BUILDING A 21st-CENTURY ADVISORY FIRM - CFA...

Transcript of BUILDING A 21st-CENTURY ADVISORY FIRM - CFA...

WWW.CFAINSTITUTE.ORG1 © 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

BUILDING A 21st-CENTURY ADVISORY FIRMJOSHUA M. BROWNCEO, Ritholtz Wealth Management

Moderated by THOMAS J. BOCZAR, CFA, Intelligent Edge Advisors

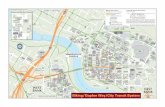

CFA Institute Conference:Wealth Management 2016Strategies for Private ClientsWednesday, 16 March 2016Radisson Blu MinneapolisMinneapolis, Minnesota

Joshua M. Brown is CEO at Ritholtz Wealth Management and is also known as “The Reformed Broker.” In this informative presentation, Brown discusses how he turned blogging into a business and the importance of social media in the financial industry.

JOSHUA M. BROWN: I don’t know, I have a mic on my tie, and there are two mics here. All right.

Good afternoon, Milwaukee. It’s an honor to be here.

[Laughter.]

JOSHUA M. BROWN: Some of you might not know this. I’m actually a CFA Level 4, which means I can levitate. So don’t be intimidated, I’m just a regular guy.

I have about 90 minutes’ worth of slides on smart beta, so if anyone wants to use the restroom before we get—

[Laughter.]

WWW.CFAINSTITUTE.ORG2

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: No, I’m not going to talk about investing today. I know you guys had an entire day of that. I’m going to talk a little bit about how we’re building our firm. I’m really proud of what we’ve done, and I think there are some interesting insights that I can share to an audience like this. I know not everyone here is an FA or is in wealth management, but hopefully if you come from another discipline, you will still get something out of this. Either way, I have taken the liberty of having the doors chained, so it doesn’t really matter, you have no choice.

Which is my clicker? Green? Okay.

All right. For those who don’t know me, I write one of the most widely read financial blogs in the world. I started “The Reformed Broker” blog in November of 2008, so I am now in my eighth year writing about the markets and investing on a daily basis. Over the last few months, the site has been visited by over a quarter of a million unique readers and it does about a million page views every couple of months or so.

I’m also a little bit active on Twitter. The Wall Street Journal—I don’t know why I’m leaning into this—the Wall Street Journal named me one of the top Twitter accounts in the wealth management industry. Time Magazine and Barron’s called me the top follow in finance. And as we speak, I’m on the verge of breaking 135,000 followers, many of which are not porn stars or software pro-grams, so that’s kind of cool.

[Laughter.]

JOSHUA M. BROWN: These are the books. In 2012, I wrote Backstage Wall Street, which was kind of my way of absolving myself of all the sins of my retail brokerage career by putting it all out there, no one else could go back and find it. Business Insider called it riveting. The New York Times said it was adequate, literally.

[Laughter.]

JOSHUA M. BROWN: But basically the idea behind the book was, What happens when Wall Street and Main Street collide? And I had a lot of experience in those collisions.

The second book was Clash of the Financial Pundits, which really concerns all the various experts that appear in the media and looks at the history of that literally going back to the South Sea Bubble in the 1700s. There has never been finance without the financial media. In fact, the first examples of writing ever found were market reports. The pharaoh wanted to know what a head of cattle or a flock of sheep or whatever was going for in the market, so since there has been human communication, we’ve been talking to each other about markets, and the book kind of explores what went wrong. No, the book takes us through the present, today.

WWW.CFAINSTITUTE.ORG3

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

And this is my daytime soap opera. Some of you may have seen it, probably with the volume off, so now you know what my voice sounds like.

[Laughter.]

JOSHUA M. BROWN: This is the infamous decabox where whomever shouts the loudest is probably the one that’s right. And then we get into my day job, and I’m not sure why I’m covering my crotch.

[Laughter.]

JOSHUA M. BROWN: Maybe I was worried Barry was going to hit me.

So the firm is called Ritholtz Wealth Management, and we’re two years old and growing very quickly. We’re in New York City. Most firms are bigger than ours, but no one is growing as fast as us, and that’s what I’m here to talk about today because I think I have some not necessarily secrets, but some ideas that might help everyone in this room do something similar. We launched with four people and $90 million under management in the fall of 2013. We’ve tripled that, broke $300 million recently. We’ve added 10 additional advisers and support employees, and now we have offices in Portland, Oregon; Grand Rapids, Michigan; Naples, Florida; Tuxedo Park, New York; and out on Long Island. So it’s been a really great experience building a firm from scratch, making a lot of mistakes, learning from them. I’m probably making mistakes as I speak, but I guess that’s part of the game.

So we don’t use recruiters and we don’t run employment ads. Every single person that works at the firm came in, whether we’re talking about research people or certified financial planners or client associates or whatever they’re called these days, trainee advisers, every single person came in through the blogs. They’re reading what we have to say, they agree with it, they want to be a part of it. So when my friend down the street at Morgan Stanley tells me about culture, you know, it’s not culture, you joined there two years ago because they gave you $750,000. This is culture.

[Laughter.]

JOSHUA M. BROWN: I’m not giving anyone anything. So it’s been really cool because what we’re doing is we’re building a firm and the bedrock is what we actually think and how we want to serve clients and how we want to build portfolios, how we want to manage money, and everyone that’s joined the firm came because of that message, and I wouldn’t have it any other way. And this is really the power of social media, which I’m going to get into in a minute, you put your point of view out there and like-minded people find you and they want to be involved with what you’re doing. This also works with clients. The firm gets dozens of inbound inquiries every week. Our biggest challenge has been scaling up in order to deal with the flow. And I have friends from

WWW.CFAINSTITUTE.ORG4

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

around the industry; from what I’m told, that is the opposite problem of most firms. Most RIAs are more than ready to take on clients, they’re just not sure where their next 2 dozen, 3 dozen clients are going to come in from. So we’ve kind of figured things out in reverse; hence, hiring and having a staff now of 14 people. We’re probably not big enough to justify having 14 people, but we’re bullish.

