annual report 2003 - Lindab · lindab annual report 2003 6 CEO's comments 8 strategies for growth...

Transcript of annual report 2003 - Lindab · lindab annual report 2003 6 CEO's comments 8 strategies for growth...

4 the year in brief

2

l indab annual report 2003

6 CEO's comments

8 strategies for growth

10 lindab's solutions

14 proximity and expansion

18 processes of quality

22 a strong organisation

24 ventilation business area

30 profile business area

36 other business

38 administration report

41 key figures

42 consolidated income statement

43 consolidated balance sheet

46 consolidated cash flow statement

47 parent company income statement and balance sheet

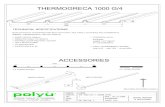

In the Profile business area, the Rainline and Building System product areas are home to our compre-

hensive range of roof drainage products and our extensive range of building systems for offices, warehouses,

farm buildings, etc. Light-gauge purlins and wall studs, together with roof and wall cladding, are key compo-

nents in the Building System product area.

48 accounting policies

50 notes

60 auditor's report

62 board of directors

64 group management

66 technical glossary

In the Ventilation business area, the central product

area is Air Duct Systems

– circular and rectangular ducting solutions for ventilation systems.

Around this we have gradually built up a comprehensive

range of technical products – Indoor Climate

product area - whose role is to provide a well ventilated,

comfortable and quiet indoor climate.

3

Lindab is an international group which develops, manufactures and markets sheet

metal products and system solutions in the Ventilation and Profile business areas.

The Ventilation business area focuses on the ventilation industry, offering everything

from ventilation components to complete indoor climate solutions.

The Profile business area focuses on the construction industry, offering an extensive

range of building components and complete steel building systems for both residential

and commercial properties.

Having two clearly defined business areas - Ventilation and Profile - ensures an effec-

tive operational focus and the best use of shared resources in the group.

Since sheet metal forms the basis for both business areas' operations, there are

many points of contact between the two right along our quality-orientated value chain -

from purchasing, sheet metal working and production through to distribution, support

and delivery. Neatness and order in everything we do, a down-to-earth relationship with

customers and partners, and an unwavering focus on solutions that simplify construc-

tion are the factors which are bringing profitable growth not only for us but also for our

customers.

The Lindab group generated sales of SEK 5 302 M in 2003 and had 3 874 employees in

26 countries in Europe and North America. Its head office is in Grevie near Båstad in

southwestern Sweden.

this is lindab

4

Market conditions were less favourable

than we anticipated at the beginning of the

year. This led to the rapid launch of various

rationalisation projects during the first half

of 2003. The initiatives in Germany,

Switzerland and the UK were the most

important for rapidly improving profitability

through increased efficiency. The "Fill the

Gap" profitability programme was also an

important milestone for the continued

actionorientated focus on income and

costs throughout the group.

These activities duly boosted earnings,

and a strong performance in the third and

fourth quarters pushed up EBITA for the

year to SEK 305 M (325). Sales grew by 1%

to SEK 5 302 M (5 235).

The very strong growth in our markets

in Central and Eastern Europe continued in

2003. We also noted increased demand

and an improved market situation in the

USA during the second half of the year. In

the Nordic region we maintained our volu-

mes in a falling market, so increasing our

market share. The market in Western

Europe was weak but stabilised somewhat

towards the end of the year.

In Germany work began on reorgani-

sing our branch network to achieve an

improved production structure.

In Switzerland we acquired the compa-

ny FEA during the spring and then embar-

ked on a comprehensive restructuring pro-

gramme, which included bringing together

all local production at the new facilities in

Eiken that came with the acquisition.

In the UK there was a review of product

ranges and prices, which will limit the num-

ber of external products in favour of those

manufactured in-house.

The fourth quarter saw the completion

of the group's largest investment yet in the

form of the new production plant outside

Prague in the Czech Republic.

the year in brief

In 2003 the Lindab group generated sales of SEK 5 302 M (5 235), an increase of 1%. The

appreciation of the SEK reduced sales growth by three percentage points, while the year's

acquisitions and disposals added one percentage point and higher volumes added a fur-

ther three.

EBITA amounted to SEK 305 M (325). Earnings growth accelerated over the course of the

year, and fourth-quarter earnings were substantially higher than in 2002.

Two acquisitions were made during the year in the Ventilation business area: Swiss ven-

tilation company FEA AG and Bravida A/S's duct manufacturing business in Denmark.

Together with the disposal of the galvanising business at JiWeGalv AB and Eskilstuna

Galvan AB, this has enabled the group to concentrate even more sharply on its core busi-

ness.

Lindab made its single largest investment yet in the form of a new Central European pro-

duction facility outside Prague in the Czech Republic, which will be one of the cor-

nerstones of the group's continued production optimisation programme.

On 1 March 2004 Anders Persson left his position as business area manager at Profile to

become HR manager at group level. Peter Andsberg took over as business area manager

at Profile on the same day and will be based in Hungary, which has been Profile's largest

growth market in recent years.

Cash flow from operating activities totalled SEK 395 M (118).

Lindab is supplying facade systems for the Turning Torso, Malmö's new 192 metre tall landmark.

l indab summary & strategies

5

The group made its single largest investment yet during the year.

Early in 2003 the board decided to build a new Central European plant

to manufacture standard products in the Ventilation business area,

together with a smaller production unit for the Profile business area.

The plant outside Prague in the Czech Republic extends to more

than 25 000 square metres and was planned, built, inaugurated and

started up in less than seven months. The result is more cost-effective

production of labour-intensive products and greater proximity to the

growing markets of Central Europe and Russia.

Lindab further sharpened its focus on core business during the year. The acquisition of

FEA in Switzerland and Bravida's duct manufacturing business in Denmark strengthened

our resources in the Ventilation business area. Lindab's position as a system supplier,

especially in the Swiss market, was advanced significantly by the acquisition. There has

also been a major restructuring programme in Switzerland.

JiWeGalv and Eskilstuna Galvan were sold during the autumn. This means that the

group's operations now focus almost exclusively on our core business of efficiently pro-

cessing sheet metal and adding value and benefits that make life easier for our customers

and their customers in turn.

A profitability programme called "Fill the Gap" was launched across the group in 2003.

It builds on a number of key instruments for the analysis, ranking, certification and imple-

mentation of important activities intended to boost profitability and sharpen the focus on

the group's core business. "Fill the Gap" is also a means of cementing the strong com-

mon culture and approach to be found at Lindab. The certified activities now being imple-

mented throughout the group are intended to result in increased sales, higher market

share, better products and more efficient utilisation of resources.

The aim of the "Fill the Gap" programme with its detailed and concrete action plans is

to plug the gap between our actual EBITA and our long-term target EBITA of 9% on ave-

rage through sales-generating and cost-cutting activities.

2003 2002Sales, SEK M 5 302 5 235

EBITA, SEK M 305 325

Equity/assets ratio, % 43 43

Average number of employees, group 3 920 3 766

of which in Sweden 1 303 1 366

The new plant outside Prague.

Lindab aquired FEA in Switzerland during the year

Management meeting on "Fill the Gap".

