ARCELOR FINANCE ORGANIZATION November 2005 Martine Hue Senior Vice President Investor Relations.

-

Upload

sophia-jordan -

Category

Documents

-

view

214 -

download

0

Transcript of ARCELOR FINANCE ORGANIZATION November 2005 Martine Hue Senior Vice President Investor Relations.

ARCELOR FINANCE ORGANIZATION

November 2005

Martine HueSenior Vice President Investor Relations

P. 2

7 PRINCIPLES

“Cash belongs to ARCELOR”

Centralization of financial risks (ARCELOR FINANCE, ARCELOR TREASURY)

Global cash pooling organization and finance policy (procedures approved by Audit Committee)

Balanced debt structure: Bank/Market/Institutions

Liquidity risk management with « safety net » credit lines

Gearing (Debt/Equity) under 50% in 2004. Today under 20%

Internal dividend distribution: 100% pay out Ratio with limited exceptions

Investment grade rating : S&P : BBB

Moody’s : Baa2 / outlook positive

P. 3

M. WURTH CFO, Member of Manager Board

INVESTOR RELATIONS CONSOLIDATION

FINANCETAX, INSURANCE AND LEGAL

CONTROLLER DESK

ORGANIZATION

P. 4

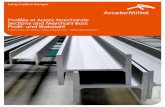

FINANCE

Organized as a « CORPORATE BANK »

P. 5

CORPORATE BANK

FUNDINGGROUP

OPERATIONS TREASURY

FINANCE

•Bank relations

•Market operations (Bonds,…)

•Structured finance

•Rating Agency

•Credit Committee

•Balance sheet structure

•Internal funding

•Internal dividend policy

•Cash Pooling

•Forex

•Commodities

•Energy, CO2

Country branches: France, Germany/Luxembourg, Belgium/NL, Spain, Italy, USA, Brazil

M&A (Finance)

•Internal Investment Bank

•Valuations

•Deal structuring

One functional structure

ARCELOR FINANCE (Luxembourg)

ARCELOR TREASURY (Paris)

M&A SUPPORT (Luxembourg)

P. 6

0.01%

Arcelor S.A.

Arbed S.A. Aceralia CS S.A.Usinor S.A.

Arcelor Treasury

SNC

99.95%commanditaire

0.008% commandité0.008% commandité

Banks & Capital Markets

Cash Pool

Arcelor FinanceS.C.A.

Debt

99.99 %

Equity

Debt

Intra-group debt

0.008%commandité

99,56%

95,03%

99,02%

0.008% commandité

Guaranty

Arcelor Corporate Bank

Operational UnitsDealing room Banks

Operational Units

Arbed Investments S.A.

Arbed Investments Services S.A.

99,99% 99,92%

commanditaire commanditaire0.008% 0.008%

• Arcelor Treasury Snc and Arcelor Finance ScA: Specific General Partnership structure

• Acting partners have jointly and indefinitely unlimited responsibility of Arcelor Finance debt

• 80% minimum of Gross debt located at Arcelor Finance level or over to avoid « Structural Subordination »

FINANCE Specific Legal Structure

P. 7

DEBT STRUCTURE (on checking)

81% Euros, 12% US Dollars, 7% others

2/3 variable rate

1/3 fixed rate

DIVERSIFICATION OF FUNDING (Gross Debt)

21%

40%

14%

9%

16%Credit Institutions

Bonds

Convertibles

Commercial Paper

Others

P. 8

No operational lease

True Sale of Receivables program

ASSET MANAGEMENT

LIQUIDITY MANAGEMENT

Syndicated committed Bank facility 3 billions€

+ More than 1.5 billion € bilateral Bank facilities

+ Umbrella lines for Trade Finance all over the world

P. 9

ARCELOR BALANCE DEBT STRUCTURE (as of September 30, 2005)

(Billions €)

EquityFixed Assets 13.6

16.2

Minority 1.9

Provisions LTWCR 4.55.2

Gross DebtCASH 5.6

4.2

1.4 NET