Bank Earnings Management and Tail Risk during the ... tail risk 11_13_2012.pdf · LEE J. COHEN...

-

Upload

vuongquynh -

Category

Documents

-

view

217 -

download

2

Transcript of Bank Earnings Management and Tail Risk during the ... tail risk 11_13_2012.pdf · LEE J. COHEN...

LEE J. COHEN

MARCIA MILLON CORNETT

ALAN J. MARCUS

HASSAN TEHRANIAN

Bank Earnings Management and Tail Risk during

the Financial Crisis

We show that a pattern of earnings management in bank financial statementshas little bearing on downside risk during quiet periods, but seems to have abig impact during a financial crisis. Banks demonstrating more aggressiveearnings management prior to 2007 exhibit substantially higher stock mar-ket risk once the financial crisis begins as measured by the incidence of largeweekly stock price “crashes” as well as by the pattern of full-year returns.Stock price crashes also predict future deterioration in operating perfor-mance. Bank regulators may therefore interpret them as early warning signsof impending problems.

JEL codes: G01, G11, G21, G28, M40Keywords: financial institutions, earnings management, crashes,

financial crisis.

BANK INVESTORS HAVE LONG been concerned with tail risk,that is, extreme declines in a bank’s stock price. The financial crisis of 2007–09only heightened this concern. While regulators are more concerned with operatingperformance than stock prices per se, they too must be concerned with dramaticstock price declines to the extent that such declines signal deterioration in futureperformance (as we show below). Moreover, contingent capital regulation with marketvalue triggers also can make stock prices relevant to regulators.

The authors are grateful to Jim Booth, Ozgur Demirtas, Atul Gupta, Jim Musumeci, Jun Qian, SugataRoychowdhury, Ronnie Sadka, Phil Strahan, and seminar participants at Boston College for their helpfulsuggestions.

LEE J. COHEN is Assistant Professor of Finance, Finance Department, University of Georgia (E-mail:[email protected]). MARCIA MILLON CORNETT is Professor of Finance, Finance Department, Bentley Uni-versity (E-mail: [email protected]). ALAN J. MARCUS is Mario J. Gabelli Professor of Finance, FinanceDepartment, Boston College (E-mail: [email protected]). HASSAN TEHRANIAN is the Griffith Family Mil-lennium Chair in Finance, Finance Department, Boston College (E-mail: [email protected]).

Received January 25, 2012; and accepted in revised form November 6, 2012.

Journal of Money, Credit and Banking, Vol. 46, No. 1 (February 2014)C© 2014 The Ohio State University

172 : MONEY, CREDIT AND BANKING

While tail risk is determined in large part by bank financial policies such as thecomposition of on- and off-balance-sheet asset and liability portfolios, the ability toassess that risk also depends on bank reporting and accounting policies. For example,banks have discretion in setting the level of several key income statement accountssuch as provisions for loan losses, and they can use that discretion to modulate thetransparency, or opacity, of their financial reports. While earnings management maynot directly cause tail events, it nevertheless may affect the best estimate of tail ex-posure conditional on observable bank attributes. For example, Jin and Myers (2006)and several others have shown for industrial firms that reductions in transparency areassociated with increased tail risk. This paper asks whether the association betweenearnings management, which may be used to obscure true performance, and tail riskalso characterizes banks, and, in particular, whether earnings management predictedbank performance during the financial crisis.

Earnings management can increase the risk of extreme stock market returns if itlimits the availability of information about the firm. In Jin and Myers (2006), firmmanagers use their discretion to impede the flow of public information about firmperformance. Managers normally have an incentive to postpone the release of badnews, but in some circumstances either that incentive or the ability to hide informa-tion collapses, leading to a sudden release of accumulated negative information anda firm-specific stock price crash. In a more general setting, even if earnings manage-ment is not strategically exploited by managers, it still might result in fatter-tailedreturn distributions if it interrupts the steady flow of information to outside investors.Discrete information events will be reflected in substantial stock price movements.This should be true of financial as well as industrial firms.

Much of the earnings management literature for industrial firms has focused onthe manipulation of accruals: a pattern of departures from a simple statistical modelof “normal” accruals is taken as evidence of earnings management (Healy 1985,Dechow, Sloan, and Sweeny 1995, Cohen, Dey, and Lys 2005). Hutton, Marcus, andTehranian (2009) propose a measure of earnings management based on abnormalaccruals and find that it is in fact associated with tail risk, suggesting that it doescause information to reach the market in discrete episodes rather than diffusingsteadily and continuously.

In light of widespread concern over tail risk in financial institutions as wellas the emerging literature linking financial statement opacity to crash risk forindustrial firms, it is interesting to know whether a measure of earnings management,appropriately defined for banks, would similarly predict increased probabilityof tail risk, and in turn whether tail events in stock prices can provide timelywarnings of risk in operating performance. Of course, accruals for banks reflectdifferent considerations than those that drive accruals for industrial firms. Earningsmanagement in banks typically is measured by the proclivity to make discretionaryloan loss provisions or by discretionary realizations of security gains or losses.For example, Cornett, McNutt, and Tehranian (2009) estimate a measure of bankearnings management using these variables and find that it exhibits the reasonableproperties of being positively related to CEO pay-for-performance sensitivity and

LEE J. COHEN ET AL. : 173

inversely related to board independence. Adopting a similar approach, we show inthis paper that, like industrial firms, banks also display a positive relation betweenapparent earnings management and tail risk. However, in contrast to industrial firms,bank tail risk typically is not evident in “normal” periods, and therefore is hardto evaluate even from long sample periods. Nevertheless, earnings managementseems to have a substantial association with tail risk in crisis periods. This patternposes a difficult challenge for regulators, who are concerned most of all about largelosses. Our results suggest that earnings management might usefully be considereda reliable proxy for exposure to large losses during periods of financial stress.

The remainder of the paper is organized as follows. In Section 1, we briefly reviewthe literature on tail risk and earnings management. As part of this review, we discusshow measures of earnings management for industrial firms must be modified forbanks. Section 2 discusses our sample and data sources. Section 3 presents empiricalresults. We begin with an analysis and justification of our measure of bank earningsmanagement, and proceed to demonstrate that this measure and downside risk appearto be positively related. Finally, Section 4 concludes the paper, where we considerthe policy implications for banks and their regulators.

1. RELATED LITERATURE

1.1 Earnings Management and Crash Risk

Jin and Myers (2006) present a model in which lack of full transparency concerningfirm performance enables managers to capture a portion of the firm’s cash flows. Toprotect their positions, managers may manage earnings by hiding temporary lossesto avoid disclosing negative performance. However, if performance is bad enough,managers may be unwilling or unable to conceal any more losses. At this point, all ofthe previously unobserved negative performance information becomes public at once,resulting in a firm-specific stock price crash.1 Jin and Myers measure transparencyusing characteristics of the broad capital market in which the firm is situated and findthat cross-sectionally (i.e., across countries), less transparent markets exhibit morefrequent crashes. Hutton, Marcus, and Tehranian (2009) further test the Jin and Myersmodel by developing a firm-specific measure of earnings management and show thatit predicts higher crash risk at the firm-specific level as well. Consistent with theseresults, Kothari, Shu, and Wysocki (2009) provide evidence, based on voluntarymanagement earnings forecasts, that managers withhold bad news when possible.

A common measure of earnings management in industrial firms is based on discre-tionary accruals from the modified Jones (1991) model (Dechow, Sloan, and Sweeney

1. In the Jin and Myers model, insiders can actually divert cash flow to themselves. This would bedifficult in the banking context, but even here, managers can increase their compensation by artificiallymeeting earnings targets. Of special interest is the possibility that a history of nondecreasing earnings thatinduces investors to view the bank as low risk may increase the stock price and the value of equity-basedcompensation. This risks a sudden dramatic change (and a stock price crash) if the bank is later forced toreport a decrease in earnings, as in Jin and Myers.

174 : MONEY, CREDIT AND BANKING

1995). Specifically, “normal” accruals are estimated from a simple statistical modelbased on firm assets, property, plant, and equipment, and change in sales. “Abnormal”or discretionary accruals are the residuals between actual accruals and the predictedaccruals from the modified Jones model. Firms with consistently large discretionaryaccruals are deemed more likely to be manipulating earnings, or at the very least,have less transparent financial statements. Healy (1985) concludes that managersuse discretionary accruals to manipulate bonus income. Sloan (1996) shows that themarket seems not to fully recognize the information content of accruals management,and Dechow, Sloan, and Sweeney (1996) argue that patterns of large discretionaryaccruals can be used to detect earnings management. Cohen, Dey, and Lys (2005) findthat abnormal accruals tend to be larger when management compensation is moreclosely tied to stock value. Finally, as noted above, Hutton, Marcus, and Tehranian(2009) find that abnormally large discretionary accruals are associated with crash risk(which they define as 3-sigma declines in stock price).

