Bloomberg businessweek

description

Transcript of Bloomberg businessweek

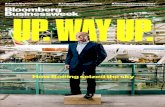

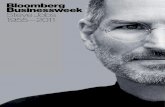

- 1. September 5 September 11,2011Bloomberg BusinessWeekAT9:03A.M.ONSEPTEMBER 11,2001, BRITTNEWHOUSESTOOD INTHE LOBBYONTHE 52NDFLOOR OFTHE SOUTHTOWER OFTHEWORLDTRADE

2. CENTER.AFTERUNITEDAIRLINESFLIGHT 175BANKEDABOVE THEHARBORBEHINDHIM, ITWASPOINTEDAT THE50THFLOOR. IFNOTTRIMMED 3. CORRECTLY, ANAIRPLANEWILLRISE AS ITACCELERATES, ANDTHE MANWHO HADKILLEDANDREPLACEDTHEAIRPLANESPILOTADDEDPOWER 4. UNTIL HEHIT THESOUTHTOWER 24FLOORSABOVENEWHOUSE. HEDOESNTREMEMBERTHE SOUNDOF THEIMPACT.At the time,hurricaneNewhouseoranranGuyearthquake-Carpenters causesAmericaslosses on aoperation.largeGuy number ofCarpenter policies.brokers Re-reinsurance insurance,treaties, in essence,which is insuranceprotect forinsurersinsurers.whena Consumcatastrophers donte-a tend to 5. know whatultimatelyreinsuranceresponsibleis because foreveryit never new thingtouchesthat Godthem can comedirectly.up with. AsReinsurers,losses grewmassivelythis decade,capitalizedyearbyand oftenyear,named afterreinsurersthe places have beenwhere they working towere figure outfounded- what theyCologne Re,can do toHannover make theRe, Munich God clauseRe, Swisssmaller, toRe-makereduce theirtheir living exposure.thinking They haveabout thebillions ofthings thatdollars atalmost stake. Theyneverareveryhappen and good atarethinkingdevastatingabout thewhen theyworld todo. Butcome.even Lloyds,reinsurers thecan be London-surprised. basedAndthe companyinsurers thatwho make inventedup their the modernmarket put professionthem on theofhook for insurance,everything,publishes afor all theyearly listrisks that of what itstretch thecallslimitsof "RealisticimaginationDisaster. This isScenarios."what the Thelistindustry imaginescasually such eventsrefers to as astwothe"Godconsecutiveclause": AtlanticReinsurers seaboardarewindstorms oran earthquake at the New Madrid fault in the Mississippi Valley, eitherof which could strain or break an insurers balance 6. sheet.Byhull2001, insuranceLloyds had for thealready planes,envisionedpropertytwo airliners insurancecolliding andover a city,workmanslaunching comp onclaims on 7. September 5 September 11,2011Bloomberg BusinessWeekthe ground, and life insurance everywhere. But even Lloydsfor cyclonic storms. No, he explained, little of that value was in-lacked the imagination to anticipate September 11. "People sured. "Honestly," said someone else, "Ive never understoodfind it hard to believe in a risk unless they can see it in theirwhy those people dont just leave. Its a dangerous place."mind," says Trevor Maynard, head of exposure managementBy definition, reinsurers work at the edge of suffering, andfor Lloyds. "When you try and describe a risk like this-someso have developed euphemisms to help them stand at a dis-terrorists are going to teach themselves how to fly a plane, tance. A catastrophe is called a "loss event." A catastrophe bigthey will fly into property, the buildings will be weakened-by enough to affect several reinsurers is called an "industry lossthe time you get to your third point, peoples eyes are glaz-event." Reinsurers both need and fear these. The first dedicat-ing over." ed reinsurer, Cologne Re, formed after a fire leveled about aFloors 49 through 54 of the south tower housed Guy quarter of the city of Hamburg, Germany, in 1842. A loss eventCarpenters home office and its 750 employees. To any of reminds insurers of the value of the product; reinsurers canNewhouses clients-insurers-professional employees in an raise rates, and the higher rates attract new capital. Accordingoffice tower would have presented an attractive bet in terms to Dowling & Partners, an investment adviser for the insuranceof risk and reward. There are few slips and falls in white-collarindustry, after Hurricane Andrew ran across southern Flori-work and not much dangerous equipment lying around. New- da in 1992, eight new reinsurers entered the market, togetherhouse indulges in mild profanity and, thinking like