AN ECONOMIC ANALYSIS OF SHAWL INDUSTRY IN …sajms.com/wp-content/uploads/2015/09/14.pdf · 6 Ted...

Transcript of AN ECONOMIC ANALYSIS OF SHAWL INDUSTRY IN …sajms.com/wp-content/uploads/2015/09/14.pdf · 6 Ted...

Published By Universal Multidisciplinary Research Institute Pvt Ltd

151 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

AN ECONOMIC ANALYSIS OF SHAWL INDUSTRY IN KASHMIR VALLEY

Shazia Hamid

Research Scholar Department of Economics

Department of Economics University of Kashmir India

Abstract

The present study is designed to explore in detail the cost structure and returns of Shawl industry of Handicraft sector in district Srinagar which is the major producer of handicraft goods in Kashmir Valley The main focus of the study is whether the industry can help to raise the income levels of people associated with it and offer more employment opportunities to the people of the State The results of the study reveal that Gross returns per rupee of investment in shawl industry on an average accounts to Rs 247 The study further reveals that Net returns per rupee of investment are high accounting to Rs 147 which implies that every one rupee of investment fetches a profit of one and a half rupee Besides the study also throws some light on socio-economic profile of the handloom unit owners

Key words Handicrafts Shawl industry Cost and Return Analysis profitability Gross

Margin Benefit-Cost Ratio

1 Introduction

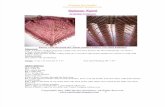

Kashmir is famous for its beautiful and delicate art and craft from times immemorial The

agility of local artisans coupled with their artistic imagination reflected through a wide range

of products has delighted people world over for centuries Handicraft sector continues to

remain an important sector for socio-economic development of the people of state This is

because of the absence of necessary infrastructure required for large scale industrialization

Because of these facts this industry has received a priority for its development right from the

fifth five year plan Moreover this is a type of sector which requires less investment on

infrastructure and raw-material skilled as well as unskilled labors are also locally available

Kashmiri handicrafts industry has witnessed a phenomenal growth over the past decades and

now occupies a place of prominence in the state as well as Indian economy in terms of its

massive potential for employment generation and exports As per the official estimates

handicraft sector provides employment to about 378 lakh workers engaged in different types

Published By Universal Multidisciplinary Research Institute Pvt Ltd

152 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

of handicraft activities From the production point of view this sector occupies a prominent

place in the industrial scene of the state The handicraft production has gone up to an amount

of Rs 165030 crores at the end of the year 2012-13 The handicraft sector of Jammu and

Kashmir is important from the export point of view as well During 2012-13 handicraft goods

worth Rs 108080 crore were exported1

The range of crafts of Jammu and Kashmir is so vast which includes carpets shawls paper-

machie wood carving willow-work namdhas kandkari copper ware and lots more Shawl

making is one of the most important cottage industries of Kashmir valley Shawl

manufacturing is said to be as old as ldquoThe Hills of Kashmirrdquo2 Word Shawl has been derived

from Indo-Persian word ldquoShalrdquo which meant fine woven woolen fabric used as a drape

Statistics reveal that at present there are about 20000 artisans engaged in the industry turning

out shawls worth Rs 1500 crores annually3 The significance of handicraft sector should not

be judged only by its income generating capacity employment potential and contribution to

exports but its importance for promotion of tourism and maintenance of ecological balance of

the state It is therefore necessary to determine the profitability and viability of shawl making

industry of handicraft sector with the aim of evolving strategies for development of this

sector

2 Objectives of the Study

1 To carry out socio-economic analysis of handloom unit holders

2 To assess the viability of Shawl making units

3 To ascertain that shawl making units are economically profitable enterprises

3 Review of Related Literature

Dirk Hansohm and Karl Wohlmuth4 (1985) in their combined study aimed to identify the

handicraft sector and the investments made in this sector which are less risky and expected to

bear profits more quickly as well as constraints faced by this sector Ted Barber and Dr M