Clearly, measures of abnormal accruals from the Jones (1991) model need tobe modified for banks or other financial institutions that are not engaged in sales-based businesses. Instead, the focus for banks typically tends to be on loan lossprovisions or the realizations of gains or losses on securities, both of which allowconsiderable management discretion. Leeway in these variables may be used tosmooth earnings (Beatty, Ke, and Petroni 2002) or to shore up regulatory capital(Beaver and Engel 1996, Ahmed, Takeda, and Thomas 1999). Notice that thesegoals conflict with transparency by making it more difficult for outside analysts todiscern the true financial condition of the firm. Such practices presumably impedeinformation flow, and it is at least conceivable that they also make information more“lumpy,” particularly as the limits of accounting discretion are reached. In the nextsubsection, we consider earnings management in banks more closely.

1.2 Earnings Management in Banks

Loan loss provisions are an expense item on the income statement, reflectingmanagement’s current assessment of the likely level of future losses from defaultson outstanding loans. The recording of loan loss provisions reduces net income.Commercial bank regulators view accumulated loan loss provisions, the loan lossallowance account on the balance sheet, as a type of capital that can be used toabsorb losses. A higher loan loss allowance balance allows the bank to absorb greaterunexpected losses without failing. Symmetrically, if the loan loss allowance is lessthan expected losses, the bank’s capital ratio will overstate its ability to sustainunexpected losses.

In addition to loan loss provisions, banks also have discretion in the realizationof security gains and losses (Beatty, Chamberlain, and Magliolo 1995, BeattyKe, and Petroni 2002). Unlike loan loss provisions, security gains and lossesare relatively unregulated and unaudited discretionary choices. It is unlikely thatauditors, regulators, or shareholders will subsequently take issue with a manager’sdecision to sell an investment security that happens to increase or decrease earnings.

LEE J. COHEN ET AL. : 175

Thus, realized security gains and losses represent a second way that managementhas been able to smooth or otherwise manage earnings.

More recently, however, evolving accounting rules, particularly SFAS 157 (whichtook effect in November 2007), have increased scrutiny of earnings managementachieved through the recording of gains or losses in the securities portfolio. Fair valueaccounting requires assets and liabilities to be listed on a firm’s balance sheet at currentvalues. Thus, bank earnings can be affected by security sales only to the extent thatvalues have changed over the very short term. As discussed below, our sample periodruns from 1997 through 2009. Thus, the ability to manage earnings by strategicallyrealizing securities gains or losses decreases during the period of our analysis.2

Consistent with these considerations, previous studies have found that banks useboth loan loss provisions and securities gains and losses to manage earnings andcapital levels. Scholes, Wilson, and Wolfson (1990) find that capital positions play arole in banks’ willingness to realize gains on municipal bonds. Collins, Shackelford,Wahlen (1995), Beaver and Engel (1996), and Ahmed, Takeda, and Thomas (1999)find that discretionary accruals are negatively related to capital, although Beatty,Chamberlain, and Magliolo (1995) reach the opposite conclusion. Wahlen (1994)shows that managers increase discretionary loan loss provisions when they expectfuture cash flows to increase. Finally, Beatty, Ke, and Petroni (2002) find that publicbanks are more likely than private ones to use loan loss provisions and realizedsecurities gains and losses to eliminate small earnings decreases. By and large, bothloan loss provisions and the realization of securities gains and losses appear to beopportunistically used to manage earnings. Indeed, earnings management may beused to discreetly smooth earnings over time or to eventually take a “big bath,” thatis, report one drastic earnings decline after hiding a series of smaller declines inprevious years (Arya, Glover, and Sunder 1998, Demski 1998), a pattern consistentwith infrequent but large stock market declines.

2. DATA

The sample examined in this study includes all publicly traded banks headquarteredin the United States and operating during the 1997 through 2009 period. We use bankcharacteristics measured in the decade prior to the financial crisis to predict tailrisk in both the precrisis period, 1997–2006, and the crisis period, 2007–09. Allaccounting data are obtained from the Y-9C consolidated Bank Holding Company(BHC) database, which aggregates bank affiliates and subsidiaries to the bank holdingcompany level for U.S. domestic banks, found on the Chicago Federal Reserve’s

2. In addition, in March 2009, ASC320 required financial institutions to recognize other than temporaryimpairment (OTTI) on their available-for-sale (AFS) and held-to-maturity (HTM) portfolios. If the loss isconsidered temporary, the adjustment is reported in other comprehensive income and may be subsequentlyrecovered if the value of the investment returns. However, if management considers the loss other thantemporary, the loss is charged to operations and subsequent recoveries of fair value are not recorded inearnings until the investment is sold. Banks’ treatment of OTTI could be viewed as a way of obscuringtheir performance.

176 : MONEY, CREDIT AND BANKING

TABLE 1

NUMBER OF COMMERCIAL BANKS IN THE SAMPLE

Year BHCs

1997 2891998 2831999 3042000 3122001 3252002 3462003 3622004 3542005 3672006 3252007 2992008 2792009 267Total 4,112

NOTE: This table lists the distribution of the sample bank holding companies (BHCs) by year. All accounting data are obtained from FFIECCall Reports databases found on the Chicago Federal Reserve’s website (www.chicagofed.org).

website, www.chicagofed.org. Bank stock return data are collected from the Centerfor Research in Security Prices (CRSP) database. Table 1 lists the number of publiclytraded banks with available consolidated BHC data by year in our sample. Ouranalysis includes a total of 4,112 bank-years.

2.1 Discretionary Loan Loss Provisions and Security Sales

Variation in bank earnings is driven predominately by the performance of the loanportfolio. Loans over 90 days past due and still accruing interest as well as loansno longer accruing interest are observable measures of the current loans at risk ofdefault. While a portion of the loan loss provisions set aside for these obviously “bad”loans will be standard and nondiscretionary, there is considerable room for judgmentin the eventual losses that will be realized on these as well as healthier loans. Bankstherefore may manage earnings through allowable discretion in the recording of loanloss provisions. In principle, each bank manager’s basis for judgment with respect tothese provisions is subject to periodic review by regulators.3 However, in practice,large banks in particular appear to have considerable discretion: Gunther and Moore(2003) find that while there are many instances of regulator mandated revisions inloan loss provisions, only six in their study involve banks with over $500 million intotal assets and only four involve banks that are publicly traded. In addition, as notedabove, banks also have had leeway to manage earnings through the discretionary

3. Managerial judgment must be based on a “reviewable record” as noted in the Chicago FederalReserve’s Micro Data Reference Manual’s data dictionary in its description of Item BHCK4230: Provisionfor Loan and Lease Losses. The item should “ . . . include the amount needed to make the allowance forloan and lease losses . . . adequate to absorb expected . . . losses, based upon management’s evaluationof the loans and leases that the reporting bank has the intent and ability to hold for the foreseeable futureor until maturity or payoff.”

LEE J. COHEN ET AL. : 177

realization of security gains and losses, particularly prior to 2007 and the enactmentof SFAS 157.

The challenge is to devise a measure of discretionary loan loss provisions anddiscretionary realization of securities gains and losses and combine them into ameasure of earnings management. We employ the Beatty, Ke, and Petroni (2002)model of “normal” loan loss provisions using OLS regressions that allow for bothyear and regional (specifically, eight regional districts defined by the Comptroller ofthe Currency) fixed effects. We estimate the model in the period ending in 2006, thelast full year before the onset of the financial crisis. This ending date ensures thatdisruptions to normal bank behavior patterns elicited by the crisis will not affect ourestimates of normal reserving behavior. Their regression model is:4

LOSSi t = αtr + β1LNASSETi t + β2NPLi t + β3LLRi t + β4LOANRi t

+β5LOANCi t + β6LOANDi t + β7LOANAi t + β8LOANIi t

+β9LOANFi t + εi t , (1)

wherei = bank holding company identifier;t = year (1994 to 2006);r = U.S. Office of the Comptroller of the Currency defined district

number;αtr = fixed effect for region and year;

LOSS = loan loss provisions as a fraction of total loans;LNASSET = the natural log of total assets;

NPL = nonperforming loans (includes loans past due 90 days or more andstill accruing interest and loans in nonaccrual status) as a percentageof total loans;

LLR = loan loss allowance as a fraction of total loans;LOANR = real estate loans as a fraction of total loans;LOANC = commercial and industrial loans as a fraction of total loans;LOAND = loans to depository institutions as a fraction of total loans;LOANA = agriculture loans as a fraction of total loans;LOANI = consumer loans as a fraction of total loans;LOANF = loans to foreign governments as a fraction of total loans;

ε = error term.