Social media. Look, I’m somebody that spent a decade cold calling high net worth individuals and begging them to spend just a few minutes talking with me, and I did that for a really long time, probably nine years too long, but I can tell you this is a way more fun method to build a business and to get the word out there than cold calling, sending out postcards, sponsoring booths at the town fair, or whatever the things that I used to do, this is better, and the reason why it’s better is because we’re saying what we actually think, not what we think people want to hear, and I think that’s really important.

When you have people calling you, people with portfolios who want to ask you questions about investing or want to talk about their financial plan, or their lack of a financial plan is what we get a lot, obviously, they’re a lot more receptive to what you have to say, and, as a result, they’re more willing to share information about themselves quickly. And what that means for the cycle of speaking to a person for the first time and having them become a client is that things move much more quickly when there’s a good fit, a good adviser-client fit, which is not always the case. But if they’ve been reading you for a while, there’s a comfort level that already exists that takes an adviser typically a much longer time to build up. And so this is what the blogs do for us. It’s not that these people know us personally, they have a good sense of what we believe about investing, they have some sense of what we profess to be our ethics and our morals, and they come in already with that in the front of their minds. That’s the reason they’re coming in to us, and that’s a really powerful way to start things off. Even if it doesn’t end up becoming a client, it’s still a great meet-ing. So we’re really proud of that method, and it wasn’t on purpose, we discovered it by accident, but we’re going to keep doing it.

We didn’t invent this concept. There is major precedent in having multiple voices and having people find us because they like somebody within the firm. So Ben Carlson is blogging for us. Ben is based in Grand Rapids, Michigan. He’s an institutional investor who is now going to serve institutional investors with our firm. Michael Batnick is my Director of Research, another CFA. Michael writes about portfolio construction. Barry Ritholtz writes for Bloomberg View and is the oldest living financial blogger, started in 1998. And Barry talks about politics and Lamborghinis. So we have multiple people talking about multiple things.

This is the band One Direction. They nailed this dynamic. The Beatles nailed it five decades before. Teenage girls all have their favorites, and their favorites will all be different. We have different people reading us for different reasons. Some people might read me that can’t stand Barry. Some

WWW.CFAINSTITUTE.ORG5

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

people might read Ben, but they haven’t yet discovered Michael. The model is really powerful and it really works well. My personal favorite, by the way, is Zayn because he is the dark, brooding one.

[Laughter.]

JOSHUA M. BROWN: But, look, Ben Carlson is the shy one. So—

Again, this has been done before. This is the Wu-Tang Clan: the RZA, GZA, Ol’ Dirty Bastard, Inspectah Deck, Raekwon the Chef, U-God, Ghostface Killah, and the Method Man. So the Wu Tang Clan had a very clever business arrangement that not a lot of people know about, but it’s a great blueprint for what we’re doing. When they recorded as the Clan, they were on Loud Records, but when they recorded individually, each of them was free to pursue a record deal with any record company and build out their own presence, and we’re doing something very similar, probably not as glamorous or as profane.

[Laughter.]

JOSHUA M. BROWN: But Barry writes for Bloomberg View. I have an exclusive with Fortune. Ben Carlson is writing I think for MarketWatch. Michael Batnick writes for the Enterprising Investor, which is a CFA Institute blog. So we don’t care where people post, the only thing we care about is what they’re saying is compliant, number one, and number two, it’s helpful to investors; and those are the two tests that our employee/communicators need to meet with their content. So if it’s not helping regular investors or it’s confusing them or scaring them, unacceptable. And if it’s not compliant, then they can’t do it either. And that gives you a lot of room, believe it or not, to do good content. Those are not very difficult barriers to get over.

And then when we all come together, we form like Voltron, and we’re more powerful than we would be on our own. Think about how many individual advisers are out there with blogs. There are a lot of them and really good ones, but it’s really hard for them to get found, whereas we do a pretty good job at linking to each other. We’re tying at each other’s insights to make something bigger. This might have been one metaphor too many.

[Laughter.]

JOSHUA M. BROWN: So why are we doing all this? Let’s talk about the opportunity. Consumer households now have $37.9 trillion in investable assets, about $59 trillion in financial assets, and $94.1 trillion in total assets, about $80 trillion in net worth. That’s a lot of money, guys. There are 10.1 million consumer households with over a million dollars in net worth, and that’s back above its prior peak from ‘07. And what they all have in common is they need help, every single one of them, trust me. But where do they go? Who do they turn to? It has never been more important to be able

WWW.CFAINSTITUTE.ORG6

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

to differentiate yourself as a financial adviser than it is right now, and social is how we do it, and it’s how anyone can do it if they want to put in the time and the effort.

The thing about our industry right now is that everything is in flux, every dollar in assets is up for grabs. I had coffee this morning with a local adviser from a nationally known bank, he’s not in the room now, but he tells me the bank thinks that their brand is important to the customers. Customers could not care less, literally could not care less. The customers are there for him. And I think that applies universally. I don’t think that’s a regional thing, it’s not an age thing, it’s not a brand thing, it’s just that’s just the way it is. And so if that’s the reality and you are an entrepre-neurial investor, now is your time. These are the good old days that we’ll be talking about decades from now when everything was up for grabs and you have a shot to make it your own. They’re here right—those times are right now.

This is what the industry currently looks like: 301,000 financial advisers across all channels, down from 338,000 advisers 10 years ago. So our industry is shrinking in terms of people. We also have a graying industry. The average age of an adviser is 50.9 years old. Forty-three percent of the industry is over the age of 55. One-third of financial advisers are between 50 and 64 years old and are planning to retire over the next 10 years. We have one of the oldest industries in America, second only to Walmart greeters, but we’re number two.