a broker,valued at $2.9 billion. Although hurricanes seem frequent, theoften lapses without warning into the voice of his customers insurance industry defines them as "low frequency" events;as they think about risk. "If I insure 40 of these firms in twothere are perhaps 10 a year and not tens of thousands. Unliketowers across 200 floors, probably the worst is that eight ofcar accidents, you cannot look at the last decade of hurricanethem, maybe six of them, could be involved in the same loss,"results and predict this years losses with any accuracy.he says. "Because the fire department can get there... usually Andrews $25 billion in losses, along with the then-newa fire never spreads, historically, beyond six floors."availability of cheaper computing power, helped push insur-The insurance industry describes these kinds of risks as ers and reinsurers toward computer-driven modeling, which"high frequency": The more often a kind of accident occurs,leaned on meteorology and seismology to more preciselythe easier it is to guess its chance of happening and the easier define potential losses by estimating storm paths and cate-it is to price insurance coverage. For slips, lawsuits, and fires, gories and fault lines and tremor strengths. The models arehistorical trends predict future probability. "What they hadntsophisticated, but reality is wily.imagined," says Newhouse, picking his words carefully, "wasAfter September 11, another eight new reinsurers followedan intentional act of human causative agency." the higher rates and entered the market, together valued at Guy Carpenter lost 29 employees on September 11. When S8.6 billion. Hurricanes Katrina, Rita, and Wilma lured fivethe plane hit his building, most of Newhouses employees weremore new reinsurers with $5 billion in capital. Between catas-well below him or out of the tower already. Guy Carpenterstrophes, the new capacity drives premiums back down andchief executive officer had traveled to an annual conference inreinsurers are forced to undervalue risks to stay in ^^Monte Carlo, leaving Newhouse as the most senior manager.After American Airlines Flight 11 hit the north tower, he toldeveryone to leave. The company had been in the World TradeCenter in 1993 when a bomb exploded below the north tower.His employees did not need to be reminded that the worldwas a dangerous place, even if the buildings collapse still lay youtside of the realm of imagination. By the time Newhousereached the plaza level, a cordon of police officers waited todirect him through the mall below. When he got back to streetlevel both towers were still standing. The hole in the northtower glowed, he says, like a dragon in a cave. He saw the chaos on the ground beneath the towers andlooked for a Hudson River ferry. He had no trouble gettingon board; there was no rush. "There were people hangingaround," he says, "working their cell phones and watching."They were still there in the streets, watching, when his ferrybacked out and the floors of the south tower began to collapseand accelerate down. Until that second, they hadnt believedthat anything more could happen to them. No experience offear drove them to get far away, as fast as they could, until itwas too late. I was standing there, too. I survived by dumb luck.In the fall of 1998 I started a job in New York with one ofthe worlds largest reinsurers. Soon after, at a meeting in a con-ference room above Park Avenue, someone complained that themarket for reinsurance had gone soft. "What we need," he said,"is a good catastrophe." It was a joke, but true, too. I offeredthat a cyclone had hit Bangladesh and it had been an active year 8. September 5 September 11,2011Bloomberg BusinessWeekthe market. Vincent J. Dowling of Dowling & Partners refers tothis as the "cheating phase" of the cycle. That is, even thoughcatastrophes present an existential threat to insurers, and thesober assessment of risk is a firm-defining competency, insur-ers, like people, can get complacent."The psychology piece dominates, even in boardrooms,"NOTHING SAYSTHEREsays David Bresch. "People