C HAPTER 4 Understanding Interest Rates. A DMINISTRATIVE D ETAILS. Next week we will run the...

-

Upload

oscar-rodgers -

Category

Documents

-

view

213 -

download

0

Transcript of C HAPTER 4 Understanding Interest Rates. A DMINISTRATIVE D ETAILS. Next week we will run the...

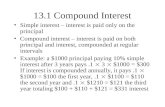

CHAPTER 4Understanding Interest Rates

ADMINISTRATIVE DETAILS.

Next week we will run the interest rate experiment from aplia.com.

There is a homework assignment that is due before next weeks class to prepare you for the experiment.

Requires bringing a laptop computer to class.

Requires installation of the CSUN VPN on your laptop.http://csunecon.com/?p=63

THE IMPORTANCE OF FINANCIAL MARKETS

Financial Markets (or the ability to borrow and lend) improves welfare in 2 ways.Efficiently allocates investible funds among

alternative investments. Provide the ability to borrow and lend money

allows people to adjust spending patterns over time.

Therefore, access to Financial Markets makes people better off.

4-3

4-4

Gravina Island Bridge projected to cost about $500 million dollars connecting Gravina Island (pop. 50) to the mainland.

F-22, 28 billion to develop.

Cost $361,000,000 dollars per aircraft

F-35, $282,000,000,000 total program cost.

Cost $92 million per aircraft.

MQ-9

Cost $12 million per aircraft.

Rank Country Military expenditure, 2009 % of GDP, 2008

1 United States 663,255,000,000 4.30% Next 10 Largest 531,682,000,000 2 China 98,800,000,000 2.00%3 United Kingdom 69,271,000,000 2.50%4 France 67,316,000,000 2.30%5 Russian Federation 61,000,000,000 3.50%6 Germany 48,022,000,000 1.30%7 Japan 46,859,000,000 0.90%8 Saudi Arabia 39,257,000,000 8.20%9 Italy 37,427,000,000 1.70%

10 India 36,600,000,000 2.60%11 South Korea 27,130,000,000 2.80%12 Brazil 27,124,000,000 1.50%13 Canada 20,564,000,000 1.30%14 Australia 20,109,000,000 1.80%15 Spain 19,409,000,000 1.20%16 Turkey 19,009,000,000 2.20%17 Israel 14,309,000,000 7.00%18 Greece 13,917,000,000 3.60%19 United Arab Emirates 13,052,000,000 5.9%

20 Netherlands 12,642,000,000 1.40%

MILITARY EXPENDITURES.

U.S. military spending is large compared to GDP and is enormous compared to other countries.

“As many frustrated Americans who have joined the Tea Party realize, we cannot stand against big government at home while supporting it abroad.

We cannot talk about fiscal responsibility while spending trillions on occupying and bullying the rest of the world. We cannot talk about the budget deficit and spiraling domestic spending without looking at the costs of maintaining an American empire of more than 700 military bases in more than 120 foreign countries.

We cannot pat ourselves on the back for cutting a few thousand dollars from a nature preserve or an inner-city swimming pool at home while turning a blind eye to a Pentagon budget that nearly equals those of the rest of the world combined.”

Ron Paul

The views from atop Los Angeles Unified School District's downtown headquarters are sweeping: Disney Hall, the Music Center complex, iconic high-rise buildings that make up the L.A. skyline.

Inside the 29-story building, more than 3,400 employees filter through LAUSD's main offices every week. The triangular, 928,000-square-foot tower at 333 S. Beaudry Ave. had historically been difficult to lease while owned by Bank of America. It was purchased and renovated by LAUSD in 2001 for $154 million.

But even today, according to a top LAUSD official, the building seems too ostentatious in light of budget cuts and other financial issues the country's second-largest public school district is grappling with.

But Superintendent David Brewer III maintained that Beaudry should not be viewed as a typical corporate building, saying it lacks the granite, fine wood and other trappings of some of downtown's more grandiose skyscrapers.

"It's pretty austere," Brewer said, adding that his own offices are adequate.

He said that while $154 million might seem pricey for the purchase and rehabilitation of the building, it is far less than the cost of leasing space downtown for all of the district's administrators and support staff. Brewer said he hopes the building eventually will come to be seen as a symbol of efficiency as he reduces the size of the central administration and consolidates leased space at other downtown locations into Beaudry.

"It will be a symbol of success versus a symbol of bureaucracy. We'll consolidate all in one and save a fortune, and that's the ultimate in decentralization.

EFFICIENT ALLOCATION OF INVESTIBLE FUNDS

Billions of dollars

Potential Projects 1 2 3 4 5 6

Expected Rate of Return 20% 15% 10% 5% 2% 1%

Required Investment (billions

of dollars) 20 10 15 8 5 10

Interest Rate

20%

20

15%

30 45

10%

5%

2%

1%

5853 68

Demand (borrowers)

Suppose there are 6 potential projects that could be funded and the expected rates of return and required investments are given in the table above.

If there was a pool of 53 billion dollars of investible funds, what is an efficient allocation of funds among the potential projects, i.e. what allocation will maximize social welfare.

4-9

Proposed 1.2 billion dollar 72,000 seat NFL stadium next to the convention center.

Supported by 350 million dollars of government bonds to finance construction with AEG promising to repay the bonds with revenue from the stadium.

4-10

3808 Woolwine Dr, Los Angeles.

2145 sq. ft. house built in 1932.

Was worth approximately $600K in 2006.

Repossessed in Nov. 2010 with a mortgage of $298,199.

Sold in Feb. 2011 for 170,000.

On the market Sept. 2011, now for $338K.

