BMR Edge: Direct & Indirect Tax

-

Upload

bmr-advisors -

Category

Economy & Finance

-

view

94 -

download

6

Transcript of BMR Edge: Direct & Indirect Tax

Vol. 11 Issue 3.2 February 2015

About BMR Advisors | BMR in News | BMR Insights | Events | Contact Us | Feedback

Direct tax

High Court

Interest under section 234B of the Income-tax Act, 1961 (“Act”) cannot be levied on a

non-resident to the extent of taxes deductible by the payer under section 195 of the

Act

This batch of appeals concerned non-resident taxpayers engaged in the business

of manufacturing equipment relating to oil and gas, energy etc. Pursuant to notice

issued under section 148 of the Act, the taxpayers filed tax returns reporting nil

income. During the audit, the Revenue Authorities (“RA”) concluded that the

taxpayers had Permanent Establishment (“PE”) in India and determined that tax

along with interest under section 234B of the Act was payable by them. On

appeal, the taxpayers contended that there was no failure to pay advance tax as

tax was deductible from the payers, which had to be reduced in computing the

advance tax liability as per section 209 of the Act. The Commissioner of Income-

tax Appeals [“CIT(A)”] and Income-tax Appellate Tribunal (“ITAT”) relied on the

Delhi High Court (“HC”) ruling in Jacabs Civil Inc (330 ITR 578) (Del) on this issue

and held in favor of the taxpayer. On further appeal, the RA referred to the Delhi

HC ruling in Alcatel Lucent USA Inc (223 Taxman 176) (Del) and contended the

taxpayers cannot argue that the payer had absolute liability to deduct tax when the

taxpayers had themselves reported NIL income in the tax returns filed by

them.. However, the HC held that the conclusions in the Alcatel ruling were limited

to the circumstances of the case. It further held that the obligation to deduct tax

cannot be founded on the assertions of the interested parties. It observed that

where the payee claimed that the income was not liable to tax, the payer had the

responsibility to apply to the RA to determine liability to deduct tax. It also

observed that the amendment by the Finance Act 2012, allowing credit for tax

deductible by payer while computing the advance tax liability of the payee taxpayer

on the basis of actual deduction, was effective only from April, 2012 and not for the

years in appeal before it. Accordingly, the HC held that there was no failure to pay

advance tax by the taxpayers to the extent of taxes deductible by the payers (even

Contents

DIRECT TAX

High Court decisions . . . . . . . . . . .

ITAT decisions . . . . . . . . . . . . . . . . .

Key Notifications and Circulars. . . . . .

INDIRECT TAX

Central Excise. . . . . . . . . . . . . . . . . .

VAT/Sales Tax. . . . . . . . . . . . . . . . . .

Service Tax. . . . . . . . . . . . . . . . . . .

Customs. . . . . . . . . . . . . . . . . . . . . .

Key Notifications and Circulars . . . . .

Getting The Deal Through: Tax on

Inbound Investment 2015

Managing Tax Disputes in India

if not actually deducted) and hence, interest under section 234B of the Act cannot

be levied.

DIT vs GE Packaged Power Inc and Others (ITA 352/2014) (HC, Delhi)

Reopening of assessment after a period of 4 years from the end of the assessment

year held to be invalid in the absence of any fresh material requiring such

reopening

The taxpayer, an Indian company, claimed deduction under section 80HHE of the

Act towards export of software, which was accepted by the RA during original

assessment proceedings. However, after a period of 4 years from the concerned

AY, the RA reopened the assessment under section 147 of the Act on the ground

that the turnover as per the profit and loss account of the taxpayer was higher than

the turnover considered for computing the deduction under section 80HHE of the

Act. Though the CIT(A) quashed the assessment order stating that the RA

reopened the assessment on a mere change of opinion, the ITAT remanded the

matter back to the CIT(A) for reconsideration after providing an opportunity to the

RA to place its contentions. On taxpayer’s appeal against the ITAT order, the HC

observed that the RA can reopen an assessment after a period of 4 years only if

the taxpayer had failed to disclose fully and truly all material facts necessary for

assessment. The taxpayer contended that that turnover was part of the profit and

loss account of the taxpayer and hence there was no failure to disclose any

material fact necessary for the purpose of assessment. The RA referred to

Explanation 1 to section 147 of the Act, which provided that production of account

books before the RA will not necessarily amount to full and true disclosure of all

material facts. However, the HC held that since the Explanation uses the terms

“not necessarily”, the burden is equally placed on the RA to exercise due diligence

in examining the record during the regular assessment proceedings.

Accordingly, it held that reopening of assessment is not valid in the absence of any

fresh tangible material for the RA to have ‘reason to believe’ that the income of the

taxpayer escaped assessment.

Donaldson India Filters Systems Pvt Ltd vs DCIT (ITA No. 86/2014) (HC, Delhi)

Loan to a shareholder alone can be treated as dividend

The taxpayer, an individual, received a loan from a company (“Company A”) which

had in turn availed a loan from another company (“Company B”) in which the

taxpayer had 50 percent shareholding interest. Although the taxpayer was not a

shareholder in Company A, the RA taxed the loan received by the taxpayer from

Company A, as dividend under section 2(22)(e) of the Act, on the basis that the

Taxand’s Global Guide to

M&A Tax 2013

BMR Advisors rated Tier 1 firm,

International Tax Review, World

Tax Guide 2015 for the eighth

consecutive year

BMR Advisors ranked Tier

1 for Transactional and M&A

Tax excellence by International

Tax Review annual Transactional

Tax Survey 2014.

BMR Advisors has been ranked

number one (by deal count)

most active transaction advisor

for Private Equity, M&A in India

for the year 2013 by Venture

Intelligence.

Direct Tax

Sivam Subramanian

Ankitha Jain

Dhruv Kumar

Farha Sultana

Indirect Tax

Anshul Aggarwal

Shreya Tripathi

Nitish Malik

Divya Mahajan

loan was in substance received from Company B, where the taxpayer was a

shareholder. On appeal, the CIT(A) as well as the ITAT held that section 2(22)(e)

of the Act, which creates a legal fiction by taxing loan by a company to its

substantial shareholder as dividend, should be strictly construed and cannot be

applied where the taxpayer is not a shareholder of the Company A. On further

appeal by the RA, the HC observed that the object of section 2(22)(e) of the Act

was to ensure that an entity does not distribute its accumulated profits to its

shareholders in the form of a loan or advance and that the section would not apply

when the taxpayer had not taken a loan from Company B, where he was a

shareholder. Accordingly, the HC dismissed the appeal of the RA on the basis that

on a strict interpretation of section 2(22)(e) of the Act, the provision cannot be

invoked unless the taxpayer is a shareholder in the lending company.

CIT vs Jignesh P Shah (ITA No 197/2013) (HC, Bombay)

Anti-avoidance provisions to plug ‘dividend stripping’ transactions will not apply

when units are transferred after 3 months from date of its purchase and ‘Record’

date is irrelevant

The taxpayer, an individual, had acquired units of mutual funds, received dividends

and thereafter sold the units after three months from the date of acquisition and

incurred short term capital losses. As per, section 94(7) of the Act, if any person

acquires any security or unit within a period of three months prior to the ‘record

date’ and transfers such units within a period of three months after ‘such date’,

then the loss incurred, to the extent of dividend received has to be ignored. During

the audit, the RA noted that these units were sold within three months from the

record date for declaration of dividend and disallowed the loss claimed applying the

section 94(7) of the Act. On appeal, while the CIT (A) upheld the order of the RA,

the ITAT ruled in favour of the taxpayer and held that the three month period has to

be reckoned from the date of purchase and not ‘record date’. On appeal by the

RA, the High Court, noted that ‘record date’ is a fixed date whereas date of

purchase would vary from person to person. The High Court also observed that if

the legislature had intended to refer to the record date when it used the term ‘such

date’ in the provision, the legislature could have specifically used the term ‘record

date’ as it had done in clause (a) of the same provision dealing with acquisition of

units. Accordingly, the High Court held that the term ‘such date’ refers to the

purchase date. Since, the sale of units by the taxpayer fell outside the three month

period when computed from the purchase date, it was held that the capital loss

cannot be disallowed under section 94(7) of the Act.