6

In the 2002 annual report we identified

three key challenges that Lindab faces over

the next few years: to retain and develop

the strength that is the Lindab culture, to

ensure that the organisation retains its

motivation, entrepreneurial spirit and

enthusiasm, and to supplement this with a

clear commercial mindset to ensure profi-

table growth.

THE FIRST YEAR

Over the last year we have helped to safe-

guard the Lindab culture by cementing

relations between employees and compa-

nies in the group. Cooperation between

departments in different countries has been

strengthened. Another tangible result of our

efforts is the work on developing the

group's core values: neatness and order,

down to earth, simplify construction.

Our business structure, which builds

on active leadership and a clear emphasis

on a dynamic action-orientated approach,

has increased the organisation's efficiency

and profit focus. One of the important tools

that we have developed and used is the

profitability programme "Fill the Gap", a raft

of certified activities for optimising resource

utilisation and earnings growth. We have

begun the development of a common cor-

porate language in order to maximise

transparency, clarity and simplicity. Clearer

and more extensive use of management

groups at different levels of the organisa-

tion is an important change. And our cen-

tral support functions for purchasing,

logistics, legal affairs, communication and

so on have taken shape and are now con-

tributing to the more rational and efficient

utilisation of resources within the group,

which has further enhanced quality in seve-

ral areas.

Our focus on professionalism is an

important measure for ensuring profitable

growth. Another very important point in this

context is the realisation that we need to

charge customers for major sources of

added value, such as better products,

longer lifetimes and more efficient/local

distribution. If we are close to customers,

we can understand them better and deve-

lop solutions that are more profitable both

for them and for us. Over the last year we

have noted greater acceptance of our new

way of working, and growing involvement

in areas such as product development and

product launches.

Lindab is a company with both feet

firmly and proudly planted on the ground.

That special twinkle in the eye and the con-

stant drive to spy new opportunities can be

seen throughout the group.

HOW THINGS WENT

In terms of market conditions, 2003 was

weaker than we had anticipated, especial-

ly in Western Europe. The year also started

badly in the USA. Nevertheless we mana-

ged to gain market share in our main mar-

kets and strengthen our position for the

future. In the light of this, we are not dis-

appointed with an EBITA margin of 5.8%,

down just 0.4 percentage points on 2002.

IMPORTANT EVENTS

The new production plant outside Prague

in the Czech Republic is Lindab's single lar-

gest investment yet. Other important

events naturally included the acquisitions

and disposals carried out during the year to

further strengthen our position in the

Ventilation business area's core business.

The acquisition of FEA in Switzerland and

Bravida's duct manufacturing business in

Denmark has increased our chances of

supplying even better system solutions in

these markets, and the sale of JiWeGalv

and Eskilstuna Galvan in 2003 was another

step in the continued concentration on

Lindab's core business.

No acquisitions were made in the

Profile business area. Lindab Butler, which

was acquired in 2002, completed its first

full year as part of the group. The company

l indab summary & strategies

CEO's comments

7

has successfully been integrated with the

other units and has turned losses into pro-

fits. Thanks not least to a professional

restructuring programme implemented by

the company's management, we are loo-

king forward to growing volumes and ear-

nings at Lindab Butler in the future.

We are delighted to see that our activi-

ties in Central and Eastern Europe are

generating strong growth. Romania is a

good example of how we have been able

to combine rapid growth with good profita-

bility, and is also another important base for

continued expansion in the region. During

the year we also established sales offices in

Russia, Bulgaria and Slovakia. Together

with the offices already started up in places

like Sarajevo and Belgrade, this means that

we now have a strong organisation in a

region with great potential for Lindab.

Our expansion into Central and

Eastern Europe starting in Hungary has

shown that we have a clearly defined and

well developed expansion concept. We can

see good potential for the continued rapid

expansion of Lindab's business areas in

this fast-growing market.

OUTLOOK

We believe that the market will continue to

feature low growth and a degree of uncer-

tainty this year, but that Lindab's sales and

market share will continue to grow.

The year began with substantial in-

creases in steel prices, which is expected

to have a major impact on the industry. We

can see both risks and opportunities in the

current market climate. The changes made

in 2003 leave us well equipped for future

profitable growth. We plan to expand into

new markets and make further acquisi-

tions. With our clearer business strategy,

more efficient and rational operations, new

Central European production plant and

highly motivated and dedicated workforce,

we predict bright things for Lindab as we

actively continue to tread our established

path to profitable growth.

8

strategies for growth We will continue to focus on two business areas: Ventilation and

Profile.

Air Duct Systems (circular duct systems) and Rainline (roof drai-

nage systems) and Building System (steel building systems) are

the key product areas in each business area.

Central and Eastern Europe and the USA remain our primary

growth markets.

Growth is to be achieved through increased system sales and

through expansion in markets where our products have low

market penetration and high growth potential.

The "Fill the Gap" profitability programme focusing on sales-

generating and cost-cutting activities launched in 2003 is being

stepped up.

Further acquisitions will be made to gain market share, syner-

gies and new products.

Lindab's internationalisation is to continue.

FINANCIAL TARGETSGrowth in sales, % approx. 15

Operating margin (EBITA), % approx. 9

Return on capital employed, % > 20

Equity/assets ratio, % > 35

More than 700 Polaris and Professor supply-air beams have been

supplied for the Navet development in Gothenburg.

l indab summary & strategies

The growth targets and growth strategy

formulated in 2002 are unchanged.

The long-term strategic goals we set

for sales and earnings should be viewed as

averages over a number of years rather

than targets for each individual year.

The target for sales growth has three

components: organic growth, growth

through acquisitions, and inflation. For

natural reasons, acquisitions are depen-

dent on purely commercial factors.

Economic developments outside the com-

pany's control also impact on the actual

rate of growth each year.

But our objective is clear. By genera-

ting long-term profitable growth at the sta-

ted levels on the strength of our mission,

we aim to further cement Lindab's market

position and realise our vision.

OUR BUSINESS IDEA

Lindab aims to offer the market readily

assembled high-quality products in two

business areas, Ventilation and Profile.

The basis for this is Lindab's extensive

knowhow in developing, manufacturing,

marketing and distributing sheet metal pro-

ducts.

OUR VISION

Lindab is to be the quick, flexible and local

partner that delivers high quality in every

way in both of its business areas,

Ventilation and Profile.

We are to be perceived as the compa-

ny that focuses constantly on meeting

customers' needs and offers solutions that

create more added value and make custo-

mers' life easier than any other.

design

tender/order

product/system

delivery

installation

operation

Design and calculation kick off every construction process. Our proximity and expertise enable us to assist HVAC en-

gineers, designers and architects, and to contribute to economical, ecological and functional solutions in which Lindab's

products play an important role. Our IT tools offer these professionals design and product selection solutions which are

easy to use, save money and result in solutions with functionality assured.

Tendering and ordering lay the foundations for subsequent efficient project management and profitable logistics flows.

Thanks to our tried-and-tested procedures and close customer relations, along with our new project management tool in

the form of the LinPro software package, installers can easily and efficiently build up orders tailored entirely to each par-

ticular project's needs in terms of delivery times and addresses.

