Birla Insurance Group 2015 · 15 40 65 90 115 140 4.0 5.0 6.0 7.0 8.0 9.0 10 .0 Ma Jan-15 Feb-15...

Transcript of Birla Insurance Group 2015 · 15 40 65 90 115 140 4.0 5.0 6.0 7.0 8.0 9.0 10 .0 Ma Jan-15 Feb-15...

April 2015

Index

Fund Managers Profile

Fund Performance

Secure Fund

Stable Fund

Growth Fund

Money Market Fund

Income Advantage Fund

Gilt Fund

Bond Fund

Fixed Interest Fund

Short Term Debt Fund

Pg 1

Pg 3

Pg 4

Pg 5

Pg 6

Pg 7

Pg 8

Pg 9

Pg 10

Pg 11

Pg 12

Pg 13

Pg 14

as on 30th April 2015

Growth Advantage Fund

Market Outlook

Market Update

1

Economy Review

RBI in its April Monetary policy review left the policy rates unchanged. RBI expressed its discomfort on

the fact that there was no transmission of policy rates despite a weak credit off-take. Following the RBI

policy meet, many of the commercial banks announced a cut in their base rate of 25 basis points. As

per RBI, the further rate cuts will depend upon - 1) Lower inflation especially food, effect of recent rains

and monsoon outlook, 2) Government action on deficit and reforms and 3) US Fed rate actions.

Moody's – a leading global rating agency upgraded India's outlook to 'positive' from 'stable'.

The Indian Met Department (IMD) has released its first forecast for the upcoming monsoon, predicting

below-normal rainfall (93% of normal). Please see table below for details –

The IMD pegged the overall probability of below-normal or deficient rainfall at 68% (33% - deficient +

35% - below normal).

On the political side, the government takes more measures to ease supply bottlenecks. We expect a

continued reduction in the number of stalled/shelved projects and an increase in revived projects. The

government is also looking to get clearance from both the houses of parliament of the Land Acquisition

bill and the GST bill in the month of May.

Key Economic Indicators

35

Rainfall Range (% of LPA)

CategoryForecastprobability(%)

Deficient

Below Normal

Normal

Above Normal

Excess

<90

90 - 96

96 - 104

104 - 110

>110

33

28

3

1

Negative growth in IIP

-0.50%

0.00%

0.50%

1.00%

1.50%

Feb-15 Mar-15

IIP

Slowdown in PMI

50

50.5

51

51.5

52

52.5

53

53.5

Services PMI Manufacturing PMI

Mar-15

Apr-15

WPI and CPI continue the downward trend

-3.00%

-2.00%

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

WPI CPI

Feb-15

Mar-15

Market Update

2

Outlook for Equities

The markets lost 3.5% in April. The apparent reason a) weak corporate earnings b) tax department

notices to FIIs on MAT, and c) expectations of a weak monsoon. FIIs emerged as net buyers to the tune

of $1.2bn in Apr 15. This took their CYTD tally to $7.2bn. DIIs were net buyers in the order of $1.8bn. We

believe that the current correction should be used by long term investors as buying opportunity. Equities

do not look expensive with Sensex currently at 13.8 multiple of FY17 earnings. We expect significant

gains in equity funds for long term investors.

Outlook for Debt

The bond yields have moved up by 10 basis points in the month of April. The fall in yields was mainly in

anticipation of higher inflation in the coming months due to unseasonal rains and below normal

monsoons. Structural liquidity is however at comfortable levels. The 10 years Government bond yields

have increased to 7.85% levels. We expect 10 year G-sec yield to be in the range of 7.75% - 8.00%. The

corporate bond yields are expected to trail the G-sec market with a spread of 35-40 basis points.

RBI is likely to cut rates by a further 50 bps during the year. The yield on the 10 year government bond

can be expected to ease to 7% by the end of FY-16. This will result in significant gains for our investors in

debt funds.

30-Apr-15 31-Mar-15 % ChangeINDEX

Nifty

Sensex

BSE 100

Dow Jones

Hang Seng

Nikkei

Nasdaq

8181.50 8491.00 -3.65%

27011.31 27957.49 -3.38%

8321.56 8606.60 -3.31%

17840.52 17776.12 0.36%

19520.01 19206.99 1.63%

28133.00 24900.89 12.98%

4941.42 4900.89 0.83%

bps

Key Indices

10 year G-Sec

5 Year G-Sec

91 Day T Bill

364 day T-Bill

MIBOR

Call Rates

30-Apr-15 31-Mar-15 % Change

7.86% 7.74% 1.53%

7.88% 7.75% 1.65%

7.92% 8.27% -4.42%

7.90% 7.93% -0.38%

8.09% 8.76% -8.28%

7.51% 7.80% -3.86%

BSE NSE

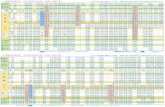

5 year AAA Corporate Bond Spread10 Yr G-Sec Yield

Pe

rce

nta

ge

(%)

