ATMs in China 2014

-

Upload

kapronasia -

Category

Business

-

view

292 -

download

1

Transcript of ATMs in China 2014

Webinar: ATMs in China 2014

July 16th, 2014 - 17:00 – 17:45 Beijing Standard Time

The webinar will start in a few minutes.

For more information about the topics covered in this webinar or Kapronasia, please visit www.kapronasia.com or send us an

email: [email protected]. Twitter: @chinafintech

ATMs in China 2014 Prepared by Fiona Zhao Moderated by Paul Robinson Presented by Zennon Kapron July 16th, 2014

Section 1: Industry Overview Section 2: ATM Purchasers and Manufacturers Section 3: Risks and Opportunities Section 4: Future trends Section 5: Conclusions

ATM Industry in China – Deployments

Number of networked ATMs in China growing • Average annual growth rate: 20% • Install base peaked at 520,000 in 2013, surpassing the U.S.

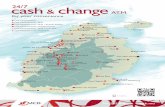

Number of ATMs deployed vs. population • 382 units per million people; growth from 307 per million in 2012 • Surpassed global average level of 346 units for the first time • Lags behind developed markets (786 in Western Europe) • Still room to grow?

ATM Industry in China – Penetration of ATMs

Average number of payment cards per ATM • In 2013, every ATM served 8086 payment cards

• Better performance than in 2012: 8504 • Behind international average of 4000 -> still room for growth

Current locations and density of ATMs • Most of China’s ATMs located in large / middle-sized cities rather than in

small cities and rural areas • ATM per million citizens 765 in Beijing and 648 in Shanghai;

developed economies (795 sets/million) • Sichuan province: just over 50 units/million

ATM Industry in China – Density

Withdrawal • Cash first, then card • …but doesn’t represent all the ATMs in China

Transfer • Most banks’ ATMs can be used for transferring to other banks’ payment

cards. ICBC’s transfer is only within ICBC’s payment cards. However, this will change in 2014.

Commission Charge • If using ICBC’s payment card to withdraw from an ICBC ATM in a different

city, ICBC charges a 1% commission. The minimum amount is RMB 1, the maximum amount is RMB 50.

• If using ICBC’s payment card to withdraw from another banks’ ATM in a different city, the ICBC charges are higher. So, for each transaction, ICBC charges 1% commission, plus RMB 4 as a cross-bank transfer fee.

ATM Industry in China – Functionality & Differences

Section 1: Industry Overview Section 2: ATM Purchasers and Manufacturers Section 3: Risks and Opportunities Section 4: Future trends Section 5: Conclusions

ATM Buyers • Pretty much everyone is buying: national-owned commercial banks, joint

-stock banks, postal saving banks, city commercial banks, rural commercial banks and rural credit cooperatives

• Purchasing volume: more ATMs were purchased in 2012 than needed, drop in 2013

54000 60000

74800

100700

85600

0

20000

40000

60000

80000

100000

120000

2009 2010 2011 2012 2013

ATMs Purchased by Banks: 2009-2013

ATM Purchasers and Manufacturers – Buyers

ATM Buyers • Characteristics:

• Largest clients: Big Five banks ICBC, ABC, Bank of China (BoC), CCB and Bank of Communications -> share of overall market down in 2013, but still more than half the market

• Massive purchases from rural financial institutions in recent years (stimulated by China’s government support policy) • ABC, rural credit cooperatives, rural commercial banks and

postal saving banks: 44.5% market share in 2013 • Specifically, rural credit cooperatives and rural commercial

banks: 21.76%, the largest ATMs purchaser. • Main product purchased: Cash Recycling System (CRS)

• CRS allows for cycling cash deposited -> withdrawal • ATM deposits much more common in China • Less maintenance required

ATM Purchasers and Manufacturers – Buyers

ATM Manufacturers • Top Five Players

• GRG Banking Equipment Co.,Ltd (GRG), Hitachi, Shenzhen Yihua Computer Ltd (Yihua), Diebold, NCR => 70% market share

• Domestic GRG is the largest seller in the market with 23% in 2013; led market for successive 6 years

GRG 23.28%

Hitachi 18.37%

Yihua 12.85%

NCR 9.19%

Diebold 9.16%

OKI 5.85%

Eastcom 4.12%

Wincor Nixdorf 4.56%

Kingteller 3.64%

Cashway 3.63%

Others 5.35%

Market Share of Key ATM Suppliers in 2013

ATM Buyers and Manufacturers – Manufacturers

ATM Manufacturers • CRS may determine future competitive marketplace in China • The core competitiveness: the core cycling technology in CRS • Current situation:

