Brendan O’Neil Managing Director IHS Global Insight June 4, 2013

description

Transcript of Brendan O’Neil Managing Director IHS Global Insight June 4, 2013

Brendan O’Neil

Managing Director

IHS Global Insight

June 4, 2013

Copyright © 2011 IHS Inc. All Rights Reserved.

About IHS

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to long-term, sustainable growth and employs more than 6,000 people in more than 30 countries around the world.

US Economic Outlook US Economic Outlook

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• The economy’s fundamentals are improving, but fiscal policy headwinds will restrain near-term growth.

• We expect the federal spending sequester to last through September, taking 0.4 percentage point off 2013 real GDP growth, compared with a no-sequester case.

• Monetary policy will remain accommodative into 2015.

• Housing markets will continue their resurgence, supporting growth.

• Consumers will cautiously increase spending in response to gains in asset values, employment, and income.

• The US energy boom is creating jobs, investment, and a competitive advantage.

• Real GDP growth will pick up from 2.0% this year to 2.8% in 2014. Upside and downside risks are evenly balanced.

The US economy continues its uneven expansion

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

2012 2013 2014 2015

Real GDP 2.2 2.0 2.8 3.2

Consumption 1.9 2.2 2.5 2.5

Residential investment 12.1 16.3 18.5 20.1

Business fixed investment 8.0 4.7 6.6 7.2

Federal government -2.2 -5.3 0.1 -1.5

State & local government -1.4 -0.8 -0.1 0.7

Exports 3.4 2.6 5.1 5.4

Imports 2.4 2.3 5.3 4.2

(Percent change)

US economic growth by sector

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

2012 2013 2014 2015

Industrial production 3.6 3.2 3.0 3.3

Payroll employment 1.7 1.5 1.6 1.8

Light-vehicle sales (Millions) 14.4 15.3 15.7 16.2

Housing starts (Millions) 0.78 0.97 1.27 1.57

Consumer Price Index 2.1 1.4 1.6 1.6

Core CPI 2.1 1.9 2.0 1.8

Brent crude oil price ($/barrel) 112 105 93 89

Federal funds rate (%) 0.1 0.2 0.2 0.2

10-year Treasury yield (%) 1.8 2.0 2.5 3.0

(Percent change unless noted)

Other key US indicators

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• The most likely outcome is continued moderate economic growth.

• Fiscal tightening is under way, with the expiration of the payroll tax cut, substantial tax increases for high-income households, and spending restraints.

• Real GDP growth will pick up in 2014 and 2015, led by strengthening housing markets and business investment.

• Upside and downside risks are evenly balanced.

• The major downside risks are:• An intensified debt crisis and deepening recession in Europe.• An oil-price shock resulting from supply disruptions in the Middle East.

• On the upside, easing credit conditions and a stronger housing-market recovery could spark faster US growth.

Bottom line for the US economy

Regional Outlook Regional Outlook

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Employment: Top Performers 2012

* Unemployment rate in December 2012.

Rank State 2012 (% y/y) Top SectorUnemployment

Rate (%) *

1 North Dakota 6.0 Mining 3.2

2 Oklahoma 2.6 Mining 5.1

3 Utah 2.4 Mining 5.6

4 Texas 2.4 Mining 6.2

5 Arizona 2.1 Construction 7.9

6 Louisiana 2.1 Mining 6.9

7 Kentucky 2.0 Prof. & Business 8.0

8 Indiana 2.0 Durables Mfg 8.3

9 Colorado 1.9 Mining 7.5

10 Washington 1.7 Durables Mfg 7.5

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Continued modest job growth in 2013

2.3%

Percent

-0.8 to 0.7

0.7 to 1.0

1.1 to 1.4

1.5 to 3.1

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

… Picking up in 2014

2.3%

Percent

0.9 to 1.4

1.4 to 1.6

1.6 to 1.9

1.9 to 2.7

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

14131211

2.5

2.0

1.5

1.0

0.5

0.0

5350

5300

5250

5200

5150

5100

5050

5000

per

cent c

han

ge

year

ago

Thousan

ds

Growth - L Level - R

Ohio Employment Forecast

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Ohio Wage Gains (nominal total wages and salaries)

