on the 5rei2ht re(eipts

Respon#ent Co&&issioner o5 Internal Revenue, throu2h his e;a&iners, 5ile# the (orrespon#in2 in(o&e ta; returns

5or an# in ehal5 o5 the 5or&er un#er -e(tion 1/ o5 the !ational Internal Revenue Co#e Applyin2 the then

prevailin2 &ar@et (onversion rate o5 .390 to the ?- K100, the 2ross re(eipts o5 petitioner !" Ree#eri$

A&ster#a& 5or 193 an# 194 a&ounte# to .38*,88*/0 an# ./3/,0/*00, respe(tively On June 30, 19,

respon#ent Co&&issioner assesse# sai# petitioner in the a&ounts o5 .193,93*0 an# .**,90494 as #e5i(ien(y

in(o&e ta; 5or 193 an# 194, respe(tively, as a nonFresi#ent 5orei2n (orporation not en2a2e# in tra#e or

usiness in the .hilippines un#er -e(tion *4 : 1: o5 the <a; Co#e

On the assu&ption that the sai# petitioner is a 5orei2n (orporation en2a2e# in tra#e or usiness in the .hilippines,

on Au2ust *8, 19, petitioner Royal Intero(ean )ines 5ile# an in(o&e ta; return o5 the a5ore&entione# vessels(o&pute# at the e;(han2e rate o5 .*00 to ?-s100 1 an# pai# the ta; thereon in the a&ount o5 .1,83//* an#

.9,44894, respe(tively, pursuant to -e(tion *4 : *: in relation to -e(tion 3 B: e: o5 the !ational Internal

Revenue Co#e an# -e(tion 13 o5 Revenue Re2ulations !o * On the sa&e two #ates, petitioner Royal Intero(ean

)ines as the husan#in2 a2ent o5 petitioner !" Ree#eri$ A+-<REA+ 5ile# a written protest a2ainst the

aove&entione# assess&ent &a#e y the respon#ent Co&&issioner whi(h protest was #enie# y sai# respon#ent

in a letter #ate# +ar(h 3, 199= On +ar(h 31, 199, petitioners 5ile# a petition 5or review with the respon#ent

Court o5 <a; Appeals prayin2 5or the (an(ellation o5 the su$e(t assess&ent A5ter #ue hearin2, the respon#ent

(ourt, on Ee(e&er 1, 19, ren#ere# a #e(ision &o#i5yin2 sai# assess&ents y eli&inatin2 the /0N 5rau#

(o&pro&ise penalties i&pose# upon petitioners .etitioners 5ile# a &otion 5or re(onsi#eration o5 sai# #e(ision ut

this was #enie# y the respon#ent (ourt

>en(e, this petition 5or review where petitioners raise# the 5ollowin2 issues=

A ><>R !" RERIJ A+-<REA+ !O< >A"I!G A! O66IC OR .)AC O6 B?-I!-- I!

<> .>I)I..I!-, >O- "--)- CA))E O! <> .>I)I..I! .OR<- 6OR <> .?R.O- O6

)OAEI!G CARGO- O!) <ICFO! I! 193 A!E A!O<>R I! 194 M ->O?)E B <ALE A- A

6ORIG! COR.ORA<IO! !O< !GAGE I! <RAE OR B?-I!-- I! <> .>I)I..I!- ?!ER

-C<IO! *4: 1: O6 <> <AL COE OR ->O?)E B <ALE A- A 6ORIG! COR.ORA<IO!

!GAGE I! <RAE OR B?-I!-- I! <> .>I)I..I!- ?!ER -C<IO! *4: *: I! R)A<IO!

<O -C<IO! 3 e: O6 <> -A+ COE A!E

B ><>R <> 6ORIG! LC>A!G RCI.<- O6 !" RERIJ A+-<REA+ ->O?)E B

CO!"R<E I!<O .>I)I .I! .-O- A< <> O66ICIA) RA< O6 .*00 <O ?- K100, OR A< .390

<O ?- K100

.etitioners (onten# that respon#ent (ourt erre# in hol#in2 that petitioner !" Ree#eri$ A+-<REA+ is a nonF

resi#ent 5orei2n (orporation e(ause it alle2e#ly #isre2ar#e# -e(tion 13 o5 Revenue Re2ulations !o * provi#in2

5or the #eter&ination o5 the net in(o&e o5 5orei2n (orporations #oin2 usiness in the .hilippines: an# in hol#in2

that the 5orei2n e;(han2e an2 e re(eipts o5 sai# petitioner 5or purposes o5 (o&putin2 its in(o&e ta; shoul# e

(onverte# into .hilippine pesos at the rate o5 .390 to ?- K100 instea# o5 .*00 to ?- K100

<he petition is #evoi# o5 &erit

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 9/48

9

.etitioner !" Ree#eri$ A+-<REA+ is a 5orei2n (orporation not authoriDe# or li(ense# to #o usiness in the

.hilippines It #oes not have a ran(h o55i(e in the .hilippines an# it &a#e only two (alls in .hilippine ports, one in

193 an# the other in 194 In or#er that a 5orei2n (orporation &ay e (onsi#ere# en2a2e# in tra#e or usiness, its

usiness transa(tions &ust e (ontinuous A (asual usiness a(tivity in the .hilippines y a 5orei2n (orporation, as

in the present (ase, #oes not a&ount to en2a2in2 in tra#e or usiness in the .hilippines 5or in(o&e ta; purposes

<he Court repro#u(es with approval the 5ollowin2 #isuisition o5 the respon#ent (ourt M

A (orporation is itsel5 a ta;payin2 entity an# spea@in2 2enerally, 5or purposes o5 in(o&e ta;,

(orporations are (lassi5ie# into a: #o&esti( (orporations an# : 5orei2n (orporations -e( *4a:

an# :, <a; Co#e: 6orei2n (orporations are 5urther (lassi5ie# into 1: resi#ent 5orei2n (orporations

an# *: nonFresi#ent 5orei2n (orporations -e( *4: 1: an# *: <a; Co#e: A resi#ent 5orei2n

(orporation is a 5orei2n (orporation en2a2e# in tra#e or usiness within the .hilippines or havin2 an

o55i(e or pla(e o5 usiness therein -e( 842:, <a; Co#e: while a nonF resi#ent 5orei2n (orporation

is a 5orei2n (orporation not en2a2e# in tra#e or usiness within the .hilippines an# not havin2 any

o55i(e or pla(e o5 usiness therein -e( 84h:, <a; Co#e:

A #o&esti( (orporation is ta;e# on its in(o&e 5ro& sour(es within an# without the .hilippines, ut a

5orei2n (orporation is ta;e# only on its in(o&e 5ro& sour(es within the .hilippines -e( *4a:, <a;

Co#e -e( 1, Rev Re2s !o *: >owever, while a 5orei2n (orporation #oin2 usiness in the