1 Digest of Statistics 2012-2013 Directorate of Economics and Statistics JampK p 67 2 Bakshi RS ldquoHistory of Economic Development in Kashmirrdquo Gulshan publishers 2002 3 Digest of Statistics 2012-2013 Directorate of Economics and Statistics JampK p 66 4 Dirk Hansohm and karl mohlmuth (1985) ldquoPromotion of Rural handicrafts as a means of structural adjustment in Sudan with special reference to Darfur region

Published By Universal Multidisciplinary Research Institute Pvt Ltd

153 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Soundarapandian5 (2002) reveal in his study that handloom sector continues to remain a

dominant industrial segment of the country inspite of using traditional methods of production

The study further reveals that the protection policies of government have led the weavers to

become dependent entrepreneurs Marina Krivoshlykova6 (2006) conducting an extensive

study on analysis of the global market for handicrafts and the key trends that affect producers

in developing countries and offers recommendations for handicraft sector Emokaro C O et

al (2010) in their combined study have shown that catfish farming is not only profitable but

equally viable in Kogi sate of Nigeria The study reveals that the said trade fetches average

annual gross revenue of $5723 and an average net profit margin of $ 2576 with a net profit

margin of 5146 Sunita Sharma7 (2010) in her study studied ldquoRole of handicraft industry

in the production employment and export promotion The author further says that the state

leans heavily towards the small-scale sector However the small scale industry has shown a

continuous growth in number from 2203 in 1973-74 to 49426 in 2006-07 Also that

handicraft industry occupies important place in the economy of JampK state

4 Data and Research Methodology

Data was obtained from both primary and secondary sources for the present study The main

sources of secondary data are Books and Journals official records of various departments

The primary data was gathered through a field study in district Srinagar by administering a

well designed questionnaire For this purpose stratified random sampling technique has been

brought into operation As per the official records (2008-09) of the Directorate of Handloom

Development there are 3663 handloom units scattered over the entire range of district

Srinagar So two areas with maximum concentration and two areas with minimum

concentration have been purposively chosen in handloom sector This way total number of

Handloom units came to 1299 out of which a 10 random sample from each area

constituting 130 handloom units have finally been chosen for the study All unit holders were

interviewed personally by present investigator at their respective work places

5 Soundarapandian M (2002) ldquoGrowth and Prospects of Handloom Sector in Indiardquo Lal Publications New Delhi 6 Ted Barber and Marina Krivoshlykona (2006) ldquoGlobal market Assessment for Handicraftsrdquo Vol-I P 23 7 Sunita Sharma (2010) ldquoRole of handicraft industry in production employment and export promotion A case study of Jammu and Kashmir staterdquo Kashmir journal of Social Sciences Vol 4 2010 pp4361

Published By Universal Multidisciplinary Research Institute Pvt Ltd

154 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

To workout the profitability of Shawl making units in Handicraft industry following

analytical tools have been used

GR= Q times P NP = GRndash TC

TC = TFC + TVC NPM = x 100

WhereGR = Gross RevenueQ = Quantity of Output P = Price per Unit of Output

NP = Net Profit TPC = Total Cost TFC = Total Fixed Cost TVC = Total Variable Cost

GM = Gross Margin and TR = Total Revenue

5 Results and Discussions

Present study has been discussed under the following two headings

i) Socio-economic profile

ii) Economic Analysis

51 Socio-Economic Profile of Shawl making (Handloom) Unit Owners

511 Age of Unit Owners

Age is an important socio economic factor There is a positive relation between young age

and efficiency in production Young people are more energetic to adopt new ideas and

innovations easily and quickly which in turn leads to high productivity Figure below shows

age profile of Unit Owners in the study area

Figure 1 Age of Unit Owners

It is evident from the above pie chart that majority of the Unit Owners fall in the working age

group of 18-60 ie about 85 percent followed by 15 per cent of Unit Owners who lie in the

age group of more than 60 years and no unit holder was found in the age group of below 18