4-11

Proposed Keystone Pipeline.

Estimated cost 13 billion dollars.

4-12

Obama Officials Defend Solar Loan to Bankrupt Firm as Emails Show Past Concerns

Obama administration officials on Wednesday defended a $528 million loan to a solar-panel company that went bankrupt this month, claiming the firm fell victim to global economic trends but that federal investment in alternative energy must continue.

The testimony came as Republican and Democratic lawmakers raised sharp questions about the decision that ultimately left taxpayers on the hook for millions, and as newly released emails show administration officials were raising doubts about the loan proposal to Solyndra months before it was finalized.

But emails released by the House Energy and Commerce Committee show that the relevant credit committee decided "not to engage in further discussions with Solyndra" in the final days of the Bush administration. After the change in administration, officials restarted the loan review process for Solyndra.

One Republican aide said the emails released as part of that probe show the White House was more concerned with press events surrounding the loan than the soundness of Solyndra. The aide said "corners were cut."

The emails at least show budget analysts felt rushed by the White House to review the loan guarantee in time for an announcement by Vice President Biden in September 2009.

The concerns flared in August 2009, when staff with the Energy Department wrote of a "major outstanding issue," relating to the project's solvency. They noted an estimate said the project would run out of cash in September 2011.

But other administration officials presumed the parent company, as well as private investors, would cushion the project and ensure its completion.

The company filed for bankruptcy this month.

President Obama visited Solyndra in May 2010, heralding the company as “leading the way toward a brighter and more prosperous future.” He also cited it as a success story from the government’s $787 billion economic stimulus package.

“Less than a year ago, we were standing on what was an empty lot. But through the Recovery Act, this company received a loan to expand its operations,” Obama said at the time. “This new factory is the result of those loans.”

In 2009, the Obama administration fast-tracked Solyndra’s loan application, later awarding it $535 million in guarantees from the stimulus funds.

The deal later came under scrutiny from independent government watch dogs and members of Congress, which said the administration had bypassed key taxpayer protections in a rush to approve the funds — claims the administration has denied.

EFFICIENT ALLOCATION OF INVESTIBLE FUNDS

Billions of dollars

Potential Projects 1 2 3 4 5 6

Expected Rate of Return 20% 15% 10% 5% 2% 1%

Required Investment (billions

of dollars) 20 10 15 8 5 10

Interest Rate

20%

20

15%

30 45

10%

5%

2%

1%

5853 68

Demand

The efficient allocation, i.e. the allocation that would maximize social welfare, would be to fund the projects with the highest rate or return and leave the ones with lower (or negative) rates of return unfunded.

In a free or unregulated market, this is exactly the allocation that would occur because people investing their own money would seek out the projects with the highest returns.

Adding uncertainty into the mix would not change this result.

Supply

EFFICIENT ALLOCATION OF INVESTIBLE FUNDS

Billions of dollars

Potential Projects 1 2 3 4 5 6

Expected Rate of Return 20% 15% 10% 5% 2% 1%

Required Investment (billions

of dollars) 20 10 15 8 5 10

Interest Rate

20%

20

15%

30 45

10%

5%

2%

1%

5853 68

Demand

Suppose a different allocation occurred, possibly due to government intervention that directed loanable funds to projects that would not be funded in a free unregulated market.

What effect would this have on social welfare?

For instance, suppose money was taken from project 2 and diverted to project 6?

Net loss of 14%*10 billion = $1.4 billion.

Supply

FREE MARKETS AND EFFICIENT ALLOCATIONS Generally speaking, loanable funds will be allocated

efficiently if decisions are left in the hands of those who will be rewarded financially if funds are allocated correctly and penalized financially if funds are incorrectly allocated.

This does not mean that every investment funded by private investors will be profitable or able to repay money borrowed because no one can foresee the future.

Private investors will make mistakes but when they do, they alone will suffer the consequences.

Gross misallocation of loanable funds generally occur when the person making the decision about whom to lend to is not rewarded for choosing wisely and not punished for choosing poorly.

4-15

EXAMPLES OF MISALLOCATION OF LOANABLE FUNDS REDUCING SOCIAL WELFARE.

Spanish promotion of green energy. http://www.juandemariana.org/pdf/090327-employment-public-aid-re

newable.pdf Spent $774,000 for each “green job” created. Destroyed 2.2 jobs for each “green job” created. Increased the price of electricity costing consumer and driving

businesses that are heavy electricity users to other countries. Chinese promotion of green energy.

http://www.nytimes.com/2010/09/09/business/global/09trade.html In both cases, if producing electricity using wind or the sun was the

lowest cost method of producing power, no government subsidy would be necessary to “promote” the industry. If a solar panel costs $100,000 to produce and produces a flow of

electricity worth $50,000 over its life, subsidizing its production reduces social welfare.

If a solar panel costs $100,000 to produce and produces a flow of electricity worth $200,000 over its life, no subsidy is necessary.

The main beneficiary of the subsidies are purchasing countries like the U.S.

4-16

EXAMPLES OF MISALLOCATION OF LOANABLE FUNDS REDUCING SOCIAL WELFARE.

Municipal Finance of Sports Stadiums. http://online.wsj.com/article/SB100014240527487042692

04575270802154485456.html History of government financing public sports stadiums

is that the debt eventually has to be repaid with general tax revenue rather than revenue from the stadium.

If the stadium offered and expected return above the market rate of interest, no public financing would be necessary.

Explanations for the interference in the market: Stupidity. Corruption. Redistribution of Income.