14131211

5.5

5.0

4.5

4.0

3.5

3.0

2.5

2.0

5.5

5.0

4.5

4.0

3.5

3.0

2.5

2.0

perc

ent c

hang

e ye

ar a

go

percent change year ago

Ohio US

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

(Percent unless otherwise noted)

Ohio Forecast Summary

2011 2012 2013 2014

Employment 1.3 1.5 0.6 1.2

Unemployment Rate 8.7 7.2 7.0 6.7

Personal Income 5.4 3.8 2.4 4.4

Housing Starts (000) 13.4 16.5 19.5 24.6

Retail Sales 8.3 5.4 2.8 2.4

Real Gross State Product 1.1 2.2 1.1 2.1

Economic Contributions of Economic Contributions of Unconventional Oil & GasUnconventional Oil & Gas

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Unconventional Oil and Gas Plays in North America

Enough to satisfy more than 100 years of consumption at current rates

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Nearly $5.1 Trillion in Cumulative Capital Investments are Expected to be Made Between 2012 and 2035.

0

50

100

150

200

250

300

350

400

2012 2015 2020 2025 2030 2035

Unconventional Oil and Gas Capital Expenditures(billions of 2012 dollars)

Unconventional Gas

Unconventional Oil

Spending will feed into broader the broader supply chain through capital-intensive purchases of heavy equipment, technical skills and services, and information technology.

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

From 2012 to 2035, the Employment Contribution of the Unconventional Oil and Gas Industry will Double

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2012 2015 2020 2025 2030 2035

Employment Contributions of Unconventional Oil and Gas Activity

(thousands of workers)

InducedIndirect

Direct

The greatest future job growth will occur between 2012 and 2020 – 3 million jobs by 2020.

Copyright © 2011 IHS Inc. All Rights Reserved.

Impact of Unconventionals on the US Economy in 2020

Producing States Non-Producing States

Top 10 Other Top 10 Other

Extensive Supply Chain will spread Economic Contribution beyond Producing States…

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Top 20 States for Unconventional Related Employment - 2012

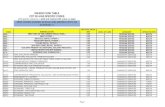

Direct Indirect Induced TotalTexas 159,474 171,204 245,406 576,084Pennsylvania 25,628 33,219 43,821 102,668California 6,480 33,337 56,737 96,553Louisiana 24,314 25,511 29,142 78,968Colorado 23,737 21,555 32,329 77,622North Dakota 19,746 24,099 27,978 71,824Oklahoma 21,137 18,821 25,367 65,325Utah 10,123 17,762 26,536 54,421New York 94 13,144 31,191 44,429Ohio 4,210 13,601 21,020 38,830Illinois 3,421 12,563 22,668 38,652Michigan 8,017 10,551 19,280 37,848Missouri 12,404 8,574 16,739 37,716Florida 208 10,603 25,721 36,532Arkansas 11,933 8,661 12,506 33,100New Mexico 7,117 7,690 8,818 23,625Wisconsin 2,280 6,360 11,120 19,760

US State-Level Employment Contribution of Unconventional Oil and Gas: 2012(Number of workers ranked by total employment contribution)

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Top 20 States for Unconventional Related Employment - 2025

Direct Indirect Induced TotalTexas 242,533 299,682 433,487 975,702Pennsylvania 73,984 83,296 113,148 270,428Ohio 52,810 54,222 80,796 187,829Oklahoma 61,882 52,779 72,721 187,382California 9,207 58,534 102,625 170,366Colorado 40,241 39,966 61,757 141,964North Dakota 30,613 38,809 44,870 114,292Louisiana 34,260 34,522 44,712 113,495New York 387 23,119 56,284 79,790Illinois 7,086 24,253 43,331 74,670Florida 308 21,750 51,424 73,483Michigan 15,130 21,555 36,690 73,376Missouri 23,364 16,931 32,324 72,618Arkansas 18,188 14,698 21,089 53,974Utah 6,061 14,110 22,020 42,190Minnesota 5,611 11,058 22,714 39,383West Virginia 13,736 10,315 14,143 38,194