0

85

15

Age in yearsBelow 18 18-60 60 and above

Published By Universal Multidisciplinary Research Institute Pvt Ltd

155 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

512 Education of Handloom Unit Owners

Education is the most powerful weapon which you can use to change the world (Nelson

Mandela) It is a tool that provides individuals with better understanding and capabilities of

laying productive units which leads to social and economic development Fig 2 shows the

level of education of the Unit Owners

Figure 2 Level of Education of Unit Owners

It is clear from the above diagram that out of the total Unit Owners surveyed about 8 per cent

of Unit Owners are illiterate 26 per cent have received elementary education 42 per cent

have attained education up to the secondary level 16 per cent of Unit Owners are educated up

to higher secondary level and 8 per cent Unit Owners fall in the category of higher levels of

education The study reveals that more than 50 per cent of the Unit Owners are well educated

which shows that Handicraft industry has an immense potential to generate employment for

educated people

513 Nature of Ownership

Ownership pattern is an important factor that determines the growth and development of

small units Different types of ownership of Unit Owners in the study area are presented in the

fig 3 below

8

26

42

168 0

EducationIlliterate Elementary

Secondary Higher secondary

Graduate Post Graduate

Published By Universal Multidisciplinary Research Institute Pvt Ltd

156 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Figure 3 Type of Ownership of Unit Owners

The fig above shows that about 85 percent of the enterprise owners are sole proprietors while

as 15 percent of enterprises have partnership No enterprise was reported operating on

leasehold arrangement

514 Financial Sources

Finance is the life blood of any economic activity Finance plays an important role for the

growth and development of any type of industry The following pie diagram gives

information regarding the sources of finance of the sample Unit Owners

Figure 4 Sources of Finance

The above diagram reveals that a huge percentage of respondents ie 59 per cent have their

own capital about 36 per cent of the Unit Owners take assistance from the banks while as

only a small percentage of Unit Owners figuring 4 per cent borrow (from their relatives and

friends) without any interest

515 Establishment of the Units

85

150

OwnershipSingle Joint Leased

37

59

4

Financebanks own capital others

Published By Universal Multidisciplinary Research Institute Pvt Ltd

157 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the establishment of the units is concerned information from the Unit Owners was

collected through a questionnaire regarding for how long they are involved in the business

The response provided by the respondents is given below

Figure 5 Experience of Unit Owners

As seen in fig 5 majority of the Unit Owners ie 39 per cent (51 units) were involved in the

business between 10 to 20 years followed by 33 per cent (44 units) of the Unit Owners who

have been in the business from less than 10 years and rest 26 per cent of Unit Owners have an

experience of handling the business for more than 20 years (35 units) This shows that from

last twenty years this sector has been able to attract more individuals to set up their own

Handloom units

52 Economic Analysis

The study is designed to make an analysis of the cost structure and return to investment of the

Shawl industry

521 Cost Structure

The input costs as already mentioned are categorized as fixed and variable costs The fixed

costs include machinery land and building insurance charges depreciation etc while as

variable costs include human labor raw material energy charges (power and fuel) repair and

maintenance charges etc The analysis of the data for the empirical estimation of the above

mentioned variables has been done in the context with the level of investment For this

Less than 10

Between 10-20

20 and above

4451

35

0

Time of Establishment Years

Frequency

Published By Universal Multidisciplinary Research Institute Pvt Ltd

158 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

purpose the industrial units have been categorized into three classes as units with an

investment of below Rs 40 lacs between Rs 40 and Rs 90 lacs and above Rs 90 lacs

Published By Universal Multidisciplinary Research Institute Pvt Ltd

159 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 1 Aggregation of Category Wise Cost Structure per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs

Salary to

managerial

staff

Rental

value

Capital Insurance Other

costs

Total Fixed

Cost

Raw

material

Labor cost Energy

Cost

Repair and

maintenance

Other

costs

Total

Variable

Cost

Cost Per

Shawl (Rs)