measure against the perceived re-ality around them and not against possible futures."Bresch is in charge of sustainability and risk managementfor Swiss Re, founded in 1863 after a city fire in Glarus, Swit- CANT BE 10 WORLD TRADEzerland, and now the worlds second-largest reinsurer. "If thegap between modeled reality and perceived reality is too big,"says Bresch, "that tells you something about the market shareyoud like to achieve." In other words, what the models show CENTER EVENTS IN A YEAR,"as a best guess of a risk may not be what the insurers perceivethe risk to be, and it can take more than just data alone to scareinsurers into paying for risks at a rate that keeps reinsurerssolvent over the long term. That takes an industry loss event. SAYS TRILOVSZKY.It takes a catastrophe.Heike Trilovszky runs corporate underwriting for MunichRe, the worlds largest reinsurer. The afternoon of Septem-ber 11, the press and the companys shareholders needed to "THERE CANNOT BE Aknow what Munich Res losses would be. "To get answers wehad to ask the brokers." she says. "Aon Benfield, Guy Carpen-ter, they had offices in those buildings. It was odd. Is my coun-terpart still alive?" Before the end of the week, Munich had MATHEMATICAL MODEL FORan initial estimate. In October, Trilovszky was at an off-sitemeeting when a board member arrived late. He had seen therevised loss estimate and he was pale. "We will survive," hesaid, "but its serious." Munich Res losses after September 11 PEOPLE LIKE BIN LADEN"be one of them. Most reinsurance treaties renew on Jan. 1 andultimately came to S2.2 billion.the meeting oriented itself around a new question: What doReinsurance treaties are full of exclusions, but before Sep-we do on 1/1/2002? "There were 15 managers, all with a back-tember 11 terrorism was not considered significant enough toground in property," says Trilovszky. "We had flip chart paperand we put it on the floor. We were kneeling on the floor, work-ing out concepts, brainstorming ideas ... that was the MunichRe strategy for terrorism risk in the first days after 9/11." InCOOLD WE INTEREST YOU IN A POLICY?INSURED LOSSES*BY CATEGORYFor the insurance industry at least, you can put a price on tragedy: According to Swiss Res catastrophe statistics, natures wrath andman-made disasters cost society approximately S218 billion in 2010. France 447s loss over the Pacific,In the transit damage. Airyear that included insurers paid out around $2.1b in 9. While the Indonesian earthquakeand tsunami of 2004 claimed morein property and businessinterruption coverage.September11 cost than 220,000 lives, Hurricane insurers around S23.1b Katrina was far more costly to Explosions or fires, including atinsurers at S72.3b.a sugar refinery, oil pipeline, and mattress factory, amounted to more than S5.3b in insured2001 damage.2002 2003 2004 2005 200620072008 2009 2010KEY: * Storms/floodsEarthquakes/tsunamis Transit/shipping/aviation accidents Major fires/explosions Terrorism/crime/misc. 10. September 5 September 11,2011 Bloomberg BusinessWeek2002,ask history for thehis low-frequencyNew- the company They remind him when approaching a reinsurer about a clientReinsurers keeps somerest of a collection ofModels existwith in underwritesays risks"The him prefer theindustry," risks they I togetherwhy to reinsurance industry, Newhouse of office the industrywroteasthe broker, theout Trade come oilbomb- insured value to hear, speak, and say no evil. The monkeys are all gifts, givencan name; suchrisk we ofthat everything inofsuch terrorism World cover Centerwith anhouse, after the a"is kindisany treatyin sets a failed monkeys, treaty called a "named plaster hurricanes, earthquakes, and spills,of greater than $50afterears,prices every what Trilovszky calls to him to rebuild a much larger collection that was lost whenperils" 1993 until overraise Terrorism terrorismbut ofthey hands million. mouths, and eyes.catastrophe to Far more often, however,one. ing with dont exist catastrophe. Then three cover. either the for for is theTrilovszky it." Until sign an all-perilswas motivated