ANNUAL CASE STUDY PORTFOLIO RETURN 91.79% · PORTFOLIO CASE STUDIES: MONEY MANAGEMENT pg25 ANNUAL...

Transcript of ANNUAL CASE STUDY PORTFOLIO RETURN 91.79% · PORTFOLIO CASE STUDIES: MONEY MANAGEMENT pg25 ANNUAL...

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

1

Weekly for Saturday July 7th, 2019. Based on Thursday’s Close

CONTENTS

ANNUAL CASE STUDY PORTFOLIO RETURN 91.79% pg1

ANNUAL CASE STUDY PORTFOLIO REVIEW July 1 2018 – June 30 2019 – 91.79% RETURN pg5

READERS’ QUESTIONS: CASE STUDY PORTFOLIO SET-UP pg13 TRADE GALLERY pg15 NEWSLETTER OUTLOOK: INDEX TARGET MOVE UPWARDS pg24

PORTFOLIO CASE STUDIES: MONEY MANAGEMENT pg25

ANNUAL CASE STUDY PORTFOLIO RETURN 91.79% By Daryl Guppy

Much of this newsletter is allocated to coverage of the annual case study results, and the results form the past six months. The realised, banked

return from the case study portfolio was 91.79%. It was a difficult 12 months with the market trading sideways for most of the period and subject

to rapid volatility corrections. The rise in the past six months reflects the easing of credit via low interest rates. During the week I met with Philip Lowe, Governor of the

Reserve bank, and with several other Reserve Bank board members. A market rally, and potentially a bubble, is a result of low interest rates as

people look for better returns for capital. This changes the nature of the market and market behaviour so trading tactics must be adjusted. We will look at adjusted trading approaches in the coming weeks.

NOT IN LOV

Last week we offered three options for managing underperforming stocks. These are stocks that, when the rest of the market has developed good momentum, they move sideways or go counter market trend. When

effective stops are in place this is not a large risk to capital, but nor is it the most effective use of capital.

Traders can stay with the trade simply because no exit signal has been generated. If this choice is made, then the stop should be adjusted so that any exit on

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

2

stop locks in a small profit rather than a loss. This was not applied as there was no significant rally.

Other traders will exit the trade at the best possible favourable price so they

can deploy the capital more effectively elsewhere. Traders must balance the need to give time for the trend behaviour to develop against the loss of potential gains and

risk by deploying capital in other trades. The failure of the rally with the retreat on Monday showed a collapse of momentum. The trade exit was the next day near $11.33 for a profit of $600 or 3%

A third option is to tighten stops when price rallies. As price moves towards the upper resistance level the stop is tightened. This provides a profit exit if price retreats,

but also allows price to move above the resistance level. This option was not applied during the week as the price did not rally.

We added a lazy follow the market trade as an example three weeks

ago. The trade is so lazy that there is no significant update to last week’s management notes.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

3

The trade turned out to be so lazy that price was unable to move above the

previous high. LOV created a double top pattern which is an indication of a trend

retreat. When the rest of the market went up, LOV retreated to near the value of the entry price. The Stop loss value has not changed.

Lazy trading is the opposite of fighting the market. It means finding trades that are compatible with the market direction and behaviour. This includes a duplication of the rally and retreat behaviour within the context of a well-supported uptrend.

Traders find these trades either by defining the technical conditions and then constructing a search to find stocks that meet those conditions. We look for all stocks

where today’s price is equal to the value of the 15-day EMA in the past 5 days and which have had 2 days of higher closes. This finds stocks that are potentially bouncing away from the lower edge of the short term GMMA.

We then simply eyeball stocks to find those with compatible behaviours. The technical scan is faster, but the results are too general. You get many trading

candidates but in the final analysis you still have to eyeball them. We use LOV as an example of this type of lazy trading found through a

combination of technical and eyeball scans.

Long term uptrend is well defined with the GMMA. The long-term group is well separated and provides good support. It absorbs the retreats and acts as a base for a

rebound. Rally behaviour is tradable in itself with returns of 10% or more.