[Laughter.]

JOSHUA M. BROWN: The RIA channel is growing headcount in distinction to the overall industry. It’s also growing AUM at a fairly rapid clip. There are 10.6 million managed accounts across the RIA industry, which is up 65 percent since 2009. There are over 10,000 firms that call themselves independent advisers. The best way to get a handle on their size is to look at the top three custodians. But while the opportunity is massive, very few firms are positioned to grab their share of what that opportunity is. There’s a $30 trillion generation of wealth transfer now under-way. I know you guys hear about it every day. Sixty-six percent of the kids who inherit their parents’ money end up leaving the incumbent adviser. Anyone want to bet that that gets better? Probably not. They’re going to find an adviser on their own, and in most cases, they’re going to find an adviser online. It’s just a fact. Look at how they spend their day. It’s pretty clear if you’re going to be in the wealth management industry over the next 10 years, you will need a Web pres-ence, and it will have to look different than the local Italian restaurant where the music auto plays. That’s not going to cut it anymore. The next generation spends approximately 25 hours a day online. That’s not an actual stat, I made it up.

[Laughter.]

JOSHUA M. BROWN: And they’re mostly using social apps, it’s not even websites anymore, and so if you’re going to do this, you might as well do it right. So there’s a couple of things that I

WWW.CFAINSTITUTE.ORG7

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

think are worth pointing out. And I don’t know what my time looks like. I think I’m okay. Don’t delegate this. If you’re a senior person at a wealth management firm and you plan to be in the business beyond 10 years, at least try to do this yourself. Don’t give it to the interns, don’t point to the youngest person in the firm and tell him it’s his job. Try to be involved. That’s not to say don’t get help, but—and to hire another consultant is probably not going to work either because the only thing that works in social is being yourself. So PR shtick is not going to do the trick, you’re just going to be another firm spewing nonsense into the atmosphere that no one is paying attention to.

Don’t spend any money on those consultants. This is one of them. This guy actually is a seven-figure salary at AOL. He’s their futurist. Forget about these people. They don’t know anything.

[Laughter.]

JOSHUA M. BROWN: They can’t help you, I promise. I’ve met them. Don’t pay people to post tweets for your firm. It doesn’t take that much time and effort. Come up with something yourself. Don’t pay people to do your Facebook. Don’t pay people—you have to be involved because the consultant is never going to understand how viscerally and emotionally you feel about your own firm, your own service, your own product. They’re just never going to be able to do it the way that you can do it if you actually commit to doing it.

I’ll talk quickly about Twitter. This is how the industry thinks about Twitter. It’s changed a little bit. Don’t pay people to get you Twitter followers. I’ve seen that really backfire on a hedge fund. A decently well-known hedge fund paid somebody to build up his Twitter following and was outed. A mutual fund manager I know, same thing. If you’re going to commit to spending time there, which you certainly don’t have to do, do it yourself. It’s a meritocracy. If you’re add-ing value, if you’re sharing good information, if you’re retweeting good accounts, you will build followers, you will build attention for yourself, and, you know, your content should really be a bal-ance of original ideas that you have and reactions to the content of others. This is not sitting in a room all day, “Oh, my god, what am I going to tweet?” Go about your day. Things will occur to you. You will read something that resonates with you or that you think is helpful to your follow-ers. It’s a very organic thing. There’s no think tank.

Reacting to the news of the day is a good way to stay in the conversation; it forces you to stay sharp and up to date. You’re probably having discussions with clients about the news of the day. Most of those discussions are, “Hey, it doesn’t matter, believe me,” but you’re still having those discussions. So that’s something that goes on, on Twitter all the time. Keep in mind, even though we all know in this room that nothing matters, the clients don’t believe that, the clients really believe that news is important, and they are paying you in part to stay up to date with what the news is. Trust me. That’s part of your role, is when they call up and say, “Oh, my god, did you see that Portuguese bond auction?”

[Laughter.]

WWW.CFAINSTITUTE.ORG8

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: You may not have a strong opinion on what it means or doesn’t mean, but, “Oh, yeah, I saw it. That was crazy.”

[Laughter.]

JOSHUA M. BROWN: Whatever. That’s part of your role. I know it’s ridiculous, but it’s the truth.

Another thing I would say on this is that reasonable expectations are key. The worst thing that you could do is start a blog and then say, “Why isn’t anyone reading it?” the next day. The best thing that could happen is nobody reads you for three months, six months, and the reason why is you will be unable to read the first few things you wrote, they will be like torture to read, because it takes a long time to find your voice, and you might not even know or have fully formed ideas about all the stuff that you end up writing about. I didn’t know anything five years ago. I think the process made me a little bit smarter. I try to learn new stuff every day. My blog has never been about, “Let me give you my interpretation of everything”; it’s always been about, “Hey, I’m on this learning odyssey, come along with me. Here are 10 things I’m reading today.” I don’t have a strong view on every subject. I’m not an expert on a lot of things, most things, and I think the readers understand that and they like that aspect of it. There is no reason why everyone can’t do that. We can’t all be George Soros, right? We can’t all be a master of everything that’s going on.

Another important thing is no fighting, no wars, no responses to people that say nasty things. If you attain any kind of prominence whatsoever via a blog or because you get quoted in an article somewhere or a Twitter feed, someone is going to not like you, that’s just the way the world works. It’s really important that you don’t respond. You have to be seen as being above it. There is no response to somebody saying something nasty to you that could ever make you look good, and the recent presidential debates are a good example of that.

[Laughter.]