people, his last office disappeared."nonfortuitous." excludehave ofaterrorism frommarket forcesdoesnt thefrom a few angry, forwe rewrite to It stems acts coverage or them to Sixties there cover. model noand nothing says thereHe looks atus if they can Center eventsAlthoughcrashes. "Would it hurtrisks thatifal-airplane reinsurers can exclude World Tradehours clause-a time limit-on damage crashes coverage altogether. cant be 10 me as hein aclaimedfor frequent?aIt all-perils she says. model," she Swiss Res global headquarters face Lake Zurich, over-ready know to me fromcannotout for myselfthebecamelikeyear.be to figure it be a mathematicalbe single about from an would," treaty-an would more "There hurricane. Now sosays,of is is 96 hours.notexample-theyitcannotact doesnt haveImfor it. "Becausebeen a re-"As it terrorism, say sure we ever wasntstandard people like Newhouse has he "for now, to bin Laden."had alooking a small yacht harbor. Bresch and a colleague, Andreasexclude what Donald 35 years. Every new Itsproperty losshe says,Rumsfeldbefore adding,insurance broker for an aircraft crash. in- big enough," from pausing might call an Schraft, sometimes walk the 20 minutes to theunknown unknown. ThatsnewGod clause. thetheoretical. It lives within the event, of ex-dustry loss event-every thean error he "economically." The cost of catastrophe-istrain station together after work, past moremodels dictates how much second somethingthe biggest inhave." The the industry spends plains, we his career, he likes to say, and heyachts, an arboretum, and a series of bridges.unexpected happens, though, its it. "Im notknows by now that every catastrophe longer on understanding and preventing no teach- In September 2005, probably on one of thesetheoretical or unimaginable. it," hewant to bees the industrydidnt react to you adds, "but saying people something. "Ifwalks, the two began to discuss what they nowable know, if [an event], if youlife is threatened you to price your companys want to be able call "Faktor K," for "Kultur": the culture factor.to buildsizeindustryloss, a capital base that can by the an of the and youre going to reactLosses from Hurricanes Katrina, Rita, andhandledifferently." much it... then youd better figure out a way Wilma had been much higher than expectedto define it. Then capital can be accumulatedin ways the existing windstorm models hadntto deal with it."predicted, and it wasnt because they were far off 2005 September Andrew on wind velocities. 1992 $14.87Costliest 2004 Hurricane Charley2005$24.87billionetIvan 2005U.S., Mexico, Rita 2004 disaster Katrina2011Hurricane U.S. 1994earthquake, Top 10 billionWilma HurricaneNorthridge 2008 Hurricane U.S.,Jamaica, Haiti,11 Ike$20.48 billion U.S.,$23.13 billion al$14.02 billion $72.3 billion $11.26 $20.6 $9.29 $235eOQ~~0Otsunami, nuclearGulf ofearthquake1970DisastersU.S. Cuba andMexico,Since U.S.,JapanBahamas Caribbean,Cuba, Jamaica, et alU.S. Barbados, et al The problem had to do more with how people on the Gulf Coast were assessing wind- storm risk as a group. Mangrove swamps on the Louisiana coast had been cut down and used as fertilizer, stripping away a barrier that could have sapped the storm of some of its energy. Levees were underbuilt, not over- built. Reinsurers and modeling firms had fo- cused on technology and the natural scienc-I es; they were missing lessons from economists and social scientists. "We cant just add anoth- m er bell and whistle to the model," says Bresch. "Its about how societies tolerate risk.""We approach a lot of things as much aswe can from the point of statistics and harddata," says David Smith, head of model devel-opment for Eqecat, a natural hazards mod-eling firm. "Its not the perfect expression."The discrepancy between the loss his firmmodeled for Katrina and the ultimate claims-based loss number for his clients was the larg-est Smith had seen. Like others in the industry.Eqecat had failed to anticipate the extent oflevee failure. Construction quality in the Gulfstates before Katrina was poorer than antici-pated, and Eqecat was surprised by a surgein