CIT vs Sarosh Nowrojee Burjorjee (ITA No 1025 and 1026/2008) (HC,

Karnataka)

Mukesh Butani, New Delhi

+91 11 3066 3010

[email protected] Rajeev Dimri, New Delhi

+91 124 669 5050 [email protected]

Gokul Chaudhri, New Delhi

+91 124 669 5040

[email protected] Bobby Parikh, Mumbai

+91 22 6135 7010

[email protected] Abhishek Goenka, Bangalore

+91 80 4032 0100 [email protected]

Sriram Seshadri, Chennai

+91 44 4298 7000

Amit Jain, Pune +91 20 668 19010

Snippet

Guidelines expected to be

introduced for repatriation of black

money

The Government is proposing to

introduce guidelines in order to

provide a one-time opportunity to pay

taxes and repatriate any black money

ITAT

Adjustment for location savings not warranted when arm’s length price is

determined on the basis of local market comparable companies

The tax payer, a pharmaceutical company engaged in providing contract

manufacturing and contract Research services to its overseas parent,

benchmarked its transactions under the Transaction Net Margin Method (“TNMM”)

with Indian companies as comparable companies. During the audit, the RA noted

that the manufacturing operations, which were earlier carried out in the USA and

European countries were shifted to the taxpayer in the preceding years. The RA

concluded that the shifting of operations to India resulted in significant location

savings to the AE. Accordingly, the RA made upward adjustments to the

ALP. On appeal, the adjustments were upheld by the DRP. On further appeal,

the ITAT held that the taxpayer and the AE operate in perfectly competitive market

and the taxpayer does not have any exclusive access to the factors that may result

in any location specific advantages. The ITAT noted that there was neither any

super profit in the entire supply chain nor any unique advantage for the taxpayer

over its competitors, due its operations in India. The ITAT also noted that the

comparable companies selected by the taxpayer being Indian company, the benefit

of location savings if any, would anyways get reflected in the increased profitability

of the said comparable companyas well. Accordingly, the ITAT held that therefore

no separate adjustment on account of location savings was required to be made in

the hands of the taxpayer.

Watson Pharma Pvt Ltd vs DCIT (ITA No 1423/2014) (ITAT, Mumbai)

Income from transfer of movie rights accrues only in the year when the said right

commence and not in the year when the full consideration was received in advance

The taxpayer, a film producer, had transferred certain home video rights and movie

satellite rights to a company. The rights were available to the transferee over a

period of five years. However, the consideration for the entire five year period was

received in lump sum in the first year. As the rights of each film commenced on a

different date, the taxpayer offered to tax in the first year, income only to the extent

it pertained to the rights which commenced during the year. During the audit, the

RA held that the entire consideration was taxable in the first year itself, as the

rights were transferred irrevocably and in return, the taxpayer obtained irrevocable

rights to utilize the advances. On appeal, the CIT(A) held that only one-fifth of the

entire consideration was to be taxed as income of the first year. On appeal by the

RA, the ITAT observed that it was the real, and not hypothetical accrual of income,

which should be considered. The ITAT also noted that the rights in certain films

commenced only in the subsequent years. Accordingly, it held that all the film

stored outside India. In furtherance to

the stringent measures unveiled in the

Union Budget to curb black money, it

is expected that this facility would also

be introduced along with the

introduction of a comprehensive

legislation to tackle black money.

Source: Times of India

Snippet

Likely incorporation of Organization

for Economic Cooperation and

Development (“OECD”) initiatives

on tax avoidance in General Anti

Avoidance Rules (“GAAR”)

provisions

rights did not commence in the first year and ruled that the consideration received

in respect of any movie right can be taxed only in the year when the right

commences and not in the first year when the consideration was received in

advance by the taxpayer.

B.R. Films vs the ACIT (ITA No. 3632/ 2012) (ITAT, Mumbai)

Overdue trade receivables are closely linked with the primary transaction of sale to

AE and should be aggregated for benchmarking purposes

The taxpayer, a jewel manufacturer, had sales receivables from AEs outstanding

for 330 days to 350 days, on which it did not charge any interest. During the audit,

the RA made a transfer pricing adjustment towards interest on such

receivables. The DRP upheld the order of the RA. On appeal, the taxpayer

contended that the outstanding receivable was not an international

transaction. Further, it argued that since it did not charge interest on receivables

from non-AEs as well, which ranged from 120 to 220 days, there cannot be

adjustment towards interest on the receivable from the AEs. It also argued as an

alternative contention that the adjustment in any case should not exceed its cost of

funds. The ITAT held the overdue trade receivable to be an ‘international

transaction’ considering the amendment to section 92B of the Act by Finance Act,

2012. However, it held that the transaction, is closely linked to the primary

transaction of sale of goods and should be aggregated for benchmarking

purposes. It noted that the credit period allowed depends on various factors

including the price charged and hence, the overdue receivables cannot be

analyzed independently. Even if it were to be independently analyzed, if the

taxpayer is not differentiating between the long pending receivables from AE and

non-AE, i.e. does not charge interest in either case, the remaining factors are

quantum of receivables and the extent of credit period. It held that if the product of

the average credit period and the amount outstanding for AE and non-AE

receivables are comparable, then the transactions are at arms’ length and no

adjustment is called for. The ITAT also ruled that the interest rate pertaining to

loan transactions cannot be taken as the benchmark, but only the cost of total

funds to the taxpayer should be considered as the benchmark for imputing interest

on the outstanding receivables from the AEs. Accordingly, the ITAT directed the

RA to re-determine the ALP on the basis of the above directions.

Goldstar Jewellery Limited vs JCIT (ITA No.6570/2012) (ITAT, Mumbai)

TPO cannot determine the value of services availed by the taxpayer as nil on the

basis that there was no need for such service to be availed

Snippet

The Government is considering the

incorporation of the provisions relating

to the Base Erosion and Profit Shifting

(“BEPS”) project of the OECD, in

GAAR so as to effectively deal with the

problem of tax avoidance by MNCs.

This is in line with India Inc.’s

commitment along with other G20

countries to the OECD plan on

BEPS. India has been at the forefront

in raising the issues concerning tax

avoidance and automatic exchange of

information with a view to curbing tax

evasion.

Source: Economic Times

The taxpayer, an Indian company was engaged in the business of providing

formwork and scaffolding material to companies engaged in the construction

business. Since it was in its first full year of operations, the taxpayer availed

certain site related technical support services from its AE. The costs involved for

the said services was allocated to the taxpayer by the AE on the basis of time

spent by the employees of the AE. During the audit, the RA concluded that the

ALP of the services was nil since the taxpayer did not provide evidence for availing

such services and did not establish the nature of benefits received on availing such

services. The DRP upheld the order of the RA. On appeal, the ITAT noted it was

not the case of the RA that the taxpayer, which was in its first year of operation,

had the necessary in-house expertise and would have necessarily availed such

expertise from its AE. It also noted that the taxpayer had provided invoices raised

by the AE which was based on the time spent by the employees of the AE. The

ITAT held that the jurisdiction of the RA in a transfer pricing audit was limited to

determining whether the price paid by the AE was at ALP or not and hence the RA

should not have proceeded on the premise that the taxpayer was not in the need of

the services. Accordingly, the payment made by the taxpayer to the AE for the

services was held to be allowable.