4-17

EFFICIENT ALLOCATION OF INVESTIBLE FUNDS

Billions of dollars

Potential Projects 1 2 3 4 5 6

Expected Rate of Return 20% 15% 10% 5% 2% 1%

Required Investment (billions

of dollars) 20 10 15 8 5 10

Interest Rate

20%

20

15%

30 45

10%

5%

2%

1%

5853 68

Demand

Any interference in the allocation of funds that occurs in an unregulated market reduces social welfare.

And redistributes income from one group to another group.

Supply

Consumption today

Con

sum

pti

on in

th

e fu

ture Use Budget line and IC analysis to show how access to

financial markets makes people better off by allowing them to control when and how much they consume over time.

Consider a person who will make $50,000 today and $50,000 in the future. What does his budget line look like if the interest rate is 10%?

Starting point without financial markets. $50K

$50K

What are the endpoints of the budget line and what behavior do the represent?

If the person engaged in zero consumption in the future, how much consumption could he engage in today?

If the person engaged in zero consumption today, how much consumption could he have in the future?

Suppose a person wanted to consume $60K today.

$60K

$39K

If a person borrowed $10K today at 10% interest he would owe $11K in the future.

THE INTER TEMPORAL BUDGET CONSTRAINT

Consumption today

Starting point without financial markets. $50K

$50K

Present Value =50,000/(1.1)+ 50,000=45454.54+ 50,000=95,454.54

Future Value = 50,000 (1.1) + 50,000= $105,000

Consumption tomorrow

$105K

$95,454.54

The inter temporal budget constraint shows combinations of consumption now and in the future that are attainable with a certain flow of income and access to financial markets, i.e. the ability to borrow and lend money at the current interest rate.

The present value of the person’s income stream is the horizontal intercept, i.e. what is the maximum amount of consumption the person given his stream of income and access to financial markets, i.e. the ability to borrow and/or lend at market interest rate.

The future value of a person’s income stream is the vertical intercept, i.e. what is the maximum amount of consumption he could engage in given his stream of income and access to financial markets.

Consumption today

Starting point without financial markets. $50K

$50K

Suppose interest rates increase to 20%.

How would this affect the inter temporal budget constraint and the present and future value of his income stream?

If tried to borrow money could he borrow more or less if the interest rate is higher?

Consumption tomorrow

$105K

$95,454.54

If he tried to lend money could he spend more or less in the future if the interest rate is higher?

50,000 +(50,000)/(1.2)=91,666.67

50,000 +(50,000)(1.2)=110,000

Consumption today

$50K

$50K

A Discount Bond is piece of paper promising to pay a certain amount of money at a certain future date.

If a person sells a discount bond he is borrowing money.

If a person buys a discount bond .

Suppose this person bought 50 discount bonds for $8 each.

What is the interest rate?

25%

Where on the inter temporal budget constraint will he be?

Consumption tomorrow

Discount Bond

I will pay you $10 in the future.

Discount Bond

I will pay you $10 in the future.

Spend $400 on bonds today and receives $500 in the future.

$49,600

$50,500

The Bond Market and Direct Finance.

Consumption today

Starting point without financial markets. $50K

$50K

Present Value =50,000/(1.1)+ 50,000=45454.54+ 50,000=95,454.54

Future Value = 50,000 (1.1) + 50,000= $105,000

Consumption tomorrow

$105K

$95,454.54

What will the intertemporal budget constraint look like if the person earns 50K today and expects to earn 50K in the future?

Suppose policy makers could convince this person that his income in the future would be 75K in the future.

What effect would this have on his inter-temporal budget constraint?

$75K

Starting point without financial markets where current income is $50K and future income is $75K

New budget constraint

Good B

Any combination of 2 goods on IC1 give equal levels of utility.

IC1

Indifference curves capture a person ‘s tastes and preferences, i.e. how much relative enjoyment he gets from consuming different goods.

Any particular indifference curve shows combinations of two goods that give the person equal utility or, stated alternatively combinations of two goods that a person doesn’t care which he receives.

Comparing indifference curves, the person is always happier if he could move to a consumption bundle that is on a higher IC, i.e. farther out from the origin.

Good A

Indifference Curves

IC2

Any combination of 2 goods on IC2 is preferred over any combination on IC3.

X

Y

Bundle Y is preferred over Bundle X because Y has the same amount of good B and more good A

Automobiles

IC1

Income

Indifference Curves

IC2

X Y

How would you describe the movement from X to Y?

Nissan Cube, $15,000Honda Fit, $17,000

Which point is the Cube and which is the Fit?

How would you describe the movement from X to Y?

Automobiles

IC1

Income

Indifference Curves and Equilibrium

IC2

X

Y

The person chooses the point on the inter-temporal budget constraint which is on the highest indifference curve.

Y is preferred to X because IC2 is farther out from the origin than IC1.

Consumption today

Starting point.

$50K

$50K

Consider the indifference curves of two people who both make 50K today and expect to make 50K in the future whose IC’s are depicted below.

Which person is going to be a net borrower today and which person will be a net saver today?

Consumption tomorrow

$105K

$95,454.54

Blue will be a borrower and red will be a saver.

Moving from the starting point to here, is the person a net borrower or net lender?

Will he buy or sell bonds?

Indifference Curves and Equilibrium

Consumption today

Starting point.

$50K

$50K

How will a decrease in current interest rates affect current consumption and net borrowing and lending or stated alternatively, if the Federal Reserve followed a monetary policy which lowered interest rates how would this affect an ongoing recession?

The decrease in the interest rate will cause the inter temporal budget constraint to rotate.

The present value of his income will increase.

He will consume more now and less in the future.

Consumption tomorrow

$105K

$95,454.54

What effect will a reduction in interest rates have on a recession?

