Buffett beyond value

Transcript of Buffett beyond value

E1FFIRS

Date:Jan19,2010

Time:10:56am

E1FFIRS

Date:Jan19,2010

Time:10:56am

Buffett

BeyondValue

E1FFIRS

Date:Jan19,2010

Time:10:56am

E1FFIRS

Date:Jan19,2010

Time:10:56am

Buffett

BeyondValue

WhyWarrenBuffettLooksto

GrowthandManagement

WhenInvesting

PremC.Jain

JohnWiley&Sons,Inc.

E1FFIRS

Date:Jan19,2010

Time:10:56am

Copyright©2010byPremC.Jain.Allrightsreserved.

PublishedbyJohnWiley&Sons,Inc.,Hoboken,NewJersey.

PublishedsimultaneouslyinCanada.

Nopartofthispublicationmaybereproduced,storedinaretrievalsystem,ortransmittedinanyformorbyanymeans,electronic,mechanical,photocopying,recording,scanning,orotherwise,exceptaspermittedunderSection107or108ofthe1976UnitedStatesCopyrightAct,withouteitherthepriorwrittenpermissionofthePublisher,orauthorizationthrough

paymentoftheappropriateper-copyfeetotheCopyrightClearanceCenter,Inc.,222RosewoodDrive,Danvers,MA01923,(978)750-8400,fax(978)750-4470,oronthewebatwww.copyright.com.RequeststothePublisherforpermissionshouldbeaddressedtothePermissionsDepartment,JohnWiley&Sons,Inc.,111RiverStreet,Hoboken,NJ07030,(201)748-6011,fax(201)748-

6008,oronlineat

http://www.wiley.com/go/permissions.

LimitofLiability/DisclaimerofWarranty:Whilethepublisherandauthorhaveusedtheirbesteffortsinpreparingthisbook,theymakenorepresentationsorwarrantieswithrespecttotheaccuracyorcompletenessofthecontentsofthisbookandspecificallydisclaimany

impliedwarrantiesofmerchantabilityorfitnessforaparticularpurpose.Nowarrantymaybecreatedorextendedbysalesrepresentativesorwrittensalesmaterials.Theadviceandstrategiescontainedhereinmaynotbesuitableforyoursituation.Youshouldconsultwithaprofessionalwhereappropriate.Neitherthepublishernorauthorshallbe

liableforanylossofprofitoranyothercommercialdamages,includingbutnotlimitedtospecial,incidental,consequential,orotherdamages.

Forgeneralinformationonourotherproductsandservicesorfortechnicalsupport,pleasecontactourCustomerCareDepartmentwithintheUnitedStatesat(800)762-2974,outsidethe

UnitedStatesat(317)572-3993orfax(317)572-4002.

Wileyalsopublishesitsbooksinavarietyofelectronicformats.Somecontentthatappearsinprintmaynotbeavailableinelectronicbooks.FormoreinformationaboutWileyproducts,visitourwebsiteatwww.wiley.com.

LibraryofCongress

Cataloging-in-PublicationData:

Jain,PremC.1950–

Buffettbeyondvalue:whyWarrenBuffettlookstogrowthandmanagementwheninvesting/PremC.Jain.

p.cm.

Includesbibliographicalreferencesandindex.

ISBN978-0-470-46715-2(cloth)

1.

Investments.2.

Investmentanalysis.3.

Buffett,Warren.I.

Title.

HG4521.J2642010

332.6–dc22

2009041474

PrintedintheUnitedStatesofAmerica

10987654321

E1FTOC

Date:Feb4,2010

Time:2:24pm

Contents

Preface

ix

Acknowledgments

xv

PartOne

IntroductionandBackground

1

Chapter1

TheThrillofInvestinginCommonStocks

3

Chapter2

1965–2009:LessonsfromSignificantEventsin

BerkshireHistory

9

PartTwo

BuffettInvesting=Value+Growth

23

Chapter3

ValueInvesting—It’sLike

BuyingChristmas

CardsinJanuary

25

Chapter4

GrowthInvesting

43

Chapter5

IntrinsicValue

57

Chapter6

BuffettInvesting=Value+Growth

69

v

E1FTOC

Date:Feb4,2010

Time:2:24pm

vi

contents

PartThree

OtherPeople’sMoney

87

Chapter7

Insurance:OtherPeople’sMoney

89

Chapter8

Reinsurance:MoreofOtherPeople’sMoney

99

Chapter9

TaxDeferment:Interest-FreeLoansfrom

theGovernment

109

PartFour

SuccessinRetailing,Manufacturing,

andUtilities

113

Chapter10

IfYouDon’tKnowJewelry,KnowYourJeweler

115

Chapter11

CompeteLikeMrs.B

123

Chapter12

WhyInvestinUtilityCompanies?

129

Chapter13

HighProfitsinHonest-to-Goodness

ManufacturingCompanies

137

PartFive

Risk,Diversification,andWhentoSell

143

Chapter14

RiskandVolatility:HowtoThinkProfitably

aboutThem

145

Chapter15

WhyHoldCash:LiquidityBringsOpportunities

155

Chapter16

Diversification:HowMany

BasketsShould

YouHold?

161

Chapter17

WhentoSell

169

PartSix

MarketEfficiency

175

Chapter18

HowEfficientIstheStockMarket?

177

Chapter19

ArbitrageandHedgeFunds

185

E1FTOC

Date:Feb4,2010

Time:2:24pm

Contents

vii

PartSeven

Profitabilityand

Accounting

193

Chapter20

M=Monopoly=Money

195

Chapter21

WhoWinsinHighlyCompetitiveIndustries?

205

Chapter22

Property,Plant,andEquipment:GoodorBad?

211

Chapter23

KeytoSuccess:ROEandOtherRatios

217

Chapter24

AccountingGoodwill:IsItAnyGood?

223

PartEight

Psychology

229

Chapter25

HowMuchPsychologyShouldYouKnow?

231

Chapter26

HowtoLearnfromMistakes

243

PartNine

CorporateGovernance

249

Chapter27

Dividends:DoTheyMakeSenseinThisDay

andAge?

251

Chapter28

ShouldYouInvestinCompaniesThat

RepurchaseTheirOwnShares?

257

Chapter29

CorporateGovernance:Employees,Directors,

andCEOs

263

Chapter30

LargeShareholders:TheyAreYourFriends

273

Conclusion

B=Baseball=Buffett

277

Appendix

ASummaryoftheBook

281

Notes

283

AbouttheAuthor

295

Index

297

E1FTOC

Date:Feb4,2010

Time:2:24pm

E1FPREF

Date:Jan19,2010

Time:11:46am

Preface

Thisbookisforeveryonewithaseriousinterestinlearningabout

stockmarketinvestingusingprinciplesespousedbyWarren

Buffett.Justover20yearsago,whileteachingattheWharton

School,IstumbleduponanessaybyWarrenBuffettthat

motivatedme

tocarefullyinvestigatehisinvestmentstyle.1IwasintriguedwhenIrealizedthattherewasafundamentaldifferencebetweenBuffett’sattitude

towardinvestingandtheacademicapproach.Whileacademicsgenerally

anchorontheimpossibility

ofmakingabove-averagereturns,Buffett

proposesjusttheopposite.Hearguesthatwithacarefulstudyofcompanyfundamentalsandmanagementquality,investorsdefinitivelycanearn

above-averagereturns.Hisoutstandinglong-termrecordsupportshis

claim.WhenfacedwithBuffett’srecord,mostacademicseitherdismiss

itasanoutlierorbrandhimageniuswhocannotbecopiedorexplained.

Iwantedtoknowiftherewasasystematicwayofunderstandingand

emulatinghisinvestmentphilosophy.

Mostauthors,includingacademics,characterizeBuffettasavalue

investor.Buffettisnotjustavalueinvestor—atleastnotinthepopularsensethatthe“value”monikerisused.Buffett’spubliclytradedcompany,BerkshireHathaway,hasgrownatanannualizedrateofabout20percent

inassets,revenues,networth,andmarketvaluefor44years.Hisper-

formanceisclosertowhatwouldbeexpectedfromasuccessfulgrowth

investor.Unlikeotherbusinessmenwhomayhavealsoamassedgreatfor-

tunes,Buffettstandsalonebecausehislong-term

successreflectsgrowth

ix

E1FPREF

Date:Jan19,2010

Time:11:46am

x

preface

ofhisbusinessand

investmentsinseveraldifferentindustrieswithouteverridingahottrend.ThereisanothermajordifferencebetweenBuffett

andothersuccessfulinvestors,whichisactuallythemainreasonIchose

tostudyhimdiligently.WarrenBuffettisamanofthehighestlevelof

integrity.Heknowsthathehasaspecialgift,andinsteadofkeepingittohimself,hehaschosentosharehisimmenselyvaluableexperienceswith

anyonewhocarestodosomeresearch.Aremarkableteacher,Buffett

haswrittenaconsiderablebodyofmaterialonhisideasandprinciples,

whichallowsforcarefulexaminationofhisstrategiesandmotivations.

ThekeyreasonforBuffett’sunparalleledsuccessisnotonlyhisability

tostayresolutewiththeprimaryvalueinvestingprincipleofmaintain-

ingalowdownsideriskbutalsohisskillatpairingit

withthegrowth

investingprincipleofputtingmoneyintocompanieswithsustainable

growthopportunities.Thus,hecombinestheprinciplesofboththe

valueandgrowthinvestmentstrategies.Yet,hedoesnotinvestinhigh-

techcompanies,assomanygrowthinvestorsdo.Hisgrowthstrategyis

bestunderstoodbystudyingthebusinesseshehaspurchasedatBerkshire

Hathaway.Buffettbuysgoodbusinessesthatalreadypossessoutstand-

ing,high-integritymanagement.Hereliesonthe

sameprinciplesfor

investingincommonstocks.Ielaborateonhisinvestmentprinciples

throughoutthebookalongwiththespecifictopicscoveredineachchap-

ter.Theseprinciplesareusefulwhetheryouareinvestinginabullmarketorabearmarket.

BuffettandContemporaryTeachingsat

BusinessSchools

Mygoalasateacher-researcherisnotonlytoexplorewhatBuffett

practicesbutalsotofindanswerstowhyhispracticesaresuccessful.

In1997,mydesireto

understandwhyBuffett’sinvestmentstyleworksandhowhisstrategiesblendwiththelessonsfromcontemporaryfinanceledmetodevelopanewcourseatTulaneUniversity.Thiscoursetooka

newapproachtofinance,wherestudentsstudiedBuffett’swritingsand

decisionsinconjunctionwith

modernfinanceresearch.Thestudents

alsoanalyzedalargenumberofbusinesses.In1999,Tulanecontributed

$2millionfromtheuniversity’sendowmentfundtocreateaportfolio

E1FPREF

Date:Jan19,2010

Time:11:46am

Preface

xi

tobemanagedbystudentsundermyguidance.IleftTulanein2002for

GeorgetownUniversity,butProfessorSheriTicecontinuestoteachthe

increasinglypopularcourseatTulane.