US State-Level Employment Contribution of Unconventional Oil and Gas: 2025(Number of workers ranked by total employment contribution)

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

OH Revenue Associated with Unconventional Activity

(2012 $M)2012 2015 2020 2025 2030 2035 2012-2035**

Federal Taxes 537 1,235 2,150 2,877 3,673 4,218 57,681

Personal Taxes 439 960 1,619 2,152 2,748 3,168 43,440

Corporate Taxes 98 275 530 725 925 1,050 14,241

Federal Royalty Payments 0 0 0 0 0 0 0

Federal Bonus Payments 0 0 0 0 0 0 0

State and Local Taxes 911 2,438 4,594 6,147 7,626 8,453 120,275

Personal Taxes 164 349 573 723 854 915 14,175

Corporate Taxes 738 2,018 3,789 5,048 6,225 6,841 97,967

Severance Taxes 1 14 53 96 154 215 2,185

Ad Valorem Taxes 8 56 176 274 383 471 5,807

State Royalty Payments 0 1 4 7 10 12 141

State Bonus Payments 0 0 0 0 0 0 0

Total Government Revenue 1,448 3,673 6,744 9,024 11,300 12,672 177,956

Lease Payments to Private Landowners 4 22 45 67 96 119 1,490

NOTES: *Total unconventional activity represents the sum of unconventional oil and unconventional gas activity.

**2012-2035 represents the total for all years including those years not reported.

Source: IHS Global Insight

Contribution of Unconventional Gas and Oil to Government Revenue and Private Lease Payments: Ohio

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Upstream Development Causing a Ripple Effect Through the Economy

Employment Contribution in 2020

Upstream unconventional oil and natural gas activity, on average, demonstrates

one of the larger employment multipliers.

On average direct employment will

represent about 20% of all job resulting from

unconventional oil and gas activity with the

balance contributed by indirect and induced

employment.

Copyright © 2011 IHS Inc. All Rights Reserved.

U.S. Downstream Investment will total $217 billion over next six years

Striking the BalanceStriking the Balance

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Concern is Motivated by a Variety of Risks, Impacts, and Uncertainties

Local

Macro

StakeholderUncertainty

ImpactManagement

Sca

le o

f Im

pac

t

Source of Concerns

Climate Change

Water Use

Road & Traffic

Air Quality

Public Services

Seismicity

Drinking Water

Complicating Factors

•Priorities unique to each play & community

•Local & national debate inform each other

•Temptation to confuse the means with the ends

•Community preparedness

•Politicized confidence in regulators

•Jurisdictional conflicts

•All pay for the sins of the few

•Uneven distribution of benefits

Wildlife

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Timeline for shale gas development and production

27

Source: IHS CERA.00502-3_1704

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Rapid increase in local bans and moratoriums

• New York• State moratorium since 2010, future unclear• Municipalities: 48 bans, 106 moratoriums, 91 more in development*

• Pennsylvania• Regional moratorium in the Delaware River Basin• Municipalities: At least 5 prohibitions, including the city of Pittsburgh• Act 13 passed in February 2012

• Colorado• Longmont• Fort Collins

• Ohio• Yellow Springs

*As of 2/12/13. Source: fracktracker.org

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

NY Moratoria

Source: fracktracker.org

Dunn County, North Dakota

Growing Pains within County Government Services

30

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• High ratio of splitting of properties. ( small acreage sales)• Increase valuation of property. (land priced by the square foot)• $50,000 homes in 2006 have sold for $175,000 in 2011.• The property valuations have increased by 19.4% since 2010. • Increased recording because of sales & splits.• Numerous requests for valuation of land.• Creations of subdivisions have increased work load.• Higher request for determination of land ownership.(many old

problems arise daily because of the lack of good records)• Department has purchased a service agreement with GIS tracking

system.• Huge demand for property for housing and industrial business. (truck

parting, RV sites, mobile home parks, small shops, etc.)