15

40

65

90

115

140

4.0

5.0

6.0

7.0

8.0

9.0

10 .0

Jan-1

5

Feb-1

5

Mar-

15

Ma

r-1

4

Ap

r-1

4

Ma

y-1

4

Ju

n-1

4

Jul-1

4

Au

g-1

4

Oct

-14

Se

p-1

4

No

v-1

4

De

c-1

4

Ap

r-1

5

3000

4000

5000

6000

7000

8000

9000

10000

11000

16000

18000

20000

22000

24000

26000

28000

30000

Jan-1

5

Feb-1

5

Mar-

15

Ma

r-14

Ap

r-14

Ma

y-14

Ju

n-1

4

Jul-14

Au

g-1

4

Oct

-14

Sep-1

4

Nov-

14

De

c-14

Apr-

15

Fund Managers Profile

Mr. Sameer Mistry

Mr. Parin Vora

Mr. Sameer Mistry joined BSLI in January 2009. He has over 15 years of experience in Equity Research and Fund Management. Prior to joining us, he worked as a Fund Manager with Reliance Capital Asset Management, Tata Mutual Fund and SBI Life Insurance. Sameer has done his BE (Electronics & Telecom) as well as an MBA in Finance.

Mr. Sameer Mistry - Fund Manager – Equity

Mr. Parin S Vora has been with BSLI since October 2007 and is primarily responsible for Fixed Income trading and Fund Management. He has 15 years of experience in Fixed Income Industry and was associated with Birla Sun Life Securities & Mata Securities. Parin has done his MBA in Finance from Welingkar’s Institute of Management and DPMIR from Narsee Monjee Institute of Management studies.

Mr. Parin S Vora - Chief Manager – Investments

3

Fund Performance as on 30th April 2015

Group Funds Figures in percentage (%)

Fund Name Benchmark CompositionSecureStableGrowthGrowth AdvantageMoney MarketIncome AdvantageFixed InterestShort Term Debt FundBond Fund

Gilt Fund

BSE 100BSE 100BSE 100BSE 100

-----

-

Crisil Composite Bond Index Crisil Composite Bond IndexCrisil Composite Bond IndexCrisil Composite Bond Index

-Crisil Composite Bond IndexCrisil Composite Bond IndexCrisil Short Term Bond IndexCrisil AAA long term index & Crisil AA short term index

-

Crisil Liquid Fund IndexCrisil Liquid Fund IndexCrisil Liquid Fund IndexCrisil Liquid Fund IndexCrisil Liquid Fund IndexCrisil Liquid Fund IndexCrisil Liquid Fund Index

CRISIL Liquid Fund Index

Disclaimer:This document is issued by BSLI. While all reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. This document is for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any investment strategy, nor does it constitute any prediction of likely future movements in NAVs. Past performance is not necessarily indicative of future performance. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Birla Sun Life Insurance Company Limited, nor any person connected with it, accepts any liability arising from the use of this document. You are advised to make your own independent judgment with respect to any matter contained herein. The investment risk in investment portfolio is borne by the policyholder. The name of the funds do not in any way indicate their quality, future prospects or returns. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions Insurance is the subject matter of solicitation.BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS: IRDA clarifies to public that IRDA or its officials do not involve inactivities like sale of any kind of insurance or financial products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.

ULGF00212/06/01BSLGSECURE109ULGF00312/06/01BSLGSTABLE109ULGF00112/06/01BSLGGROWTH109ULGF01026/11/07BSLIGGRADV109ULGF00824/08/04BSLIGRMMKT109ULGF01425/02/10BSLGINCADV109ULGF00416/07/02BSLGFIXINT109ULGF01322/09/08BSLGSHTDBT109ULGF00530/05/03BSLIGRBOND109