Fromtheoutset,itisimportanttorecognizethatBuffett’sideasare

notalwaysatoddswithmodernfinancetheories.Forexample,thecon-

ceptsofdiscountingcashflowsandnetpresentvaluearetaughtinall

businessschools.Resemblingthenetpresentvalueconcept,concepts

likeintrinsicvalueandmarginofsafetyareatthecoreofBuffett-styleinvesting.Furthermore,themuch-talked-aboutconceptofdiversificationisdiscussedinasomewhatsimilar,althoughnotidentical,fashion

bothbyinvestmenttextsandbyBuffett.Thereisplentyofcommonality

betweenthebusinessschoolcurriculumandBuffett’sapproach.How-

ever,thisbookcoversideasfromBuffettthatgobeyondwhatprofessors

generallyoffer.Mygoalistoprovideadditionalinsightsto

leadyou

towardamorepracticalapproachtoinvestinginthestockmarket.

FocusonImportantQuestions

OnekeytraitthatmakesBuffettsuccessfulishisabilitytofocus.To

remainfocused,Ipresent

manysectionsofthebookinaquestion-

and-answerformat.ThisSocraticstyleforcesonetopinpointimportant

questionsthatfellowinvestors,students,andcolleagueshaveaskedme

overtheyears.AtBerkshireHathawayannualmeetings,manyofwhich

Ihaveattendedoverthepast20years,WarrenBuffettandCharlie

Munger(chairmanandvicechairmanofBerkshireHathaway,respec-

tively)answerquestionsfromtheaudienceforseveralhours.Buffett

alsousedaquestion-and-answerformatin2003when

heaccepted

myinvitationtoaddressGeorgetownUniversityMBAstudentsand

faculty.

AlthoughthisbookconcentratesonBuffett’sinvestingstyle,Ibring

inrelatedideasfromotherinvestorsandacademic

researchtohelp

improveyourinvestmentstrategies.Forexample,nodiscussiononinvest-

ingiscompletewithoutincorporatingthepioneeringandstillrelevant

worksofBenjaminGrahamandDavidDodd.Similarly,Idrawfromthe

thoughtsofPhilipFisherandPeterLynchtodiscussgrowthinvesting

strategies.

E1FPREF

Date:Jan19,2010

Time:11:46am

xii

preface

NoonecanteachBuffett’sideasbetterthanBuffetthimself.Clearly,

heknowsathingortwoaboutinvesting.InMarch2008,ForbesmagazinerankedBuffettastheworld’swealthiestmanwithanestimatedpersonal

wealthof$62billion.2I

wrotehimaletterin1997suggestingthatfuturegenerationswouldthankhimifheweretowriteabook.Heresponded,

“Idefinitelyhaveabookinmind,thoughmuchofwhatIhavetosayhas

beencoveredintheannualreports.”WhilewewaitforBuffetttowrite

hisinvestmentbook,Idecidedtosharemyownanalyses.Tounmaskhis

thoughts,IcarefullystudiedBerkshireHathaway’sannualreportsfrom

thepast50years,his1958to1969partnershipletters,andasmanyofhisotherwritingsasIcouldfind.Ihavebenefitedimmenselyfromthiseffortandhavedonemy

besttocaptureBuffett’sinvestmentideasinthisbook.

HowMuchBackgroundDoYouNeedto

UnderstandBuffett’sPrinciples?

Buffettdoesnotrecommendsophisticatedmathematicalmodels.He

writes,“Toinvestsuccessfully,youneednotunderstandbeta,effi-

cientmarkets,modernportfoliotheory,optionpricing,oremerging

markets.”3Withthissentimentinmind,Ihavemadecertainthatyoudo

notneedanyknowledgeofmathematicalfinanceto

benefitfromthis

book.ConsistentwithBuffett’steachings,myexperiencetellsmethat

theuseofmathematicalmodelstopickindividualstocksisnotparticu-

larlyhelpful.Itmayevenbeharmfulbecauseitcanleadyoutobecome

overconfidentinyourabilities.Asthefinancialcrisisin2008–2009has

shown,over-relianceonmathematicalmodelscanresultinafalsesense

ofsecurityintheunderstandingofriskandreturn.

Someknowledgeofaccountingandfinanceis

essentialtofollowthis

book,butmostpeopleinvestinginthestockmarketalreadyunderstand

suchtermsasearnings,dividends,andreturnonequity.Myobjectiveistoshowhowtointerpretthosetermssothatyoucanusethemeffectivelytoimproveyourinvestingstyle.Ifyouhavenoknowledgeof

basicinvestmentterms,youmayfindsomesectionsofthisbookalit-

tleadvanced.Eventhen,youwillseethatthereismoretopickinga

stockthanbeingawhizinmanipulatingnumbers.Ifstockpickingcould

indeedbeformulatedasamathematicalmodel,mutual

fundmanagers

E1FPREF

Date:Jan19,2010

Time:11:46am

Preface

xiii

couldsimplyhireabunchofrocketscientistsandearn

superiorreturns.

Buttheevidenceisjusttheopposite:Itappearsthatinvestorswhouse

simpleprinciplesgenerallydobetterthanthosewhorelyheavilyon

mathematicalmodels.

ToconcentrateonBuffett’sinvestingprinciples,Irestrict

mydiscus-

siontoBuffett’sinvestment-relatedideas,howwecanlearnfromthem,

andwhytheywork.Othershavealreadyreviewedhisinterestinglife

story.4Idoubtthatyouneedtobeasfascinatedbybridgeorbaseballasheistobecomeasuccessfulinvestor.

Similarly,youneednothavebeen

borninOmaha,Nebraska,orsharehistasteinfood.Evenhisfriend

andbusinesspartnerCharlieMungerdoesnotagreewithallofBuffett’s

philosophicalideas.WhileBuffettisaDemocrat,MungerisaRepubli-

can.Youneednotbeeither.BykeepingthebookfocusedonBuffett’s

investmentphilosophies,Ihighlightonlytheissuesrelevanttoinvesting.

WhatCanYouLearnfromThisBook?

Thisbookisdividedintoninepartsand30chapters.Thereiscontinuity

acrosschapters,butyoucanreadmostofthemindependently.

InPartI(Chapters1and2),mymainobjectiveistoconvinceyou

thatinvestingislikesearchingforburiedtreasure.OnereasonBuffett

issuccessfulisthatheenjoysthisprocess,andyouare

morelikelyto

besuccessfulifyoutreatitasagameandhavefunwithit.Next,I

chronologicallyoutlineseveralimportanteventsinBerkshire’shistorytodrawinsightsintoBuffett’sphilosophy.Suchahistoricalbackgroundis

usefultokeeptheremainder

ofthebookinperspective.

PartII(Chapters3to6)explainsbasicinvestmentstrategies,so-called

valueinvestingandgrowthinvesting.Usingconcreteexamples,Iexplainhowyoumaycomputeintrinsicvalueandmarginofsafetybeforeyouinvest.

ParticularlyinChapter6,I

explainwhyBuffett’sstrategiesshouldnotbeclassifiedasvalueinvestinginthetraditionalsense.Hedoeswhatismostlogicalandfrequentlycombinesvalueandgrowthinvestingstrategies

effectively.Ingeneral,itisamistake,andwouldlimityourimagination,topigeonholeBuffett’sapproachintoanysingle

investingstyle.Hedoes

whatismostrationaltocreatevalueinthelongrun.Forlackofabetterterm,Isimplycallhimarenaissanceinvestor.

E1FPREF

Date:Jan19,2010

Time:11:46am

xiv

preface

InPartIII(Chapters7to9),IlookathowBuffettusesinsurance

togeneratecashflowsforotherinvestments.TounderstandBuffett,you

musthavesomeunderstandingofthe

insurancebusiness,whichisthe

mainstayofBerkshireHathaway.

InPartIV(Chapters10to13),IdiscussseveralofBuffett’sinvest-

mentsinretailing,utilities,andmanufacturing.Theseexamplesprovide

furtherinsightintohisemphasisongrowthandmanagementquality.In

PartV(Chapters14to17),IemphasizeBuffett’sopinionsconcerning

severalclassictopics,suchasdiversificationandrisk.

InPartVI(Chapters18and19),IdiscussBuffett’sthoughtsonmarket

efficiencyandthewaysinwhichyoumayincorporatehisthoughtsinto

yourdecisionmaking.

InPartVII(Chapters20to24),Ireviewseveralimportantissues

relatedtoprofitabilityandaccounting.Althoughthesechapterswillnot

makeyouanaccountant,theywillprovideyouwithaperspectivethat

isnotcommonininvestingcircles.

InPartVIII(Chapters25and26),Ifocusonpsychologybecauseto

beasuccessfulinvestor,youmustunderstandyourselfandthebiasesthatplayarolein

yourdecisionmakingandthedecisionmakingofothers.

PartIX(Chapters27to30)isdevotedtocorporategovernance,

Buffett’sthoughtsonCEOsandothermanagers,andwhyheemphasizes

appropriatecompensationstructurethroughoutafirm.Theconclusion

ofthebookdiscussesBuffett’semphasisondevelopingasuitabletem-

peramentforwinninginthemarket,justasabaseballplayerneedsto

developatemperamentforwinningonthediamond.

Overall,thebookwillallowyoutodiscoverthatBuffetthasachieved

successbyemphasizingtheimportanceofhigh-qualitymanagersmore

thananyothermetric.Hecallshismanagersthe“All-Stars”anddiscussestheiraccomplishmentslavishlyinBerkshireannualreports.Bycontrast,

mostresearchandteachingsinbusinessschoolsusefinancialnumbersas

thekeymetricforfinancialsuccessandunderstandingbusinesses.My

objectiveistodevelopyourunderstandingbeyondtheideasyoumay

havelearnedinyourcollegecourses,gleanedbyreadingarticlesinthe

popularmedia,orpickedupthroughanyotheroutlets.My

motivation

isnotjusttoproviderulesforinvestingbutalsotohelpimproveyour

mind-setforinvesting.Havingtherightmind-setispivotal,whether

youareanindividualinvestor,astudent,anacademic,oraprofessional

portfoliomanager.

PremC.Jain

E1FLAST

Date:Jan19,2010

Time:11:56am

Acknowledgments

WhenIinitiallynarratedWarrenBuffett’ssuccessstory,my

father,alwaysaphilosopher,

remindedmewhatIfre-

quentlyaskedhimwhenIwasachild:“Why?”Theanswer

isthatIamgrateful.IamgratefultomystudentsatWharton,Tulane,

andGeorgetownoverthepast25yearswhoaskedinnumerablequestions

andhelpedmefocusmythoughts.Mycolleagues,everskepticalaspro-

fessorsare,gavemethebenefitoftheirexplanationsandunderstanding

ofdifferencesbetweenhowacademicsthinkandhowbusinessmenand

moneymanagersthink.Iamsincerelygratefultomy

longtimefriend

LarryWeiss,whoreadanearlyversionoftheentirebookandwent

throughseveralchaptersoverandoveragainasIdevelopedmyideas.

