Annual Report 2017 - · PDF fileWateen continued to improve its revenues in FY17to PKR 7,024...

Transcript of Annual Report 2017 - · PDF fileWateen continued to improve its revenues in FY17to PKR 7,024...

CONTENTS

Wateen Telecom Ltd. Annual Report 201701

2

4

6

9

Corporate Information

Directors’ Report

Attendance of the Board Members

Auditors' Report to the Members

FINANCIAL STATEMENTS

Balance Sheet

Profit & Loss Account

Statement of Comprehensive Income

Cash Flow Statement

Statement of Changes in Equity

Notes to and forming part of the Financial Statements

CONSOLIDATED FINANCIAL STATEMENTS

Auditors' Report to the Members

Consolidated Balance Sheet

Consolidated Profit & Loss Account

Consolidated Statement of Comprehensive Income

Consolidated Cash flow Statement

Consolidated Statement of Changes in Equity

Notes to and forming part of the Consolidated Financial Statements

ANNEXURES

Pattern of Shareholding

Categories of Shareholding

Notice of Annual General Meeting

Form of Proxy

10

12

13

14

16

17

55

56

58

59

60

62

63

105

106

107

109

CORPORATE INFORMATION

BOARD OF DIRECTORS

List of Board of Directors as of June 30, 2017

H.H. NAHAYAN MABARAK AL NAHAYAN

ADEEL KHALID BAJWA

RIZWAN ALI TIWANA

ABID HASAN

KHWAJA AHMAD HOSAIN

MANAGEMENT TEAMManagement as of June 30, 2017

RIZWAN ALI TIWANACHIEF EXECUTIVE OFFICER

MUHAMMAD AQIB ZULFIQARCHIEF FINANCIAL OFFICER & COMPANY SECRETARY

HASSAN HAYAT QURESHIHEAD OF LEGAL

ZAFAR IQBAL CH.VICE PRESIDENT HR & ADMIN

TAHIR HAMEEDCHIEF COMMERCIAL OFFICER- BROADBAND & MEDIA BUSINESS

ZAFAR MASOODDIRECTOR PROGRAM MANAGEMENT OFFICE

JAUHER ALIVICE PRESIDENT TECHNICAL

JUNAID SHEIKHCHIEF COMMERCIAL OFFICER- CARRIER & ENTERPRISE BUSINESS

AUDITORSEY Ford RhodesChartered Accountants96B-1 4th Floor Pace Mall Building M.M. Alam Road Gulberg IILahore

REGISTERED OFFICEMain Walton Road, Opp. Bab-e-Pakistan, Walton Cantt., Lahore.

PRESENT PLACE OF BUSINESSMain Walton Road, Opp. Bab-e-Pakistan, Walton Cantt., Lahore.

SHARE REGISTRARTHK Associates (Pvt.) Limited,

st1 Floor, 40-C, Block-6, P.E.C.H.S, Karachi.

Wateen Telecom Ltd. Annual Report 201702

Wateen Telecom Ltd. Annual Report 201703

BANKERSStandard Chartered Bank Pakistan LimitedHabib Bank LimitedBank Al Habib LimitedNational Bank of PakistanPak Libya Holding Company (Pvt.) LimitedSummit Bank LimitedAskari Bank LimitedSoneri Bank LimitedPak Brunei Investment Company LimitedThe Bank of KhyberBank Alfalah Ltd.Allied Bank of PakistanTelenor Micro Finance BankNIB Bank LimitedThe Bank of PunjabDubai Islamic Bank LimitedMeezan Bank LtdUnited Bank LimitedMobilink Microfinance Bank Limited

LEGAL ADVISORSIjaz Ahmed & Associates

Suite No. 425, 4th Floor, Siddique Trade Centre,

72 Main Boulevard, Gulberg, Lahore, Pakistan

DIRECTORS' REPORT

The Directors' of Wateen Telecom Ltd (the 'Company') are pleased to present the audited financial statements of the Company for the year ended June 30, 2017.

INDUSTRY OUTLOOK

Data demand for Pakistan is gradually evolving as the country continues to adopt primary ICT services for

businesses and personal use. According to PTA, broadband subscribers in the country have grown to 45.5m

by July-17 (Source: PTA Telecom Indicators), majority of which are served by mobile broadband (approx.

95%). These rapid changes in the ecosystem, has resulted in increased demand for services such as tele

housing, for which Wateen has been well-placed to serve the needs of the Mobile Network Operators.

For the period, Wateen grew its Triple Play services business for consumer and SME market with offerings in

new cities primarily led by demand for reliable quality services as well as premium TV services.

With emerging signs of a modern economy and steady economic turn-around in Pakistan, growth is coming in new avenues of ICT related services, for which a start-up culture is evolving in the country. These new services will also utilize data services, which is a healthy sign for the economy. Wateen continues to sustain and grow its operations with the evolving needs of its customers.

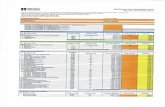

FINANCIAL PERFORMANCE

Wateen continued to improve its revenues in FY17to PKR 7,024 million, as compared to PKR 6,957 million in

FY16. This growth can be attributed to the enterprise and consumer business, led by demand for reliable

connectivity services.For the current period, Wateen recorded its highest EBIDTA - post 2009, amounting to

PKR 1,721 million in FY17 compared to PKR 1,581 million in FY16 and a continued reliance on cash-flow

from operations PKR 1,004million in FY17 as compared to PKR 1,245 million in FY16.

Enterprise and consumer business, have continued to show significant growth this year and closed at PKR 1,647 million in FY17, compared to PKR 1,264 million in FY16. This is mainly attributable to huge investment of PKR 460 million by the Company, growth in branch network connectivity of the Financial Sector in the Enterprise business and increased demand for reliable broadband and TV services in the Consumer sector especially in Gulberg Lahore. This growth is a result of well-coordinated sales efforts as well as the Managements' focus on grabbing more land/area as well as continuously improving service quality levels for all products and services.

LDI has shown a steady performance despite fierce competition and closed at PKR 2,158 million in FY17, as

compared to PKR 2,143 million in FY16.

OFC revenue shown decline which is mainly due to shifting of some projects in FY 18, OFC revenue close at

PKR 2,686 million in FY 17, as compared to PKR 2,858 million in FY16.

Tele housing contributed significant growth in revenues, approximately 140%, which was mainly attributable

to the newly merged Jazz Company and CM Pak, who continue to trust Wateen as their reliable

infrastructure partner, and was closed at PKR 463 million in FY17, compared to PKR 193 million in FY16.

Wateen Telecom Ltd. Annual Report 201704

FY 17

Revenue (PKR million) 7,024

EBITDA (PKR million) 1,721

Cash flow from Operations

(PKR million)

Loss per share – PKR (1.87)

1,004

FY 16

6,957

1,581

(3.18)

1,245

Wateen Telecom Ltd. Annual Report 201705

Despite significant improved performance of the Company in past three years, Company has still posted net

losses after taxation PKR 1,156 million as compared to PKR 1,961 million in FY 16, losses are mainly on

account of finance cost of PKR 1,791 million in FY 17.

In view of the current performance and management focus on investing in profitable ventures along with

further restructuring of its existing debts, the management believes that these steps will further improve the

profitability of the Company in the ensuing years.

SIGNIFICANT DISCLOSURES

(I) MANAGEMENT'S ASSESSMENT OF GOING CONCERN

As fully explained in note 2(iii) to the annexed financial statements the management of the Company has carefully assessed a number off actors in assessing the going concern status of the Company covering the operational performance of the business, the ability to implement a significant debt restructuring of the Company's existing debts and the appetite of majority shareholder to continue financialsupport. Based on the analysis of these, management is comfortable that the Company will be able to continue as a going concern in the foreseeable future.

(II) DEBT RESTRUCTURING

As fully explained in note 9 to the annexed financial statements, Company's local loans were

restructured in October 2014 and Second Amendatory Agreement (SAA) was signed and a facility of

Subsidiary Company Wateen WiMAX (Pvt) Limited (WWL) also emerged on account of Company

Restructuring Syndicate Term Finance Agreement (STFA).