JOSHUA M. BROWN: You just can’t look good responding. That’s the end of every one of these guys, when they took the bait and responded, that was the end of their campaign, every single one of them. It was the end for Carly, it was the end for Jeb, it was the end for Marco. So, look, every 1,000 followers you get on Twitter, probably 10 of them are terrible people and will scream something at you. They’re not mad at you, they’re mad at themselves, they’re just taking it out on you, and you’ve got to just mute, block, move on, no fighting.

The other thing is that there is no real blueprint. I think we’ve figured out some good stuff, but somebody in this room is going to take the ball and run with it and figure out something that I never would have thought of. And we did not invent this. Ken Fisher built a $50 billion wealth management empire with the power of his investment beliefs. He used books and magazine

WWW.CFAINSTITUTE.ORG9

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

articles and then eventually full-page newspaper ads, but that was the media of his day, in the 1920s and ‘30s, that’s what you—no.

[Laughter.]

JOSHUA M. BROWN: That’s what you did, the ‘70s, ‘80s, that was the media of the day. Ric Edelman a little bit more recently, same thing. He built a huge empire with a syndicated radio show. So radio maybe is a little bit passé. Newspapers, no one is reading them under 30. Fine. So the new media is social media. And when we look at guys like Edelman and like Fisher, those are people that we kind of look up to and we say what they’ve built is incredible, and they did it not on schlock, they did it based on what they actually think about investing. They spoke their minds, they spoke their opinions. So we think that’s kind of cool and we hope to be on the same path.

Just real quick, on adviser social media use in general, don’t get caught up in the debate about which is better. You won’t know which one works for you until you learn them. There is a high likelihood that you’ll be better on some than others. It doesn’t matter. Find the way that you like to communicate and maximize that. No one needs to be a master at everything. I know people who are killing it on Facebook right now, killing it. I know people on LinkedIn that are abso-lutely killing it. I’m not doing anything finance-wise on either of those sites really. So there are a lot of ways to skin the cat, and there will be new services that come along a year from now, 2 years from now, that we can’t even anticipate, like Tinder.

[Laughter.]

JOSHUA M. BROWN: And someone will do finance Tinder very well, and it won’t be me because I’m married, but someone is going to be the king of finance Tinder.

[Laughter.]

JOSHUA M. BROWN: Anyway, don’t—it will probably be Tom Brakke.

[Laughter.]

JOSHUA M. BROWN: But don’t get caught up in that. Facebook, this is my plan, how to make money from Facebook.

[Laughter.]

JOSHUA M. BROWN: I’m using Facebook. I have like this matrix of how private this stuff is to me. So Facebook is the most private thing for me. I don’t really have any contacts from the industry that I’m friends with on Facebook, I try to keep that for myself, and it’s mostly pictures of my kids

WWW.CFAINSTITUTE.ORG10

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

doing sports. It’s not that fascinating. Nobody in the industry would want to follow me. Instagram is a little bit of a gray area because it could be something I’m eating for lunch, a bowl of spaghetti, and then it could be like a slide from a conference, and, I don’t know, maybe it’s a little bit finance, it’s a little bit not. I haven’t figured that part out yet. And then LinkedIn is really just professional, everyone once in a while syndicating one of my own blog posts there. And Twitter I’m using purely professionally. I don’t have any friends that are on it because everyone on it’s a weirdo—

[Laughter.]

JOSHUA M. BROWN: —and my friends in real life are like normal, and they don’t understand what I’m doing on there. So it’s a matrix. And for some people, Facebook will really do the trick because it’s instant networking with people you know. It’s people that are in your social circle that you’ll already be friends with there, and maybe those people have financial questions. I’ve seen it work.

This is something I throw in because it’s a book that changed my life, and I try to tell people who are going down this road the importance of creating a community around you. And I met Tom Brakke I think 6 years ago, and we’ve been friends ever since, and the two of us have introduced other fellow travelers to each other, and we’ve kind of built this community out of financial and investment bloggers, and it’s growing, it’s not shrinking, and we add people to it all the time. And I met Isaac Presley, who is sitting here. He’s an adviser from Portland who flew in for this, and he is running a portfolio for an RIA, and he’s got an awesome blog called “Cordant Wealth,” and just through Twitter and social media, “Hey, I’m going to be at the same conference. Let’s have lunch.” So we have lunch. And he doesn’t eat carbs, I find out, which is terrible for me, so I refrain from the bread basket. But Isaac is like a rock star in training. He’s going to be a huge blogger. He’s awesome. If you read his blog, you can sense intelligence, personality, et cetera. So that’s what this medium gives us the possibility to do.

This is the book that was kind of the architect of my attitude. When I left the brokerage world, I became an adviser. I read this book around the same time. And I recommend everyone in the room read it because it talks about building a community around yourself and making yourself somebody who is more helpful to others than you are looking to get back and what that does for your career. And I talked to Bob Burg, the author, and I told him that he changed my life, and I’ve had 20 or 30 people that I’ve recommended this book to come back to me via email and say, “Hey, I saw you at a conference. You recommended this book. You have no idea what this did for me.” So I think this really goes hand-in-hand with this idea of building a 21st-century firm.

The last thing I want to say is about speaking to the audience. So these are millennials. As I mentioned, 66% of the next generation takes the assets away from Mom and Dad’s broker. That’s who I have in mind when I write, that’s who I think my audience is, but that doesn’t mean every-one else isn’t also interested. So I get as many investor inquiries from people in their sixties as I do from people in their thirties, but I try to speak to the people in their thirties, and I think the

WWW.CFAINSTITUTE.ORG11

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

people in their fifties and sixties also want in on that conversation. It’s backwards from what the social media consultants will tell you. It’s backwards from what the wire house firms are doing, running commercials with old people in an apple orchard or whatever. So I’m doing the opposite of that. And the bet is that if I reach the 66% now, as they inherit wealth/invent the next hot burrito or whatever they’re doing, I’m the person that they’re going to want to go to, or at least members of my firm who are younger than me and have more hair.