The fitted value in equation (1) represents normal loan losses based on the com-position of the loan portfolio, and therefore, the residual of the regression is taken

4. Cornett, McNutt, and Tehranian (2009) also employ the Beatty, Ke, and Petroni (2002) model.However, they use the level of nonperforming loans on the right-hand side, whereas Beatty, Ke, andPetroni use the change in nonperforming loans. We experimented with both specifications, and found thatit made no difference to our results. We present the results using levels, as it allows our sample to begin ayear earlier.

178 : MONEY, CREDIT AND BANKING

as the “abnormal” or discretionary component of loan loss provisions.5 However,because equation (1) models loan loss provisions as a fraction of total loans, whileour measure of earnings management (defined below) is standardized by total assets,we transform the residual from equation (1) and define our measure of discretionaryloan loss provisions (DISC_LLPit) as

DISC LLPi t = εi t× LOANSi t

ASSETSi t, (2)

where LOANSit = total loans and ASSETSit = total assets of bank i in year t.To find discretionary realizations of gains and losses on securities, we again follow

Beatty, Ke, and Petroni (2002). We estimate the following OLS regression over theprecrisis period with time fixed effects. Their model of “normal” realized securitygains and losses (GAINSit) is

GAINSi t = αt + β1LNASSETi t + β2UGAINSi t + εi t , (3)

wherei = bank holding company identifier;t = year (1994 to 2006);

GAINS = realized gains and losses on securities as a fraction of beginning-of-year total assets (includes realized gains and losses from available-for-sale securities and held-to-maturity securities);

LNASSET = the natural log of beginning-of-year total assets;UGAINS = unrealized security gains and losses (includes only unrealized gains

and losses from available-for-sale securities) as a fraction of totalassets at the beginning of the year;

ε = error term.

The residual from equation (3) is taken as the discretionary component of realizedsecurity gains and losses (DISC_GAINSit). Panel A of Table A1 in the Appendixsummarizes the variables used to find discretionary and nondiscretionary loan lossprovisions and realized securities gains, Panel B reports descriptive statistics forall variables in equations (1) through (3), and Panel C presents the results of theregressions in equations (1) and (3).

Note that higher levels of loan loss provisions decrease earnings, while higherlevels of realized securities gains and losses increase earnings. Accordingly, wedefine bank i’s “discretionary earnings” in year t, DISC_EARNit, as the combinedimpact of discretionary loan loss provisions and discretionary realization of securities

5. This approach is analogous to the common use of the modified Jones model to derive “normal”accruals for industrial firms and the use of residuals from that model as a measure of discretionary accruals.Our procedure differs for the crash years, however. As noted above, we apply the coefficients estimatedthrough 2006 to bank data in 2007–09 to estimate discretionary loan loss provisions during those years.Therefore, disruptions to bank activities during the crash will not distort our estimates of “normal” bankbehavior.

LEE J. COHEN ET AL. : 179

TABLE 2

SUMMARY STATISTICS FOR BANKS, PRECRISIS YEARS: 1997–2006

Mean Median Std dev 1st%ile 99th%ile Observations

Panel A. Descriptive statistics on discretionary earnings variables

DISC_EARN (%) −0.014 0.004 0.370 −1.185 0.858 3,267DISC_LLP (%) −0.004 −0.023 0.257 −0.481 0.867 3,267DISC_GAINS (%) −0.018 −0.023 0.281 −0.656 0.764 3,267Return on assets (%) −0.014 0.004 0.370 −1.185 0.858 3,267

Panel B. Descriptive statistics on earnings management variables

EARN_MGT (%) 0.601 0.392 0.991 0.069 3.876 3,267LLP_MGT (%) 0.430 0.299 0.501 0.044 2.630 3,267GAINS_MGT (%) 0.380 0.227 0.902 0.029 2.845 3,267

Panel C. Descriptive statistics on bank stock market performance

Worst-week return (%) −7.138 −6.398 3.596 −19.778 −2.317 3,267Residual standard deviation (%) 3.098 2.883 1.257 1.172 7.612 3,267

NOTE: This table provides summary statistics for all variables used in the analysis. DISC_EARN = discretionary earnings as a percent oftotal assets = DISC_GAINS – DISC_LLP, DISC_LLP = discretionary loan loss provisions as a percent of total assets, DISC_GAINS =discretionary realized security gains and losses as a percentage of total assets. Return on assets = net income in year t/total assets at end ofyear t.

EARN_MGT = |DISC_EARNt−1| + |DISC_EARNt−2| + |DISC_EARNt−3|LOAN_MGT = |DISC_LLPt−1| + |DISC_LLPt−2| + |DISC_LLPt−3|GAINS_MGT = |DISC_GAINSt−1| + |DISC_GAINSt−2| + |DISC_GAINSt−3|

Panel C statistics on bank performance are summary statistics of annual data for the sample of banks pooled across years. Worst-week returnis lowest bank-specific return over the course of each fiscal year. Residual standard deviation is the standard error of regression residuals fromthe estimation of an index model regression, equation (8), of bank returns against the return on the CRSP value-weighted market index andthe Fama–French bank industry index. Each regression is estimated for each bank using weekly observations for the year.

gains or losses:

DISC EARNi t = DISC GAINSi t−DISC LLPi t . (4)

High levels of DISC_EARN amount to underreporting of loan loss provisions and/orhigher realizations of securities gains, which, ceteris paribus, increase income. Nega-tive values for DISC_EARN would indicate that loan loss provisions are overreportedand/or fewer security gains are realized, both of which decrease reported operatingincome.

Panel A of Table 2 reports descriptive statistics for each variable in equation (4), es-timated over the precrisis period, 1997–2006.6 The average level of both discretionaryloan loss provisions and realized securities gains (both as a percent of assets) are mea-sured as departures from normal behavior (i.e., as regression residuals), and thereforeby construction, are virtually zero.7 However, there is meaningful variation in these

6. The exclusion of 2007–09 from these summary statistics explains why there are 4,112 banks inTable 1, but only 3,267 observations in Table 2. Also, while the behavioral equations (1) and (3) areestimated over the 1994–2006 period, the final sample period does not begin until 1997 because some ofthe variables used in the following regression analysis entail 3-year lagged values (see below).

7. The average value is not precisely zero because, while we estimate equations (1) and (3) over the1994–2006 period, the final sample begins in 1997 as the earnings management variables are defined as3-year moving sums of lagged values.

180 : MONEY, CREDIT AND BANKING

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

1.6%

1.8%

2.0%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

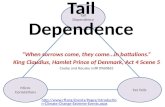

FIG. 1. Standard Deviation of Discretionary Earnings.

NOTE: Cross-sectional standard deviation of discretionary earnings, DISC_EARN, across the sample of banks in eachyear. Discretionary earnings equal discretionary realization of securities gains or losses minus discretionary loan lossprovisions, each expressed as a percentage of total assets.

numbers. Discretionary loan loss provisions, DISC_LLP, in the precrisis period rangefrom a 1st percentile value of −0.481% to a 99th percentile value of 0.867% of assets,with a standard deviation (across banks and time) of 0.257% of assets. The corre-sponding range for realized securities gains is from −0.656% to 0.764% of assets,with a standard deviation of 0.281% of assets. The standard deviation of discretionaryearnings, DISC_EARN, is 0.370% of assets, indicating that a nontrivial portion ofthe variation in reported bank performance (the standard deviation of bank ROA is0.614%) is due to management’s discretionary accounting and security sales choices.

Figure 1 plots the standard deviation across banks of DISC_EARN in each year.Notice the dramatic increase in the cross-sectional standard deviation of discretionaryearnings in the 2007–09 period. This may indicate that normal bank behavior asexpressed in equation (4) significantly changes during the crisis. We therefore willfocus primarily on patterns computed prior to 2007. The next section offers furtherevidence on accounting discretion.

2.2 Earnings Management

Table 3 examines the time-series properties of discretionary earnings,DISC_EARN, as well as its two components, discretionary loan loss provi-sions, DISC_LLP, and discretionary realizations of gains or losses on securities,DISC_GAINS. We regress each of these variables on their own past values in theprevious 3 years. We estimate the relation over the precrisis period, 1997–2006, be-cause Figure 1 suggests that the extreme events of the crisis years might disrupt thepatterns that characterized each bank in the previous decade.