MyspecialthanksgotomyfriendsValentinDimitrov,acarefulreader

andatrustedco-author,forhisdiscussionswithmeformanyyearsabout

Buffett’sprinciplesandforhisongoingcommentsonthemanuscriptat

differentstages,andNancyPitts,whoreadeverywordwithacriticaleye,askedmanyquestions,andhelpedimprovethemanuscript.IthankElisa

DiehlandCindyLeitnerforcarefullycopyeditingtheentiremanuscript

atdifferentstages.

Ihavebenefitedfrommycolleagues’andfriends’knowledgeabout

investingandBuffett.Theylistenedpatiently,sometimesarguedand

discussed,gavedetailedcomments,andcontributedtothebookin

manyways.Forthis,IthankReenaAggarwal,BillBaber,DaleBailey,

GaryBlemaster,JenniferBoettcher,JimBodurtha,RandyCepuch,

xv

E1FLAST

Date:Jan19,2010

Time:11:56am

xvi

acknowledgments

PreetiChoudhary,GeorgeComer,GeorgeDaly,HemangDesai,Bill

Droms,JasonDuran,AllanEberhart,PatriciaFairfield,ThereseFlana-

gan,AlokeGhosh,JackGlen,ZhaoyangGu,IngridHendershot(babyb),

JimHeurtin,ManishJain,SaurabhJain,VarunJain,S.P.Kothari,

AmitKshetarpal,SubirLall,CharlesLee,JeffMacher,

AnanthMad-

havan,JimMarrocco,JerryMartin,AlanMayer-Sommer,JohnMayo,

ChuckMikolajczak,VishalMishra,LenkaNaidu,KusumNarang,

KeithOrd,SandeepPatel,LeePinkowitz,DennisQuinn,Sundaresh

Ramnath,KorokRay,PietraRivoli,SriniSankaraguruswamy,Carole

Sargent,MissieSaxon,JasonSchloetzer,PamelaShaw,PaulSpindt,

EmmaThompson,SheriTice,CathyTinsely,JoaquinTrigueros,Joanna

ShuangWu,andTeriYohn.IamcertainIhavenot

includedeveryone,

andIapologizetothosewhosenamesshouldalsoappearhere.

IthankWarrenBuffettforallowingmetousecopyrightedmaterial

fromhisletterstoshareholdersandothersources.Formyinitialeducationandensuinggifts

inlife,IcreditmyteachersinanelementaryschoolinasmalltowninIndia.Allmyearningsfromthisbookwillbedonated

tochildren’seducation.Mostimportant,Iamespeciallygratefultomy

parents,mybrotherSubhash,andmythreesistersGunmala,Kanak,and

Manjuandtheirfamiliesfortheirunwaveringloveandsupport.

P.C.J.

E1PART01

Date:Dec10,2009

Time:4:13pm

PartOne

INTRODUCTIONAND

BACKGROUND

InChapter1,Iexplainwhyitiseasytobeattheprofessionalmutual

fundmanagersandhow,withsomeeffort,youcanalsooutperform

themarketasawhole.Idemonstratethatinthelongrun,rewards

fromplayingthegameofinvestingarelarge.InChapter2,Iuseimpor-

tanteventsfromBerkshireHathaway’shistoryasabackdropforvarious

investinglessonsthatcanbelearnedfromWarrenBuffett.

1

E1PART01

Date:Dec10,2009

Time:4:13pm

E1C01

Date:Jan18,2010

Time:3:29pm

Chapter1

TheThrillofInvesting

inCommonStocks

It’snotthatIwantmoney.It’sthefunofmakingmoneyand

watchingitgrow.1

—WarrenBuffett

WarrenBuffetthasoftenmentionedthatheenjoysrunning

BerkshireHathawayandhasfunmakingmoney.Iassume

thatyoutoowanttoearnhighratesofreturnonyour

investmentswhilehavingfundoingit.ItisnotdifficulttodoifyoumastercertainprinciplesthatBuffettfollows.Youplaybaseball,golf,bridge,

orthestockmarketbecauseitisenjoyable.Butyouenjoythegame

evenmorewhenyoudefeattheopponent,especiallywhenyoubeata

seeminglysuperiorplayer.Canyouwininthegameofinvesting?Yes,you

can,solongasyouarewillingputsomeeffortintoit.Andnotonlycan

youwin;thethrillofthegamearisesbecauseyoucan

winoften.You

haveweakopponents:“Mr.Market,”whosuffersfromup-and-down

moods,andprofessionalmoneymanagers,whocanbeoutperformed

justaseasily.2Thisgameisnotasdifficultasmostpeoplethink.Itisasmuchfunasatreasurehunt.

BerkshireHathawayisjustoneofthe

treasuresIhavediscovered.Thisintroductorychapterwillconvinceyou

thattherewardsfrombecomingabetterinvestorareenormous.Laterin

3

E1C01

Date:Jan18,2010

Time:3:29pm

4

introductionandbackground

thebook,IexplainBuffett’sprinciplesandwhytheywork,sothatyou

mayusethemtoearnthose

rewardsbyinvestinginthestockmarket.

Howa1PercentAdvantageBecomes

a100PercentGain

OnlyoneinfiveactivelymanagedmutualfundsbeatstheStandard&

Poor’s(S&P)500index.Thus,ifyouinvestin

activelymanagedmutualfunds,youroddsofbeatingthemarketareonlyone-in-five.Theseodds

areindeedlow.Averysimpleapproachtoimproveyouroddsisto

investinindexfundsbecausetheirreturnswillbeclosetothemarket

returns.Byinvestinginindex

fundsinsteadofmutualfunds,yourodds

ofbeatingthemarketimprovefromone-in-fivetofour-in-five.Butwhy

stopthere?Ifyouhavesomemoneytoinvestforthelongrun,whynot

investincommonstocks?Withcommonstocks,youcanimproveyour

returnsevenmore,especiallyifyouenjoytheprocessandputsomeeffortintolearningtheprinciplesthatmasterinvestorslikeBuffetthavelaid

out.Anothergreatinvestor,PeterLynch,echoesthisviewpoint:“[A]n

amateurwhodevotesasmallamountoftimetostudycompaniesin

anindustryheorsheknowssomethingaboutcanoutperform95per-

centofthepaidexpertswhomanagethemutualfunds,plushavefun

doingit.”3

Howmuchskilldoyouneedtobemuchbetteroffthaninvesting

inactivelymanagedmutualfunds?Inthelongrun,notmuch!Letme

explain.Basedonalonghistoricalrecord,theexpectedreturnonthe

marketisabout7percentto10percentperyear.Forsimplicity,let’suse10percentasabenchmark.Then,yourreturnfromanaveragemutual

fundwillbeonly8percentbecauseabout2percentgoestowardexpenses

inrunningthemutualfund,whichincludesthemanagementfees.Ifyou

invest$1,000withamutualfundandthemutualfundgivesyouareturn

of8percentperyear,yourinitialinvestmentof$1,000

willbecome

$6,848in25years;thatis,youwillhaveanetgainof$5,848.

Assumethatyouareabletodevelopjusta1percentreturnadvantage

overthemarketinthegameofinvestingorpickingstocks.Remember

thatyoualsodonotincurthe2percentexpensesinfeesandcharges

whenyouinvestinmutualfunds.With1percentabovethemarket,or

E1C01

Date:Jan18,2010

Time:3:29pm

TheThrillofInvestinginCommonStocks

5

35,000

30,000

5%

25,000

10%

20,000

15%

15,000

Dollars

10,000

5,000

0

0

1

2

3

4

5

6

7

8

910111213141516171819202122232425

YearsfromInitialInvestment

Figure1.1

Growthof$1,000after25orIntermediateYearsatDifferentRates

ofReturn

11percentperyear,yourinitial$1,000investmentwillbecome$13,585

attheendof25years,whichisanetgainof$12,585.Thus,yournet

gainismorethantwicewhatyouwouldhavehadifyouhadinvestedin

mutualfunds.Itisalmostunbelievable,butthenumbersdonotlie.Even

ifyoudecidenottoputallyourmoneyunderyourownmanagement

andinvestallofitinindividualstocks,youmayfinditworthwhileto

takechargeofsomeofyourowninvestments.Ifnothing

else,itwillbe

agreatlearningexperienceandanewsourceofexcitement.

Anadditionaladvantageofinvestinginindividualstocksisthatyou

willpaylowertaxes.Ifyoupickyourinvestmentscarefullyanddonotsellthemforalongtime,youpay

substantiallylessintaxesthanifyouhad

investedinmutualfunds.Thus,evenifyoudonotdevelopa1percent

advantageoverthemarket,youwillcomeoutsubstantiallyaheadwhen

youjudiciouslyinvestinindividualstocksratherthanmutualfunds.

Figure1.1showswhat$1,000willbecomein10,15,20,and25years

ifyouearn5percent,10percent,or15percentperyear.Notethatif

youcanearn15percentperyear,youradvantageoverthemarketis

enormous.A$1,000initialinvestmentwillbecome

$32,919in25years

ata15percentannualrateofreturn.

The2008–2009stockmarketcrashmayhavemadeyoupessimistic

aboutinvesting.However,historytellsusthatyouhaveanadvantage.

E1C01

Date:Jan18,2010

Time:3:29pm

6

introductionandbackground

Thiseventactuallyoffersyouagreatopportunitytofindgoodstocksto

investin.Buffettrecently

wroteintheNewYorkTimesthatforhispersonalaccount,heisbuyingcommonstocksinthismarket.4Another

legendaryinvestorwithanoutstandingrecordoverseveraldecades

writes,“OneprinciplethatIhaveusedthroughoutmycareeristoinvest

atthepointofmaximum

pessimism.”5So,spendsometimelearningto

investwisely.Let’sfirstlookatreturnsyouwouldhaveearnedifyouhadinvestedinBuffett’scompany,BerkshireHathaway.

HowMuchWouldYouHaveEarnedIfYou

HadInvestedwithBuffett?

Inthepast30yearsendingin2008,BerkshireHathawayhasgivenan

annualizedreturnofover23percentperyear.Thisistwicetherateof

returnyouwouldhaveearnedwiththeDowJonesIndustrialAverageor

theS&P500index.Obviously,WarrenBuffett’s

performanceisincred-

ible.Intermsofdollaramounts,ifyouhadinvested$1,000inBerkshire

Hathawayabout30yearsago,yourinvestmenttodaywouldamountto

about$500,000.Thelessonisclear:LearnfromWarrenBuffett’sinvest-

mentphilosophy,whichisdescribedthroughoutthisbook.Youmay

notbeabletoattainhislevelofsuccess,butyoudonothavetobe

WarrenBuffetttoearnrespectablereturnsinthestockmarket.Ifyou

canreplicateeven,say,one-fourthorone-thirdofthe

advantagehehas

overthemarket,youwillearnveryhighlong-termreturns.Theaver-

ageinvestorislikelytobearelativelysmallinvestor.Itiseasiertobeatthemarketwithsmalleramountsofmoneythanwithlargeinvestments.

WhenBuffettranhispartnershipsinthelate1950s

tolate1960s,his

returnswereevenlarger.Now,Buffettcannotinvestinsmallercompa-

niesbecausetheBerkshireportfolioissolarge.Butasmallinvestorhastheadvantageofbeingabletoinvestinsmallercompanies.ForBerkshire

asawhole,returnswere

higherwhenthecompanywassmaller,buteven

overthepast15years,theaverageannualizedreturnhasbeen12percent

comparedwithonlyabout6percentfortheS&P500index.

