Benchmarking Report QUE$TOR - cdn.ihs.com · QUE$TOR 2017 Q3 Benchmarking IHS Markit November 2017...

Transcript of Benchmarking Report QUE$TOR - cdn.ihs.com · QUE$TOR 2017 Q3 Benchmarking IHS Markit November 2017...

Benchmarking Report

QUE$TOR

2017 Q3 Release

November 2017

QUE$TOR is a registered trademark of IHS Markit.

Contents

Introduction 1

Technical Benchmarking 3

Onshore Technical Benchmarking 4

Offshore Technical Benchmarking 4

Cost Benchmarking 5

Onshore Cost Benchmarking 8

Offshore Cost Benchmarking 9

Release Benchmarking 10

Software Support Contacts 14

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 1

Introduction We are pleased to announce the release of IHS QUE$TOR 2017 Q3. As with previous updates, this version contains both product enhancements and cost updates. This benchmarking report has been prepared to provide an understanding of the effects the changes between QUE$TOR 2017 Q3 and the previous version, QUE$TOR 2017 Q1, have on capital costs estimations when a QUE$TOR project is updated. The method of analysis is to run projects using three versions of QUE$TOR. Projects are run in the previous version (QUE$TOR 2017 Q1), the updated version (QUE$TOR 2017 Q3), and an intermediate version that only incorporates the technical changes and feature additions made to the latest release of the software. The difference between the previous and the updated version quantifies the combined cost and technical changes. The change in results from the previous to the intermediate version describes technical changes and the difference between the results of the intermediate build and those of the updated version reveals the change in costs that stem from market movements. To make the analysis as meaningful and realistic as possible a large sample of projects (approximately 450) are used which are based on real assets and potential developments around the world. The projects have been selected to give a diverse international portfolio (Figure 1).

Figure 1

0

10

20

30

40

50

60

70

80

Africa Australasia Europe Far East Latin America Middle East North America

Offshore Onshore

Breakdown of benchmarking portfolio by region and project type

Source: IHS Markit © 2017 IHS Markit

Nu

mb

er

of

pro

jects

QUE$TOR 2017 Q3 Benchmarking

Page 2 November 2017 IHS Markit

The portfolio of projects is roughly split into 250 offshore and 200 onshore developments. Every region contains both project types, although the overall portfolio is not intended to include all possible projects but to be a representative sample. As a result some projects or regions may be more or less represented than others. The benchmarking analysis serves multiple purposes. Internally, this analysis enables the team to check whether the new capital cost estimates are consistent with the changes described in the Release Notes. This is achieved by highlighting how technical changes have been included and their potential to mask other cost changes that occur in the application. As a communication to our users, the analysis provides a comparison of cost change effects by region, component type and cost category. This report is meant to supplement the market changes discussions contained in the QUE$TOR 2017 Q3 Release Notes, which are shipped with the application.

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 3

Technical Benchmarking Technical benchmarking is used to distinguish between the effects of new technical definitions on project costs in QUE$TOR and the effects of cost database changes. Technical benchmarking is a process that allows the comparison of the costs of developments from different builds of QUE$TOR based on the same cost databases, with the aim of isolating the effects of the new technical specifications. This provides an understanding for the reasons behind the changes and helps validate QUE$TOR as new features are developed. Most technical changes made to QUE$TOR this release have improved the product by giving users more options when modelling projects (electrically heat traced flowlines, plate and frame heat exchangers, new subsea tie-back option, high grade linepipe options onshore) and as such have had no impact on project costs by default. After reviewing the technical benchmarking results, two changes were witnessed to have an effect on costs:

Onshore: fluid temperature calculations now allow for subsurface heat loss and choke heat loss (due to the Joule-Thomson effect)

Offshore: associated liquids design flowrate value restricted to a minimum of 10 bbl/day in order to avoid a program stability issue involving unrealistically low flows

The changes have had a limited impact on project costs, as shown in Figure 2.

Figure 2

0%

10%

20%

30%

40%

50%

60%

-16%

-15%

-14%

-13%

-12%

-11%

-10%

-9%

-8%

-7%

-6%

-5%

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

Offshore Onshore

Distribution of cost changes due to new technical definitions in QUE$TOR 2017 Q3

Source: IHS Markit © 2017 IHS MarkitChange in project cost

Perc

en

tag

e o

f p

roje

cts

QUE$TOR 2017 Q3 Benchmarking

Page 4 November 2017 IHS Markit

Onshore Technical Benchmarking It is clear from Figure 2 that the new technical definitions in QUE$TOR have had a limited impact on onshore project capital costs. Almost 70% of onshore projects changed slightly, varying between -1% and 1%. Investigating the origin of these changes reveals Production facilities to be the most affected component, followed by Terminals, and Infrastructure. All the cost changes witnessed in onshore projects in the technical benchmarking can be attributed to the onshore change outlined in the previous section of this report. A small proportion of the portfolio’s onshore projects (<5%) had a combination of factors (i.e. main flow is gaseous, very low liquid flowrates, and large difference between the reservoir and ambient temperatures) that caused the technical change, which allows for subsurface and choke heat losses, have a detectible effect on project costs.