Our product range and system solutions are the hub around which our business is built. We are unique in being able

to offer our customers such a wide variety of both standard products and fully customised solutions from one and the

same source. Together with our other services and support, this results in a total solution that makes us our customers'

problem-solver and coordinating supplier of complete, profitable package solutions.

Delivery is about three things and three things only from the customer's point of view: the right product at the right place

at the right time. With a tight construction schedule, there is no margin for error - whether this concerns a consignment

of standard products collected or delivered from the local Lindab branch or a special order shipped directly from one of

our production plants. For us, delivery precision will always be a priority.

Installing products and system solutions is among our customers' key roles. Easy, safe and rapid assembly is the result

of labour-saving and smart solutions. Our circular duct fittings with rubber seals and our ready-cut, easy-to-handle and

dry steel wall studs are good examples of this. For our customers, installation is synonymous with economy, ergonomics

and efficiency. And that is exactly what we offer.

Operation begins once installation is complete and the project has been handed over. Now it is up to good function, easy

maintenance and minimum lifecycle costs to give the building's owner peace of mind and trouble-free operation. Thanks

to the quality ethic which has always guided our product development and product characteristics, our system solutions

assure designers, installers and investors alike of a cost-effective solution for the future.

In 2002 and 2003 we carried out an extensive programme of work internally to verify and formulate our threecore values: neatness and order, down to earth and simplify construction. This work was also the source ofour new slogan: "We have the solution". This neatly sums up our overall promise to the market and to ourcustomers: a total solution which adds value and benefits that make life easier for our customers and theircustomers in turn. The most important components of this total solution are presented over the followingpages.

9

10

Our solutions build on a clear foundation

of quality. This way of thinking is reflected in

all of our activities, from product develop-

ment, manufacturing processes and distri-

bution through to the way we service

customers through proximity, support and

a broad range of products and system

solutions.

The following pages look in a little more

depth at how our quality ethic pervades the

whole of our organisation and all of our pro-

cesses, and present a few snapshots which

illustrate in concrete terms what this means

for our customers and partners in their day-

to-day work.

Lindab - we have the solution.

Chilled beams are part of the Climate product area.

Roof tiles are an important element in the Coverline product area.

l indab l indab's solut ions

11

lindab's solutions

Silencers for duct systems are the key product in the Acoustics product area.

Steel wall studs are key products in the Construline product area, and are also included in the Building System product area.

13

PB teknik AB is a successful HVAC and

sanitation consulting firm which has won a

series of prestigious contracts requiring

very high standards of expertise and know-

how in both ventilation technology and

water and sewerage technology. One of its

more complex projects in 2003 was the

construction of an HVAC and sanitation

installation for the Swedish National

Veterinary Institute's new high-risk labora-

tory in Ultuna. We spoke to chief engineer

Torbjörn Lång from PB teknik at the new

laboratory.

The 450 m2 laboratory was designed to

comply with risk classes P4 Animal, the

highest level, and P3 Human, the second

highest level. "This means that the labora-

tory has been designed to be completely

sealed off from the outside world - neither

air, water, wastewater nor anything else can

escape from its four walls," Torbjörn Lång

explains. "The exhaust air system is fitted

with double HEPA filters enclosed in sepa-

rate safety boxes and equipped with

bubble-tight dampers - the most airtight of

all. The result of this is a system and envi-

ronment which are extremely safe and

allow maintenance and filter changes to be

carried out with the same high levels of

safety."

PB teknik has used Lindab's CADvent

software for designing, drawing and calcu-

lating ventilation systems for many years. In

this case the entire ventilation system and

also all the pipework were drawn in

Lindab's new CADvent plus package: "This

was the first time we've used CADvent

plus," says Lång. "As our contract covered

the entire HVAC and sanitation installation,

we wanted to do everything in the same

software environment. Now we could draw

everything in CADvent plus and neatly

avoid collisions between pipes. We could

also use the package's advanced sound

calculation modules to carry out a com-

plete acoustic analysis in all octave bands

for the ventilation system. This enabled us

to deal with a number of tricky acoustics

problems right from the planning stage."

PB teknik's work also had benefits for

the installer once the many Lindab pro-

ducts and other systems came to be

installed: "By designing everything in

CADvent, we could give the fitters 3D

installation drawings," says Lång. "These

made life a lot easier, especially when

installing this complex facility."

advantage: design

Torbjörn Lång from PB teknik outside the Swedish National Veterinary Institute's high-risk laboratory in Ultuna.

PB teknik designed its HVAC and sanitation systems using Lindab's CADvent plus software package.

in new markets. Building up new branches

and representative offices is crucial to our

continued internationalisation. We therefore

anticipate further growth in our branch net-

work in the near future.

Our focus on proximity means that our

distribution system is constantly evolving.

For us, the important thing is to follow the

market and its needs as closely as possible

- to be wherever we spy the best openings.

This is why we are currently reallocating

14

Being close to our customers and our

markets has always been of utmost impor-

tance to Lindab.

It is this local presence and daily con-

tact with customers that enable us to gain

the best possible understanding of custo-

mers' needs, and so to offer and supply

package solutions which give installers,

contractors and principals the best value

for money and the highest quality. It is also

through this local presence that we can

Sweden and Århus in Denmark to

Budapest in Hungary and Portsmouth in

the USA give tens of thousands of custo-

mers worldwide ready access to our broad

range, good service and smart solutions.

In many of our markets, including

Sweden, Denmark, Norway and Germany,

we have our own well developed network

of branches and collection points, while in

countries like Hungary, Italy and the USA

we work through a network of leading dea-

proximity and expansion

Bucharest, Romania

Bargteheide,Germany

Helsinki,Finland

Växjö,Sweden

l indabs lösni

provide support and assistance and build

up strong long-term customer relations on

the basis of mutual trust, confidence, neat-

ness and order.

A rapid response, short decision paths

and a direct and honest approach - these

are things that our customers, both large

and small, can always expect from us.

This proximity to customers has been

achieved by being present in more than

125 locations in 26 countries. Local repre-

sentative offices from Jönköping in

lers and distributors. A growing proportion

of sales in the Profile business area is also

being channelled through local builders'

merchants, both in markets where we have

our own branch network and in those

where we sell through dealers.

CHANGING NEEDS

One of the most important activities to

bring us increased organic growth is the

gradual expansion of our branch network -

both in our existing markets and, not least,

and restructuring in the German and Polish

markets, for example. This work is partly

about finding the best possible geographi-

cal spread of branches, and partly about

being represented in such a way as to

make the most of what we have to offer in

terms of product range, support, opening

hours, service and so on.

Our extensive branch network and

long experience in distribution are a great

advantage in our work on further develo-

ping this central concept. By constantly

l indab l indab's solut ions

assessing, ranking and selecting the featu-

res of our branches that are most important

in customers' eyes, we are establishing

best practice in this area, which means that

we are ensuring that our branch network is

expanded on the best possible basis.