Youneverknow:Youmighthavetheskillstopicktherightstocks

andbecomeasgoodaninvestorasWarrenBuffett.Aslongasyouare

notreckless,thereislittledownsideintryingtofindoutwhetheryou

E1C01

Date:Jan18,2010

Time:3:29pm

TheThrillofInvestinginCommonStocks

7

havesomeoftheskillstobesuccessful.OnegreatthingaboutBuffettisthathehaswrittengenerouslyaboutwhathedoesandhowhedoesit.If

youhavepatienceandthewillingness,let’sstart

learningaboutbusinessesandinvestingfromthemaster.

Conclusions

Buffetthasoftendescribedhisinvestingphilosophyassimplebutnoteasy.

Itissimpleinthesensethatallyouneedtodoistoidentifyoutstandingbusinessesthatarerunbycompetentandhonest

managersandwhose

commonstockissellingatareasonableprice.Buthowdoyouthat?

Thisbookmakestheprocessofdiscoveringthosebusinessesaseasyas

possible.

E1C01

Date:Jan18,2010

Time:3:29pm

E1C02

Date:Jan18,2010

Time:3:50pm

Chapter2

1965–2009:Lessons

fromSignificantEvents

inBerkshireHistory

Historyisphilosophyteachingbyexamples.

—Thucydides,anancientGreekhistorian

WhenWarrenBuffetttookcontrolofBerkshireHathaway

in1965,itwasasmalltextilemanufacturingcompanyin

NewEngland.Theprospectsofthetextileindustryatthe

timewereratherbleak.BuffetthastransformedBerkshireintoalarge

insurance,utility,manufacturing,andretailingconglomerate.In44years,thecompany’sbookvaluehasgrownfrom$19to$70,530perclassA

share,andthestockpricehascorrespondinglygrownfromabout$8

to$96,600.ThefollowinglistofsignificanteventsinBerkshirehistory

servestwopurposes.First,itisimportanttolearnfromtheexamples

othershaveset;andsecond,itpresentsaquicklookat

manyofBuffett’sprinciples.Inlaterchapters,wewillexploretheseprinciplesfurther.

9

E1C02

Date:Jan18,2010

Time:3:50pm

10

introductionandbackground

1965:NotThrowingGoodMoneyafterBad

EventWarrenBuffettislistedasaBerkshiredirectorforthefirsttime,althoughheisnotyetthechiefexecutiveofthecompany.Startingto

accumulateBerkshiresharesin1962at$7.60pershare,

Buffettacquired

acontrollinginterestinthecompanyby1965withanoverallaverage

costof$14.86pershare.

LessonRevenuesatBerkshirehavebeendeclining,from$64million

to$49million,intheprior16years.However,thecompany

didnot

investmuchtopropupthedecliningtextilebusiness.Thedecisionnottoinvestinadecliningbusinessisagoodexampleoftheoften-usedmaxim:

“Don’tthrowgoodmoneyafterbad.”Berkshire’scashflowsareinstead

usedforbuyingitsown

sharesbackintheopenmarketandforinvestinginothersecurities.Themainlessonisthatoneshouldbecarefulininvestinginacompanythatisusingitscashflowstosustainadyingbusiness.

1967:InvestinYourCircleofCompetence

EventBerkshiremakesitsdebutintheinsurance

businessbyacquiringtwoinsurancecompaniesfor$9million:NationalIndemnityCompany

andNationalFireandMarineInsuranceCompany.Bothcompaniesare

basedinOmahawhereBuffettlives.

LessonBuffettprobablyhadalong-termplantoslowly

developthe

insurancebusiness.Thisisanearlyperfectexampleofhowalongjourneystartswithasmallfirststep.Heinvestswithinhiscircleofcompetence:insurance.

1973:CashFlowIsKing

EventBerkshireincreasesitsinvestmentinBlueChipStamps.

LessonInthetradingstampbusiness,thecompanyreceivescashin

advanceforstamps:anIOU.Thecompanydoesnothavetopayinterest

ontheseIOUs,anditcanusethecashthusreceivedforinvestments

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory11

inotherbusinesses.ThisisagoodexampleofBuffett’sphilosophyof

generatingcashflowwithlittlerisk.Theinsurance

businesshassimilar

characteristics.

1977:SuccessfulGrowth

EventTheinsurancebusinesscontinuestogrowatafastpacethroughexpansionandacquisitions.Buffettreportsthatintheprior10years,

insurancepremiumsgrewby

about600percent,from$22millionto

$151million.

LessonBuffett’sexcellentknowledgeoftheinsuranceindustryhelpshimtoidentifytopmanagersandthendelegatethemtorunindividual

units.Notethatinsurancewasnotafast-growing

industry.Outstanding

managersarethekeytosuccessfulgrowth.Investwiththemwhenyou

findsuchopportunities.

1980:BuyingSharesafterPricesFall

EventBerkshireinitiallyinvestedinGEICOin1976whenGEICO

wasclosetobankruptcy.BerkshireincreasesitsholdinginGEICOto

7.2millionshares,equaltoanequityinterestofabout33percent.

LessonBuffettexplainshisinvestmentsinGEICOandAmerican

Expressasfollows:

GEICO’sproblemsatthattimeputitinapositionanalogoustothatof

AmericanExpressin1964followingthesaladoilscandal.Bothwere

one-of-a-kindcompanies,temporarilyreelingfromtheeffectsofa

fiscalblowthatdidnotdestroytheirexceptional

underlyingeconomics.

TheGEICOandAmericanExpresssituations,extraordinarybusiness

franchiseswithalocalizedexcisablecancer(needing,tobesure,askilledsurgeon),shouldbedistinguishedfromthetrue“turnaround”situation

inwhichthemanagersexpect

—andneed—topulloffacorporate

Pygmalion.1

E1C02

Date:Jan18,2010

Time:3:50pm

12

introductionandbac

kground

Buffetthasemphasizedthatmostturnaroundcandidatesdonotsuc-

ceed.However,GEICOandAmericanExpressareexceptionsbecause

theunderlyingbusinesseswerehealthy.Youshouldbuysharesaftera

precipitousfallinpricesonlywhenyoucanassessthatthecompany’sproblemsaretemporary.

1984:ReportedVersusTrueFinancialResults

EventBuffettdescribeshowestimatesoflossesintheinsurancebusinesscanbesubstantiallydifferentfromthefinaltally,and,therefore,reportedearningsaresubject

tochange.In1983,reportedunderwritingresults,

basedonestimatesin1983,indicatedalossof$33million;butayear

later,correctedfiguresturnouttobe$51million,about50percentmorethantheoriginalestimate.

LessonThefollowingstoryexplainsthatwhenmanagers

planto

manipulateearnings,itisnotdifficult.

Amanwastravelingabroadwhenhereceivedacallfromhissister

informinghimthattheirfatherhaddiedunexpectedly.Itwasphysically

impossibleforthebrotherto

getbackhomeforthefuneral,buthetold

hissistertotakecareofthefuneralarrangementsandtosendthebill

tohim.Afterreturninghome,hereceivedabillforseveralthousand

dollars,whichhepromptlypaid.Thefollowingmonth,anotherbill

camealongfor$15,andhepaidthat,too.Anothermonthfollowed,

withasimilarbill.When,inthenextmonth,athirdbillfor$15was

presented,hecalledhissistertoaskwhatwasgoingon.“Oh,”shesaid.

“Iforgottotellyou.WeburiedDadinarentedsuit.”2

Preparationoffinancialstatementsrequiresalargenumberofestimates.

Whenanalyzingacompany,youshouldexamineseveralyears’worth

offinancialstatements,notjusttherecentones.

1985:CapitalExpenditures

EventBerkshireHathaway

closesitstextileoperations,whichwasitsmainbusinesswhenBuffetttookcontrolofthecompanyin1965.

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory13

LessonBuffettwrites:“It[is]inappropriateforevenanexceptionallyprofitablecompanytofundanoperationonceitappearstohaveunendinglossesinprospect.”3Asanexample,BuffettstatesthatBurlington

Industries,anothertextilecompany,unsuccessfullyinvestedmorethan

$200pershareonthe$60

stock.Hewrites,“Whenamanagementwith

areputationforbrilliancetacklesabusinesswithareputationforpoor

fundamentaleconomics,itisthereputationofthebusinessthatremains

intact.”4Whenyouseeacompanymakingnewinvestmentsinadying

business(e.g.,theautoindustryintheUnitedStatesinrecentyears),youshouldnotinvestinthatcompany.

1986:CorporateJetsandOtherLuxuries

EventInsmallprint,Buffettwrites,“Weboughtacorporatejetlastyear.”5

LessonCorporatejetsareveryexpensiveandcostalot

tooperate

andmaintain,or,asBuffettputsit,“costalottolookat.”Whileit

seemsappropriateforBuffetttoacquireacorporatejet,heclearlyfeelsuncomfortable.AsBenjaminFranklinsaid,“Soconvenientathingitis

tobeareasonablecreature,sinceitenablesonetofindor

makeareasonforeverythingonehasamindtodo.”6Asaninvestor,youcanlearn

aboutacompany’strueculturefromitsspendingpractices.

1988:HoldingPeriodofanInvestment

EventBerkshirebuys14.2millionsharesofCoca-Colafor$592mil-

lion.WithrespecttothisfirstmajorpurchaseofCoca-Colastock,Buffettstatesthathisfavoriteholdingperiodisforever.Hefurtherstates,“Wecontinuetoconcentrateourinvestmentsinaveryfewcompaniesthat

wetrytounderstandwell.”7HealsorecallsMaeWest,“Toomuchofa

goodthingcanbe

wonderful.”8

LessonInabout10years,themarketvalueoftheCoca-Colastock

holdingwillincreasetenfold.OnereasonBuffettcanholdinvestments

forlongperiodsisthatheinvestsonlyincompaniesthatheunderstands

E1C02

Date:Jan18,2010

Time:3:50pm

14

introductionandbackground

andthathaveoutstandingmanagement.WithrespecttoCoca-Cola’s

CEO,Buffettwrites:

Throughatrulyrareblendofmarketingandfinancialskills,Roberto

[Goizueta]hasmaximizedboththegrowthoftheproductandthe

rewardsthatthisgrowthbringstoshareholders.Normally,theCEO

ofaconsumerproductscompany,drawingonhisnaturalinclinations

orexperience,willcauseeithermarketingorfinancetodominatethe

businessattheexpenseoftheotherdiscipline.WithRoberto,themesh

ofmarketingandfinanceisperfectandtheresultisa

shareholder’s

dream.9

Excellentinvestmentopportunitiesarefewandfarbetween.When

youfindsuchstocks,youshouldbuyalotandholdthemfora

longtime.

1989:LookingFoolishVersusActingFoolish

EventIn1989,twonaturaldisastersaffectedtheinsuranceindustrysignificantly.First,HurricaneHugocausedbillionsofdollarsofdamage

intheCaribbeanandtheCarolinas.Second,withinweeks,California

washitbyanearthquakecausinginsureddamagethatwasdifficultto

estimate,evenwellaftertheevent.