ULGF00630/05/03BSLIGRGILT109

SFIN

4

Absolute Return

CAGR

ReturnsPeriod

Absolute Return

CAGR

Returns Money Market Fund

Short Term Debt Fund

BM BM BMPeriod

1 month

3 months

6 months

1 Year

2 Years

3 Years

4 Years

5 Years

Since Inception

Absolute Return

CAGR

Returns Gilt Fund Bond Fund Fixed Interest Fund

BM BMPeriod

-0.31%

-0.20%

7.00%

15.54%

7.36%

9.34%

8.33%

7.44%

7.04%

1 month

3 months

6 months

1 Year

2 Years

3 Years

4 Years

5 Years

Since Inception

1 month

3 months

6 months

1 Year

2 Years

3 Years

4 Years

5 Years

Since Inception

Secure Fund BM Stable Fund BM Growth Advantage

BM BMGrowth Fund

Income Advantage Fund

-0.41% -0.42%

0.08% -0.24%

5.25% 3.93%

16.46% 13.57%

10.76% 9.16%

11.16% 9.65%

9.32% 8.42%

8.43% 7.69%

10.95% 7.40%

-0.82% -0.91%

-0.50% -1.33%

4.89% 3.09%

19.33% 15.10%

12.77% 10.54%

12.62% 10.64%

9.75% 8.51%

8.86% 7.81%

13.70% 8.82%

-1.21% -1.40%

-1.15% -2.42%

4.63% 2.25%

22.41% 16.61%

14.92% 11.88%

14.07% 11.60%

10.04% 8.56%

9.21% 7.88%

15.26% 10.36%

-1.54% -1.73%

-1.50% -3.14%

4.90% 1.68%

24.84% 17.60%

16.59% 12.76%

15.43% 12.22%

10.90% 8.56%

10.11% 7.90%

13.62% 7.77%

0.65% 0.54%

1.98% 1.81%

4.11% 3.64%

8.58% 7.71%

8.81% 7.98%

9.10% 7.89%

9.13% 7.96%

8.85% 7.59%

9.45% 7.04%

0.51% 0.47%

1.62% 1.71%

4.33% 4.15%

9.06% 8.95%

8.61% 8.04%

9.35% 8.34%

9.38% 8.29%

8.82% 7.55%

8.94% 7.10%

0.04% 0.23%

0.80% 1.22%

5.80% 5.03%

13.27% 11.50%

8.73% 7.29%

10.04% 8.28%

10.76% 8.22%

9.70% 7.44%

9.80% 7.52%

0.37% 0.25%

1.44% 1.28%

4.82% 4.69%

11.29% 10.89%

8.72% 7.89%

10.14% 8.79%

10.04% 8.66%

9.25% 7.61%

10.99% 8.33%

-0.12% 0.23%

0.60% 1.22%

6.29% 5.03%

13.68% 11.50%

9.55% 7.29%

10.94% 8.28%

10.62% 8.22%

9.77% 7.45%

8.97% 5.32%

Asset held as on 3 ` 1009.09cr0th April 2015:

GOVERNMENT SECURITIES: 47.40%

9.23% Government Of India 2043 6.88%

8.6% Government Of India 2028 6.82%

8.83% Government Of India 2023 6.64%

7.16% Government Of India 2023 5.60%

8.83% Government Of India 2041 2.52%

8.33% Government Of India 2026 2.27%

9.2% Government Of India 2030 1.65%

8.79% Government Of India 2021 1.58%

8.13% Government Of India 2022 1.56%

8.26% Government Of India 2027 1.48%

Other Government Securities 10.40%

8.9% Steel Authority Of India Ltd. 2019 1.97%

8.57% REC Ltd. 2024 1.56%

9.25% PGC Of India Ltd. 2019 1.13%

9.15% ICICI Bank Ltd. 2022 1.03%

9% Tata Capital Financial Services

Limited 2017 0.99%

9.95% Tata Motors Ltd. 2020 0.92%

8.58% HDFC Ltd. 2018 0.85%

9.95% Family Credit Limited 2016 0.70%

8% MVM Limited 2017 0.66%

9.6% L&T Finance Ltd. 2016 0.65%

Other Corporate Debt 13.74%

ICICI Bank Ltd. 1.44%

HDFC Bank Ltd. 1.42%

Infosys Ltd. 1.27%

Tata Motors Ltd. 0.98%

Larsen&Toubro Ltd. 0.88%

Reliance Industries Ltd. 0.84%

State Bank Of India 0.78%

Axis Bank Ltd. 0.77%

HDFC Ltd. 0.72%

Tata Consultancy Services Ltd. 0.71%

Other Equity 9.86%

RATING PROFILE

Exposure to Equities has slightly increased to 19.67 from 19.05%, exposure to G-Secs has increased to 47.40% from 46.89% while that to MMI has decreased to 8.74 from 11.01% on a MOM basis. Over 91% of the debt portfolio remains invested in highest rated instruments.The fund is predominantly invested in large cap stocks and maintains a well diversified equity portfolio.

%

%

Modified Duration: 5.71 years

EQUITY: 19.67%

NAV as on 30th April 2015: 42.25`

CORPORATE DEBT: 24.19%

Maturity Profile

ASSET ALLOCATION

MMI, : 8.74%Deposits, CBLO & Others

Objective:

Strategy:

To build your capital and generate better returns at moderate level of risk, over a medium or long-term period through a balance of investment in equity and debt.

Generate better return with moderate level of risk through active management of fixed income portfolio and focus on creating long term equity portfolio which will enhance yield of composite portfolio with low level of risk appetite.

Fund Snapshot Know the Fund Better

Group Secure FundFund Manager: Sameer Mistry (Equity) & Parin Vora (Debt) | Total Experience: 15 years &15 years

ULGF00212/06/01BSLGSECURE109

Benchmark: BSE 100 & Crisil Composite Bond Index & Crisil Liquid Fund Index

SECTORAL ALLOCATION

Portfolio as on Thursday, April 30, 2015

Maturity Profile

Date of Inception: 19-Jun-01

0.69%AA-AAA

24.68%

65.94%

Sovereign

0.60%A+

A1+0.43%

1.41%AA

AA+6.24%

47.40%G-Secs

MMI, Deposits, CBLO & Others

8.74%

NCD24.19%

EQUITY19.67%

Secure BM

5

1.02%

1.09%

1.16%

2.59%

2.60%

2.94%

3.33%

5.49%

6.10%

7.95%

8.01%

9.58%

10.72%

12.99%

24.43%

RETAILING

LOGISTICS

MANUFACTURING

OTHERS

TELECOMMUNICATION

CEMENT

METAL

FMCG

CAPITAL GOODS

FINANCIAL SERVICES

OIL AND GAS

AUTOMOBILE

PHARMACEUTICALS

SOFTWARE / IT

BANKING

7 years & above2 to 7 years

Less than 2years

60.25%

22.42%

17.33%

Ma

y-0

7

Oct

-07

Ma

r-0

8

Au

g-0

8

Jan

-09

Jun

-09

No

v-0

9

Ap

r-1

0

Se

p-1

0

Fe

b-1

1

Jul-11

De

c-11

Ma

y-1

2

Oct

-12

Ma

r-1

3

Au

g-1

3

Jan

-14

Jun

-14

No

v-1

4

Ap

r-1

5

Asset held as on 3 306.17cr0th April 2015: `

RATING PROFILE

Over 97% of the debt portfolio remains invested in highest rated instruments.The fund is predominantly invested in large cap stocks and maintains a well diversified equity portfolio. Top 4 equity sectors remain same as the previous month.