The other thing I would say is just make things happen. So it’s not just about Facebook and blogging and tweeting. Use that as your admission ticket to go to events like this and to meet people when you go to places like this, and you never know what will come of it. And I just can’t emphasize enough, you have to love this stuff and turn it into a lifestyle if you really want to see it mushroom and blow up.

Another thing I would say—how am I doing on time? I feel like this guy is grading a test while I’m talking.

[Laughter.]

JOSHUA M. BROWN: I’m all right? All right.

THOMAS J. BOCZAR: You’ve got a half hour.

JOSHUA M. BROWN: Oh. I definitely don’t want the whole half hour. I cede my time.

[Laughter.]

JOSHUA M. BROWN: All right. I would say also you are what you read. You know, if you want to be a sharer of quality—and a quality disseminator of information, then the sources that you get your information from have to be high quality as well. One of the tools I use for that is Feedly, F-e-e-d-l-y. This thing is awesome. I have a premium membership, and it’s like two dollars a month or something, but it’s the best tool to aggregate all of the posts, blog posts, and articles, and things that you care about being produced, every one from Isaac at Cordant Wealth blog to the Wall Street Journal to Bloomberg News. You can really curate a very powerful feed for yourself of all the news and opinion sources that you want and keep yourself up to date, whether that’s in service of doing a blog or just making yourself a better adviser to your client, I highly recommend using that.

And then I think another thing that’s helpful is to not just only read investing books. Like I was talking to someone today, if you read one or two Bill Bernstein books, you’re probably all set. He’s not going to radically change what he thinks two years later. Try to read some literature. Try to read some fiction. That stuff will make you a better communicator and a better writer, and it’s

WWW.CFAINSTITUTE.ORG12

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

really apparent when you read investment bloggers or financial bloggers, who is overdosing on investment books and who is branching out a little bit. And the best example of that is my friend Patrick O’Shaughnessy. A lot of you guys know James O’Shaughnessy of O’Shaughnessy Asset Management. His son, Patrick, is one of the smartest people I know, and he reads like 20 books a month, and he shares his reading list. He makes his old reading list downloadable as an Excel, and then you could sign up for free, and every month he blasts out, “Here are the new books I’m about to tackle,” and that’s a really valuable resource. And he’s reading very wide variety of topics, and then he writes. He’s got a really kick-ass blog, too. And he relates things from history and science and literature to the investment world, and a lot of these really complicated quant topics that he’s preoccupied with click because he’s not writing as a quant, he’s writing as a writer. So I think that’s a really helpful way to think about doing this.

Let’s see, the final lesson. I mentioned this before, but I can’t emphasize it enough. I don’t do Fantasy Football, I don’t do—like this is my—so people say, “How do you have so much time?” Because this is what I love. I love investing. I fell in love with the markets in my teens in the mid-’90s. I remember Snapple going public, which was a Long Island company; Boston Chicken, that didn’t work out so well; Callaway Golf. There were a host of IPOs. And then Netscape hit the world like a meteor. It was at the time I think the biggest IPO one-day gain, and that was like ‘96 or ‘97, and I just—I watched that whole thing happen, and I just—I fell in love. And so when people are like, “Well, how do you have so much time?” Because I’m doing this, it’s a love affair with investing and trying to become better and trying to figure out what other investors are doing and why it’s working and trying to keep up with the latest research. I love bloggers who summarize white papers because I can’t keep my eyes open reading them myself, but I just—I love this stuff, and I’ve attracted a community around me of other like-minded people, some of them work with me, some of them work at other RIA firms. This stuff consumes us.

When I’m traveling to another city, I try to get together with people, and constantly trying to bet-ter myself. I really don’t have any other choice. I don’t have an MBA, I’m not a CFA, I’m not a CFP. My value to my clients and to my firm is as, I guess, a thought leader, as much of a clownish term as that is, I guess I’m a thought leader, and so I have just chosen to embrace that with open arms, and I’m having fun doing it. And I want to tell you something, when it’s starting to click, whatever you do, when you start to feel like, “I’m getting really good at this,” and it took me 15 years or 12 years to find that thing, but when you find it and it’s working, it is the best feeling on Earth, literally the best. And when you can build a practice around clients who have come to you for the power of your ideas, not because they’re brother-in-law or whatever, but because they respect what you think, that’s an amazing feeling. It’s a much better way to do it than any other way. And then when you can surround yourself with other portfolio managers, analysts, advisers, who are on the same page, that’s the best way to proceed in this industry. Will everyone be able to do it? I don’t know, but isn’t that worth a try? Isn’t that worth the endeavor?

So I’ll leave it there, and I guess if anyone asked any questions—I feel like I was pretty verbose.

WWW.CFAINSTITUTE.ORG13

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

THOMAS J. BOCZAR: No, you got a lot of questions, a lot of good ones. You know, almost every question has some element of the regulatory risk. A lot of folks want to know how you’re regulated. Are you state? Are you SEC? Do you use internal, external compliance folks? Because there are so many firms that have a no blogging policy.

JOSHUA M. BROWN: Yep.

THOMAS J. BOCZAR: So how do you go about changing that attitude and getting the com-pliance right?

JOSHUA M. BROWN: So the compliance piece is the most important piece because—well, first of all, let me just say this about the regulators and regulation in general. I think that their response to the rise of social media was so smart, I think they nailed it, they got it exactly right. What they basically did was they came out with a notice to members in 2010, “Hey, we’re aware of this stuff, we’re aware that there are social networks. Be advised, all the rules still apply. Just because you’re saying something on a social network doesn’t mean that you have a different restric-tion from if you were to make a public appearance on a radio show or a TV.” Right? So they put it up. What they didn’t do was step on it. What they didn’t do was just say, “Nope, no chance, can’t do it.” They totally got it right, and as a result, it’s something that advisers can do to communicate with clients.