WWL was conceived as a corollary of a joint venture ('JV') contemplated between the Company and Augere

Pakistan for consolidation of the WiMAX business, through a Master Transaction Agreement (MTA) dated

4th December, 2013 (“Consolidated Business”). The parties considered that the synergy established

through the creation of the JV would provide the necessary impetus to make the struggling WiMAX related

business viable.

The envisaged JV for the Consolidated Business within WLL did not materialize and the Company is in

negotiation with lenders to settle this matter. Loan Installments under STFA are paid till April 2016 and last

two installments of the Subsidiary Company WWL are not paid on due dates, however Conditions

Precedents (CP) under STFA are fully complied.

Loan installments under SAA are paid as per repayment schedule. Only one CP under SAA is pending and

the management of the Company is taking all necessary steps to fulfill that CP. Once the CP of the SAA has

been fulfilled, the banks will formally issue letter to the Company which will complete the entire restructuring

process.

As a part of further restructuring with the Company's international lenders, the Deutsche Bank AG facility has

been assigned on 10th August 2017 to Parent Company Warid Telecom International (WTI) and the facility

from ECGD will also be restructured in the same manner. The management is of view that restructuring will

further improve the financial position of the Company.

EARNINGS PER SHARE

Earnings per share are PKR (1.87) for FY 2017 as compared to PKR (3.18) in FY 2016.

DIVIDENDDue to net loss, the Company has been unable to declare any dividends.

FUTURE OUTLOOK Pakistan, being the sixth most populous country in the world is yet to fully exploit its existing infrastructure and market potential to foster growth. Advanced economies adopt digitization to disrupt and innovate, thus facilitating socio-economic growth and productivity even when the global economy is weak. By contrast, Pakistan's emerging ICT market often fails to attract foreign investment due to inconsistent government policies, lacking skills, and security concerns. For the next financial year, political upheaval is likely to subdue economic activity, as the next general elections in the country approach.

Keeping in view the above, the Management has initiated a drive for 'idea generation' to bring out new opportunities for Wateen to capitalize on in addition to its existing business lines. Wateen also intends to increase its residential areas of offerings in order to benefit from the growing demand for reliable broadband and TV services.

Holding Company InformationWarid Telecom International LLC, UAE18thFloor, Al Neem Tower, Khalifa Street, P.O.Box 44222, Abu Dhabi, U.A.E

BOARD AUDIT COMMITTEEThe Board Audit Committee of the Company has been established with the purpose of assisting the Board of Directors in fulfilling their oversight responsibilities relating to internal controls, financial and accounting matter, compliance and risk management practices.

COMPOSITION OF BOARD AUDIT COMMITTEEMEETINGS ATTENDED

ABID HASAN (Independent Director) Chairman 3KHWAJA AHMAD HOSAIN (Independent Director) Member 3

CONSOLIDATED FINANCIAL STATEMENTSConsolidated financial statements of the Company are also included as part of this annual report.

AUDITORSThe present Auditors M/s EY Ford Rhodes, Chartered Accountants have completed their assignment for the year ended June 30, 2017 and shall retire on the conclusion of the Annual General Meeting. Audit Committee and the Board of Directors considered and recommended the re- appointment of M/s EY Ford Rhodes, Chartered Accountants as Auditors of the Company for the year ending June 30, 2018.

WEB PRESENCEAnnual financial statements of the Company are also available on the Wateen website www.wateen.com for information of the shareholders and others.

ACKNOWLEDGEMENTSThe Board of Directors of the Company, would like to thank all our customers, suppliers, contractors, service providers, sponsors and shareholders for their continued support. We would like to commend the diligent and dedicated efforts of our employees across the country which has enabled the Company to successfully face the challenges of a highly competitive telecom environment. We would also like to express our special thanks to the Government of Pakistan and the Abu Dhabi Group for their continued support and encouragement.

ATTENDANCE OF THE BOARD MEMBERS

Wateen Telecom Ltd. Annual Report 201706

S. No.

Name of Directors

Board Meetings

Attendance during

2016 -17

1.

H.H. NAHAYAN MABARAK AL NAHAYAN

NIL

2.

ADEEL KHALID BAJWA

3

3. RIZWAN ALI TIWANA 3 4. ABID HASAN 3 5.

KHWAJA AHMAD HOSAIN

3

Financial Statements

Wateen Telecom Ltd. Annual Report 201707

INDEPENDENT AUDITORS' REPORT TO THE MEMBERS

We have audited the annexed balance sheet of Wateen Telecom Limited (the Company) as at 30 June 2017 and the related profit and loss account, statement of comprehensive income, cash flow statement and statement of changes in equity together with the notes forming part thereof (hereinafter referred to as the 'financial statements'), for the year then ended and we state that we have obtained all the information and explanations which, to the best of our knowledge and belief, were necessary for the purposes of our audit.

It is the responsibility of the Company's management to establish and maintain a system of internal control, and prepare and present the above said statements in conformity with the approved accounting standards and the requirements of the Companies Ordinance, 1984. Our responsibility is to express an opinion on these statements based on our audit.

We conducted our audit in accordance with the auditing standards as applicable in Pakistan. These standards require that we plan and perform the audit to obtain reasonable assurance about whether the above said statements are free of any material misstatement. An audit includes examining on a test basis, evidence supporting the amounts and disclosures in the above said statements. An audit also includes assessing the accounting policies and significant estimates made by management, as well as, evaluating the overall presentation of the above said statements. We believe that our audit provides a reasonable basis for our opinion and, after due verification, we report that:

(a) in our opinion, proper books of account have been kept by the Company as required by the Companies Ordinance, 1984;

(b) in our opinion:

i) the balance sheet and profit and loss account together with the notes thereon have been drawn up in conformity with the Companies Ordinance, 1984, and are in agreement with the books of account and are further in accordance with accounting policies consistently applied, except for the changes in Note 4 and 5 with which we concur;

ii) the expenditure incurred during the year was for the purpose of the Company's business; and

iii) the business conducted, investments made and the expenditure incurred during the year were in accordance with the objects of the Company;

(c) in our opinion and to the best of our information and according to the explanations given to us, the balance sheet, profit and loss account, statement of comprehensive income, cash flow statement and statement of changes in equity together with the notes forming part thereof conform with approved accounting standards as applicable in Pakistan, and, give the information required by the Companies Ordinance, 1984, in the manner so required and respectively give a true and fair view of the state of the Company's affairs as at 30 June 2017 and of the loss, comprehensive income, its cash flows and changes in equity for the year then ended; and

(d) in our opinion, no zakat was deductible at source under the Zakat and Ushr Ordinance, 1980(XVIII of 1980).

Emphasis of Matter

We draw attention to note 2 (iii) to the financial statements related to management's assessment of going concern. The majority shareholders have committed to provide financial support to the Company to enable it to continue its operations. Our opinion is not qualified in respect of this matter.

Other Matters

The financial statements for the year ended 30 June 2016 were audited by another firm of chartered accountants. The audit report dated 29 November 2016 expressed an unmodified opinion with an emphasis of matter paragraph in relation to management's assessment of going concern.

Chartered AccountantsAudit Engagement Partner: Farooq Hameed Lahore: November 06, 2017

Wateen Telecom Ltd. Annual Report 201709

BALANCE SHEETAS AT JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201710

Note 2017 2016

(Rupees in thousand)

EQUITY AND LIABILITIES

SHARE CAPITAL AND RESERVES

Authorised capital

Issued, subscribed and paid-up capital

General reserves

Accumulated loss

NON-CURRENT LIABILITIES

Long term finance - secured

Long term portion of deferred mark up

Long term finance from shareholders - unsecured

Medium term finance from an associated company - unsecured

DEFERRED LIABILITIES

Deferred government grants

CURRENT LIABILITIES

Current portion of long term finance - secured

Current portion of deferred mark up

Current portion of Medium term finance from an associated

company - unsecured

Short term running finance - secured

Short term finance from associated company - unsecured

Trade and other payables

Interest / markup accrued

TOTAL EQUITY AND LIABILITIES

CONTINGENCIES AND COMMITMENTS

7

7

8

9

10

11

12

13

9

10

12

14

15

16

17

18

The annexed notes 1 to 49 form an integral part of these financial statements.