GROWTH THROUGH EXPANSION

Our long experience of continuous growth

through expansion into new markets,

combined with our good insight into custo-

mers' various needs, also has clear advan-

tages when we move into brand new coun-

tries. Our continued expansion in Central

and Eastern Europe is now being stepped

up through our new representative office in

Moscow in Russia and through our increa-

sed focus on markets like Romania and

Croatia. In the USA too we anticipate

growth through a wider presence in the

east of the country, but also through con-

tinued expansion westwards in the longer

term.

Assessing new openings and opportu-

nities for future growth and expansion is a

continuous process. We currently have a

portfolio of complete and detailed plans for

expansion into new markets, primarily

those to the east but also parts of Europe

and the USA where we do not currently

operate. We are also constantly on the

lookout for interesting new acquisitions.

Farum,Denmark

Northampton,UK

PortsmouthUSA

Budapest,Hungary

15

ngar

The new plant outside Prague is a strategic resource for Lindab's

continued eastward expansion.

17

Open House Production AB represents

a brand new concept for the construction

of residential and other properties. In a pro-

duction facility reminiscent of a modern car

plant, the company manufactures virtually

complete apartment modules which are

then transported to the building site and

hoisted into place for final assembly. The

company's techniques and methods are

based on architect Peter Broberg's ideas

for building affordable housing for ordinary

people. We met CEO Ulf Åberg at the com-

pany's production facility in Arlöv.

"We're currently supplying 1 200 apart-

ments for the Bunkeflostrand development

in Malmö," he says. "All of our production

is based on an industrial approach with

recurring standardised processes. So

Lindab's solutions fit like hand in glove."

Open House is using steel wall studs, light-

gauge purlins and profiled sheeting from

Lindab for all joist floors, walls and roofs. "It

goes without saying that these products

are ideally suited to industrial production

demanding great precision and consistent

product properties," he continues. "Al-

though other suppliers can also offer this,

what makes Lindab unique and led us to

choose them as our partner is their clear

focus on complete system solutions based

on their extensive expertise and knowhow

when it comes to lightweight construction

techniques and design. Without their invol-

vement in the development of our concept

for industrial, modularised construction, we

would not have come this far this quickly."

Lindab and Open House are continuing

to develop the whole of the system solution

that Lindab is supplying. "It covers everyt-

hing from logistics and delivery planning to

technological development and the use of

Lindab's various software packages for

lightweight construction," says Åberg. "I

want to constantly make our production

and our flows more efficient, which also

means that we're becoming a more effi-

cient customer for Lindab. This is undoub-

tedly making both companies even more

profitable."

advantage: system

Ulf Åberg from Open House (left) in the thick of things at the company's

extensive production facility in Arlöv.

18

Lindab's vision is clear and concise:

"Lindab is to be the quick, flexible and local

partner that delivers high quality in every

way in both of its business areas,

Ventilation and Profile.

"We are to be perceived as the compa-

ny that focuses constantly on meeting

customers' needs and offers solutions that

create more added value and make custo-

mers' life easier than any other."

The whole of our business and all of

our day-to-day activities build on these

ideas - and on our conviction that quality is

something that comes from within as the

result of long-term and methodical work on

improvement.

We now have 47 years' experience of

constantly getting better and better. From

this platform we have built a value chain

which really does provide solutions that

simplify construction for our customers.

Our research and development, our

production technology and optimised use

of raw materials, and our ongoing quality

and environmental work are examples of

processes that are key to our success.

NEATNESS AND ORDER IN

PRODUCTION

The processing of our raw material, sheet

steel, begins at our steel processing cen-

tres. The made-up (sized, cut and trimmed)

sheet is then taken to our various produc-

tion facilities, the most important being

Lindab's competence centres in Grevie

and Förslöv in Sweden, Farum and

Haderslev in Denmark, our new Central

European plant outside Prague in the

Czech Republic, and Budapest in Hungary.

At these sites in particular, but naturally

also at all of our other production units, the

effective management, planning and opti-

misation of resource utilisation is an impor-

tant task.

Anyone who has ever visited one of our

large production facilities will have been

struck by the neatness and order to be

found there, right through from the raw

material reaching the production machine-

ry to the finished packed products leaving

the factory. This is quite simply the result of

our internal expertise and experience when

it comes to production technology and

quality-orientated methods for design, tool

technology, logistics and, not least, large-

scale production systems.

FRONTLINE RESEARCH AND

DEVELOPMENT

Realising our vision, which includes offe-

ring "solutions that create more added

value and make customers' life easier than

any other", relies heavily on our research

and development work. Here our clear

ambition in both business areas is to deve-

lop unique solutions and products that put

us right on the frontline.

In the Ventilation business area, there is

continuous development work in the Air

Duct Systems and Indoor Climate product

areas, with the emphasis on finding innova-

tive new solutions which offer further bene-

fits in terms of function, assembly, airtight-

ness, energy saving and individualised

indoor climate control. The option of carry-

ing out full-scale tests and practical experi-

ments in our air, acoustics and climate

laboratories in Denmark and Sweden is an

invaluable resource in this context.

Work on developing new products and

solutions is also a continuous process in

the Profile business area. New solutions for

optimising load-bearing elements and

improving the soundproofing of interior

partitions, and full-scale tests of load-bea-

ring structures are examples of ongoing

programmes. There is also a clear focus on

improving the properties of the steel we

use, including processing tolerances, coa-

tings and colour durability. This work is

often undertaken in collaboration with our

main steel suppliers.

Research collaborations with universi-

ties play a key role in our research and

development work. We currently have pro-

jects under way with universities in

Sweden, Denmark, Poland, Hungary and

Romania.

Through our internal product commit-

tees - which include representatives from

R&D, production and marketing - and con-

tinuous training for our sales force, we can

then gradually introduce the resulting new

solutions into the marketplace.

FOCUS ON QUALITY AND

ENVIRONMENT

Lindab's operational policy stipulates,

among other things, that we "must con-

tinuously and professionally improve our

performance in terms of quality, environ-

ment, health and safety. We must adopt a

proactive approach to quality with the

focus on customer needs, and we must

always consider the environmental conse-

quences of our activities." This clear decla-

ration leaves no margin for subjective inter-

processes of quality

lindab l indab's solut ions

19

pretation: we simply need to keep on get-

ting better.

We realised the benefits of systematic

and targeted quality work at an early stage.

Two of our production units introduced ISO

9000 certified quality management

systems as early as 1993, making us one

of the first 200 companies in Sweden to

receive this then unique certification.

Today the majority of the Lindab compa-

nies in Sweden have certified quality

systems, as do a further nine Lindab com-

panies in Europe. The transition to the new

ISO 9001:2000 standard is virtually com-

plete.

An ISO standard for environmental

management systems was also introduced

in 1996, and we immediately set about

phasing it in at our production units. When

our first unit was certified to ISO 14001 in

1997, we were again among the first in

Sweden. Today the majority of our

Swedish units are certified to ISO 14001,

as are five of our European production

units.

Worldwide, 18 of our production units

have quality management systems certi-

fied to ISO 9001:2000, and 14 have envi-

ronmental management systems certified

to ISO 14001.