Consumption today

Starting point where the person earns and consumes 50K today and 50K in the future.

$50K

$50K

Consumption tomorrow

$105K

Consider an economic policy which simply changes people’s expectations about the future.

Suppose policy makers could convince this person that his income in the future would be 75K in the future.

What effect would this have on his inter-temporal budget constraint?

$75K

New budget constraint where the person expects to earn more in the future

New equilibrium

Consumption today

Starting point where the person earns and consumes 50K today and 50K in the future.

$50K

$50K

Consumption tomorrow

$105K

Consider an economic policy which simply changes people’s expectations about the future.

What effect would this have on current consumption and current demand for goods and services?

What effect would this have on the bond market, i.e. would the amount of net borrowing increase?

Would interest rates rise or fall?

$75K

New budget constraint where the person expects to earn more in the future

New equilibrium

People would increase current consumption by borrowing against the future income.

This would increase the supply of bonds, lowering their price and increasing interest rates.

Consumption today

Starting point where the person earns and consumes 50K today and 50K in the future.

$50K

$50K

Consumption tomorrow

$105K

Consider an economic policy which made people expect less income in the future.

$75K

REAL AND NOMINAL INTEREST RATES Nominal interest rate makes no allowance for

inflation

Real interest rate is adjusted for changes in price level so it more accurately reflects the cost of borrowing

Ex ante real interest rate is adjusted for expected changes in the price level

Ex post real interest rate is adjusted for actual changes in the price level

FISHER EQUATION

= nominal interest rate

= real interest rate

= expected inflation rate

When the real interest rate is low,

there are greater incentives to borrow and fewer incentives to lend.

The real inter

er

r

e

i i

i

i

est rate is a better indicator of the incentives to

borrow and lend.

FIGURE 1 REAL AND NOMINAL INTEREST RATES (THREE-MONTH TREASURY BILL), 1953–2008

Sources: Nominal rates from www.federalreserve.gov/releases/H15. The real rate is constructed using the procedure outlined in Frederic S. Mishkin, “The Real Interest Rate: An Empirical Investigation,” Carnegie-Rochester Conference Series on Public Policy 15 (1981): 151–200. This procedure involves estimating expected inflation as a function of past interest rates, inflation, and time trends and then subtracting the expected inflation measure from the nominal interest rate.

What does it tell you about inflation that the nominal rate is above the real rate.?

CHAPTER 5

The Behavior of Interest Rates

2 MODELS USED TO PREDICT AND UNDERSTAND CHANGES IN INTEREST

RATES

•Basic supply and demand analysis in the bond market.

•Liquidity Preference Model (Keynesian)

UNDERSTANDING WHAT CAUSES CHANGES IN INTEREST RATES.

Use basic supply and demand analysis in the bond market.

Assume that there is only one type of bond—a simple discount bond with a face value of $1000.

The price of bonds determines the interest rate and the bond price is inversely related to interest rate.

What happens when bond prices are below the equilibrium price.

For any one year discount bond

i = F - P

PF = Face value of the discount bond

P = current price of the discount bond

The yield to maturity equals the increase

in price over the year divided by the initial price.

As with a coupon bond, the yield to maturity is

negatively related to the current bond price.

If the price of a discount bond with a face value of $1000 is $1000 then the interest rate is zero

If the price of a discount bond with a face value of $1000 is $800 then $800 is being lent, $200 interest is being paid and the interest rate is 25%

UNDERSTANDING WHAT CAUSES CHANGES IN INTEREST RATES.

• Suppose the demand for bonds increases?

• Is this due to more people wanting to lend or borrow?

• Lend.

• At the current price ($850) is there excess demand or excess supply?

• Excess demand.

• What will happen to the price and quantity of bonds sold?

• More bonds sold.

• Higher price.

• What happens to interest rates?

• Interest rates fall.

UNDERSTANDING WHAT CAUSES CHANGES IN INTEREST RATES.

• Suppose the supply for bonds increases?

• Is this due to more people wanting to lend or borrow.

• Borrow

• At the current price ($850) is there excess demand or excess supply?

• Excess supply.

• What will happen to the price and quantity of bonds sold?

• More bonds sold.

• lower price.

• What happens to interest rates?

• Interest rates rise.

DETERMINING THE QUANTITY DEMANDED OF AN ASSET

Analysis of changes in interest rates using The Supply and Demand for bonds requires identifying what causes shifts in the supply and demand curves and doing simple supply and demand analysis.

List of factors that can affect the demand for bonds. Wealth: the total resources owned by the individual, including all

assets

Expected Return: the return expected over the next period on one asset relative to alternative assets

Risk: the degree of uncertainty associated with the return on one asset relative to alternative assets

Liquidity: the ease and speed with which an asset can be turned into cash relative to alternative assets

THEORY OF ASSET (BOND) DEMAND

Holding all other factors constant:1. The quantity demanded of an asset is positively

related to wealth

2. The quantity demanded of an asset is positively related to its expected return relative to alternative assets

3. The quantity demanded of an asset is negatively related to the risk of its returns relative to alternative assets

4. The quantity demanded of an asset is positively related to its liquidity relative to alternative assets

SUMMARY TABLE 1 RESPONSE OF THE QUANTITY OF AN ASSET DEMANDED TO CHANGES IN WEALTH, EXPECTED RETURNS, RISK, AND LIQUIDITY

SUPPLY AND DEMAND FOR BONDS

• At lower prices (higher interest rates), ceteris paribus, the quantity demanded of bonds is higher: an inverse relationship

• At lower prices (higher interest rates), ceteris paribus, the quantity supplied of bonds is lower: a positive relationship

MARKET EQUILIBRIUM

Occurs when the amount that people are willing to buy (demand) equals the amount that people are willing to sell (supply) at a given price

Bd = Bs defines the equilibrium (or market clearing) price and interest rate.