.hilippines is ta;ale on in(o&e solely 5ro& sour(es within the .hilippines, it is per&itte# to

#e#u(tions 5ro& 2ross in(o&e ut only to the e;tent (onne(te# with in(o&e earne# in the

.hilippines -e(s *4: *: an# 3, <a; Co#e: On the other han#, 5orei2n (orporations not #oin2

usiness in the .hilippines are ta;ale on in(o&e 5ro& all sour(es within the .hilippines, as interest,

#ivi#en#s, rents, salaries, wa2es, pre&iu&s, annuities Co&pensations, re&unerations,

e&olu&ents, or other 5i;e# or #eter&inale annual or perio#i(al or (asual 2ains, pro5its an# in(o&e

an# (apital 2ains <he ta; is 30N now 3/N: o5 su(h 2ross in(o&e -e( *4 : 1:, <a; Co#e:

At the ti&e &aterial to this (ase, (ertain (orporations were 2iven spe(ial treat&ent, na&ely,

uil#in2 an# loan asso(iations operatin2 as su(h in a((or#an(e with -e(tion 11 o5 the Corporation

)aw, e#u(ational institutions, #o&esti( li5e insuran(e (o&panies an# 5or 5orei2n li5e insuran(e

(o&panies #oin2 usiness in the .hilippines -e( *4a: S (:, <a; Co#e: It ears e&phasis,

however, that 5orei2n li5e insuran(e (o&panies whi(h were not #oin2 usiness in the .hilippines

were ta;ale as other 5orei2n (orporations not authoriDe# to #o usiness in the .hilippines -e(

*4(: <a; Co#e:

!ow to the (ase at ar >ere, petitioner !" Ree#eri$ A&ster#a& is a nonFresi#ent 5orei2n

(orporation, or2aniDe# an# e;istin2 un#er the laws o5 <he !etherlan#s with prin(ipal o55i(e in

A&ster#a& an# not li(ense# to #o usiness in the .hilippines pp 8F81, C<A re(or#s: As a nonF

resi#ent 5orei2n (orporation, it is thus a 5orei2n (orporation, not en2a2e# in tra#e or usiness within

the .hilippines an# not havin2 any o55i(e or pla(e o5 usiness therein -e( 84h:, <a; Co#e: As

state# aove, it is there5ore ta;ale on in(o&e 5ro& all sour(es within the .hilippines, as interest,

#ivi#en#s, rents, salaries, wa2es, pre&iu&s, annuities, (o&pensations, re&unerations,

e&olu&ents, or other 5i;e# or #eter&inale annual or perio#i(al or (asual 2ains, pro5its an# in(o&e

an# (apital 2ains, an# the ta; is eual to thirty per centum o5 su(h a&ount, un#er -e(tion *4: 1:

o5 the <a; Co#e <he a((ent is on the wor#s o5FFTsu(h a&ount A((or#in2ly, petitioner ! "

Ree#eri$ A&ster#a& ein2 a nonFresi#ent 5orei2n (orporation, its ta;ale in(o&e 5or purposes o5

our in(o&e ta; law (onsists o5 its 2ross in(o&e 5ro& all sour(es within the .hilippines

<he law see&s (lear an# spe(i5i( It thus (alls 5or its appli(ation as wor#e# as it leaves no leeway

5or interpretation <he appli(ale provision i&poses a ta; on 5orei2n (orporations 5allin2 un#er the

(lassi5i(ation o5 nonFresi#ent (orporations without any e;(eptions or (on#itions, unli@e in the (ase o5

5orei2n (orporations en2a2e# in tra#e or usiness within the .hilippines whi(h (ontaine# at the

ti&e &aterial to this (ase: an e;(eption with respe(t to 5orei2n li5e insuran(e (o&panies A#heren(e

to the provision o5 the law, whi(h spe(i5ies an# #eter&ines the ta;ale in(o&e o5, an# the rate o5

in(o&e ta; appli(ale to, nonFresi#ent 5orei2n (orporations, without &entionin2 any e;(eptions,woul# there5ore lea# to the (on(lusion that petitioner !" Ree#eri$ A&ster#a& is su$e(t to

in(o&e ta; on 2ross in(o&e 5ro& all sour(es within the .hilippines

A 5orei2n (orporation en2a2e# in tra#e or usiness within the .hilippines, or whi(h has an o55i(e or pla(e o5 usiness

therein, is ta;e# on its total net in(o&e re(eive# 5ro& all sour(es within the .hilippines at the rate o5 */N upon the

a&ount ut whi(h ta;ale net in(o&e #oes not e;(ee# .100,00000, an# 3/N upon the a&ount ut whi(h ta;ale

net in(o&e e;(ee#s .100,00000 On the other han#, a 5orei2n (orporation not en2a2e# in tra#e or usiness

within the .hilipp&es an# whi(h #oes not have any o55i(e or pla(e o5 usiness therein is ta;e# on in(o&e re(eive#

5ro& all sour(es within the .hilippines at the rate o5 3/N o5 the 2ross in(o&e 2

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 10/48

10

.etitioner relies on -e(tion *4 : *: an# -e(tion 3 B: e: o5 the <a; Co#e an# i&ple&entin2 -e(tion 13 o5 the

In(o&e <a; Re2ulations ut these provisions re5er to a 5orei2n (orporation en2a2e# in tra#e or usiness in the

.hilippines an# not to a 5orei2n (orporation not en2a2e# in tra#e or usiness in the .hilippines li@e petitionerFshipF

owner herein <hus, the respon#ent (ourt aptly rule#=

It &ust e stresse#, however, that -e(tion 3 e: o5 the Co#e, as i&ple&ente# y -e(tion 13 o5

the Re2ulations, provi#es the rule o5 the #eter&ination o5 the net in(o&e ta;ale in the .hilippines

o5 a 5orei2n stea&ship (o&pany #oin2 usiness in the .hilippines <o assure that nonFresi#ent

5orei2n stea&ship (o&panies not en2a2e# in usiness in the .hilippines an# not havin2 any o55i(e

or pla(e o5 usiness herein are not (overe# therein, the re2ulations e;pli(itly an# (learly provi#e

that the net in(o&e o5 a 5orei2n stea&ship (o (o&pany #oin2 usiness in or 5ro& this (ountry is

as(ertaine#, un#er the 5or&ula (ontaine# therein, 5or the purpose o5 the in(o&e ta;U <he reason

is easily #is(ernile As state# aove, the ta;ale in(o&e o5 nonFresi#ent 5orei2n (orporations

(onsists o5 its 2ross in(o&e 5ro& all sour(es within the .hilippines A((or#in2ly, a 5orei2n

stea&2ship (orporation #erives in(o&e partly 5ro& sour(es within an# partly 5ro& sour(es without

the .hilippines i5 it iscarrying on a $usiness of transportation service etween points in the

.hilippines an# points outsi#e the .hilippines "ol 3, 19/, 6e#eral <a;es, .ar 1389: Only then