Our business of manufacturing pro-

ducts from sheet steel has only a very limi-

ted impact on the environment. Processes

that could generate emissions to water

take place in closed systems, and dusty air

is continuously treated before release. The

steel that provides the raw material for our

products is recycled once products reach

the end of their lives. By seeking to mini-

mise the consumption of resources in

connection with our products throughout

their lifecycle, we contribute to sustainable

development.

Neatness and order has been one of our core

values for almost 50 years. It applies right along

our value chain, from production to delivery.

Research and development is a vital ingredient

for continued growth. During the year we were

granted more than five new patents and develo-

ped nearly 15 new products.

Full-scale trials are an important part of this

work, which results in better solutions for our

customers. During the year full-scale trials were

performed in connection with opera house pro-

jects in Copenhagen and Oslo and the National

Philharmonic concert hall in Budapest.

Many of our production plants in Sweden,

Denmark and elsewhere are located in areas of

great natural beauty and historical interest which

need to be conserved. Our environmental

commitment has without doubt been influenced

and stimulated by this.

When our products leave the factories and our

logo adorns labels, boxes and signs, this says

far more than just who made them. For our

customers it signals another consignment of

high-quality solutions from a key partner -

Lindab.

21

Sydtotal AB is one of Sweden's leading

ventilation companies and a loyal Lindab

customer for many years. The company

operates throughout Sweden and interna-

tionally, taking on everything from the

assembly and installation of ventilation

systems to turnkey HVAC and sanitation

contracts. We met principal shareholder

Erling Pålsson at Lindab's branch in

Malmö.

"Lindab's quality and product range are

naturally of fundamental importance," he

says. "But it's the people here at Lindab

who play the most important role in our

relationship. When we, the customer, dis-

cuss things with Staffan and his people

here in Malmö, there are no long decision

paths to make life difficult and put obsta-

cles in our way. Quick decisions, proximity

and straight answers are what we get here,

just as at all of the other Lindab branches

we work with - and that is exactly what

we're after."

Always feeling welcome is the ingredient

that Erling Pålsson picks out as the key to

Sydtotal's good relationship and close and

rewarding collaboration with Lindab: "This

is a key issue. And there must also be

some of that special twinkle in the eye - we

have so many dealings with each other that

it's great to have a bit of fun together too."

He also highlights Lindab's work on

product development and system solutions

for ventilation technology: "Lindab is defini-

tely the company that has done the most in

this area. Especially when it comes to cir-

cular duct systems, your role as market lea-

der is undisputable. Your branch network

now gives us ready access to all of these

solutions. Rapid and accurate deliveries

give our jobs that all-important flow."

That said, even Lindab can get things

wrong every now and again. "This is when

our close relationship really comes into its

own," Pålsson says. "If you're close to peo-

ple, you're also close to a solution. If

something goes awry, the guys here sort it

out. Simple as that.

"Personally I view many of the people I

work with at Lindab more as personal

friends than as suppliers. So I think you've

come a long way - your added value is

more than just good products and a broad

range. You can always rely on a friend."

advantage: relationship

Christian Lantz at the customer counter at Lindab's

branch in Malmö.

A delighted Erling Pålsson from Sydtotal AB (left) with branch manager

Staffan Hansson at Lindab's branch in Malmö.

22

In autumn 2001 Lindab carried out an in-

depth analysis of its organisation and busi-

ness structure. This led to an extensive

reorganisation in spring 2002, when the

business was divided into two clear busi-

ness areas - Ventilation and Profile - to

sharpen the focus on increased efficiency,

better resource utilisation and profitable

growth as our overriding objectives.

FROM UPHILL TO DOWNHILL

Changes on this scale - a new corporate

structure, new areas of responsibility, new

internal networks and major alterations to

the chain of command - will always impact

on an organisation during the first dizzying

stages. And this was also the case at

Lindab. The fact that we also acquired a

new management team during this period

and had to handle the whole change pro-

cess in the midst of a market slowdown put

real pressure on the organisation.

The new organisation has now been in

place for two years, and we are seeing

clear and very positive results from the

reorganisation in 2002. We have made

appreciable advances in efficiency and

resource utilisation in many strategic areas,

including product development, production

technology, marketing and financial mana-

gement. We are more open internally,

having torn down barriers and stepped up

communication at every level and in every

direction. The national boundaries of the

old organisation have been removed, and

the whole organisation can see the poten-

tial of our new way of working together and

can better apply best practice within the

group. All this is contributing to the emer-

gence of a new and even more business-

orientated corporate culture - one that

retains all of the positive aspects of what

we call the Lindab spirit: motivation, entre-

preneurial spirit and enthusiasm. This is

making the whole organisation a clear

action-orientated cohesive force and

resource for our mutual advancement.

A WHOLE NEW LEVEL

The new organisation, with its increased

transparency and improved information

flows, is now broadly appreciated by our

employees. This new scenario is opening

up new business opportunities and is con-

tributing to the more rapid introduction of

products and system solutions in more and

more of our markets. It is only when people

can actually envisage the opportunities that

their commitment can be assured.

Today we stand far stronger than just

two short years ago. The work in which so

many managers and other employees have

been involved on top of tending to our day-

to-day business, together with the produc-

tion transfers and staff cutbacks introdu-

ced, has been a major challenge, especially

a strong organisation

for those directly affected. But this has all

been necessary. Standing on the threshold

of a better and stronger market, the whole

group is now ready in a whole new way to

generate profitable growth in line with our

long-term targets.

Lindab's great strength has always

been its employees' expertise, commit-

ment, initiative and enthusiasm. Today this

strength is even greater thanks to our

workforce of more than 3 800 dedicated

employees, and the dynamism and will to

constantly get better, more efficient and

more profitable can be seen throughout the

organisation.

l indab l indab's solut ions

23

Working together towards common goals with motivation, entrepreneurial spirit and enthusiasm has long

characterised the unique Lindab spirit.

24

Air Duct Systems is the central product area in the Ventilation business area. It comprises a

complete range of products and fittings for the construction of both large and small ventila-

tion duct systems of every conceivable dimension. The combination of a very broad product

range and unique product solutions makes Air Duct Systems the natural choice for easily

fitted, airtight and energy-efficient duct systems. Lindab has been the world's largest produ-

cer of circular duct systems for several years now.

l indab vent i lat ion business area

25

ventilationbusiness area

summary

The Ventilation business area generated sales of SEK 2 965 M (3 071) and EBITA of SEK

160 M (193). Adjusted for non-recurring costs in 2003 and capital gains on the sale of pro-

perties in 2002, EBITA was unchanged from 2002.

Central and Eastern Europe and the Finnish and French markets performed well. Growth

in other markets was more cautious. Since the market as a whole contracted, Lindab was

nevertheless able to increase its share of most of its markets in both Europe and the USA.

Strategic acquisitions were made in Switzerland and Denmark during the period to fur-

ther strengthen our position as a system supplier.

A new Central European production plant was built, inaugurated and started up outside

Prague in the Czech Republic. This is Lindab's single largest investment yet and has

resulted in both substantially more cost-effective production and greater proximity to our

important growth markets.