PERI India Pvt. Ltd vs DCIT (ITA No. 7265/2012) (ITAT, Mumbai)

ITAT upholds benchmarking of software services under Cost Plus Method (“CPM”)

after factoring risk adjustments

The taxpayer, a provider of software development services to AEs and non-AEs,

benchmarked its transactions under the internal CPM. While the gross profit

margin in the non-AE segment was computed at 70 percent, the taxpayer carried

out certain adjustments for differences in functional and risk factors and

determined the adjusted margins at 7 percent, which was lower than the margins

earned by the taxpayer in the AE segment. During the audit, the RA rejected the

risk adjustment. On appeal, the CIT(A) ruled in favour of the taxpayer. The

contentions of the RA/taxpayer on the risk adjustments and the ruling of the ITAT

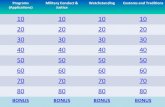

on further appeal by the RA are summarized in the table below:

Risk adjustments claimed by

the taxpayer

RA’s contention ITAT Ruling

1. Discount for long term

contracts with AEs: Since

the contract with the AEs

were non-terminable for a

period of 5 years as

against the Non-AE

contracts which were for 1

The RA held that long

term contract with

AEs should not

warrant a discount.

The ITAT observed that

the contract term was a

relevant factor and

approved the claim for

an adjustment.

However, since the

basis of computing the

Merger of caps on overseas

investments likely to give more

headroom to foreign investors

The Budget proposal to have a

composite cap for foreign investors is

likely to pave way for an increase in

overseas investments in

India. According to experts, the move

to eliminate separate

Foreign Portfolio Investment (“FPI”)

and Foreign Direct Investment (“FDI”)

caps will create headroom and

flexibility for overseas

investors. Presently, many sectors

including banks and exchanges have

sub-limits or separate caps for FPIs

and FDIs. It is expected that banking,

infrastructure, defence, ports and

exchanges are likely to be the main

beneficiaries of the move

Source: Business Standard

year and terminable, the

taxpayer claimed a

discount of 30 percent and

21 percent on the gross

profits for the AE and Non

AE segments

respectively. The discount

was stated to be computed

based on its past

experience.

discount was not

provided by the

taxpayer, the ITAT held

that a 15 percent

discount (being 70

percent of taxpayer’s

claim) to be reasonable

2. Discount for technology

imparted by AE: The

taxpayer claimed that the

technology to enable the

provision services was

imparted by the

AE. Accordingly, a

discount of 15 percent on

the gross profit was

claimed as an adjustment.

The RA rejected the

claim as there was no

formal agreement, no

evidence for the

technology transfer

and no basis

provided by the

taxpayer for

computing discount

factor at 15 percent.

The ITAT approved the

relevance of the

discount claimed for the

technology

transfer. However,

since the basis of

computing the discount

was not provided by the

taxpayer, the ITAT held

that a 6 percent

discount (being 60

percent of taxpayer’s

claim) to be reasonable

3. Discount for Project

management costs not

incurred in AE segment:

Taxpayer claimed 40

percent discount on gross

margin towards project

management efforts not

required in AE contract.

This was estimated on the

basis of 1/3rd of marketing

cost savings

The RA restricted the

discount to a lower

percent after

re-computing it with

reference to the

markup and turnover

in the Non-AE

segment.

The ITAT upheld the

RA’s approach on the

basis that discount is to

be computed with

reference to the Non-

AE segment data

4. Credit risk: The taxpayer

further claimed a discount

of

5 percent on gross profit or

3 percent on sales price

toward the credit risks

The RA rejected the

claim

The ITAT upheld the

RA’s contention as the

credit risk was already

factored in the discount

provided for project

management cost

DCIT Vs American Megatrends India Pvt Ltd (ITA No.1981/08) (ITAT, Chennai)

Snippet

Prosecution measures in cases of

default in remittance of taxes to be

enhanced

As a matter of concern over the

shortfall in revenue collections

through the Tax Deductions at Source

(“TDS”) mechanism, the Income-tax

(“IT”) Department has decided to

enhance prosecution against large

defaulters. The CBDT in this backdrop

has issued Standard Operating

Procedures setting out the procedure

for identification of cases and

launching of prosecution along with

the timelines for completing the entire

process. Please refer BMR Edge

dated February 5, 2015 for our

detailed analysis of the same.

Source: Economic Times

Provisions of section 50C of the Act does not apply to leasehold rights in land

The taxpayer had taken certain lands on a 99 years’ lease. It transferred the

leasehold rights for an agreed consideration. In its return of income, it computed

the capital gains with reference to the agreed consideration. During the audit, the

RA invoked the provisions of section 50C of the Act and adopted the value

applicable for stamp duty purposes (“guideline value”) as the full value of

consideration and computed the capital gains accordingly. On appeal, the CIT(A)

upheld the order of the RA. On further appeal, the ITAT referred to the language

used in section 50C of the Act and held that while leasehold right in land is a

capital asset, all capital assets are not covered within the scope of section 50C of

the Act. It noted that section 50C of the Act covers only ‘capital assets being land

or building or both’ and accordingly ruled that the guideline value cannot be

adopted for computing the capital gains on transfer of leasehold rights on land.

Kancast Pvt Ltd vs ITO (ITA No. 1265/2011) (ITAT, Pune)

Specific PE clause supersedes general clause on fee for technical services (“FTS”)

The taxpayer, a cement manufacturer, made remittances to various non-resident

suppliers for purchase of plant and machinery without deduction of tax at

source. The RA opined that the payments were not only for import but also for

installation, commissioning and assembly of plant and machinery. Since it was a

composite transaction, the RA held that the income of the non-resident should be

treated as accruing or arising in India and that taxes should be withheld under

section 195 of the Act and treated the taxpayer as assessee in default for failure to

withhold tax. On appeal, the CIT(A) confirmed the order of the RA. On further

appeal, the ITAT examined the taxability of such remittances in light of various

applicable Double Taxation Avoidance Agreements (“DTAA”) and held that:

• Installation / assembly PE would arise only if the activities in the Source State

exceed the threshold time limits prescribed in the DTAA;

• The onus is on the RA to establish that a PE existed for the taxpayer;

• Installation / assembly activities, although are in the nature of technical services

cannot be taxed as FTS, in the absence of a PE in India. As the tax treaty does

not provide any tie-breaker rules for overlapping provisions unlike in the case of

provisions relating to Service PE, the specific Installation PE clause would

prevail over general FTS clause;

Snippet

Decline in IT Department’s

estimates of taxable income

suppressed by India Inc.

The IT department has scaled down its

estimate of income suppression by

multinational corporations in India in

the 2014-15 audit of intra-group cross-

border transactions to Rs 47,000

crore. This represents a decline of

around 22 percent from the extra

taxable income the department had

attributed to the firms in the previous

audit.

Source: Financial Express

• Installation / assembly activities do not satisfy ‘make available’ condition

present in the FTS clause of certain DTAAs as it does not involve transfer of

technology or enable the recipient of services to perform services on its own

without recourse to the service provider.

Accordingly, the ITAT concluded that in the absence of an Installation PE, the

income of the non-residents are not taxable in India and consequently, taxpayer is

not required to withhold tax from the remittances to the non-residents under section

195 of the Act.

Birla Corporation Limited vs ACIT (TDS) (ITA No. 251 and 252/2013) (ITAT,

Jabalpur)

Legal expenses are allowable only when the proceedings are inextricably linked to

business of the taxpayer

The taxpayer, a sole proprietor, was convicted and arrested in a criminal case on

the charge of evasion of customs duty. The taxpayer incurred legal expenses for

defending his case and claimed the same as business expenditure. During the

audit, the RA disallowed it by holding it as personal expenditure. On appeal, the

CIT(A) upheld the stand of the RA. On further appeal before the ITAT, the

taxpayer contended that it was not open to the RA to question the commercial

expediency of the expenditure incurred. The ITAT held that the expenditure can be

allowed only where the taxpayer demonstrates that it was inextricably linked to the

business. It further held that since the proceedings in the taxpayer’s case were for

evasion of customs duty, it resulted in criminal case personally against the

taxpayer and the legal expenses cannot have been said to be incurred for business

purposes. Accordingly, the ITAT ruled that the expenditure should be disallowed.