Modified Duration: 6.43 yearsNAV as on 30th April 2015: ` 57.84

SECTORAL ALLOCATION

Objective:

Strategy:

Helps you to grow your capital through enhanced returns over a medium to long term period through investments in equity and debt instruments, thereby providing a good balance between risk and return.

To earn capital appreciation by maintaining diversified equity portfolio and seek to earn regular return on fixed income portfolio by active management resulting in wealth creation for policyholders.

Fund Snapshot Know the Fund Better

Group Stable FundFund Manager: 15 years

Sameer Mistry (Equity) & Parin Vora (Debt) | Total Experience: 15 years &

ULGF00312/06/01BSLGSTABLE109

Benchmark: BSE 100 & Crisil Composite Bond Index & Crisil Liquid Fund Index

Portfolio as on Thursday, April 30, 2015

6

Date of Inception: 31-Aug-01

MMI, Deposits, CBLO & Others: 8.48%

NCD16.37%

AA1.25%

AAA25.34%

Sovereign

70.71%

AA+1.83%

34.42%

Equities

MMI, Deposits, CBLO & Others

8.48%

ASSET ALLOCATION

Maturity Profile

Stable BM

GOVERNMENT SECURITIES: 40.72%

9.23% Government Of India 2043 10.82%

8.83% Government Of India 2023 6.83%

8.28% Government Of India 2032 4.30%

8.79% Government Of India 2021 3.84%

8.6% Government Of India 2028 3.46%

8.33% Government Of India 2026 3.11%

8.08% Government Of India 2022 2.06%

8.3% Government Of India 2040 1.70%

7.16% Government Of India 2023 1.41%

8.26% Government Of India 2027 1.26%

Other Government Securities 1.95%

8.65% REC Ltd. 2019 3.22%

10.1% PGC Of India Ltd. 2017 1.69%

9.25% LIC Housing Finance Ltd. 2023 1.56%

9.4% NABARD 2016 0.99%

9.6% HDFC Ltd. 2016 0.99%

10.85% REC Ltd. 2018 0.87%

9.61% Power Finance Corpn. Ltd. 2021 0.86%

9.33% NABARD 2017 0.83%

11.25% Power Finance Corpn. Ltd. 2018 0.67%

10.15% Kotak Mahindra Prime Ltd. 2017 0.67%

Other Corporate Debt 4.02%

ICICI Bank Ltd. 2.53%

HDFC Bank Ltd. 2.51%

Infosys Ltd. 2.23%

Tata Motors Ltd. 1.73%

Larsen&Toubro Ltd. 1.54%

Reliance Industries Ltd. 1.43%

State Bank Of India 1.35%

Axis Bank Ltd. 1.28%

HDFC Ltd. 1.27%

Tata Consultancy Services Ltd. 1.24%

Other Equity 17.32%

EQUITY: 34.42%CORPORATE DEBT: 16.37%

40.72%G-Secs

1.02%

1.18%

2.66%

2.96%

3.39%

3.44%

5.52%

6.09%

7.83%

7.90%

9.70%

10.92%

13.07%

24.32%

RETAILING

MANUFACTURING

TELECOMMUNICATION

CEMENT

METAL

OTHERS

FMCG

CAPITAL GOODS

FINANCIAL SERVICES

OIL AND GAS

AUTOMOBILE

PHARMACEUTICALS

SOFTWARE / IT

BANKING

7 years & above2 to 7 years

Less than 2years

60.38%

24.03%

15.59%

A1+0.87%

De

c-0

6

Ma

y-0

7

Oct-

07

Ma

r-0

8

Au

g-0

8

Ja

n-0

9

Ju

n-0

9

No

v-0

9

Ap

r-1

0

Se

p-1

0

Fe

b-1

1

Ju

l-11

De

c-1

1

Ma

y-1

2

Oct-

12

Ma

r-1

3

Au

g-1

3

Ja

n-1

4

Ju

n-1

4

No

v-1

4

Ap

r-1

5

Asset held as on 3 432.05cr0th April 2015: `

GOVERNMENT SECURITIES: 32.06%

8.83% Government Of India 2023 8.43%

8.33% Government Of India 2026 4.17%

8.6% Government Of India 2028 2.94%

9.53% State Government Of Gujrat 2024 2.52%

8.79% Government Of India 2021 2.19%

9.23% Government Of India 2043 2.11%

8.2% Government Of India 2022 2.00%

8.28% Government Of India 2032 1.44%

7.16% Government Of India 2023 1.00%

7.95% Government Of India 2032 0.93%

Other Government Securities 4.34%

8.7% Power Finance Corpn. Ltd. 2020 1.97%

8.55% Power Finance Corpn. Ltd. 2021 1.86%

9.02% Rec Ltd. 2022 0.86%

10.15% Kotak Mahindra Prime Ltd. 2017 0.83%

NABARD 2017 0.81%

10.05% Can Fin Homes Ltd. 2017 0.78%

9.23% LIC Housing Finance Ltd. 2022 0.72%

9.46% Power Finance Corpn. Ltd. 2015 0.69%

7.6% HDFC Ltd. 2017 0.66%

11.25% Power Finance Corpn. Ltd. 2018 0.63%

Other Corporate Debt 4.70%

ICICI Bank Ltd. 3.61%

HDFC Bank Ltd. 3.58%

Infosys Ltd. 3.18%

Tata Motors Ltd. 2.47%

Larsen&Toubro Ltd. 2.20%

Reliance Industries Ltd. 2.11%

