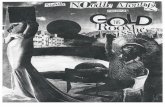

april issue gold

-

Upload

kevi-chishios -

Category

Documents

-

view

227 -

download

1

description

Transcript of april issue gold

YES

CANWE

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS529

1295

0005

77

00001>

ISSUE 25 APRIL 14 - MAY 13, 2013PRICE €4.95

POWERED BY:

PRIVATISATION THINKING OUT OF THE (PHONE) BOX

PLUS: MONEY / BUSINESSECONOMYTAX & LEGALLIFESTYLE / OPINION

ENERGYVTTI’S €300 MILLION INVESTMENT

INTERVIEWSANDREY DASHINMARIA-JOSÉ SOBRINIJOHNY STAVRINOU

+ RAKIS CHRISTOFOROU, ROLF MEAKIN, PHILIP VAN DALSEN

Cyprus remains an extremely attractive jurisdiction14 EXPERTS DISCUSS THE FUTURE OF PROFESSIONAL SERVICES

BROUGHT TO YOU BY

100% SECURED CLIENT FUNDS In the midst of global economic uncertainty, nothing is more important than investing with someone you trust. With a strong and unwavering presence in Cyprus, ForexTime prides itself in being a sound and reputable investment firm with the experience, knowledge and skill to deal with whatever the markets may be experiencing. Capable of weathering any financial storm and adamant in protecting our clients’ funds in a secured banking system, we will always strive to ensure maximum performance, customer satisfaction and confidence in your dealings with us.

ForexTime Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) license number 185/12

There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved still seem unclear to you, please seek independent financial advice.

© 2013 ForexTime Ltd.

www.forextime.com, [email protected], Tel: +357 25 558777

WITH FOREXTIME, INVESTMENT GRADE BANKING IS A GUARANTEE.

4 Gold the international investment, finance & professional services magazine of cyprus

6 816

issue 25april 14 - may 13

2013

FEATURE

Why GREAT SERvicE JUST iSn’T Good EnoUGhBy mike mccormac 47

Think AboUT iT. iT cAn bE donE by peter economides 82

ThE bAiloUT AGREEmEnT REAchEd WiTh ThE TRoikA UndoUbTEdly mARkS ThE

End oF An ERA FoR ThE cypRUS bAnkinG SySTEm

bUT hoW Will iT AFFEcT ThE coUnTRy’S pRoFESSionAl

SERvicES SEcToR?

+ opinion

35 | “i bEliEvE in cypRUS”Andrey Dashin has no intention of quitting Cyprus now that things have suddenly become tough

40 | hEEEERE’S Johny!One of the best-kept secrets on the Cyprus business scene

44 | vTTi’S €300 million invESTmEnT Multiple benefits expected for the local economy

48 | ThinkinG oUT oF ThE (phonE) boxNo-one will lose out through the proposed privatisation of Cyta, says global expert Rolf Meakin.

52 | REGUlATion, REGUlATion, REGUlATionCySEC Vice-Chairman Andreas Andreou on the long-overdue Fiduciaries Law and what it means

56 | REAliSm blEndEd WiTh opTimiSmNo change to IBL Bank’s development plans, says Manager Ghada Shami Christofides

EdiToRiAlUp FRonTFivE minUTES WiTh…

68 {money}

72 {business}

74 {economy}

76 {tax& legal}

78 {lifestyle}

17

40

5644

52xxxxx

ndrey dashin, the millionaire russian businessman behind the alpari family of online forex service providers and, more recently, of his own new venture forextime, has no intention of quitting cyprus now that things have suddenly become tough. in this exclusive interview he dismisses the german press’s money laundering allegations as “mass media noise”, praises the professionalism of those involved in the services

sector and explains why he pays to keep the road leading to the limassol vil-lage where he lives free of litter and rubbish.By JohnVickers, Photography by Jo Michaelides

Gold: Given the success of Alpari, what made you create ForexTime?Andrey Dashin: In Alpari we hired the best professionals to sit on the Board of Directors while the main shareholders mainly restricted themselves to being just that and were not involved in the day-to-day business. But I’m young and very active and I felt the need to do something, to create a new company in which I could implement my own ideas – sometimes controversial ideas! – and my own vision. In Alpari there were many people, all mature industry professionals, who shared this vision and my expectations and so I have brought them with me to ForexTime. Fortunately everything is going according to plan. As an international company it doesn’t rely exclusively on activity in Cyprus so in this sense it is “crisis-resilient”.

