Business of Giving IMHO

-

Upload

international-medical-health-organization -

Category

Documents

-

view

224 -

download

0

description

Transcript of Business of Giving IMHO

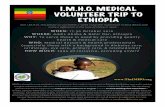

International Medical Health International Medical Health Organization (IMHO)Organization (IMHO)

BUSINESS OF BUSINESS OF GIVINGGIVING

Why Give?Why Give?• Importance of doing/supporting charitable

work: humanitarian needs are vast• Tax breaks• Avoid estate taxes and

probate court• Turn your charitable vision into a reality!• Start today & see benefits during your

lifetime• Ensure your legacy in the future

Ways you can give to Ways you can give to IMHOIMHO

1. Monetary Donations: Cash, Direct Debit, PayPal

2. Whole Life Insurance3. Appreciated Stocks4. Properties 5. Sri Lanka Properties

Ways you can give to IMHO, Ways you can give to IMHO, cont.cont.

6. Sri Lanka Pensions7. Grant Writing8. “In Memory of…”9. Family Foundations10.Living Trusts11.Charitable Trusts

Change Your Approach to Change Your Approach to LifeLife

• You Be the Change

• Enlightenment & Awareness

• Philanthropic Forums

• Social Events for Service

• Fun & Fundraising

• Love All & Serve All

Estate PlanningEstate Planning

UNDERSTANDING YOUR UNDERSTANDING YOUR TAXESTAXES

DURING YOUR LIFE TIME YOU PAY TAXES: INCOME TAXES CAPITAL GAINS TAXES SALES/USE TAXES PROPERTY TAXES GIFT TAXES

UPON DEATH OF BOTH SPOUSES YOU PAY: ESTATE TAXES

Estate PlanningEstate Planning

WHAT: ANY ASSET BECOMES AN ESTATE UPON DEATH

WHY: TO AVOID PROBATE AND SAVE TAXES

WHEN: NOW

Probate CourtProbate Court

PROBATE COURT: SPECIALIZED COURT THAT ONLY CONSIDERS CASES THAT DEAL WITH THE DISTRIBUTION OF DECEDENT’S ESTATE

ANY INDIVIDUAL WHO HAS GENERALLY MORE THAN $100K IN ASSET VALUE WILL END UP IN PROBATE COURT UNLESS THEY HAVE CREATED THE FOLLOWING: 1. FAMILY LIVING TRUST 2. CHARITABLE PRIVATE FAMILY FOUNDATION 3. CHARITABLE REMAINDER TRUST AND/OR

OTHER TRUSTS

Save Save Approx. 25% NOWApprox. 25% NOW

BY CREATING A FAMILY LIVING TRUST AND/OR CHARITABLE FAMILY PRIVATE FOUNDATION YOU IMMEDIATELY SAVE APPROXIMATELY 25% OF YOUR ASSETS BY AVOIDING PROBATE COURT & LEGAL FEES

Living WillLiving Will

A LIVING WILL IS NOT A SUBSTITUTE FOR A FAMILY LIVING TRUST

A LIVING WILL IS A COMPLEMENTARY DOCUMENT TO A FAMILY LIVING TRUST

A LIVING WILL DOES NOT AVOID PROBATE COURT

Gift Tax ExclusionsGift Tax Exclusions

A GIFT HAS TO BE GIVEN BEFORE DEATH BY AN INDIVIDUAL OR FROM THEIR LIVING TRUST

GIFT EXCLUSION IS $1 MILLION PER SPOUSE FOR 2009 THRU 2011 (DURING THEIR LIFE)