Now, just having that guiding principle of whatever you can’t do at a regular public appearance you also can’t do on social is not enough because there is some nuance. So on LinkedIn, you have to turn off the ability of other people to endorse you, for example. Like there are other things that go along with it. Archiving, extraordinarily important. Just like you archive your emails, it’s no different. So we use Smarsh, which I’m sure 90 percent of the people in the room are familiar with, to archive every employee in the firm that’s on Twitter in the capacity as a employee of the firm. The same company doing our email. The same company doing our blogs. We have got an internal CCO who is monitoring all of our blogs, everything that we’re saying. We’ve got dis-claimers on everything. So at the bottom of every one of my posts, “This is not a solicitation to buy or sell any investment. Click here for the full terms and conditions.” You arrive at that page, you get the mutual fund disclaimer, the past performance, the municipal bond disclaimer. I don’t ever talk about municipal bonds, but it’s all there. Because what we never want to happen is for us to say something incidental to just trying to communicate and have it be construed as, “Oh, I just got advice from a blog.” You are not getting any advice from my blog.

The other thing on the compliance front is—and we work with an outside compliance firm as well, and I think the best thing I can say is that thank God there is compliance because if it was a Wild West on social media, can you imagine how tarnished our industry would become? Like if there were guys out there tweeting out track records, you know, it would just devolve into madness and no one would trust anything that anyone says. So it’s great that there are restrictions. We

WWW.CFAINSTITUTE.ORG14

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

don’t talk about performance. We don’t talk about track records. We don’t talk about—we don’t try to give individual advice over social networks. We don’t answer investment questions online, there are no lightning rounds.

[Laughter.]

JOSHUA M. BROWN: We just don’t do it because there is no way to do it compliantly, A; and, B, we don’t think it would help anyone anyway. Of what use is it to say, “Here is the best mutual fund for an emerging market”? Why would that be helpful to anyone? We all know it’s VWO, it’s a Vanguard ETF.

[Laughter.]

JOSHUA M. BROWN: All right. So next.

THOMAS J. BOCZAR: If one sticks the toe in the water and decides to do this, what’s the best way to learn without really hurting yourself?

JOSHUA M. BROWN: I think the blog is more important than anything else. And, again, pray to God that no one reads it. Don’t show it to anyone, just do it. It’s not like, oh, write a white paper. It’s 300 words. “The Wall Street Journal said this today. I disagree with it. Here’s why I think they’re wrong.” Hope that nobody reads it. Do that five days a week for a month, and then look at the last thing you wrote versus the first thing you wrote, and if there is no improvement, then stop.

[Laughter.]

JOSHUA M. BROWN: And definitely don’t email me a link.

[Laughter.]

JOSHUA M. BROWN: No. But there probably will be an improvement, and here’s the cool thing, there might even be some evolution to what your original thoughts were on the topic because one of the things that writing about investing forces you to do is research. It forces. You can’t just say whatever, you have to, “Here’s what I think and here are the reasons why I think it.” And that process, even if you never turn out to be a better writer or blogger or communicator, I guarantee you get a little bit smarter.

THOMAS J. BOCZAR: You talked about a lot of the benefits and your approach to this. Has anything hurt you? Have you had any stories that really didn’t work out as you anticipated?

WWW.CFAINSTITUTE.ORG15

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: Yeah. So when I first started, I was probably a little bit less gentile.

[Laughter.]

JOSHUA M. BROWN: I was probably a little bit less political, and I probably burned some bridges. I’ve definitely done some things and said some things that I regret. I guess it’s just the nature of being—having a public persona. These days everyone is being more careful than ever because we kind of live in this PC gotcha culture, and I guess that’s what it has to be for now until things evolve. But when I first started writing, I was also very angry. I was coming out of the bro-kerage industry. I felt that anyone that I went to as a mentor led me astray down the wrong road, only taught me the wrong things to do, and I kind of had so much vitriol for the industry that I went at it, you know, and maybe that’s just because I was eight years younger and filled with rage and I needed somewhere to vent. I once called the guys that run Buckingham Asset Management, all passive—I once called them the “passive Taliban.” That probably wasn’t cool. I don’t know.

[Laughter.]

JOSHUA M. BROWN: I’m friends with them now. I apologized.

[Laughter.]

JOSHUA M. BROWN: I almost had a slap fight with Peter Schiff at a gold conference.

[Laughter.]

JOSHUA M. BROWN: You know, like I’ve—yeah, there are some things that I regret. But what did Sinatra say? You know? It is what it is.

THOMAS J. BOCZAR: You’ve obviously had first mover advantage, you’re one of the leading firms out there doing this. Are you afraid that at some point other firms will be, quote/unquote, found? Is that going to eliminate the opportunity, or do you think because you have that first mover advantage, you’ll turn it into an insurmountable lead?

JOSHUA M. BROWN: So we probably do more to promote the blogs of other investment advisory firms than any group of people in the world. Every single day, Barry shares 10 links in the morning and then like another 8 or 9 in the afternoon of things that he’s been reading, and I would say like a third of them are links to our competitors. We don’t have competitors. If you want to work with Ben Carlson or with Barry or with me, there is no other version of that, it’s just us. And if you don’t, that’s fine, too. But we’re a brand, and if you want our brand, we are the one-stop shop, but we don’t have the monopoly on every great idea, we don’t know everything there is to know about investing. We have friends at other firms that might. And so when they

WWW.CFAINSTITUTE.ORG16

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

write something that’s great, we can’t wait to link out to it, we can’t wait to send traffic. And that gets back to this Go-Giver philosophy. I have no idea what that’s worth to me, the fact that I’ve been doing that for seven years, but I know it’s helping my readers, because the alternative to that is me saying, “Take my word for it on every subject under the sun,” and there’s no way that would be a help to my readers because I’m very ignorant about a lot of things to do with finance. So just saying, “Look, I don’t know about this thing, but it seems like it might be important, and this guy who runs an RIA across the country wrote something really smart, you should go read that,” I know that helps my readers. Maybe it helps me. But that’s been kind of our philosophy from day one. We’ll keep doing that, and if other people, quote/unquote, get discovered, and we have a role in that, that makes us proud, not fearful, and we hope that that comes back to us, and I have a pretty good idea that it does on a daily basis.