LessonBeforethe1989naturaldisasters,premiumsintheinsuranceindustrywereinadequate.Unlikemanyothers,Buffettstayedawayfrom

unprofitablebusinesses.Immediatelyaftertheearthquake,thetableswereturned.Givenitsstrongfinancialposition,BerkshireHathawayoffered

towriteupto$250millionofcatastrophiccoverage,advertisingtheofferintradepublications.

AsBuffettexplains:“Whenratescarryanexpectationof

profit,we

wanttoassumeasmuchriskasisprudent.Andinourcase,that’salot.”10

Takinglargeriskswithadequatepremiumsisprofitableinthelongrun

butmayappearfoolish.Tothis,Buffettresponds:“Wearewillingtolookfoolishaslongaswedon’tfeelwehave

actedfoolishly.”11Thekeylessonistoactrationally,regardlessofhowitappearstoothers.

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory15

1990:PessimismIsYourFriend

EventForthebankingindustry,1990wasadisastrousyear.FearsofaCaliforniarealestatedisastercausedthepriceofWellsFargostocktofallbyalmost50percent.Buffettpurchasedanadditional4millionsharesin

WellsFargo,increasing

Berkshire’sholdingtoabout10percentofthe

bank’soutstandingshares.

LessonBuffettwrites:“Themostcommoncauseoflowpricesis

pessimism—sometimespervasive,sometimesspecifictoacompanyor

industry.”12Butyoualso

needtobecareful,Buffetcautions:“Noneof

thismeans,however,thatabusinessorstockisanintelligentpurchase

simplybecauseitisunpopular;acontrarianapproachisjustasfoolish

asafollow-the-crowdstrategy.Whatisrequiredisthinkingratherthan

polling.Unfortunately,BertrandRussell’sobservationaboutlifeingen-

eralapplieswithunusualforceinthefinancialworld:Mostmenwould

ratherdiethanthink.Manydo.”13In2008–2009,whenthestockmar-

ketwasdownbyabout40percent,Buffettwrites,

“Wheninvesting,

pessimismisyourfriend,euphoriatheenemy.”14

1991:Risk

EventMidway,PanAm,andAmericaWestenterbankruptcy,making

1991adisastrousyearfortheairlineindustry.BuffettestimatesthatBerkshire’s

investmentof$358millioninU.S.Airhaddeclinedby35percent

to$232million.Onlyayearearlier,BuffetthadwrittenthattheU.S.Airinvestment“shouldworkoutallrightunlesstheindustryisdecimated

duringthenextfewyears.”15

LessonThereisalwaysrisk

ininvesting,whetheryouinvestinairlinesorAIG.Itispossibletoloseasignificantpercentageeveninfixed-incomesecurities,althoughtheyaregenerallylessrisky.Thereisyet

anotherlessonabouttheairlineindustry:“Despitethehugeamountsof

equitycapitalthathavebeeninjectedintoit,theindustry,

inaggregate,haspostedanetlosssinceitsbirthafterKittyHawk,”16writesBuffett.

AfterhisexperienceswithU.S.Air,Buffettseemstohavedecidedthat

E1C02

Date:Jan18,2010

Time:3:50pm

16

introductionandbackground

investingintheairlinesindustryisnotinhiscircleofcompetence.Ifyouinvestinyourcircleofcompetence,youarelikelytoavoidhighlyrisky

investments.

1992:StockSplits

EventBerkshire’sstockpricecrossesthe$10,000markforthefirsttime.

LessonAstockpricelevelshouldnotbeusedasanindicatorofpotentialreturns.Astocksplitisnothelpfulforalong-terminvestor.Buffettstates,“Overall,webelieveourowner-relatedpolicies—includingthe

no-splitpolicy—havehelpedusassembleabodyofshareholdersthatis

thebestassociatedwithanywidelyheldAmericancorporation.”17In

theend,whatmattersistheperformanceofthecompany.Donotinvest

inacompanyjustbecauseithashadastocksplit.In2009,

Berkshire

announcedthatitwouldsplititsclassBsharesfor50:1inconnection

withitsacquisitionofBurlingtonNorthernSantaFe.Withoutthesplit,

smallBurlingtonshareholderswouldnotreceiveBerkshiresharesina

tax-freeexchange.

1993:IdentifyingExcellentCEOs

EventBuffett’sadmirationforMrs.B,NebraskaFurnitureMart’sCEO,iswell-known.Inadmiration,hewritesthefollowing:

Mrs.B—RoseBlumkin—hadher100thbirthdayonDecember3,

1993.(Thecandlescostmorethanthecake.)Thatwasadayonwhich

thestorewasscheduledtobeopenintheevening.Mrs.B,whoworks

sevendaysaweek,forhowevermanyhoursthestoreoperates,found

theproperdecisionquiteobvious:Shesimply

postponedherparty

untilaneveningwhenthestorewasclosed.

ShecametotheUnitedStates77yearsago,unabletospeakEnglish

anddevoidofformalschooling.In1937,shefoundedtheNebraska

FurnitureMartwith$500.

Lastyear,thestorehadsalesof$200million,

alargeramountbyfarthanthatrecordedbyanyotherhomefurnish-

ingsstoreintheUnitedStates.Ourpartinallofthisbegantenyears

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory17

agowhenMrs.BsoldcontrolofthebusinesstoBerkshireHathaway,

adealwecompletedwithoutobtainingauditedfinancialstatements,

checkingrealestaterecords,orgettinganywarranties.Inshort,her

wordwasgoodenoughforus.

Naturally,IwasdelightedtoattendMrs.B’sbirthday.Afterall,she’s

promisedtoattendmy100th.18

LessonBuffetthasoftenemphasizedtheimportanceofasoundtrackrecord.Obviously,Mrs.Bdidnotneedahigh-leveluniversitydegreeto

runabusinesssuccessfullyoveralongperiodoftime.Buffettsawagreatopportunityinherabilitiesanddidnothesitatetobecomeherpartner.

InvestwithCEOswhohaveanexcellenttrackrecord.

1994:ExtraordinaryResultsinOrdinaryBusinesses

EventBuffettdiscussestheextraordinarysuccessofScottFetzer,aBerkshiresubsidiarythatwasacquiredin1986for$315million.He

writes,“HadScottFetzer

beenonthe1993500list—thecompany’s

returnonequitywouldhaverankedfourth.YoumightexpectthatScott

Fetzer’ssuccesscouldonlybeexplainedbyacyclicalpeakinearnings,amonopolisticposition,orleverage.Butnosuchcircumstancesapply.”19

ThenwhatdoesexplainScottFetzer’ssuccess?

LessonBuffettoffersthisexplanation:“ThereasonsforRalph’s[ScottFetzer’sCEO]successarenotcomplicated.BenGrahamtaughtme45

yearsagothatininvestingitisnotnecessarytodoextraordinarythingstogetextraordinaryresults.Inlaterlife,Ihavebeensurprisedto

findthatthisstatementholdstrueinbusinessmanagementaswell.Whata

managermustdoistohandlethebasicswellandnotgetdiverted.ThatispreciselyRalph’sformula.”20Onceagain,similartotheexampleofMrs.

B,learningtoidentifyexcellentmanagersthroughtheirtrackrecordwillhelp

youagreatdealinearningsuperiorreturns.

1995:CorporateAcquisitions

EventIn1995,BerkshireacquiresHelzberg’sDiamondShops.Inthisconnection,Buffettwrites,

E1C02

Date:Jan18,2010

Time:3:50pm

18

introductionandbackground

Jeffwasourkindofmanager.Infact,wewouldnothaveboughtthe

businessifJeffhadnotbeentheretorunit.Buyingaretailerwithout

goodmanagementislikebuyingtheEiffelTowerwithoutanelevator.21

LessonUnlikeBuffett’sacquisitions,mostacquisitionsdonotworkwellbecausetheydonotcomewithexcellentmanagementandgood

underlyingbusinesseconomics.Themergersareoftenmotivatedby

hubrissoaptlyexplainedbyPeterDrucker:“Dealmakingbeatswork-

ing.Dealmakingisexcitingandfun,andworkingisgrubby.Running

anythingisprimarilyanenormousamountofgrubbydetailwork...

dealmakingisromantic,sexy.That’swhyyouhave

dealsthatmakeno

sense.”22Buffetthasregularlyquestionedtheacquisitionpracticesofmostmanagers,andsoshouldyou.

1996:SellingTooEarly

EventBerkshireHathawaybecomesthe100percentownerofGEICO

whenitpurchasestheshares

—about50percent—thatitdidnotalready

own.AlthoughBuffettfirstpurchasedGEICOsharesin1951onhis

personalaccount,hesoldthosesharesin1952,onlytolamenthisdecisionlater.Heboughtbackintothecompanyovertheyearsstartingin1976.

LessonBuffettexplainsthatalthoughhemadeaprofitwhenhesoldhisGEICOsharesfor$15,259in1952,“inthenext20years,theGEICO

stockIsoldgrewinvaluetoabout$1.3million,whichtaughtmealessonabouttheinadvisabilityofsellingastakeinanidentifiablywonderful

company.”23Onapersonalaccount,IfirstpurchasedmyBerkshireshares

in1987andsoldwithinayear,onlytoregretthatdecisionlater.IhavesincepurchasedmoreofBerkshireshares,anditiscurrentlymylargest

holding.Donotsellagoodstockforasmallprofit.

1996:HiringPractices

EventThe79-year-oldfounderandCEOofFlightSafetyInternational,AlUeltschi,sellshiscompanytoBerkshireHathaway.Alhashadalife-longaffairwithaviationandactuallypilotedCharlesLindbergh.Buffett

explainshishiringpracticesasfollows:

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory19

AnobservermightconcludefromourhiringpracticesthatCharlieand

IweretraumatizedearlyinlifebyanEEOCbulletinonagediscrimina-

tion.Therealexplanation,howeverisself-interest.It’sdifficulttoteachanewdogoldtricks.ThemanyBerkshiremangerswhoarepast70

hithomerunstodayatthesamepacethatlongagogavethemreputa-

tionsasyoungsluggingsensations.Therefore,togetajobwithus,just

employthetacticofthe76-year-oldwhopersuadedadazzlingbeauty

of25tomarryhim.“Howdidyouevergethertoaccept?”askedhis

enviouscontemporaries.Thecomeback:“ItoldherIwas

86.”24

LessonWhatmattersistheperformanceoftheindividual,andonlyonthatbasisshouldapersonbejudged,notonthebasisofage.AsBuffett

furtherexplains,“Almaybe79,buthelooksandactsabout55.Hewill

runoperationsjustashehas

inthepast:Weneverfoolwithsuccess.

Ihavetoldhimthoughwedon’tbelieveinsplittingBerkshire’sstock,

wewillsplithisage2-for-1whenhehits100.”25Ignoreageandother

prejudiceswhenevaluatingthosewithwhomyoushouldinvest.

1997:Patience

EventBerkshirereportsalargenontraditionalinvestmentof$4.6billioninlong-termzero-coupontreasurybonds.Ifinterestrateswereto

rise,Berkshirewouldloseheavily;andiftheinterestratesweretofall,Berkshirewouldmakeoutsizedgains.WhydidBuffettmakesuch

an

unconventionalinvestment?