Praveen Saxena Vs JCIT (ITA No. 3674/2010) (ITAT, Delhi)

Disallowance under section 14A of the Act is not applicable in the absence of

exempt income

The taxpayer, an Indian company, had in the preceding years made investments in

subsidiaries. It did not earn any dividend in the year. During the audit, the RA

disallowed certain expenses under section 14A of the Act read with Rule 8D on the

ground that it was incurred to earn exempt income. On appeal, the CIT(A)

restricted the disallowance to a nominal amount on an ad-hoc basis. On appeal by

the RA, the ITAT observed that expenditure such as audit fees and professional

charges, were required to be incurred by the taxpayer irrespective of whether any

exempt income would be earned or not. The ITAT further held that section 14A of

Snippet

Government to provide clarity on

taxation of ‘consortium’ structures

for attracting investments

In order to attract investments in the

infrastructure sector, the Government

is looking to provide clarity over

taxation of ‘consortium’ structures

which are commonly used for

implementing large turnkey

projects. The move comes after

taxation of consortium structures such

as “association of persons” emerged

as a roadblock for foreign investors.

Source: Economic Times

the Act would not apply when no exempt income was earned by the taxpayer

during the year and held in favour of the taxpayer.

ITO vs Pioneer Radio Training Services Pvt Ltd (ITA No. 4448/Del/2013) (ITAT,

Delhi)

Carry forward of unabsorbed capital expenditure incurred for scientific research

cannot be disallowed by applying section 79 of the Act due to change in

shareholding pattern

The taxpayer, a manufacturer of network equipment had unabsorbed capital

expenditure incurred towards approved Scientific Research, which was deductible

under section 35 of the Act. During the year, there was a change in shareholding

of more than 51 percent of the equity shares of the taxpayer company. During the

audit, the RA treated the unabsorbed capital expenditure as a business loss and

disallowed it applying section 79 of the Act, considering the change in

shareholding. On appeal, the CIT(A) upheld the order of the RA. On further

appeal before the ITAT, the taxpayer contended that the unabsorbed capital

expenditure should be treated on par with unabsorbed depreciation and not as

business losses. The ITAT referred to the ruling of the Mumbai bench in Mahyco

Vegetable Seeds Limited (25 SOT 46), wherein it was held that the unabsorbed

capital expenditure eligible for deduction under section 35 of the Act should be

treated as unabsorbed depreciation considering the specific provisions under

section 35(4) of the Act. Accordingly, the ITAT ruled that in case of revenue

expenditure incurred for scientific research and remaining unabsorbed, it would be

treated as unabsorbed business losses and the provisions of section 79 of the Act

would apply. However, in respect of unabsorbed capital expenditure, it would be

treated as unabsorbed depreciation and the disallowance contemplated under

section 79 of the Act would not be applicable.

DCIT vs Tejas Networks Limited (ITA No.1684/ 2012) (ITAT, Bangalore)

Key Notifications and Circulars

Central Board of Direct Taxes (“CBDT”) clarifies scope of ‘other sums

chargeable’ under section 40(a)(i) of the Act

The provisions of section 40(a)(i) of the Act provide that any interest, royalty, fees

for technical services or other sum chargeable under this Act payable in India to a

non-resident (not being a company) / a foreign company or payable outside India

would be disallowed if there has been a failure in withholding, or remittance of

appropriate taxes. As disallowance of ‘other sum chargeable’ is triggered when

taxes are not withheld under section 195 of the Act, doubts had arisen if the term

Snippet

Government to consider

establishing of niche Finance

Special Economic Zones (“SEZs”)

The Finance Ministry is exploring the

possibility of establishing special

Finance SEZs, from where global

financial institutions can freely provide

services, unhindered by India’s current

regulatory system that does not permit

unlimited cross-border exchange of

capital. The Finance Ministry has also

released its policy framework to set up

such SEZs, wherein it has

recommended the enactment of a

separate legislation for regulating the

same. Such a concept was envisaged

earlier in 2007 to ease financial

regulations but was not implemented

following the 2008 economic crisis.

Source: Financial Express

refers to the whole sum remitted or only the portion which is taxable under the

Act. In this regard CBDT has, by its Circular dated February 12, 2015, clarified that

it is only the appropriate portion that is chargeable to tax which would form part of

the disallowance. The same is in line with its earlier Instruction No.2/2014 dated

February 26, 2014.

Source: CBDT Circular No 3 dated February 12, 2015

Interest under section 234A of the Act not applicable on Self-Assessment

taxes

As per section 234A of the Act, in computing the interest for filing of tax return

beyond the prescribed due date, advance tax paid, tax deducted at source and

other specified credits can be reduced from the tax determined on the income for

the year. Self-assessment tax paid after March 31st of the year, but before the due

date for filing the tax return was not a specified deduction in computing the

interest. In this background, the CBDT has, by its Circular No.2/2015 dated

February 10, 2015, clarified that self assessment tax paid by taxpayers before the

due date of filing return of income is also to be considered as a component of tax

to be reduced from the amount of tax payable on total income to arrive at the base

on which interest under section 234A of the Act would be chargeable. This is in

line with the principle emanating from the ruling of the Supreme Court in the case

of CIT vs Prannoy Roy (309 ITR 231).

Source: CBDT Circular No. 2 dated February 10, 2015

Safe Harbour Rules (“SH Rules”) prescribed for Government companies

The CBDT has by its Notification No. 11/2015 dated February 4, 2015 issued SH

Rules for Specified Domestic Transactions being supply, transmission or wheeling

of electricity by Government companies. The SH Rules are introduced by way of

amendment to the Income Tax Rules, 1962 and the Rules 10THA – 10THD

Source: CBDT Notification dated February 4, 2015

India notifies protocol amending Tax Treaty with South Africa

The Government of India has notified its Protocol Amending the Tax Treaty

between India and South Africa to amend the provisions of Article 25 relating to

Exchange of information. The amended provisions provide that both countries

would exchange any necessary information to implement the provisions of the

Treaty or the domestic laws. It also provides that request for information would not

Snippet

Supreme Court (“SC”) to constitute

special bench for hearing tax and

criminal cases

In an attempt to clear the piling

backlog of tax cases and to expedite

their disposal, the SC has constituted

a special bench to hear taxation

cases from March 9, 2015

onwards. It is estimated that tax

cases account for a fifth of the

pending litigations before the SC.

Source: Live Mint

be denied merely on account of the same being held by a bank or a financial

institution.

Source: Ministry of Finance Notification No 10 dated February 2, 2015

Reserve Bank of India (“RBI”) liberalizes norms relating to Foreign Currency

– Indian Rupee (“FCY-INR”) swap transactions

RBI has by its Circular dated February 13, 2015, has liberalized the norms relating

to FCY-INR swap transactions. The earlier regulations provided that eligible

residents can enter into FCY-INR swaps to hedge exchange rate / interest rate risk

exposures arising out of long term foreign currency borrowings subject to

operational guidelines. However, once such swap transactions were cancelled, it

was not permissible to re-book or re-enter into the transactions. The present

circular provides that in cases where the period of the underlying liability is still in

force, re-entering or re-booking of fresh swap contracts would be permitted for

hedging purposes, but only after the expiry of the tenor of the original swap

contract that had been cancelled.