LEE J. COHEN ET AL. : 181

TABLE 3

TIME-SERIES BEHAVIOR OF COMPONENTS OF DISCRETIONARY BANK EARNINGS

Dependent variable Explanatory variable Coefficient t-statistic

Panel A. Discretionary earnings

DISC_EARN DISC_EARN(−1) 0.105 5.65DISC_EARN(−2) −0.054 −2.79DISC_EARN(−3) −0.150 −7.61Observations 3,267Fixed effects Y

Panel B. Discretionary loan loss provisions

DISC_LLP DISC_LLP(−1) 0.210 11.30DISC_LLP(−2) −0.093 −4.80DISC_LLP(−3) −0.111 −5.70Observations 3,267Fixed effects Y

Panel C. Discretionary securities gains/losses

DISC_GAINS DISC_GAINS (−1) 0.027 1.40DISC_GAINS (−2) −0.084 −4.18DISC_GAINS (−3) −0.196 −9.67Observations 3,267Fixed effects Y

NOTE: Each component of earnings management is regressed on its own lagged values. Observations are annual over the period 1997–2006.Discretionary items are estimated as residuals from equations that predict loan loss provisions and realized securities gains and losses basedon bank characteristics (see Beatty, Ke, and Petroni 2002). The models of “normal” loan loss provisions and realized securities gains andlosses are contained in the Appendix. These regressions are estimated with bank and year fixed effects.

Panel A of Table 3 shows that in the short term (i.e., at a 1-year lag), discretionaryearnings exhibit positive serial correlation, with a positive and statistically significantcoefficient (0.105) on the 1-year lagged value. However, at longer lags of 2 or 3years, this relation reverses. The coefficients at these lags (−0.054 and −0.150,respectively) are negative, highly significant, and of considerably greater combinedmagnitude than the coefficient on the 1-year lag. When we decompose discretionaryearnings into its two components, we find precisely the same patterns (Panels B andC). Both discretionary loan loss provisions as well as discretionary realizations ofsecurities gains or losses show the same positive serial correlation at 1-year horizons,but negative and larger combined serial correlations at the 2- and 3-year horizons. Thispattern suggests that discretionary contributions to earnings due either to “abnormal”loan loss provisions or to security sales show a reliable tendency to reverse in lateryears.

If managers consistently employ unbiased estimates of future loan losses to deter-mine the proper level of current reserves, we would find no time-series dependencein the discretionary loan loss series. The significant time-series patterns that actuallycharacterize the data suggest that loan loss provisions are subject to strategic con-siderations. Managers may use their discretion in choosing loan losses to paint somedesired picture of the firm. But over time, as accumulated loan loss provisions mustbe reconciled to actual loss experience, those discretionary choices must be reversed.

182 : MONEY, CREDIT AND BANKING

Similarly, the reversal patterns in realized gains or losses on security sales suggestthat managers selectively choose securities to sell based in part on the contributionto current earnings, leaving them with a preponderance of offsetting gains or losseson future sales.

The pattern revealed in Table 3 is highly reminiscent of the literature on discre-tionary accruals that has been used to examine earnings management in industrialfirms. There too we observe some short-term momentum in discretionary accrualsfollowed by reversals. For example, Dechow, Sloan, and Sweeney (1996) examinethe pattern of discretionary accruals for known earnings manipulators, specifically,firms subject to enforcement actions by the SEC. Discretionary accruals graduallyincrease as the alleged year of earnings manipulation approaches and then exhibit asharp decline. The initial increase in discretionary accruals is consistent with manip-ulation to increase reported earnings: the decline, with the reversal of prior accrualoverstatements. Our results on discretionary choices for banks similarly demonstratea pattern of reversals that undoes prior distortion of reported earnings.

Therefore, we define earnings management, EARN_MGT, as the 3-year movingsum of the absolute value of DISC_EARN. Although managers may prefer account-ing choices that increase earnings, following Hutton, Marcus, and Tehranian (2009),who look at earnings management and crash risk in industrial firms, we use absolutevalues of discretionary earnings rather than signed values. Both positive and negativeabnormal earnings may indicate a tendency to manage earnings: discretionary ac-counting choices that artificially enhance reported earnings in one period eventuallymust be reversed. Like them as well, we use the 3-year moving sum (instead of a1-year value) to capture the multiyear effects of discretionary choices because themoving sum is more likely to reflect sustained, underlying bank policy.

EARN MGT = |DISC EARNt−1| + |DISC EARNt−2| + |DISC EARNt−3|. (5)

We also break earnings management into its components, loan loss provisions andrealized securities gains and losses, to see whether one or the other of these sourcesof discretionary behavior has greater association with tail risk. Therefore, we alsoevaluate the following 3-year moving sums:

Loan loss management: LLP MGT = |DISC LLPt−1| + |DISC LLPt−2|+ |DISC LLPt−3|. (6)

Securities gains/losses management:

GAINS MGT = |DISC GAINSt−1| + |DISC GAINSt−2| + |DISC GAINSt−3|.(7)

Panel B of Table 2 presents descriptive statistics for these variables in the precrisisyears. The mean value of EARN_MGT (computed over the preceding 3 years, t − 3to t − 1) is 0.601% of assets. The mean value of LLP_MGT is 0.430% of assets, and

LEE J. COHEN ET AL. : 183

the mean of GAINS_MGT is 0.380%.8 During the period, mean return on assets is1.090%. Therefore, these values are appreciable fractions of typical ROA.

2.3 Tail Risk

We are ultimately concerned with tail risk, specifically, the impact of cross-sectional variation in earnings management on the incidence of extreme negativereturns. Therefore, we need to net out that portion of returns attributable to commonmarket factors and industry effects. Bank-specific returns are defined as the residualsfrom an expanded index model with both market and bank-industry factors. We esti-mate equation (8) each bank-year using weekly data, and allow for nonsynchronoustrading by including two lead and lag terms for the market and industry indexes(Dimson 1979)9

r j,t = α j + β1, j rm,t−2 + β2, j ri,t−2 + β3, j rm,t−1

+β4, j ri,t−1 + β5, j rm,t + β6, j ri,t + β7, j rm,t+1

+β8, j ri,t+1 + β9, j rm,t+2 + β10, j ri,t+2 + ε j,t , (8)

where rj,t is the stock market return of bank j in week t, rm,t is the CRSP value-weighted market index, and ri,t is the Fama–French value-weighted bank industryindex. The residual of equation (8), εj,t, is the bank-specific return in each week. Ourbank-specific crashes therefore represent extreme price movements over and abovethose due to market-wide and industry-wide events.

Summary statistics for worst-week bank-specific returns and residual risk in theprecrisis years appear in Panel C of Table 2. The average residual standard deviationof bank-specific stock returns in this period is 3.098%. Figure 2 shows that this valueis fairly consistent over the precrisis period. Under the assumption that bank-specificreturns are normally distributed, the expected value of the worst-week bank-specificreturn in a sample of 52 weekly observations would be 2.26 standard deviations belowthe mean; with a mean of zero and standard deviation of 3.098% for the precrisisperiod, this would imply an expected worst-week return of −2.26 × 3.098% =−7.00%. In fact, the sample-average worst-week return in the precrisis period is−7.138%, suggesting that, at least prior to the crisis, fat-tailed distributions are notan issue.

However, Figure 2 demonstrates that residual standard deviations rise sharply withthe onset of the crisis. As bank-specific returns already control for market and industryperformance, this pattern indicates that banks are differentially affected by the crisis,leading to greater within-industry dispersion of returns.

Part of the increase in cross-sectional dispersion, of course, is due to the sharpincrease in the incidence of banks that suffer a crash during the financial crisis.

8. These values do not add up because the absolute value of a sum is not the sum of absolute values.9. Results using only one lead and lag of weekly returns were nearly identical.

184 : MONEY, CREDIT AND BANKING

0%

1%

2%

3%

4%

5%

6%

7%

8%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Res

idua

l sta

ndar

d de

viat

ion

of w

eekl

y re

turn

FIG. 2. Standard Deviation of Bank-Specific Weekly Rates of Return.

NOTE: Standard error of regression residuals from estimation of index model regression, equation (8), of bank returnsagainst the return on the CRSP value-weighted market index and the Fama–French bank-industry index. Each regressionis estimated for each bank using weekly observations for the year. The residual standard deviations are averaged acrossbanks in each year.

TABLE 4

INCIDENCE AND AVERAGE MAGNITUDE OF WEEKLY CRASHES

Year Percentage crashes Mean crash (measured in standard deviations) Median crash (measured in standard deviations)

1997 3.8% −3.40 −3.191998 8.1% −3.42 −3.321999 11.2% −3.46 −3.282000 12.8% −3.68 −3.552001 7.7% −3.42 −3.272002 10.4% −3.52 −3.522003 10.8% −3.65 −3.432004 9.3% −3.56 −3.452005 10.6% −3.60 −3.512006 11.7% −3.51 −3.342007 21.7% −4.00 −3.662008 74.2% −5.61 −4.632009 81.6% −5.89 −5.18

NOTE: The percentage of crashes equals the fraction of banks with at least 1 week in the year with bank-specific returns less than 3.09standard errors below the mean. The mean (median) crash is the average (median) across banks of the weekly stock return during crash weeks,expressed as a multiple of the bank-specific standard deviation.