When Bd > Bs , there is excess demand, price will rise and interest rate will fall

When Bd < Bs , there is excess supply, price will fall and interest rate will rise

SHIFTS IN THE DEMAND FOR BONDS

Wealth: in an expansion with growing wealth, the demand curve for bonds shifts to the right

Expected Returns: higher expected interest rates in the future lower the expected return for long-term bonds, shifting the demand curve to the left

Expected Inflation: an increase in the expected rate of inflations lowers the expected return for bonds, causing the demand curve to shift to the left

Risk: an increase in the riskiness of bonds causes the demand curve to shift to the left

Liquidity: increased liquidity of bonds results in the demand curve shifting right

SUMMARY TABLE 2 FACTORS THAT SHIFT THE DEMAND CURVE FOR BONDS

FIGURE 2 SHIFT IN THE DEMAND CURVE FOR BONDS

SHIFTS IN THE SUPPLY OF BONDS

Expected profitability of investment opportunities: in an expansion, the supply curve shifts to the right

Expected inflation: an increase in expected inflation shifts the supply curve for bonds to the right because the expected real rate of interest declines.

Government budget: increased budget deficits shift the supply curve to the right

SUMMARY TABLE 3 FACTORS THAT SHIFT THE SUPPLY OF BONDS

FIGURE 3 SHIFT IN THE SUPPLY CURVE FOR BONDS

FIGURE 4 RESPONSE TO A CHANGE IN EXPECTED INFLATIONWhen expected

inflation rises, the real cost of borrowing falls leading to an increase in the supply of bonds

When expected inflation rises, the expected return to holding bonds decrease leading to a decrease in the demand for bonds

The decrease in the price of bonds leads to an increase in the nominal rate of interest paid on bonds.

FIGURE 7 BUSINESS CYCLE AND INTEREST RATES (THREE-MONTH TREASURY BILLS), 1951–2008

Source: Federal Reserve: www.federalreserve.gov/releases/H15/data.htm.

FIGURE 6 RESPONSE TO A BUSINESS CYCLE EXPANSION

During a business cycle expansion, the increase in income and wealth causes an increase in the demand for bonds.

During a business cycle expansion, the increase in business opportunities leads to an increase in the supply of bonds

If supply increases more than demand, the price of bonds falls and interest rates rise.

FIGURE 5 EXPECTED INFLATION AND INTEREST RATES (THREE-MONTH TREASURY BILLS), 1953–2008

Source: Expected inflation calculated using procedures outlined in Frederic S. Mishkin, “The Real Interest Rate: An Empirical Investigation,” Carnegie-Rochester Conference Series on Public Policy 15 (1981): 151–200. These procedures involve estimating expected inflation as a function of past interest rates, inflation, and time trends.

What does it mean if the expected rate of inflation is above the nominal interest rate?

SAMPLE EXAM QUESTION

Read the attached article about the Euro and the Greek debt crisis. Consider the effect on the price and interest rate of risk free bonds issued by the U.S. government. Use both the Supply and Demand for bonds and the Liquidity Preference Framework to analyze the effect of a possible Greek default on U.S. interest rates. Compare and contrast your analyses.

Discuss and show the effects on the demand for U.S. government bonds and the risk free rate of interest using the graph on the left. Identify each factor which will cause the demand curve to shift and plot the

corresponding shift on the graph below. Factors to consider include changes in wealth, expected returns, expected inflation, risk and liquidity.

Identify each factor which will cause the supply curve to shift and plot the corresponding shift on your graph. Factors to consider include expected profitability of investment opportunities, expected inflation, and government budget deficits.

Discuss and show the effects on the demand for money in the U.S. using the Liquidity Preference Framework on the right hand graph. Identify each factor which will cause the demand for money to shift. Factors to

consider include income effects, price level effects, and expected inflation. What does the Liquidity Preference Framework predict will happen to interest

rates?

4-56

A bail-out for Greece is just the beginningBy Martin WolfPublished: May 4 2010 20:13 | Last updated: May 4 2010 20:13

Desperate times; desperate measures. After months of costly delay, the eurozone has come up with an enormous package of support for Greece. By bringing in the International Monetary Fund, at Germany’s behest, it has obtained some additional resources and a better programme. But is it going to work? Alas, I have huge doubts.

So what is the programme? In outline, it is a package of €110bn (equivalent to slightly more than a third of Greece’s outstanding debt), €30bn of which will come from the IMF (far more than normally permitted) and the rest from the eurozone. This would be enough to take Greece out of the market, if necessary, for more than two years. In return, Greece has promised a fiscal consolidation of 11 per cent of gross domestic product over three years, on top of the measures taken earlier, with the aim of reaching a 3 per cent deficit by 2014, down from 13.6 per cent in 2009. Government spending measures are to yield savings of 5¼ per cent of GDP over three years: pensions and wages will be reduced, and then frozen for three years, with payment of seasonal bonuses abolished. Tax measures are to yield 4 per cent of GDP. Even so, public debt is forecast to peak at 150 per cent of GDP.

In important respects, the programme is far less unrealistic than its intra-European predecessor. Gone is the fantasy that there would be a mild economic contraction this year, followed by a return to steady growth. The new programme apparently envisages a cumulative decline in GDP of about 8 per cent, though such forecasts are, of course, highly uncertain. Similarly, the old plan was founded on the assumption that Greece could slash its budget deficit to less than 3 per cent of GDP by the end of 2012. The new plan sets 2014 as the target year.