GIFT CAN BE GIVEN TO MULTIPLE PEOPLE, BUT LIMITED TO $1 MILLION TOTAL FOR EACH SPOUSE

Estate Taxes ExclusionsEstate Taxes Exclusions

UPON DEATH OF BOTH SPOUSES, THE ESTATE WILL BE SUBJECT TO ESTATE TAXES OF: UP TO 45% IN 2009 (WITH AN EXCLUSION OF

$3.5M) 0% in 2010 UP TO 45-55% (MOST LIKELY) IN 2011

ONE OF THE MANY TOOLS THAT IS AVAILABLE TO REDUCE ESTATE TAXES IS A CHARITABLE PRIVATE FAMILY FOUNDATION

AS AN ALTERNATIVE, CONSIDER A CHARITABLE TRUST

Coping with Coping with Estate TaxesEstate Taxes

TO BUY LIFE INSURANCE FROM YOUR ASSETS IN THE TRUST TO PAY UP TO APPROX. 55% (CAN VARY) OF YOUR ESTATE (I.L.I.T.) TAXES.

RETAIN APPROX. 45% (CAN VARY) OF YOUR ESTATE, OR

RETAIN YOUR LIFE PROCEEDS AND DONATE YOUR ESTATE TO YOUR CHARITABLE PRIVATE FAMILY FOUNDATION AND PAY NO ESTATE TAXES.

A Possible ScenarioA Possible Scenario

ESTATE AFTER EXCLUSIONS= $5M

ESTATE TAXES @45% = $2.25M

LIFE INSURANCE PROCEEDS PAY ESTATE TAXES $2.25M

NET PROCEEDS TO FAMILY $ 5M

Charitable Family Charitable Family FoundationFoundation

CHARITABLE FAMILY FOUNDATION CAN BECOME THE BENEFICIARY OF NET ASSETS IN EXCESS OF ESTATE TAX EXCLUSION, WITHOUT PAYING ESTATE TAXES.

YOUR ADULT CHILDREN OR FAMILY MEMBERS OR ANOTHER “PERSON” (AS TRUSTEES OF THE CHARITABLE PRIVATE FAMILY FOUNDATION) CAN DISTRIBUTE ANNUALLY TO THE CHARITY(-IES) OF YOUR CHOICE.

Filing IRS Form 706 within 9 Months Filing IRS Form 706 within 9 Months of Deathof Death

ALL ASSETS PASS THRU TO THE SURVIVING SPOUSE UPON THE 1ST DEATH: FILE WITH IRS, NO ESTATE TAXES.

UPON 2ND DEATH, ALL ASSETS PASS THRU TO BENEFICIARIES OF THE FAMILY LIVING TRUST:* FILE WITH IRS, PAY UP TO APPROX. 45-

55% ESTATE TAXES ON THE VALUE OF ESTATE AFTER EXCLUSIONS (DEPENDS ON THE YEAR)

Save on Current Taxes through Business Save on Current Taxes through Business of Givingof Giving

DURING YOUR LIFETIME, TRANSFER ASSETS TO YOUR OWN CHARITABLE PRIVATE FAMILY FOUNDATION & SAVE ON INCOME TAX DOLLARS (CURRENT VALUE)

UPON DEATH, ASSETS TRANSFER TO YOUR OWN CHARITABLE FAMILY FOUNDATION & YOU SAVE ON ESTATE TAX DOLLARS

Public CharityPublic Charity

DONATION TO A PUBLIC CHARITY: YOU RECEIVE A WRITE OFF ON YOUR

AGI (ADJUSTED GROSS INCOME)-LINE 31, FORM 1040CASH: 50%PROPERTY: 30%

Charitable Private Family Charitable Private Family FoundationFoundation

DONATION TO A CHARITABLE PRIVATE FAMILY FOUNDATION:

YOU RECEIVE A WRITE OFF ON YOUR AGI (LINE 31, FORM 1040)CASH: 30%APPRECIATED PROPERTY: 20%

Mission Fueled by VisionMission Fueled by Vision

PUT YOUR CHARITABLE VISION TO WORK WITH CURRENT INCOME TAX DOLLARS.

CONTINUE YOUR CHARITABLE MISSION WITH ESTATE TAX DOLLARS

Contact IMHOContact IMHO

START TO MAKE YOUR VISION A REALITY TODAY: CONTACT US!

www.TheIMHO.org