demand after the storm that inflated pricesfor labor and materials to rebuild. Smith rec-ognizes that these are questions for sociolo-gists and economists as well as engineers, andhe consults with the softer sciences to get hismodels right. But his own market has its de-mands, too. "The more we can base the modelon empirical data," he says, "the more defend-able it is."After their walk around the lake in 2005,Swiss Res Bresch and Schraft began meetingwith social scientists and laying out two goals.First, they wanted to better understand the cul-ture factor and, ultimately, the risks they wereunderwriting. Second, they wanted to use thatunderstanding to help the insured preventlosses before they had to be paid for.The business of insurers and reinsur-T Damage estimates for 2011 Hurricane Irene have not yet been totaled 11. September 5 September 11,2011Bloomberg BusinessWeekerTop 10 DeadliestsDisasters Since 1970r 1970 Bholadeaths300,000 deaths255,000 cyclone 2010 earthquake1976 Tangshan222,570e0 0Bangladeshearthquake ChinaHaitistsonbalan2005 Kashmir20081970 Ancash 2004 Boxing Day 220,000deaths 2008 tropical 138,000 deaths 138,300 deaths 1991 tropical66,000 deaths73,300 Sichuan87,449Greatc o0O AfghanistanPakistan,tsunami et alIndia,Gorky Indonesia, Peru earthquake BangladeshChina Thailand, cyclone Nargis Burmaingariskbe-tweentwoextremes.Iftheriski 12. sntprobableenough,orthepotentiallossisntexpensiveenough,there 13. snoreasonforanyonetobuyinsuranceforit.Ifitstooprobableand 14. thelosstooexpensive,thepremiumwillbeunaffordable.Thisisbadfo 15. rboththeinsuredandtheinsur-er.Sotheinsuranceindustryhasanint 16. erestinwhatitcalls"lossmitigation."Itencouragespoten-tialcustom 17. erstokeeptheirprop-ertyfrombeingdestroyedinthefirstplace.IfS 18. wissReistryingtoaffectthebehavioroftheprop-ertyownersitunder 19. writes,itssendingasignal:Somebehaviorissoriskythatitshardt 20. oprice.Keepitup,andyoullhavenoin-suranceandwellhavenobusi 21. -ness.Thatsbadforeveryone. Tothatend,SwissRe 2010 Northern55,630 deaths >hHemisphere summerRussiaasstart-edspeakin 22. gaboutclimaterisk,notclimatechange.Thatthecli-mateischangingh 23. asbeenestab-lishedintheeyesoftheindustry."Foralongtime,"says 24. Bresch,"peoplethoughtweonlyneededtododetailedmodelingtotruly 25. understandinaspecificregionhowtheclimatewillchange....Youcan 26. dothatforever."Inmanyplaces,hesays,climatechangeisonlypartof 27. thestory.Theotherpartiseconomicdevelopment.Inotherwords,were 28. buildinginthewrongplacesinthewrongway,sowrongthatwhatwebui 29. ldoftenisnteveninsurable.Inaninter-viewpublishedbySwissRe,Wo 30. lfDombrowsky,oftheDisasterRe-searchCenteratKielUniversityinGer 31. many,pointsoutthatitswrongtosaythatanaturaldisas-terdestroye 32. dsomething;thede-structionwasnotnaturesfaultbutourown. In 1888 the city ofSundsvall in Sweden, builtof wood, burned to theground. A group ofreinsurers, Swiss Re amongthem, let Swedens insurersknow there was going tobe a limit in the future on 33. losses from woodenhouses, and it was goingto be low. Sweden beganbuildingwith stone.Reinsurance is a product,but also a carrot in thenegotiation between cultureand reality; it lets societiesknow what habits areunsustainable. More recently, thecompany has been workingwith McKin-sey & Co., theEuropean Commission, andseveral environmentalgroups to develop amethodology it calls the"economics of climateadaptation," a way toencourage city planners to.-);:"-build in a way thatwill be insurable in thefuture. A studyDATA: SWISS RE; PHOTO: OLIVIER LABANMATTEI/AFP/GETTY IMAGES 34. September 5 September 11,2011Bloomberg BusinessWeekof the U.K. port of Hull looks at potential losses by 2030 under ent perspective: The companies that buy insurance are com-several different climate scenarios. Even under the most ex- plaining, she says, that insurers and reinsurers have capital buttreme, losses were expected to grow by $17 million due to cli- arent willing enough to take on new business risks, such as themate change and by $23 million due to economic growth. How risk of a compromised brand or stolen intellectual property.Hull