The trend is also well defined with the long side ATR. This is used as a stop loss. This is a 2*ATR value for this trend trade. As the trade develops and moves into profit the ATR can be used as an alert stop.

For case study purposes the LOV example is entered near $11.00 as price

begins the rally from the lower edge of the short term GMMA. The value of the 2*ATR

is used as the stop loss. This is at $10.75 and puts $454.55 at risk.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

4

You can download the ATR indicator for MT4 at https://www.mql5.com/en/market/product/29683 Use this to improve your trade risk management.

CASE STUDY EQUITY CURVE

The LOV case study trade is closed for a profit of $600 or 3%. The case study

portfolio return is $600 or 0.6% for the period starting July 1, 2019 and ending June

30, 2020. For the year starting July 1, 2018 – 2019 the case study portfolio return is

$91,794 or 91.79%. For the year starting July 1, 2017-2018, the case study portfolio return is

$115,330 or 115.3%. For the year starting July 1, 2016-2017, the case study

portfolio return is $92,464.15 or 92.5%. For the year starting July 1, 2015- 2016, the case study portfolio return is $156,450 or 156.45%.

Equity trade size is generally kept constant at $20,000 in the case study portfolio so it is easier to compare the case study trades over this and other years.

Unless otherwise noted in the trade management notes, all equity case study trades are managed on an end of day basis, with the exit taken at the best reasonable price on the day after the stop loss is triggered.

Warrant and CFD trades are generally kept constant at $10,000. Warrant and CFD trades are closed on an intraday basis using a guaranteed stop loss as this is a

primary method of managing derivative risk. FX trades are generally kept constant at $5000. Stops are managed intraday.

This capital allocation reflects the risk in each of these asset classes.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

5

ANNUAL CASE STUDY PORTFOLIO REVIEW July 1

2018 – June 30 2019 – 91.79% RETURN By Daryl Guppy

In recent months the market has rallied. This is different from the first half of the year where strong trends broke rapidly, and whipsaw volatility was extreme. This

delivered the usual average of 13 trades for the 6-month period. Trades were open on average for 13.1 trading days. The success rate was 64.67% which is worse than the long-term average.

The XJO CFD trade returned 114.8%. The ELS equity trade returned 19%. The GBP/AUD trade returned 462%. This underlines the importance of using a variety

of trading instruments. The purpose of the newsletter is to model for readers the methods used by

professional traders in all market conditions. Our twenty-two-year average returns of

98.63% for the case study portfolio are testimony to the effectiveness of this approach. Our objective is to teach readers the methods of success so readers can

apply these techniques with confidence to help boost their trading returns.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

6

TWELVE MONTH REVIEW We start this annual review of the case study notional portfolio with several

observations. First is our absolute aversion to losses. We acted very quickly to cut

losses where losses keeping them around 0.05% of capital. The primary returns came from derivative trading with CFDs and FX trades. One third of the trades in the

twelve-month period with derivative trades where small moves gave magnified returns. This also included the hedging strategy case studies with RMD. The AJZ case study gapped below the strop, giving us the largest loss of $2,286. Other losses

remained with the 2% limit usually with less than 1% of capital at risk. This was the average trading period with 26 trades for the year. Normally the case study portfolio

includes around 13 trades per six-month period. The success rate is less than our long-term average, with 61.54% of trades turning into winners.

Return for the six-month period is 91.74%. This added $91,794 to the case

study portfolio. (Note Spreadsheet extract below uses rounded figures) Trades were open for an average of 19.7 days, or a little under 4 weeks. Most successful trades

were around 14 days. Longer term trades were most often losers confirming the need to exit trades quickly if they do not generate profits.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

7

SIX MONTH REVIEW

We acted very quickly to cut losses where losses keeping them around 0.05%

of capital. High volatility meant prices sometimes crashed below stops as with EXL but losses remained with the 2% limit. This was a little higher than average trading

period with 16 trades. This reflects the sideways market prior to the recent rally. Normally the case study portfolio includes around 13 trades per six-month period. The success rate is less than our long-term average, with 60% of trades turning into

winners. Return for the six-month period is 64.67%. This added $64,672 to the case

study portfolio. (Note Spreadsheet extract below uses rounded figures) Trades were open for an average of 13.1 days, or a little under 3 weeks. Most successful trades were around 7 days. This is similar to 2018 and reflects an increase in market

volatility in sideways markets.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

