APRIL2019 Orlando Metro · APRIL2019 Orlando Metro National Home Values Current: $226,800 Monthly...

Transcript of APRIL2019 Orlando Metro · APRIL2019 Orlando Metro National Home Values Current: $226,800 Monthly...

www.zillow.com/research/

APRIL2019 Orlando Metro

National Home Values

Current: $226,800Monthly Change: -0.1%Quarterly Change: 0.4%Annual Change: 6.1%Negative Equity*: 8.2%

Orlando Home Values

Current: $238,900Monthly Change: -0.1%Quarterly Change: 0.6%Annual Change: 7.5%Negative Equity*: 6.1%

Home Values Forecast

(next 12 months)

National: 2.8%Orlando Metro: 3.4%

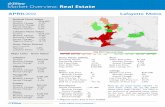

Major Cities - Home Values

OrlandoCurrent: $241,200Monthly Change: -0.4%Annual Change: 6.7%

KissimmeeCurrent: $217,400Monthly Change: 0.1%Annual Change: 10.6%

ApopkaCurrent: $244,200Monthly Change: -0.3%Annual Change: 7.3%

SanfordCurrent: $200,500Monthly Change: -0.1%Annual Change: 9.6%

OviedoCurrent: $318,500Monthly Change: -0.2%Annual Change: 8%

Esri, HERE, DeLorme, MapmyIndia, © OpenStreetMap contributors, and the GIS user community

City ZHVI Year-over-Year-0.4% -0.3% - -0.2% 0.9% - 4.0% 4.1% - 5.9% 6.0% - 7.7% 7.8% - 10.1% 10.2% - 14.1%

Home Values (ZHVI)Increasing Values: 78.8%Decreasing Values: 14.7%Fall From Peak: -10%Peak ZHVI Date: 2006-08Peak ZHVI: $265,300

RentZillow Rent Index: $1,536Monthly Change: 0.3%Annual Change: 6.4%

Rent List Price: $1,620Rent List/Sq. Ft.: $1.1

SalesMedian Sale Price: $–Monthly Change: –%Annual Change: –%

Sale Price/Sq. Ft.: $–Sale-to-list Price Ratio: –Sold for a Loss/Gain: –%/–%

ListingsMedian List Price: $295,000Monthly Change: 1.7%Annual Change: 1.9%

List Price/Sq. Ft.: $149Listings with Price Cut: 19.2%Amount of Price Cut: 2.2%

ForeclosuresHomes Foreclosed: –/10, 000Monthly Change: –Annual Change: –

Foreclosure Resales: –%Monthly Change: –ppAnnual Change: –pp

How do we track home values? Totrack home values, we use the ZillowHome Value Index (ZHVI). The ZHVI isthe mid-point of estimated home valuesfor the area. Half the estimated homevalues are above this number and halfare below.

* Negative equity data is from 2018Q2.

APRIL2019

*The top 20 largest cities and top 10 (or all) counties within the metro are listed. Additional counties, cities, neighborhoods and ZIP codes may be

available online at www.zillow.com/research/data by emailing [email protected]

Zillow Research:Zillow R© is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the placethey call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics andanalytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housingdata and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price ExpectationsSurvey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow HomeValue Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence inlocal housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ: Z), andheadquartered in Seattle.

www.zillow.com/research/

Largest Cities Covered by Zillow

Hom

eValues-ZHVI($)

ZHVIMoM

(%)

ZHVIQoQ

(%)

ZHVIYoY

(%)

ZHVIPeak($)

PeakMon

th

Change

from

Peak(%

)

Rents-ZRI($)

ZRIMoM

(%)

ZRIQoQ

(%)

ZRIYoY

(%)

ForecastYoY

(%)

NegativeEquity(%

)

Altamonte Springs 194,600 0.1 1.5 11.4 1,333 0.6 1.8 4.9 5.6 6.7Apopka 244,200 -0.3 0.6 7.3 1,561 0.5 1.6 6.8 3.2 6.0Casselberry 222,200 0.1 2.1 8.3 1,500 0.2 0.5 5.3 4.3 4.8Clermont 265,400 -0.1 -0.2 4.4 1,631 0.4 1.7 8.7 1.8 4.7Eustis 200,500 0 0.3 8 1,362 0.4 1 3.4 3.6 4.7Kissimmee 217,400 0.1 0.9 10.6 1,378 0.4 1.2 3.7 5.3 8.9Lake Mary 303,000 0.2 1.7 6.9 1,800 0.4 1.1 3.9 4.2 4.5Leesburg 171,100 -0.2 0.5 6.2 1,310 0.5 1.2 4.5 3.5 6.6Longwood 292,800 0.2 1.8 7.3 1,788 0.4 1.4 5.7 4.4 3.5Ocoee 247,500 -0.2 0.5 6.3 1,633 0.5 1.5 6.9 2.7 4.7Orlando 241,200 -0.4 0.4 6.7 1,432 0.1 1 7 2.8 6.6Oviedo 318,500 -0.2 0.8 8 1,850 0.4 1.3 6.2 3.5 4.0Pine Hills 1,278 0.5 1.6 6.7 9.2Poinciana 184,000 0.1 1.3 12.2 1,346 0.2 1.2 7.9 5.9 8.8Saint Cloud 241,100 0 0.7 8.8 1,511 0.5 1.5 6 4.3 6.4Sanford 200,500 -0.1 1 9.6 1,399 0.4 0.8 5.3 4.6 6.0Windermere 435,500 -0.2 0.7 4.9 2,403 0.2 0.4 3.5 2.5 5.9Winter Garden 304,900 0.2 1.4 7.7 1,752 0.5 1.5 8.1 4.4 6.0Winter Park 411,400 -1.2 -2.2 1.5 2,076 0.7 1.9 5.8 -1.3 4.3Winter Springs 277,600 0.3 1.5 8.9 1,664 0.4 1 4.7 4.5 3.8

Largest Counties Covered by Zillow

Hom

eValues-ZHVI($)

ZHVIMoM

(%)

ZHVIQoQ

(%)

ZHVIYoY

(%)

ZHVIPeak($)

PeakMon

th

Change

from

Peak(%

)

Rents-ZRI($)

ZRIMoM

(%)

ZRIQoQ

(%)

ZRIYoY

(%)

ForecastYoY

(%)

NegativeEquity(%

)Lake County 218,400 -0.1 0.2 7.3 1,441 0.3 1.3 6.9 3.3Orange County 248,400 -0.3 0.2 6.2 1,573 0.4 1.3 6.4 2.5Osceola County 218,800 0.1 1.2 10.6 1,460 0.4 1 5 5.4Seminole County 255,600 0 1.2 7.7 1,606 0.4 1.1 4.8 3.7