Table 4 presents annual measures of crash propensity. We measure residual standarddeviation for each bank in each year.10 If returns in the coming year are normally

10. Once we reach the crisis years, however, bank-specific crashes will have large impacts on theestimate of cross-sectional dispersion in that year. To avoid the resulting overestimate in residual standard

LEE J. COHEN ET AL. : 185

distributed, only 0.1% of banks in any week would be expected to exhibit bank-specific returns less than 3.09 standard deviations below their mean value, and inany year, only 1 − (1 − 0.001)52 = 0.0507 or 5.07% of banks would experiencea week with returns below this level. In fact, crash incidence exceeds this value.Table 4 shows for each year the actual percentage of banks with firm-specific returnsin at least 1 week falling below this cutoff. The percentage in the precrisis yearsis generally between 5% and 10%, but it balloons to 74.2% in 2008. The negativereturns corresponding to these crashes are quite large; in the precrisis period, themedian bank-specific loss in a crash week is roughly 3.39 times the weekly residualstandard error from equation (8), or about 10.5%, while in the 2007–09 period themedian loss in a crash week is 4.49 times the standard error.

3. EMPIRICAL RESULTS

3.1 Crash Risk

Table 5 presents an analysis of the association between crash risk and earningsmanagement. The table reports probit (panel) regressions for the likelihood of a bank-specific crash in any year. The dependent variable (indicating a crash) is assigneda value of 1 if in any week in that year the bank-specific return is less than −3.09times the bank-specific standard deviation. The right-hand-side variables of interestare EARN_MGT or, in alternative specifications, its two components, LLP_MGTor GAINS_MGT. These are winsorized at their 1st and 99th percentile values. Wealso interact these explanatory variables with a financial crisis dummy to allow themto have different effects during the crisis period. The additional controls are totalbank assets, bank capital ratio,11 and the Amihud (2002) measure of stock illiquidity.Amihud’s measure equals the ratio of the absolute value of daily stock returns dividedby daily dollar trading volume, averaged over the year. Less liquid stocks may bemore prone to tail events, as they are less able to absorb sudden shifts in demand.The regressions are estimated with year fixed effects.12

Column (1) of Table 5 employs EARN_MGT as the right-hand-side variable,while column (2) breaks out earnings management into its two component terms. Incolumns (1) and (2), the coefficients on these terms are fixed over the entire sampleperiod. In these columns, earnings management as a whole and more particularly dis-cretionary loan loss provisions are marginally significant. However, in columns (3)and (4), we introduce crisis-period interaction terms that allow earnings management

deviation, we set residual standard deviation for 2007–09 equal to the firm’s average value in the precrisisyears.

11. The capital ratio for each bank is defined as (Tier 1 capital allowable under the risk-based capitalguidelines) / (average total assets net of deductions), as reported on the bank’s consolidated Y-9C Report.In turn, total bank assets equal all foreign and domestic assets reported on each bank’s consolidated Y-9CReport.

12. Including bank fixed effects would result in biased coefficient estimates (Stata 2009, p. 410), sowe exclude them in Table 5. Nevertheless, in unreported regressions, we experimented with bank fixedeffects and found that they had almost no impact on our estimates.

186 : MONEY, CREDIT AND BANKING

TABLE 5

CRASH INCIDENCE AS A FUNCTION OF BANK EARNINGS MANAGEMENT

(1) (2) (3) (4)

EARN_MGT 8.215* 2.566(t-statistic) (1.935) (0.415)(Economic magnitude) 0.01969 0.00655

EARN_MGT * CRISIS 22.699**

(2.219)0.08882

LLP_MGT 11.860** −1.280(2.052) (−0.148)0.02088 −0.00269

GAINS_MGT −0.529 2.390(−0.067) (0.252)−0.00078 0.00437

LLP_MGT * CRISIS 62.140***

(3.627)0.16432

GAINS_MGT * CRISIS −3.405(−0.234)−0.00644

Total assets (t − 1) 0.088 0.119 0.070 0.114(0.243) (0.328) (0.193) (0.304)0.00036 0.00049 0.00033 0.00058

Capital ratio (t − 1) −1.475 −1.080 −2.099 −0.526(−1.175) (−0.882) (−1.387) (−0.410)−0.00772 −0.00566 −0.01251 −0.00344

Amihud measure (t − 1) −0.782 −0.825 −0.615 −0.596(−0.973) (−1.028) (−0.763) (−0.728)−0.00410 −0.00563 −0.00478 −0.00508

Firm fixed effects N N N NYear fixed effects Y Y Y YN 4,112 4,112 4,112 4,112Pseudo R2 0.278 0.278 0.280 0.282

NOTE: Probit regressions, with dependent variable equal to 1 if the lowest bank-specific return in the year is worse than 3.09 standarddeviations below zero. Sample period = 1997–2009. Bank specific returns are calculated as residuals from estimation of an index modelregression, equation (8), of weekly bank returns against the return on the CRSP value-weighted market index and the Fama–French bankindustry index. Earnings management variables are winsorized at 1st and 99th percentile values. Regressions are estimated with year fixedeffects. Economic magnitude equals the predicted change in the probability of a crash week occurring during the year given a change in theright-hand-side variable from the 10th percentile in the sample distribution to the 90th percentile. *significant at 10% level; **significant at5% level; ***significant at 1% level.

to have different effects in the pre- and postcrisis periods. In this specification, thereis no apparent relationship between earnings management and crash likelihood in theprecrisis years (the coefficients on EARN_MGT or its components are all statisticallyinsignificant at the 5% level in columns (3) and (4)), but the interaction terms betweenthe crisis dummy and both earnings management and loan-loss provisions are statisti-cally significant. For example, the EARN_MGT * CRISIS interaction term in column(3) has a t-statistic of 2.219 and a coefficient of 22.699. Most of the power of totalEARN_MGT clearly comes from management of loan loss provisions rather thanfrom securities gains or loss management. The LLP_MGT * CRISIS interaction termin column (4) has a t-statistic of 3.627 with a positive coefficient, 62.140. In contrast,securities gains or losses management apparently has little relation to crash propen-sity. Even in the crisis, it is statistically insignificant, with the GAINS_MGT * CRISIS

LEE J. COHEN ET AL. : 187

term receiving a t-statistic of only 0.234. This may be due to the fact that (as discussedabove), during the latter part of our sample period, SFAS 157 significantly limited theability of banks to use security portfolio gains and losses as a tool to manage earnings.

The economic impacts in Table 5 equal the increase in crash probability duringthe year corresponding to an increase in each variable from the 10th percentile of thesample distribution to the 90th percentile. This is analogous to a shift of the right-hand-side variable from the middle of the first quintile of its distribution to the middleof the fifth quintile, and thus is comparable to a common “(5) − (1) difference.” Theimpact of EARN_MGT during the crisis is economically large, 8.88%, and the impactof LLP_MGT is even higher, 16.43%. The latter value is between one-fifth and one-quarter of the unconditional probability of a crash in the crisis years (see Table 4).By way of comparison, Hutton, Marcus, and Tehranian (2009) find that a comparableincrease in earnings management in their sample of industrial firms increases crashlikelihood by around one-sixth of the unconditional probability of a crash. Crashsensitivities for this sample of banks are thus a bit stronger than the correspondingvalues for industrial firms.

The control variables, total assets, capital, and liquidity, all are statistically in-significant in explaining crash likelihood. In sum, it appears from Table 5 that banksengaging in greater earnings management are more likely to experience crashes dur-ing the crisis, even though such crash risk does not make itself evident in the precrisisyears.

Table 6 presents similar regressions, but instead of a 0–1 crash indicator on theleft-hand side, we use a 0–1 jump indicator, where a jump is defined as an increasein stock price of a least 3.09 standard deviations. This allows us to test whetherbank earnings management is related to skewness (specifically, negative crashes) orkurtosis (fat tails on both sides of the return distribution). Table 6 is notable for whatit does not show. With only one exception, neither earnings management nor eitherof its components is significant in any of the specifications. We conclude from theseresults that while crash risk is reliably higher for banks that manage earnings moreaggressively, jump potential is not.

To test this more formally, we compute chi-square tests for the equality of theregression coefficients on EARN_MGT in predicting crash versus jump probabili-ties.13 The chi-square statistic for such equality is 25.3, which allows us to rejectthe hypothesis of equality at a 0.00% level. A similar test for the (joint) equal-ity of the coefficients on the components of earnings management, LLP_MGT andGAINS_MGT, yields a chi-square of 14.7 and a p-value of 0.07%.