#oes -e(tion 3 e: o5 the <a; Co#e, are i&ple&ente# y -e(tion 13 o5 the Re2ulations, apply in

(o&putin2 net in(o&e su$e(t to ta; <here is no asis there5ore 5or an assertion that -e(tion 3

e: #oes not #istin2uish etween a 5orei2n (orporation en2a2e# in usiness in the .hilippines an# a5orei2n (orporation not en2a2e# in usiness in the .hilippines p 84, C<A re(or#s: Ee(ision, pp

11F1*:

<he (onversion rate o5 .*00 to ?- K100 whi(h petitioners (lai& shoul# e appli(ale to the in(o&e o5 petitioners

5or in(o&e ta; purposes instea# o5 .390 to s100 is li@ewise untenale <he transa(tions involve# in this (ase are

5or the ta;ale years 193 an# 194 ?n#er Rep A(t !o *09, the &onetary oar# was authoriDe# to 5i; the le2al

(onversion rate 5or 5orei2n e;(han2e <he 5ree &ar@et (onversion rate #urin2 those years was .390 to ?- K100

<his (onversion rate issue was #e5initely settle# y this Court in the (ase o5

Commissioner of )nternal Revenue vs.

Royal )nterocean (ines an& the Court of +ax Appeals 4 to wit=

It shoul# e note# that on July 1 , 19/9, the poli(y in(orporate# in Cir(ular !o *0 an#

i&ple&ente# in suseuent (ir(ulars was rela;e# with the ena(t&ent o5 Repuli( A(t !o *09

whi(h #ire(te# the &onetary authorities to ta@e steps 5or the a#option o5 a 5ourFyear pro2ra& o5

2ra#ual #e(ontrol, #urin2 whi(h the +onetary Boar#, with the approval o5 the .resi#ent, (oul# an#

#i# 5i; the (onversion rate o5 the .hilippine peso to the ?- #ollar at a ratio other than that

pres(rie# in -e(tion 48 o5 Repuli( A(t */ Eurin2 the perio# involve# in the (ase at ar, the 5ree

&ar@et (onversion rate ran2e# 5ro& .34 to .3/ to a ?- #ollar at whi(h rate the 5rei2ht 5ees in

uestion were (o&pute# in the (onteste# assess&ent Inas&u(h sai# 5rees were revenues #erive#

5ro& 5orei2n e;(han2e transa(tions, it 5ollows ne(essarily that the petitioner was 5ully $usti5ie# in

(o&putin2 the ta;payerHs re(eipts at I# 5ree &ar@et rates

;;; ;;; ;;;

<he (ase o5 the ?nite# -tates )ines, on whi(h the appeale# #e(ision o5 the Court o5 <a; Appeals is

an(hore#, re5ers to transa(tions that too@ pla(e $efore the approval o5 Repuli( A(t *09 on July

1, 19/9 when the only le2al rate o5 e;(han2e otainin2 in the .hilippines was .* to ?- K1, an# all

5orei2n e;(han2e ha# to e surren#ere# to the Central Ban@ su$e(t to its #isposition pursuant to

its own rules an# re2ulations ?pon the other han#, the present (ase re5ers to transa(tions that

too@ pla(e #urin2 the e55e(tivity o5 Repuli( A(t *09 when there was, apart 5ro& the parity rate, a

le2al 5ree &ar@et (onversion rate 5or 5orei2n e;(han2e transa(tions, whi(h rate ha# een 5i;e# in

open tra#in2, su(h as those involve# in the (ase at ar

In#ee#, in the (ourse o5 the investi2ation (on#u(te# y the Co&&issioner on the a((ountin2 re(or#s o5 petitioner

Royal Intero(ean )ines, it was veri5ie# that when sai# petitioner pai# its a2en(y 5ees 5or servi(es ren#ere# as

husan#in2 a2ent o5 the sai# vessels, it use# the (onversion rate o5 .390 to ?- K100 5 It is now estoppe# 5ro&

(lai&in2 otherwise in this (ase >R6OR, the petition is E!IE with (osts a2ainst petitioners <his #e(ision is

i&&e#iately e;e(utory an# no e;tension o5 ti&e to 5ile &otion 5or re(onsi#eration shall e entertaine# -O

ORERE

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 11/48

11

G.R. No. 352 %epte:e6 14 199

*#R'(N$ C!RP!R#T$!N ;<o6e6ly *a6u:eni = $i/a Co. Lt/.> petitioner,vs C!**$%%$!N(R !F $NT(RN#L R((N( #N, C!RT !F T#7 #PP(#L% respon#ents

F(RN#N C.J.:

.etitioner, +arueni Corporation, representin2 itsel5 as a 5orei2n (orporation #uly or2aniDe# an# e;istin2 un#er thelaws o5 Japan an# #uly li(ense# to en2a2e in usiness un#er .hilippine laws with ran(h o55i(e at the 4th 6loor,6+I Buil#in2, A#uana -treet, Intra&uros, +anila see@s the reversal o5 the #e(ision o5 the Court o5 <a;Appeals 1 #ate# 6eruary 1*, 198 #enyin2 its (lai& 5or re5un# or ta; (re#it in the a&ount o5 .**9,4*440representin2 alle2e# overpay&ent o5 ran(h pro5it re&ittan(e ta; withhel# 5ro& #ivi#en#s y Atlanti( Gul5 an#.a(i5i( Co o5 +anila AGS.:

<he 5ollowin2 5a(ts are un#ispute#= +arueni Corporation o5 Japan has euity invest&ents in AGS. o5 +anila 6orthe 5irst uarter o5 1981 en#in2 +ar(h 31, AGS. #e(lare# an# pai# (ash #ivi#en#s to petitioner in the a&ount o5.849,*0 an# withhel# the (orrespon#in2 10N 5inal #ivi#en# ta; thereon -i&ilarly, 5or the thir# uarter o5 1981en#in2 -epte&er 30, AGS. #e(lare# an# pai# .849,*0 as (ash #ivi#en#s to petitioner an# withhel# the(orrespon#in2 10N 5inal #ivi#en# ta; thereon

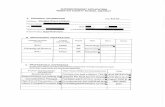

AGS. #ire(tly re&itte# the (ash #ivi#en#s to petitionerHs hea# o55i(e in <o@yo, Japan, net not only o5 the 10N 5inal#ivi#en# ta; in the a&ounts o5 .4,48 5or the 5irst an# thir# uarters o5 1981, ut also o5 the withhel# 1/N pro5itre&ittan(e ta; ase# on the re&ittale a&ount a5ter #e#u(tin2 the 5inal withhol#in2 ta; o5 10N A s(he#ule o5#ivi#en#s #e(lare# an# pai# y AGS. to its sto(@hol#er +arueni Corporation o5 Japan, the 10N 5inal inter(orporate#ivi#en# ta; an# the 1/N ran(h pro5it re&ittan(e ta; pai# thereon, is shown elow=