Offshore Technical Benchmarking Referring back to Figure 2 once again, it is clear that offshore projects experienced fewer changes than onshore projects. Over 60% of offshore projects did not experience any changes in their costs due to technical changes to QUE$TOR and the remaining projects only changed capital costs by 2% or less. The Topsides component was largely responsible for the change in project costs, in rare cases changing enough to induce a change in the supporting substructure. All cost deviations observed offshore in the technical benchmarking can be attributed to the single change already highlighted in this report. Of the over 200 offshore projects in the portfolio, less than three had unreasonably small associated flows and were impacted significantly when those were rounded up to 10 bbl/day. Many projects with associated liquid flowrates of under the newly designated minimum did not experience a significant change in costs. It is only when the flowrate was unusually low that the program had a hard time sizing the Topsides component sensibly. In summary, there have been few technical changes that users need to become aware of before updating their projects by using the new version of QUE$TOR. The improvements made to the software this release will only have an impact when there are excessively low flowrates.

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 5

Cost Benchmarking Following the technical benchmarking, the portfolio projects were run through the release version of QUE$TOR 2017 Q3, and the results analysed. The analysis method to get the cost changes compares the new release version with the results generated by the intermediate build in order to focus solely on cost changes due to new market conditions. The distribution of project cost changes for all projects in the assembled portfolio can be seen in Figure 3.

Figure 3 Onshore projects mostly changed by between 0% and 3%, with an average change of 1.5%. Offshore project costs showed a far wider range of variation, and averaged an increase of 1.2%. Figure 4 shows the regional breakdown of onshore and offshore project cost changes. Onshore project costs increased in every region, while offshore cost changes were up strongly in Europe, muted in Australasia and Latin America, and negative in Africa. The regional discrepancies visible offshore but not onshore help explain why the offshore distribution in Figure 3 is so much more widely distributed than the relatively narrow onshore distribution.

0%

5%

10%

15%

20%

25%

30%

35%

-4% -3% -2% -1% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13%

Offshore Onshore

Distribution of cost changes due to market movements in QUE$TOR 2017 Q3

Source: IHS Markit © 2017 IHS MarkitChange in project cost

Perc

en

tag

e o

f p

roje

cts

QUE$TOR 2017 Q3 Benchmarking

Page 6 November 2017 IHS Markit

Figure 4 Figure 5 shows the change in project costs by cost category for the total project portfolio. In this graph, Prefabrication and Fabrication were averaged together. Installation is both the most regionally variable cost category and the most severely impacted by the enduring lack of activity, explaining to some extent the differences between onshore and offshore costs observed in Figure 4. On average QUE$TOR’s various cost categories increased by around 2%, with the exceptions of Installation (which fell by 0.5%) and Construction (which increased only slightly). European costs usually increased much more than those of other regions, while African costs usually decreased the most. Exceptions to this behaviour can be explained by the portfolio’s composition. As Construction is an onshore cost category, European projects tend to be located in Eastern Europe where developments did not benefit from the appreciation of the Euro. African cost changes were the lowest for almost all cost categories, except for the Design and Project Management (D&PM). This is attributable to the procurement strategy definition of the portfolio as a large majority of the African projects source their engineering needs from Europe.

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

Africa Australasia Europe Far East Latin America Middle East North America

Offshore Onshore

Regional breakdown of cost changes

Source: IHS Markit © 2017 IHS Markit

Avera

ge

ch

an

ge in

pro

ject

co

st

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 7

Figure 5 Installation cost changes exhibited the widest range of all the cost categories, chiefly due to Europe and Africa. The two main factors behind the regional differences were exchange rates and market changes. The Euro appreciated strongly against the US dollar (USD) while Nigeria’s recent emergence from recession has not yet had an impact. Support vessel costs in the North Sea dropped precipitously when the downturn started and so have much more to make up for. Rates in Africa did not drop as strongly when the downturn first began, but the imbalance between supply and demand in the competitive offshore rig and support vessel markets is now taking its full toll. Onshore and offshore cost changes will be discussed in detail separately in the next two sections.