13. This test requires that the coefficients for jumps versus crashes be nested in a single regressionframework, which allows us to impose a constraint that the coefficients are equal. Therefore, we computethese chi-square statistics using a multinomial probit regression allowing for three states: crashes, jumps,or neither event.

188 : MONEY, CREDIT AND BANKING

TABLE 6

JUMP INCIDENCE AS A FUNCTION OF BANK EARNINGS MANAGEMENT

(1) (2) (3) (4)

EARN_MGT 2.807 1.134(t-statistic) (0.899) (0.318)(Economic magnitude) 0.01036 0.00398

EARN_MGT * CRISIS 9.191(1.287)0.04950

LLP_MGT 10.488** 7.590(2.127) (1.391)0.02841 0.02039

GAINS_MGT −8.715 −10.263(−1.320) (−1.352)−0.01979 −0.02397

LLP_MGT * CRISIS 22.761(1.375)0.07696

GAINS_MGT * CRISIS 11.886(0.961)0.02876

Total assets (t − 1) −0.587*** −0.553*** −0.597*** −0.575***

(−3.891) (−3.913) (−3.931) (−4.206)−0.00370 −0.00349 −0.00384 −0.00376

Capital ratio (t − 1) 0.044 0.242 −0.190 0.189(0.029) (0.196) (−0.115) (0.141)0.00035 0.00195 −0.00156 0.00158

Amihud measure (t − 1) 0.554 0.412 0.644 0.545(0.665) (0.500) (0.766) (0.653)0.00446 0.00433 0.00689 0.00594

Firm fixed effects N N N NYear fixed effects Y Y Y YN 4,112 4,112 4,112 4,112Pseudo R2 0.278 0.278 0.280 0.282

NOTE: Probit regressions, with dependent variable equal to 1 if the lowest bank-specific return in the year is more than 3.09 standard deviationsabove zero. Sample period = 1997–2009. Bank-specific returns are calculated as residuals from estimation of an index model regression,equation (8), of weekly bank returns against the return on the CRSP value-weighted market index and the Fama–French bank industry index.Earnings management variables are winsorized at 1st and 99th percentile values. Regressions are estimated with year fixed effects. Economicmagnitude equals the predicted change in the probability of a jump week occurring during the year given a change in the right-hand-sidevariable from the 10th percentile in the sample distribution to the 90th percentile. *significant at 10% level; **significant at 5% level;***significant at 1% level.

3.2 Stock Price Crashes versus Operational Risk

As we acknowledge above, regulators may be less concerned with stock price riskper se than with the underlying operating performance of a bank. Moreover, stockprice movements may reflect variables such as short-term fluctuations in risk premiathat do not reflect on operational performance. On the other hand, large stock pricedrops may in fact signal a market expectation of deteriorating performance, and thiswould concern regulators. We address these issues by examining full-year stock priceperformance, implied volatilities, and changes in bank return on assets.

First, we consider the relation between earnings management and annual returns(rather than weekly crashes) during the crisis. Stock returns over a full year may bemore reflective of persistent underlying conditions than weekly returns, even if theyare extreme. We calculate each bank’s annual firm-specific return by compounding its

LEE J. COHEN ET AL. : 189

p-val 0.028 0.819 0.029 0.019 0.004 0.836 0.111 0.199 0.072 0.468 0.598 0.006 0.002

1.2%-0.1%

2.4%

3.9%

1.7%

0.1%1.3% 0.8% 1.0%

0.3% 0.3%

7.0%

13.0%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

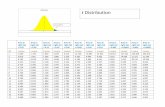

FIG. 3. Earnings Management and Annual Returns.

NOTE: In each year, banks are ranked by earnings management and sorted into five quintiles. The difference in annualfirm-specific returns between quintile (1) and quintile (5) banks are presented for each year. Annual firm-specific returnsare computed by compounding weekly idiosyncratic returns within bank-years. A positive value indicates that the mostaggressive earnings-management quintile outperformed the least aggressive quintile. The p-values are presented for thedifference between the fifth and first quintile annual returns in each year.

weekly idiosyncratic returns. We then rank banks by earnings management and assigneach bank to an earnings management quintile. Finally, we compute the differencein the average annual firm-specific return between the banks in the upper and lowerearnings management quintiles. As shown in Figure 3, annual returns also support thehypothesis that earnings management is associated with greater downside risk duringthe crisis years, and that this risk differential is substantial. That is, until the crisis, thedifference in the average annual firm-specific returns between banks in the upper andlower earnings management quintiles is generally small and statistically insignificant.But in 2008 and 2009, the difference spikes. The most aggressive earnings managersunderperform the least aggressive ones by highly substantial margins, 7.0% and13.0% in those 2 years. These large economic differences are also highly statisticallysignificant, with p-values of 0.6% and 0.2% in the 2 years. Interestingly, the otheryears in which bank earnings management is correlated with underperformance arethe years of financial turbulence corresponding to the final run-up and then collapseof the dot-com sector in the 1999–2001 period.

These results reinforce the conclusion of the probit regressions that earnings man-agement is related to substantial downside exposure, not to fat tails more generally.They also imply that crash weeks are not as a rule followed by a stock price recovery.High earnings management banks show greater crash risk during the crisis as wellas considerable sustained underperformance throughout the crisis. The consistencyof the crash risk probit regressions and these annual return differentials suggest thatthe stock price declines reflect a reassessment of underlying bank prospects ratherthan short-lived financial market fluctuations due, for example, to high-frequencyvariation in risk premia.

190 : MONEY, CREDIT AND BANKING

TABLE 7

INCREASE IN IMPLIED VOLATILITY OF BANKS AS A FUNCTION OF EARNINGS MANAGEMENT AND ITS COMPONENTS

Mean implied Mean impliedvolatility volatility

Jan. 31, 2007 N Jan. 30, 2009 N Difference t-stat (p-value)

Panel A

EARN_MGT [bottom tercile] 0.199 12 0.815 12 0.616EARN_MGT [top tercile] 0.178 18 0.929 18 0.751Diff-in-diff 0.135 1.597 (0.121)

Panel B

LLP_MGT [bottom tercile] 0.180 17 0.929 17 0.749LLP_MGT [top tercile] 0.195 15 0.730 15 0.535Diff-in-diff −0.213 3.546 (0.0013)

Panel C

GAINS_MGT [bottom tercile] 0.193 9 0.806 9 0.612GAINS_MGT [top tercile] 0.191 23 0.953 23 0.762Diff-in-diff 0.150 −1.638 (0.112)

NOTE: In this table, we rank banks by earnings management and then assign them to terciles. The mean implied volatility of at-the-money calloptions for each group is computed precrisis (January 31, 2007) and mid-crisis (January 30, 2009). The difference-in-difference is positivewhen high earnings management banks demonstrate greater increases in implied volatility than low earnings management banks.

Further corroboration for the view that the higher rate of stock price crashes formore aggressive earnings managers is due to a reassessment of their prospects isfound in the positive correlation between earnings management and loan loss pro-visions during the crisis years. That correlation is 0.324, indicating that loan lossprovisions during the crisis increased with the aggressiveness of earnings manage-ment as measured before the crisis. In other words, compared to less aggressiveearnings managers, aggressive banks revealed during the crisis greater negative in-formation about the quality of their loan portfolios. In contrast, earnings managementand loan loss provisions in the precrisis years are nearly unrelated, with a correlationcoefficient of only 0.035.14

To examine whether the greater stock price decline of high-earnings managementbanks documented in Figure 3 might be related to increases in risk and thereforerisk premia, Table 7 examines the increase in implied volatility from the precrisisperiod to the crisis period as a function of bank earnings management.15 If theimplied volatilities of aggressive earnings managers increase by more than those of

14. Symmetrically with the positive correlation between earnings management and loan loss provisionsin the crisis years, one may have expected negative correlation in the precrisis years, with more aggressiveearnings managers understating potential loan loss exposure. If high earnings management banks maderiskier loans, however (which seems to be the case based on loan loss provisions during the crisis), thelack of correlation between loan loss provisions and earnings management would imply that there was infact underreserving in the precrisis years, since those riskier loans should have elicited higher reserves.

15. We collect these implied volatilities from the OptionMetrics database. We average the impliedvolatilities of the closest-to-the-money 30-day call and put options.

LEE J. COHEN ET AL. : 191

less aggressive ones, it is possible that their differential stock price declines mightbe related to differential changes in risk premium. For example, perhaps aggressiveearnings managers precrisis were not as good at managing risk (or took on morerisk), which was revealed during the crisis. Or perhaps the market feared that moreopaque banks were hiding more bad news during the crisis. If implied volatility isnot associated with earnings management, however, it becomes more plausible thatthe greater stock price declines of high earnings management banks during the crisisreflect expected deterioration of operating performance.