8

The second observation is the integrity of the case study portfolio. We are careful about the integrity of the case study portfolio results. People are often quick to

point out trades that are fast moving and which deliver large profits are often some of the short-term trades. They suggest that these are somehow manipulated, or carefully chosen. They conveniently ignore the * which shows that some of these

trades are personal trades. They also fail to mention the trades which were closed for a small profit. And they ignore the sometimes-large hits taken when price gaps down

as with the second trade in oil. We close these trades because it is consistent with the trade plans that were being modeled in the case study. Our intention is to show you the realistic operation of trading – warts and all.

The third observation is the frequency of trading. It reflects the volatility behavior of the market. We used 42 trades open for an average of 23.9 days. In this

six-month period the win/loss ratio was 83.33% and the return was 115.33 % on capital for the period.

We still see the common pattern of trading results where two or three trades contribute disproportionately to the overall portfolio results. One of the objectives in

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

9

trade and portfolio management is to know how to most effectively manage the trades that turn out to be big fish. Although we always hope that every trade will turn out to be the big one, the reality is that most of our trades are much smaller fish.

All the case study trades for the past six months are included in the Trade Gallery section of the newsletter. These simply give a summary of each trade.

Readers should always refer to the individual issues of the newsletter for a more complete discussion of the management techniques applied to each case study trade. The TRADE OPEN date shown refers to the newsletter issue in which the case study

trade was first opened. It does not refer to the day the case study trade was entered.

PORTFOLIO REVIEW The notional case study trade portfolio is an integral part of the newsletter

because this is used to demonstrate, in contemporary time, the application of

particular strategies. However, we also run a wider mix of articles. They include: Coaching style articles where readers are asked to apply analysis and

then compare their notes with ours. Discussions of trading strategies and approaches that tackle

contemporary issues. This includes parabolic trends, trading bands and

price spike analysis. These articles provide the tools necessary for a better understanding of market activity, although we do not generally

include this in the notional case study examples. New indicators and revision of classic indicators. The objective is to

understand how to more effectively apply the tools that appear in your charting programs.

Case study trades that show selection, assessment, management and

exits steps. These form the core of the notational case study portfolio. Other articles showing how indicators and trading strategies are applied

to effectively analyze selected stocks. To ensure these retain their educational function and do not become investment advice, these discussions are based on recent price charts.

Several features should be noted when examining the case study portfolio.

These returns in the case study trades were not the maximum returns available from these trades. They generally extracted about half to two thirds of the available price move.

The case study trades also illustrated some effective ways to deal with made markets where traders can use the market makers obligation as an additional

tool to manage entries and exits. These techniques are applied in these trades in a falling market, but they apply equally to all warrant trades.

These case study trades included several personal trades. Usually we avoid

using this in case studies because of the potential for conflict of interest. However, in these examples, the personal trade was completed before the

newsletter containing the example was published. The techniques were discussed in advance, but the case study examples were historical by the time traders found them in the newsletter.

The newsletter has also grown and changed over the past 21 years. The

notional case study trade portfolio will remain an integral part of the newsletter because this is used to demonstrate, in contemporary time, the application of particular strategies. However, we have also included a wider mix of articles. They

include: Case study trade management notes have changed format to show how the

trading plan evolves over time as the trade develops. To make it easier to read, new notes are highlighted so regular readers can just read the updates if they wish.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

10

Coaching style articles where readers are asked to apply analysis and then compare their notes with ours.

Discussions of trading strategies and approaches that tackle contemporary

issues. This includes trading CFDs, parabolic trends, trading bands, and price spike analysis. These articles provide the tools necessary for a better

understanding of market activity, although we do not generally include this in the notional case study examples.

New indicators, such as Trend Volume Analysis, different applications of

standard indicators and revision of classic indicators. The objective is to understand how to more effectively apply the tools that appear in your charting

programs. Case study trades that show selection, assessment, management and exit

steps. These form the core of the notational case study portfolio.