builds in the next two decades matters more to it than theLike many reinsurers, Munich Re underwrites a line calledlevels of carbon dioxide in the air. A similar study for Entergy,"contingent business interruption." Essentially, if for somea New Orleans-based utility, concluded that adaptations on reason a supplier fails to produce a crucial pan for a factory,the Gulf Coast-such as tightening building codes, restoringbusiness interruption insurance covers the factorys owner.wetlands and barrier islands, building levees around chemi-The earthquake off the coast of Japan this March happenedcal plants, and requiring that new homes in high-risk areas be on a Friday; on Saturday, Trilovszky was doing research on anelevated-could almost completely offset the predicted cost ofinitial loss assessment when she discovered that a technology100-year storms happening every 40 years.company in Louisiana had already stopped operations. It hadAs with Swedens stone houses, all of these adaptations cost run out of chips. "That," she says, "was my eye-opener."more money in the short run, but reinsurers must take the Reinsurers are already exposed to a loss after a naturallong view, and they can drag development along with them.catastrophe. But given the complexity of global supply chains,The public, whom the reinsurers refer to as "the original in-its hard to tell exactly how much more loss will come fromsured," should be concerned by these hints. Even when they business interruptions elsewhere in the world. Two seeminglyare forced to sign all-perils covers, reinsurers are writing moreuncorrelated risks-an earthquake in Japan and a tech firm inknown risks out of their treaties. Swiss Re publishes an annualLouisiana-are now related. Losses gather mass and complex-report on catastrophe losses; since the 1970s losses have been ity on their way toward reinsurers, which serve as a garbageincreasing exponentially. Its this graph that gives reinsurersbin for systemic risk. Reinsurers havent yet figured out howpause. The God clause includes less each year because everyto respond to the problem of contingent business interruptionloss event-every catastrophe-reminds them of the hubris of after a catastrophe. "The easy thing to do is, we dont coverthinking God doesnt have any surprises left.this," Trilovszky says. "The question is to adjust the product soMunich Res Trilovszky offers a similar point from a differ- its still useful for the insured but possible for the insurer." A Japanese soldier rescues an elder in Natori after the March 2011 earthquake and tsunami 35. September 5 September 11,2011Bloomberg BusinessWeek IN JAPAN, STONE TABLETS MARK THE HIGH-WATER MARKS OF PAST TSUNAMIS. THEY ALL SEND THE SAME MESSAGE: WHEN WE ARE GONE, REMEMBER THIS FLOOD. AND PREPARE FOR THE NEXT ONEYou could think of politicians as underwriters, too. Like tower began to fall, it just didnt occur to me that anythingBresch and Trilovszky, they must compare the probabilities of worse could happen. Its a simple story. I wasnt worried aboutlow-frequency events, weighing the risk of a downturn against terrorism. And now I am.a sovereign default, or of Chinese imperial ambition againstIn December 2001,1 was working late, back up on the 47thmore small wars in the Middle East, or of climate changefloor, when the fire alarm rang. I bolted from my desk andagainst the cost of regulation. past a break room where two janitors were still sitting. "DontReinsurers, however, have no incentive to mislead. Theirwe need to leave?" I asked. "Theyll tell us if we have to," theychoices on risk, with billions of dollars at stake, are necessarily said. I ran, alone, down 47 flights of stairs and emerged on thealigned with the pursuit of truth. If a reinsurer is more scaredstreet without wallet, coat, or keys. There was no fire. I spentof a risk than it should be, its shareholders will punish it. Ifthe night with friends. I had overpriced the risk of terrorism.it is less scared than it should be, the world, eventually, willCatastrophes do not surprise all societies equally. Gre;break it. There are