Source: RBI Circular dated February 13, 2015

RBI toughens stand on defaulting exporters

Under the extant foreign exchange regulations, where an exporter of goods

receives an advance payment for shipment of goods, it is to be ensured that such

shipment is made within the period stipulated. On account of an increase in the

number and amount of advances remaining outstanding beyond such period, the

RBI by its Circular dated February 9, 2015 directed Authorized Dealer (“AD”)

Category-1 banks to follow up with exporters to ensure timely completion of

obligation. Further, AD bankers have also been directed to exercise proper due

diligence and ensure compliance with KYC and AML guidelines with a view to

ensure that only bonafide export advances flow into India. It has also advised the

banks to forward a list of chronic defaulters and doubtful cases to the Directorate of

Enforcement for further investigation.

Source: RBI Circular dated February 9, 2015

Indirect tax

Excise

An order in appeal merges with the adjudication order appealed against; no other

right of appeal can lie against the adjudication order on the same issue

Snippet

The taxpayer cleared certain pipes manufactured at its factory to the work site, for

execution of a turnkey contract and discharged excise duty liability with respect to

the manufactured pipes on cost plus basis, as applicable to captive

consumption. The adjudicating authority passed an order including the freight cost

of the manufactured pipes from factory gate to the work site in the assessable

value of the goods since that the pipes were captively consumed at the work site

and not at the factory gate.

The taxpayer preferred an appeal against this order before the Commissioner

(Appeals), who ruled in favour of taxpayer. The RA did not appeal against this

appellate order but preferred another appeal against the original order of

adjudicating authority before the Commissioner (Appeals), contending that excise

duty should be discharged by the taxpayer on the sale price of the pipes. The

taxpayer objected to this appeal filed by the RA on the ground that the appellate

order had merged with the adjudication order. However, the Commissioner

(Appeals) held that the issue raised by the RA was independent and the ‘doctrine

of merger’ would not apply. The Chennai Bench of the Customs, Excise and

Service Tax Appellate Tribunal (“CESTAT”) was of the view that the doctrine of

merger would apply. The HC observed that the core issue raised by the RA and

the taxpayer was the same ie levy of excise duty on the cost of production and thus

the order of the Commissioner (Appeals) should be treated as merged with the

original order, thereby extinguishing any other right to appeal against the original

order.

CCE, Chennai vs The Indian Humes & Pipe Co Ltd, CESTAT (Civil

Miscellaneous Appeal No.2749 of 2008) (HC, Madras)

Banding single soap packs into combo packs amounts to 'manufacture',; job work

exemption is not available if principal manufacturer claims area based exemption

The taxpayer was engaged in the activity of banding single unit soaps into multi-

piece combo packs for Hindustan Unilever Ltd (”HUL”). The banding tapes used

by the taxpayer were pre-printed with the brand name and the MRP of the combo

pack. The taxpayer paid service tax on the banding activity. Separately, HUL had

obtained an area based exemption for the manufacturing activities carried out by it

under Notification No. 50/2003-CE dated June 10, 2003. The RA contended that

the activity carried out by the taxpayer is a ‘deemed manufacture’ and thus is liable

to excise duty. The CESTAT observed as follows:

• The activities of the taxpayer would amount to ‘manufacture’ as a job worker

and not as a service provider; however, it would not be entitled to the benefit of

SC to adjudicate what constitutes

‘reasonable time’ to be declared as

an asessee in default

The provisions of section 201 of the

Income-tax Act, 1961 (“Act”) provides

that a person would be declared as an

“assessee in default” for failure to

withhold, or remit after withholding,

appropriate taxes. The provision does

not however prescribe a time period

for passing such an order. Further,

there have also been divergent views

have taken by different High Courts

on this issue. In this backdrop, the

SC has admitted an appeal filed by

the IT Department, and is poised to

adjudicate what would constitute

“reasonable time” for declaring an

assessee as an assessee-in-default.

Source: Financial Express

exemption from excise duty (as a job worker) as the principal manufacturer was

claiming area based exemption;

• Since the taxpayer was under the bona fide belief that it was not a

manufacturer, and considering the fact that it obtained registration under the

Finance Act, 1994 and that it made requisite declaration under notification

50/2003, albeit incomplete, there was no suppression of information.

The question of eligibility of the taxpayer to the area-based excise exemption was

remanded to the adjudicating authority and it was ordered that the service tax paid

by the taxpayer should be refunded on application by the taxpayer.

M/s Vasantham Enterprises vs CCE, Chandigarh (Appeal No. E/3130/2009-

EX[DB]) (CESTAT, New Delhi)

Issue of separate debit notes is sufficient proof that freight charges do not form part

of the assessable value

The taxpayer is a manufacturer and sold goods from the factory gate. The

taxpayer made arrangement for transportation of the goods to its customers’

premises and collected the amounts charged by the transporter by separately

issuing debit notes to the customers. The RA contended that since the

transportation charges were not separately disclosed on the original invoices

raised to customers, the same would amount to a violation under Rule 5 of Central

Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000 and

therefore the exclusion of such charged from assessable value would not be

allowable. The CESTAT relied on the decision in the case of CCE vs. Garware

Enterprises Ltd [2014 (301) ELT 349 (Tri. Mum)] and observed as follows:

• Rule 5 of the Excise Valuation Rules mandates separate disclosure of

transportation charges on the invoice with the intent to exclude such amount

from the assessable value;

• The taxpayer had issued separate debit notes for the amount of freight paid by

them to the transporters and thus the freight charges do not form part of the

assessable value.

CCE, Mumbai-III vs Emerson Network Power (I) Ltd (Appeal No.E/936, 937/05

–Mum) (CESTAT, Mumbai)

VAT/ CST

Snippet

Government launches ‘e-Biz’ portal

to facilitate ease of doing business

The Government of India has

launched a single window portal

called ‘E-biz’ to facilitate faster

clearances for doing business and to

integrate the services offered by

multiple regulatory agencies at a

central location. The portal will provide

access to at least 13 services from

various agencies such as Ministry of

Corporate Affairs (such as checking

name availability, Director

Identification Number etc.) Central

Board of Direct Taxes (such as PAN/ /

TAN applications), Reserve Bank of

India (“RBI)”, Employees' Provident

Fund Organisation and Directorate

General of Foreign Trade at a single

place.

Source: Economic Times

Supreme Court (“SC”) upholds imposition of sales tax on the goods involved in

processing and supplying of photographs, photo prints and photonegatives

The taxpayer challenged the constitutional validity of Entry 25 of Schedule VI of

Karnataka Sales Tax Act, 1957 (“KST Act”), which was introduced to levy of VAT

on works contract in nature of processing and supplying of photographs, photo

prints and photo negatives, with retrospective effect from July 01, 1989. The

taxpayer also sought to challenge retrospective application of said entry as being

violative of Article 265 of the Constitution of India.

After delving into the legislative history of works contract amendments and plethora

of landmark judicial decisions on the issue, the SC observed that post insertion of

clause 29A in Article 366 of the Constitution of India, works contract (which was

indivisible) could be bifurcated into two contracts, one for sale of goods and other

for provision of service. Thus sales tax could be levied on the goods component of

a works contract. Further, it was also observed that in case of transactions

covered under Article 366(29A) of Constitution of India, the dominant nature test

cannot be applied to determine the nature of the transaction.

In view of these observations, the SC held that entry 25 of Schedule VI of the KST

Act imposing VAT on processing and supplying of photographs, photo prints and

photonegatives is constitutionally valid. With respect to retrospective application of

aforesaid entry, the SC held that the legislature has powers to introduce a

retrospective amendment and that the same cannot be challenged.

State of Karnataka vs M/s Pro Lab & Others (Civil Appeal No. 1145 OF 2006)

(SC)

‘Work Station’ for a software developer is an accessory for manufacturing/

processing of goods and not a ‘furniture’; ITC is not restricted under Karnataka

VAT

The taxpayer was engaged in the business of development and sale of computer

software, and provision of technical consultancy services. The taxpayer purchased

work stations and availed input tax credit (“ITC”) on the same. The RA sought to

disallow such ITC on the ground that work stations qualified as ‘furniture’ on which

ITC was specifically restricted under Schedule 5 of the Karnataka Value Added

Tax, 2003 (“KVAT Act”). As per the KVAT Act, the only exception to the aforesaid

rule was when the restricted goods were used for resale or further manufacturing

process.