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

D&PM Equipment Materials Fabrication Construction Installation

Africa Australasia Europe Far East

Latin America Middle East North America Average

Regional breakdown of project cost changes by category

Source: IHS Markit © 2017 IHS Markit

Avera

ge

ch

an

ge b

y c

os

t cate

go

ry

QUE$TOR 2017 Q3 Benchmarking

Page 8 November 2017 IHS Markit

Onshore Cost Benchmarking Onshore development costs have increased by 1.5% on average over the past two quarters. Figure 6 shows the average change in onshore component costs for each region, as well as the component averages for the portfolio. It reveals that all components varied in a similar manner, showing a 1-2% change. Infrastructure costs are immediately noticeable for their irregular regional distribution, which is due almost entirely to exchange rates as expenditures in this component tend to be overwhelmingly local.

Figure 6 African costs were consistently the most negatively affected across all the onshore components, again owing primarily to exchange rates. Recalling Figure 4, onshore costs have increased by an average of 1.5% in every region except Africa, where they were flat overall. The African database represents a regional average, so it is recommended that users modify their procurement strategies to account for their specific project location.

-5%

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

Production facility Terminal Onshore drilling Infrastructure Pipeline Wellpad group

Africa Australasia Europe Far East

Latin America Middle East North America Average

Regional breakdown of average onshore cost changes by component

Source: IHS Markit © 2017 IHS Markit

Avera

ge

co

st

ch

an

ge f

or

co

mp

on

en

t

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 9

Offshore Cost Benchmarking Offshore development costs are even more dominated by regional differences than the onshore costs seen in Figure 6. Figure 7 shows the average cost change for each offshore component, and it is clear that Europe and Africa consistently represent regional extremes, mainly due to exchange rate variations.

Figure 7

The European portfolio is made up of projects priced in British pound, euro, and Norwegian kroner, all of which appreciated by over 7% against the USD in the last six months. Furthermore, European costs fell much harder than those of other regions during the downturn, and now have more to make up for. On the other hand, the Nigerian recession has meant local expenditures have fallen, especially for the many international investors in the upstream sector. The steep decline in African drilling costs shows the effects of the prolonged lack of activity on the rig and vessel markets in the region. Despite the regional variations, global averages of cost changes are similar across the offshore components, ranging from 0% up to 2%. The depreciation of the USD against many other currencies has increase costs. Upstream markets showed small changes in different directions over the last two quarters; however, the impact of exchange rates has inflated the averages to those shown in Figure 7

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

Topsides Floaters Subsea Jacket Offshore pipeline Offshore drilling

Africa Australasia Europe Far East

Latin America Middle East North America Average

Regional breakdown of average offshore cost changes by component

Source: IHS Markit © 2017 IHS Markit

Avera

ge

co

st

ch

an

ge f

or

co

mp

on

en

t

QUE$TOR 2017 Q3 Benchmarking

Page 10 November 2017 IHS Markit

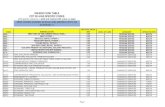

Release Benchmarking In this section technical and cost changes are brought together to give an idea of what changes in costs users are likely to see when updating their project files from QUE$TOR 2017 Q1 to QUE$TOR 2017 Q3. While cost changes arising from technical changes and those coming from the updated cost databases have been discussed separately, Figures 8 and 9 bring together these changes to depict the total effect.

Figure 8 Onshore changes by component averaged at 1%, with the exception of Production facilities which increased by 4%, half of which is attributable to actual market changes. International labour costs are higher due to the weakening of the USD, and many steel markets have made gains that caused costs to increase throughout the supply chains of many upstream markets. Many markets that suffered greatly when the downturn began now have little room left to cut their prices and so no longer pull down upstream costs.

-1%

0%

1%

2%

3%

4%

5%

Production facility Terminal Onshore drilling Infrastructure Pipeline Wellpad group

Technical Cost Total

Overall cost changes to onshore components

Source: IHS Markit © 2017 IHS Markit

Avera

ge

co

st

ch

an

ge in

co

mp

on

en

t

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 11

Figure 9 Viewed by component, development costs seem to have increased more offshore than onshore. The Offshore drilling component however, which represents a substantial part of any development project, has shown no change in overall costs on average. This explains how onshore costs have increased more than offshore ones on a project total level despite showing smaller increases on a component level. Only Topsides and Production facilities have been impacted by more than 1% due to technical changes while other components witnessed only negligible changes, as has previously been presented in the Technical Benchmarking section. The new temperature calculations sometimes impacted other components. For example, the removal of a cooler would have consequences for power demand, construction areas, labour requirements, and possibly more. This may affect Infrastructure, Terminal, and Wellpad costs. Offshore, heavier topsides (due to rounding up flows smaller than 10 bbl/day) may require substructures that could carry the extra weight. A histogram of the portfolio projects cost changes is shown in Figure 10. The distribution looks broadly similar to the one depicting only the cost changes deriving from market movements in Figure 3, with the exception of smaller columns at the positive and negative extremes. These values represent projects that experienced significant changes in cost due to the new technical definitions in QUE$TOR.