LessonBuffettfirstexplainstheneedfordisciplinewhenthereisexuberanceinthestockmarket.

Underthosecircumstances,wetrytoexertaTedWilliamskindof

discipline.Inhisbook,The

ScienceofHitting,Tedexplainsthathecarvedthestrikezoneinto77cells,eachthesizeofabaseball.Swingingonlyatballsinhis“best”cell,heknew,wouldallowhimtobat.400;reaching

forballsinhis“worst”spot,thelowoutsidecornerofthestrikezone,

wouldreducehimto.230.In

otherwords,waitingforthefatpitch

wouldmeanatriptotheHallofFame;swingingindiscriminately

wouldmeanatickettotheminors.26

E1C02

Date:Jan18,2010

Time:3:50pm

20

introductionandbackground

Buffettdecidednottoswing—thatis,nottomakeadditionalinvest-

mentsinthestockmarketin1997.However,healsomakesitclearthat

“juststandingthere,dayafterday,withabatonmyshoulderisnotmy

ideaoffun.”27Patience,althoughnoteasy,isnecessaryforsuccessin

investing.Whenstockpriceappearshighrelativetofundamentals,stay

awayfrominvesting.

1999:TakingResponsibility

EventBerkshirehastheworstabsoluteperformanceofBuffett’stenuretodateand,comparedwiththeS&P500index,theworstrelativeperformanceaswell.BuffettgiveshimselfaDincapitalallocation.

LessonItisaneverydaymattertoseecorporatemanagersblaming

otherswhentheircompany’sperformanceisbelowpar.Ifnotother

individuals,theguiltypartyisfrequentlytheclimateortheinterestrates.

Instead,withrespecttothe1999results,Buffettwrites:

EvenInspectorClouseaucouldfindlastyear’sguiltyparty:yourChair-

man.Myperformanceremindsmeofthequarterbackwhosereport

cardshowedfourFsandaDbutwhononethelesshadanunderstand-

ingcoach.“Son,”hedrawled,“Ithinkyou’respendingtoomuchtime

onthatonesubject.”My“onesubject”iscapital

allocation,andmy

gradefor1999mostassuredlyisaD.28

Donotblameothers.Whenyoutakeresponsibilityforyourfailed

investments,asBuffettoftendoes,itiseasiertolearnfromyourmistakesandavoidrepeatingtheminthefuture.

2000:SellinginEuphoria

EventBuffettmentionsthatthe“long-termprospectforequitiesingeneralisfarfromexciting.”29

LessonWithhindsight,onecanconcludethatBuffettshouldhave

soldsomeoftheholdingsbeforethestockmarketstartedtodecline

E1C02

Date:Jan18,2010

Time:3:50pm

1965–2009:LessonsfromSignificantEventsinBerkshireHistory21

in2000.TheCoca-Colasharestradedatpricesashighas$85pershare

in1998.Tenyearslater,in2009,Coca-Colastockpriceisabout$45per

share.AsBuffetthasrecognized,thestockmarketdoesbecomeeuphoric

periodically,andthemainlessonisthataninvestorshouldsellinthosecircumstances.

2001:NotLosingFocus

WhenDisasterStrikes

EventOnSeptember11,2001,terroristsattacktheWorldTradeCen-

terinNewYorkandthePentagoninWashington,DC.

LessonBuffettestimatedthatinsurancelossessurroundingtheeventsofSeptember11were$2.2billion,oneofthelargestinBerkshirehistory.

EvenBerkshiredidnotanticipateaterroristattackandhadnot

protecteditselffromsuchamegadisaster.OnSeptember26,hewroteto

hismanagers:“Whatshouldyoubedoinginrunningyourbusiness?Just

whatyoualwaysdo...almostalloperating

decisionsthatmadesenseamonthagomakesensetoday.”30Essentially,Buffettsuggeststhatsuch

disasterscouldactuallypresentopportunitiesformanagerstoexpand

theirbusinesses.

2002:FinancialWeaponsofMassDestruction

EventUsingEnronasanexample,Buffettdiscussespossibilitiesofhugelossesfromderivativecontractsandhisdecisiontoclosedown

thederivativebusinessthatcamewiththeacquisitionofGeneralRein

1998.

LessonBuffettwrites,“Wetrytobealerttoanysortof

megacatastropherisk,andthatourposturemaymakeusundulyapprehensiveabout

theburgeoningquantitiesoflong-termderivativescontracts.”Hewas

remarkablyprescientinstating,“Inourview,derivativesarefinancial

weaponsofmassdestruction,carryingdangersthat,while

nowlatent,are

potentiallylethal.”31InvestorsinlargecompanieslikeEnron,WorldCom,

AIG,BearStearns,LehmanBrothers,FreddieMac,andFannieMaelost

allormostoftheirinvestmentsbecausethesecompaniesindulgedheavily

E1C02

Date:Jan18,2010

Time:3:50pm

22

introductionandbackground

inderivativesthattheycouldhavedonewithout.Theimportantlesson

foranaverageinvestoristhatoneshouldavoidinvestingincompanies

withdifficult-to-understandbusinessmodelsorfinancialstatements.

2008-2009:MarketCrashes

EventDuringaspanofsixmonthsfromSeptember2008toMarch

2009,BerkshirestockclassAexperiencespricesashighas$150,000per

shareandaslowas$75,000,representingadeclineof50percent.The

marketasawholeexperiencesasimilardownturn.

LessonAsBuffettpointsout:“Amidthisbadnews,

however,never

forgetthatourcountryhasfacedfarworsetravailsinthepast....Withoutfail,however,we’veovercomethem.”32Thisisnotthefirsttimethat

Berkshire’sstockpricehasgonedownby50percent.Ithashappened

threeothertimessince

Buffetttookcontroloverthecompanyin1965.

Inrecentyears,from1998to2000,Berkshire’sstockpricedroppedby

about45percent,from$79,000to$44,000.Berkshirewasagoodbuy

aftersuchadecline.WhileIrecommendthatyoudoyourhomework,

late2009,inmyopinion,isstillagoodtimetobuyBerkshirestockand

stocksinotherconservativelyfinanced,prominentcompanies.

Conclusions

Fromitsfirstacquisitionoftwosmallinsurancecompaniesin1967,

BerkshireHathawayhasexpandeditsinsurancebusinessandbecome

oneofthelargestinsuranceoperationsintheworld.Theeventsand

milestonesofthepast44yearsdiscussedinthischapterreflectmanyof

Buffett’sdecisionsandpractices.Hislongand

successfultrackrecordandhiswillingnesstosharehisthoughtsmakeitpossibleforustostudyhisideasindepth.Therestofthebookisdevotedtodevelopingagood

understandingoftheinvestingprinciplesthatBuffettbothespousesand

exemplifiesandwhythoseprincipleswork.

E1PART02

Date:Dec10,2009

Time:4:15pm

PartTwo

BUFFETTINVESTING=

VALUE+GROWTH

Thephrasevalueinvestingpopularlymeansaninvestingstylebased

onfinancialratiossuchasprice-to-earningsormarket-to-book.

Bycontrast,ingrowthinvesting,oneseekstodiscovercompaniesthatarelikelytogrowatafastpaceinthefuture.InChapters3and4,Idiscussvalueinvestingandgrowthinvesting,respectively.Bothinvestingstyleshavemerits.Chapter5focusesonthe

conceptofintrinsicvalue,

thevalueyouassigntoastockbasedonitsassetsandearnings.InChapter6,IexplainhowwecanbestlearnfromBuffettbyviewinghimasan

integratorofbothvalueandgrowthinvestingprinciples.

23

E1PART02

Date:Dec10,2009

Time:4:15pm

E1C03

Date:Jan29,2010

Time:12:55pm

Chapter3

ValueInvesting—It’sLike

BuyingChristmasCards

inJanuary

[W]ehadlearnedfromBenGrahamthatthekeytosuccessful

investingwasthepurchaseofsharesingoodbusinesseswhenthe

marketpriceswereatalarge

discountfromunderlyingbusiness

values.1

—WarrenBuffett

Ifyoulovebargains,youwilllovevalueinvesting.Valueinvesting

isregardedasthecornerstoneofBuffett’sinvestingstrategy.Value

investingissimilartobuyingsomethingwhileit’sonsale.Anevery-

dayexampleofvalueinvestingisbuyingChristmascardsinJanuaryat

abouthalfthepriceofthesamecardsamonthearlier,inDecember.IfyoubuyChristmascardsinJanuaryandusethemthefollowingChristmas,

youwillhaveimplicitlyearnedareturnofabout100percentonyour

investment.Ifyoutendtocomeupwithsuchideas,implementthem,

andcomputeyourpotentialreturns,youareanaturalvalueinvestor.For

valueinvestinginthestockmarket,youbuywhenprices

arelowrelative

tofundamentals(e.g.,earningsandbookvalue),andthenwaitforprices

tomoveup.

25

E1C03

Date:Jan29,2010

Time:12:55pm

26

buffettinvesting=value+growth

Moststocksdonotsellforbargainprices,justasmostitemsinthe

localmalldonotsellforbargainprices.Gooddealsarenotavailableeveryday.

Aninvestormustbepatientandwaitforsuchopportunitiestoarrive.

Youneedpatiencetowaitforatrulyoutstandingvalueopportunity,and

youneedevenmorepatienceafteryoupurchaseastock.Itoftentakes

timeforpricetoreflectvalue.Inthecaseof

Christmascardinvesting,

youneedtowaitaboutayear.Inthestockmarket,thewaitisoftenevenlonger.

ThestockmarketalsohascomplicationsthatdonotariseinChrist-

mascardinvesting.WeknowthatChristmasarrivesfaithfullyevery

DecemberandthatanopportunitytoinvestinChristmascardsarrives

soonafter.Ontheotherhand,goodopportunitiesinthestockmarketdo

notannouncetheirarrival.Norcanyoualwaysanticipatetheindustryor

geographiclocationinwhichopportunitiesmightarise.

Furthermore,

youwillneverknowforsurethatanopportunityisstaringatyou.There

isnoguarantee:Youalwayshavesomechanceofendingupwithabad

outcome.Whilevalueinvestingisnotaseasyasitlooksatfirstglance,youcanbecomeagoodvalueinvestor

withtimeaslongasyoucarefully

followthephilosophydevelopedbyBenjaminGraham.

ValueInvestingandTwoEssentialPrinciples

BenjaminGrahamdevelopedthecoreprinciplesforinvestinginfinancial

securities.Tothebestofmyknowledge,heneverusedthetermvalue

investingtodescribehisapproach.FromwhatIcandetermine,hedidnotgiveanynametotheinvestingprincipleshedeveloped.Nomatter

whathecalledit,heisgenerallyknownasthefatherofvalueinvesting.

