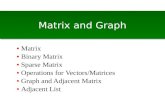

Ansoff's Matrix

description

Transcript of Ansoff's Matrix

-

Ansoffs matrix

-

Ansoff demonstrates the choices of strategic direction open to a firm in the form of a matrix. (Refer next slide)

-

Market penetration Price reductions Spend more on advertising Buy rivals Modest product refinements Competitive strategy

Product development Investment in research and development of additional products Acquire rights to make new products Buy in products and re-badge Joint developments with other companies who need access to the firms distribution channels or brands

Diversification Related diversification Unrelated diversification

Market development New customer segments New regions and areas of the country Foreign markets

Existing products New products Ex

isti

ng

mar

kets

N

ew m

arke

ts

-

Market penetration

This strategy increases the firms investment in a product/market and so are generally only used in markets which are growing, and hence the investment may be recouped.

-

Product development

This involves extending the product range available to the firms existing markets.

The critical factor to the success of this strategy is the profitability of the customer group for which the products are being developed.

Firms present competitive advantages in serving the market must confer on to the new good. These can include; Established distribution channels

Brand which can credibly applied to the new product

Customer information that allows accurate targeting.

-

Market development

Here the firm develops through finding another group of buyers for its products.

-

Market development Contd.

This strategy is more likely to be successful where;

The firm has a unique product technology it can leverage in the new market

The firm benefits from economies of scale if it increases output

The new market is not too different from the one it has experience of

The buyers in the market are intrinsically profitable

-

Diversification

Here the firm is becoming involved in an entirely new industry, or a different stage in the value chain of its present industry.

1. Related diversification a relationship can be seen between current and new business.

1. Concentric diversification Where a technical similarity exists between the industries but the marketing effort will need to be changed.

2. Vertical integration Where the company moves along their value system.

-

Diversification Contd.

2. Unrelated diversification (Conglomerate growth)

This is where N will expand their business into a collection of businesses without any relationship to one another.

-

Diversification Contd. In vertical integration (say for example

backward integration), the reaction of competitors will need to considered as there will be a shift in the stakeholder groups as follows.

Before backward integration After backward integration

Competitors

Suppliers

Customers

Previous competitors will become our customer

Previous suppliers will become our

competitors

Previous customers will remain as our customers

-

Diversification - Tradeoffs

Economies of scale company can benefit from the overall size by producing particular products in large quantities

Economies of scope company can benefit from being able to share resources or link activities between different products and markets

Learning by exploration Exploitation improve process with the

experience Dependency Company mitigates its dependency

on a particular product, customer, market or technology

-

Diversification - Tradeoffs

Management attention the extent to which senior management can continue to give attention to a particular product whilst doing the same thing to new products

Customer responsiveness How quickly can the company respond to new and challenging customer needs whilst responding to the existing customers.

Overhead cost the extent to which these will increase

Competition How competitors will react.

-

Using Ansoffs matrix in the exam

The student can say a particular strategy can be classified as (e.g. product development) according to Ansoffs matrix.

To apply Ansoffs matrix to your issue you need to focus your argument on risk (explained in next few slides) and the key factors to ensure the success (explained in previous slides) of that strategy.

-

Using Ansoffs matrix in the exam

For example you would comment that:

A product development strategy would result in additional risk over and above a market penetration strategy

A market development strategy will be more successful the closer the characteristics of the new markets are to existing markets

A product development strategy will be more successful only if new product satisfies the critical success factors required in existing markets.

-

Strategic development and risk

Developing a firm beyond its present product/market space exposes it to a combination of four sorts of risks.

Market risk

Product risk

Operational and managerial risk

Financial risk

-

1. Market risk

The firm has entered a new market where established firms already operate.

Not correctly understanding the culture of the market or the needs of the customer

High costs due to lack of economies of scale

Failure to be seen as credible by the buyers due to lack of track record

Exposure to retaliation by established firms with more entrenched positions

-

2. Product risk

The firm is involving itself in a new production process which is already being conducted by rival firms.

High production cost due to lack of experience

Initial quality problems or inferior products

Lack of established production infrastructure and supply-chain

-

3. Operational and managerial risk

This is where the management will not be able to run the new business properly.

Management will also be distracted from running the original business effectively too.

-

4. Financial risk

Shareholders are generally suspicious of radical departures (particularly diversification) due to:

Product and market risk lead to volatile returns

Firm may need to write off substantial new net assets if venture fails

Investment will reduce dividends and/or necessitate new borrowing

-

THANK YOU