10,000,000

6,174,746

134,681

(36,814,375)

(30,504,948)

-

-

14,334,440

-

14,334,440

2,419,524

16,896,335

4,899,393

600,000

687,664

100,000

4,921,303

3,166,060

31,270,755

17,519,771

10,000,000

6,174,746

134,681

(35,675,906)

(29,366,479)

-

-

14,041,457

-

14,041,457

2,567,744

16,865,384

3,924,871

600,000

765,512

-

4,819,062

2,450,281

29,425,111

16,667,832

______________ __________

Chief Executive Director

BALANCE SHEET AS AT JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201711

Note 2017 2016

(Rupees in thousand)

ASSETS

NON-CURRENT ASSETS

Property and equipment

Operating assets 19

Capital work in progress 20

Intangibles 21

Long term investment in subsidiary companies 22

Deferred tax assets 23

Long term loan to subsidiary company 24

Long term deposits and prepayments

Long term deposits 25

Long term prepayments 26Long term trade debts 27

CURRENT ASSETS

Trade debts 27

Contract work in progress

Stores, spares and loose tools 28

Advances, deposits and prepayments 29

Tax refunds due from the Government

Interest / markup accrued

Cash and bank balances 30

TOTAL ASSETS

9,725,435 525,433

11,228 10,262,096

137,661

-

-

419,515

33,196

593,501

1,046,212

2,252,052

-

452,489

2,509,783

593,255

9,702

256,521

6,073,802

17,519,771

9,167,410

1,028,815

15,212 10,211,437

137,661

-

-

479,760

40,116

634,447

1,154,323

1,703,037

61,884

378,537

2,217,375

548,309

9,768

245,501

5,164,411

16,667,832

PROFIT AND LOSS ACCOUNTFOR THE YEAR ENDED JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201712

2017 2016

Note

(Rupees in thousand)

Revenue 31 7,024,292

6,956,578

Cost of sales (excluding depreciation and amortisation) 32 4,010,396

3,957,949

General and administration expenses 33 1,784,782

1,360,070

Advertisement and marketing expenses 23,737

21,188

Selling and distribution expenses 2,735

91

Provisions 34 132,998 557,380

Other income 35 (651,040) (521,312)

Earnings before interest, taxation, impairment

depreciation and amortisation 1,720,684 1,581,212

Less: Depreciation and amortisation 741,005 699,489

Finance cost 36 1,790,853 2,428,743

Provision for long term loan to and impairment of

investment in subsidary company 37 74,479 153,243

Finance income 38 (177,510) (182,022)

Loss before taxation (708,143)

(1,518,242)

Taxation 39 447,810

442,737

Loss for the year (1,155,953)

(1,960,979)

The annexed notes 1 to 49 form an integral part of these financial statements.

______________ __________

Chief Executive Director

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201713

Note 2017 2016

(Rupees in thousand)

Loss for the year (1,155,953) (1,960,979)

Other comprehensive income

Other comprehensive income not to be reclassified to profit or loss

in subsequent periods:

Remeasurement gain/(loss) on staff retirement benefit plan 43.4 17,484 (11,808)

Total comprehensive income for the year (1,138,469) (1,972,787)

The annexed notes 1 to 49 form an integral part of these financial statements.

______________ __________

Chief Executive Director

CASH FLOWS STATEMENT

FOR THE YEAR ENDED JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201714

2017 2016

(Rupees in thousand)

CASH FLOW FROM OPERATING ACTIVITIES

Loss before taxation (708,143)

(1,518,242)

Adjustment of non cash items:

Depreciation and amortisation 741,005

699,489

Finance cost 1,790,853

2,428,743

Loss on sale of operating assets 208,063

115,075

Cost associated with IRU of optic fiber cable 248,783

273,007

Deferred USF grant recognised during the year (148,220)

(143,561)

Provisions 132,998

557,380

Reversal of provision for store obsolesce (95,789)

-

Reversal of provision for doubtful advances and other receivables (49,092)

-

Provision for long term loan to and impairment of investment in subsidiary company 74,479

153,243

Provision of markup on advances to associated companies -

60,388

Stores and spares written off 16,599

Write back of liability (553,563)

(493,876)

2,349,517

3,666,487

1,641,374

2,148,246

Changes in working capital:Increase in trade debts (612,497)

(238,677)

Decrease in contract work in progress 61,884

168,841

Decrease in stores, spares and loose tools 21,837 21,523

Increase in advances, deposits and prepayments (271,886) (52,334)

(Increase)/decrease in Interest Accrued 67 (95)

Increase/(decrease) in trade and other payables 664,303 (542,394)

(136,292) (643,135)

Income taxes paid (492,756) (244,953) Contribution made in gratuity fund (8,500) (14,768) Cash flow from operating activities 1,003,826 1,245,390

CASH FLOW FROM INVESTING ACTIVITIES

Property, plant and equipment additions (1,179,968) (1,280,853) Proceeds from sale of property, plant and equipment 13,966

30,236

Long term loan to subsidiary company (74,479)

(155,243)

Long term deposits receivable/received 60,245

(11,113)

Long term prepayments paid 6,919

16,011 Cash flow from investing activities (1,173,317) (1,400,963)

-

Wateen Telecom Ltd. Annual Report 201515

CASH FLOWS STATEMENT

FOR THE YEAR ENDED JUNE 30, 2017 2017 2016

(Rupees in thousand)

______________ __________

Chief Executive Director

CASH FLOW FROM FINANCING ACTIVITIES

Long term finance from shareholders - unsecured received 251,547

315,000 Short Term Finance from Associated Company 100,000

-

Long term finance repaid (15,000)

(8,934)

Deferred grants received -

112,204

Finance cost paid-net (78,188)

(85,404)

Cash flow from financing activities 258,359

332,866

INCREASE IN CASH AND CASH EQUIVALENTS 88,868

177,293

Cash and cash equivalents at beginning of the year (520,011)

(697,304)

CASH AND CASH EQUIVALENTS AT END OF THE YEAR (431,143)

(520,011)

CASH AND CASH EQUIVALENTS COMPRISE:Cash and bank balances 256,521

245,501

Short term running finance - secured (687,664)

(765,512)

(431,143)

(520,011)

The annexed notes 1 to 49 form an integral part of these financial statements.

STATEMENT OF CHANGES IN EQUITYFOR THE YEAR ENDED JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201716

______________ __________

Chief Executive Director

Share General Accumulatedcapital reserve loss Total

Balance as at July 1, 2015 6,174,746

134,681

(33,703,119)

(27,393,692)

Loss for the year - - (1,960,979) (1,960,979)

Other comprehensive loss - - (11,808) (11,808)

Total comprehensive loss for the year - - (1,972,787) (1,972,787)

Balance as at June 30, 2016 6,174,746 134,681 (35,675,906) (29,366,479)

Loss for the year - - (1,155,953) (1,155,953) Other comprehensive income - - 17,484 17,484 Total comprehensive loss for the year - - (1,138,469) (1,138,469)

Balance as at June 30, 2017 6,174,746 134,681 (36,814,375) (30,504,948)

The annexed notes 1 to 49 form an integral part of these financial statements.

------------------------------(Rupees in thousand) ----------------------------------

1. Legal status and operations

2. Basis of preparation

(i) Statement of compliance

(ii) Accounting convention

(iii) Management's assessment of going concern

Operational performance

Wateen Telecom Limited (the Company) was incorporated in Pakistan as a private limited company underCompanies Ordinance, 1984 on March 4, 2005 for providing Long Distance and International public voicetelephone (LDI) services and Wireless Local Loop (WLL) service in Pakistan. The Company commenced itsLDI business commercial operations from May 1, 2005. The Company transferred its WLL license to whollyowned subsidiary Wateen WiMAX (Private) Limited (WWL) during the year ended June 30, 2015. The legalstatus of the Company was changed from "Private Limited" to "Public Limited" with effect from October 19,2009 and thereafter, the Company was listed on Karachi, Lahore and Islamabad Stock Exchanges.Subsequently, the Karachi, Lahore and Islamabad Stock Exchanges accepted the request for delisting of the Company and accordingly the Company stood delisted from these stock exchanges with effect fromFebruary 17, 2014. The registered office of the Company is situated at Lahore. The Company is a subsidiary of Warid Telecom International LLC, United Arab Emirates (WTI) and its ultimate parent is Abu DhabiGroup.