1981 6IR-<?AR<R

three &onthsen#e# 33181:

In .esos:

<>IRE?AR<R

three &onthsen#e# 93081:

<O<A) O66IR-< an#

<>IRE uarters

Cash Eivi#en#s .ai# 849,*044 849,*000 1,99,44000

10N Eivi#en# <a;ithhel#

84,9*00 84,9*00 19,94400

Cash Eivi#en# net o510N Eivi#en# <a;

ithhel#

4,4800 4,4800 1,/*9,4900

1/N Bran(h .ro5itRe&ittan(e <a; ithhel#

114,1**0 114,1**0 **9,4*440 2

!et A&ount Re&itte# to.etitioner

/0,03/80 /0,03/80 1,300,010

<he 10N 5inal #ivi#en# ta; o5 .84,9* an# the 1/N ran(h pro5it re&ittan(e ta; o5 .114,1**0 5or the 5irstuarter o5 1981 were pai# to the Bureau o5 Internal Revenue y AGS. on April *0, 1981 un#er Central Ban@ Re(eipt!o /880 )i@ewise, the 10N 5inal #ivi#en# ta; o5 .84,9* an# the 1/N ran(h pro5it re&ittan(e ta; o5.114,1* 5or the thir# uarter o5 1981 were pai# to the Bureau o5 Internal Revenue y AGS. on Au2ust 4, 1981un#er Central Ban@ Con5ir&ation Re(eipt !o 90/930 4

<hus, 5or the 5irst an# thir# uarters o5 1981, AGS. as withhol#in2 a2ent pai# 1/N ran(h pro5it re&ittan(e on(ash #ivi#en#s #e(lare# an# re&itte# to petitioner at its hea# o55i(e in <o@yo in the total a&ount o5 .**9,4*440 onApril *0 an# Au2ust 4, 1981 5

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 12/48

12

In a letter #ate# January *9, 1981, petitioner, throu2h the a((ountin2 5ir& -y(ip, Gorres, "elayo an# Co&pany,sou2ht a rulin2 5ro& the Bureau o5 Internal Revenue on whether or not the #ivi#en#s petitioner re(eive# 5ro& AGS.are e55e(tively (onne(te# with its (on#u(t or usiness in the .hilippines as to e (onsi#ere# ran(h pro5its su$e(tto the 1/N pro5it re&ittan(e ta; i&pose# un#er -e(tion *4 : *: o5 the !ational Internal Revenue Co#e asa&en#e# y .resi#ential Ee(rees !os 10/ an# 13

In reply to petitionerHs uery, A(tin2 Co&&issioner Ruen An(heta rule#=

.ursuant to -e(tion *4 : *: o5 the <a; Co#e, as a&en#e#, only pro5its re&itte# aroa# y aran(h o55i(e to its hea# o55i(e whi(h are e55e(tively (onne(te# with its tra#e or usiness in the.hilippines are su$e(t to the 1/N pro5it re&ittan(e ta; <o e e55e(tively (onne(te# it is notne(essary that the in(o&e e #erive# 5ro& the a(tual operation o5 ta;payerF(orporationHs tra#e orusiness it is su55i(ient that the in(o&e arises 5ro& the usiness a(tivity in whi(h the (orporation isen2a2e# 6or e;a&ple, i5 a resi#ent 5orei2n (orporation is en2a2e# in the uyin2 an# sellin2 o5&a(hineries in the .hilippines an# invests in so&e shares o5 sto(@ on whi(h #ivi#en#s aresuseuently re(eive#, the #ivi#en#s thus earne# are not (onsi#ere# He55e(tively (onne(te#H with itstra#e or usiness in this (ountry Revenue +e&oran#u& Cir(ular !o //F80:

In the instant (ase, the #ivi#en#s re(eive# y +arueni 5ro& AGS. are not in(o&e arisin2 5ro& theusiness a(tivity in whi(h +arueni is en2a2e# A((or#in2ly, sai# #ivi#en#s i5 re&itte# aroa# arenot (onsi#ere# ran(h pro5its 5or purposes o5 the 1/N pro5it re&ittan(e ta; i&pose# y -e(tion *4

: *: o5 the <a; Co#e, as a&en#e# 3

Conseuently, in a letter #ate# -epte&er *1, 1981 an# 5ile# with the Co&&issioner o5 Internal Revenue on-epte&er *4, 1981, petitioner (lai&e# 5or the re5un# or issuan(e o5 a ta; (re#it o5 .**9,4*440 representin2pro5it ta; re&ittan(e erroneously pai# on the #ivi#en#s re&itte# y Atlanti( Gul5 an# .a(i5i( Co o5 +anila AGS.:on April *0 an# Au2ust 4, 1981 to hea# o55i(e in <o@yo

On June 14, 198*, respon#ent Co&&issioner o5 Internal Revenue #enie# petitionerHs (lai& 5or re5un#(re#it o5.**9,4*440 on the 5ollowin2 2roun#s=

hile it is true that sai# #ivi#en#s re&itte# were not su$e(t to the 1/N pro5it re&ittan(e ta; asthe sa&e were not in(o&e earne# y a .hilippine Bran(h o5 +arueni Corporation o5 Japan an#neither is it su$e(t to the 10N inter(orporate #ivi#en# ta;, the re(ipient o5 the #ivi#en#s, ein2 a

nonFresi#ent sto(@hol#er, nevertheless, sai# #ivi#en# in(o&e is su$e(t to the */ N ta; pursuant toArti(le 10 *: : o5 the <a; <reaty #ate# 6eruary 13, 1980 etween the .hilippines an# Japan

Inas&u(h as the (ash #ivi#en#s re&itte# y AGS. to +arueni Corporation, Japan is su$e(t to */N ta;, an# that the ta;es withhel# o5 10 N as inter(orporate #ivi#en# ta; an# 1/ N as pro5itre&ittan(e ta; totals si(: */ N, the a&ount re5un#ale o55sets the liaility, hen(e, nothin2 is le5t toe re5un#e#

.etitioner appeale# to the Court o5 <a; Appeals whi(h a55ir&e# the #enial o5 the re5un# y the Co&&issioner o5Internal Revenue in its assaile# $u#2&ent o5 6eruary 1*, 198 9