Have your say on Martin Wolf’s column and read contributions by leading economists

Two other features of what has been decided are noteworthy: first, there is to be no debt restructuring; and, second, the European Central Bank will suspend the minimum credit rating required for the Greek government-backed assets used in its liquidity operations, thereby offering a lifeline to vulnerable Greek banks.

So does this programme look sensible, either for Greece or the eurozone? Yes and no in both cases.

Let us start with Greece. It has now lost access to the markets (see chart). Thus, the alternative to agreeing to this package (whether or not it can be implemented) would be default. The country would then no longer pay debt interest, but it would have to close its primary fiscal deficit (the deficit before interest payments), of 9-10 per cent of GDP, at once. This would be a far more brutal tightening than Greece has now agreed. Moreover, with default, the banking system would collapse. Greece is right to promise the moon, to gain the time to eliminate its primary deficit more smoothly.

Yet it is hard to believe that Greece can avoid debt restructuring. First, assume, for the moment, that all goes to plan. Assume, too, that Greece’s average interest on long-term debt turns out to be as low as 5 per cent. The country must then run a primary surplus of 4.5 per cent of GDP, with revenue equal to 7.5 per cent of GDP devoted to interest payments. Will the Greek public bear that burden year after weary year? Second, even the IMF’s new forecasts look optimistic to me. Given the huge fiscal retrenchment now planned and the absence of exchange rate or monetary policy offsets, Greece is likely to find itself in a prolonged slump. Would structural reform do the trick? Not unless it delivers a huge fall in nominal unit labour costs, since Greece will need a prolonged surge in net exports to offset the fiscal tightening. The alternative would be a huge expansion in the financial deficit of the Greek private sector. That seems inconceivable. Moreover, if nominal wages did fall, the debt burden would become worse than forecast.

Willem Buiter, now chief economist at Citigroup, notes, in a fascinating new paper, that other high-income countries, notably Canada (1994-98), Sweden (1993-98) and New Zealand (1990-94), have succeeded with fiscal consolidation. But initial conditions were much more favourable in these cases. Greece is being asked to do what Latin America did in the 1980s. That led to a lost decade, the beneficiaries being foreign creditors. Moreover, as creditors are now paid to escape, who will replace them? This package will surely fail to return Greece to the market, on manageable terms, in a few years. More money will be needed if debt restructuring is unwisely ruled out.

For other eurozone members, the programme prevents an immediate shock to fragile financial systems: it is overtly a rescue of Greece, but covertly a bail-out of banks. But it is far from clear that it will help other members now in the firing line. Investors could well conclude that the scale of the package required for tiny Greece and the overwhelming difficulty of agreeing and ratifying it, particularly in Germany, suggest that further such packages are going to be elusive. Other eurozone members might well end up on their own. None is in as bad a condition as Greece and none has shown the same malfeasance. But several have unsustainable fiscal deficits and rapidly rising debt ratios (see chart). In this, their situation does not differ from that of the UK and US. But they lack the same policy options.

This story, in short, is not over.

For the eurozone, two lessons are clear: first, it has a clear choice – either it allows sovereign defaults, however messy, or it creates a true fiscal union, with strong discipline and funds sufficient to cushion adjustment in crushed economies – Mr Buiter recommends a European Monetary Fund of €2,000bn; and, second, adjustment in the eurozone is not going to work without offsetting adjustments in core countries. If the eurozone is willing to live with close to stagnant overall demand, it will become an arena for beggar-my-neighbour competitive disinflation, with growing reliance on world markets as a vent for surplus. Few are going to like this outcome.

The crises now unfolding confirm the wisdom of those who saw the euro as a highly risky venture. These shocks are not that surprising. On the contrary, they could have been expected. The fear that yoking together such diverse countries would increase tension, rather than reduce it, also appears vindicated: look at the surge of anti-European sentiment inside Germany. Yet, now that the eurozone has been created, it must work. The attempted rescue of Greece is just the beginning of the story. Much more still needs to be done, in responding to the immediate crisis and in reforming the eurozone itself, in the not too distant future. [email protected]

Bond Market (Demand)1. Risk: increased of Greek bonds increases

demand for U.S. govt. bonds. 2. Liquidity: reduced liquidity of Greek bonds

increases relative liquidity of and demand for U.S. bonds.

3. Wealth and Expected Inflation : unclear.Bond Market (Supply)

1. Expected Profitability of Investments: fewer investment possibilities reduces supply of bonds.

2. Expected Inflation: unclear3. Budget Deficits: unclear

Demand for Money (U.S)1.Income Effect: uncertain2.Price Level Effect: uncertain3.Expected Inflation Effect: uncertain

THE LIQUIDITY PREFERENCE FRAMEWORK

Keynesian model that determines the equilibrium interest rate

in terms of the supply of and demand for money.

There are two main categories of assets that people use to store

their wealth: money and bos s d d

s d s d

s d

s d

nds.

Total wealth in the economy = B M = B + M

Rearranging: B - B = M - M

If the market for money is in equilibrium (M = M ),

then the bond market is also in equilibrium (B = B ).

FIGURE 8 EQUILIBRIUM IN THE MARKET FOR MONEY

Money Supply is depicted as a vertical line because it is controlled by the Fed.

DEMAND FOR MONEY IN THE LIQUIDITY PREFERENCE FRAMEWORK

Why is the demand for money downward sloping? As the interest rate increases:

The opportunity cost of holding money increases… The relative expected return of money decreases…

…and therefore the quantity demanded of money decreases.

The higher the rate of interest the less money you will demand because by holding money you forego interest.