These financial statements have been prepared in accordance with the approved accounting standards asapplicable in Pakistan. Approved accounting standards comprise of such International Financial ReportingStandards (IFRS) issued by the International Accounting Standards Board (IASB) as are notified under theCompanies Ordinance, 1984 (repealed), provisions of and directives issued under the CompaniesOrdinance, 1984 (repealed). In case requirements differ, the provisions or directives of the CompaniesOrdinance, 1984 (repealed) shall prevail.

The Company’s operating performance reflected improvement during the year ended June 30, 2017 byposting the earnings before interest, taxation, depreciation and amortization (EBITDA) of Rs. 1,721 million(June 30, 2016: Rs. 1,581 million) as a highest EBITDA after financial year 2008 - 2009. Further, during theyear, the Company has been able to generate positive cashflows from operations for an amount of Rs.1,004 million (June 30, 2016: Rs. 1,245 million).

The Companies Ordinance, 1984 has been repealed after the enactment of Companies Act, 2017. However,as allowed by the SECP vide its Circular No. 17 dated 20 July 2017 read with related press release, thesefinancial statements have been prepared in accordance with the provisions of the repealed CompaniesOrdinance, 1984.

These financial statements are the separate financial statements of the Company. In addition to theseseparate financial statements, the Company also prepares consolidated financial statements.

These financial statements have been prepared on the basis of 'historical cost convention' except asotherwise stated in the respective accounting policies notes.

In assessing the going concern status of the Company, management has carefully assessed a number offactors covering the operational performance of the business, the ability to implement a significant debtrestructuring of the Company’s existing debts and the appetite of majority shareholder to continue financialsupport. Based on the analysis of these, management is comfortable that the Company will be able tocontinue as a going concern in the foreseeable future. Set out below are the key areas of evidence thatmanagement has considered:

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2017

Wateen Telecom Ltd. Annual Report 201717

Wateen Telecom Ltd. Annual Report 201718

Ongoing Shareholder Support

(iv) Critical accounting estimates and judgments

(i)

(ii) Impairment of DSL assets (note 20)

(iii) Impairment of investment in and loan to subsidiary company (note 22 & 24)

(iv) Provision for doubtful debts (note 27)

(v) Provision for obsolete stores (note 28)

(vi) Provision for doubtful advances and other receivables (note 29)

(vii) Provision for current and deferred tax (note 23 & 39)

(viii) Employees' retirement benefits (note 43)

(ix) Deferred government grants (note 13)

During the year ended June 30, 2017 Company incurred net loss after taxation of Rs. 1,156 million (June30, 2016: Rs. 1,961 million) and had net current liabilities as at June 30, 2017 of Rs. 25,197 million (June30, 2016: Rs. 24,261 million) of which Rs. 10,029 million (June 30, 2016: Rs. 12,212 million) and Rs. 4,899million (June 30, 2016: Rs. 3,925 million) relate to loan installments and deferred markup, respectively duefor repayment after June 30, 2017 but classified as current liabilities as mentioned in notes 9 and 10respectively. Net current liabilities also include markup of Rs. 1,771 million (June 30, 2016: Rs. 1,358million) on account of subordinated loan from shareholders of the Company. Further, during the past fiveyears, the majority shareholder has provided financial support in the form of long term finance amounting toUSD 136.4 million to meet the capital requirements of the Company (un availed finance facility fromshareholder amounts to USD 72.6 million (June 30, 2016: USD 75 million) at June 30, 2017. Theshareholders have committed to provide financial support to enable the Company to continue its operations and fulfil its financial obligation.

The Company's majority shareholder Warid Telecom International LLC, UAE (WTI) continues to providemanagement with comfort with regards to its ongoing support and this is evident from further loan of USD2.4 million extended to the Company during the year ended June 30, 2017 (June 30, 2016: USD 3 million)for the Company.

In addition, Warid Telecom International LLC, UAE (WTI) guarantees the local Syndicate Finance Facility,and certain sponsors' guarantees are also provided to the foreign debt holders. The continued support ofWTI including the guarantees and financial assistance from WTI is likely to enable the Company to continueits operations and fulfill its financial obligations for a minimum period of twelve months from the year end.Based on the above the Board and management is confident that WTI will continue to provide strongsupport to the Company.

Keeping in view the foregoing and other related operational facts, the management believes that theCompany is able to operate on a going concern basis in the foreseeable future and these financialstatements have been prepared reflecting this assumption.

The preparation of financial statements in conformity with approved accounting standards requires the useof certain critical accounting estimates. It also requires management to exercise its judgment in the processof applying the Company’s accounting policies. Estimates and judgments are continually evaluated and arebased on historic experience, including expectations of future events that are believed to be reasonableunder the circumstances. The areas involving a higher degree of judgment or complexity, or areas whereassumptions and estimates are significant to the financial statements, are as follows:

Operating assets - estimated useful life of property, plant and equipment (note 19)

Debt restructuring

As part of further restructuring the Company is negotiating with lenders whereby it is proposed that Deutsche Bank AGfacility will be novated to Warid Telecom International LLC,UAE (WTI) and facility from ECGD will also be restructured.The management is of the view that above restructuring will further improve the financial position of the Company.Subsequent to year end, on August 10, 2017, Deutsche Bank AG facility has been novated from the Company to WaridTelecom International LLC, UAE (WTI). Accordingly, the amount is payable by the company to WTI on same terms. now

majority

Wateen Telecom Ltd. Annual Report 201719

3.

IFRS 2

IFRS 10

IAS 7

IAS 12

IFRS 4

IAS 40

IFRIC 22 Foreign Currency Transactions and Advance Consideration

IFRIC 23 Uncertainty over Income Tax Treatments

IFRS 14

IFRS 16 IFRS 17

IASB Effective

Dates (Annual

periods

beginning on or

after)Standard or Interpretation

01 Jan 2018

01 Jan 2018

01 Jan 2019

Share-based Payments – Classification and Measurement of Share-based Payments Transactions (Amendments)

Consolidated Financial Statements and IAS 28 Investment in Associates and Joint Ventures - Sale or Contribution of Assets between an Investor and its Associate or Joint Venture (Amendment)

Financial Instruments: Disclosures - Disclosure Initiative - (Amendment)

Income Taxes – Recognition of Deferred Tax Assets for Unrealized losses (Amendments)

Insurance Contracts: Applying IFRS 9 Financial Instruments with IFRS 4 Insurance Contracts – (Amendments)

Investment Property: Transfers of Investment Property (Amendments)

LeasesInsurance Contracts

01 Jan 2016

01 Jan 201901 Jan 2021

IFRS 9 01 Jan 2018Financial Instruments: Classification and Measurement

Regulatory Deferral Accounts

IFRS 15 01 Jan 2018Revenue from Contracts with Customers

The Company expects that the adoption of the above standards will have no material effect on theCompany’s financial statements, in the period of initial application, except for IFRS 16. The management is in the process of determining the effect of application of IFRS 16.

Effective Dates

(Annual periods

beginning on or

after)

01 Jan 2018

Not yet finalized

01 Jan 2017

01 Jan 2017

01 Jan 2018

The following standards, amendments and interpretations with respect to the approved accountingstandards as applicable in Pakistan would be effective from the dates mentioned below against therespective standard or interpretation.

Standard note for standards, interpretations and amendments to approved accounting standards

that are not yet effective

Standard or Interpretation

The above standards and amendments are not expected to have any material impact on the Company'sfinancial statements in the period of initial application except for IFRS 15. The management is in the process of determining the effect of application of IFRS 15.

In addition to the above standards and amendments, improvements to various accounting standards havealso been issued by the IASB in December 2016. Such improvements are generally effective for accountingperiods beginning on or after January,01 2018. The Company expects that such improvements to thestandards will not have any impact on the Company's financial statements in the period of initial application.

Further, following new standards have been issued by IASB which are yet to be notified by the SECP for the purpose of applicability in Pakistan.

Wateen Telecom Ltd. Annual Report 201720

4.

5 Improvements to Accounting Standards Issued by the IASB in September 2014

IFRS 7 Financial Instruments: Disclosures - Servicing contracts

IAS 19 Employee Benefits - Discount rate: regional market issue

IAS 34 Interim Financial Reporting - Disclosure of information 'elsewhere in the interim financial report.