-1%

0%

1%

2%

3%

4%

5%

Topsides Floaters Subsea Jacket Offshore pipeline Offshore drilling

Technical Cost Total

Overall cost changes to offshore components

Source: IHS Markit © 2017 IHS Markit

Avera

ge

co

st

ch

an

ge in

co

mp

on

en

t

QUE$TOR 2017 Q3 Benchmarking

Page 12 November 2017 IHS Markit

Figure 10 Figure 10 shows that certain offshore projects can be expected to experience steeper increases in costs than others. As exchange rates had an important impact on upstream markets this update, users should make sure to account for the currencies involved in their expenditures. Figure 11 compares total offshore project cost changes from Figure 10 with a benchmarking analysis that excludes the costs of all drilling components.

0%

5%

10%

15%

20%

25%

30%

-14%

-13%

-12%

-11%

-10%

-9%

-8%

-7%

-6%

-5%

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

Offshore Onshore

Cost change distribution when updating from QUE$TOR 2017 Q1 to QUE$TOR 2017 Q3

Source: IHS Markit © 2017 IHS Markit

Perc

en

tag

e o

f p

roje

cts

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 13

Figure 11 It is clear that without drilling, the variance in the cost distribution decreases, and it shifts slightly towards the positive side. The average of the ‘No drilling’ distribution is 1.7%. For additional information on market changes, please refer to the Release Notes documents associated with QUE$TOR 2017 Q3. Contact information for QUE$TOR support in multiple regions can be found in the concluding section of this report.

0%

5%

10%

15%

20%

25%

30%

Full No drilling

Comparison of change in offshore project costs with and without the drilling component

Source: IHS Markit © 2017 IHS Markit

Perc

en

tag

e o

f p

roje

cts

QUE$TOR 2017 Q3 Benchmarking

Page 14 November 2017 IHS Markit

Software Support Contacts If you have any problems or questions relating to any of the QUE$TOR suite applications, please contact the Software and Engineering Support Desk. Support e-mail address: [email protected] Licensing support e-mail: [email protected] (Note: ‘s’ rather than ‘$’) The IHS software support team key contacts are: North America Jonathan Stephens - Product Manager, [email protected] Abhishek Verma - Senior Field Development Engineer, [email protected] Zayd Wahab – Cost Analyst, [email protected] 1401 Enclave Pkwy, Suite 200 Houston Texas 77077 USA Tel: (+1) 281 752 3200

Europe, Africa, and the Middle East Rita Antonelli – QUE$TOR Product Management Principal, [email protected]

Matthew Butcher - Field Development Engineer, [email protected]

Greville Williams - Engineering Manager, [email protected]

Ropemaker Place 25 Ropemaker Street London EC2Y 9LY United Kingdom Tel: (+44) 1344 328300

QUE$TOR 2017 Q3 Benchmarking

IHS Markit November 2017 Page 15

South and Central America Alan Delgado Valvas - Customer Solution Advisor, [email protected] Insurgentes Sur 800 Piso 11 #3 Mexico City 03100 Mexico Tel (+52) 55 3067 6458 Thais Hamilko - Product Specialist, E&I Prod Line-LATAM, [email protected] Rua São Bento, 29 – 7° andar Centro Rio de Janeiro RJ, CEP 20090-010 Brazil Tel: (+55) 21 3299 0440 S.E. Asia & Australia

Sanjay Sinha – APAC Field Development SME, [email protected] First Floor, Tower A Vatika Business Park Sohan Road, Sec 49 Gurgaon 122018 - Haryana India Tel: (+91) 124 454 2699 China

Yaxing Wang – Sr. Customer Solution Advisor, [email protected] Room 3001 China World Office 1 No.1, JianGuoMenWai Avenue Beijing 100004 China Tel: (+86) 10 5633 4567

QUE$TOR 2017 Q3 Benchmarking

Page 16 November 2017 IHS Markit

Russia Aram Yesayan – Customer Care Advisors Principal [email protected] Tsvetnoy Blvd, 2 Bld. 1 Entrance B, 4th Floor 127051 Moscow Russia Tel: (+7) 495 733 9512