Muchhasbeenwrittenaboutvalueinvestinginthepastfewdecades,

butauthorsdefineitindifferentways.Thecommonelementsacross

variousdefinitionsfrombothpractitionersandacademicssuggestthat

valueinvestingimpliesaninvestingstylethat

emphasizesusingfinancialratiossuchastheprice-to-earningsormarket-to-bookratios.Theterm

valueinvestingisalsocommonlyinvokedwhenonedoesnotinvestinfast-growingcompaniesorstickstoconservativelyfinancedcompanies.

Avalueinvestorissomeonewhofocusesfirstand

foremostonpreserving

capital.Earninghighreturnsisdesirablebutsecondary.

E1C03

Date:Jan29,2010

Time:12:55pm

ValueInvesting—It’sLikeBuyingChristmasCardsinJanuary

27

Howeffectiveisvalueinvestingasameansforgeneratinghigh

returns?Doesthisstylegenerateabove-marketreturns?Buffett’sinor-

dinatesuccessisgenerallyattributedtovalueinvesting.However,asI

willdiscussinthenextfewchapters,Buffett’sinvestingstyledoesnot

fitthepopular,butlimiting,definitionofvalueinvesting.Furthermore,weshouldnotrelyonevidencefromafewsuccessstoriestoconclude

thatvalueinvestinggenerateshighreturns.Anecdotalevidencedoesnot

proveaproposition;itcanonlyofferexamples.Withoutthescientific

evidenceprovidedbyresearch,wecanbeincorrectlyconvincedbyanec-

dotes.Academicresearch,aswewillseeinthischapter,stronglysupportsvalueinvesting,andthus,thereismorethananecdotalevidence

tosupportthemeritsofvalueinvesting.Butfornow,let’sfocusonthetwo

mostsignificantprinciplesemergingfromthevalueinvestingliterature,

primarilyfromGraham’svoluminouswritingsandinparticularfromhis

famousbookTheIntelligentInvestor.2Iexplainwhy

theseprinciplesworkandwhatmakesthemimportant.

Principle1:PriceShouldNotBeHighRelativetoaCompany’s

AverageEarningsoveraNumberofYears

Thefirstprincipleessentiallyrelatestothemostoftendiscussedratio

inthefinancialworld,theprice-to-earningsratio,orsimplytheP/E

ratio.ThemarketP/Eratiorosefrom18intheearly1990stoabout

30intheearly2000sasinterestratesdeclinedsteadilyduringthesame

period.Asinterestratesincreasedstartingintheearly

2000s,themarketP/Eratiodeclinedbacktobelow20.Duringthemid-1970stoearly

1980s,themarketP/Eratiowentdowntoaslowas7to9becauseof

highinterestratesandeconomicslowdown.Intermsofspecificnumbers,

afterevaluatingthecurrent

conditionsin1972,BenjaminGrahamstates,

“Wesuggestthatthis[P/E]limitbesetat25timesaverageearnings,andnotmorethan20timesthoseofthelast12-monthperiod.”3

Therearetwolessonsthatwecanlearnfromhistory.First,itisgen-

erallyagoodideatoavoid

investinginstockswhenthemarketP/Eratio

ishigh,sayhigherthan20.Second,wecanextendthesameargumentto

individualstocks,withonecaveat.Youshouldexamineacompany’sP/E

ratiooveranumberofyears,bylooking,perhaps,atthepriceinrelationtothepast

fiveto10years’earnings.Ifyouuseonlyrecentearnings,

E1C03

Date:Jan29,2010

Time:12:55pm

28

buffettinvesting=value+growth

50

45

Priceto10-yearaverageearnings

Averagefrom1881to2009

40

35

30

25

20

15

Price-to-earningsratio

10

5

0

1881

1889

1897

1905

1913

1921

1929

1937

1945

1953

1961

1969

1977

1985

1993

2001

2009

Year

Figure3.1Price-to-EarningsRatiofrom1881to2009

acompanymayhavealowP/Eratiobecauseearningsaretemporar-

ilyhigh,oritmayhaveahighP/Eratiobecause

earningsaretempo-

rarilylow.

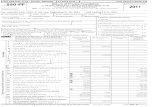

Figure3.1showsthehistoryofthemarket’sP/Eratiowhereearnings

aredefinedastheaverageofthepast10years’earnings.Theaverage

ratioovertheentiretimeis16.3.4Thelatestratioof18.9

attheendofOctober2009isslightlyhigherthantheaverage.Youcanseethatwhen

theratioisveryhigh,itreversestowardtheaverageandfrequentlygoessubstantiallybelowtheaverage.Justbecausetheratioiscurrentlynear

theaveragedoesnotimplythatitcannotgoanyloweror

higher.Overall,thischartsuggeststhatiftheratioisveryhigh,asitwasin2005–2007,itisnotagoodtimetoinvest.Ontheotherhand,whentheratioisvery

low,itisagoodtimetoinvest.

SeveralsuccessfulinvestorshaveusedtheP/Eratioasthecoreof

theirinvestmentstrategy,includingJohnNeff,whoiswellknownfor

successfullymanagingbillionsofdollarsthroughtheVanguardWind-

sorFundformorethan30years—averylongtimeinthemutualfund

managementbusiness.Veryfewmutualfundmanagers

havemanaged

largeportfoliossuccessfullyforsuchalongperiod.WhywasJohnNeff

E1C03

Date:Jan29,2010

Time:12:55pm

ValueInvesting—It’sLikeBuyingChristmasCardsin

January

29

sosuccessful?“WereliedonrelentlessapplicationsoflowP/Esympa-

thies,abettedbyattentiontofundamentalsandaliberaldoseofcommon

sense.”5

Investorsmayalsouseothervaluationratiossuchasthemarket-to-

bookortheS&P500earningsasafractionofgrossdomesticproduct

(GDP),whichBuffetthasreferencedinhiswritings.Attheaggre-

gatelevel,itdoesnotmatterwhichratioyouexamine.The

results

aresimilar.Attheindividualstocklevel,whetheryouusetheP/E

ratioorthemarket-to-bookratiooranotherratioentirely,youshould

dependonthenatureofthecompany’sbusinessandtheavailabilityof

suitabledata.

Principle2:EachCompanySelectedShouldBeLarge,Prominent,

andConservativelyFinanced

ThisprincipleisstraightfromGraham.Herecommendsinvestinginlarge

andprominentcompaniesbecauseitisnoteasytoevaluatesmalland

less-knowncompanies.Theirfinancialstatementsarelessreliable,and

theymaybemoreeasilyaffectedbyunforeseencircumstances.Inother

words,theriskinvolvedininvestinginsmallandless-

knowncompanies

ishigh.“WhereshouldIstarttolookforworthwhilecommonstocks?”

youmayask.Buffettoftenrecommendsthatanaverageinvestormay

startwiththeValueLinesheets.ValueLineusuallydoesnotfollowsmallcompanies.Thus,thefirst

criterionofinvestinginlargecompaniesis

easilymet.ValueLinealsoprovidesastock’shistoricalrecordovertheprior20years.Theavailabilityofalongtrackrecordisusefulbecause

youcandecidewhetherthecompanyisprominent.Youmayreadthe

ValueLinedescriptionofthecompanyandthendecidewhetheryouwanttoconductadditionalresearch.

RegardingGraham’spositionthatacompanyshouldbeconserva-

tivelyfinanced,itispossibletodiscussatgreatlengthwhatexactlythistermmeans.However,whetherthecompanyisconservatively

financed

willbeimmediatelyclearfromacursoryexaminationofitsshort-and

long-termdebtlevelsinrelationtoitstotalassets,oritsdebt-to-equityratio.Tomakelifesimpleforinvestors,ValueLineranksstocksonascaleofsafety,fromonetofive.Coca-Cola,amajorholdingofBerkshire

Hathaway,usuallyhasthehighestsafetyrankingofone.Alarge,

E1C03

Date:Jan29,2010

Time:12:55pm

30

buffettinvesting=value+growth

establishedcompanysuchasCoca-Cola,withamarketcapitalization

ofabout$100billionattheendof2008,hasonlyabout$3billion

oflong-termdebt.Itisnotdifficulttoconcludethatthecompanyis

conservativelyfinanced.

BerkshireHathawayhasalwaysbeenconservativelyfinanced.Whyis

conservatismimportant?Becauseitisdifficulttopredictwhenfundswillbesuddenlyneededforprofitableinvestmentsorforclaims.Aconservativelyfinancedcompanycanraisefundsinshortorder,andaliquidity

crisisintheeconomywouldnotaffectthecompany.Forexample,in

2008,largeandprominent(butnotconservativelyfinanced)companiessuchasCiticorp,GoldmanSachs,andGeneralElectricsufferedsignificantly,andseveralothersweremerged,declaredbankruptcy,orwereon

thevergeofbankruptcy.On

theotherhand,BerkshireHathawayused

thisasanopportunitytoinvestincompaniessuchasGoldmanSachsand

GeneralElectric.Thus,inthelongrun,conservativelyfinancedcompa-

niesarelikelytoproducehigherreturnsastheyareinapositiontotakeadvantageof

suchopportunities.

WhileIconsiderthesetwoprinciplesorguidelinestobemostimpor-

tant,theyareprinciplesandnotspecificrules.Forexample,notalllargecompaniesmaylendthemselvestosoundfinancialanalysisbecauseof

thecomplexityoftheir

business.Itmaynotbeeasytodefinewhich

companyisprominentandwhichisnot.Thus,youwillhavetouse

afairamountofjudgmentinselectingyourinvestmentseveninyour

applicationoftheseprinciples.

OtherHelpfulGuidelinesforValueInvesting

Tohelpyouwithnarrowingyourfieldofinquiry,Idiscusssomeofthe

morecommonconceptsthatBuffettandothervalueinvestorshaverelied

onoverthedecades,conceptsthathavewithstoodthetestoftime.

ASharpDeclineintheStockMarket

Asharpdeclineinthestockmarketgenerallypresentsagoodinvestment

opportunity.Inmid-1973,afterthemarkethaddeclineddramatically,

E1C03

Date:Jan29,2010

Time:12:55pm

ValueInvesting—It’sLikeBuyingChristmasCardsinJanuary

31

BerkshireHathawayboughtalargestakeof1.9millionsharesinthe

WashingtonPostCompany(WPC).Youmightthinkthat

onlyBuf-

fettcouldseethatthecompanyofferedsuchagoodopportunity.He

suggestedjusttheopposite:“Calculatingtheprice/valueratiorequired

nounusualinsights.Mostsecurityanalysts,mediabrokers,andmedia

executiveswouldhaveestimatedWPC’sintrinsicvalueat$400to$500

million,justaswedid.Andits$100millionstockmarketvaluewas

publisheddailyforalltosee.”6In2009,evenaftera50percentdeclineinitspriceinrecentyears,WPCistradingatabout$400pershare,and

ithaspaidregulardividends.Berkshire’sinvestmenttranslatesintoan

annualizedreturninexcessof15percentperyearincludingdividends,

anexcellentreturncomparedtoabout9percentinthemarketduring

thisperiod.