IFRIC 4 Determining whether an arrangement contains lease

IFRIC 12 Service concession arrangements

6. Summary of significant accounting policies

6.1 Employees' retirement benefits

(i)

(ii)

IFRS 11 Joint Arrangements - Accounting for Acquisition of Interest in Joint Operation (Amendment)

IAS 1 Presentation of Financial Statements - Disclosure Initiative (Amendment)

IAS 16 Property, Plant and Equipment and IAS 38 intangible assets - Clarification of Acceptable Method ofDepreciation and Amortization (Amendment)

IAS 16 Property, Plant and Equipment IAS 41 Agriculture - Agriculture: Bearer Plants (Amendment)

IAS 27 Separate Financial Statements – Equity Method in Separate Financial Statements (Amendment)

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations - Changes in methods of disposal.

IFRS 7 Financial Instruments: Disclosures - Applicability of the offsetting disclosures to condensed interimfinancial statements

IFRS 10 Consolidated Financial Statements, IFRS 12 Disclosure of Interests in Other Entities and IAS 27Separate Financial Statements – Investment Entities: Applying the Consolidation Exception (Amendment)

The adoption of the above amendments, improvements to accounting standards and interpretations did not have any effect on the financial statements.

Upto February 28, 2015, the Company provided gratuity to all permanent employees in accordance with therules of the Company. Effective March 1, 2015, the benefit was discontinued and amount due to employeesas at February 28, 2015 was to be paid at the time of final settlement. However, during the year ended 30June 2017, the company has reinstated the benefit effective from March 1, 2015 as if the scheme had neverbeen discontinued. Actuarial valuation is conducted periodically using Projected Unit Credit Method, andlatest valuation was carried out at June 30, 2017. The details of actuarial valuation are given in note 43.

Contributory provident fund for all permanent employees of the Company is in place. Contribution for theyear amounted to Rs. 28.399 million (June 30, 2016: Rs. 28.421 million) (8.33% per employee) and ischarged to income for the year.

New accounting standards, interpretations, and amendments applicable to the financial statements

for the year ended 30 June 2017

The Company has adopted the following accounting standards and the amendments and interpretation ofIFRSs which became effective for the current year:

The following interpretations issued by the IASB have been waived off by SECP effective January 16, 2012:

Actuarial gains and losses (remeasurement gains / losses) on employees’ retirement benefit plans arerecognized immediately in other comprehensive income and past service cost is recognized in profit andloss when they occur. Calculation of gratuity requires assumptions to be made of future outcomes whichmainly includes increase in remuneration, expected long-term return on plan assets and the discount rateused to convert future cash flows to current values. Calculations are sensitive to changes in the underlyingassumptions.

Wateen Telecom Ltd. Annual Report 201721

6.2 Taxation

Current

Deferred

6.3 Government grant

6.4 Borrowings and borrowing costs

6.5 Trade and other payables

6.6 Provisions

Grants that compensate the Company for expenses incurred, are recognized on a systematic basis in theincome for the year in which the related expenses are recognized. Grants that compensate the Company forthe cost of an asset are recognized in income on a systematic basis over the expected useful life of therelated asset.

Borrowings are recognized initially at fair value, net of transaction costs incurred. Borrowings aresubsequently stated at amortized cost; any difference between proceeds (net of transaction costs) and theredemption value is recognized in the income statement over the period of the borrowings using effectiveinterest method.

Liabilities for creditors and other amounts payable including payable to related parties are carried at cost,which is the fair value of the consideration to be paid in the future for the goods and / or services received,whether or not billed to the Company.

Borrowing costs incurred that are directly attributable to the acquisition, construction or production ofqualifying assets are capitalized as part of the cost of that asset. All other borrowing costs are charged toincome for the year. Qualifying assets are assets that necessarily takes substantial period of time to getready for their intended use.

The tax expense for the year comprises of current and deferred tax, and is recognized in income for theyear, except to the extent that it relates to items recognized directly in other comprehensive income, inwhich case the related tax is also recognized in other comprehensive income.

The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted atthe date of the balance sheet. Management periodically evaluates positions taken in tax returns, withrespect to situations in which applicable tax regulation is subject to interpretation, and establishesprovisions, where appropriate, on the basis of amounts expected to be paid to the tax authorities.

Deferred income tax is accounted for using the balance sheet liability method in respect of all temporarydifferences arising between the carrying amounts of assets and liabilities in the financial statements and thecorresponding tax base used in the computation of taxable profit.

Deferred tax liabilities are recognized for all taxable temporary differences and deferred tax assets arerecognized to the extent that it is probable that taxable profits will be available against which the deductibletemporary differences, unused tax losses and tax credits can be utilized.

Deferred income tax is calculated at the rates that are expected to apply to the period when the differencesreverse, and the tax rates that have been enacted, or substantively enacted, at the date of the statement offinancial position.

Government grants are recognized at their fair values and included in non-current liabilities, as deferredincome, when there is reasonable assurance that the grants will be received and the Company will be ableto comply with the conditions associated with the grants.

Provisions are recognized when the Company has a present legal or constructive obligation as a result ofpast events, it is probable that an outflow of resources embodying economic benefits will be required tosettle the obligation and a reliable estimate of the amount can be made. Provisions are reviewed at eachbalance sheet date and are adjusted to reflect the current best estimate.

Wateen Telecom Ltd. Annual Report 201722

6.7 Contingent liabilities

6.8 Dividend distribution

6.9 Property and equipment

6.10 Intangible assets

(i) Licenses

(ii) Computer software

The amortization on licenses acquired during the year, is charged from the month in which a license isacquired / capitalized, while no amortization is charged in the month of expiry / disposal of the license.

These are carried at cost less accumulated amortization and any identified impairment losses. Amortizationis calculated using the straight line method, to allocate the cost of the software over its estimated useful life,and is charged to profit and loss account. Costs associated with maintaining computer software, arerecognized as an expense as and when incurred.

The amortization on computer software acquired during the year is charged from the month in which thesoftware is acquired or capitalized, while no amortization is charged for the month in which the software isdisposed off.

Property and equipment, except freehold land and capital work-in-progress, is stated at cost lessaccumulated depreciation and any identified impairment losses; freehold land is stated at cost less identifiedimpairment losses, if any. Cost includes expenditure, related overheads, mark-up and borrowing costs (note6.4) that are directly attributable to the acquisition of the asset.

Depreciation on operating assets is calculated, using the straight line method, to allocate their cost overtheir estimated useful lives, at the rates mentioned in note 19.

Subsequent costs, if reliably measurable, are included in the asset’s carrying amount, or recognized as aseparate asset as appropriate, only when it is probable that future economic benefits associated with thecost will flow to the Company. The carrying amount of any replaced parts as well as other repair andmaintenance costs, are charged to income during the period in which they are incurred.

A contingent liability is disclosed when the Company has a possible obligation as a result of past events, theexistence of which will be confirmed only by the occurrence or non-occurrence, of one or more uncertainfuture events, not wholly within the control of the Company; or when the Company has a present legal orconstructive obligation, that arises from past events, but it is not probable that an outflow of resourcesembodying economic benefits will be required to settle the obligation, or the amount of the obligation cannotbe measured with sufficient reliability.

The distribution of the final dividend, to the Company’s shareholders, is recognized as a liability in thefinancial statements in the period in which the dividend is approved by the Company’s shareholders; thedistribution of the interim dividend is recognized in the period in which it is declared by the Board ofDirectors.

These are carried at cost less accumulated amortization and any identified impairment losses. Amortizationis calculated using the straight line method from the date of commencement of commercial operations, toallocate the cost of the license over its estimated useful life specified in note 21, and is charged to incomefor the year.

Depreciation on additions to property and equipment, is charged from the month in which the relevant assetis acquired or capitalized, while no depreciation is charged for the month in which the asset is disposed off.Impairment loss, if any, or its reversal, is also charged to income for the year. Where an impairment loss isrecognized, the depreciation charge is adjusted in future periods to allocate the asset’s revised carryingamount, less its residual value, over its estimated useful life.

The gain or loss on disposal of an asset, calculated as the difference between the sale proceeds and thecarrying amount of the asset, is recognized in profit or loss for the year.