The HC observed that in the absence of a definition of ‘furniture’ under the KVAT

Act, the term has to be interpreted in the common parlance, without imposing a

Snippet

Series of steps need to be taken for

service tax and excise for the

smooth rollout of the Goods and

Services Tax (“GST”)

Minister of State for Finance, Jayant

Sinha, made a statement that rollout

of the GST would require more

changes on the service tax front,

besides tinkering in excise duties, to

bring them at par with the proposed

tax regime.

Source: Business Standard

scientific or technical meaning. The HC further observed that a ‘work station’

designed for scientific or engineering applications and used to sit and operate a

computer with all accessories cannot be interpreted to be a generic piece of

furniture like chairs, table, etc, Thus the HC held that a ‘workstation’ is an

accessory for use in the manufacture or processing of goods for sale on which ITC

was available without restriction.

State of Karnataka vs M/s Infosys Technologies Limited (STRP NOS.7/2011 &

64-69/2011 & 113-121/11 & STRP 103/11 & 217-236/2011) (HC, Karnataka)

In case of turnkey contracts, the State where the contract is executed is not

competent to levy tax on inter-state procurements and imports

The taxpayer was awarded a contract under International Competitive Bidding for

supply and installation of a turnkey project by its client. The taxpayer entered into

three different contracts with its client wherein the first contract was for import of

plant and machinery, second was inter-state / intra-state procurement of plant and

machinery and third was for provision of service in the turnkey contract. The

taxpayer paid applicable taxes on import, inter-state and intra-state procurements

of plant and machinery and service tax on services rendered during the execution

of contract.

The RA sought to levy VAT on supplies made under the contract by way of import

and inter-state procurement on the basis that the taxpayer executed a composite

contract in the State of West Bengal.

The Calcutta HC observed that after forty-sixth amendment in the Constitution,

works contract is capable of being bifurcated into a supply contract and a service

contract. It was also observed that it is not a universal rule that if the works

contract is on the turn key basis, it cannot be segregated and taxed

separately. The HC held that whether a turnkey contract can be segregated or not

would depend on language of contracts and the intention of the parties entering

into such contract.

The HC observed that the RA had not examined the true nature of the transaction

and simply proceeded on the fact that the contracts are on a turnkey basis and

partakes the character of invisible and inseparable works contract exigible to the

sales tax. The HC remanded the matter back to the RA to re-consider the issue in

light of the observations of HC.

Reliance Infrastructure Ltd & Anr vs Deputy Commissioner, Sales Tax & Anr

(Writ Petition No. 24939 (W) of 2012 with CAN 10009 of 2014) (HC, Calcutta)

Snippet

Engineering Export Promotion

Council (“EEPC India”) appreciates

the budget proposals since it

boosts manufacturing

EEPC India has appreciated the

budget proposals as it would increase

the manufacturing capabilities of the

country. As per EEPC, the priority to

Digital India and the boost to

electronic hardware are the right

initiatives towards `Make in

India'. The EEPC has urged the

Government to come up with the

Foreign Trade Policy and list out

priorities and measures for boosting

exports, which can give create jobs

while boosting manufacturing.

Source: Business Line

Permitting subsidiaries to use the brand name of the parent amounts to transfer of

right to use goods

The taxpayer is the principal or holding company in the group of companies mainly

referred to as TATA companies and collectively belonging to House of

‘TATA’. With a view to systematically enhance the brand equity and legally protect

the word TATA, the taxpayer entered into TATA Brand Equity and Business

Promotion Agreement (“Brand Agreement”) with the subsidiary companies. The

said agreement provided for guidelines for use of the ‘TATA’ name in the course of

business by the subsidiary companies.

The RA alleged that allowing the subsidiary companies to use the brand name is

liable to tax under the Maharashtra Sales Tax on the Transfer of Right to use any

Goods for any Purpose Act, 1985 (“TRUG Act) and accordingly demand was

raised on the taxpayer. The demand raised was further upheld by the first and

second level appellate authorities.

In the appeal before the HC, the taxpayer contended that the Brand Agreement

has been executed to protect the brand / equity by disallowing abuse or misuse, by

placing certain constraints on the use of the same. Thus, no transfer of right to use

trademark and name was involved. Also, tax under the TRUG Act is leviable on

exclusive transfer of right to use any goods and not on conditional transfer.

The HC held that the transaction between the taxpayer and the subscribers of the

Brand Agreement envisage that there is a transfer of right to use goods and

observed as follows:

• The TRUG Act nowhere restricts the levy of tax on exclusive transfer of right to

use goods only. Even conditional transfer of right to use goods would come

under the ambit of the said act; and

• The decision in the case of BSNL is not applicable to the facts and

circumstances in the case of the taxpayer. Further, the decision in the case of

Duke Sons Private Limited is not bad in law since it has been consistently

applied subsequent to the BSNL decision.

Tata Sons Limited vs State of Maharashtra (Writ Petition No.2818 OF 2012)

(HC, Bombay)

Multifunction network printers qualify as computer peripherals

The taxpayer claimed that image runner ie multifunctional printers (“MFP”) sold by

them fall under the entry covering ‘computers… and its peripherals…’, thereby

Snippet

Customs duty cut on components

not enough for consumer

electronic products

The Budget may have cut customs

duty on components used in premium

consumer electronic products such as

OLED televisions, frost-free

refrigerators and microwave ovens to

promote the 'Make in India' initiative,

but the industry says the steps would

not lead to any significant investment

since the market for these goods is

too small to make local manufacturing

viable.

Source: The Economic Times

attracting VAT at rate of 4 percent. The taxpayer contended that the predominant

function of the Image Runner printer is printing documents. The RA contended

that there was no specific entry which covered MFP and thus the VAT rate

applicable is 12 percent. The contention of the RA was upheld by the CESTAT

stating that hold that the functions of Image Runner, such as xerox and photo

copying, fax machine are clearly mentioned in Part D Entry 14(iv).

The Madras HC referred to the decision of the SC in the case of Xerox India

Limited [2010 (260) ELT 161 (SC)], wherein it was held that MLP serves as input

and output of computer and would be covered under tariff heading 8471 60 which

covers ‘Printers in Automatic Inter Processing Machine (ADD)’ instead of

classifying it under others category. Further, while deciding the matter the SC laid

emphasis on the predominant use of the instrument. The HC observed that MFP is

an input output device that works in conjunction with the computer and also has got

scanning facility for the very same function of input and output device and

therefore, it is clearly a "peripheral" of computers.

M/s Canon India (P) Ltd vs State of Tamil Nadu (Tax Case (Revision) Nos.94

to 96 of 2014) (HC, Madras)

Stock transfer to depots outside the State for further sale to sole distributor is an

interstate sale

The taxpayer is a joint venture company engaged in the manufacture and sale of

products. The products were sold through a sole distributor, who was also one of

the partners to the joint venture company. The taxpayer transferred majority of the

manufactured goods to its various branches and depots outside the State for

further sale to the sole distributor. The branches / depots of the manufacturer were

located adjacent to the depot of the sole distributor. The taxpayer claimed that the

movement of goods to its branch / depots were stock transfers and did not pay any

tax on such movement. The taxpayer discharged the local VAT on the sale made

to its sole distributor from its branch / depot in each State

The RA contended that the movement of goods from factory of taxpayer to its

branches / depots is not a stock transfer but inter-state sale of goods to its sole

distributor. In order to support its contention, the RA relied on the distributor

agreement wherein it was agreed that the sole distributor would periodically place

an order on the taxpayer for selling of taxpayer’s products throughout

India. Accordingly, the taxpayer transferred requisite quantity of goods to its

branches / depots in each State for further sale to its sole distributor.