Because most banks do not have traded options, the sample size in Table 7 issmall, and therefore we group banks into earnings management terciles rather thanquintiles. The mean implied volatility of at-the-money call options for each groupis computed precrisis (January 31, 2007) and mid-crisis (January 30, 2009). Table 7shows that all implied volatilities increased during the crisis. For the bottom tercile,implied volatility increased from 0.199 precrisis to 0.815 mid-crisis, while for thetop tercile, implied volatility increased from 0.178 to 0.929. However, there is noevidence that more aggressive earnings managers demonstrate greater increases inimplied volatility. The difference-in-difference statistic in Panel A (for total earningsmanagement) indicates that more aggressive banks have slightly higher increases inimplied volatility over the period, but by a statistically insignificant amount (t-statistic= 1.597). Panel B focuses on the loan loss provision component of earnings man-agement, which is most predictive of both crash risk and annual underperformanceduring the crisis. By this measure, more aggressive earnings managers have a lowerincrease in implied volatility. For the bottom tercile, implied volatility increases from0.180 precrisis to 0.929 mid-crisis, while for the top tercile, implied volatility in-creases from 0.195 to 0.730. The difference-in-difference t-statistic in Panel B is3.546, significant at better than 1%. This result is at odds with a risk premium-basedexplanation of the comparatively poor stock price performance of the more aggres-sive earnings managers. Gains management (Panel C) shows the opposite pattern,but again at a statistically insignificant level. In sum, changes in implied volatilityare not related to stock price performance during the crisis, which strengthens thecase that the stock price performance is more related to operating performance thanto variation in risk premium.

Finally, to focus on a measure of more direct interest to bank regulators, we examinewhether banks that experience a crash are more likely to suffer a deterioration infuture operating performance. Specifically, for each year, we first classify banksas having experienced a crash or not. Then we compute the average change inreturn on assets (net income/assets) for crashers versus noncrashers. The changein ROA is measured as ROA in the year following the crash minus ROA in theyear preceding the crash. By skipping the year of the crash itself, we avoid anyconfounding effects of stock price crashes that might result from announcementsconcerning operating performance during the crash year. Comparing average changesin ROA for crashers versus noncrashers provides a difference in differences across thatparticular year. Repeating this procedure for each year of the sample, we can perform a

192 : MONEY, CREDIT AND BANKING

TABLE 8

DECLINE IN OPERATING PERFORMANCE FOR CRASHING VERSUS NONCRASHING BANKS

Difference in differences t-statistic p-value

All crashing banks −0.11% 1.95 7.1%50% most severe crashing banks −0.22% 1.90 9.1%25% most severe crashing banks −0.44% 2.27 2.7%

NOTE: This table reports the average change in ROA for banks with crashes in a given year versus the average change in ROA for noncrashingbanks. Change in ROA is computed as ROA in the year following a crash minus ROA in the year preceding a crash. The difference indifferences is computed for each year of the sample. Averages and standard deviations are calculated across the years in the sample period.The table reports Fama–MacBeth statistics with 12 degrees of freedom.

Fama–MacBeth estimate of the average differential change in performance acrosscrashing and noncrashing banks.

The results, reported in Table 8, show that banks that experience a crash aremore likely to suffer a deterioration in future operating performance. The first line ofTable 8 reports the difference-in-differences results. Crashers in any year demonstratean average incremental deterioration in ROA of 11 basis points relative to noncrashersacross the year. The t-statistic is 1.95, but with only 12 degrees of freedom, the p-valueis 7.1%. When we stratify crashers further, however, the results are more substantial.For example, in the second line of the table we order crashing banks in each year bythe size of their crash and focus on the half of the banks with the more severe crashes.These banks demonstrate a much higher difference-in-differences deterioration ofROA compared to noncrashers: 22 basis points compared to only 11. Here, thet-statistic is 1.90, with a p-value of 9.1%. Finally, we cut the crashing subsample inhalf again and look at only the most severe quarter of the crashers. The difference-in-differences deterioration in ROA again rises substantially, to 44 basis points, witha t-statistic of 2.29 and a p-value of 2.7%. While the small number of observationsin this exercise generally impedes statistical significance, these results neverthelessindicate that bank-specific crashes seem to predict a deterioration of bank operatingperformance in the year following a crash; tellingly, more extreme crashes predictgreater deterioration. Moreover, the differences in differences are economically large.A typical bank ROA even in good times is less than 1.5%. So, a swing of between11 to 44 basis points is substantial. Thus, stock market crashes seem to provideuseful early warning signs of coming deterioration in operating performance, and,in turn, capital adequacy. While regulators would have to wait a full year to observeROA directly, it appears that future changes in ROA can be inferred from stock pricecrashes today.

4. CONCLUSION

While earnings management has little apparent predictive significance for down-side risk during the precrisis period, it is highly predictive of such risk during the

LEE J. COHEN ET AL. : 193

crisis. Downside risk for banks exhibiting greater earnings management in the precri-sis period is substantially greater during the crisis years. The association of earningsmanagement with crash risk is economically large, with a magnitude that approachesone-quarter of the unconditional probability of a crash. Management of loan lossprovisions appears to be far more important than discretionary choices in the re-alization of gains or losses on security holdings. This downside risk is evidentfrom full-year returns as well as extreme weekly returns, implying that these re-sults do not reflect merely short-term stock price fluctuations. Neither do variationsin risk and risk premia as reflected in implied volatility seem to be the cause of thisphenomenon. Moreover, crashes in stock prices predict deterioration in operationalperformance.

The challenging policy implication of these results for regulators, investors, andrisk managers is that tail risk does not seem to be evident in precrisis data—wedo not observe the downside risk associated with earnings management until acrisis. This, of course, limits the use of past rate of return data to assess risk ofextreme returns. Nevertheless, these results indicate that a history of earnings man-agement, whatever its motivation, helps to predict bank performance during a crisis.Therefore, even if that tail risk has not been manifest during “normal” periods, onemight reasonably look at earnings management as predictive of exposure to tailevents.

While we do not have any direct evidence on the mechanism underlying theassociation between earnings management and downside risk, it seems reasonable tospeculate that banks that massage earnings have more to hide. They may easily denythe market relevant information during quiet periods. However, when a crisis strikesand stresses become more evident, the negative information revealed about themmay lead to a more substantial revision of market perception about their operatingperformance with consequent impact on their stock prices.

APPENDIX: MODELS OF LOAN LOSS PROVISIONS AND REALIZED SECU-RITY GAINS AND LOSSES

The Beatty, Ke, and Petroni (2002) model presented in equation (1) applies toincremental loan loss provisions in any year. As a model of “normal” loss provisions,it gives us a basis for detecting abnormal provisions, and that is the major requirementfor our empirical model. Nevertheless, taking a broader view, it is worth pointing outthat their equation is broadly consistent with a model in which firms target the level ofloan loss reserves. Suppose that total loan loss reserve targeted by each firm, T(LLR),can be described by the following equation (with variable definitions in Table A1 onthe following page):

T(LLRit) = αtr + β1LNASSETit + β2NPLit + β4LOANRit + β5LOANCit

+β6LOANDit + β7LOANAit + β8LOANIit + β9LOANFit + εit. (A1)

194 : MONEY, CREDIT AND BANKING

We cannot observe T(LLRit) directly, but we do observe actual loss provisionsin each year, and these provisions presumably will fluctuate in the same directionas changes in T(LLRit) as firms make at least partial adjustments to theoreticallydesirable levels of loan loss reserves. Therefore, one may interpret equation (1) as atransformed version of (9) together with a partial adjustment model.

