BERMUDA THE GLOBAL LEADER IN INSURANCE-LINKED SECURITIES...

Transcript of BERMUDA THE GLOBAL LEADER IN INSURANCE-LINKED SECURITIES...

ILS Market Profile Bermuda is the world’s leading domicile for insurance-linked securities. By the end of Q3 2014, the total volume of 103 catastrophe bonds, ILS, and insurance-linked investment funds on the Bermuda Stock Exchange (BSX) reached $13.5 billion—more than half the world’s total.

Capital markets and the (re)insurance industries have long held a mutually beneficial relationship. In recent years, this synergy has strengthened and evolved with the establishment of new financial products, including insurance-linked securitisations, that have created new investment opportunities for fund managers and have also provided (re)insurance companies with diverse tools to manage risk and to increase capacity.

MARKET STRENGTHWith a highly regarded regulatory framework, sophisticated legal system, developed infrastructure and global companies with a physical presence, Bermuda maintains a reputation as a quality jurisdiction that has continuously shown the ability to respond to changes in market conditions while meeting its clients’ commercial needs.

RISK INNOVATIONBermuda has been at the forefront of risk innovation for more than 70 years. The Island is one of the world’s leading risk markets with a depth of talent that has solidified the jurisdiction as a global centre of risk innovation. Investors and the market look to Bermuda’s lead for the next industry innovation.

CONVERGENCEAs the World’s Risk Capital and the market leader in the alternative investment fund industry, Bermuda is the ideal location for the convergence of capital markets and (re)insurance.

Bermuda has swiftly emerged as the leader in the creation, listing and servicing of a variety of ILS products, evidenced by an increase in ILS formations and continued interest in third-party, capital-backed reinsurer start-ups.

A number of fund structures targeting the ILS market operate in Bermuda, and administrators and other service providers are tailoring services to support growing interest in ILS.

FIT-FOR-PURPOSE REGULATIONThe BMA, recognising that speed to market is essential, has over the years developed a thorough, but pragmatic, licensing process.Collaboration among industry participants led to a fit-for-purpose designation in 2009 of the Special Purpose Insurer (SPI) within the BMA’s insurance supervisory structure, with SPIs representing an efficient means to issue ILS such as catastrophe bonds.

The BMA has been proactive in ensuring the regulatory framework governing this sector is appropriate, sensible and robust and has taken steps to increase efficiency, reduce incorporation time, and reduce costs.

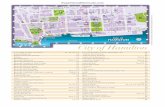

WORLD-CLASS STOCK EXCHANGEThe Bermuda Stock Exchange (BSX) features a fully electronic trading and settlement platforms and commercially sensible regulation. A member of the World Federation of Exchanges, the BSX provides an important level of confidence to its listed issuers and investors. Despite being a small exchange, the BSX prides itself on providing all the services and functions offered by peers in New York or London.

BERMUDA THE GLOBAL LEADER IN INSURANCE-LINKED SECURITIES (ILS)

BERMUDA IS THE LEADING JURISDICTION FOR THE CREATION, LISTING AND SERVICING OF INSURANCE-LINKED SECURITIES.

n The outstanding amount of ILS issued in Bermuda to date represents almost 60 percent of global volume.

n The total insurance-linked listings on the BSX reached a value of $13.5 billion by Q3 2014.

n The average deal size in Q2 2014 for Bermuda-issued ILS transactions was $301 million.

n The BSX supports both domestic and foreign ILS listings, the latter augmenting the secondary market.

bda.bm+1 441 292 0632 Maxwell Roberts Building n 6th Floor n 1 Church Street n Hamilton HM 11 n Bermuda

ABOUT BERMUDA BUSINESS DEVELOPMENT AGENCY (BDA)The BDA helps companies set up operations in Bermuda and supports existing Bermuda companies as they consolidate, grow and flourish. The agency provides access to information and resources to assist companies with their jurisdictional decision-making. The agency implements marketing and business development strategies to stimulate growth in our economy. As a public-private partnership, the BDA connects you to Bermuda industry professionals, and key contacts in the Bermuda Government and regulatory officials at the Bermuda Monetary Authority.