THOMAS J. BOCZAR: We appreciate that. We also appreciate your openness in terms of sharing your business model.

JOSHUA M. BROWN: You guys pay me a lot of money.

[Laughter.]

THOMAS J. BOCZAR: I know that’s not true, from experience.

[Laughter.]

THOMAS J. BOCZAR: But you mentioned Ric Edelman using public radio. We appreciate your openness, but are there any other firms that you think are doing a good job right now doing kind of what you’re doing?

JOSHUA M. BROWN: Yeah. I mentioned Buckingham. They’re great guys. Larry Swedroe writes for ETF.com. I read every single thing that he writes and I link to it almost every day. Carl Richards is a personal friend of mine. I met Carl probably six years ago, five years ago. He’s been a profound influence on my writing. And we think they do a great job. We think Alan Roth, who is out of Colorado, does a great job. Meb Faber is a genius, and he and I have become friends over the years. That’s another competing RIA, Cambria, and he is just so fantastic, you can’t possibly get mad when you see him getting a lot of attention or traffic because what he is writing and saying is so smart. So, yeah, there are a lot of examples, and if you want to see more of them, check out my morning Linkfest. I’m linking to smart financial advisers that are writing great blogs pretty much every single day.

THOMAS J. BOCZAR: Thank you for that. In terms of where you find this more useful, obvi-ously you’re using it for recruiting purposes, but you’re finding it useful to attract clients. Where do you think it’s more useful? Are you finding it more useful, one or the other?

WWW.CFAINSTITUTE.ORG17

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: So I get asked this a lot. I don’t really have a scientific survey done on this, but I think my readership is half and half, half professional, half civilian.

[Laughter.]

JOSHUA M. BROWN: It doesn’t bother me because my Director of Financial Planning, a guy named Kris Venne, was sitting in a—this is 2012—sitting in a Wells Fargo branch in Syracuse, New York, staring out at a steel gray sky, talking to himself and reading my blog. And I get an email from him about something totally unrelated to investing that turns into a correspondence. He ends up coming down, looking at how we’re running our practice, Barry and I, neither of which is a CFP. Barry was a chief strategist at brokerage firms, and you know what I was. So Kris said, “Let me see your CRM,” and I held up a legal pad, no exaggeration, true story, and Kris said, “You know what you guys need is practice management.” So Kris is a reader of the blog, never going to be a client, he’s an adviser like me, comes in, rips out everything we’re doing, makes it better, makes it workable, and helps us build a firm.

Bill Sweet, another example, is a guy doing high-level tax prep work for small businesses in upstate New York, and he’s a CFP. He’s been reading the blog for four years. He says, “You know what? I realized I can’t be a solo practitioner anymore. I’m spinning my wheels. Let me talk to you guys.” We know within five minutes he’s one of us, five minutes in our conference room. I was offering him a job while he was talking.

That’s the kind of thing that’s happened for us. So if I’m writing for mostly advisers on any given day or mostly potential clients, I have no time to think about that because I really do see a huge opportunity in both lanes.

THOMAS J. BOCZAR: Fair enough. What percentage of time, of your time in the office or whatever, do you actually—are you performing blogging, and your colleagues, too? What per-centage? It’s got to be a pretty large amount, I would think.

JOSHUA M. BROWN: So me more so than my colleagues because I’m not really client facing. Right? So I’m meeting clients for lunch when they’re in town in New York, but I don’t add much value in a client-to-adviser discussion because we’ve oriented the firm around planning, and so we have CFPs as the client facing. And then I’m involved with clients when we’re talking portfolio, which is usually toward the beginning of the relationship to make sure they understand how our portfolios tie into their plan or toward the end of a relationship when the market is blowing up and they’re on their second strike with the adviser, and then they’ve called them for the third time, “Sell all my—,” you know, fill in the blank. That’s like me basically at the end saying, “Look, it doesn’t seem like you understand what we do here.” So, but when I’m not doing that, I have a lot of time to read, I have a lot of time to write, and I’m very lucky in that regard. I don’t know if it

WWW.CFAINSTITUTE.ORG18

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

will always be the case. I’m the CEO of the firm, which I actually have to perform come CEO functions.

THOMAS J. BOCZAR: Sure.

JOSHUA M. BROWN: Which I have no training to do, by the way. But, so as the firm gets bigger, maybe I have less time to write, maybe I have less time to do that, but for right now, it seems like it’s probably two-thirds of the day.

THOMAS J. BOCZAR: Intermediate, longer term down the road, how do you think robo advisers are going to impact your business that you’re building?

JOSHUA M. BROWN: We don’t actually consider them to be advisers, we consider them to be robo allocators, which is fine, nothing wrong with that. I think it’s a useful service, but they’re not actually giving advice because advice is personal, and there is nothing personal about filling out seven questions and being handed a portfolio. So we’re not anti-robo allocation. We actu-ally built a service, it’s called Liftoff, we haven’t really done much to promote. We haven’t spent a dollar in marketing. We rarely talk about it. It’s got 63 accounts with $4 million in it with no effort whatsoever. We look at the people that end up in that solution or people that come to us and say, “Can you help me? I don’t know what to do with my money.” But they don’t qualify for full-blown financial planning, wealth management, trust and estate review.” It’s overkill. They don’t need it, they shouldn’t pay us for it, but I also don’t want to send them out into the wild and have them meet a guy from, you know, Northwest Mutual—no—I don’t know, I don’t know.