McCullough in the USA, while the machi-

nery business is headed by Christer

Brovinius.

PRODUCTS

The Ventilation business area comprises

three main product areas (Air Duct

Systems, Indoor Climate and IT Solutions)

aimed at installers, consultants and archi-

tects in the ventilation and indoor climate

sector:

Air Duct Systems is our range of circular

ducts, duct fittings, rectangular

duct products and hoods.

These products are used in

the construction of ventila-

tion systems. New moder-

nised T-pieces, bends and

reducers were launched during

the year.

Indoor Climate comprises three ranges of

systems and products which together

make for a pleasant, healthy and produc-

tive indoor climate with good air circulation,

pleasant temperatures and low noise levels

from fans and duct systems. A new range

of diffusers, beams and grilles of uniform,

coordinated designs and colours was laun-

ched under the name of Designline during

the year and has been warmly welcomed

by architects and others.

Comfort is our range of diffusers, grilles

and dampers used to regulate

and control the flow of air in

a room.

Climate is our range of chilled beams,

facade systems, ceiling heating

and control solutions that

impact directly on comfort

and temperature in a room.

Beams with in-built light

fittings were launched during

the year, along with a new con-

densation control unit.

The Ventilation business area compri-

ses the group's business in ventilation and

indoor climate systems and has three

parts: the European operation, the US ope-

ration, and the production of machinery at

Spiro S.A. in Switzerland and Spiral-Helix

Inc. in the USA.

Ventilation's core business is the Air Duct

Systems product area - the manufacture,

marketing and distribution of circular and

rectangular duct systems. Lindab is the

world's largest manufacturer of circular

duct systems.

A range of accessories has gradually

been added around this central product

system, which - along with our IT tools -

enable us to market competitive and com-

plete system solutions for the ventilation

and indoor climate sector.

The business area's hallmarks are a

broad and well proportioned product port-

folio, high-quality system solutions and

logistics, and proximity to the market.

Through many years' investment in re-

search and development, including at our

own world-leading air and acoustics labo-

ratories, we have built up stable expertise

and unique knowhow in ventilation and

indoor climate technology. This makes us a

partner well equipped to meet the market's

need for system solutions and components

for a pleasant and productive indoor climate.

The ventilation business is headed by

Johan Bergkvist in Europe and Dick R.

26

Acoustics is a broad range of silencers for

a quiet and pleasant indoor

environment.

We command a very

strong position in the Air Duct

Systems product area in the Scandinavian

and German markets, and are the market

leader in Denmark. The best growth pro-

spects in the Scandinavian market are in

the Indoor Climate product area, which we

believe to have great potential.

Elsewhere in Europe there is scope to

improve our position in all product areas. In

the immediate future we anticipate increa-

sed sales of both circular duct systems and

the more technical Indoor Climate pro-

ducts. Since rectangular duct systems are

l indab vent i lat ion business area

Sales, SEK M 2 965

EBITA, SEK M 160

Operating margin, % 5.4

Investment in fixed assets

(gross), SEK M 125

Average number of employees 2 462

of which in Sweden 629

2003

An indoor climate with good air circulation and a pleasant temperature is vital

for productivity and comfort, as here in the Hasselblad building in Gothenburg.

ITline is our unique portfolio of user-friend-

ly and time-saving software

packages for ventilation

and indoor climate

systems. These tools are

used by HVAC engineers,

consultants and architects in

the design and production documentation

phases of each construction project. This

work leads to the all-important specifica-

tion of individual products through the

documents and bills of materials genera-

ted. These documents produced by the

HVAC engineer also provide the basis for

the installer's tender. By generally increa-

sing the proportion of Lindab products

specified in these key documents for pro-

duct selection, we significantly increase the

chances of increased sales in the

Ventilation business area.

New versions of the DIMsilencer and

TeknoSIM acoustics and heating packages

were introduced during the year. In the USA

we also launched the new LinPro package

for distributors and installers, which links

together the design, tender/order and deli-

very phases in an elegant project manage-

ment tool which makes both customers'

and our own tendering processes more

efficient.

IMPORTANT EVENTS

A new Central European production facility

was built and taken into use in the Czech

Republic, and two strategic acquisitions

were made.

The new factory outside Prague gives

the business area a modern and cost-

effective production plant of more than

25 000 square metres in a growing Central

European market. The investment has led

to production changes at our factories in

Sweden and Denmark through the transfer

to the Czech Republic of the production of

some duct fittings and diffusers, for exam-

ple. The same goes for some of the local

production that previously took place in

Central Europe.

The acquisition of FEA in Switzerland

and Bravida's duct manufacturing busi-

ness in Denmark during the year has in-

creased our resources in the Ventilation

business area. These acquisitions form part

of our plan to take part in the restructuring

of the market brought on in part by the sub-

dued market climate.

These acquisitions have brought the

business area both new production capaci-

ty and new production technology in rec-

27

Duct systems 61% (61)

Indoor climate 18% (16)

Machinery 4% (5)

Ventilation accessories 17% (18)

ventilationbusiness area

still dominant in many European markets,

we have strengthened our position in this

area too, partly through acquisitions. This

not only increases our competitiveness as

a system supplier but also opens up inte-

resting opportunities to market and intro-

duce circular duct systems and their bene-

fits more effectively. The standardisation of

our broad product range into a smaller

number of locally customisable variants is

an important element in the product deve-

lopment work under way in these two cen-

tral product areas.

SALES BY PRODUCT GROUP

Nordic region 48% (47)

Other markets 1% (1)

Central and Eastern Europe 5% (4)

Western Europe 36% (37)

USA 10% (11)

SALESBY MARKET

tangular duct systems. This gives us a

more favourable position in the market as

we can now offer a more comprehensive

system solution to installers of both circular

and rectangular duct systems together with

a wide range of indoor climate products.

Our position as system supplier in the

Swiss market has been advanced signifi-

cantly by these acquisitions. Here the

acquisition has been integrated into a wider

restructuring programme, which has inclu-

ded transferring the bulk of local produc-

tion to the new facilities in Eiken.

SALES AND MARKETS

The business area's sales fell to SEK 2 965

M (3 071) in 2003, equivalent to 56% (58) of

the Lindab group's sales. Adjusted for cur-

rency effects and structural changes, sales

were unchanged from 2002.

Operating profit amounted to SEK 160

M (193). Adjusted for non-recurring costs in

2003 and capital gains on the sale of pro-

perties in 2002, operating profit was

unchanged from 2002.

The European market was hit by weak

demand in the construction sector, which

impacted on the business area's sales.

Newbuild, rebuild and renovation activity all

fell, and did not partially balance each other

out as in the past. Volumes in the ventila-

tion and indoor climate sector as a whole

fell by around 10%, leading to increased

pressure on prices and excess capacity.

However, for Lindab's Ventilation busi-

ness area this meant a clearly stronger

market position since we managed to

maintain volumes at a level unchanged

from 2002.

The weakest markets were Germany,

Sweden and Norway. Our sales in Central

and Eastern Europe are continuing to grow,

albeit from a low level. France and Finland

performed well, and we reported good

results there in 2003.