In support o5 its re$e(tion o5 petitionerHs (lai&e# re5un#, respon#ent <a; Court e;plaine#=

hatever the #iale(ti(s e&ploye#, no a&ount o5 sophistry (an i2nore the 5a(t that the #ivi#en#s inuestion are in(o&e ta;ale to the +arueni Corporation o5 <o@yo, Japan <he sai# #ivi#en#s were#istriutions &a#e y the Atlanti(, Gul5 an# .a(i5i( Co&pany o5 +anila to its sharehol#er out o5 itspro5its on the invest&ents o5 the +arueni Corporation o5 Japan, a nonFresi#ent 5orei2n (orporation<he invest&ents in the Atlanti( Gul5 S .a(i5i( Co&pany o5 the +arueni Corporation o5 Japan were#ire(tly &a#e y it an# the #ivi#en#s on the invest&ents were li@ewise #ire(tly re&itte# to an#re(eive# y the +arueni Corporation o5 Japan .etitioner +arueni Corporation .hilippine Bran(hhas no parti(ipation or intervention, #ire(tly or in#ire(tly, in the invest&ents an# in the re(eipt o5the #ivi#en#s An# it appears that the 5un#s investe# in the Atlanti( Gul5 S .a(i5i( Co&pany #i# not(o&e out o5 the 5un#s in5use# y the +arueni Corporation o5 Japan to the +arueni Corporation.hilippine Bran(h As a &atter o5 5a(t, the Central Ban@ o5 the .hilippines, in authoriDin2 there&ittan(e o5 the 5orei2n e;(han2e euivalent o5 si(: the #ivi#en#s in uestion, treate# the+arueni Corporation o5 Japan as a nonFresi#ent sto(@hol#er o5 the Atlanti( Gul5 S .a(i5i( Co&panyase# on the supportin2 #o(u&ents su&itte# to it

-u$e(t to (ertain e;(eptions not pertinent hereto, in(o&e is ta;ale to the person who earne# itA#&itte#ly, the #ivi#en#s un#er (onsi#eration were earne# y the +arueni Corporation o5 Japan,an# hen(e, ta;ale to the sai# (orporation hile it is true that the +arueni Corporation .hilippineBran(h is #uly li(ense# to en2a2e in usiness un#er .hilippine laws, su(h #ivi#en#s are not thein(o&e o5 the .hilippine Bran(h an# are not ta;ale to the sai# .hilippine ran(h e see nosi2ni5i(an(e thereto in the i#entity (on(ept or prin(ipalFa2ent relationship theory o5 petitionere(ause su(h #ivi#en#s are the in(o&e o5 an# ta;ale to the Japanese (orporation in Japan an# notto the .hilippine ran(h 10

>en(e, the instant petition 5or review

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 13/48

13

It is the ar2u&ent o5 petitioner (orporation that 5ollowin2 the prin(ipalFa2ent relationship theory, +arueni Japan isli@ewise a resi#ent 5orei2n (orporation su$e(t only to the 10 N inter(orporate 5inal ta; on #ivi#en#s re(eive# 5ro&a #o&esti( (orporation in a((or#an(e with -e(tion *4(: 1: o5 the <a; Co#e o5 19 whi(h states=

Eivi#en#s re(eive# y a #o&esti( or resi#ent 5orei2n (orporation liale to ta; un#er this Co#e M 1:-hall e su$e(t to a 5inal ta; o5 10N on the total a&ount thereo5, whi(h shall e (olle(te# an# pai#as provi#e# in -e(tions /3 an# /4 o5 this Co#e

.uli( respon#ents, however, are o5 the (ontrary view that +arueni, Japan, ein2 a nonFresi#ent 5orei2n(orporation an# not en2a2e# in tra#e or usiness in the .hilippines, is su$e(t to ta; on in(o&e earne# 5ro&.hilippine sour(es at the rate o5 3/ N o5 its 2ross in(o&e un#er -e(tion *4 : 1: o5 the sa&e Co#e whi(h rea#s=

: +ax on foreign corporations M 1: !onFresi#ent (orporations M A 5orei2n (orporation noten2a2e# in tra#e or usiness in the .hilippines shall pay a ta; eual to thirtyF5ive per (ent o5 the2ross in(o&e re(eive# #urin2 ea(h ta;ale year 5ro& all sour(es within the .hilippines as #ivi#en#s

ut e;pressly &a#e su$e(t to the spe(ial rate o5 */N un#er Arti(le 10*: : o5 the <a; <reaty o5 1980 (on(lu#e#etween the .hilippines an# Japan 11 <hus=

Arti(le 10 1: Eivi#en#s pai# y a (o&pany whi(h is a resi#ent o5 a Contra(tin2 -tate to a resi#ento5 the other Contra(tin2 -tate &ay e ta;e# in that other Contra(tin2 -tate

*: >owever, su(h #ivi#en#s &ay also e ta;e# in the Contra(tin2 -tate o5 whi(h the (o&panypayin2 the #ivi#en#s is a resi#ent, an# a((or#in2 to the laws o5 that Contra(tin2 -tate, ut i5 there(ipient is the ene5i(ial owner o5 the #ivi#en#s the ta; so (har2e# shall not e;(ee#

a:

: */ per (ent o5 the 2ross a&ount o5 the #ivi#en#s in all other (ases

Central to the issue o5 +arueni JapanHs ta; liaility on its #ivi#en# in(o&e 5ro& .hilippine sour(es is there5ore the#eter&ination o5 whether it is a resi#ent or a nonFresi#ent 5orei2n (orporation un#er .hilippine laws

?n#er the <a; Co#e, a resi#ent 5orei2n (orporation is one that is en2a2e# in tra#e or usiness within the.hilippines .etitioner (onten#s that pre(isely e(ause it is en2a2e# in usiness in the .hilippines throu2h its.hilippine ran(h that it &ust e (onsi#ere# as a resi#ent 5orei2n (orporation .etitioner reasons that sin(e the.hilippine ran(h an# the <o@yo hea# o55i(e are one an# the sa&e entity, whoever &a#e the invest&ent in AGS.,+anila #oes not &atter at all A sin2le (orporate entity (annot e oth a resi#ent an# a nonFresi#ent (orporation#epen#in2 on the nature o5 the parti(ular transa(tion involve# A((or#in2ly, whether the #ivi#en#s are pai# #ire(tlyto the hea# o55i(e or (ourse# throu2h its lo(al ran(h is o5 no &o&ent 5or a5ter all, the hea# o55i(e an# the o55i(eran(h (onstitute ut one (orporate entity, the +arueni Corporation, whi(h, un#er oth .hilippine ta; an#(orporate laws, is a resi#ent 5orei2n (orporation e(ause it is transa(tin2 usiness in the .hilippines

<he -oli(itor General has a#euately re5ute# petitionerHs ar2u&ents in this wise=

<he 2eneral rule that a 5orei2n (orporation is the sa&e $uri#i(al entity as its ran(h o55i(e in the.hilippines (annot apply here <his rule is ase# on the pre&ise that the usiness o5 the 5orei2n(orporation is (on#u(te# throu2h its ran(h o55i(e, 5ollowin2 the prin(ipal a2ent relationship theoryIt is un#erstoo# that the ran(h e(o&es its a2ent here -o that when the 5orei2n (orporationtransa(ts usiness in the .hilippines in#epen#ently o5 its ran(h, the prin(ipalFa2ent relationship isset asi#e <he transa(tion e(o&es one o5 the 5orei2n (orporation, not o5 the ran(h Conseuently,the ta;payer is the 5orei2n (orporation, not the ran(h or the resi#ent 5orei2n (orporation