4-63

4-64

Problems faced by organized crime.

Why the mafia liked vending machines and casinos.

SHIFTS IN THE DEMAND FOR MONEY

Income Effect: a higher level of income causes the demand for money at each interest rate to increase and the demand curve to shift to the right

Price-Level Effect: a rise in the price level causes the demand for money at each interest rate to increase and the demand curve to shift to the right

SHIFTS IN THE SUPPLY OF MONEY

Assume that the supply of money is controlled by the central bank

An increase in the money supply engineered by the Federal Reserve will shift the supply curve for money to the right

FIGURE 9 RESPONSE TO A CHANGE IN INCOME OR THE PRICE LEVEL

An increase in the price level or an increase in income will cause an increase in interest rates everything else equal.

FIGURE 10 RESPONSE TO A CHANGE IN THE MONEY SUPPLY

An increase in the money supply will cause a decrease in interest rates everything else equal.

SUMMARY TABLE 4 FACTORS THAT SHIFT THE DEMAND FOR AND SUPPLY OF MONEY

EVERYTHING ELSE REMAINING EQUAL?

Liquidity preference framework leads to the conclusion that an increase in the money supply will lower interest rates------but the liquidity effect and an increase in the price level causes counteracting effects. Income effect finds interest rates rising because increasing

the money supply is an expansionary influence on the economy (the demand curve shifts to the right).

Price-Level effect predicts an increase in the money supply leads to a rise in interest rates in response to the rise in the price level (the demand curve shifts to the right).

Expected-Inflation effect shows an increase in interest rates because an increase in the money supply may lead people to expect a higher price level in the future (the demand curve shifts to the right).

FIGURE 10 RESPONSE TO A CHANGE IN THE MONEY SUPPLY

Whether an increase in the money supply will increase or decrease the interest rate depends on the relative strength of the counteracting forces, i.e. income effect, price level effect, and expected inflation effect.

PRICE-LEVEL EFFECT AND EXPECTED-INFLATION EFFECT

A one time increase in the money supply will initiate a chain of events that will effect interest rates over time as the relative strength of two effects changes. A one time increase in the money supply will cause prices to rise to a

permanently higher level by the end of the year. The interest rate will rise via the increased prices.

Price-level effect remains even after prices have stopped rising.

A rising price level will raise interest rates because people will expect inflation to be higher over the course of the year. When the price level stops rising, expectations of inflation will return to zero.

Expected-inflation effect persists only as long as the price level continues to rise.

FIGURE 10 RESPONSE TO A CHANGE IN THE MONEY SUPPLY

Wealth/Liquidity Effect

Temporary Expected Inflation Effect

FIGURE 11 RESPONSE OVER TIME TO AN INCREASE IN MONEY SUPPLY GROWTH

FIGURE 12 MONEY GROWTH (M2, ANNUAL RATE) AND INTEREST RATES (THREE-MONTH TREASURY BILLS),1950–2008

Sources: Federal Reserve: www.federalreserve.gov/releases/h6/hist/h6hist1.txt.

EXAM QUESTION FROM SPRING 2010. Consider the two economic models used to explain interest rates from the

textbook- the Liquidity Preference Framework and the Theory of Asset Demand. Explain and label all changes on your graph.

Use the graphs below and compare and contrast predictions about the change in interest rates from both models if the government increased the money supply.

Consider Part (3) from question 1. Use the graphs below and analyze the effects on interest rates from the change in expectations about future employment prospects on current interest rates.

In your opinion, which framework offers more insight into the determination of future interest rates. Explain.

Quantity of Bond

Price of Bonds

Quantity of Money

Interest Rate

CHAPTER 6The Risk and Term Structure of Interest Rates

FIGURE 1 LONG-TERM BOND YIELDS, 1919–2008

Sources: Board of Governors of the Federal Reserve System, Banking and Monetary Statistics, 1941–1970; Federal Reserve: www.federalreserve.gov/releases/h15/data.htm.

RISK STRUCTURE OF INTEREST RATES

Bonds with the same maturity have different interest rates due to: Default risk Liquidity Tax considerations

RISK STRUCTURE OF INTEREST RATES

Default risk: probability that the issuer of the bond is unable or unwilling to make interest payments or pay off the face value U.S. Treasury bonds are considered default free

(government can raise taxes).

Risk premium: the spread between the interest rates on bonds with default risk and the interest rates on (same maturity) Treasury bonds

FIGURE 2 RESPONSE TO AN INCREASE IN DEFAULT RISK ON CORPORATE BONDS

TABLE 1 BOND RATINGS BY MOODY’S, STANDARD AND POOR’S, AND FITCH

RISK STRUCTURE OF INTEREST RATES

Liquidity: the relative ease with which an asset can be converted into cash Cost of selling a bond

Number of buyers/sellers in a bond market

Income tax considerations Interest payments on municipal bonds are exempt

from federal income taxes.

FIGURE 3 INTEREST RATES ON MUNICIPAL AND TREASURY BONDS

TERM STRUCTURE OF INTEREST RATES

Bonds with identical risk, liquidity, and tax characteristics may have different interest rates because the time remaining to maturity is different

TERM STRUCTURE OF INTEREST RATES Yield curve: a plot of the yield on bonds with

differing terms to maturity but the same risk, liquidity and tax considerations Upward-sloping: long-term rates are above

short-term rates

Flat: short- and long-term rates are the same

Inverted: long-term rates are below short-term rates

FACTS THEORY OF THE TERM STRUCTURE OF INTEREST RATES MUST EXPLAIN

1. Interest rates on bonds of different maturities move together over time

2. When short-term interest rates are low, yield curves are more likely to have an upward slope; when short-term rates are high, yield curves are more likely to slope downward and be inverted

3. Yield curves almost always slope upward

THREE THEORIES TO EXPLAIN THE THREE FACTS

1. Expectations theory explains the first two facts but not the third

2. Segmented markets theory explains fact three but not the first two

3. Liquidity premium theory combines the two theories to explain all three facts

FIGURE 4 MOVEMENTS OVER TIME OF INTEREST RATES ON U.S. GOVERNMENT BONDS WITH DIFFERENT MATURITIES

Sources: Federal Reserve: www.federalreserve.gov/releases/h15/data.htm.