rewards for politicians, corporations, thinkBankoff, an historian at the University of Hull in Britain, hastanks, and activists who dissemble about risk. There are none defined for the Philippines a "culture of risk," a set of adapta-for reinsurers. If theyre taking on less of it than their insur- tions built around the constant threat of natural disaster. Ag-ers would like them to, then the world is more dangerous than ricultural systems in the Philippines focus on minimizing losswere willing to admit. What a reinsurer will underwrite, then, rather than maximizing yield. The islands developed a kindoffers a marker, one edge of what Bresch calls the gap betweenof low, buttressed "earthquake baroque" style for stone build-modeled and perceived reality. For instance, no event of theings. Communities are quick to relocate out of danger.last 10 years-the invasion of Iraq, the reelection of George W. In a paper this year on risk culture in Western Europe, his-Bush, the surge, the election of Barack Obama, or the death torian Christian Pfister of the University of Bern in Switzerlandof Osama bin Laden-has persuaded the reinsurance industry details how towns pass on memories of disaster. A stone houseto budge from its stance on terrorism risk on Jan. 1, 2002. For in Wertheim, Germany, sits on the Tauber River, painted withthose with billions waged on getting it right, terrorism is now the dates and levels of floods back to 1621. Storm tide markersa constant, and almost impossible to cover. dot the North Sea coast. In 1606 the farmers of Italys AostaValley built a chapel near the glacier that delivered regularBy 20O1,1 was working as a consultant for another reinsurer,floods and began a procession to it every July. And on JapansConverium. The company kept its U.S. front office on the 47th east coast, stone tablets mark the high-water marks of tsuna-floor of One Chase Manhattan Plaza at the corner of Nassaumis. They all send the same message: When we are gone, re-and Cedar streets. I did several stupid things on September 11. member this flood. And prepare for the next one.I already knew an airplane had hit a tower when I got on theFrom Newhouses office you can see, near the reception-subway to go to work. I learned of the second plane while I ist, a monument to the 29 Guy Carpenter employees who werewas still on the train, got off at my stop, and walked four blockskilled on September 11. It stands about five feet high, in pol-closer. I bumped into my 9 a.m. meeting in the lobby of One ished wood, inscribed with 29 names and topped with a crys-Chase. He told me we had been sent home and started walking tal flame. Newhouse is now Guy Carpenters CEO. When I tellnorth. I rode the elevators 47 stories up, since I figured I wouldhim that I was downtown on September 11, he reaches into aneed my laptop. I called my mother and told her I was safe. box below his desk and gives me a pin hed had made for staffI rode the elevator back down and walked a block closer and clients: the towers of the World Trade Center, wrappeduntil I was separated from the south tower by a small park. Asin a single black ribbon. I mention the tsunami stones, manyNewhouse stepped onto a boat for New Jersey, I stood and lis- of which had been ignored in the burst of economic activitytened to news on the radio of a limousine parked with its win-in Japan that followed World War II. Commerce grows alongdows down, and I watched. When the south tower began to dangerous places, on rivers and coastlines. Is it possible, I ask,fall the ash was thick, black, and moving fast, and I assumed,that theres a value to forgetting? He pauses. "If the stone isbriefly, that I was going to die. And then I didnt. Maps of Sep- there the stone is there," he says, "but 500 years of upside,tember 11 victims show bodies recovered on that block at thewith the absolute certainty that its going to be the generationcorner of Cedar and Broadway. I ran, found a hole in the dust after me, not me, that gets drowned-thats human nature,that was the door to Two Chase Plaza, and I lived. Until theisnt it?"