Corollarily, i5 the usiness transa(tion is (on#u(te# throu2h the ran(h o55i(e, the latter e(o&esthe ta;payer, an# not the 5orei2n (orporation 1

In other wor#s, the alle2e# overpai# ta;es were in(urre# 5or the re&ittan(e o5 #ivi#en# in(o&e to the hea# o55i(e inJapan whi(h is a separate an# #istin(t in(o&e ta;payer 5ro& the ran(h in the .hilippines <here (an e no otherlo2i(al (on(lusion (onsi#erin2 the un#ispute# 5a(t that the invest&ent totallin2 *83*0 shares in(lu#in2 that o5

no&inee: was &a#e 5or purposes pe(uliarly 2er&ane to the (on#u(t o5 the (orporate a55airs o5 +arueni Japan, ut(ertainly not o5 the ran(h in the .hilippines It is thus (lear that petitioner, havin2 &a#e this in#epen#entinvest&ent attriutale only to the hea# o55i(e, (annot now (lai& the in(re&ents as or#inary (onseuen(es o5 itstra#e or usiness in the .hilippines an# avail itsel5 o5 the lower ta; rate o5 10 N

But while puli( respon#ents (orre(tly (on(lu#e# that the #ivi#en#s in #ispute were neither su$e(t to the 1/ Npro5it re&ittan(e ta; nor to the 10 N inter(orporate #ivi#en# ta;, the re(ipient ein2 a nonFresi#ent sto(@hol#er,they 2rossly erre# in hol#in2 that no re5un# was 5orth(o&in2 to the petitioner e(ause the ta;es thus withhel#totalle# the */ N rate i&pose# y the .hilippineFJapan <a; Convention pursuant to Arti(le 10 *: :

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 14/48

14

<o si&ply a## the two ta;es to arrive at the */ N ta; rate is to #isre2ar# a asi( rule in ta;ation that ea(h ta; hasa #i55erent ta; asis hile the ta; on #ivi#en#s is #ire(tly levie# on the #ivi#en#s re(eive#, the ta; ase uponwhi(h the 1/ N ran(h pro5it re&ittan(e ta; is i&pose# is the pro5it a(tually re&itte# aroa# 12

.uli( respon#ents li@ewise erre# in auto&ati(ally i&posin2 the */ N rate un#er Arti(le 10 *: : o5 the <a; <reatyas i5 this were a 5lat rate A (loser loo@ at the <reaty reveals that the ta; rates 5i;e# y Arti(le 10 are the &a;i&u&rates as re5le(te# in the phrase shall not e;(ee# <his &eans that any ta; i&posale y the (ontra(tin2 state(on(erne# shoul# not e;(ee# the */ N li&itation an# that sai# rate woul# apply only i5 the ta; i&pose# y our lawse;(ee#s the sa&e In other wor#s, y reason o5 our ilateral ne2otiations with Japan, we have a2ree# to have ourri2ht to ta; li&ite# to a (ertain e;tent to attain the 2oals set 5orth in the <reaty

.etitioner, ein2 a nonFresi#ent 5orei2n (orporation with respe(t to the transa(tion in uestion, the appli(aleprovision o5 the <a; Co#e is -e(tion *4 : 1: iii: in (on$un(tion with the .hilippineFJapan <reaty o5 1980 -ai#se(tion provi#es=

: +ax on foreign corporations. M 1: !onFresi#ent (orporations M iii: On #ivi#en#s re(eive#5ro& a #o&esti( (orporation liale to ta; un#er this Chapter, the ta; shall e 1/N o5 the #ivi#en#sre(eive#, whi(h shall e (olle(te# an# pai# as provi#e# in -e(tion /3 #: o5 this Co#e, su$e(t to the(on#ition that the (ountry in whi(h the nonFresi#ent 5orei2n (orporation is #o&i(ile# shall allow a(re#it a2ainst the ta; #ue 5ro& the nonFresi#ent 5orei2n (orporation, ta;es #ee&e# to have eenpai# in the .hilippines euivalent to *0 N whi(h represents the #i55eren(e etween the re2ular ta;

3/ N: on (orporations an# the ta; 1/ N: on #ivi#en#s as provi#e# in this -e(tion

.ro(ee#in2 to apply the aove se(tion to the (ase at ar, petitioner, ein2 a nonFresi#ent 5orei2n (orporation, as a2eneral rule, is ta;e# 3/ N o5 its 2ross in(o&e 5ro& all sour(es within the .hilippines P-e(tion *4 : 1:Q

>owever, a #is(ounte# rate o5 1/N is 2iven to petitioner on #ivi#en#s re(eive# 5ro& a #o&esti( (orporation AGS.:on the (on#ition that its #o&i(ile state Japan: e;ten#s in 5avor o5 petitioner, a ta; (re#it o5 not less than *0 N o5the #ivi#en#s re(eive# <his *0 N represents the #i55eren(e etween the re2ular ta; o5 3/ N on nonFresi#ent5orei2n (orporations whi(h petitioner woul# have or#inarily pai#, an# the 1/ N spe(ial rate on #ivi#en#s re(eive#5ro& a #o&esti( (orporation

Conseuently, petitioner is entitle# to a re5un# on the transa(tion in uestion to e (o&pute# as 5ollows=

<otal (ash #ivi#en# pai# .1,99,44000less 1/N un#er -e( *4: 1: iii : */4,9100FFFFFFFFFFFFFFFFFF

Cash #ivi#en# net o5 1/ N ta;#ue petitioner .1,444/*400less net a&ounta(tually re&itte# 1,300,010FFFFFFFFFFFFFFFFFFF

A&ount to e re5un#e# to petitionerrepresentin2 overpay&ent o5

ta;es on #ivi#en#s re&itte# . 144 4/*40VVVVVVVVVVV

It is rea#ily apparent that the 1/ N ta; rate i&pose# on the #ivi#en#s re(eive# y a 5orei2n nonFresi#entsto(@hol#er 5ro& a #o&esti( (orporation un#er -e(tion *4 : 1: iii: is easily within the &a;i&u& (eilin2 o5 */ No5 the 2ross a&ount o5 the #ivi#en#s as #e(ree# in Arti(le 10 *: : o5 the <a; <reaty

<here is one 5inal point that &ust e settle# Respon#ent Co&&issioner o5 Internal Revenue is laorin2 un#er thei&pression that the Court o5 <a; Appeals is (overe# y Batas .a&ansa Bl2 1*9, otherwise @nown as the Ju#i(iaryReor2aniDation A(t o5 1980 >e alle2es that the instant petition 5or review was not per5e(te# in a((or#an(e withBatas .a&ansa Bl2 1*9 whi(h provi#es that the perio# o5 appeal 5ro& 5inal or#ers, resolutions, awar#s, $u#2&ents, or #e(isions o5 any (ourt in all (ases shall e 5i5teen 1/: #ays (ounte# 5ro& the noti(e o5 the 5inalor#er, resolution, awar#, $u#2&ent or #e(ision appeale# 5ro&