State Bank Of India 1.97%

Axis Bank Ltd. 1.86%

HDFC Ltd. 1.82%

Tata Consultancy Services Ltd. 1.77%

Other Equity 25.03%

RATING PROFILE

Over 96% of the debt portfolio remains invested in highest rated instruments.The fund is predominantly invested in large cap stocks and maintains a well diversified equity portfolio. Top 4 equity sectors remain same as the previous month.

Modified Duration: 5.54 years

EQUITY: 49.61%

NAV as on 30th April 2015: ` 69.71

CORPORATE DEBT: 14.51%

Maturity Profile

ASSET ALLOCATION

MMI, Deposits, CBLO & Others: 3.82%

SECTORAL ALLOCATION

Objective:

Strategy:

To achieve optimum balance between growth and stability to provide long-term capital appreciation with balanced level of risk by investing in fixed income securities and high quality equity security.

To ensure capital appreciation by simultaneously investing into fixed income securities and maintaining diversified equity portfolio. Active fund management is carried out to enhance policy holder’s wealth in long run.

Fund Snapshot Know the Fund Better

Group Growth Fund

ULGF00112/06/01BSLGGROWTH109

Benchmark: BSE 100 & Crisil Composite Bond Index & Crisil Liquid Fund Index

Portfolio as on Thursday, April 30, 2015

7

Date of Inception: 31-Aug-01

Fund Manager: 15 years

Sameer Mistry (Equity) & Parin Vora (Debt) | Total Experience: 15 years &

G-Secs

32.06%

49.61%

Equities

NCD

3.82%

MMI, Deposits, CBLO & Others14.51%

AAA

27.38%

68.84%

Sovereign

A+

0.99%

AA+

1.03%

AA

1.76%

Gr. Growth BM

1.01%

1.19%

2.69%

2.93%

3.47%

3.48%

5.50%

6.04%

7.89%

7.97%

9.70%

10.87%

12.98%

24.29%

RETAILING

MANUFACTURING

TELECOMMUNICATION

CEMENT

METAL

OTHERS

FMCG

CAPITAL GOODS

FINANCIAL SERVICES

OIL AND GAS

AUTOMOBILE

PHARMACEUTICALS

SOFTWARE / IT

BANKING

7 years & above2 to 7 years

Less than 2years

59.02%

32.91%

8.06%

De

c-0

6

Ma

y-0

7

Oct-

07

Ma

r-0

8

Au

g-0

8

Ja

n-0

9

Ju

n-0

9

No

v-0

9

Ap

r-1

0

Se

p-1

0

Fe

b-1

1

Ju

l-11

De

c-1

1

Ma

y-1

2

Oct-

12

Ma

r-1

3

Au

g-1

3

Ja

n-1

4

Ju

n-1

4

No

v-1

4

Ap

r-1

5

Asset held as on 3 39.23cr0th April 2015: `

GOVERNMENT SECURITIES: 28.57%

8.33% Government Of India 2026 6.57%

9.23% Government Of India 2043 5.82%

8.83% Government Of India 2023 4.04%

9.2% Government Of India 2030 2.82%

8.6% Government Of India 2028 2.70%

8.83% Government Of India 2041 2.23%

7.8% Government Of India 2021 1.65%

8.2% Government Of India 2022 0.70%

7.49% Government Of India 2017 0.63%

8.15% Government Of India 2022 0.39%

Other Government Securities 1.02%

9.05% Petronet LNG Ltd. 2019 2.59%

8.57% REC Ltd. 2024 2.58%

7.6% Power Finance Corpn. Ltd. 2015 1.27%

8.95% Bank Ltd. 2022 0.77%

8.7% Power Finance Corpn. Ltd. 2020 0.52%

11.95% HDFC Ltd. 2018 0.28%

HDFC

ICICI Bank Ltd. 4.35%

HDFC Bank Ltd. 4.31%

Infosys Ltd. 3.82%

Tata Motors Ltd. 2.97%

Larsen&Toubro Ltd. 2.64%

Reliance Industries Ltd. 2.51%

State Bank Of India 2.35%

Axis Bank Ltd. 2.21%

HDFC Ltd. 2.18%

Tata Consultancy Services Ltd. 2.13%

Other Equity 30.10%

RATING PROFILE

93% of the debt portfolio remains invested in highest rated instruments.The fund is predominantly invested in large cap stocks and maintains a well diversified equity portfolio. Top 4 equity sectors remain same as the previous month.

Modified Duration: 6.88 years

EQUITY: 59.57%

NAV as on 30th April 2015: ` 25.08

CORPORATE DEBT: 8.00%

Maturity Profile

ASSET ALLOCATION

MMI, Deposits, CBLO & Others: 3.87%

Gr. Advantage BM

SECTORAL ALLOCATION

Objective:

Strategy:

The Objective of the fund is to provide blend of fixed return by investing in debt & money market instruments and capital appreciation by predominantly investing in equities of fundamentally strong and large blue chip companies.