Other articles showing how indicators and trading strategies are applied to effectively analyze selected stocks. To ensure these retain their educational

function and do not become investment advice, these discussions are based on recent price charts.

PAST RESULTS The average of case study success rate is 83.33%. This is above the 70%

average we aim for. This means that around 8.3 out of 10 trading choices develop into profitable trades.

However, this is not the win/loss ratio that leads to success. The real basis of success lies in the way that unsuccessful trades are handled. We rode losses very tightly over this period, with all losses being under 1% of total trading capital. The

largest loss was $2,143 or 2.1% of total trading capital. This was in a trade in an ordinary stock. This caution and tight risk management is reflected in the low dollar

value of the loss in losing trades.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

11

Total return for the period was 91.79% on capital. This is a realized profit of $91,794 This means we started out with $100,000 and added $91,794 during the

twelve months. Most equity trades were around $20,000. Derivative trades were around $10,000 FX trades were around $5,000. Full detailed results for all previous years are available on http://www.guppytraders.com/gup15.htm.

Are these still exceptional returns? We don’t think so. The twenty-two-year results show a consistent level of return that is substantially better than the

performance of the broad market index. On a twenty-two-year basis, we can realistically aim for around a 75% return or more on capital or better from the market. It is achieved by careful and disciplined risk management. It is not achieved

by ‘hot tips’ or by pretending that we can select stocks more successfully than others. The single most important lesson that traders can learn from these portfolio results is

that success rests on the trader’s ability to cut losses quickly. Even if the stop loss exit subsequently turns out to be incorrect this does not destroy good trading results.

This report sheet includes all of the case study trades discussed during the last

six months. We do not hide losing trades, or poor performers. We do not conveniently forget to include some trades in the hope that readers will have forgotten about them.

These results are achievable. They can be duplicated. You might not achieve the same

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

12

level of return, but the case study trades show what is possible. They are also a powerful reason for not accepting poor trading results.

MEASURING RETURNS We measure our returns by money in the bank. It is an old-fashioned measure

that gives the trader a realistic idea of just how well he is doing. We avoid false measures of success. There are four false measures.

Counting open profits Open profits are calculated by taking the last traded price and turning this into

a portfolio value. This can make us all instant millionaires – on paper. Readers will know how some sample trades have been very profitable but have later been closed at a smaller profit because the exit conditions are not triggered until much later.

Annualized returns

This is the industry standard and we believe it is misleading. The sample trade might return 48% in just one month of trading. An annualised figure takes this realised return – the return that was actually banked – and calculates what it would

have been for the twelve months. This translates into a whopping annualised return of 576%. This is an ‘in your dreams’ return because the trade will not be at the same

price in twelve months as it was when we made the exit.

Pretending losses don’t count We have been disturbed by the trend with some market commentators who

pretend that losses do not count. This approach ranges from the comment that in 10

years time, the September 11 drop will show as a minor blip to some writers who include many stock tips, but only track those that work out.

We believe these approaches are misleading. Failed trades have a significant impact on trading results. We get much better returns if we exclude the three losing trades. We also exclude honesty if we do this.

Accept poor performance because of difficult market conditions

Trading is about making the best possible use of your capital. Our capital grows by completing profitable trades and cutting losses quickly. In the case studies, we demonstrate the difference that this approach makes to trading results. We are not

prepared to accept that highly trained and well-paid professionals cannot do better than the broad market when a consistent application of risk management shows that

better results are achievable. Losing 5% when the market falls 7% is not a measure of success. We use a true hedge fund approach, using zero as the absolute benchmark, and using positive returns from the market as a starting point against

which we measure our performance. Trading is about making our trading capital work hard. If you are able to

average a 10% return on each trade, then trading capital begins to build solidly. When you maintain that steady 10% return on $50,000, then $100,000, then $150,000 and so on, then your trading success is well established. Consistent returns enhanced by

money management are the objective of trading. As a final note, please remember that some of these trading examples are

designed to fail because we want to show the adverse consequences of particular trading strategies. There are many trading styles and many trading indicators. Not all of them work in Australian markets, and not all of them work in all market conditions.