Structural measures were introduced

during the year in Germany, Switzerland

28

and the UK affecting both production and

distribution.

A number of new markets were

assessed during the year, and several

concrete expansion plans have been pre-

pared in anticipation of the right time to

move.

The business area also prepared a

detailed marketing plan during the year. It

turns the spotlight onto a wealth of coordi-

nating activities whose ultimate aim is to

generate increased profitable growth.

Growing the overall use of circular duct

systems, especially outside the Nordic

region, is an important part of our activities.

Another is a more in-depth understanding

of pricing in our value chain, especially

given the growing price pressure in the

market. The restructuring and reallocation

of the branch network also began during

the year in a bid to further strengthen our

presence in a number of important markets

in Europe.

We will continue to target, support and

provide information for HVAC engineers,

consultants and architects. These groups

are not paying customers but are neverthe-

less important in their capacity as providers

of specifications, and so impact indirectly

on tender volumes. Adding value for these

groups too will boost our sales and growth.

Energy consumption and the indoor

climate are increasingly important issues in

modern society. The trend in the Western

World towards more airtight buildings is

generally increasing the need for well func-

tioning ventilation systems. More and more

is also being asked of the airtightness and

function of the actual ventilation system so

as to minimise energy consumption. Given

the unique quality, airtightness and function

of our system solutions, we see good

potential for strong growth from this per-

spective too.

USA

Caution has affected the level of long-term

investment in the USA since 11 September

2001. This has resulted in a sharply falling

market for ventilation duct systems, which

has limited Lindab's growth opportunities

in North America. Despite the weak market,

Lindab has managed to expand in the

USA, growing its market share by 8% in

2003. Sales totalled USD 38 M (35). The

market is expected to grow marginally in

2004.

Despite the weak growth trend in the

market, Lindab expects to grow quickly

and in line with the plans laid. The slightly

improved market will afford Lindab good

opportunities to exploit the benefits of its

position as the largest supplier of circular

duct systems in North America.

A complete indoor climate solution was

supplied for Hasselblad's new headquar-

ters during the year.

l indab vent i lat ion business area

Schools are among Lindab's focus areas in

the USA.

MACHINERY PRODUCTION

The companies Spiro S.A. and Spiral-Helix

Inc. develop, manufacture

and market machinery for

the production of spiral

ventilation ducts and fit-

tings. We command a mar-

ket-leading position in this seg-

ment, which focuses on the ventilation

industry in Europe, Asia and North

America. Production was concentrated at

the facilities in Switzerland during the year.

COMPETITION

The Ventilation business area has relatively

few global competitors that can offer the

same breadth of range and local presence.

However, there are a number of major

players in the various product areas with

considerable power and a strong market

position. Close monitoring means that our

knowledge and information in this area is

very good.

The prevailing market climate has

increased the frequency of closures, mer-

gers and acquisitions in the sector. We

have exploited this situation through ac-

quisitions and a continued intensive marke-

ting drive, which has increased our market

share in both Europe and the USA.

Our most important competitors are

Fläkt Woods AB, Aldés S.A. and C.

Hallströms Verkstäder AB in the Air Duct

Systems product area; Stifab Farex AB,

Halton Oy, Fläkt Woods AB and Gebrüder

Trox GmbH in the Indoor Climate product

area; and the software packages

MagiCAD, LiNear, CATS and Map in the

ITline product area.

OUTLOOK

2004 will be another tough and demanding

year, which will be mostly about retaining

our position, restructuring our operations

and continuing to prepare for the market

recovery which we do not expect to see

until late 2004 and early 2005.

An extensive marketing campaign "the

round solution" will be launched in Europe

in 2004 to highlight the benefits of standar-

dised circular duct systems in terms of

economy, function and assembly, together

with the local presence, support and exper-

tise that we have to offer. The campaign will

be a key element in our work to increase

the proportion of circular duct systems in

the European market, and will run for a long

period.

Effectively and convincingly selling the

added value that we offer is vital for our

success. By strengthening the professiona-

lism of our sales force, we hope to grow

even stronger.

Work on productivity and efficiency will

continue throughout our value chain, inclu-

ding production, administration and sales.

One of the most highly prioritised jobs in

2004 will be to turn around earnings in the

German, Swiss and UK markets.

The ongoing evaluation and evolution

29

Products from the Air Duct Systems product area have found homes as diverse as bowling alleys and modular pro-

cess facilities for the international pharmaceutical industry.

of our distribution network will continue

during the year so that we achieve the opti-

mum utilisation of our distribution resour-

ces on the basis of market needs.

When the market finally does turn, we

will stand extremely strong, well prepared

and well equipped for a pronounced

growth scenario with good profitability. We

expect this to happen in late 2004 and early

2005.

30

Rainline is one of the Profile business area's two

key product areas. It offers a complete range of

guttering, downpipes and accessories for efficient

roof drainage.

With more than 60 different products, the

system can meet a great diversity of needs and is

aimed both at professionals, such as sheet metal

workers and building contractors, and at the DIY

market. A variety of product solutions ensure rapid

and safe assembly, and a broad choice of colours

makes Rainline suitable for all types of environ-

ment and building.

l indab prof i le business area

31

profilebusiness area

summary

The Profile business area increased its sales by 8% to SEK 2 003 M (1 859). EBITA amoun-

ted to SEK 155 M (160), affected by narrower margins due to the increased price of sheet

steel.

The business taken over through the acquisition of Butler Europe Kft. in 2002 is now

almost fully integrated into our other operations in the Building System product area.

There was continued growth in the business area's system sales in the form of hall and

building systems in the Building System product area.

Growth is continuing in Central and Eastern Europe, but with the focus gradually shifting

further eastwards. There was increased price pressure in Scandinavia.

The Profile business area comprises the

group's business in products and product

systems for the construction sector, and

operates exclusively in Europe. On 1 March

2004 Anders Persson left his position as

business area manager at Profile to beco-

me HR director at group level. Peter

Andsberg took over as business area

manager at Profile on the same day and will

be based in Hungary, which has been

Profile's largest growth market in recent

years.

PRODUCTS

The Profile business area's products and

system solutions are aimed at the con-

struction industry and building contractors

in all three regions and at the sheet metal

working industry in Sweden, Norway,

Finland and Central and Eastern Europe.

Parts of the product range are also sold in

the DIY market. Six main product areas

have been defined in this business area:

Rainline is the market's broadest range of

products for effective and safe

roof drainage. It consists of

more than 60 components

and offers straightforward

and uncomplicated assem-

bly of guttering and downpipes.

Products are divided into a standard

range and a special range for professional

users such as sheet metal workers and

building contractors. There was a gradual

shift towards high-build polyester-coated

steel during the year, which has advanta-

32

ges both in the manufacturing process and

in the form of easier handling during

assembly and a better environmental per-

formance.

Coverline is a wide range of profiled sheet

metal wall and roof cladding in

different designs and

colours. These products

offer strong and durable

cladding with a long life and

cost-effective assembly. The

range extends from tile-like roof plates

through trapezoid sheeting to floor-decking

for roof and joist floor construction. Here

too there was a continued shift towards

high-build polyester-coated steel for sur-

face-treated products.