Dependingonyourlevelofrisktolerance,itisreasonabletoargue

thatyoushouldincreaseyourinvestmentinthestockmarketwhenever

thereisa20percentcorrectionfromreasonablepricelevels.Itisnot

thepricedeclinepersethatisimportant;itisthepricein

relationtoearnings,asthesecondprinciplementionedearlierrequires.Perhapsa

marketP/Eofabout12suggestsopportunitiesbasedonthefactthatthe

long-runmarketP/Eaverageisabout16.Ofcourse,suchaninvestment

shouldnotbefortheshorttermbecausethedecline

couldcontinue

foraconsiderabletime.Youshouldcertainlygaugethevaluationsofthe

marketasawholeinrelationtoitsfundamentals.Ifthedeclinecontinues,youmaythinkaboutincreasingyourinvestment.Thus,insomecases,

youwillhavetowaitalong

whileforthestockmarkettocomeback.

Patience,onceagain,isaprerequisiteforearningsuperiorreturns.

In2008,theS&P500indexdeclinedbyabout37percentand

evenBerkshireHathaway’sstockpricedeclinedby32percent.Arethere

opportunitiesinthismarket?Buffettthinksso.Inanop-edarticleintheNewYorkTimes,October17,2008,hewrote:“I’vebeenbuyingAmericanstocks.ThisismypersonalaccountI’mtalkingabout,inwhich

IpreviouslyownednothingbutUnitedStatesgovernmentbonds.”Of

course,noone—noteven

WarrenBuffett—cantimethestockmarket

perfectly.SinceOctober17,whentheS&P500indexstoodat940,it

declinedtoaslowas676,oradeclineof28percent,byearlyMarch2009.

Thesearetryingtimesforinvestorsallovertheworld.ItisdifficulttobeE1C03

Date:Jan29,2010

Time:12:55pm

32

buffettinvesting=value+growth

optimisticinrecessionarytimes.However,“wheninvesting,pessimism

isyourfriend,euphoriathe

enemy.”7

TheIndustryThatLeadstheDecline

Thestockmarketdeclinein2008and2009waspervasiveacrossmany

industries,althoughfinancialstockshavebeenhitespeciallyhard.Such

pervasiveslidesare

uncommon.Usually,a10percentto20percent

declineisledbyoneorafewindustries.Inthoseinstances,theindustrythatleadsthedeclinemayleadtherecoveryandofferearlyinvesting

opportunities.Forexample,inthefallof1998,Russiafacedapayment

crisisanddefaultedonitsdebt.TheU.S.stockmarketwentdownby

about20percent,ledbythefinancialandtechnologysectors.Thesame

sectorsthenprovidedthemostgainsinthefollowingyear.Ingeneral,

whenamarketdeclineisledbyoneortwoindustrial

sectors,itisworthwhiletopayspecialattentiontogoodcompaniesinthosesectors.Even

inthesesituations,itisimportanttokeepinmindthatyoushouldinvestonlyifyouarecomfortablewiththefundamentalsofthecompany.

DuringtheRussiandefaultcrisis,thestockpriceof

MerrillLynch

declinedfromahighof$102pershareinJuly1998to$42persharein

October1998,a60percentdrop.Inmyview,itwasasubstantialdecline

andofferedanopportunityforhigherreturnsinthefuture.Thefollowingyear,MerrillLynch’sstockprice

wentupbyabout100percent.Merrill

Lynch’sbusinesswasnotdifficulttoanalyzeatthetime.(Itsbusiness

becamemorecomplexseveralyearslater.)Itwasnottheonlycompany

thatofferedthiswonderfulopportunity.Youcouldhaveboughtinto

anyofthewell-knownfinancialcompaniesanddonewell.Theaverage

declineinthewell-knownstocksofCitigroup,ChaseManhattan,and

BankofAmericawasabout50percent.Andeachoneofthemservedup

a100percentreturnin1999.Althoughitisnoteasyto

timethemarket,

opportunitieslikethesearelargeenoughtoofferasubstantialmargin

ofsafety.During1998,Berkshirepurchasedabout1millionadditional

sharesofAmericanExpress,increasingitsholdingto50.5millionshares.

Thedecisiontopurchasewasprobablyinfluencedbythedeclineinthe

sharepriceofAmericanExpress.Duringthe2008–2009marketcrash,

AmericanExpress,onceagain,wentdownfrom$60persharetoabout

$10pershare,onlytoreboundto$40pershare

withinayear.

E1C03

Date:Jan29,2010

Time:12:55pm

ValueInvesting—It’sLikeBuyingChristmasCardsinJanuary

33

WatchOutforTemptations

Valueinvestingdoesnotsuggestthatoneshouldinvestindiscriminately

whenacompany’sstockpricedeclinesandthestocklookscheaprelative

toitspriceafewmonthsearlier.Ifyoustartbuyingthingseverytime

youwalkintoastorethatishavinga50percentoffsale,youwillsoonbeindebtorbankruptcy.Allitemsonsalearenottrueinvestmentbargains

butareinsteadinvitationstocollectjunk,onlytobesoldatyournext

garagesaleforafractionofwhatyoupaid.Bewareofthesetempting,

yetmisleading,so-calledbargains.

Kmarthasoftenappearedasabargainstock.TheriseofWal-Martas

asuccessfulretailerledtothedeclineofKmart’sstockpriceintheearly1990s.AteverystageofKmart’spricedecline,thestockappearedtobe

abargainifyoulookedatitsP/Eratio.Afteralmostadecade,thestockpricewasonlyabout$9pershare,havingdeclinedfromahighof$27in

theearly1990s.Itcontinuedtolookinexpensiverelativetoitsearningspershare—andunfortunately,IinvestedinKmart.IprovedGraham

right:“Observationover

manyyearshastaughtusthatthechieflosses

toinvestorscomefromthepurchaseoflow-qualitysecuritiesattimesoffavorableconditions.”8DuringthetimethatKmart’sstockpricewas

declining,themarketwentupabout300percent,andWal-Martwasa

phenomenalsuccess,amassingagainofabout700percent.IfIhadmade

afewtripstoKmartstoresanddugdeeperintoitsfinancialstatements,

itwouldhaveoccurredtomethatKmartwasalow-qualitycompany

relativetoWal-Mart.Andlow-qualitycompaniessuch

asKmartdonot

survive.In2002,Kmartwentbankrupt.

Often,companiesgetintotroubleandtheirstockpricesfall

significantly.Theyappeartobegoodturnaroundcandidates.Most

turnarounds,however,donot

endupsuccessful,andyoushouldnot

betemptedtoinvestinthem.Thus,alowpriceisnotagoodindicator

forinvesting.Outstandingturnaroundstories,suchasthatofChryslerinthe1970s,giveinvestorshopethatothercompaniesintroublemayturn

aroundinthesamemanner.However,unlessyouareinapositiontosee

thattheturnaroundisindeedhighlyprobable,youshouldnotinvestin

turnarounds.

TheprincipleofavoidingturnaroundsislikeavoidingChristmastree

(asopposedtoChristmascard)investing.TowardtheendofDecember,

E1C03

Date:Jan29,2010

Time:12:55pm

34

buffettinvesting=value+growth

Christmastreesareavailableatthrowawayprices,ifnotforfree.Fromaninvestmentperspective,buyingaChristmastreeattheendoftheseason

isawasteofmoney.Thepriceislow,butthevalueisevenlower.Ina

fewdays,whenthetreehasturnedbrownandsheditsneedles,itwill

havetobethrownaway.

DoesValueInvestingReallyWork?

Afterthisdiscussionofvalueinvesting,youmightaskifthereisreliableevidenceinsupportofvalueinvesting.Academicshaveaskedthisquestionforalongtimebecausetheyareusuallynotsatisfiedbyanecdotal

evidence.Buffetthasaddressedthisissuehead-on.SpeakingatColumbia

Universityin1984,hepresentedtheperformancerecordsofsevendis-

ciplesofBenjaminGraham.Healsoincludedtheperformanceoftwo

pensionfundsforwhichhehadhelpedselectmanagers

withvalueorien-

tation.Theresultsshowthatvalueinvestorsdoverywell.Buffettwrites:

“[I]fyoufoundanyreallyextraordinaryconcentrationofsuccess,you

mightwanttoseeifyoucouldidentifyconcentrationsofunusualcharac-

teristicsthatmightbecausalfactors.Scientificinquirynaturallyfollowssuchapattern.”9Inthiscase,themaincommoncharacteristicwasthe

valueinvestingapproachthatalltheGrahamdiscipleshadfollowed.

ItisnotsurprisingthatBuffett’sfindingsdidnothaveanyeffecton

thegeneralacademicopinion,atleastuntilrecently.Academicsusually

relyonevidencefromverylargedatasetsandareconvincedonlywhen

astrategyhasbeenshowntoworkoverlongperiods.Inotherwords,an

academicstudywouldconcludeinfavorofan

investmentstrategyonly

ifevenamonkey(computer)couldreplicatethestrategy.Inmyopinion,

thisisnotnecessarilyaverygoodapproachtoadvanceourknowledge,

butitistheacademicstandard.Nevertheless,recentacademicresearch

seemstohaveturnedthecornerinfavorofvalueinvesting.

AcademicResearchEvidence

Academicresearchisbasedonanalyzinglargesetsofdatausingextensivecomputerpower.Weshouldkeepinmindthatitisalmostimpossibletoprogramacomputertoidentifywhat

BenjaminGrahamcalls

“large,prominent,andconservativelyfinanced”companiesoridentify

E1C03

Date:Jan29,2010

Time:12:55pm

ValueInvesting—It’sLikeBuyingChristmasCardsin

January

35

high-qualitymanagement.Forexample,howwouldacomputerknow

thattheCEOofBerkshireHathawayisagoodmanager?Forthisreason,

qualitativevariablesareallbutignoredinmostacademic

studiesortheirtreatmentissimplistic.Indefenseofacademicstudies,thegoodnewsis

thatthosestudiesmeetthehighestpossiblestandardsofanystudiesof

largedatasets,andeverythingaboutthemethodologyisclearlylaidout.

Hence,theydoprovideusreliablestatisticalresultstoponder.

Researchhasshownthatevensimplevalueinvestmentstrategies,

suchasinvestinginlowP/Estocks,produceoutstandingreturnsovera

numberofyears.Theseresultshavebeenreplicated

bymanyresearchers

overdifferentperiodsandare,thus,reliable.Therefore,itcanbe

concludedthataninvestorwhoimplementssimplevalueinvestment

strategiesandusesotherdiscerningqualitativevariablesshouldobtain

evenbetterreturns.Grahampointsoutthat“[an]investorshouldstart

withthelow-multiplier[i.e.,lowP/E]idea,butaddotherquantita-

tiveandqualitativerequirementstheretoinmakinguphisportfolio.”10

ManyapparentlowP/EstockssuchasKmartand

BethlehemSteelwould

nothavebeenselectedbycarefulvalueinvestorsbecausethecompanies

wereneitherprominentnorconservativelyfinanced.Inthenextsec-

tion,Idiscusstwosetsofstudies.Ifirstpresentadiscussionofstudiesthatcompareperformancesof

portfoliosconstructedbyhighversuslow

P/Estocks,andthenIcompareperformancesofportfoliosconstructed

byhighmarket-to-bookversuslowmarket-to-bookstocks.

PerformanceofHighversusLowP/EStocks

Themostprominentofrecentstudiesonvalueinvestingwasconducted