It is more instructive to show how they fail to work than it is to show only successful strategies. Understanding why strategies fail is an important step in building

successful strategies. The information in the newsletter reflects three influences. The first is my own

trading strategies. The newsletter is effectively largely a report on my ongoing

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

13

analysis and research about the current market. Some issues closely track the exact steps I have taken in making a trading decision. It is not always something specially written for newsletter readers.

The second is influence from people who read the newsletter. Although I will not comment on individual questions about individual stocks, some of the stocks

included are in response to readers’ questions. All of these influences also go into the case study selection.

The third is from writers who have contributed to the newsletter over the last

year. They illustrate many specialized techniques and new approaches. We currently do not include these in the sample trading portfolios.

These case study portfolio results do resemble real world results. The newsletter is designed to be a useful tool to help you identify trading techniques that work and to use money management approaches that enhance your trading returns.

The case study portfolio is used as a handy running reference for these examples and shows what is possible with good trading discipline and risk management.

The same level of sample portfolio results can be achieved by readers if they develop the discipline to act consistently on stop loss conditions. This is perhaps the most important single message in the newsletter. Trading is about money

management, not about prediction. Success comes from discipline, not from a set of fancy or expensive indicators. Exceptional success comes from the confident

application of the correct trading technique at the appropriate time supported by clear stop loss conditions designed to protect capital. It is not always easy, but if done

properly, it is very profitable. Each trade is an island. It should stand alone, contributing profits, or small losses to the overall level of trading capital. When traders consider positions in a

portfolio context, there is a tendency to sell the best performing stocks to help compensate for the losses being incurred with the weaker portfolio stocks. It is better

trading practice to cut the weakest and continue to ride the profits with the strongest. Traditionally, Christmas and the end of the financial year are good times for a portfolio reassessment, but any time when you will be away from the markets for more than a

few days also demands a portfolio review. A trading review involves closing those positions which could turn nasty while you are away. A portfolio review means taking

a solid look at the poor performing stocks you have fallen in love with. Despite the personal pain, some do have to be put down.

READERS’ QUESTIONS: CASE STUDY PORTFOLIO

SET-UP By Daryl Guppy

At the end of each newsletter, we include a list of notional case study trades

and we provide a summary report every six months. Our returns have been excellent since 1996 and they show what is possible for private traders when trading discipline

is consistently applied. The returns are also possible because of our trading size. The average trade in our samples is $20,000. Institutional traders pay this in brokerage

alone on many trades. Our smaller trading size means we can take advantage of opportunities that larger traders avoid. It is these returns, even in difficult markets, that make trading such a successful way to make your capital work. By keeping each

trading example at the same dollar size, it makes it easier to compare the results of trading strategies and techniques used over previous years.

Equity trades are kept at $20,000. Trades are managed on an end of day basis, with the exit taken at the best reasonable price on the day after the stop loss is triggered.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

14

Warrant and CFD trades are $10,000. Warrant and CFD trades are closed on an intraday basis using a guaranteed stop loss as this is a primary method of managing derivative risk.

FX trades are $5000. Stops are managed intraday. These notional case studies are monitored in real time and show how various

trading strategies are implemented. The case study tracking money management section is intended to show how specific trading approaches discussed in previous tutorials have worked out. This section is not a model portfolio, nor is it a collection of

stock tips. It is a developing example of how trading strategies are applied - and modified - how losses are controlled and how profitable exits are made - within the

rules of the case study trade. The return on equity is a way of keeping score and does not represent the best possible returns. For this reason, profits are not added to trading equity. This fails to take advantage of compound returns, but it is consistent

with the tutorial nature of the newsletter. Each case study is selected because it is typical of trading patterns common in

many stocks in the market at that time. The contemporary examples show the trading principles, and it is left to readers to apply these principles to their own stocks that are moving in similar ways.