Construline is Lindab's building compo-

nent range for modern steel

structures using steel wall

studs, light-gauge purlins,

battens etc. The benefits of

building with steel are consi-

derable. Lightweight construc-

tion results in better overall economy and

superior workplace ergonomics. Factory-

made and delivery-marked lengths elimi-

nate wastage and result in a clean and

easily worked workplace.

The use of steel studs in infill walls and

of steel for flat-to-pitch conversions is gro-

wing in volume. The development of IT

tools for design and estimation in this pro-

duct area continued during the year.

One of the most high-profile contracts

in this area in 2003 was the supply of steel

wall studs, light-gauge purlins and profiled

sheeting for what is currently the largest

residential construction project in Sweden,

the Bunkeflostrand development, where all

apartments are being prefabricated

industrially in separate modules and then

transported to the building site for final

assembly. Growth in the use of this ground-

breaking technique is believed to be likely,

which means potential for further growth in

this product area.

Doorline is a range of garage and indust-

rial doors. A CFC-free sand-

wich design with embossed

steel cladding results in a

well insulated, durable and

aesthetic door. Both garage

and industrial doors are fitted

with Lindab's unique crush and drop pro-

tection solutions. Some production in this

product area was transferred to external

suppliers in Central Europe during the year,

resulting in a more favourable cost picture

for these products. This is expected to

result not only in increased component

sales in this expansive region, but also

increased use of Doorline in supplies of

halls and building kits in the Building

System product area.

Sales, SEK M 2 003

EBITA, SEK M 155

Operating margin, % 7.7

Investment in fixed assets

(gross), SEK M 61

Average number of employees 1 206

of which in Sweden 412

2003

lindab prof i le business area

The Rainline roof drainage system on a

house in Fårö, Sweden.

SALES BY MARKET

SALES BY PRODUCT GROUP

Building System is a range of prefabrica-

ted building kits, consisting of

a steel frame and other

materials for an entire buil-

ding. One side of this pro-

duct area consists of prefa-

bricated building kits which are,

in principle, of unlimited size, design and

function. The other side comprises smaller

and more straightforward farm, warehouse

and industrial buildings.

Thus the product area spans all types

of prefabricated industrial and commercial

building for a wide range of different needs

and standards.

Familyline is a range of prefabricated buil-

ding kits for individual resi-

dential units, marketed

exclusively in Central and

Eastern Europe.

SALES AND MARKETS

The business area's sales grew by 8% to

SEK 2 003 M (1 859) in 2003, equivalent to

38% (35) of the Lindab group's sales.

Operating profit amounted to SEK 155

M (160). Increases in steel prices during the

period put pressure on margins.

The market in Sweden, Norway and

Finland was hit relatively hard by stagnating

construction activity. Nevertheless we lar-

gely succeeded in maintaining volumes,

and in Sweden we noted an interesting

new trend as sales of steel wall studs to

builders' merchants grew at the expense of

traditional wooden studs.

The business area made more positive

progress in the UK, which is the reason for

the initiative currently under way there.

There was a major reorganisation during

the year, which included the recruitment of

new personnel to focus on increasing

sales, primarily of products in the Rainline

range. This will provide a platform for gra-

dually stepping up sales in the other pro-

duct areas.

Developments in Denmark were in line

with the other Nordic countries, while

Germany was even harder hit by the pre-

vailing climate of weak growth, causing

sales to stagnate.

To improve our competitiveness in

Poland, the distribution system is being

expanded and two new branches are being

opened this year. These measures will

increase Lindab's presence in an expan-

sive market.

In the Czech Republic the business

area's production and sales were trans-

ferred to the new Central European plant

outside Prague. The Romanian market per-

formed very well, and new product areas

have gradually been added to existing

ones. Romania is also responsible for

developing Bulgaria through a new repre-

sentative office in Sofia.

Hungary is increasingly approaching

maturity as a market with a more normal

rate of growth. However, it will remain a

very important base for Lindab's continued

expansion eastwards, with potential mar-

kets including Russia. Hungary is also

33

Sheet metal, profiles,

steel buildings and doors 65% (62)

Roof drainage systems 20% (22)

Sheet metal working accessories 15% (16)

Nordic region 51% (56))

Central and Eastern Europe 40% (35)

Western Europe 8% (8)

profilebusiness area

Other markets 1% (1)

responsible for our initiatives in Bosnia,

Serbia and the Ukraine, where we have our

own representative offices.

The Building System business at

Lindab Butler is based in Hungary. It has

completed its first full year as part of the

group and is gradually being integrated

with other Lindab companies in the pro-

duct area. The business performed well,

winning many large contracts during the

year.

An increased push into Russia began

during the year with the opening of a new

representative office in Moscow, which is

now being built up. The potential here -

especially for the hall solutions at Building

System but also for the Rainline, Coverline

and Construline component ranges - is

believed to be very good. A large number

of halls were sold in this market during the

year, and the figures for component sales

were also good.

34

COMPETITION

The Profile business area operates in a rela-

tively fragmented European market with

few large players and many small players.

Lindab is unique in being able to market

such an extensive range of steel building

components and system solutions.

Some new trends in the competitive

situation can be seen in the form of increa-

sed competition in the markets of Central

and Eastern Europe. Many of our main

competitors, such as Finland's Rannila

Steel Oy, are clearly focusing on this region,

both through intensified sales initiatives

and through local production. In Poland, for

example, we are seeing many smaller pro-

ducers growing larger in terms of both

volumes and product range. This trend will

require us to be very alert, proactive and

ready to step up a gear. Always to be

better at quality, logistics, proximity and

total solutions remains our strategy.

The enlargement of the EU in spring

2004 will move customs boundaries in

such a way that being competitive in a mar-

Sheet metal roof tiles for residential use from the Coverline product area and complete

hall building kits from the Building System product area illustrate the breadth of the Profile

business area.

ket like Russia will require local production.

The EU's enlargement also means that the

area covered by European standards will

be greater, which can only be seen as an

advantage for us since we have been wor-

king to these standards for so long.

In the Rainline product area,

Germany's Rheinzink GmbH & Co. KG,

Sweden's Plannja AB and Britain's Marley

Extrusions Ltd. are strong competitors. In

Scandinavia, Icopal a/s has increased its

focus on this area through the acquisition

of Wijo AB, whose relatively aggressive

position in the Swedish market impacted

on our sales to Swedish builders' mer-

chants in 2003. Rannila Steel Oy's move

into Hungary, with its own production and

intensified marketing, is another notable

development.

In the Building System product area,

our main competitors include Remco

Building Systems BV, Atlas Ward GmbH

and Astron Buildings. Astron is in the pro-

cess of starting up production in Russia.

l indab prof i le business area

OUTLOOK

A number of areas will be of particular

importance in 2004 and subsequent years.

We need to continue our initiatives in the

Rainline product area, and we need to

increase the market share of our halls and

building systems in the Building System

product area. Russia, many of the other