Wateen Telecom Ltd. Annual Report 201723

6.11 Impairment of non-financial assets

6.12 Non current assets/disposal group held for sale

6.13 Investment in subsidiaries

6.14 Right of way charges

6.15 Trade debts and other receivables

6.16 Stores, spares and loose tools

6.17 Cash and cash equivalents

6.18 Revenue recognition

Non-current assets are classified as assets held-for-sale when their carrying amount is to be recoveredprincipally through a sale transaction and sale is considered highly probable. They are stated at the lower ofcarrying amount and fair value less cost to sell.

Investments in subsidiaries, where the Company has control or significant influence, are measured at cost inthe Company’s financial statements. The profits and losses of subsidiaries are carried in the financialstatements of the respective subsidiaries, and are not dealt within the financial statements of the Company,except to the extent of dividends declared by these subsidiaries.

Right of way charges paid to local governments, concerned authorities and land owners for access of landare carried at cost, which is charged to profit and loss account on straight line basis over the period of rightof way.

Cash and cash equivalents are carried at cost. For the purpose of the cash flow statement, cash and cashequivalents comprise cash in hand and bank and short term highly liquid investments with original maturitiesof three months or less, and that are readily convertible to known amounts of cash, and subject to aninsignificant risk of changes in value.

Dividend income is recognized when the right to receive payment is established.

Revenue is recognized as related services are rendered.

Revenue from granting of Indefeasible Right of Use (IRU) of dark fiber upto 20 years or more is recognizedat the time of delivery and acceptance by the customer.

Revenue from sale of equipment is recognized when the goods are delivered to the customers.

Trade debts and other receivables are carried at their original invoice amounts, less any estimates made fordoubtful debts based on a review of all outstanding amounts at the year end. Bad debts are written off whenidentified.

Assets that have an indefinite useful life, for example freehold land, are not subject to depreciation and aretested annually for impairment. Assets that are subject to depreciation or amortization are reviewed forimpairment on the date of balance sheet, or whenever events or changes in circumstances indicate that thecarrying amount may not be recoverable. An impairment loss is recognized, equal to the amount by whichthe asset’s carrying amount exceeds its recoverable amount. An asset’s recoverable amount is the higher ofits fair value less costs to sell and value in use. For the purposes of assessing impairment, assets aregrouped at the lowest levels for which there are separately identifiable cash flows. Non financial assets thatsuffered an impairment, are reviewed for possible reversal of the impairment at each balance sheet date.Reversals of the impairment loss are restricted to the extent that asset’s carrying amount does not exceedthe carrying amount that would have been determined, net of depreciation or amortization, if no impairmentloss has been recognized. An impairment loss, or the reversal of an impairment loss, are both recognized inthe income statement.

Stores, spares and loose tools are carried at cost less allowance for obsolescence. Cost is determined onweighted average cost formula basis. Items in transit are valued at cost, comprising invoice values andother related charges incurred up to the date of the statement of financial position.

Interest income is recognized using the effective yield method.

Wateen Telecom Ltd. Annual Report 201724

6.19 Functional and presentation currency

6.20 Foreign currency transactions and translations

6.21 Financial instruments

(a) Financial assets

Classification and subsequent measurement

(i) Fair value through profit and loss

(ii) Held to maturity

(iii) Loans and receivables

The Company classifies its financial assets in the following categories: fair value through profit or loss, held-to-maturity investments, loans and receivables and available-for-sale financial assets. The classificationdepends on the purpose for which the financial assets were acquired. Management determines theclassification of its financial assets at initial recognition. Regular purchases and sales of financial assets arerecognized on the trade date - the date on which the Company commits to purchase or sell the asset.

Financial assets at fair value through profit or loss, include financial assets held for trading andfinancial assets, designated upon initial recognition, at fair value through profit or loss.

Financial assets at fair value through profit or loss are carried in the balance sheet at their fairvalue, with changes therein recognized in the income for the year. Assets in this category areclassified as current assets.

Items included in the financial statements of the Company are measured using the currency of the primaryeconomic environment in which the entity operates (the functional currency). These financial statements arepresented in Pakistan Rupees (Rs.), which is the Company’s functional currency.

Foreign currency transactions are translated into the functional currency, using the exchange ratesprevailing on the date of the transaction. Monetary assets and liabilities, denominated in foreign currencies,are translated into the functional currency using the exchange rate prevailing on the date of the balancesheet. Foreign exchange gains and losses resulting from the settlement of such transactions, and from thetranslation of monetary items at year end exchange rates, are charged to income for the year.

Financial assets and liabilities are recognized when the Company becomes a party to the contractualprovisions of the instrument and derecognized when the Company loses control of the contractual rights thatcomprise the financial assets and in case of financial liabilities when the obligation specified in the contractis discharged, cancelled or expires. All financial assets and liabilities are initially recognized at fair valueplus transaction costs other than financial assets and liabilities carried at fair value through profit or loss.Financial assets and liabilities carried at fair value through profit or loss are initially recognized at fair value,and transaction costs are charged to income for the year. These are subsequently measured at fair value,amortized cost or cost, as the case may be. Any gain or loss on derecognition of financial assets andfinancial liabilities is included in profit or loss for the year.

Non derivative financial assets with fixed or determinable payments and fixed maturities areclassified as held-to-maturity when the Company has the positive intent and ability to hold theseassets to maturity. After initial measurement, held-to-maturity investments are measured atamortized cost using the effective interest method, less impairment, if any.

Loans and receivables are non derivative financial assets with fixed or determinable payments,that are not quoted in an active market. After initial measurement, these financial assets aremeasured at amortized cost, using the effective interest rate method, less impairment, if any.

The Company’s loans and receivables comprise 'Long term deposits', ‘Trade debts’, 'Contractwork in progress', ‘Advances, deposits and other receivables,' ‘Tax refund due from government’and ‘Bank balances’.

(iv) Available for sale

Available-for-sale financial assets are non-derivatives, that are either designated in this category,or not classified in any of the other categories. These are included in non current assets, unlessmanagement intends to dispose them off within twelve months of the date of the statement offinancial position.

Wateen Telecom Ltd. Annual Report 201725

Impairment

(b) Financial liabilities

Initial recognition and measurement

Subsequent measurement

The measurement of financial liabilities depends on their classification as follows:

(i)

(ii)

(c) Offsetting of financial assets and liabilities

6.22 Derivative financial instruments

Financial assets and liabilities are offset and the net amount reported in the balance sheet, when there is alegally enforceable right to set off the recognized amounts and there is an intention to settle on a net basis,or realise the asset and settle the liability simultaneously. Legally enforceable right must not be contingenton future events and must be enforceable in normal course of business and in the event of default,insolvency or bankruptcy of the Company or the counter party.

Derivates are initially recognized at fair value on the date a derivative contract is entered into and aresubsequently remeasured at fair value. Changes in fair value of derivates that are designated and qualify asfair value hedges are recorded in income statement together with any changes in the fair value of thehedged asset or liability that are attributable to the hedged risk.

The Company assesses at the end of each reporting period whether there is an objective evidence that afinancial asset or group of financial assets is impaired as a result of one or more events that occurred afterthe initial recognition of the asset (a ‘loss event’), and that loss event (or events) has an impact on theestimated future cash flows of the financial asset or group of financial assets that can be reliably estimated.

The Company classifies its financial liabilities in the following categories: fair value through profit or loss andother financial liabilities. The Company determines the classification of its financial liabilities at initialrecognition. All financial liabilities are recognized initially at fair value and, in the case of other financialliabilities, also include directly attributable transaction costs.

Fair value through profit or loss

Financial liabilities at fair value through profit or loss, include financial liabilities held-for-tradingand financial liabilities designated upon initial recognition as being at fair value through profit orloss. Financial liabilities at fair value through profit or loss are carried in the statement of financialposition at their fair value, with changes therein recognized in the income for the year.

After initial measurement, available-for-sale financial assets are measured at fair value, withunrealized gains or losses recognized as other comprehensive income, until the investment isderecognized, at which time the cumulative gain or loss is recognized in income for the year.

Other financial liabilities

After initial recognition, other financial liabilities which are interest bearing are subsequentlymeasured at amortized cost, using the effective interest rate method.