Source: Dunn County Commissioner Daryl Dukart

Tax Department

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• 765 traffic violations• 213 criminal court cases• 205 civil cases• 3 staff employees• Recorders office collected

$147,107 • Oil revenue starts to come into

the county

• 2576 traffic violation• 377 criminal court cases• 298 civil cases• 6 staff employees• Recorders office collected

$603,095• Addition of a new Courtroom • Moved to digital documents

Clerk of Court

2012 estimates

Source: Dunn County Commissioner Daryl Dukart

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• 1200 miles of road with only 27 paved miles

• Very few highly impacted roads from truck traffic

• General road maintenance was two to three operation per year on all roads

• General road surface materials used are gravel or scoria

• Annual cost to maintain was about $1500 per mile

• 1202 miles of roads with only 25 paved miles

• 330 miles of heavily impacted truck traffic routes (over 100 trucks per day)

• Weekly maintenance is required on the 330 miles of highly impacted roads

• Cost to maintain impacted roads is $26,000 per mile annually

• Materials for road surfacing are getting tighter in supply because of competition from the energy sector

Roads and Traffic

2011

Source: Dunn County Commissioner Daryl Dukart

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• 3 employees• 4 vehicles• Average calls per day 6

• 9 employees• 9 vehicles• Average calls per day 46• Large amounts of overtime

causing stress to employees and equipment

• Looking at adding another employee and vehicle on July 1st 2012

• Budget has increased by 300% over three years

Sheriff’s Department

Q1 2012

Source: Dunn County Commissioner Daryl Dukart

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

• The States Attorney Office has seen a substantial increase in child abuse and neglect, domestic violence, violent crime, alcohol related offenses, and illegal drugs.

• Traffic and alcohol related offenses combined had a substantial increase of 300%.

• Financial problems combined with alcohol and illegal drugs appear to the be the gateway for an increase in domestic violence and child abuse and neglect cases.

• Most of the increased case load involves individuals who have recently relocated to western North Dakota to pursue employment opportunities in the Bakken.

States Attorney Office

Source: Dunn County Commissioner Daryl Dukart

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Bakken Shale Development Impacts

Positive:

•Created many new job opportunities (many $50,000 plus salary type of jobs )

•Increased salary levels in western North Dakota

•Brought additional money to the farm and ranch communities

•Creation of many new businesses in the area

•Increase sales of trucks, cars, and farm equipment

•Has changed our life styles

Negative:

•Estimated 3200 outside workers drive

to Dunn County daily to work

•Overload of patrons at restaurants,

gas stations, and stores of all kinds

•Lack of employees

•Detrition of roads because of heavy

traffic loads

•Traffic everywhere

•Total stress on all county

departments is greater than we

expected

•Lack of funds to meet demandsSource: Dunn County Commissioner Daryl Dukart

© 2013, IHS Inc. No portion of this presentation may be reproduced, reused, or otherwise distributed in any form without prior written consent.

Takeaways

• Fiscal and social pressures ride shotgun with prosperity. • There is a structure to environmental regulation at federal, state, and local levels, as

well as limitations.• However, some of the boundaries are blurry, and power struggles ensue.• Local authorities are entering the fray, creating a new and highly uncertain dimension of

regulation.

Discussion Questions• Can industry and environmental stakeholders really work together?• Are Energy Security & Economic Development incompatible Environmental Protection

& Health Safety?• Is “political entrepreneurialism” trumping the political process?• What steps can industry take? Collaboration with regulators, communities, NGOs?• What aspects of environmental regulation are most important, and what level of

government is responsible?• What are the mutually agreeable best practices to optimize opportunities and minimize

risks?• Will lingering uncertainty be the risk premium that deters future investment?• Is disenfranchisement the source of local opposition?