– Domestic CRS manufacturer: GRG & Yihua -> strong research and development capability

– Hitachi ->targeted at CRS from the very beginning / led among foreign ATMs manufacturers

• Domestic ATM suppliers may replace foreign peers • Robust performance of domestic ATM suppliers (GRG & Yihua) • China government’s encouragement in purchasing domestic ATM

brands -> Hitachi was reported to have stolen information from ATMs in China

ATM Buyers and Manufacturers – Manufacturers

Section 1: Industry Overview Section 2: ATM Purchasers and Manufacturers Section 3: Risks and Opportunities Section 4: Future trends Section 5: Conclusions

Potential IT risk: • Outdated Windows systems:

• Microsoft announced end of security update services for Windows XP system as of April 8th 2014.

• Problem for ATM industry as 95% of ATMs are on Windows XP • ATM manufacturers have stop-gap solutions in place

• Different case in China • China ATMs only connects to interbank network rather than external:

relatively difficult to be attacked but doesn’t mean absolutely safe • Solutions:

• Some banks choose Window 7 system for new ATMs • For the old ATMs: bring opportunities for companies like Jowto

Technology->launches “XP Suo”, to enhance ATM system security immune ability as well as to prevent attacks from Hackers and virus-> unknown whether this will be a long-term solution

Risks and Opportunities

Section 1: Industry Overview Section 2: ATM Purchasers and Manufacturers Section 3: Risks and Opportunities Section 4: Future trends Section 5: Conclusions

ATM Outsourcing Services • China ATM market: largest in the world • Banks need to focus on core business • Many have outsourced: ATM location selection, bank outlet construction,

maintenance services, operations management, cash management, etc.. • Currently ATM service providers tend to be small and not terribly

sophisticated • Performance of GRG Banking and Guangzhou Hui Tong, subsidiary of

GRG, steadily increasing

Future Trends

Potential growth in cross-bank funds transfer • Using the ATM to transfer money between banks; promoted by China

Unionpay • Popular among commercial banks and cardholders: CCB’s growth in cross

-bank payment transaction volume via ATM reached 279% in 2013 • In 2013, the large commercial banks, except for ABC and ICBC, all opened

ATM transfer funds services. ABC and ICBC in 2014 Convergence of ATMs and Mobile Technology • ICBC ATMs->Users can withdrawal and transfer with mobile phone

numbers • User enters either the destination phone number to make a transfer or their

own to pick up money that has been sent. • For instance, after making withdrawal reservation via mobile banking, users

can withdraw cash via any ATM, using mobile number, reservation number and code from ICBC

Future Trends

The Potential Future of ATM: VTM? • Virtual Teller Machine (VTM) or iTM: HD screen /

camera, scanner for reading ID cards, document, signatures; 24-hour virtual counter services

• Large increase in VTM Install base in 2013 • Since CGB deployed the first VTM in June 5th

2012, more banks joined in this game -> BOC, ICBC, CEB, Minsheng Bank, China Commercial Bank, ABC, Baotou Bank, Kunlun Bank, etc. (More data on VTM deployment in the ATMs in China report)

• VTMs will replace traditional counter service gradually

– Provides comprehensive financial services including foreign exchange, financial products etc

– Save costs – Estimate: 95% counter services will shift to

VTMs; VTMs market capacity, 2-3 times of ATMs

Future Trends

Section 1: Industry Overview Section 2: ATM Purchasers and Manufacturers Section 3: Risks and Opportunities Section 4: Future trends Section 5: Conclusions

Conclusion • Potential sizable growth in China’s ATMs market

• ATMs installed per million citizens still lags behind developed • Payment cards served by one ATM far less than international

• ATMs Buyers market • Big five banks still dominate the ATM purchase market. • Purchases from rural financial institutions large; government support • CRS purchases dominate

• ATMs Manufacturers market • Dominated by domestic brands such as GRG and Yihua and foreign

brands including Hitachi, OKI and Diebold • Domestic ATMs manufacturers will further expand market as

Chinese government encourages banks to use domestic technology • VTM---the potential future?

• The future of banks will be on the way of “intelligent” ATMs • VTM seems to help joint-equity commercial banks more as they lack

in number of outlets • Largely promoted by China’s largest ATMs supplier – GRG

Webinar: ATMs in China 2014

For more information about the topics covered in this webinar or Kapronasia, please visit www.kapronasia.com or send us an email: [email protected]. Twitter: @chinafintech

Q&A