[Laughter.]

JOSHUA M. BROWN: You know, I don’t want to see them getting sold an annuity or what-ever. Like so this was a way for us to put something online and they could click a link, and the pitch to them is, “Look, maybe this is a good solution for you, maybe it’s not. You and I are not going to talk every day, but we built these portfolios, we do the rebalancing, we stand by the fact that these are low-cost, fantastic portfolios, and they will work for you if you continue to add in money every month, like you should in your thirties.” And so who knows what that turns into? But it’s not disruptive because the minute—or, look, we have clients, we have young people in San Francisco, we go out there once a year, tech people. They know the founders of Wealthfront and Betterment; they might have even funded a round. They’re like, “Oh, yeah, I have a hundred grand at Wealthfront, and then my company got bought out, I had $2.8 million,” and that was real money, so I had to get serious. That’s why I’m talking to you guys.

So I don’t know if that’s everyone. I think there is room for Wealthfront. I think they will be the biggest B to C. Betterment is really smart. I know Jon Stein. I think very highly of what they’re doing. They’re—I wouldn’t call it pivoting, they’re kind of doing B to C, and then they’re also

WWW.CFAINSTITUTE.ORG19

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

going to do B to B, they’re going to work with people like you so that you have portfolio ideas. They will build the software. And they’re doing Betterment for Business, they’re doing 401(k). I think there is room for the two of them to be really big brands. I think Vanguard and Schwab will get the lion’s share of the business, and I don’t think there will be anyone else. The rest of the industry will be filled in by people like us utilizing those tools.

And the best analogy I can give you is email. When email first came along in the late ‘90s, I was around, I was an intern at a firm, and I remember the firm’s policy. They called a meeting and they said, “All the advisers are asking about email and brokers are asking about email, so we called this meeting to lay out our firm policy. Our policy is no.”

[Laughter.]

JOSHUA M. BROWN: That’s true. “There is no email. We don’t do it. We don’t know from it. We don’t want to see it. We don’t want you sending it.” And obviously that eventually changed. Some firms adopted email faster than others. Some firms had a branch manager sending it only. Some firms, you had to print it out and have it signed by a compliance officer and then retype it into—so the early adopters of emails in our industry, we didn’t call them email advisers, “Oh, he’s an email adviser.”

[Laughter.]

JOSHUA M. BROWN: There is no robo adviser. There are advisers using next-generation soft-ware tools and advisers that will eventually learn to, and that’s really it. I mean, I don’t view it as it’s going to be the standalone thing that puts everyone out of business because at the end of the day, people want to work with people on things like legal issues, medical issues, financial issues. These are the most important things. It doesn’t mean that we don’t need better and better tools to do it.

THOMAS J. BOCZAR: Tell us your thoughts about Snapshot. Have you—

ATTENDEE: Snapchat.

THOMAS J. BOCZAR: Snapchat. Sorry.

[Laughter.]

JOSHUA M. BROWN: Have you figured that out?

JOSHUA M. BROWN: It’s the creepiest thing I’ve ever been asked.

[Laughter.]

WWW.CFAINSTITUTE.ORG20

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: No. Yeah, I’m on Snapchat. I can’t use it, though, professionally because there is no way to compliantly create content there. Also, it’s totally moronic.

[Laughter.]

JOSHUA M. BROWN: I’m on it. I have friends on it. We’re sending each other pictures of steaks we’re grilling. I don’t even know what’s going on.

[Laughter.]

JOSHUA M. BROWN: Like we’re swapping faces with our kids, and it’s—it’s a very powerful tool for people with not a lot to do.

[Laughter.]

JOSHUA M. BROWN: Like in their teens, they’re on it all day, and I totally get it, I would be also. If I were like in high school and everyone in the high school is on it and they’re constantly sharing facial expressions with each other, I would be on it. I don’t think that there is anything professional to do there, and I don’t think it can be archived or compliantly done. So we’ll take a pass on that one. We’ll wait for the next one.

[Laughter.]

THOMAS J. BOCZAR: I think most other folks are, too. We have one question, we saved the best for last. If you were stranded on a desert island, would you rather be stranded with Pete or Jon Najarian, and why?

JOSHUA M. BROWN: Oh, wow.

[Laughter.]

JOSHUA M. BROWN: So Pete and Jon Najarian, for those of you that don’t watch the show, are two of my castmates. They’re two of the best guys I’ve ever met in this industry. They actu-ally have pivoted themselves into more of our business. They ran a brokerage firm called option-MONSTER that was an options brokerage, which was acquired by a private equity firm, and now they are Najarian Family Office. So they are doing wealth management. They’ve teamed up with a group from UBS in the Minnesota area, UBS or Morgan Stanley. But the answer to your question is probably neither—

[Laughter.]

WWW.CFAINSTITUTE.ORG21

Building a 21st-Century Advisory Firm

© 2016 CFA INSTITUTE. ALL RIGHTS RESERVED.

JOSHUA M. BROWN: —because I feel like they would be braiding ponytails and bench press-ing me, and I don’t know.

[Laughter.]

JOSHUA M. BROWN: But I love them and I’ve learned a lot about the business from them, and they’re awesome.

THOMAS J. BOCZAR: Well, we appreciate you coming here. We’re out of time. But thank you so much.

JOSHUA M. BROWN: Thank you. Thank you.

[Applause.]

![Minneapolis, minnesota[1]](https://static.fdocuments.net/doc/165x107/555447a1b4c905b7428b4918/minneapolis-minnesota1-5584a0691ac38.jpg)