<his is (o&pletely untenale <he (ite# B. Bl2 1*9 #oes not in(lu#e the Court o5 <a; Appeals whi(h has een(reate# y virtue o5 a spe(ial law, Repuli( A(t !o 11*/ Respon#ent (ourt is not a&on2 those (ourts spe(i5i(ally&entione# in -e(tion * o5 B. Bl2 1*9 as 5allin2 within its s(ope

<hus, un#er -e(tion 18 o5 Repuli( A(t !o 11*/, a party a#versely a55e(te# y an or#er, rulin2 or #e(ision o5 theCourt o5 <a; Appeals is 2iven thirty 30: #ays 5ro& noti(e to appeal there5ro& Otherwise, sai# or#er, rulin2, or#e(ision shall e(o&e 5inal

Re(or#s show that petitioner re(eive# noti(e o5 the Court o5 <a; AppealsHs #e(ision #enyin2 its (lai& 5or re5un# onApril 1/, 198 On the 30th #ay, or on +ay 1/, 198 the last #ay 5or appeal:, petitioner 5ile# a &otion 5orre(onsi#eration whi(h respon#ent (ourt suseuently #enie# on !ove&er 1, 198, an# noti(e o5 whi(h was

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 15/48

15

re(eive# y petitioner on !ove&er *, 198 <wo #ays later, or on !ove&er *8, 198, petitioner si&ultaneously5ile# a noti(e o5 appeal with the Court o5 <a; Appeals an# a petition 5or review with the -upre&e Court 14 6ro& the5ore2oin2, it is evi#ent that the instant appeal was per5e(te# well within the 30F#ay perio# provi#e# un#er RA !o11*/, the whole 30F#ay perio# to appeal havin2 e2un to run a2ain 5ro& noti(e o5 the #enial o5 petitionerHs &otion5or re(onsi#eration

>R6OR, the uestione# #e(ision o5 respon#ent Court o5 <a; Appeals #ate# 6eruary 1*, 198 whi(h a55ir&e#the #enial y respon#ent Co&&issioner o5 Internal Revenue o5 petitioner +arueni CorporationHs (lai& 5or re5un# isherey R"R-E <he Co&&issioner o5 Internal Revenue is or#ere# to re5un# or 2rant as ta; (re#it in 5avor o5petitioner the a&ount o5 .144,4/*40 representin2 overpay&ent o5 ta;es on #ivi#en#s re(eive# !o (osts -oor#ere#

G.R. No. 19010 July 11 01

#CC(NTR( $NC. .etitioner,vs C!**$%%$!N(R !F $NT(RN#L R((N( Respon#ent

%(R(N! J.:

<his is a .etition 5ile# un#er Rule 4/ o5 the 199 Rules o5 Civil .ro(e#ure, prayin2 5or the reversal o5 the Ee(ision o5the Court o5 <a; Appeals n Ban( C<A n Ban( : #ate# ** -epte&er *009 an# its suseuent Resolution #ate# *3O(toer *0091

A((enture, In( A((enture: is a (orporation en2a2e# in the usiness o5 provi#in2 &ana2e&ent (onsultin2, usinessstrate2ies #evelop&ent, an# sellin2 an#or li(ensin2 o5 so5tware* It is #uly re2istere# with the Bureau o5 InternalRevenue BIR: as a "alue A##e# <a; "A<: ta;payer or enterprise in a((or#an(e with -e(tion *3 o5 the !ationalInternal Revenue Co#e <a; Co#e:3

On 9 Au2ust *00*, A((enture 5ile# its +onthly "A< Return 5or the perio# 1 July *00* to 31 Au2ust *00* 1stperio#: Its uarterly "A< Return 5or the 5ourth uarter o5 *00*, whi(h (overs the 1st perio#, was 5ile# on 1-epte&er *00* an# an A&en#e# uarterly "A< Return, on *1 June *0044 <he 5ollowin2 are re5le(te# inA((entureWs "A< Return 5or the 5ourth uarter o5 *00*=/

,-#phi,

Pu6cases #ount $nput #T

Eo&esti( .ur(hasesF Capital Goo#s .1*,31*,**00 .1,*31,***0

Eo&esti( .ur(hasesF Goo#s other than (apital Goo#s .4,89,/090 .,48,9/09

Eo&esti( .ur(hasesF -ervi(es .1,4//,8810 .1,4/,/881

Total $nput Ta@ P925509.0

7eroFrate# -ales .31,113,/1334

<otal -ales .33/,40,/444

A((enture 5ile# its +onthly "A< Return 5or the &onth o5 -epte&er *00* on *4 O(toer *00* an# that 5or O(toer*00*, on 1* !ove&er *00* <hese returns were a&en#e# on 9 January *003 A((entureWs uarterly "A< Return5or the 5irst uarter o5 *003, whi(h in(lu#e# the perio# 1 -epte&er *00* to 30 !ove&er *00* *n# perio#:, was5ile# on 1 Ee(e&er *00* an# the A&en#e# uarterly "A< Return, on 18 June *004 <he latter (ontains the5ollowin2 in5or&ation=

Pu6cases #ount $nput #T

Eo&esti( .ur(hasesF Capital Goo#s .80,/,*9410 .8,0,/*941

Eo&esti( .ur(hasesF Goo#s other than (apital Goo#s .13*,8*0,/410 .13,*8*,0/41

Eo&esti( .ur(hasesF-ervi(es .3,*38,/800 .,3*3,8/80

Total $nput Ta@ P3459.2

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 16/48

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 17/48

17

Resolute, A((enture 5ile# a .etition 5or Review with the C<A n Ban(, ut the latter a55ir&e# the EivisionWs Ee(isionan# Resolution*8 A suseuent +R was also #enie# in a Resolution #ate# *3 O(toer *009

>en(e, the present .etition 5or Review*9 un#er Rule 4/

In a Joint -tipulation o5 6a(ts an# Issues, the parties an# the Eivision have a2ree# to su&it the 5ollowin2 issues5or resolution=

1 hether or not .etitionerWs sales o5 2oo#s an# servi(es are DeroFrate# 5or "A< purposes un#er -e(tion108B:*:3: o5 the 199 <a; Co#e

* hether or not petitionerWs (lai& 5or re5un#ta; (re#it in the a&ount o5 .3/,18,884*1 representsunutiliDe# input "A< pai# on its #o&esti( pur(hases o5 2oo#s an# servi(es 5or the perio# (o&&en(in2 5ro&1 July *00* until 30 !ove&er *00*