Number of Number of

7. Share capital Shares Shares

Authorised share capital:Ordinary shares of Rs 10 each 1,000,000,000

10,000,000

1,000,000,000

10,000,000

Issued, subscribed and paid upshare capital:Shares alloted for consideration paid in cash:Ordinary shares of Rs 10 each 408,737,310

4,087,373

408,737,310

4,087,373

Shares alloted as bonus shares:Bonus shares of Rs 10 each 208,737,310

2,087,373

208,737,310

2,087,373

617,474,620

6,174,746

617,474,620

6,174,746

June 30, 2017 June 30, 2016

(Rupees in

thousand)

(Rupees in thousand)

Wateen Telecom Ltd. Annual Report 201726

7.1

8. General reserves

Note 2017 20169. Long term finance - secured

Syndicate of banks 9.1 7,775,471

7,789,921

Export Credit Guarantee Department (ECGD) 9.2 2,688,009

2,680,329

Dubai Islamic Bank (DIB) 9.3 334,674

335,224

Deutsche Bank AG 9.4 5,038,694

5,024,298

Loan guarantee on behalf of WWL 9.5 1,109,000

1,109,000

16,945,848

16,938,772

Unamortised transaction and other ancillary cost

Opening balance 73,387 102,927

Amortisation for the year (23,874) (29,540) (49,513) (73,387)

16,896,335 16,865,384 Less: Amount shown as current liability

Amount payable within next twelve months (6,867,832)

(4,653,075) Amount due after twelve months (10,028,503)

(12,212,309)

9.6 (16,896,335)

(16,865,384) -

-

9.1

The parent company, Warid Telecom International LLC, U.A.E held 600,747,211 (June 30, 2016: 588,577,066)ordinary shares.

(Rupees in thousand)

The Company obtained syndicate term finance facility from a syndicate of local banks to finance the capitalrequirements of the Company. During the year ended June 30, 2015, the Company and the Syndicate of Banks signedsecond amendatory agreement to restructure Syndicate term finance facility and the short term running finance fromBank Alfalah Limited (related party) running finance facility-I. The principal is now repayable in twenty unequal sixmonthly instalments. The first such installment was due on April 1, 2015 and subsequently every six months untilOctober 1, 2024. The Company is required to mandatorily prepay the outstanding amount out of net cash proceedsfrom sale of WWL or any excess cash generated by the Company after taking into account a minimum cash balance,capital expenditure and working capital requirements in each financial year. The rate of mark-up is 12% per annumfrom July 1, 2013 which shall stand deferred till payment of the final installment of principal portion (deferred payment)as referred to in note 10.1. Earlier, principal was repayable in ten unequal semi annual installments with firstinstallment due on July 1, 2014 and it carried a mark up of 6 months KIBOR per annum till December 31, 2013 and 6months KIBOR + 2.5% per annum for remaining period.

This represents reserve created in line with Board of Directors' decision to place atleast 10% of the profits in GeneralReserve Account of the company till it reaches 50% of the paid up capital of the company.

The facility is secured by way of hypothecation over all present and future moveable assets (including all currentassets) and present and future current/ fixed assets, a mortgage by deposit of title deeds in respect of immoveableproperties of the Company, pledge over fully paid ordinary shares (entire present and future) owned by the Companyin WWL and owned by WTI in the capital of the Company, a guarantee from WTI for amounts payable under secondamendatory agreement and undertaking from shareholders from WTI for retaining the shareholding and control ofWTI. Syndicate is entitled to designate one nominee to be appointed as director in the Board of Directors of theCompany.

Certain conditions precedent to the second amendatory agreement are not yet fulfilled, the management of theCompany is taking steps to fulfill those conditions. Once conditions precedent to restructured agreements are fulfilled,a formal letter shall be issued to the Company by the Syndicate of aforesaid Banks, which shall complete therestructuring process. The Company has been making payments according to second amendatory agreement.

Wateen Telecom Ltd. Annual Report 201727

9.2

9.3

9.4

Certain conditions precedent to the restructured agreement are not yet fulfilled, management of the Company is takingsteps to fulfill those conditions. Once conditions precedent to restructured agreement are fulfilled, bank will formallyissue letter to the Company which will complete the restructuring process. The company has been making paymentsaccording to terms of revised restructuring agreement.

The facility is secured by way of hypothecation over all present and future moveable assets (including all currentassets) and present and future current / fixed assets (movable and immoveable), pledge over fully paid ordinaryshares (entire present and future) owned by the Company in WWL and owned by WTI in the capital of the Company, acorporate guarantee from WTI and undertaking from shareholders from WTI for retaining the shareholding and controlof WTI.

The Company obtained term finance facility of USD 65 million (June 30, 2016: USD 65 million) from Motorola CreditCorporation (MCC) of which USD 64 million (June 30, 2016: USD 64 million) has been availed till June 30, 2017. OnAugust 19, 2011, MCC had transferred all of its rights, title benefits and interests in the original facility agreement toDeutsche Bank AG as lender, effective August 19, 2011. During the year ended June 30, 2012, the Company andDeutsche Bank AG signed an agreement to restructure the terms of loan agreement. Amount outstanding at June 30,2017 is USD 48 million (June 30, 2016: USD 48 million). The principal is repayable in ten semi annual installmentscommencing from July 1, 2014 until and including the final maturity date which is December 31, 2019. The rate ofmark-up is six month LIBOR + 1% per annum provided that rate shall be capped at 2.5% per annum. If the Companyfails to pay any amount payable on its due date, interest shall accrue on the unpaid sum from the due date up to thedate of actual payment at a rate which is 2% higher than the rate of interest in effect thereon at the time of suchdefault until the end of the current interest period. Thereafter, for each successive interest period, 2% above the six-month LIBOR plus margin provided the Company is in breach of its payment obligations hereof.

The facility is secured by way of hypothecation over all present and future moveable assets (including all currentassets) and present and future current / fixed assets (excluding assets under specific charge of CM Pak and assetswhich are subject to lien in favour of USF), a mortgage by deposit of title deeds in respect of immoveable properties ofthe Company, lien over collection accounts and Debt Service Reserve Account and personal guarantees by threeSponsors of the Company.

As explained in note 2(iii), the Company is in negotiation with the lenders to restructure the above finance facility.

The Company obtained Ijarah finance facility of Rs 530 million (June 30, 2016: Rs 530 million) from DIB. During theyear ended June 30, 2015, the Company and DIB signed an agreement to restructure the terms of the Ijarah financefacility. The principal is now repayable in twenty unequal six-monthly installments. The first such installment was dueon April 1, 2015 and subsequently every six months until October 1, 2024. The rate of mark-up is 12% per annum from commencement date which shall stand deferred till payment of the final installment of principal portion (deferredpayment) as referred to in note 10.2. Earlier, principal was repayable in ten unequal semi annual installments with firstsuch installment due on July 1, 2014 and it carried a markup of 6 months KIBOR per annum till December 31, 2013and 6 months KIBOR + 2.5% per annum for remaining period.

The Company obtained long term finance facility amounting to USD 42 million (June30, 2016: USD 42 million) fromECGD UK, of which USD 35 million (2016: USD 35 million) was availed till June 30, 2017. During the year ended June30, 2012, the Company and ECGD UK signed an agreement to restructure the terms of loan agreement includingrepayment schedule. Amount outstanding at June 30, 2017 is USD 25.60 million (2016: 25.60 million). The principal isrepayable in ten semi annual installments. The first such installment was due on July 1, 2014 and subsequently everysix months until January 1, 2019. The rate of mark-up is six month LIBOR + 1.5% per annum till June 30, 2011 and sixmonth LIBOR + 1.9% for the remaining period. If the amount of installment payable and/or interest payable is not paidon the due date, the Company shall pay interest on such amount at the applicable interest rate plus 2% per annum.

9.5 The Company transferred a portion of outstanding principal amount under Syndicate Term Finance Agreement to itswholly owned subsidiary WWL. Under the terms of agreement, the Company guaranteed the amount on behalf ofWWL and the amount guaranteed has been recognized by the Company due to curtailed scale of operations of WWL,negative value in use of WWL, loss for the year, termination of Master Transaction Agreement (MTA) and existence ofno realistic basis of preparation of financial statements of WWL on a going concern basis.