The date shown is the date of the newsletter where the full discussion of the trade construction and entry is included. This makes it easy to find the relevant

newsletter issue. It is not the date of the day the case study entry was made. The sample notional trades are usually based around a single indicator or

technique which sets up the entry conditions, the stop loss conditions and the exit

conditions for a profit. Trades are opened and closed according to these rules, and in most cases other indicators are ignored. This gives readers the opportunity to see how

a trade based on, for instance, moving average crossovers or a Trend Volume Analysis approach, work in reality. Readers can see the real difficulties in deciding which entry

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

15

signal are really a valid trading signal, as well as the way using some indicators delay the entry or the exit for too long.

This often means the case study trade would have been more successful in real

life because signals from other indicators would have been used. When case study

trades are closed, they are discussed so readers can see how the trade could have been better, or why it was closed under particular circumstances. In real life, traders

use a variety of indicators and will adjust a profitable exit according to the feel of the market. The trades in the portfolio case study section examples show the consequences of following a particular trading rule. It does not show the best trade

possible. Each week different technical analysis tools and trading approaches are

discussed. Some of these examples are added to the Money Management Portfolio. The objective is to assess how successful or unsuccessful, this trading approach is, and to see how risk management tools can be applied to limit losses. They are

notional examples of trading strategies. They are not actual trades or are they trading recommendations. In using these examples, we are trying to model how traders go

about their business of both protecting profits and limiting losses.

TRADE GALLERY These are screen shots of every case study trade discussed from Jan 1, 2019 to

June 30, 2019 showing entry and exit points. NOTE. The trade dates on the spreadsheet refer to the date of the newsletter in which these trades

appeared.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

16

GBPAUD

AMP CFD short

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

17

NUF

RSG

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

18

CAR

OSH

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

19

AOG

EHE

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

20

CSR*

ELS

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

21

EXL

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

22

EGD

GBPCAD

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

23

China A50

XJOCFD

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

24

NEWSLETTER OUTLOOK: INDEX TARGET MOVE

UPWARDS By Daryl Guppy

The XJO is dominated by trading bands and trading channels and this

gives multiple target calculations. Currently the index is using the upper edge of the trading channel as a resistance level as the uptrend carries the

index towards the resistance level created by the upper edge of the next trading band. The XJO paused near 6650 which is the projection target level

for trading band analysis and then used this consolidation as a foundation for the current rebound rally.

The next upside target based on the trading channel is near 6766 but

as the week elapses the target is adjusted to 6773. This is calculated by taking the width of the trading channel and projecting this upwards from the

point of the channel breakout. It may be that the trading band analysis is still the dominant feature and that

the trade channel analysis is simply a trend overlay on this behaviour. This trade band

analysis suggests that the next upside target is 6840 but that the value of the upper trend line in the trend channel will provide initial resistance on the way to this target.

Either way, the outlook remains bullish with support provided by the lower edge of the upper trading channel.

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

25

Unlike a trading and, the target for the trading channel breakout continues to

move. The target is always the upper edge of the trading channel which forms a

resistance point. The current resistance is 6275. Just like a trading band, the activity in a trading channel is often a rally and

retreat behaviour within the limits of the parallel bands or trend lines. The strength of the uptrend is confirmed with the GMMA relationships. The long

term GMMA is well separated and provides good support for any pullbacks. The

primary danger in the current breakout is that this becomes a bubble break followed by a rapid retreat from the trading channel resistance level.

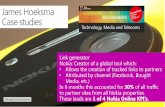

PORTFOLIO CASE STUDIES: MONEY MANAGEMENT

Starting cash position $100,000 - no brokerage or slippage 2% of risk = $2,000

NOTE Entered date is the newsletter date which contains the case study discussion.

OVERALL PROFIT TO DATE The LOV case study trade is closed for a profit of $600 or 3%. The case study

portfolio return is $600 or 0.6% for the period starting July 1, 2019 and ending June

30, 2020. For the year starting July 1, 2018 – 2019 the case study portfolio return is

$91,794 or 91.79%. The case study portfolio return is $156,450 or 156.45% for the period starting

July 1, 2016-2017. Note that this includes 6 to 21 trade results. The case study

portfolio return is $92,464.15 or 92.5% for the period starting July 1, 2015- 2016. Equity trade size is generally kept constant at $20,000 in the case study portfolio so it

is easier to compare the case study trades over this and other years. Unless otherwise noted in the trade management notes, all equity case study trades are managed on an end of day basis, with the exit taken at the best reasonable price on the day after

the stop loss is triggered.