To learn more about Bermuda as a world-class financial centre or to connect with a BDA representative, please visit our website, www.bda.bm.

Government AssuranceThe Minister of Finance has granted assurance to Bermuda companies that no income, dividend or capital gains taxes (should any be enacted) will apply to corporations or individuals until at least 2035.

Legislative EnhancementsThe Government of Bermuda has implemented a variety of legislative amendments aimed at encouraging companies to establish a presence on the Island. The Government of Bermuda is fully committed to working with the business community to make doing business in Bermuda easier and more efficient.

Legal SystemThe Island’s judicial system is based on English common law with final right of appeal to the UK Privy Council.

Sensible RegulationThe Bermuda Monetary Authority (BMA) is internationally recognised for its pragmatic, risk-based approach to regulation. It maintains quality jurisdictional standards by continually re-engineering Bermuda’s regimes to ensure alignment with relevant evolving global standards.

InfrastructureBermuda has secure, modern and world-class physical and technological infrastructure including excellent telecommunications, broadband and a fully electronic Bermuda Stock Exchange.

Launch and ListThe Bermuda Stock Exchange lists over 350 Bermuda and international fund structures. Through the Launch and List Programme, time to listing and ultimately market, is significantly reduced.

Intellectual CapitalGlobally, Bermuda is a significant supplier of insurance and reinsurance. Collaboration between senior insurance and asset management executives has led to the creation of the innovative Insurance Linked Securities (ILS) product.

Ideally LocatedWith close proximity to Europe and less than two hours from New York City, Bermuda offers the added benefit of US Customs pre-clearance to make your business trip here effortless.

Quality Of LifeBermuda has a high standard of living, excellent education and healthcare, and a temperate climate with breath-taking beauty.

THE BERMUDA REPUTATION

GLOBAL STANDARDSThe European Union (EU) and the BMA have signed a Cooperation Agreement regarding the Alternative Investment Fund Managers Directive (AIFMD). These cooperation agreements are a key element in effective supervision of non-EU AIFMs and are a pre-condition in allowing non-EU AIFMs access to EU markets or to perform fund management activities on behalf of EU managers. As part of its AIFMD compliance initiatives, the BMA aims to develop an opt-in regime to enable Bermuda-based AIFMs to maintain seamless operations across the European market.

The BMA is a full member of the International Organization of Securities Commissions (IOSCO), and a founding member of the International Association of Insurance Supervisors (IAIS).

Bermuda was the first offshore jurisdiction elevated to the Organisation for Economic Co-operation and Development’s (OECD) “White List” category. The OECD’s most recent assessment rated Bermuda favourably on international standards of tax transparency (the same level as the US, the UK and Germany).

The Island is also recognised for its leadership within the OECD Global Forum and Financial Action Task Force (FATF) for its robust KYC, AML and ATF controls.

Bermuda has 41 signed bilateral TIEAs and over 60 multilateral TIEA partners through Bermuda’s recent adoption of the Multilateral Convention on Mutual Assistance in Tax Matters. In December 2013, post G20 meetings, the Financial Stability Board affirmed Bermuda as having sufficiently strong adherence to regulatory and supervisory standards on international cooperation and information exchange standards.

Bermuda is a member of the Group of International Finance Centre Supervisors.

The Bermuda Stock Exchange (BSX) is a full member of the World Federation of Exchanges, and an affiliate member of IOSCO. It is recognised by the SEC as a Designated Offshore Securities Market; the UK FCA as a Designated Investment Exchange; the UK HM Revenue & Customs as a Recognised Stock Exchange; and most recently has been designated by Canada’s Ministry of Finance.

Bermuda has signed Model II Inter-Governmental Agreements (IGAs) with both the US and the UK under the Foreign Account Tax Compliance Act (FATCA). Under this arrangement, Foreign Financial Institutions (FFIs) registered in Bermuda have direct control over the information collected and reported to the IRS. Switzerland and Japan have also elected the Model II IGA route.