Gold: You set up ForexTime knowing that Cyprus was already negotiating a bailout with the Troika, which suggests that you were, in a sense, making a point and stat-ing your faith in Cyprus. Would you agree with this interpretation?A.D.: Yes and I still believe in the future of Cyprus because it still has the prerequisites that will enable it to continue as an interna-tional financial centre. First of all, the people here are top quality professionals. From the standpoint of the labour market, I have always believed that Cyprus offers me good opportunities. The other side of this equation concerns regulation and the Cypriot authori-ties. The financial authorities and, from what I know, the people in the new government are experienced, business-oriented people. I believe in these people. We speak the same language. I’ve had many conversations with them and I know how they think and what they want. We’ve been able to establish a very good, close collaboration between the business community and the authorities and I believe that this stable partnership will be maintained.

Gold: Do you believe that the countries of the eurozone and their partners were specifically targeting Russian money when formulating a bailout plan for Cyprus?A.D.: No, I don’t. First of all, I don’t believe in the “nationality” of money. Money is money. Secondly, I don’t believe in these conspiracy theories about Russian money and money laundering. I discount them as “mass media noise” which we need to dispel and see the root cause of the problem: that the Cyprus banking system had become disproportionately overblown and we all knew this. Implementation of this bailout will mean that the Cyprus banking system is going to shrink – I don’t know by how much – but it is going to emerge smaller but stronger. I also think that these measures are actually going to bring very healthy changes to Cyprus as a whole.

Gold: There has been a lot of talk, espe-cially in Germany, about alleged money laundering of Russian money in Cyprus. As a Russian businessman taking advan-tage of what Cyprus has to offer, how do you feel about all Russians being seen in the negative light?A.D.: People in certain countries obviously

have preconceptions about Russians and maybe about Cyprus as well. So the mixture of a perceived “shady image” for both Cyprus and Russians has led to this idea that we are involved in some sort of illegal activity. How do I feel? I’m pretty calm about this to tell you the truth. I don’t feel that I need to dis-pel these rumours. If someone wants to believe them, it’s up to them. Let them live under an illusion. But that’s all this is: baseless rumours.

48 Gold the international investment, finance & professional services magazine of cyprus

I don’tbelIeve In the “nationality” of money. Money Is Money

Real businessmen turn a negative situation into something posItIve

35

xxxx

the international investment, finance & professional services magazine of cyprus Gold 57

of EvErything

PrEParing for thE

Internet

Gold: It’s surely no secret that companies can improve their performance in a va-riety of strategic areas by aligning their ICT infrastructure with their business goals. Are there still companies out there that are unaware of this basic idea?Maria-José Sobrini: Although there are very few companies which are unaware of this basic idea, many of them take bad decisions. In general when companies fail, conventional wisdom blames external fac-tors: the economy, regulatory actions, and geopolitical challenges are but three prime culprits beyond the control of decision makers. In reality, however, bad decisions –factors within the control of companies themselves – are what overwhelmingly cause firms to lose their leading positions. Over the past 10 years, 159 of the 500 largest companies globally by revenue have been displaced. And in many cases, company executives may not have realized the impact of their own decisions or they may not have been well informed when they made them. This observation is supported by a survey of 1,028 executives and 993 junior managers and individual contributors conducted by Cisco’s Internet Business Solutions Group (IBSG). Though many of their subordinates begged to differ, 71% of executives rated their performances and decision-making abilities from “good” to “excellent.” These included leaders in financial services, where 439 bank failures since 2008 continue to leave a legacy of economic malaise, and retail executives, who have seen 37 major companies file for bankruptcy protection in their industry since 2010.The good news is that a revolution in deci-sion-making stands to change things for the better. Cisco IBSG calls it Decision-Driven Collaboration.

This new model represents a funda-mental transformation in the way leaders perceive and manage collaboration in the

InformatIon and CommunICatIons teChnology (ICt) Is help-Ing more and more CompanIes, organIsatIons and even governments around the world Improve theIr perfor-manCe. whIle the more far-sIghted ones are adoptIng Cloud ComputIng, others are lookIng even further ahead to the fourth phase of the Internet, the “In-ternet of everythIng”. marIa José sobrInI, dIreCtor of Ibsg medIterranean, CIsCo, Is dedICated to showIng busInesses and organIsatIons how to take advantage of InformatIon and CommunICatIons teChnology (ICt). she spoke to gold about the ImportanCe of e-CommerCe, soCIal networks and the Cloud to busIness, and gave her predICtIon about the next bIg thIng. By John Vickers

MARIA SOBRINI

Those in the IT community need to stop acting like vendors and, instead, focus on helping people solve problems

workplace. It is supported by breakthroughs in col-laboration tools, including video, mobility, social media, cloud services, and cutting-edge analytics. But it begins with recognition that everyone is a decision-maker. And while the executives still make the final call, expertise from all corners of the organ-isation is welcomed into the process. The ultimate payoff is millions of better decisions (not just big, critical decisions, but smaller, daily ones as well) that are fact-based, highly informed, and ever more ef-ficient and effective.

Gold: Given the speed at which technology is changing and developing, isn’t there a danger that companies may need to be constantly invest-ing in new products rather than in their core business?M.J.S.: Technology should allow companies to con-centrate on their core business and it should make business process flow much easier. If IT does its job right, it will be deeply embedded in the fabric of ev-ery business process over the next few years. IT and business groups will work together seamlessly. To do this, though, those in the IT community need to stop acting like vendors and, instead, focus on help-ing people solve problems. We are rapidly approach-ing an “inflection point” in the industry where we’ll need IT leaders who are experts in business first and IT second. IT needs to become a business partner. IT professionals and businesses must speak the same language. Businesses must ask how IT can help solve its business goals, and IT leaders must help business leaders achieve their goals.

Gold: In your experience, are successful com-panies generally open to innovation or do you regularly come across a mentality of “we have always done things this way”?M.J.S.: Successful companies are not just open to innovation but most of the time they are leading it.

We can see an explosion of new technolo-gies that create new winners and losers in nearly every industry. In an engagement with a major global manufacturer, Cisco IBSG identified three key factors in the product innovation process that com-panies must clearly understand and be able to orchestrate. They must develop a technology strategy, arrange and manage ecosystem partners, and prepare and ex-ecute detailed plans for managing market interactions, from initial introduction through full-scale market management. How well they deliver on this model will help determine whether a company will be a disruptor in its market space or one of the disrupted.

Gold: How significant are social net-works to business today?M.J.S.: I’ll just mention some numbers and leave the conclusions to your read-ers. A whopping 90% of young people use their smartphones to help them face the day, often before they get out of bed! Even before a cup of coffee, young people grab their smartphone. They’re check-ing it for e-mails, texts and social media updates. The phone has become as much a morning ritual as the toothbrush. The gap between my generation and younger ones in how we use technology is getting smaller. Interestingly, as we older folks are getting more comfortable with technol-ogy (and seeing its value), younger people are getting less starry-eyed. For example, more than a third of the young people that we surveyed suspect that people pres-ent themselves differently online than in the physical world. This year’s study also found that three out of four don’t trust Internet sites to keep their data private, and nearly a third are very concerned about security and identity theft. This younger generation’s relationship with technology is really maturing.

56 Gold the international investment, finance & professional services magazine of cyprus

62

60 | ThE onE And onlyRakis Christoforou is one of only 18 Forensic Accountants outside the USA

62 | pREpARinG FoR ThE inTERnET oF EvERyThinG

Maria José Sobrini, Director of IBSG Mediterranean, Cisco, on the importance of social networks and the cloud to business

76

59

78

68

YES

CANWE

T H E F I R S T N A M E I N E T H I c S

We are a global, independent provider of trust, fund and corporate administration services.

We are committed to helping our clients protect, nurture and grow their wealth.

Above all, we are a people business.

To find out more about our services and to get to know us better, visit

www.firstnames.com

c H R I S T O S

EDITORIAL

YES

CANWE

THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS529

1295

0005

77

00001>

ISSUE 25 APRIL 14 - MAY 13, 2013PRICE €4.95

POWERED BY:

PRIVATISATION THINKING OUT OF THE (PHONE) BOX

PLUS: MONEY / BUSINESSECONOMYTAX & LEGALLIFESTYLE / OPINION

ENERGYVTTI’S €300 MILLION INVESTMENT

INTERVIEWSANDREY DASHINMARIA-JOSÉ SOBRINIJOHNY STAVRINOU

+ RAKIS CHRISTOFOROU, ROLF MEAKIN, PHILIP VAN DALSEN

Cyprus remains an extremely attractive jurisdiction14 EXPERTS DISCUSS THE FUTURE OF PROFESSIONAL SERVICES

John Vickers,Chief Editor

Yes We Can… and We Must

It is the former British Prime Minister Harold Wilson who is credited with first uttering the saying “A week is a long time in politics”. Here in Cyprus we have had extraordinary proof of the truth of Wilson’s words over the past month and, in particular, during the period 15-25 March when the country’s banking sector came crashing down in spec-tacular fashion following a week of tough negotiations with the Troika of international lenders on the terms of a financial assistance package.

Somewhat ironically for Gold, our March issue, featuring a cover story/interview with the new President, was published on 14 March, just one day before the world of Cyprus changed so dra-matically. In that issue, Nicos Anastasiades spoke about the importance of the professional services sector: “It is probably the only one that has proved resilient in this recession and this resilience indicates that, if we actively try to change things for the better, the possibilities are almost unlimited.”

Today, the sector is being called upon to show just how resilient it is, following the extraordi-nary events surrounding the island’s two main banks and the effect that the resolution of Laiki and restructuring of Bank of Cyprus may have on professional services, investors, high net worth indi-viduals and Cyprus-based companies. As you will see in our latest cover story, opinions are divided on how easily and how soon the sector will recover but the overall view of the professionals, experts and commentators with whom we spoke is that, despite the blow that has undoubtedly been dealt to the island’s reputation, Cyprus retains most – if not all – of the attractions and advantages that have been its main selling points for investors over the past decade.

Flexibility is a key quality in business and while, for the past two years, business leaders and experts have repeatedly told Gold that any attempt to change the 10% rate of corporate tax would spell disaster, they are now – unanimously – expressing the view that the rise to 12.5% will not have a noticeable effect on investment decisions. Fears that major companies would relocate or take their funds elsewhere have also proved to be unfounded, at least for now. Restrictions are still in place, so it is difficult to judge but, for example, many lawyers and accountants are happy to report that their foreign clients are not rushing to Malta or Luxembourg and, on page 36, you can read how at least one leading Russian businessman, Andrey Dashin, views the situation.

To say that the Cypriots are still in shock is an understatement. As Dashin says in our exclusive interview, “It’s one thing to know about a situation and another to wake up one morning and discover that your bank account has just got smaller.” However, while the professionals working in the finan-cial sector have also suffered a blow, they are showing remarkable fortitude and determination not to let the banking crisis sound the death knell for their own area of expertise. This is, of course, the only approach possible if the sector is to quickly regain its damaged prestige.

While a week is a long time in politics, a year often seems to fly past: this issue marks the second birthday of Gold. Over the past 24 months, we have attempted to bring you, our readers, a clear and objective analysis of all the issues concerning the professional services sector, international busi-ness, finance and investment in Cyprus. As you will see in this month’s cover story, various writers have warned during this time about the need to restructure the overextended banking sector. One of our key stated objectives from the start has been to play a role in promoting the country as a leading regional business and services centre. This has not changed. We shall continue to seek out success stories, to publicise the advantages that Cyprus undoubtedly has over its competitors, and to provide a platform for the voices and views of the professionals offering legal, accounting, fiduci-ary and other services.

This year, the economic/political/social situation on the island is too serious for us to indulge in cheerful birthday celebrations but we are proud to be here and grateful for your continued sup-port. I sincerely hope that we shall have genuine cause for optimism in April 2014.

6 Gold THE INTERNATIONAL INVESTMENT, FINANCE & PROFESSIONAL SERVICES MAGAZINE OF CYPRUS

MANAGING DIRECTOR: George Michail

GENERAL MANAGER: Daphne Roditou Tang

MEDIA MANAGER: Elena Leontiou

EDITOR-IN-CHIEF: John Vickers

SENIOR EDITOR: Kyproula Papachristodoulou

CONTRIBUTORS TO THIS ISSUE: Christina Antoniou Pierides,

Andreas Christofides, Peter Economides, Loucas Marangos, Mike McCormac,

Stephen Michaelides, Steven Newbery, Andreas Neocleous, Chloe Panayides,

Olga Rybalkina, Polakis Sarris, Savvas Savouri, George Savvides, George Theocharides

ART DIRECTION: Anna Theodosiou

SENIOR DESIGNER: Alexia Petrou

PHOTOGRAPHY: Jo Michaelides

MARKETING EXECUTIVE: Kevi Chishios

SALES & BUSINESS DEVELOPMENT EXECUTIVE:

Phivos KarayiannisADVERTISING EXECUTIVES:

Irene Georgiou, Christopher ConstantinouOPERATIONS MANAGER:

Voulla NicolaouSUBSCRIPTIONS:

Kevi Chishios

PRINTERS: Cassoulides Masterprinters

CONTACT:5 Aigaleo St., Strovolos 2057, Nicosia, Cyprus

Mailing address: P.O.Box 21185, 1503, Nicosia, Cyprus

Tel: +357 22505555, Fax: +357 22679820e-mail: [email protected]

website: www.goldmagazine.com.cysubscriptions: [email protected]

ISSN 1986 - 3543PUBLISHED BY IMH

BROUGHT TO YOU BY

Get Gold on your tablet!

editorial.indd 6 09/04/2013 14:39

Focus on tomorrow,starting today

www.pwc.com.cy

© 2013 PricewaterhouseCoopers Ltd. All rights reserved

We listen. We learn what you want to do and we help you create the value you are looking for. Value that is based on the knowledge that our almost 1.000 local professionals draw from 180.000 experts in 158 countries. We focus on the provision of Assurance, Advisory, Tax and Global Compliance Services.

Cyprus and Spain conclude Double Tax Treaty

A fter negotiations lasting several years, a Double Tax Treaty was signed in February between Cyprus and Spain. At the signing ceremony, the Spanish Ambassador to Cyprus, Anna Salomon Perez, said that the Treaty would facili-

tate investments from Cyprus to Spain and vice versa, and that marked a strengthening of economic relations between the two countries. The new Double Tax Treaty will enter into force three months after it is ratified. Until the new agreement takes effect unilateral relief for Spanish taxes paid will continue to be available under domestic tax legislation.

The most significant provisions of the treaty, which follows the OECD Model Convention, are shown right:

The Treaty will facilitate investments from Cyprus to Spain and vice versa

up front

A two-day Business and Real Estate Forum was held at the Pre-mier Palace Hotel in Kiev, Ukraine on 29-30 March 2013 with the participation of 18 Cypriot com-panies.Organised by MIBS Group with the

support of the Cyprus Chamber of Commerce & Industry (CCCI), the

Cyprus Investment Promotion Agency (CIPA), the Embassy of Cyprus in Ukraine and the Cyprus Tourism Organisation,

the event was addressed by the Ambassador of Cyprus to Ukraine, Evago-ras Vryonides, Markos Shia-panis of MIBS Group, Igor Pon-dolev from the

Ukrainian Chamber of Commerce and Industry, Charis Papacharalambous, Director-General of CIPA, lawyers Polakis Sarris and Antigoni Fakonti (Polakis Sarris & Associates), Polis Kourousides (Total Valuations), Andreas L. Papadopoulos (Hellenic Bank), Nicos Chimarides (PwC Cyprus) and Costas Hadjicosti (Abacus). Presentations were later made of the Develop-ers that took part in the event: from all the regions of Cyprus: Aliada, Aphrodite Hills, Aristo Developers, Chaps Developers, Karma Develop-ers, Giovani Developers, Oikos Group, K & P Chris-tou, Kouroushi Bros, Pafilia, Property Gallery, Vavlitis Group and Zantis Group of Companies. Throughout the two days of the Forum, an exhi-bition of properties in all districts of Cyprus was open at the venue.

The Forum was followed by a press confer-ence at which the participants answered ques-tions from 22 representatives of the Ukrainian and international media. A Gala Reception was later attended by more than 200 Ukrainian busi-nessmen and government officials.

Cyprus Business and real estate Forum in ukraine

8 Gold the international investment, finance & professional services magazine of cyprus

F ollowing the recent successful launch of Banc De Binary in Cyprus and the acquisition of a Cyprus Securities and Exchange

Commission (CySEC) licence, the compa-ny has further enhanced its credibility and reputation as an industry leader by reaching another significant milestone by gaining a foothold in the European market.

Within a three-month period, Banc De Binary has made huge steps towards establishing binary options as a regulated investment tool. As a result of its efforts, the company is now registered with the UK’s Financial Services Authority (FSA), the German Federal Financial Supervi-sory Authority (BaFin), Spain’s Comision Nacional del Mercado de Valores (CNMV) and the Italian Commissione Nazionale Societa e la Borsa (CONSOB), following Cyprus’ lead in the regulation of binary options. These developments will allow the firm to accept new investors from the UK, Germany, Spain and Italy. Banc De Binary founder and CEO, Oren Laurent, said: “We have long voiced our desire to expand into these markets and through the registration of Banc De Binary in the UK, Germany, Spain and Italy now we can serve investors throughout Europe. Our clients can be assured of the highest level of professional standards, customer service, financial security and transparency in their transactions with us”. Banc De Binary offers investors four types of accounts, all with the guarantee of their premium 24/7 service facilities. With state-of-the-art award-winning trading platforms, Banc de Binary offers trading on more than 90 trad-able assets and additionally provides daily market research reviews.

Banc De Binary registers in four major european countries

(Left to right)

eLena Shiapani (Managing

Director, MiBS group), chriStiS

papaDopouLoS (Bank of cypruS),

evagoraS vryoniDeS (aMBaSSaDor

of cypruS to ukraine), generaL

Sergey pitigorech, MarkoS anD

Maria ShiapaniS, MikhaiL

krotov (ceo, Main group).

Dividends: 0% withholding tax

applies if the beneficial owner is a company (other than a partnership) holding at least 10% of the capital

of the company paying the dividend. A rate of

5% applies in all other cases.

Royalties: 0% withholding tax

applies with respect to copyrights of literary, artistic or scientific work, including

films, any patent, trademark, secret formula or process or information concerning industrial, commercial or

scientific experience.

Capital Gains:

Gains from the disposal of immovable property are taxed in

the country in which the immovable property is situated. Gains from the disposal of shares or comparable

interests (other than those listed on the Stock Exchange of either country) deriving more than 50% of their value from immovable property, are taxed in the country in which the immovable

property is situated. Gains from the disposal of any other type

of shares are taxed in the country of which the

seller is resident.

Interest:

0% withholding tax.

T he Board of Directors of the Cyprus Shipping Chamber (CSC) held an official meeting with the

Minister of Communications & Works, Tasos Mitsopoulos, on 2 April 2013. During the meet-ing, the Minister was briefed about the opera-tional problems faced by shipping companies, as a result of the current situation of the Cyprus economy following the 24 March agreement reached with the Eurogroup. There followed a discussion on measures that will allow shipping companies in Cyprus to continue to operate normally and provide significant support to the economy.

shipping remains in Cyprus and supports the economy

Following a proposal by the Chamber, it was decided to initiate a joint promotional cam-paign on the shipping companies’ commitment to remain in Cyprus and the advantages of Cyprus as a reliable and competitive maritime centre.

The Minister stressed the importance attached by the new government to the local shipping industry and thanked the CSC for the continuous support provided by the Cyprus-based shipping companies to the country’s economy.

LaIkI Bank CuSTomeRS

In uk eSCape

Levy

T housands of customers with funds in the UK arm of Cypriot bank Laiki will escape any levy on their accounts.

The Bank of England’s new Prudential Regulation Authority (PRA) has announced that all those whose accounts are in credit will be automatically moved to Bank of Cyprus in the UK. This means that up to £85,000 of their deposits will be protected under the UK compensation scheme. But 15,000 Laiki customers with an estimated £270m in their accounts in the UK are be-ing told their money is safe. On average, Laiki customers in the UK have £18,000 in their accounts. About 5% of custom-ers have more than £85,000, according to Bank of Cyprus UK. Any money above that amount would not be guaranteed by the UK compensation scheme, but the Bank of England confirmed that all deposits had been moved to Bank of Cyprus UK.

pISSaRIDeS meeTS eSSex unIveRSITy aLumnI

Nobel Prizewinning economist Professor Christopher Pissarides met with University of Essex alumni and prospective students at a special evening held

at the Eleon Leisure Park in Nicosia on 15 March.The event offered 85 alumni and 30 pro-spective students, plus their guests, a chance to meet one of the world’s most celebrated economists who has also recently taken on a key role within the new Cypriot government as head of the newly-formed Economic Policy Council.

Professor Pissarides, who com-pleted a Master’s Degree at Essex after obtaining a First in Economics, talked about his memories of the University and his academic career including his work on the economics of unemploy-ment, especially job flows and the effects of being out of work, which led to him receiving the 2010 Nobel Prize in Economic Sciences. Jo Rogers of the University of Essex Development and Alumni Relations Office said: “This was a unique chance for our alumni and prospective students to hear Professor Pissarides speak about his work and his recollections of his time at Essex. We are immensely proud of Professor Pissar-ides’ achievements and delighted he has maintained close links with the Univer-sity and our Department of Economics throughout his career. Those links were celebrated last year when the University awarded Professor Pissarides an honor-ary degree. The evening was also a great chance to network with fellow Essex alumni. We have incredibly strong links with Cyprus and have more than 200 Cypriot students studying at Essex at

the moment. The support of our alumni commu-nity and their success helps the University of Essex continue to be one of the most popu-

lar destinations for students from Cyprus looking to study at a

UK univer-sity.”

Jotun, one of the world’s leading manufacturers of decorative paints,

marine, protective and powder coatings, has just opened its new office in Limassol. The event was attended by the Nor-wegian Ambassador to Greece and Cyprus, Sjur Larsen, and the President and CEO of Jotun A/S, Morten Fon.

Products of the Jotun Group, which has 71 com-

panies and 36 production facilities on all continents, are available in more than 90 countries through its own subsidiaries, joint ventures, agents, branch offices and distributors. Jotun’s total sales in 2012 amounted to €2.12 bil-lion. The Group has more than 9,000 employees.

Jotun was founded in 1926 by Odd Gleditsch in Sandef-jord, Norway, where its head

office is located. To this day the Jotun Group remains under the private ownership of the Gleditsch family. Jotun Cyprus Ltd was formally established in 2011.

Jotun stated earlier this month that it believes strongly in “a future on and for Cyprus” and, to this end, is now investing in new and modern offices with a view to future growth.

jotun cyprus opens new LimassoL office

10 Gold the international investment, finance & professional services magazine of cyprus

up front

a irports have tradition-ally been places to avoid unless you are forced to use them. Going through lengthy security checks and queuing up to show your passport are hardly enjoyable experiences but

once you are inside, more and more airports around the world are trying to make your stay as interesting and exciting as possible. In Europe, 48% of airport revenues actually come from non-aeronautical sectors as they attempt to liven up the pre-flight experience by providing a variety of weird and wonderful distractions to keep weary travellers enter-

tained. From live music concerts to contem-porary art exhibitions and from IMAX cinemas to public ice rinks, some have so much going on they’re on the verge of becoming travel destinations in themselves.

CNN selected seven of the world’s biggest and busiest airports where entertainment and leisure services are taking off in a big way.

The moST Fun aIRpoRTS

➊ San FranciscoElaborate art installations are now a common fixture at airports around the world, but San Francisco Interna-tional (SFO) was offering travelers an insight into the aesthetic more than 30 years ago. The SFO Museum – comprising more than 20 galleries across four terminals – was inaugu-rated in 1980 and continues to host an ever-changing schedule of exhibi-tions on a diverse range of subjects. Passengers are free to browse the airport’s myriad exhibits while non-flying visitors on day trips from the San Francisco Bay Area are also able to stop by. Recent events include a collection of pan-Asian ceramics dat-ing as far back as the seventh cen-tury AD and a photographic expose on the secret life of plants.

➎ munichMunich is famed for its Oktoberfest beer festival and the city’s airport aims to bring a sample of the alcohol-fueled fun to thirsty passengers. Airbau, a Bavarian-style tavern complete with its own brew-ery and traditional German beer-garden, serves up over 110,000 gallons of homemade hops from its home in the airport’s Terminal 1 every year. Like all genuine Oktoberfest celebrations, Airbau also plays host to a lively music program during busy periods and an outdoor beer garden.

➏ SydneyPotted plants are a common adornment in many air-port waiting areas, but the Qantas First Lounge at Syd-ney International Airport, Australia, takes green decor to altogether more holistic levels. The luxury facility is home to a 30-metre vertical garden, comprising 8,400 plants. The giant installation is incorporated into the fa-cility’s restaurant and day spa treatment rooms, where passengers can relax with a massage or refreshing shower. A business centre and library, meanwhile, offer optimum quiet space for working travellers.

➐ hong kongAt 13.8 metres high and 22.4 metres wide, Hong Kong International’s on-site cinema is the world’s only airport IMAX and the largest cinema in the Chinese territory. Hong Kong residents as well as travellers are able to ac-cess the cinema given its landside position at the airport. Both 2D and 3D movies are regularly shown, including the latest Hollywood blockbusters and so called “edutainment” features.

➋ Seoul-IncheonIncheon Airport on the outskirts of Seoul, South Korea, has earned a reputation for travel excellence. The sprawling complex is one of the world’s busiest passenger and cargo hubs, snapping up the Airports Council International world’s best airport in air service quality award for seven consecu-tive years. Integral to this success is the wide selection of fun activi-ties and facilities to keep waiting passengers occupied. An ice rink, casino, spa and sauna represent just a few of the cool distractions on offer. A five-minute shuttle drive away from the airport, trav-ellers can tee off for a relaxing round on the airport’s 18-hole Incheon Golf Club course.

➌ SingaporeSingapore’s Changi Airport may claim to be Southeast Asia’s premier air cargo hub, but it’s also one of the original innovators in the field of airport entertainment. The giant facility was one of the first to introduce free Wi-Fi areas whilst a roof-top pool and Jacuzzi has been open to passengers since the late 1990s. Amenities introduced in recent years include an interactive art gallery, children’s fun slide and an on-site nature trail. Free city tours of Singapore are also available to any passenger with a stopover of five hours or more.

➍ nashvilleNashville has long been con-sidered one of the cradles of American music. Elvis Presley, Dolly Parton and Johnny Cash have all been fixtures of the city’s famed recording studios. Keen to play up this lively musical past, Nashville Inter-national Airport puts on regular live concerts for travellers and music enthusiasts alike. Four stages – one located outside security and three more be-yond – host upwards of 100 free events every year. Country music and jazz per-formances are staples here but rock bands and traditional Celtic acts are also a common sight.