The CESTAT observed that although the respective branch of taxpayer had issued

the Form F for each movement of goods from factory to its braches/depots,

Snippet

however, the lorry receipts of the goods transported were signed by the sole

distributor. Accordingly, the CESTAT held that the movement of pre-identified

goods from the taxpayer’s factory to various depots / branches was pursuant to the

distribution agreement between the taxpayer and the sole distributor and that such

transfer was an interstate sale of goods liable to CST.

M/s Kimberly Clark Lever (P) Ltd vs The State of Maharashtra (VAT Appeal No

59 OF 2011 & VAT APPEAL No. 423 of 2013) (MSTT, Mumbai)

Service tax

CENVAT Credit available on acquired technical knowhow despite delays in

initializing production activity

The taxpayer acquired technical know-how for the purpose of manufacturing

pharmaceuticals. The payment for acquiring such technical knowhow was

discharged in entirety and CENVAT Credit on the same was availed, however the

production activity was not started by the taxpayer. The RA disputed the availment

of CENVAT Credit on such technical know-how on the ground that know-how was

a ‘ready to use’ service and non-initialization of the production activity within a

reasonable period of time (4 years in the present case) would render such credit

inadmissible. The Commissioner (Appeals) also denied such credit on this ground

and held that the same may be available when the production process is started

and know-how is utilized.

The CESTAT observed that technical know-how once obtained, begins to be

utilized right from the time of necessary setting-up required for manufacturing the

product. The CESTAT drew an analogy with a factory and observed that the time

lag in setting up of a factory and actual production can be quite long, and the

Commissioner (Appeals) has failed to lay down the yardstick for determining what

should be a reasonable period for starting production. The CESTAT placed

reliance on the CESTAT ruling in the case of Cadila Health Care Ltd. vs CCE

[2010 (17) STR (Tribunal)], and held that CENVAT Credit was eligible on technical

know-how.

Indswift Laboratories Ltd vs CCE & ST, Chandigarh – II (Appeal

No.ST/52950/2014-CU[DB]) (CESTAT, New Delhi)

When proportionate credit is already reversed but without intimation, enforcing

Rule 6(3A) of the Credit Rules is not warranted

The taxpayer availed credit on input services used for providing both taxable and

exempt services and reversed proportionate credit in terms of Rule 6(3)(ii) of the

Govt announces Rs 850 crore

package for Andhra

The NDA government announced a

financial and special development

package for the industrial sector of both,

Andhra Pradesh (AP) and

Telangana. The package includes Rs

500 crore as 'ad hoc support' to bridge

the resource gap for the current

financial year, as well as Rs 350 crore

as special development package for

backward areas in Rayalaseema and

north coastal districts. Since Rs 500 is

only an ad hoc support, the AP

government is hopeful of more funds.

Source: Times of India

Credit Rules at the end of the year. However, the taxpayer neither filed any

intimation before adopting the said method as required in terms of Rule 6(3A) of

the Credit Rules, nor the duty was reversed provisionally every month. The RA

denied the benefit of proportionate reversal of credit to the taxpayer since the

conditions prescribed under Rule 6(3A) were not met and demanded service tax,

based on an amount equivalent to 8%/ 6% of the value of exempt service.

The CESTAT held that the amount reversed by the taxpayer has not been disputed

by the RA and therefore it would be too harsh to raise an additional demand on the

taxpayer only on account of non-compliance of procedural requirement as per Rule

6(3A). Further, it was held that since the taxpayer has reversed the proportionate

credit, the intent to evade payment is not established and no penalty can be

imposed.

M/s Rathi Daga vs Commissioner of Central Exicse, Nashik (Appeal No.

ST/03/12) (CESTAT, Mumbai)

Service tax is not applicable on free service of cars provided by dealerships to car

buyers

The taxpayer operated an authorized service station for cars manufactured by

Maruti Udyog Limited (“MUL”). The taxpayer provided free services to its

customers ie car buyers that purchased cars manufactured by MUL. The taxpayer

engaged drivers for providing servicing to its customers through mobile-vans. The

salaries payable to such drivers was reimbursed to the taxpayer by MUL. The RA

sought to levy service tax on such salary reimbursements on the ground that the

amount constituted consideration for free services provided by the taxpayer to the

car buyers.

The CESTAT observed that provision of free service to customers was part of the

function and duties of the taxpayer, who are entitled to dealership commission and

that the recipient of such free services was the customer of the taxpayer and not

MUL. The CESTAT held that the amount reimbursed to the taxpayer for salary of

drivers is not liable to service tax for provision of authorized service station

services.

CCE, Indore vs Jabalpur Motors Limited (Final Order No. ST/A/52771/2014-

CU(DB)) (CESTAT, New Delhi)

Service tax paid on services wholly consumed within Special Economic Zone

(“SEZ”) can be claimed as refund; claim of upfront exemption not mandatory

Snippet

Highlights of the 14th Finance

Commission report

Creation of autonomous and

independent GST Compensation

fund to give comfort to states for

revenue losses suffered in the

initial years of GST implementation

Increase in the share of states of

the divisible pool to 42 percent

The taxpayer, an SEZ unit, received certain services from a service provider

situated outside the SEZ and paid service tax thereon. The taxpayer claimed

refund of the service tax paid which was also granted by the adjudicating

authorities. The RA contended that the services received by the taxpayer were

wholly consumed within SEZ and were eligible for upfront exemption and therefore,

the grant of refund by the adjudicating authorities was erroneous.

The CESTAT observed that the SEZ Act, 2005 provides that all services imported

into an SEZ to carry on authorized operations shall be exempt from service tax and

that SEZ Act has an overriding effect as prescribed under section 51 of the SEZ

Act. The CESTAT referred to the ruling in the case of Intas Pharma Ltd vs

Commissioner of Service Tax Ahmedabad [2012 (32) STR 543 (Tri-Ahmd.) and

held that refund cannot be denied for procedural infraction of having paid the

Service Tax which ought not to have been paid by the Service provider.

Eon Kharadi Infrastructure Private Limited vs CCE, Pune – III (Appeal No.

ST/20012012-Mum) (CESTAT, Mumbai)

Provision of technical knowhow is not taxable under the category of ‘consulting

engineer services’; service tax cannot be demanded from the overseas service

provider who does not have an establishment in India

The taxpayer is a company incorporated and operating from USA. During the

Financial Year (“FY”) 2003-04, the taxpayer provided technical know-how to an

Indian company for manufacturing bearings and also for up-gradation of

technology for better quality of products. As consideration, the taxpayer received

royalty from the Indian company. The RA demanded service tax from the

taxpayer, in response to which the taxpayer submitted that the liability to pay

service tax falls on the service recipient located in India and not on the taxpayer

(which is a company located abroad not having any branch or establishment in

India and which had provided the services from abroad). However, the plea of the

taxpayer was not accepted by the RA.

The CESTAT held that the service provided by the taxpayer was in the nature of

transfer of technology for manufacture of products, that such services are in the

nature of ‘Intellectual property services’ and not ‘consulting engineering services’

and that intellectual property services were not taxable during the period in

dispute. Further, relying on the decisions of Mumbai CESTAT in the cases of

Philcorp Pte Ltd v CCE, Goa [2007 (7) STR 266 (Tribunal-Mumbai)] and Relax

Safety Industries & Others v CC, Mumbai [2002 (53) RLT 1100 (CEGAT-Mumbai)]

the CESTAT held that service tax, if any, could be demanded only from the service

recipient on a reverse charge basis and not from the taxpayer who did not have

any branch / establishment in India,.