EXPECTATIONS THEORY

The interest rate on a long-term bond will equal an average of the short-term interest rates that people expect to occur over the life of the long-term bond

Buyers of bonds do not prefer bonds of one maturity over another; they will not hold any quantity of a bond if its expected return is less than that of another bond with a different maturity

Bond holders consider bonds with different maturities to be perfect substitutes

EXPECTATIONS THEORY: EXAMPLE

Let the current rate on one-year bond be 6%.

You expect the interest rate on a one-year bond to be 8% next year.

Then the expected return for buying two one-year bonds averages (6% + 8%)/2 = 7%.

The interest rate on a two-year bond must be 7% for you to be willing to purchase it.

EXPECTATIONS THEORY

1

2

For an investment of $1

= today's interest rate on a one-period bond

= interest rate on a one-period bond expected for next period

= today's interest rate on the two-period bond

t

et

t

i

i

i

EXPECTATIONS THEORY (CONT’D)

2 2

22 2

22 2

22

Expected return over the two periods from investing $1 in the

two-period bond and holding it for the two periods

(1 + )(1 + ) 1

1 2 ( ) 1

2 ( )

Since ( ) is very small

the expected re

t t

t t

t t

t

i i

i i

i i

i

2

turn for holding the two-period bond for two periods is

2 ti

EXPECTATIONS THEORY (CONT’D)

1

1 1

1 1

1

1

If two one-period bonds are bought with the $1 investment

(1 )(1 ) 1

1 ( ) 1

( )

( ) is extremely small

Simplifying we get

et t

e et t t t

e et t t t

et t

et t

i i

i i i i

i i i i

i i

i i

EXPECTATIONS THEORY (CONT’D)

2 1

12

Both bonds will be held only if the expected returns are equal

2

2The two-period rate must equal the average of the two one-period rates

For bonds with longer maturities

et t t

et t

t

t tnt

i i i

i ii

i ii

1 2 ( 1)...

The -period interest rate equals the average of the one-period

interest rates expected to occur over the -period life of the bond

e e et t ni i

nn

n

EXPECTATIONS THEORY

Explains why the term structure of interest rates changes at different times

Explains why interest rates on bonds with different maturities move together over time (fact 1)

Explains why yield curves tend to slope up when short-term rates are low and slope down when short-term rates are high (fact 2)

Cannot explain why yield curves usually slope upward (fact 3)

SEGMENTED MARKETS THEORY

Bonds of different maturities are not substitutes at all

The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond

Investors have preferences for bonds of one maturity over another

If investors generally prefer bonds with shorter maturities that have less interest-rate risk, then this explains why yield curves usually slope upward (fact 3)

LIQUIDITY PREMIUM & PREFERRED HABITAT THEORIES

The interest rate on a long-term bond will equal an average of short-term interest rates expected to occur over the life of the long-term bond plus a liquidity premium that responds to supply and demand conditions for that bond

Bonds of different maturities are partial (not perfect) substitutes

LIQUIDITY PREMIUM THEORY

int

it i

t1e i

t2e ... i

t(n 1)e

n l

nt

where lnt

is the liquidity premium for the n-period bond at time t

lnt

is always positive

Rises with the term to maturity

PREFERRED HABITAT THEORY

Investors have a preference for bonds of one maturity over another

They will be willing to buy bonds of different maturities only if they earn a somewhat higher expected return

Investors are likely to prefer short-term bonds over longer-term bonds

FIGURE 5 THE RELATIONSHIP BETWEEN THE LIQUIDITY PREMIUM (PREFERRED HABITAT) AND EXPECTATIONS THEORY

LIQUIDITY PREMIUM AND PREFERRED HABITAT THEORIES

Interest rates on different maturity bonds move together over time; explained by the first term in the equation

Yield curves tend to slope upward when short-term rates are low and to be inverted when short-term rates are high; explained by the liquidity premium term in the first case and by a low expected average in the second case

Yield curves typically slope upward; explained by a larger liquidity premium as the term to maturity lengthens

FIGURE 6 YIELD CURVES AND THE MARKET’S EXPECTATIONS OF FUTURE SHORT-TERM INTEREST RATES ACCORDING TO THE LIQUIDITY PREMIUM (PREFERRED HABITAT) THEORY

FIGURE 7 YIELD CURVES FOR U.S. GOVERNMENT BONDS

Sources: Federal Reserve Bank of St. Louis; U.S. Financial Data, various issues; Wall Street Journal, various dates.

APPLICATION: THE SUBPRIME COLLAPSE AND THE BAA-TREASURY SPREAD

Corporate Bond Risk Premium and Flight to Quality

0

2

4

6

8

10

Jan-

07

Mar

-07

May

-07

Jul-0

7

Sep-0

7

Nov-0

7

Jan-

08

Mar

-08

May

-08

Jul-0

8

Sep-0

8

Nov-0

8

Jan-

09

Corporate bonds, monthly data Aaa-RateCorporate bonds, monthly data Baa-Rate10-year maturity Treasury bonds, monthly data