Under this interpretation, the negative serial correlation estimated for ε in Table 3has an interesting implication. It suggests that a negative residual is likely to befollowed by a positive one. Therefore, a currently underprovisioned firm is likely tobe overprovisioned within a short period of time. One reading of this result is that if abank does not have enough accounting flexibility to use further underprovisioning toreach its target net income, it may take an entirely different approach and drastically

TABLE A1

BANK EARNINGS MANAGEMENT

Panel A. Variables used to find discretionary and nondiscretionary accruals

LOSS = loan loss provisions as a percentage of total loansNPL = nonperforming loans (loans past due 90 days or more and still accruing interest and loans in

nonaccrual status) as a percentage of total loansLLR = loan loss allowance as a percentage of total loansLOANR = real estate loans as a percentage of total loansLOANC = commercial and industrial loans as a percentage of total loansLOAND = loans to depository institutions as a percentage of total loansLOANA = agriculture loans as a percentage of total loansLOANI = consumer loans as a percentage of total loansLOANF = loans to foreign governments as a percentage of total loansGAINS = realized security gains and losses (includes realized gains and losses from available-for-sale

securities and held-to-maturity securities) as a percentage of total assetsUGAINS = unrealized gains and losses (includes unrealized gains and losses from available-for-sale

securities) as a percentage of total assetsASSETS = total assets (in billions of dollars)LOANS = total loans (in billions of dollars)

Panel B. Descriptive statistics on variables used to calculate discretionary and nondiscretionary loan lossprovisions and realized securities gains or losses, 1997–2009

Mean Median Std dev 1st percentile 99th percentile Observations

LOSS (%) 0.61 0.32 1.03 −0.11 5.35 4,112LOANR (%) 69.11 72.07 17.39 7.68 97.40 4,112LOANC (%) 17.32 14.88 11.51 0.59 59.94 4,112LOAND (%) 0.17 0.00 1.19 0.00 2.79 4,112LOANA (%) 0.94 0.11 2.10 0.00 10.63 4,112LOANI (%) 8.53 5.59 9.01 0.05 41.86 4,112LOANF (%) 0.02 0.00 0.20 0.00 0.57 4,112NPL (%) 0.82 0.29 1.84 0.00 7.65 4,112LLR (%) 1.45 1.32 0.63 0.46 4.12 4,112GAINS (%) 0.02 0.01 0.52 −1.07 0.84 4,112UGAINS (%) 0.04 0.03 1.47 −1.85 1.92 4,112ASSETS($ billion) 21.9 1.61 131.0 0.23 482.0 4,112LOANS($ billion) 11.2 1.04 58.4 0.13 216.0 4,112

(Continued)

LEE J. COHEN ET AL. : 195

TABLE A1

CONTINUED

Panel C. Regression results, sample period 1994–2006

Loan loss provisions Realized security gains/lossesCoefficient estimate Coefficient estimate

Independent variable (t-value) (t-value)

LNASSET −0.00003 0.00005(−0.38) (1.49)

NPL 0.1871(3.75)***

LLR 0.2692(5.64)***

LOANR −0.0043(−3.06)***

LOANC 0.0027(1.21)

LOAND −0.0055(−0.65)

LOANA −0.0094(−2.20)**

LOANI 0.0045(2.93)***

LOANF −0.074(−1.11)

UGAINS 0.2554(2.04)**

Bank-years 5,701 5,710Adjusted R2 0.510 0.1618

NOTE: Standard errors are clustered by firm.**Significant at the 5% level.***Significant at the 1% level.

overprovision (i.e., “take a bath” in current earnings) to regain its ability to under-reserve in future periods.16

Table A1 provides variable definitions, summary statistics, and regression resultsfor the Beatty, Ke, and Petroni (2002) OLS regression models explaining loan lossprovisions and realized security gains and losses for a sample of large bank hold-ing companies over the period 1994–2006. Data are obtained from Bank HoldingCompany Performance Reports (FRY-9), the Chicago Fed’s merger databases, andthe Center for Research in Security Prices (CRSP). The following regressions areestimated:

LOSSit = αtr + β1LNASSETit + β2NPLit + β3LLRit + β4LOANRit + β5LOANCit

+β6LOANDit + β7LOANAit + β8LOANIit + β9LOANFit + εit and

GAINSit = αt + β1LNASSETit + β2UGAINSit + εit.

16. We thank the referee for this observation.

196 : MONEY, CREDIT AND BANKING

LITERATURE CITED

Ahmed, Anwer S., Carolyn Takeda, and Shawn Thomas. (1999) “Bank Loan-Loss Provisions:A Reexamination of Capital Management, Earnings Management, and Signaling Effects.”Journal of Accounting and Economics, 28, 1–25.

Amihud, Yakov. (2002) “Illiquidity and Stock Returns; Cross-Section and Time-Series Ef-fects.” Journal of Financial Markets, 5, 31–56.

Arya, Anil, Jonathan Glover, and Shyam Sunder. (1998) “Earnings Management and theRevelation Principle.” Review of Accounting Studies, 3, 7–34.

Beatty, Anne L., Sandra L. Chamberlain, and Joseph Magliolo. (1995) “Managing FinancialReports of Commercial Banks: The Influence of Taxes, Regulatory Capital, and Earnings.”Journal of Accounting Research, 333, 231–62.

Beatty, Anne L., Bin Ke, and Kathy R. Petroni. (2002) “Earnings Management to AvoidEarnings Declines across Publicly and Privately Held Banks.” The Accounting Review, 77,547–70.

Beaver, William H., and Ellen E. Engel. (1996) “Discretionary Behavior with Respect toAllowances for Loan Losses and the Behavior of Security Prices.” Journal of Accountingand Economics, 22, 177–206.

Cohen, Daniel A., Aiyesha Dey, and Thomas Z. Lys. (2005) “Trends in Earnings Man-agement and Informativeness of Earnings Announcements in the Pre- and Post-SarbanesOxley Periods.” Manuscript available at SSRN: http://ssrn.com/abstract=658782 orhttp://dx.doi.org/10.2139/ssrn.658782.

Collins, Julie H., Douglas A. Shackelford, and James M. Wahlen. (1995) “Bank Differencesin the Coordination of Regulatory Capital, Earnings, and Taxes.” Journal of AccountingResearch, 33, 263–91.

Cornett, Marcia M., Jaime J. McNutt, and Hassan Tehranian. (2009) “Earnings Managementat Large U.S. Bank Holding Companies.” Journal of Corporate Finance, 15, 412–30.

Dechow, Patricia, Richard Sloan, and Amy Sweeney. (1995) “Detecting Earnings Manage-ment.” Accounting Review, 70, 193–225.

Dechow, Patricia, Richard Sloan, and Amy Sweeney. (1996) “Causes and Consequences ofEarnings Manipulation: An Analysis of Firms Subject to Enforcement Actions by the SEC.”Contemporary Accounting Research, 13, 1–36.

Demski, Joel S. (1998) “Performance Measure Manipulation.” Contemporary AccountingResearch, 15, 261–85.

Dimson, Elroy. (1979) “Risk Measurement When Shares Are Subject to Infrequent Trading.”Journal of Financial Economics, 7, 197–227.

Gunther, Jeffrey W., and Robert R. Moore. (2003) “Loss Underreporting and the AuditingRole of Bank Exams.” Journal of Financial Intermediation, 12, 153–77.

Healy, Paul M. (1985) “The Impact of Bonus Schemes on Accounting Decisions.” Journal ofAccounting and Economics, 7, 85–107.

Hutton, Amy, Alan J. Marcus, and Hassan Tehranian. (2009) “Opaque Financial Reports,R-square, and Crash Risk.” Journal of Financial Economics, 94, 67–86.

Jin, Li, and Stewart C. Myers. (2006) “R2 around the World: New Theory and New Tests.”Journal of Financial Economics, 79, 257–92.

Jones, Jennifer. (1991) “Earnings Management during Import Relief Investigations.” Journalof Accounting Research, 29, 193–228.

LEE J. COHEN ET AL. : 197

Kothari, S.P., Susan Shu, and Peter Wysocki. (2009) “Do Managers Withhold Bad News?”Journal of Accounting Research, 47, 241–76.

Scholes, Myron S., G. Peter Wilson, and Mark A. Wolfson. (1990) “Tax Planning, RegulatoryCapital Planning, and Financial Reporting Strategy for Commercial Banks.” Review ofFinancial Studies, 3, 625–50.

Sloan, Richard. (1996) “Do Stock Prices Fully Reflect Information in Accruals and Cash Flowsabout Future Earnings?” Accounting Review, 71, 289–315.

Stata. (2009) Longitudinal-Data/Panel-Data Reference Manual Release 11. College Station,TX: Stata Press.

Wahlen, James M. (1994) “The Nature of Information in Commercial Bank Loan Loss Dis-closures.” The Accounting Review, 69, 455–78.

![Medieval Sheep and Wool Types · Mouflon* 0.70 short tail Soay* 0.96 short tail Orkney]" -- short tail Shetlandt o.69 short tail St Kilda (Hebridean) *(4) Black short tail Manx Loghtan](https://static.fdocuments.net/doc/165x107/5fc6398b3821403e177e8284/medieval-sheep-and-wool-types-mouflon-070-short-tail-soay-096-short-tail-orkney.jpg)

![Long Tail Vs Short Tail Keywords in ROI Perspective [Infographic]](https://static.fdocuments.net/doc/165x107/55cdf90fbb61ebf25b8b4663/long-tail-vs-short-tail-keywords-in-roi-perspective-infographic.jpg)