The Strategy of the fund is to build and actively manage a welldiversified equity portfolio of value & growth driven stocks by following a research-focused investment approach. While appreciating the high risk associated with equities, the fund would attempt to maximize the riskreturnpay-off for the long-term advantage of the policyholders. The nonequity portion of the fund will be invested in high rated debt and money market instruments and fixed deposits.

Fund Snapshot Know the Fund Better

Group Growth Advantage Fund

ULGF01026/11/07BSLIGGRADV109

Benchmark: BSE 100 & Crisil Composite Bond Index & Crisil Liquid Fund Index

Portfolio as on Thursday, April 30, 2015

8

Date of Inception: 18-Feb-08

Fund Manager: 15 years

Sameer Mistry (Equity) & Parin Vora (Debt) | Total Experience: 15 years &

59.57%

Equities

G-Secs

28.57

NCD

3.87%

MMI, Deposits, CBLO & Others8.00%

Sovereign

78.12%

AA+

7.07%

AAA

14.81%

1.01%

1.18%

2.75%

2.93%

3.44%

3.58%

5.40%

6.08%

7.94%

7.95%

9.68%

10.85%

12.97%

24.22%

RETAILING

MANUFACTURING

TELECOMMUNICATION

CEMENT

METAL

OTHERS

FMCG

CAPITAL GOODS

OIL AND GAS

FINANCIAL SERVICES

AUTOMOBILE

PHARMACEUTICALS

SOFTWARE / IT

BANKING

7 years & above2 to 7 years

Less than 2years

71.94%

15.81%

12.25%

Jan

-11

Ap

r-11

Jul-11

Oct

-11

Jan

-12

Ap

r-1

2

Jul-1

2

Oct

-12

Jan

-13

Ap

r-1

3

Jul-1

3

Oct

-13

Jan

-14

Ap

r-1

4

Jul-1

4

Oct

-14

Jan

-15

Ap

r-1

5

Asset held as on 3 117.10cr0th April 2015: `

100% of the fund is invested in highest rated instruments.The fund continues to maintain very low maturity profile.

Modified Duration:0.48 yearsNAV as on 30th April 2015: ` 24.87

Objective:

Strategy:

The primary objective of this BSLI Fund Option is to provide reasonable returns, at a high level of safety and liquidity for capital conservation for the Policyholder

The strategy of this BSLI Fund Option is to make judicious investments in high quality debt and money market instruments to protect capital of the Policyholder with very low level of risk.

Fund Snapshot Know the Fund Better

Group Money Market FundFund Manager: Parin Vora | Total Experience: 15 years

ULGF00824/08/04BSLIGRMMKT109

Benchmark: CRISIL Liquid Fund Index

Portfolio as on Thursday, April 30, 2015

9

Maturity Profile

Less than 2 years

100.00%

ASSET ALLOCATIONRATING PROFILE

MMI, Deposits, CBLO & Others: 100.00%

Date of Inception: 30-Mar-05

MMI

MM BM

100.00%

A1+

100.00%

Jan-1

1

Apr-

11

Jul-11

Oct-

11

Jan-1

2

Apr-

12

Jul-12

Oct-

12

Jan-1

3

Apr-

13

Jul-13

Oct-

13

Jan-1

4

Apr-

14

Jul-14

Oct-

14

Jan-1

5

Apr-

15

Exposure to Corporate Debt has decreased to 8.00% from 55.22% while that to MMI has decreased to 3.87% from 44.78% on a MOM basis. Over 91% of the fund is invested in highest rated instruments.

CORPORATE DEBT: 62.08%

9.15% Larsen&Toubro Ltd. 2019 8.10%

9.9% Cholamandalam Investment &

Finance Co. Ltd. 2016 7.97%

8.64% PGC Of India Ltd. 2017 7.48%

9.1% HDFC Bank Ltd. 2022 6.83%

9.7% NABARD 2016 6.42%

10.18% LIC Housing Finance Ltd. 2016 5.64%

9.02% REC Ltd. 2022 4.09%

9.04% REC Ltd. 2019 4.05%

11.25% Power Finance Corpn. Ltd. 2018 3.87%

7.45% State Bank Of India 2015 3.17%

Other Corporate Debt 4.47%

NAV as on 30th April 2015: ` 17.28

MMI, Deposits, CBLO & Others: 37.92%

Benchmark: CRISIL Short Term Bond Index

Objective:

Strategy:

The objective of the fund is to provide capital preservation at a high level of safety & liquidity through judicious investments in high quality short‐term debt instruments.

To actively manage the fund by building a portfolio of fixed income instruments with short term duration. The fund will invest in government securities, high rated corporate bonds, good quality money market instruments and other fixed income securities. The quality & duration of the assets purchased would aim to minimize the credit risk and liquidity risk of the portfolio. The fund will maintain reasonable level of liquidity.