3 hether or not .etitioner has (arrie# over to the su((ee#in2 ta;ale uarters: or years: the alle2e#unutiliDe# input "A< pai# on its #o&esti( pur(hases o5 2oo#s an# servi(es 5or the perio# (o&&en(in2 5ro&1 July *00* until 30 !ove&er *00*, an# applie# the sa&e 5ully to its output "A< liaility 5or the sai#perio#

4 hether or not .etitioner is entitle# to the re5un# o5 the a&ount o5 .3/,18,884*1, representin2 theunutiliDe# input "A< on #o&esti( pur(hases o5 2oo#s an# servi(es 5or the perio# (o&&en(in2 5ro& 1 July*00* until 30 !ove&er *00*, 5ro& its sales o5 servi(es to various 5orei2n (lients

/ hether or not .etitionerWs (lai& 5or re5un#ta; (re#it in the a&ount o5 .3/,18,884*1, as alle2e#unutiliDe# input "A< on #o&esti( pur(hases o5 2oo#s an# servi(es 5or the perio# (overin2 1 July *00* until30 !ove&er *00* are #uly sustantiate# y proper #o(u&ents30

6or (onsi#eration in the present .etition are the 5ollowin2 issues=

1 -houl# the re(ipient o5 the servi(es e #oin2 usiness outsi#e the .hilippines 5or the transa(tion to eDeroFrate# un#er -e(tion 108B:*: o5 the 199 <a; Co#eX

* >as A((enture su((ess5ully proven that its (lients are entities #oin2 usiness outsi#e the .hilippinesX

Re(ipient o5 servi(es &ust e #oin2 usiness outsi#e the .hilippines 5or the transa(tions to uali5y as DeroFrate#

A((enture an(hors its re5un# (lai& on -e(tion 11*A: o5 the 199 <a; Co#e, whi(h allows the re5un# o5 unutiliDe#input "A< earne# 5ro& DeroFrate# or e55e(tively DeroFrate# sales <he provision rea#s=

-C 11* Re5un#s or <a; Cre#its o5 Input <a; F

A: 7eroFRate# or 55e(tively 7eroFRate# -ales F Any "A<Fre2istere# person, whose sales are DeroFrate# ore55e(tively DeroFrate# &ay, within two *: years a5ter the (lose o5 the ta;ale uarter when the sales were &a#e,apply 5or the issuan(e o5 a ta; (re#it (erti5i(ate or re5un# o5 (re#itale input ta; #ue or pai# attriutale to su(hsales, e;(ept transitional input ta;, to the e;tent that su(h input ta; has not een applie# a2ainst output ta;=

.rovi#e#, however, <hat in the (ase o5 DeroFrate# sales un#er -e(tion 10A:*:a:1:, *: an# B: an# -e(tion 108B:1: an# *:, the a((eptale 5orei2n (urren(y e;(han2e pro(ee#s thereo5 ha# een #uly a((ounte# 5or ina((or#an(e with the rules an# re2ulations o5 the Ban2@o -entral n2 .ilipinas B-.:= .rovi#e#, 5urther, <hat wherethe ta;payer is en2a2e# in DeroFrate# or e55e(tively DeroFrate# sale an# also in ta;ale or e;e&pt sale o5 2oo#s o5properties or servi(es, an# the a&ount o5 (re#itale input ta; #ue or pai# (annot e #ire(tly an# entirely attriute#to any one o5 the transa(tions, it shall e allo(ate# proportionately on the asis o5 the volu&e o5 sales -e(tion108B: re5erre# to in the 5ore2oin2 provision was 5irst seen when .resi#ential Ee(ree !o .E: 199431 a&en#e#<itle I" o5 .E 11/8,3* whi(h is also @nown as the !ational Internal Revenue Co#e o5 19 -everal Ee(isions havere5erre# to this as the 198 <a; Co#e, even thou2h it &erely a&en#e# <itle I" o5 the 19 <a; Co#e

<wo years therea5ter, or on 1 January 1988, ;e(utive Or#er !o O: *333 5urther a&en#e# provisions o5 <itleI" O *3 y trans5errin2 the ol# <itle I" provisions to <itle "I an# 5illin2 in the 5or&er title with new provisionsthat i&pose# a "A<

<he "A< syste& intro#u(e# in O *3 was restru(ture# throu2h Repuli( A(t !o RA: 134 <his law, whi(hwas approve# on / +ay 1994, wi#ene# the ta; ase -e(tion 3 thereo5 rea#s=

-C<IO! 3 -e(tion 10* o5 the !ational Internal Revenue Co#e, as a&en#e#, is herey 5urther a&en#e# to rea# as5ollows=

-C 10* "alueFa##e# ta; on sale o5 servi(es an# use or lease o5 properties ; ; ;

; ; ; ; ; ; ; ; ;

7/23/2019 C2. Taxpayers

http://slidepdf.com/reader/full/c2-taxpayers 18/48

18

: <ransa(tions su$e(t to DeroFrate M <he 5ollowin2 servi(es per5or&e# in the .hilippines y "A<Fre2istere#persons shall e su$e(t to 0N=

1: .ro(essin2, &anu5a(turin2 or repa(@in2 2oo#s 5or other persons #oin2 usiness outsi#e the .hilippineswhi(h 2oo#s are suseuently e;porte#, where the servi(es are pai# 5or in a((eptale 5orei2n (urren(y an#a((ounte# 5or in a((or#an(e with the rules an# re2ulations o5 the Ban2@o -entral n2 .ilipinas B-.:

*: -ervi(es other than those &entione# in the pre(e#in2 suFpara2raph, the (onsi#eration 5or whi(h ispai# 5or in a((eptale 5orei2n (urren(y an# a((ounte# 5or in a((or#an(e with the rules an# re2ulations o5the Ban2@o -entral n2 .ilipinas B-.:

ssentially, -e(tion 10*: o5 the 19 <a; Co#eMas a&en#e# y .E 1994, O *3, an# RA 1Mprovi#esthat i5 the (onsi#eration 5or the servi(es provi#e# y a "A<Fre2istere# person is in a 5orei2n (urren(y, then thistransa(tion shall e su$e(te# to Dero per(ent rate

<he 199 <a; Co#e repro#u(e# -e(tion 10*: o5 the 19 <a; Co#e in its -e(tion 108B:, to wit=

B: <ransa(tions -u$e(t to 7ero .er(ent 0N: Rate F <he 5ollowin2 servi(es per5or&e# in the .hilippines y "A<Fre2istere# persons shall e su$e(t to Dero per(ent 0N: rate

1: .ro(essin2, &anu5a(turin2 or repa(@in2 2oo#s 5or other persons #oin2 usiness outsi#e the .hilippineswhi(h 2oo#s are suseuently e;porte#, where the servi(es are pai# 5or in a((eptale 5orei2n (urren(y an#a((ounte# 5or in a((or#an(e with the rules an# re2ulations o5 the Ban2@o -entral n2 .ilipinas B-.: