Aona Yang measurement model for Honda CM724

Transcript of Aona Yang measurement model for Honda CM724

Students Purchasing Intention for Automobile

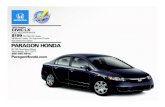

A Measurement Model for Honda Civic

Aona Yang

Boston University

CONTENT

I. INTRODUCTION...........................................................................................................................2

II. BACKGROUND RESEARCH......................................................................................................3The Client.....................................................................................................................................................3The Industry and Competitors....................................................................................................................6

III. LITERATURE REVIEW..........................................................................................................11External factors........................................................................................................................................12Internal Factors........................................................................................................................................24

IV. PROPOSED PREDICTORS FROM THE LITERATURE.......................................................30

V. THEORETICAL FRAMEWORK...............................................................................................37

VI. PROPOSED PREDICTORS WITHIN THE THEORY OF PLANNED BEHAVIOR...............40

VII. SELECTED PROPOSED PREDICTORS...............................................................................44

VIII. DEVELOPMENT OF MEASURES.......................................................................................47Multiple-item measures...........................................................................................................................50Single-item measures................................................................................................................................61

IX. DEVELOPMENT OF SURVEY INSTRUMENTS....................................................................65

X. DATA COLLECTION & ANALYSIS OF MEASURES............................................................73Step 1: Quantitative Pre-test...................................................................................................................73Step 2: Analysis of Content Validity and Reliability.............................................................................75

XI. REVISION OF SURVEY & CONCLUSIONS..........................................................................89

XII. REFERENCE...........................................................................................................................91

Appendix I. Final Survey Questionnaire.....................................................................................99

Appendix II. Coded Survey Questionnaire................................................................................105

Appendix III. Frequency Distribution.......................................................................................111

Appendix IV. Inter-item Correlation Matrix............................................................................139

Appendix V. Final Factor Analysis............................................................................................148

1

I. INTRODUCTION

Young people’s purchasing power for automobile has been significantly addressed these

years. However, according to IHS.inc (2013), young adults aged from 18 to 34 accounted for

30% less of new cars purchase in 2011, compared to sales from 2007 (IHC.inc, 2013). Experts

indicate that although Generation Y’s need for cars still exists, yet due to the tough job market

and the recovering economy, the young generation is becoming more “cautious” when seeking

out a new car (Driscoll, 2013). Honda Civic, a popular compact car line manufactured by Honda,

steps into the 43rd year of development in 2015(Honda, 2015). As a car model that mainly targets

on young market, Honda seeks to expand its customer base of college students, as well as find

out college students’ specific requirements for a new set of wheels, as a potential buyer group.

In this study, I will examine the following research question: what factors contribute to

college students’ purchase decisions of choosing a particular compact car model, as they are

exposed to such a competitive compact cars market and facing alternative choices. A

questionnaire survey will be submitted among students in Boston University, which tests how

certain variables influence the likelihood that college students choose the car model of Honda

Civic rather then other makes. Proposed predictors are adopted from previous studies pertaining

to college students’ purchasing behavior, certain automobile attributes and other latent factors.

Using quantitative research methods, this study will allow us to find whether the constructed

measurements are effective enough to capture particular beliefs and attitudes that college

students adopt, that may consequently affect their intention of purchasing automobiles.

2

II. BACKGROUND RESEARCH

The Client

Since its debut in 1972, the Honda Civic, a line of compact cars, has gone through 9 times

updates and revolution (Honda, 2015).

In 1974, Honda complemented the original two-door and three-door models of Civic

(introduced in 1972) and the 1973 style Honda CVCC together as the “sporty Honda Civic RS”

(Honda, 2015). Awarded as several “car of the year” from Europe, Japan and United States, the

first generation of Honda Civic gained an initial popularity worldwide.

During the early 1980’s, The Civic gradually gave up the style of two-door sedan, and

instead replaced it with a considerably increased dimension – 88.6 inches wheelbase for the

hatchback model and 91.3 inches for the wagon variant model (Punia, 2014). Meanwhile, all

Civic variants adopted the new CVCC engine, and the motor “came in two displacements,

namely 1,335cc which delivered 55hp of power, and 1,488cc that produced 67hp” separately

(Punia, 2014).

The fourth generation of the Civic upgraded its standard engine into a 5 variations 16-value

engine, in order to achieve greater efficiency and exceed higher speed (Honda, 2015). Along

with the fourth model, in 1991, Honda released fifth generation of the Civic line, with a

“futuristic aerodynamic form” and “flexible interior space”, mainly targeted on the young buyers

(Honda Worldwide, 2015).

The next generations of the Civic variants were dedicated to satisfy stronger demand in

increasing fuel efficiency. With the releasing of Honda Multimatic - “a new high-output,

3

continuously variable automatic transmission” (Honda,2015) – in 1995, the Civic variants

received “Car of Japan” two times separately in 1995 and 1996 (Honda,2015).

Ever since 2000, the Honda Civic continued its modern change. For the eighth generation,

Honda made two different platforms respectively for sedan /coupe, and for a hatchback designed

primarily for the European market. Because of this redesign, the Civic received another “Car of

the Year” honor in United States (Collier, 2006). The Civic line became the central of Honda’s

worldwide success. Until 2006, Honda has sold 16.5 million Civics worldwide (Collier, 2006).

The latest generation of the Honda Civic was first showed in 2011at the 2011 North

America International Auto Show. At the meantime, Honda is dedicated to add its new Eco

Assist technology to most models, building on its emphasis on small, fuel-efficient vehicles

(Green Car Congress, 2011). The Honda Eco Assist is an ecological drive assist system which

allows drivers to “maintain a fuel-efficient driving style” (Green Car Congress, 2011).

According to Green Car Congress, the Eco Assist system could effectively improve improved

their fuel economy on average by 10%, up to a maximum of 20%, after 300 drives (Green Car

Congress 2010).

In 2010, Honda Civic ended its production in Japan, as it no longer complied with the

Japanese Government dimension, as well as a nationwide reduction of consumers. Nevertheless,

the export market of Honda Civic and Civic Hybrid is still boosting (Takahashi, 2010).

For the safety part, according to the National Highway Traffic Safety Administration

(NHTSA) ‘s database of Honda Civics frontal crushing tests for different models, the eighth

generation Civic variants (both sedan and coupe) received a perfect 5-star (J.D Power, 2009).

4

Besides, the ninth generation also got a 5-star rating from frontal drivers in 2012, and another

two 5-star achievements rated respectively by side driver passengers and side rear passengers.

5

The Industry and Competitors

According to US.News’ annual ranking of 2015 best affordable compact cars, the top 6 car

models are Mazda3 by Mazda, Golf by Volkswagen, Civic by Honda, Soul by Kia, Cruze by

Chevrolet, and Focus by Ford. Mazda Mazda3 and Volkswagen Golf are tied for the first place,

with an average score of 8.8. Chevrolet Cruze and Ford Focus are tied for the fifth place

(U.S.News, 2015).

For the top three car models (Mazda Mazda3, Volkswagen Golf and Honda Civic), the

average prices are $18,051, $21,230, $18,765 respectively (U.S.News, 2015). For Mazda3, the

ranking shows that the most obvious advantage is the nimble handling and premium interior

quality. However, the model has a small cargo space in sedan that bellows the average standard

(U.S.News, 2015). By contrast, the Volkswagen golf and Honda Civic have better space

satisfaction. Besides, both three models show satisfactory performance on excellent fuel

efficiency.

Mazda Mazda3

Mazda3, also known as Mazda Axela in Japan, was first introduced in 2003. In October

2008, Mazda released the second generation of Mazda Alexa sedan at Los Angeles Auto Show

and the hatchback at the Bologna Auto Show.

In 2011, the updated version of the second generation of Mazda Axela was released in

Japan, and introduced in export market in the following year. This new facilitated Mazda3 was

the manufacturer’s first vehicle that installed their newly developed SkyActic technology, which 6

featured a SKYACTIV-G 2.0 that direct injects gasoline engine, and a SKYACTIV-DRIVE auto

transmission (Mazda, 2011). In addition, the new SkyActic tech also enabled a more enjoyable

driving experience, with a featured equipment of Mazda’s intelligent-Drive Master display. The

display ensured a smooth control of the vehicle, as well as useful hints to reduce fuel

consumption (Mazda, 2011). Taking all the new features into count, the newly facilitated 2nd

generation of Mazda3 indicated 4 advantages: “higher-quality design”, “predictable and

responsive handling”, “outstanding environmental performance”, as well as “enhanced safety

features”, according to Mazda’s official news release (Mazda, 2011).

The current redesigned Mazda3 generation was introduced in 2013 as a 2014 model

(Edmunds, 2015). New technology in terms of fuel economy and interior quality were featured

to the new model. Mazda stated that the new structure had a 30-percent improvement in torsional

rigidity, but curb weight reduced 60 to 100 pounds depending on trim level (Quiroga, 2013). A

review report of 2014 Mazda3 from CarandDriver.com said that although significant

dimensional changes had been made, you would realize the handsome and elegant model

appearance rather than these inches of differences when you first saw the new model (Quiroga,

2013). According to the latest review by Edmunds.com, the new generation of the model has a

better performance in quick accelerate. The new generation comes with two body styles, a sedan

and a hatchback, and both styles are available in 3i and 3s trims levels. For the United States

market, four model grades are available respectively as SV (2.0 Sedan), Sport (both Sedan and

Hatchback), Touring and Grand Touring (U.S.News, 2015).

According to road test adjusting by Edmunds.com, both 2.0-liter engine and 2.5-liter engine

did a goo job (Edmunds, 2015). It stated that both engines provide a quicker-above-average

7

acceleration performance, while the 2.5L engine only causes a “minimal drop in fuel economy”

(Edmunds, 2015).

Talking about sales, according to Automotive News, since August 2013, Mazda3’s sales

have fallen every month (Beene, 2014). Critiques claimed that the biggest reason for this sales

fall might be that Mazda didn’t offer the incentives that its competitors did. According to

AutoBlog.com reporter Bruce, “With the previous generation, the company offered more than

$2,700 on the hood to move them out, but the current model only carries about $1,233 in

markdowns” (Bruce, 2014).

Volkswagen Golf

The Volkswagen Golf, the second of most popular compact cars ranked by U.S.News, was

firstly introduced in 1974 by German automobile manufacturer Volkswagen. Through out its

history, most models of the Volkswagen Golf are in hatchback style. It leads the hatchback cars’

genre for years. The first generation of the Golf sold out one million within three years since its

debut. Thirty years later, the golf model has became one of the world’s best selling-model with a

built of 25 million (Kent, 2007). The Volkswagen golf won the World Car of the Year in 2009

with the Golf Mk6 model and in 2013 with the Mk7 model (Car of The Year, 2015).

According to retrieved data, most of the Golf’s models are manufactured in Germany. In

1974, Volkswagen presented the first generation of Golf as Golf Mk1, also known as

Volkswagen Rabbit in the United States market. Before, the Volkswagen’s best selling model as

well as the brand’s iconic product was the Beetle. Other models that were considered as the

8

Beetle’s competitors didn’t even reach close to its production figures (Edmunds, 2006).

However, instead of using a “curved metal that defined the Beetle’s appearance, the Golf model

adopted a “sharply creased lines”. In addition, in place of the Beetle’s two-door style, the Golf

was featured with two or four-door design with a large space cargo in the back because of its

hatchback nature (Edmunds, 2006).

In 1985, the second generation Golf Mk2 was released with a slightly grow in wheelbase

and both interior and exterior dimensions. The old name of the former generation of Golf sold in

United States - “Rabbit” was replaced by “Golf”. In 1987, the introduction of the new GTI

carried a new “DOHC, 16-value of the 1.8-liter four” power boost (Edmunds, 2006). For the next

couple of generations, the Golf and Golf GTI adopted other features changes in terms of

dimension and engine level-ups. In the year of 2006, the fifth generation golf was significantly

updated. The wheelbase stretches to 101.5 and the power base was upgraded to a new “2.5-liter

inline fibe-cylinder engine” (Edmunds 2006). Currently, the new seventh-generation of golf was

debuted in late 2012 at the Paris Motor Show (BBCTopGear, 2012). The Golf line comes with

all relevant driving systems, including gas-powered, diesel-powered, compressed natural gas-

powered, electricity-powered, and hybrid-powered.

In 2013, the Volkswagen Golf won the European Car of the Year award for the second time

(Volkswagen, 2013), as well as the World Car of the Year award (Ewing, 2013).

Kia Soul, Chevrolet Cruze and Ford Focus

9

According to 2015 Best Compact Cars ranking by U.S.News, the Kia Soul, Chevrolet Cruze

and Ford Focus were ranked from 4th to 6th (U.S.News, 2015). Besides, the 2015 Kia Sould also

ranked the 5th place in Best Affordable Small Cars ranking, in which the 2015 Honda Civic

ranked the 4th place (U.S.News, 2015).

According to the comparison chart, the three car models’ average prices are respectively

$16,206, $18,443, and $17,736. As for pros and cons, three models have different features. Both

Kia Soul and Chevrolet Cruze are named for their spacious cargo space. Kia Soul also featured

with “first-rate cabin materials”, whereas the Chevrolet Cruze is praised for its good ride and

handling balance. However, the common downside shared by these two models is the low fuel

economy for the class. As for the Ford Focus, the agile handling is known as its pros, while the

“small back seat space” and “unrefined automated manual transmission” are seen as its most

obvious downsides.

In terms of sales, CNNMoney reported that in the year of 2012, the Ford Focus total sales

reached to 1,020,410 cars globally, followed by Toyota Corolla, with 872,774 cars sold in 2012

(CNNMoney, 2013). As for the Chevrolet Cruze, China and U.S. markets are the two leading

markets that generates two thirds of all Cruze sales worldwide. Till 2014, GM(the manufacturer

of Chevrolet Cruze) has sold 1.13 million models in China and 900,000 in the U.S..

10

III. LITERATURE REVIEW

The previous section of this report has introduced the industry of current compact cars

manufacturing, the client’s developed history as well as several major competitors of Honda

Civic. The ultimate goal of this conducted research is to find out that as potential buyers, what

factors contribute to college students’ purchase decisions of choosing a particular compact car

model, as they are exposed to such a competitive compact cars market and facing alternative

choices.

Based on the understanding we’ve gained through former studies of the client, the

competitors and the industry, we will now review the literatures that are related to the topic, from

both business area and academia, to further understand the relationship between certain possible

variables and college students’ car selection. When searching literatures in BU library databases,

I typed in key words such as “automobile purchase”, “college students”, “driving behavior”, etc.

All of the literatures used in this research study are focusing on potential predictors and

factors that might affect college students’ purchasing behavior. Through the review and

evaluation of previous scholars’ research, I found a large amount of factors that could possibly

influence a college student’s car purchasing behavior. I integrated the past scholars’ work and

divided perceived variables into two primary categories: external factors and internal factors.

Within the category of “external factors”, obtained variables are divided into five subordinate

categories, which are: the people factor, the automobile features factor, the brand factor, the

online advertising factor and the public transportation factor, respectively. Whereas within the

category of “internal factors”, selected variables are more individual-centralized and human-

11

related. Those variables are divided four subordinate categories which are: the factor of

individuals’ psychological valuations, the factor of personal interests (in automobile or

enthusiasm in driving), the factor of demographic features, and the factor of Intended time-frame

for driving licensure (Sigurdadottir, Kaplan & Møller, 2014).

External factors

(1) The factor of people

The most apparent variable contained in this category is peer influence. A Study by Kyoto

University in 2013 focuses on peer’s influence on students’ car purchasing behaviors in

Bandung, an Indonesian city. The study indicates that in Indonesia, almost all the cities don't

have an advanced public transportation system besides the capital city Jakarta. Somehow the

lack of mass transportation development affected the significant increase of motorized vehicles

ownership in Indonesia (Belgiawan, Schmöcker, & Fujii, 2013).

Through review of previous studies, researches find a considerable amount of evidences to

back up their studies of peer influence’ importance towards car ownership in an “Indonesian

context” (Belgiawan et al., 2013). In addition, the researchers also aim to find out which group

of people might be affected by this peer influence most. The three hypotheses they formulate are:

1. The lower satisfaction people have with their current car, the higher the peer influence

appears; 2. The perceived regret has a positive correlation with the group influence (Belgiawan

et al., 2013); and 3. The more the group influence appears, the higher desire an individual may

feel to purchase a different car.

12

Researchers conduct a survey targets on 500 students (282 male and 218 female) age from

17-23 at Bandung Institute of Technology, who are considered to share various background.

Among which, 134 are valid respondents (students who have at least a car). The questionnaires

measurements are given on a 7-point scale. According to data analysis, the study finds a high

value of parents’ and siblings’ influence on students’ car purchasing behavior, which means

parents’ and siblings’ suggestions and advice might be valued a lot when students want to buy a

new car. Besides, the study finds a significant correlation between the level of satisfaction with

parents/siblings, which may imply that parents’ or siblings’ advice are accordance with students’

real need (Belgiwan et al., 2013). However, the study doesn’t confirm a significant relationship

between the level of satisfaction and the desire to buy a new car, as well as the peer influence in

students’ car upgrading desire.

(2) The factor of automobile features

Existing literatures have found that about three auto vehicle features might have impacts on

individuals’ choice of certain car models – Price (including overall price, insurance and extra

spend); fuel-efficiency; as well as safety and reliability).

An online survey conducted by auto insurance company the Progressive Group of Insurance

Companies (Business Wire, 2006) studied the how likely would the variable of price influence

consumers buying behaviors. The survey required participants to research new cars on a leading

vehicle valuation website - N.A.D.A. Appraisal Guides. The result indicates that most people

still regard the overall purchase price as the most important factor when they need to buy a new

car. The following factors are Make and Model, as well as Safety and Performance (Business 13

Wire, 2006). The result also shows that although consumers are aware of purchase price, they

usually ignore the other two important and valuable factors that related to price. The first one is

fuel factor, which is “how much it will cost to keep the fuel tank full” (Business Wire, 2006).

The other factor is the insurance factor since insurance usually “can be a significant cost of

owning and operating a vehicle” (Business Wire, 2006). The study concludes that even the most

savvy shopper may not be aware of the money they should pay for using and operating the car

other than the car purchase fee.

Another variable that is worth mention is fuel efficiency. A study by Kurani and Turrentine

from UC-Davis in 2004 aimed to find how would consumers think and behave related to the

concept of fuel economy or fuel efficiency when they purchase auto vehicles. Previous

researches about the relationship between perceived concepts of fuel economy were shaped by

“normative assumptions of economics” (Kurani & Turrentine, 2004), whereas in this newly

conducted research, researches focused more on helping policy makers to “ground future work”

(Kurani & Turrentine, 2004).

In this research study, Kurani and Turrentine interviewed 57 households and asked them to

report their feelings about the cars they owned, just bought and hope to buy in details. The

interviewees were divided into 10 sectors, which are pilot interviewees (households who used to

develop interview methods), college or graduate students, off-road vehicles users, state resource

agency employees, famers, computer industry workers, military households, financial job

workers, recreational industry workers and hybrid vehicle buyers, respectively (Kurani &

Turrentine, 2004).

14

Kurani and Turrentine found that because of consumers’ limited understanding, they

wouldn't realize the importance of making a long-term “economically rational decision”, which

means when given an option of paying more for a more “fuel-saving” version of car model,

customers usually can’t estimate the possible savings this could result in. Besides, the researches

also found that the phrase of “fuel-economy” was always considered belonged to

cheap/economic cars’ attributes, where as the phrase of “fuel-efficiency” was widely regarded as

an attribute of advanced engineered cars with high technology and quality (Kurani & Turrentine,

2004). According to interviewees’ report, people tried to convince themselves that fuel-economy

was related to saving money while fuel-efficiency was about saving fuel. Eventually, the study

suggested that most strategies addressed by automobile companies of educating consumers about

fuel cost savings would make them feel rather confused. Education work should be more focused

on “fuel efficiency and technical advances”. Also, an interesting finding from the study was that

based on some “emotional punch”, consumers may value fuel economy more if the car models

themselves were in shiny painted style (Kurani & Turrentine, 2004).

Another variable worth mention is the vehicles’ safety and reliability. A considerable

amount of previous literatures have found significant relationship between consumers’ perceived

reliability to a particular car model and their final purchase decision. Nevertheless, not all of

these studies find out positive or apparent correlations between automobile’s safety and their

related market performance.

Early in 1992, Virginia Commonwealth University scholars Hoffer, Pruitt and Reilly did a

research study on public-provided automotive safety information and related market responses

(Hoffer, Pruitt, & Reilly, 1992). The research specifically focused on whether the crash tests data

provided by certain public (government-run) institutes may influence the process of consumers’ 15

purchase decision making. They firstly investigated whether or how the market responses

correspond to “particularly poor test values” (Hoffer et al., 1992). They divided the test car

models into different groups by vehicle sizes and characteristics, in which they found among all

48 observations, 34 fell into the “family subcompact car category” (Hoffer et al., 1992). Next,

they tested another set of vehicles that had rather satisfied crash test results. Finally, in order to

find out the correlation between the market performances of studied vehicles and their crash test

results, they calculated the growth rates of certain vehicles models within three months right

after the crash test results’ announcement.

The data analysis showed that there was no obvious evidence that demonstrate automobile

sales growth influenced by their crash test results, though which the researchers confirmed the

publics disregarded the government car crash tests results when making their choice (Hoffer et

al., 1992).

However, there might be other “noises” that may affect the study’s accuracy of the

relationship between car reliability and buyers purchasing behavior. Recent studies still draw

attention on testing how important is automobile safety in buyers’ purchasing process. A study

by Monash University Accident Research Center in 2007 finds that consumers still put

significant interests in vehicles’ safety performance (Koppel, Charlton, Fildes, &Fitzharris,

2007). The aims of the study were to find the importance of car-safety features and how

important it is compared to other features. The researchers send out letter questionnaires to a

designed sample participants in Sweden as well as conducted telephone survey to another set of

participants in Spain (Koppel et al., 2007). According to data analysis, participants in this study

were more likely to rank safety as the most important feature when making a purchasing

decision. 16

Meanwhile, Koppel et al. (2007) also mentioned that as previous researches demonstrated,

consumers ranked price, appearance and reliability higher than safety feature. A possible

explanation for the different data result might be that the chosen participants of this study had all

recently purchased a new car. In terms of this, they were more likely to focus on the “actual”

performance of their owned cars. In addition, when participants were asked to “list up to three

factors” that they cared most concerning car safety, the top rank went to braking systems

including ABS and airbags. Besides the findings related to the feature of vehicle safety, it is also

interesting to understand the parameters that are associated with consumers’ ranking of “car-

safety is the most important feature” (Hoffer et al., 1992). According to collected responses,

these parameters include: gender, education level, age, drivers’ concern about crash tests, etc.

These findings do provide alternative referenced sources for my current research.

A more recent study in 2010 by Vrkljan and Anaby proves the same conclusion. In their

research, 2,002 Canadian drivers over 18 years old were asked to complete a survey, in which

they ranked their perceived importance of certain vehicle features from high to low (Vrkljan &

Anaby, 2010). The ANOVA tests suggest that safety and reliability (Vrkljan & Anaby, 2010). is

ranked highest among all of the features. Besides, the study also aims to test the effect of

different age and gender groups that might exert on individuals’ buying behavior. According to

Vrkljan and Anaby (2010), the collected data shows that younger generation, especially younger

males, who are also considered to be at a “higher risk of collision”, rated safety and reliability as

“least important” compared to other age and gender groups (Vrkljan & Anaby, 2010).

Furthermore, a study by Shaw and Pease (2010) examined whether individuals’ perceived

automobile security feature contributes to their willingness of recommending the purchase of a

certain car model (Shaw & Pease, 2010). The research team derived data from “Motoring 17

Which’s annual review of new and used cars” (Shaw & Pease, 2010). Result shows that vehicles

security has a significant impact on consumers’ willingness of recommend certain cat models.

(3) The factor of brand

A parsimonious model called NBD-Dirchlet of purchase incidence and brand choice was

first been introduced by Goodhardt, Ehrenberg and Chatfield in 1984 . In 2010, a study

conducted by Bennett and Graham further investigates consumers’ purchase behavior concerning

about brand to the category of automobile (Bennett & Graham, 2010). In this study, researchers

adopted a “two-purchase analysis”, which describes “two consecutive brand choices” of a

sample of buyers, including both repeating buyers and new buyers (Bennett & Graham, 2010).

Researchers collected their data from a motor fair held in Bangkok, capital of Thailand, in 2009.

Visitors were asked questions about their currently owned cars, the car they wanted to purchase

next, cars they owned before, etc. (Bennett & Graham, 2010). Then the collected answers were

compared to a published annual sales report from Toyota Motor Thailand Co..

From the data set, the study indicates that big auto firms like Toyota achieved a “slightly

higher” brand loyalty then others, with half of their existing customers would like to re-purchase

Toyota makes of cars for a second time (Bennett & Graham, 2010). Furthermore, the major

finding of this study is that Toyota’s growing sales rate, as well as its brand-share growth,

probably contributed by the first-time buyers. However, as college students, whom are mostly

considered as first-time buyers, their cognitive brand recognition and loyalty mainly comes from

what their parents, siblings or people surround them. In my study, the variable of brand-loyalty

will still be tested and related to their perceived brand reliability.

18

Another study in 2010 addressed attention on automobiles’ country of origin (Sohail &

Sahin, 2010). It analyzes the influence of this variable and the function it plays in consumers’

automobile selection (Sohail & Sahin, 2010). The study was conducted in Saudi Arabia, one of

the most fast-growing developing nations in the world. As Sohail and Sahin state, earlier studies

have shown that consumers show a preference of the products’ country of origin, and may prefer

to choose products from particular areas than others (Sohail & Sahin, 2010). They submitted a

questionnaire survey to Saudi Arabia males, since females in Saudi are “not legally permitted to

drive automobiles” and “are not key decision makers in the buying process” (Sohail & Sahin,

2010).

Data analysis shows that Japanese cars are highly rated by Saudi Arabia consumers as

“reliable” and “high-quality”. However, Japanese cars are seen not the “most socially

acceptable” cars (Sohail & Sahin, 2010). On the contrary, European cars achieve the highest

“socially acceptable” rating among participants. The researchers state that European cars are

considered to have the “greatest potential” for increasing sales growth in Saudi Arabia according

to participants’ preferences (Sohail & Sahin, 2010). Last but not least, United States automobile

brands earn a medium rating in all features. Another interesting fact that Sohail and Sahin

mentioned is that Saudi Arabians are very sensitive and responsive to country of origin

especially United States and some specific Western nations. Previous studies showed that Saudi

Arabian consumers are in the “forefront” in calling for boycotts of products that are

manufactured in the U.S. Thus, the international marketing work in Arab area must be

undertaken after a detailed market research in this area (Sohail & Sahin, 2010).

(4) The factor of online advertising influence

19

Social network site is one of the main places marketers choose to place advertisements on in

order to target younger generation and among which, college students are the key active users on

social networks (Chu, 2011; eMarketer, 2009) and are the “prime targets for SNSs advertising

campaigns” (Imran, 2014). Users adopted SNSs is still growing worldwide (Kozel, Klézl &

Pawlasová, 2013). In 2014, researchers conducted a study of social media pre-purchase search

effects on users’ attitudes among college students. A sample of 200 college students from

Islamabad was asked to complete a survey. Measurements are about students’ frequency or

willingness of clicking the advertising banners appeared on their social network sites. The data

analysis shows that when students show up a motivation of doing pre-purchase search online,

social media advertisements are proved to be an effective and mediate channel for SNSs users

(Imran, 2014). The findings provide advertisers, especially advertisers from South Asian

markets, a beneficial theoretical basis for promoting their products through SNSs advertising

banners. The researcher also suggests that SNSs advertisers should input specific products

information into their banner ads.

More related to my current research project for Honda Civic, another recent study in 2014

tests the relationship between online ads and automobile sales. They propose to explore the

effects of online advertising’s effects on vehicle sales including both search and non-search ads

(Peng, G. Zhang, S. Zhang, Dai & Li, 2014). Marketers usually seek out more effective

strategies due to limited marketing budget (Peng et al., 2014). Two research questions addressed

from the researchers are: 1. How does online advertising affect automobile sales and 2. Whether

both search and non-search ads have impact on automobile sales and what are the differences

(Peng et al., 2014).

20

The study collected sales data of 52 vehicle models in Chinese market, as well as each

model’s advertising spending data from a particular consulting company and a major search

engine company (Peng et al., 2014). According to the data analysis results, the study may

conclude that two different major findings: Frist, consumers who click on those non-search ads

on online platforms show a strong interests in corresponding car models. In other words, non-

search ads appeared online are effective for arousing brand awareness. However, those ads

clickers may not have a real intention to purchase cars concerning that these ads may appear

anywhere as long as consumers are scanning certain websites. Second, data shows that spending

on search ads have significant correlations with vehicle sales. The researchers explain that

consumers who initiate the search for specific car models are the one who own the willingness of

purchasing. Thus, automobile marketers need to focus more on search-ads when they have

demand on increasing sale growth, or otherwise focus more on non-search-ads if they want to

create brand awareness as well as enhance brand loyalty.

(5) The factor of transportation

The factor of public transportation contains variables including public transportation

provision (Cullinane, 2001), transport policy (Ozaki & Sevastyanova, 2011), as well as the

availability of grocery shopping (Bodor, Hutchinson & Rose, 2013).

Cuillinane’s study (2001) aimed to investigate whether the provision of prosperous public

transportation might reduce consumers’ willingness of buy new cars (Cullinane, 2001). The

study took Hong Kong as the experimental city, concerning that Hong Kong has been fully

covered by different kinds of public transportation. The study conducted a face-to-face

21

questionnaire survey among 389 college students among five universities in Hong Kong

(Cullinane, 2001). Collected data shows that students highly rated Hong Kong’s public

transportation since they were frequent users of it, and almost none of them own a car. Among

these students, 65% of them reported that they would not think about buying a car within the

next five years, and 33% of them reported they wouldn't buy a car within the next 10 years.

What's more, nearly 40% students stated that they don't need a car because of such a prosperous

public transportation system here. In addition, the pertaining to demographic backgrounds, the

attitude of car purchasing from male students was more “favorable” than female students

(Cullinane, 2001).

In 2011, scholars Ozaki and Sevastyanova’s did an analysis on consumers’ purchase

motivation of hybrid automobiles. They aimed to find out what drives consumers to adopt this

newly developed and “energy-sustainable” innovation. Meanwhile, they were also eager to

understand how can policies encourage or benefit them (Ozaki & Sevastyanova, 2011). In order

to achieve their research objectives, Ozaki and Sevastyanova did a questionnaire survey

contained 21 constructs. The survey was administered in 2009 and was sent to 4000 Toyota’s

customers who had purchased a Toyata Prius in the past two years (Ozaki & Sevastyanova,

2011). From their data set, they demonstrated several significant variables that have relationships

with consumers’ choice towards hybrid cars, including: Environmental benefits; social norms

and pressure, which means people’s respond to social culture and the group they belong;

practical compatibility; self-expression, which identifies individuals’ will of expressing personal

identity; positive attitudes towards new technology; as well as public transport policy (Ozaki &

Sevastyanova, 2011). Thus, researchers concluded several implications for policy makers. For

instance, as financial incentives and public transport policy appears to be important, policy

22

makers might come out more beneficial incentives to encourage hybrid car models purchasing.

Besides, tangible advantages should be made. According to Ozaki and Sevastyanova, “schemes

such as the cash-for- clunkers rebate programme need to be publicised more widely, and

provision of free/priority parking should be more extensive” (Ozaki & Sevastyanova, 2011).

Bodor, Hutchinson and Rose’s research study (2013) focused on car ownership and its

association with fruit and vegetable availability (Bodor, Hutchinson & Rose, 2013). Previous

study about individuals’ daily fruit and vegetable intake were mostly ignored the key aspect of

car ownership. Researches in this study state car ownership might provides individuals with

“greater mobility”, which allows households to shop more conveniently in local grocery stores or

“beyond neighborhood boundaries” (Bodor, Hutchinson & Rose, 2013).

The study was conducted in 2008 among 200 households from New Orleans. The data

showed that among people who don’t own a car, people’s daily intake of fruit and vegetables

was significantly associated with those shops’ located 2km away from their residence. However,

when the distance was limited to 500m -1km, this association seemed not that obvious.

Additionally, among individuals who owned cars, this fruit and vegetable availability didn't

affect intake, as previously assumed (Bodor, Hutchinson & Rose, 2013). We may thus infer that

if the residence or neighborhood people stay at is not convenient enough for daily grocery

shopping, they might grow a need for car purchasing. This indeed can be adopted as a variable

that contributes to my own study.

23

Internal Factors

(1) The factor of individuals’ psychological valuations

Existing literatures and studies demonstrate that not only tangible features attribute to

consumers’ purchasing behaviors, but also intangible factors such as psychological valuation

may also post effects on purchasing intentions. In 2002, Carrabine and Longhurst did a research

study about the place of cars among young generation (Carrabine & Longhurst, 2002), and it

leads to a conclusion that more wealthy young people’s perception of cars is related to

“anticipation”, “usage” and “meaning” (Carrabine & Longhurst, 2002).

Researchers adopt a qualitative research method to get a clearer and more detailed clue of

what young people’s daily lives contain, including pressures, happiness, as well as the ways they

interact with social cultures (Carrabine & Longhurst, 2002). 17-18 year olds students, whose

ages were considered to be the time that people reveal an initial interest of consuming

automobiles, were asked to report their current cultural life first. For instance, students were

required to give their rankings of things as television, music, sports and so on. Secondly, a focus

group discussion was generated to examine students’ feelings toward the most highly ranked

items, especially “music” (Carrabine & Longhurst, 2002). Next, semi-structured conversations

were made to examine details about their consumption practices of a range of activities,

including cars. Finally, researches made observation of certain participants who considered

themselves as “important” from previous interviews. According to content analysis, researchers

indicate that the sociology of car must resonate with the excitement that driving brings to

individuals as well as “the new horizons of sociability it seems to offer” (Carrabine & Longhurst,

2002).

24

In 2011, Bian and Forsythe draw their attention on the effect of individual characteristics on

U.S. and Chinese college students’ purchase intention for “luxury brands” (Bian & Forsythe,

2011). This research reveals a lot of interesting psychological variables that related to

individuals’ purchasing behavior, such as perceived need for uniqueness (NFU), self-

monitoring, self-expression attitude, etc. (Bian & Forsythe, 2011). A sample of 394 college

students from both U.S. and China were asked to participate a survey. The main finding of this

study is that consumers are more likely to choose brands that correspond to their self-values

(Bian & Forsythe, 2011). In addition, U.S. and Chinese students’ similarity avoidance differs

from each other. Chinese students tend to have higher similarity avoidance than U.S. students

(Bian & Forsythe, 2011). Besides, the data analysis shows that compared to U.S. students,

Chinese students seemed don't discriminate between self-expression attitude and self-

presentation attitude. In other word, Chinese students lack the ability to distinguish the difference

between self-image and social image (Bian & Forsythe, 2011).

A recent study in 2012 conducted by Chinese scholars examines Chinese college students’

“attitudes, social norms and aspiration of car ownership” (C. Zhu, Y. Zhu, Lu, He & Xia, 2012).

Researchers investigate college students’ perceived psychological values of car ownership. A

questionnaire survey was conducted in 2009, and the sample of students was chose from two

universities in southeast of China.

The researchers address that these students were chosen because they were “consumers with

greater future purchasing power” (Zhu et al., 2012). The study finds that there is a strong car-

ownership desire shared by Chinese college students. This desire of purchasing cars even

revealed at early ages when these students’ purchasing power is “still absent” (Zhu et al., 2012).

Besides, researchers also find out a strong effect of perceived psychosocial values of cars 25

including feelings of freedom, feelings of control, etc. Most of the students disagree that buying

a car is necessary for “traveling”. To tested population and even the general Chinese college

students, cars are more than a simply tool for transportation tool. To some point, the

psychosocial valuations’ impact outweighs the instrumental valuations of cars such as

convenience and speed (Zhu et al., 2012).

(2) The factor of personal interests

In 2011, Collin-Lange and Benediktsson investigated novice drivers’ automobile regime

and car usage. The study concentrated on how individuals, especially students age around 18,

enter the automobility regime, with focusing on individuals’ human components rather than

“systematic natures” of automobility (Collin-Lange & Benediktsson, 2011). For data collecting,

researchers submitted a questionnaire survey to 553 young people, age 16 to 21, in Iceland,

among which 54%(304) are females and 46%(249) are males. Collin-Lange and Benediktsson

pointed out that they chose this aging period because “16 is the legal age to start driving school”,

and the “upper age limit” is 21 (Collin-Lange & Benediktsson, 2011).

The questionnaire survey collected considerable amount of quantitative data such as “the

extent of driving license and car ownership”, distance between home and school, frequency of

car usage, etc. (Collin-Lange & Benediktsson, 2011). Futhermore, the questionnaires also asked

participants about their personal comments and reaction to specific questions pertaining to the

reason why they owned a car (if they reported they do), or extent of agreement of certain

statements about road safety, etc. (Collin-Lange & Benediktsson, 2011). The collected data from

participants showed several important findings. Firstly, young people in Iceland do use cars or

26

purchase cars from a “practical perspective” (Collin-Lange & Benediktsson, 2011), which means

young people find cars provide them flexibility and ability to be mobile. However, participants

argued that there are too many cars in Iceland at the moment and they wanted to change the

situation by adopting carpool or other related improvements to public transportation (Collin-

Lange & Benediktsson, 2011). Secondly, participants also showed social and cultural related

perspectives on car ownership rather than “pure practicaliy” (Collin-Lange & Benediktsson,

2011). They pointed out that they used cars not only for transportation purposes, but also for

social interaction. To sum up, Collin-Lange and Benediktsson concluded that young drivers have

“ambivalent” perception towards car ownership. They use cars for practical purposes, as well as

adding new interpretations on “car-based automobility” (Collin-Lange & Benediktsson, 2011).

(3) The factor of demographic features

It is no doubt that demographic features exert important roles in shaping young people’s

perception of automobile ownership and purchasing behavior. Almost all the earlier studies have

drown attention to demographic influences of college students purchasing behavior. As I’ve

already noted in previous review, Vrkljan and Anaby’s study in 2010 showed a significant

relations between genders and car-selection. From their data analysis, it’s not hard to find that

male students, who are considered to be at a higher risk of car crash, rated safety and reliability

feature as less important (Vrkljan & Anaby, 2010).

In my particular research for Honda Civic, I will adopt the demographic features that have

already been tested from former studies. I aim to test whether students from different

demographic backgrounds adopt different perspectives into automobile selection.

27

(4) The factor of Intended time-frame for driving licensure (Sigurdadottir, Kaplan &

Møller, 2014)

Earlier researches have proved that individuals’ attitudes toward car-ownership and car-

oriented behavior are shaped in their early age. Several studies conducted in recent years showed

that children and adolescents both adopt an attitude that they will obtain a driving license and

purchase a car when they grow into adults (Line, Chatterjee & Lyons, 2012; Kopnina &

Williams, 2013).

In 2014, Sigurdadottir, Kaplan and Møller conducted a research on adolescents intend time-

frame for driving licensure and car ownership, and the motivation for designing this time-frame

as well (Sigurdadottir, Kaplan & Møller, 2014). They submitted semi-structured interviews

among 50 Danish adolescents.

According to participants’ corresponding responds of their intended time-frame of driving

licensure and car ownership, researchers divided participants into three groups, relatively are:

“intended early car users”, “intended early license holders and later car users”, and “intended late

license holders and car users” (Sigurdadottir, Kaplan & Møller, 2014). Participants in the first

group are early adopters of automobiles. They are enthusiastic about automobility and other

auto-related lifestyles, including social networks. (Sigurdadottir, Kaplan & Møller, 2014).

Participants in the second group are car “pragmatists”, who seriously consider a long-term car-

oriented life style but also see the expenses as a barrier currently. The third group of participants

considers somehow shows no interest of car-oriented lifestyle either future car-ownership

(Sigurdadottir, Kaplan & Møller, 2014).

28

From content analysis, researchers indicate that family and the surrounded community plays

an important role in shaping adolescents’ attitudes towards car-ownership. For instance,

participants recalled their siblings and parents’ driving habits and travel patterns very accurately.

Thus expanding the social circle at families and communities may influence adolescents’ travel

habits (Sigurdadottir, Kaplan & Møller, 2014). Furthermore, car pragmatists (the second group)

are most motivated by “financial concerns” (Sigurdadottir, Kaplan & Møller, 2014). Last but not

least, although three groups share different valuation on personal car-oriented lifestyles, they all

“imagine a highly car-oriented” future (Sigurdadottir, Kaplan & Møller, 2014).

29

IV. PROPOSED PREDICTORS FROM THE LITERATURE

From previous literature reviews, we may identify a considerable amount of variables,

including both external and internal factors, which are related to different categories and might

affect consumers’ potential purchasing intentions. These proposed predictors are listed below.

For the readers’ convenience, I group these predictors in to nine sections which separately are:

People/peer influence; automobile attributes; brand features; online advertising influence; public

transportation; individuals’ psychological valuations; individuals’ personal interests;

demographic features and “other factors”.

Proposed Predictors of College Students’ Automobile Selection

People/Peer influence

Perceived peer influence from friends

Scholarly Sources: Koppel et al., 2007; Belgiwan et al., 2013

Perceived influence from parents

Scholarly Sources: Koppel et al., 2007; Belgiwan et al., 2013

Perceived peer influence from siblings

Scholarly Sources: Belgiwan et al., 2013

Automobile attributes

Assessment of overall purchase price

30

Scholarly Sources: Koppel et al., 2007; Sigurdadottir, Kaplan & Møller, 2014

Trade Sources: Business Wire, 2006

Perceived importance of makes and models

Scholarly Sources: Koppel et al., 2007

Trade Sources: Business Wire, 2006

Assessment of safety

Scholarly Sources: Koppel et al., 2007; Vrkljan & Anaby, 2010

Trade Sources: Business Wire, 2006

Assessment of performance

Scholarly Sources: Koppel et al., 2007; Vrkljan & Anaby, 2010

Trade Sources: Business Wire, 2006

Assessment of reliability

Scholarly Sources: Koppel et al., 2007; Vrkljan & Anaby, 2010

Trade Sources: Business Wire, 2006

Assessment of fuel price

Trade Sources: Business Wire, 2006

Assessment of insurance price

Trade Sources: Business Wire, 2006

Perceived attribute of fuel efficiency

Scholarly Sources: Kurani & Turrentine, 2004

Assessment of fuel consumption

Scholarly Sources: Koppel et al., 2007

Perceived attribute of fuel economy

Scholarly Sources: Kurani & Turrentine, 2004

31

Knowledge of car crash test results

Scholarly Sources: Hoffer et al., 1992

Assessment of car design/style

Scholarly Sources: Koppel et al., 2007; Vrkljan & Anaby, 2010

Perceived service quality of maintenance

Scholarly Sources: Koppel et al., 2007

Assessment of storage space

Scholarly Sources: Koppel et al., 2007; Vrkljan & Anaby, 2010

Beliefs in the function of ABS system

Scholarly Sources: Koppel et al., 2007

Beliefs in the function of airbags

Scholarly Sources: Koppel et al., 2007

Beliefs in the function of stability control system

Koppel et al., 2007

Beliefs in the function of braking systems

Scholarly Sources: Koppel et al., 2007

Perceived influence of car security system

Scholarly Sources: Shaw & Pease, 2010

Perceived driving comfort

Scholarly Sources: Vrkljan & Anaby, 2010

Brand features

Perception of brand loyalty

Scholarly Sources: Bennett & Graham, 2010

32

Brands’ country-origins

Scholarly Sources: Sohail & Sahin, 2010

Preference for Japanese Cars

Scholarly Sources: Sohail & Sahin, 2010

Preference for European Cars

Scholarly Sources: Sohail & Sahin, 2010

Preference for American Cars

Scholarly Sources: Sohail & Sahin, 2010

Preference for Korean Cars

Scholarly Sources: Sohail & Sahin, 2010

Online advertising influence

Perceived influence of Internet Commercial (not including social media)

Scholarly Sources: Belgiwan et al., 2013; Peng et al., 2014

Usage of SNSs

Scholarly Sources: Imran, 2014

Perceived influence of SNSs advertising

Scholarly Sources: Imran, 2014

Public transportation

Availability of public transportation

Scholarly Sources: Cullinane, 2001

33

Individuals’ psychological valuations

Willingnes of expressing personal identity

Scholarly Sources: Ozaki & Sevastyanova, 2011

Perceived need for uniqueness

Scholarly Sources: Bian & Forsythe, 2011

Attitudes toward social-function

Scholarly Sources: Bian & Forsythe, 2011

Perceived satisfaction of brand

Scholarly Sources: Bian & Forsythe, 2011

Psychological feeling of car ownership

Scholarly Sources: Zhu et al., 2012

Individuals’ personal interests

Perceived satisfaction with current car

Scholarly Sources: Belgiwan et al., 2013

Perceived regret with the current car

Scholarly Sources: Belgiwan et al., 2013

Desire of car upgrading

Scholarly Sources: Belgiwan et al., 2013

Perceived excitement of driving

Scholarly Sources: Carrabine & Longhurst, 2002

Perceived enthusiasm for automobiles

Scholarly Sources: Sigurdadottir, Kaplan & Møller, 2014

34

Other Factors:

Attitudes towards technology

Scholarly Sources: Ozaki & Sevastyanova, 2011

Perceived convenience of grocery shopping

Scholarly Sources: Bodor, Hutchinson & Rose, 2013

Perceived ease of travel

Scholarly Sources: Zhu et al., 2012

Perceived convenience of going to school

Scholarly Sources: Collin-Lange & Benediktsson, 2011

Perceived road safety

Scholarly Sources: Collin-Lange & Benediktsson, 2011

Holding of driver licenses

Scholarly Sources: Collin-Lange & Benediktsson, 2011

Intended time-frame for driving licensure

Scholarly Sources: Sigurdadottir, Kaplan & Møller, 2014

Demographic features

Students’ age

Scholarly Sources: Koppel et al., 2007; Ozaki & Sevastyanova, 2011; Bodor,

Hutchinson & Rose, 2013; Imran, 2014

Students’ gender

Scholarly Sources: Vrkljan & Anaby, 2010; Ozaki & Sevastyanova, 2011; Zhu et al.,

2012; Belgiwan et al., 2013; Bodor, Hutchinson & Rose, 2013; Sigurdadottir, Kaplan &

35

Møller, 2014

Household income

Scholarly Sources: Koppel et al., 2007; Ozaki & Sevastyanova, 2011; Belgiwan et al.,

2013

Car ownership

Scholarly Sources: Ozaki & Sevastyanova, 2011; Bodor, Hutchinson & Rose, 2013

Students’ degree program

Scholarly Sources: Zhu et al., 2012; Imran, 2014

36

V. THEORETICAL FRAMEWORK

In the former section, we listed 54 proposed predictors from the literature review. The

current study I’m conducting is mainly focusing on factors that drive college students’

automobile purchasing intention. Whilst these proposed predictors are all related to different

aspects of automobile features, individuals’ buying behaviors, as well as students’ demographic

background information, and the identifications of these predictors are extremely valuable.

However, since these predictors are derived from literatures that addressed different research

questions, used different research methods and undertake different contexts, a theoretical

framework, thus, should be adopted in order to group related predictors in a more reasonable

frame. The theoretical framework this study will employ is the Theory of Planned Behavior

(Ajzen & Fishbein, 1980).

The theory of planned behavior, also known as TPB, was proposed by Icek Ajzen in 1991,

in order to improve the prediction of particular actions by introducing perceived behavior control

(Ajzen, 1991). The theory is highly employed in studies of certain relationships between

attitudes, beliefs and behaviors, in the fields of public relations, advertising and other applied

mass media field.

Eight key variables that contained in this theory are: Behavioral Beliefs, Attitude Toward

the Behavior, Normative Beliefs, Subjective Norm, Control Beliefs, and Perceived Behavioral

Control, Interntion and Behavior (Ajzen, 1991). The following figure shows the diagram of TPB

theory.

37

Behavioral beliefs and attitude toward behavior:

According to Ajzen (1991), behavioral belief is individual’s belief about consequences of a

certain behavior (Ajzen, 1991). Whereas attitude toward a behavior is the degree of valuation

that individuals perceived as positive or negative (Ajzen, 1991).

Normative Beliefs and Subjective Norm:

The normative belief means an individuals’ perception of certain behavioral expectations

that refer to individuals or groups, or relevant family, friends or others’ belief of whether or not

he or she should perform certain behavior (Ajzen, 1991).

38

The subjective norm refers to individuals’ perceived social pressures of whether engaging

in particular behaviors or not (Ajzen, 1991). It's a perception of certain behaviors that are

influenced by “significant others” (Amjad & Wood, 2009).

Control beliefs and perceived behavioral control:

According to Ajzen (1991)’s interpretation, control beliefs refer to people’s beliefs about

presence of factors that may facilitate or impede certain behaviors (Ajzen, 1991). Perceived

behavior control illustrates individuals’ perceived ease of conducting a particular behavior

(Ajzen, 1991).

Intention and behavior:

Intention is an indication of individuals’ “readiness” to perform a behavior. It is also

considered to be the immediate antecedent of behavior (Ajzen, 1991). Last but not least, Ajzen

(1991) indicated that human behavior is individuals’ observable reaction/response to a given

situation (Ajzen, 1991).

In the model of TPB, human behavior was guided and influenced by three initial variables,

“behavioral beliefs”, “normative beliefs” and “control beliefs”. These three initial variables

firstly rise to “attitude toward behaviors”, “subjective norm” and “perceived behavioral control”

separately. In combination, “attitude toward behaviors”, “subjective norm” and “perceived

behavioral control” result in the formation of “intention”, and eventually intention may post

immediate and direct influence on behaviors (Ajzen, 1991).

39

VI. PROPOSED PREDICTORS WITHIN THE THEORY OF PLANNED BEHAVIOR

According to the theory of planned behavior, proposed predictors fit into the framework of

each constructed variables. Note that some predictors that fall outside of TPB model, as they are

considered as antecedents of behavioral belief. These predictors are also listed below. The

origins of predictors can be derived from previous section.

(1) Behavioral belief antecedents

Brands’ country-origins

Knowledge of car crash test results

Usage of SNSs

Willingness of expressing personal identity

(2) Behavioral beliefs

Assessment of overall purchase price

Perceived importance of makes and models

Assessment of performance

Perceived attribute of fuel efficiency

Assessment of fuel consumption

Perceived attribute of fuel economy

Assessment of car design/style

Perceived service quality of maintenance

Assessment of reliability

40

Perceived availability of storage space

Assessment of fuel price

Assessment of insurance price

Assessment of safety

Perceived Comfort

(3) Attitude toward the behavior

Perception of brand loyalty

Perceived satisfaction of brand

Preference for Japanese Cars

Preference for European Cars

Preference for American Cars

Preference for Korean Cars

Psychological value of car ownership

Perceived need for uniqueness

Attitudes toward social-function

Perceived satisfaction with current car

Perceived regret with the current car

Desire of car upgrading

Perceived excitement of driving

Perceived enthusiasm for automobiles

Attitudes towards technology

41

(4) Normative beliefs

Perceived peer/friends’ influence

Perceived influence from parents/siblings

Perceived influence of Internet Commercial (not including social media)

Perceived influence of SNSs advertising

(5) Subjective norms

Peer’s choice of automobiles

Parents/sibling’s choice of automobiles

Recommendation by websites

Usage of SNSs

(6) Control beliefs

Beliefs in the function of ABS system

Beliefs in the function of airbags

Beliefs in the function of stability control system

Beliefs in the function of braking systems

Perceived influence of car security system

(7) Perceived behavioral control

Perceived willingness of buying a new car

Assessment of driving safety

Perceived road safety

Perceived ease of travel

42

Perceived convenience of going to school

Perceived availability of public transportation

Perceived convenience of grocery shopping

(8) Past behavior

Frequency of driving

Holding of driver licenses

Intended time-frame for driving licensure

43

VII. SELECTED PROPOSED PREDICTORS

The selected predictors that will be used for the following study are listed below. Due to

limit of time and monetary constrains, I cannot cover all 54 predictors in our measurement

design section and apply them in our questionnaire survey. Thus, I listed 4908509 variables that

are: a. fit well in the TPB framework; b. mentioned in a variety of literatures.

(1) Behavioral beliefs

Assessment of overall purchase price

Assessment of performance

Perceived attribute of fuel efficiency

Assessment of car design/style

Perceived service quality of maintenance

Assessment of reliability

Perceived importance of makes and models

Perceived availability of storage space

Assessment of safety

Perceived Comfort

Assessment of fuel price

(2) Attitude toward the behavior

Perception of brand consciousness

Perceived satisfaction of brand

Preference for Japanese cars

44

Psychological value of car ownership

Perceived need for uniqueness

Attitudes toward social-function

(3) Normative beliefs

Perceived peer/friends’ influence

Perceived influence from parents/siblings

Perceived influence of SNSs advertising

(4) Subjective norms

Recommendation by websites

(5) Control beliefs

(None)

(6) Perceived behavioral control

Perceived ease of travel

Perceived convenience of going to school

Perceived availability of public transportation

(7) Other features

Age

Gender

Degree program

45

Car ownership

Holding of driver licenses

Intended time-frame for driving licensure

Intended time-frame for buying a car

46

VIII. DEVELOPMENT OF MEASURES

The ultimate goal of this project is to develop a set of measures and test if they could be

used to identify students’ automobile buying intention and allow researchers to capture the

information and variation. In order to accomplish this goal, I designed multiple-item measures

for 16 proposed predictors and labeled them from V1 to V16 separately. The adoption of

multiple-item measures would allow the researcher to quantify the errors going from construct to

each indicator and quantify the influence of error onto the indicators. Most of the measurements

were adapted from previous literatures, scholars’ journal, and the Marketing Scales Handbook

(Bruner, 2009). Sources were listed as below respectively for each measure. However, due to a

scarcity of pre-existing scales, I had to create original measures for some of the proposed

predictors.

Additionally, the creation of original measurements requires the researcher to stick to

several principles through which the research could maximize the probability to best capture the

variations through these self-report measures. The following principles were all retrieved from

the class notes of CM724 at Boston University, originally created by professor Michael Elasmar.

The outline of these principles is:

Forum: Language; length; focus

Content: Meaning; word choice; structure; order; assumed knowledge.

47

Language Simplicity is the key.

- The fewer numbers of syllables the better.

- Use spoken English. Avoid using slangs.

Length Length of measures:

- Short measures are better than long measures, except when

length clarifies meaning, or when length facilitates

information retrieval.

Length of response categories:

- Number of options for nominal measures

(categorical): no more than 10.

- Number of options for interval measures (scales): between 5

and 7

Length of instruments:

- A compromise needs to reach between the number of

concepts needed, the number of measures needed and the

time will take to complete the instruments.

- Web-administered or paper-administered surveys should not

exceed 15 minutes.

Focus Each measure should focus on a single dimension of a concept.

Meaning - Do not assume that participants are familiar with scientific

concepts, jargon of researchers or can engage in

computations even if these are basic.

- Transform everything into its simplest form.

- When attempting to convey meanings, provide a common

frame of reference whenever possible (you have to include a

definition to your participants).

Word-choice - Taking to account the subtleties of language when choosing

words used in the measures.

- Pay attention to the fanatic sound that it generates.

Structure - Double-negatives: Don’t use them.

48

- Placement of respond categories: Do not offer

response categories prior to stating question or providing the

statement to which they are asked to react.

Order General questions to specific questions.

Assumed

knowledge

Do not assume that the participants are familiar with the topic

that you’re researching.

The conducted measurements were listed as below.

49

Multiple-item measures

(1) Behavioral beliefs (Ajzen, 1991, 2006, 2009)

V1 Construct: Assessment of overall purchase price

Definition: An individual’s willingness of carefully evaluating a product’s overall price before purchasing.

Source: Due to a scarcity of pre-existing scales, all items were developed by the researcher.

For these questions, think about your purchase behavior. How much do you agree or disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V1-1 In general, I always carefully think about prices before buying.V1-2 Product price is what I care about most when I buy certain products.V1-3 I go for the price first rather than thinking about other features.V1-4 To me, the overall purchase price doesn't matter at all.

V2 Construct: Assessment of fuel price

Definition: An individual’s assessment of current price of gas/fuel.

Source: Due to a scarcity of pre-existing scales, all items were developed by the researcher.

For these questions, assuming you are going to buy a new car. How much do you agree or

disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V2-1 If the current gas price is high, I won’t consider buying a new car.V2-2 Fuel price is what I care a lot concerning about a new car

50

purchase.V2-3 I would be more likely to buy a car when the fuel price is considerable.V2-4 I don’t think fuel price would affect my willingness of buying a car.

V3 Construct: Assessment of insurance price

Definition: An individual’s assessment of insurance price related to a car.

Source: Due to a scarcity of pre-existing scales, all items were developed by the researcher.

For these questions, assuming you are going to buy a new car. How much do you agree or disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V3-1 I’d prefer a more reasonable insurance price when I am about to buy a new car.V3-2 I won’t consider too much about the insurance price when I am about to buy a new car.V3-3 I would carefully assess the price of car insurance when making a car purchase decision.V3-4 Price of insurance doesn’t bother me when buying a new car.

(2) Attitude toward the behavior (Ajzen, 1991, 2006, 2009)

V4 Construct: Perception of brand consciousness.

Definition: The degree to which a person is sensitive about brand names because they are viewed as communicating something about one’s self-concept.

Source: Items have been partially adapted from the Marketing Scales Handbook (Bruner,

51

2009), Scale “Brand Consciousness” as developed by Nan and Neo (2007). All other items are developed by the researcher.

For these questions, think about your purchase behavior and assume you are going to buy a new car. How much do you agree or disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V4-1 I pay attention to the brand of the car I’m going to buy.

V4-2 Sometimes I am willing to pay more money for a product because of its brand name.V4-3 I don’t care much about the brand’s name when it comes to car purchase.

V5 Construct: Perceived satisfaction of brand

Definition: The degree to which a person is sensitive about brand names because they are viewed as communicating something about one’s self-concept.

Source: Items have been partially adapted from Bian and Forsythe’s study (2011): Purchase intention for luxury brands: A cross cultural comparison, Journal of Business Research. All other items are developed by the researcher.

For these questions, think about your car ownership if you have a car, or assume your future car ownership if you don’t. How much do you agree or disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V5-1 Owning a certain brand of car would give me pleasure.V5-2 Owning a certain brand of car makes me feel good about myself.V5-3 I enjoy having my own car of a certain brand.V5-4 I don’t care much about having my own car of a particular brand.

52

V6 Construct: Preference for Japanese cars.

Definition: The degree to which a person highly prefers a car model manufactured by Japanese manufacturer.

Source: All items have been adapted from Sohail and Sahin’s study (2010): Country-of-origin effects on consumers' evaluations of automobiles: Perspectives from a Developing Nation.

For these questions, assume you are going to buy a new car. How much do you agree or disagree with the following statements?

V7 Construct: Psychological value of car ownership

Definition: Individual’s cognitive perception of owning private cars.

Source: Items have been partially adapted from Zhu et al.’s study (2012): Purchase intention for luxury brands: Perceptions and aspirations for car ownership among Chinese students attending two universities in the Yangtze Delta, China. All other items are developed by the researcher.

For these questions, think about your car ownership if you have a car, or assume your future car ownership if you don’t. How much do you agree or disagree with the following statements?

53

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V6-1 Cars made in Japan are quite reliable and seem to last the desired length of time.V6-2 Cars made in Japan occupy a very strong competitive position in comparison to cars made by other countries.V6-3 Cars made in Japan are generally of a lower quality in comparison to others.V6-4 Cars made in Japan are always carefully produced.

Strongly Disagree

Disagree Neutral Agree Strongly Agree

V7-1 Owning a car is a symbol of my success in lifeV7-2 Owning a car makes me feel more in control of my lifeV7-3 Owning a car will be necessary in the future,V7-4 Cars are a symbol of successful modern life.

V8 Construct: Perceived need for uniqueness

Definition: Individual’s psychological need for being more unique than others.

Source: Items have been partially adapted from Bian and Forsythe’s study (2011): Purchase intention for luxury brands: A cross cultural comparison, Journal of Business Research.

For these questions, think about yourself and your purchase behavior. How much do you agree or disagree with the following statements?

Strongly Disagree

Disagree Neutral Agree Strongly Agree