Fund Snapshot Know the Fund Better

Group Short Term Debt Fund

ULGF01322/09/08BSLGSHTDBT109

Asset held as on 3 25.25cr0th April 2015: ` Modified Duration: 1.91 years

Portfolio as on Thursday, April 30, 2015

10

Maturity Profile

ASSET ALLOCATION

Date of Inception: 10-Dec-08

Fund Manager: Parin Vora | Total Experience: 15 years

MMI, Deposits, CBLO & Others

37.92%

NCD

62.08%

RATING PROFILE

A1+

22.16%

AAA

67.84%

BMShort Term Debt

AA

10.00%

7 years & above2 to 7 years

Less than 2years

13.40% 26.42%

60.18%

Ja

n-1

2

Ap

r-1

2

Ju

l-1

2

Oct-

12

Ja

n-1

3

Ap

r-1

3

Ju

l-1

3

Oct-

13

Ja

n-1

4

Ap

r-1

4

Ju

l-1

4

Oct-

14

Ja

n-1

5

Ap

r-1

5

Asset held as on 3 66.86cr0th April 2015: `

97% of the fund remains invested in highest rated instruments.

Modified Duration: 6.18 yearsNAV as on 30th April 2015: ` 16.12

9.34% REC Ltd. 2024 5.55%

11.25% Power Finance Corpn. Ltd. 2018 4.06%

9.7% NABARD 2016 3.94%

9.37% Power Finance Corpn. Ltd. 2024 3.17%

9.15% Export Import Bank Of India 2022 3.14%

9.25% PGC Of India Ltd. 2019 3.09%

9.02% REC Ltd. 2022 2.16%

9.25% Of India Ltd. 2020 1.94%

9.25% Of India Ltd. 2019 1.93%

9.44% LIC Housing Finance Ltd. 2019 1.54%

Other Corporate Debt 6.65%

PGC

PGC

CORPORATE DEBT: 37.15%

Benchmark: Crisil Composite Bond index & Crisil Liquid Fund Index

Objective:

Strategy:

To provide capital preservation and regular income, at a high level of safety over a medium term horizon by investing in high quality debt instruments.

To actively manage the fund by building a portfolio of fixed income instruments with medium term duration. The fund will invest in government securities, high rated corporate bonds, high quality money market instruments and other fixed income securities. The quality of the assets purchased would aim to minimize the credit risk and liquidity risk of the portfolio. The fund will maintain reasonable level of liquidity.

Fund Snapshot Know the Fund Better

Group Income Advantage Fund

ULGF01425/02/10BSLGINCADV109

Portfolio as on Thursday, April 30, 2015

Maturity Profile

ASSET ALLOCATIONRATING PROFILE

GOVERNMENT SECURITIES: 49.23%

9.23% Government Of India 2043 17.08%

8.83% Government Of India 2023 13.42%

8.33% Government Of India 2026 6.16%

8.2% Government Of India 2022 3.23%

7.5% Government Of India 2034 3.04%

8.79% Government Of India 2021 2.11%

8.83% Government Of India 2041 1.64%

8.08% Government Of India 2022 1.58%

7.8% Government Of India 2021 0.82%

8.32% Government Of India 2032 0.16%

MMI, Deposits, CBLO & Others: 13.62%

11

Date of Inception: 23-Mar-10

Fund Manager: Parin Vora | Total Experience: 15 years

NCD

37.15% 13.62%

MMI, Deposits, CBLO & Others

49.23%G-Secs

AA+

3.45%

57.36%

Sovereign

AAA

39.20%

Gr. Inc Adv BM

7 years & above2 to 7 years

Less than 2years

62.76%

22.57%

14.68%

De

c-0

9

Ap

r-1

0

Au

g-1

0

De

c-1

0

Ap

r-11

Au

g-1

1

De

c-1

1

Ap

r-1

2

Au

g-1

2

De

c-1

2

Ap

r-1

3

Au

g-1

3

De

c-1

3

Ap

r-1

4

Au

g-1

4

De

c-1

4

Ap

r-1

5

Asset held as on 3 11.56cr0th April 2015: `

Exposure to G-Secs has increased to 94.19% from 49.23% while that to MMI has decreased to 5.81% from 13.62% on a MOM basis.

Modified Duration: 9.40 yearsNAV as on 30th April 2015: ` 21.16

Objective:

Strategy:

The fund aims to deliver safe and consistent returns over along-term period by investing in Government Securities.

Active fund management at very low level of risk by having entire exposure to government securities & money market instruments, maintaining medium term duration of the portfolio to achieve capital conservation.

Fund Snapshot Know the Fund Better

Group Gilt Fund

ULGF00630/05/03BSLIGRGILT109

GOVERNMENT SECURITIES: 94.19%

9.23% Government Of India 2043 51.88%

8.83% Government Of India 2041 11.83%

9.15% Government Of India 2024 7.48%

9.2% Government Of India 2030 6.71%

8.83% Government Of India 2023 6.39%

8.28% Government Of India 2027 4.45%

8.15% Government Of India 2022 4.38%

8.3% Government Of India 2042 0.97%

7.8% Government Of India 2021 0.09%

MMI, Deposits, CBLO & Others: 5.81%

Maturity Profile

ASSET ALLOCATION

Portfolio as on Thursday, April 30, 2015

RATING PROFILE

12

Sovereign100.00%

Date of Inception: 28-Apr-04

Fund Manager: Parin Vora | Total Experience: 15 years

MMI, Deposits, CBLO & Others

5.81%

94.19%G-Secs

7 years & above2 to 7 years

Less than 2years

96.65%

0.09% 3.27%

Asset held as on 3 243.29cr0th April 2015: `

Exposure to Corporate Debt has increased to 85.23% from 77.68% while that to MMI has decreased to 14.77% from 22.32% on a MOM basis. Over 80% of the fund remainsinvested in highest rated instruments.