Setting up an independent council

to undertake assessment of fiscal

policy implications of Budget

proposals

Source: Report of the Fourteenth

Finance Commission

Snippet

CCE, Jaipur - I vs Brenco Incorporated (Final Order No. ST/A/52765/2014-

CU(DB)) (CESTAT, New Delhi)

Customs

Refund of Terminal Excise Duty available in case of supplies made by a DTA unit

to a 100 percent Export Oriented Unit (“EOU”)

The taxpayer cleared goods to a 100 percent Export Oriented Unit (“EOU”) on

payment of central excise duty. The taxpayer sought refund of the excise duty

paid, on the ground that the supplies to an EOU qualified as a ‘deemed exports’ in

terms of Para 8.2(b) of the Foreign Trade Policy, 2009-2014 (“FTP”) and such

supplies to EOU are entitled to terminal excise duty refund. The claim of refund

was rejected by the Director General of Foreign Trade (“DGFT”) on the ground that

supplies to an EOU are eligible for exemption from payment of terminal excise

duty, subject to CT3 procedures. Subsequently the taxpayer filed a representation

before the Policy Interpretation Committee of the DGFT for an interpretation, where

also the taxpayer did not get relief as it was ruled that a policy interpretation was

not required.

The HC allowed the writ petition filed by the taxpayer against the order of the

DGFT. The HC relied on the decision of the Delhi HC in the case of Kandoi Metal

Powders Manufacturing Company Private Limited vs Union of India (2014-VIL-41-

DEL-CE), wherein it was held that supplies made to EOUs are to be regarded as

deemed exports and where the supplies are not made against ICB, the supplied

would be eligible for refund of terminal excise duty.

M/s Raja Crowns And Cans Pvt Ltd vs Union of India and Others (Writ

Petition No. 1468 of 2013) (HC, Madras)

Exemption unavailable when imported equipment is diverted in violation of the

actual-user condition

The taxpayer imported certain road construction machinery from outside India and

claimed exemption under Notification 21/ 2002 – Cus dated March 1, 2002. The

taxpayer furnished work orders from Mumbai Metropolitan Regional Development

Authority (“MMRDA”) and a contract entered into with the State Government of

Gujarat for construction of the Surat-Dhulia road. The taxpayer executed a bond

with the Custom authorities to use the imported machinery exclusively for

construction of roads and declared not to sell/ dispose-off the machinery in any

manner within a period of 5 years. However, the imported machinery was used by

the taxpayer only for one and a half years, and thereafter the machinery was given

Service tax blow for spectrum, coal

bidders

As all services provided by the

government to business entities would

be taxable, companies bidding for

telecom spectrum and coal blocks may

attract service tax. Eight telecom

companies have already deposited Rs

20,436 crore as earnest money for

participating in the sale of 2G and 3G

telecom airwaves, with the government

expected to earn at least Rs 80,000

crore. Service tax on the same could

bring an additional Rs 11,200 crore of

revenue to the government. Similarly

coal block allocations are expected to

bring in Rs 14,000 crore revenue.

Source: Business standard

on hire on a monthly hire charge. The RA contended that the taxpayer had

violated conditions of the aforesaid notification and demanded duty.

Basis the findings in the case of Shreeji Constructions [2013-TIOL-441-CESTAT-

MUM], the CESTAT held that MMRDA would not qualify as a road construction

company as required under the notification and thus the taxpayer was not entitled

for exemption under the notification ab-initio. The CESTAT also held that the

taxpayer violated the actual user condition prescribed for the period of five years

from the date of importation.

Rajhoo Barot, Atlanta Limited vs Commissioner of Customs (Import), Mumbai

(Appeal Nos C/967 & 968/2009) (CESTAT, Mumbai)

Key Notifications / Circulars

Adjudication of cases by Principal Director General of Central Excise

Intelligence

Vide this Notification it was specified that principal director general of central excise

intelligence shall have jurisdiction over the principal commissioners /

commissioners of service tax or the principal commissioners / commissioner of

central excise, for assigning show cause notices issued by the directorate general

of central excise intelligence for adjudication. A circular explaining the changes

introduced by the Notification has also being issued

Source: Notification No. 02/2015-ST dated February 10, 2015, Notification No.

02/2015- Central Excise (N.T) dated February 10, 2015 and Circular No.

994/01/2015-CX dated February 10, 2015

Drawback rates amended for various products

Drawback rates of products ranging from articles of leather, paper procuts,

footwear, articles of iron and steel neuclear reactors etc have been amended. A

circular has also been issued to clarify the amendments in entires and drawback

rates

Source: Notification No. 20/2015-Customs (N.T.) dated February 10, 2015,

Notification No. 21/2015-Customs (N.T.) dated February 10, 2015 and Circular

no 6/2015- Customs dated February 11, 2015

Amnesty Scheme notified under Rajasthan Value Added Tax Act, 2003

Snippet

With increase in rate of service tax,

services to get costlier

With an increase in service tax rate to

14 percent, whole lot of services

including air travel, hotel stays, eating

out and paying bills are set to become

costlier. As per the Finance Minister,

the rate increase is to facilitate a

smooth transition to levy of tax on

services by both the Centre and the

states.

Source: The Hindu

Snippet

Amensty scheme notified in Rajasthan which would apply to demands created upto

5 crores prior to March 31, 2011 under:

• The Rajasthan Sales Tax Act, 1954

• The Rajasthan Sales Tax Act, 1994

• The Rajasthan Value Added Tax Act, 2003 Act

• The Central Sales Tax Act, 1956

or demands which are under dispute and cases have been filed by the applicant or

by the Department on or before December 31, 2013.

The main benefit under the scheme is waiver of interest and penalty subject to

payment of whole amount of tax due and fulfilment of certain conditions.

Source: Notification No. F.12(16)FD/Tax/2009-188 dated February 09, 2015

Finance Ministry issues policy framework to set up Finance SEZ

Ministry of Finance issues policy framework to set up Finance Special Economic

Zones (SEZs) to make India a global hub of Financial Services

Source: Policy Framework for Finance SEZs dated February 6, 2015

Industries such as electronics,

medical devices, metals, fertilisers,

etc. likely to gain with a series of

cuts in customs and excise duties

announced in Budget 2015

To promote domestic manufacturing

and ‘Make in India’ for creation of jobs,

finance minister has announced cuts

on customs duty on certain inputs like

metal parts, insulated wires and cables,

refrigerators compressor parts,

compounds used in catalytic converters

and sulphuric acid for use in

manufacture of fertilisers and

compounds of video

cameras. Similarly, basic customs duty

is also being reduced on certain raw

materials used in lathe machines,

medical video endoscopes,

telecommunication grade optical fibre

cables and LCD/LED TV

panels. Additional duty of customs in

lieu of excise and VAT has been

exempted on specified raw materials

for use in the manufacture of

pacemakers.

Source: Business Standard

BMR Business Solutions Pvt. Ltd.

36B, Dr. RK Shirodkar Marg, Parel, Mumbai 400012, India

Tel: +91 22 6135 7000 | Fax: +91 22 6135 7070

BMR and Community

BMR has a strong commitment to good citizenship and community service. We are as dedicated to community work as we are to client

work. Wherever appropriate we partner with our clients in fulfilling our social responsibility. Through the firm’s ‘Go Green Initiative’ we

adopt environment friendly practices at our work place. The firm actively supports SOS Children’s Village, Indian Red Cross Society and

MillionTrees Gurgaon campaign. For more details on our social and environmental responsibility programme, click here.

Disclaimer:

This newsletter has been prepared for clients and Firm personnel only. It provides general information and guidance as on date of

preparation and does not express views or expert opinions of BMR Advisors. The newsletter is meant for general guidance and no

responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this newsletter will be

accepted by BMR Advisors. It is recommended that professional advice be sought based on the specific facts and circumstances. This

newsletter does not substitute the need to refer to the original pronouncements.

Copyright 2015. BMR Business Solutions Pvt. Ltd. All Rights Reserved

In case, you do not wish to receive this newsletter, click here to unsubscribe