CUSTOMER CAUTION NOTICE AND COPYRIGHT Algobot Pte Ltd (CRN 201604500D) Pte Ltd is not a licensed investment advisor. This publication, which is generally available to the public, falls under the Singapore Media Advice provisions. The information provided is for educational purposes only and does not constitute financial product advice. These analysis

notes are based on our experience of applying technical analysis to the market and are designed to be used as a tutorial showing how technical analysis can be applied to a chart example based on recent trading data. This newsletter is a tool to assist you in your personal judgment. It is not designed to replace your Licensed Financial Consultant or your Stockbroker. It has been prepared without regard to any particular person's investment objectives, financial situation and particular needs because readers come from diverse backgrounds, with diverse objectives and financial situations. This information is of a

general nature only so you should seek independent advice from your broker or other investment advisors as appropriate before taking any action. The publication should not be construed by any reader as Publisher's (i) solicitation to effect, or attempt to effect transactions in securities, or (ii) provision of

any investment related advice or services tailored to any particular individual's financial situation or investment objective(s). Readers do not receive investment advisory, investment supervisory or investment management services, nor the initial or ongoing review or monitoring of the reader's individual investment portfolio or individual particular needs. Therefore, no reader should assume that

the Publisher serves as a substitute for individual personalized advice from a licensed financial professional of the reader's choosing. The decision to trade and the method of trading is for the reader alone to decide. The reader maintains absolute discretion as to whether or not to follow any portion of our content. Publisher does not offer or provide any implementation services, nor does it offer or provide initial or ongoing individual personalized advice. It remains the reader's exclusive responsibility to review and evaluate the content and to determine whether to accept or reject any strategy and to correspondingly determine whether any such strategy is appropriate for a reader's individual situation.

Publisher expresses no opinion as to whether any of strategy contained on this publication is appropriate

July 7th, 2019 A publication of Algobot Pte Ltd CRN201604500D. Copyright © 2019

26

for a reader's individual situation. The author and publisher expressly disclaim all and any liability to any person, whether the purchase of this publication or not, in respect of anything and of the consequences of any thing done or omitted to be done by any such person in reliance, whether whole or partial, upon the whole or any part of the contents of this publication. Neither Algobot Pte Limited nor its officers,

employees and agents, will be liable for any loss or damage incurred by any person directly or indirectly as a result of reliance on the information contained in this publication. The information contained in this newsletter is copyright and for the sole use of trial and prepaid readers. It cannot be circulated to other

readers without the permission of the publisher. Each issue now incorporates fingerprint protection that enables us to track the original source of pirate copies. If we find that you are redistributing the newsletter then, at our discretion, we will reduce the length of your paid subscription by the value of the multiple copies we believe you are circulating. Share with nine friends, and we cut your subscription period by 90%. Contributed materials reflect the personal opinion of the authors and are not necessarily those of the publisher. Articles accurately reflect the personal views of the authors. Stocks held by the

authors are marked* and are not to be taken as a trading recommendation. This is not a newsletter of stock tips. Case study trades are notional and analysed in real time on a weekly basis. Any past investment-related performance . referred to may not be indicative of future results, and therefore, no reader should assume that the future performance of any specific investment, investment strategy will be suitable or profitable for a reader's portfolio, or equal historical or anticipated performance level(s). Algobot Pte Ltd does not receive any benefit or fee from any of the stocks reviewed in the newsletter. Algobot Pte Ltd is an

independent international financial education organization and research is supported by subscription fees. Please note that in the interest of timely publication of the newsletter, this document may be

incompletely proofed. OFFICES; Algobot Pte Ltd Head Office, 20 Cecil Street,#20-01 Equity Plaza, Singapore 049705, Singapore, 22 Hibernia Crescent, Brinkin, Darwin, Australia, Room B105-A17, No.14, Chaoyangmen Nandajie, Chaoyang District, Beijing, China.