Modified Duration: 4.13 yearsNAV as on ` 24.7930th April 2015:

Objective:

Strategy:

The fund aims to achieve capital preservation along with stable returns by investing in corporate bonds over medium-term period.

The fund follows a strategy to invest in high credit rated corporate bonds, maintaining a short-term duration of the portfolio at a medium level of risk to achieve capital conservation.

Fund Snapshot Know the Fund Better

Group Bond Fund

ULGF00530/05/03BSLIGRBOND109

CORPORATE DEBT: 85.23%

8.68% Aditya Birla Nuvo Ltd. 2020 6.12%

9.74% Tata Sons Ltd. 2024 5.02%

9.5% HDFC Ltd. 2024 4.36%

8.54% NPC Of India Ltd. 2023 4.20%

8.57% REC Ltd. 2024 3.12%

9.15% ICICI Bank Ltd. 2022 2.99%

9.04% REC Ltd. 2019 2.73%

9.55% Hindalco Industries Ltd. 2022 2.51%

9.4% Export Import Bank Of India 2023 2.19%

9.37% Power Finance Corpn. Ltd. 2024 2.18%

Other Corporate Debt 49.81%

MMI, Deposits, CBLO & Others: 14.77%

Benchmark: Crisil AAA long term index & Crisil AA short term index & CRISIL Liquid Fund Index

Maturity Profile

Portfolio as on Thursday, April 30, 2015

13

ASSET ALLOCATIONRATING PROFILE

Date of Inception: 28-Jan-07

Fund Manager: Parin Vora | Total Experience: 15 years

MMI, Deposits, CBLO & Others

14.77%

NCD85.23%

AAA

79.20%

A1+0.59%

6.28%AA

13.93%

AA+

7 years & above2 to 7 years

Less than 2years

40.16% 42.27%

17.57%

Asset held as on 3 662.70cr0th April 2015: `

Exposure to Corporate Debt has increased to 31.55% from 30.86%, to G-Secs it has increased to 67.84% from 65.06% and to MMI, it has decreased to 0.61% from 4.08% on a MOM basis. Over 94% of the fund remains invested in highest rated instruments.

Modified Duration: 7.03 yearsNAV as on ` 29.1430th April 2015:

Objective:

Strategy:

The Fixed Interest Fund, with full exposure in debt market instrument, aims to achieve value creation at low risk over a long-term horizon by investing into high quality fixed interest securities.

The strategy is to actively manage the fund at a medium level of risk by having entire exposure to government securities, corporate bonds maintaining medium to long-term duration of the portfolio to achieve capital conservation.

Fund Snapshot Know the Fund Better

Group Fixed Interest Fund

ULGF00416/07/02BSLGFIXINT109

GOVERNMENT SECURITIES: 67.84%

9.23% Government Of India 2043 18.78%

8.6% Government Of India 2028 18.38%

8.4% Government Of India 2024 9.37%

8.83% Government Of India 2023 8.12%

7.16% Government Of India 2023 3.61%

8.33% Government Of India 2026 2.49%

9.2% Government Of India 2030 1.72%

8.32% Government Of India 2032 1.57%

8.17% Government Of India 2044 1.56%

9.15% Government Of India 2024 0.89%

Other Government Securities 1.36%

8.68% LIC Housing Finance Ltd. 2020 2.04%

9.95% State Bank Of India 2026 1.67%

9.4% Export Import Bank Of India 2023 1.61%

9.64% PGC Of India Ltd. 2021 1.60%

9.37% Power Finance Corpn. Ltd. 2024 1.60%

8.48% Power Finance Corpn. Ltd. 2024 1.51%

9.55% Hindalco Industries Ltd. 2022 1.38%

8.7% Power Finance Corpn. Ltd. 2020 1.22%

8.4% NPC Of India Ltd. 2027 0.93%

10.6% IRFC. Ltd. 2018 0.81%

Other Corporate Debt 17.19%

CORPORATE DEBT: 31.55%

Maturity Profile

ASSET ALLOCATION

Benchmark: Crisil Composite Bond index & Crisil Liquid Fund Index

MMI, Deposits, CBLO & Others: 0.61%

Portfolio as on Thursday, April 30, 2015

14

RATING PROFILE

Date of Inception: 18-Nov-02

Fund Manager: Parin Vora | Total Experience: 15 years

AAA

25.47%

67.85%

Sovereign

AA+3.05%

0.59%

A1+

67.84%

G-Secs

MMI, Deposits, CBLO & Others

0.61%

NCD

31.55%

FIF BM

7 years & above2 to 7 years

Less than 2years

82.14%

17.02%

0.84%

3.04%

AA

Dec-0

6

May-0

7

Oct-

07

Mar-

08

Aug-0

8

Jan-0

9

Jun-0

9

Nov-0

9

Apr-

10

Sep-1

0

Feb-1

1

Jul-11

Dec-1

1

May-1

2

Oct-

12

Mar-

13

Aug-1

3

Jan-1

4

Jun-1

4

Nov-1

4

Apr-

15