The loan is secured through personal guarantee by one Sponsor of the Company and is ranked pari passu withunsecured and unsubordinated creditors.

Subsequent to year end,

on August 10, 2017, Deutsche Bank AG facility has been novated from the company to WTI. Accordingly, the amount is now payable by the company to WTI on same terms.

Wateen Telecom Ltd. Annual Report 201728

9.6 Latest restructured loan agreements (as referred in note 9.1 and 9.3) with the syndicate of local banks and DIB havenot yet become effective as certain conditions precedent to the restructured agreements are not yet fulfilled.Accordingly, the lenders are entitled to declare all outstanding amount of the loans immediately due and payable.Further, the Company has not paid loan installments of ECGD amounting to USD 13.749 million (June 30, 2016:USD8.713 million) and of Deutsche Bank AG amounting to USD 25.774 million (June 30, 2016: USD 16.334 million) whichfell due till the year ended June 30, 2017. The Company was also not able to make payments of markup to ECGD andDeutsche Bank AG of Rs. 56.547 million (June 30, 2016: Rs 59.160 million) and Rs. 119.929 million (June 30, 2016:Rs. 91.810 million), respectively on due dates.

In terms of provisions of International Accounting Standard 1 - 'Presentation of Financial Statements', since theCompany does not have an unconditional right to defer settlement of liabilities for at least twelve months after thebalance sheet date, all liabilities under these loan agreements are required to be classified as current liabilities. Basedon above, loan installments for an amount of Rs. 10,029 million and markup amount of Rs. 4,899 million due afterJune 30, 2017 have been shown as current liability.

10. Long term portion of deferred mark upNote 2017 2016

10.1 4,765,768

3,831,455

10.2 133,625

93,416

4,899,393

3,924,871

-

-

Syndicate of banks

Dubai Islamic Bank (DIB)

Less:

Amount shown as current liability

Amount payable within next twelve months

Amount due after twelve months (4,899,393)

(3,924,871)

10.3 (4,899,393)

(3,924,871)

-

-

10.1

i)

ii)

iii)

iv)

(Rupees in thousand)

As explained in note 9.1, the markup (deferred payments) has been restructured under the secondamendatory agreement. The deferred payments are payable in following order of priority and sequence:

Deferred payment of Rs 1,023 million pertaining to the period of January 1, 2011 till June 30, 2013shall be paid in seven unequal six-monthly installments starting from April 1, 2025 and ending on April1, 2028;

Deferred payment at 8% per annum for the period from July 1, 2013 till March 31, 2014 shall be paid in four unequal six-monthly installments starting from April 1, 2028 and ending on October 1, 2029;

Deferred payment at 5% per annum for the period from April 1, 2014 upto final due date under secondamendatory agreement shall be paid in two unequal installments due on October 1, 2029 and April 1,2030; and

After payments of all amounts above, the deferred payment at 4% per annum for the period of July 1,2013 till March 31, 2014 and at 7% per annum for the period from April 1, 2014 upto final date undersecond amendatory agreement shall be payable as a bullet payment in the year 2030 subject toavailability of the excess cash generated by the Company.

10.2

i)

ii)

10.3

As explained in note 9.3, the markup (deferred payments) has been restructured. The markup is payable inthe following sequence:

Markup calculated at 5% per annum for the period from commencement date till October 1, 2024 shallbe paid in eleven unequal six-monthly installments starting from April 1, 2025 and ending on April 1,2030; and

Markup at 7% per annum shall be paid as a bullet payment in the year 2030 subject to availability ofthe excess cash generated by the Company.

As explained in note 9.6, the entire amount has been shown as current liability.

Wateen Telecom Ltd. Annual Report 201729

11. Long term finance from shareholders - unsecured

Note 2017 2016

Facility 1 11.1 2,522,625

2,515,418

Facility 2 11.2 11,811,815

11,526,040

14,334,440

14,041,457

11.1

11.2

This loan together with accrued interest will have at all times priority over all unsecured debts of theCompany except as provided under Law. In the event the Company defaults on its financial loans or incase Warid Telecom International LLC, Abu Dhabi, UAE, no longer remains the holding company of theCompany and sells its 100% shares to any other person or party or relinquishes the control of itsmanagement then, unless otherwise agreed in writing by the lender, the entire loan together with theaccrued interest will become due and payable forthwith and shall be paid within 15 working days of theevent of default or decision of the Board of Directors of the Company accepting such a change in theshareholding as the case may be, and until repaid in full, the loan shall immediately become part offinancial loans, ranking pari passu therewith subject to the consent of the Company's existing financial loanproviders. As the loan is subordinated to all secured finance facilities availed by the Company, the entireamount of loan has been classified as non current liability.

The rights of the lender in respect of the loan are subordinated to any indebtedness of the Company to anysecured lending by any financial institution in any way, both present and future notwithstanding whethersuch indebtedness is recoverable by process of law or is conditional or unconditional. However, the loantogether with the interest shall have priority over all other unsecured debts of the Company. Further, afterthe execution of this agreement, the Company shall not avail any other loan or funding facility from anyother source without prior written consent of the lender. The Company undertakes that it shall not declaredividends, make any distributions or pay any other amount to its shareholders unless the repayment of theloan and the interest in full to the lender. As the loan is subordinated to all secured finance facilities availedby the Company, the entire amount of loan has been classified as non current liability.

The Company obtained long term finance from a shareholder amounting to USD 24 million (June 30, 2016:USD 24 million). This loan is subordinated to all secured finance facilities availed by the Company. Thisloan was repayable within 30 days of the expiry of a period of five years from the last date the lender haddisbursed the loans, which was due by the end of January 2015. The rate of mark-up is 6 months LIBOR +1.5% with 24 months grace period payable half yearly. Alternatively loans may be converted into equity byway of issuance of the Company's ordinary shares at the option of the lender at any time prior to, at or afterthe repayment date on the best possible terms but subject to fulfillment of all legal requirements at the costof the Company. The said conversion of loan shall be affected at such price per ordinary share of theCompany as shall be calculated after taking into account the average share price of the last 30 calendardays, counted backwards from the conversion request date, provided that such conversion is permissibleunder the applicable laws of Pakistan.

The Company obtained long term finance facility from a shareholder amounting to USD 185 million (June30, 2016: USD 185 million) of which USD 112.4 million (June 30, 2016: USD 110 million) has been availedat June 30, 2017. The rate of mark-up is 6 months LIBOR + 1.5% payable half yearly. As per theagreement, the Company is required to repay the full amount of loan in five equal annual installments fromJune 30, 2014 with final maturity date of June 30, 2018. However, no such installment has been paid by theCompany, as the loan is sub-ordinated to the financial loans. The lender has an option to instruct theCompany any time during the term of this agreement to convert the remaining unpaid amount of the loanand the interest in part, or in its entirety into equity by way of issuance of ordinary shares of the Company infavour of the lender in compliance with all applicable laws of Pakistan.

Upon the request of the Company for conversion of the loan and the interest into equity, the lender and theCompany shall, with mutual consent, appoint an independent auditor to determine the fair market value pershare of the borrower prevailing at the time of such request. lf the lender agrees to the price per share asdetermined by the independent auditor then the loan and the interest shall be converted into equity at therate per share decided by the independent auditor. In case the lender, in its sole discretion, disagrees withthe price per share as determined by the independent auditor then the request for conversion shall standrevoked and the loan shall subsist.

(Rupees in thousand)

Wateen Telecom Ltd. Annual Report 201730

12. Medium term finance from an associated company - unsecured Note 2017 2016

Medium term finance from an associated company - unsecured 600,000

600,000

Less: Amount shown as current liability 12.1 (600,000)

(600,000)

-

-

12.1

13. Deferred government grants

Movement during the year is as follows:

Note 2017 2016

Balance at beginning of the year 2,567,744

2,599,101

Amount received during the year -

112,204

Amount recognised as income during the year 35 (148,220)

(143,561)

Balance at end of the year 2,419,524 2,567,744

14. Short term running finance - secured

Facility - II 14.1 687,664 765,512

14.1

15. Short term finance from associated company - unsecured

Note 2017 2016

16. Trade and other payables

Creditors 16.1 577,307

887,227

Due to related parties 16.2 137,624

164,396

Due to international carriers 371,831

442,464