Below 40 50 2742 1714 362 314 144 5278 219828 3949 265 125 1177 225344 230622

40-90 56 2400 1607 364 279 110 4760 192500 4628 254 116 1250 198748 203506

90 amp above 24 1371 1000 226 164 058 2819 157738 6171 213 115 1190 161863 164682

Average 130 2171 1440 317 252 104 4286 190022 4916 244 119 1206 195318 199603

Source field survey Interest Payments Peeco Dying poly cover etc

To find an estimate of the total cost of Shawl production through Handloom units both the fixed costs as well as the variable costs have been clubbed

together in the table above From table 1 it is evident that with the increase in the size of the investment total cost component per shawl decreases

The cost of manufacturing per shawl is found to be highest for small size Unit Owners accounting for an amount of Rs 230622 followed by medium

size Unit Owners accounting for an amount of Rs 203506 and lowest for large size Unit Owners ie Rs 164682 The inference drawn from the above

analysis is that increasing returns to scale is seen to exist in the Handloom Units involved in the manufacture of shawls

Published By Universal Multidisciplinary Research Institute Pvt Ltd

160 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 2 Category Wise Cost Composition per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs Total Cost per Shawl

(Rs)

Salary to managerial staff

Rental value

Capital Insurance Other Costs

Total Fixed Cost

Raw material Labor cost

Energy Charges

Repair and Maintenance

Other cost Total Variable Cost

Below 40 50 2742

(119)

5195

1714

(074)

3247

362

(016)

685

314

(014)

595

144

(006)

273

5278

(229)

100

219828

(953)

9755

3949

(171)

175

265

(012)

012

125

(005)

006

1177

(051)

052

225344

(9771)

100

230622

(100)

-

40-90 56 2400

(118)

5042

1607

(071)

3376

364

(018)

765

279

(014)

586

110

(005)

231

4760

(234)

100

192500

(9459)

9685

4628

(227)

233

254

(012)

013

116

(006)

006

1250

(061)

063

198748

(9766)

100

203506

(100)

-

90 and above 24 1371

(083)

4863

1000

(061)

3547

226

(014)

802

164

(010)

582

058

(004)

206

2819

(171)

100

157738

(9578)

9745

6171

(375)

381

213

(013)

013

115

(007)

007

1190

(072)

074

161863

(9829)

100

164682

(100)

-

Average 130 2171

(109)

5065

1440

(072)

3360

317

(016)

740

252

(013)

588

104

(005)

243

4286

(215)

100

190022

(9519)

9729

4916

(246)

251

244

(012)

012

119

(006)

006

1206

(060)

062

195318

(9785)

100

199603

(100)

-

Source field survey

Interest Payments Peeco Dying poly cover etc

Figures in Parentheses indicate percentage share out of total cost

Figures in curly Parentheses indicate percentage share out of fixed costvariable cost respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

161 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the cost structure of Handloom units is concerned raw material is the

most expensive item in the production process of Handloom units On an

average raw material constitutes about 95 percent of the total cost Also it can

be seen that as a proportion of variable cost it still constitutes the highest level

of cost component constituting about 97 percent on an average

Human labor cost component appears only next to the cost of raw

material constituting about 251 percent of the total cost on an average This

cost component is found to be high for large investment Unit Owners followed

by medium investment Unit Owners and lowest for small size investment

holders ie 375 percent 227 percent and 171 percent respectively of the total

cost Also on an average for all the three categories it constitutes about 3

percent of the total variable cost

Annual salary cost component is the third major input used in the

Handloom units accounting for 109 percent for all the three units on an

average

Rental value of land is the fourth major component accounting for 072

percent of the total cost on an average As a component of fixed cost rental

value of land is seen to attain second position

Other costs (including expenditure on peeco dying and packaging) is

another major input next to rental value of land As a proportion of the variable

cost this cost component is seen to constitute 062 percent of the total variable

cost on an average

Energy cost component insurance cost component and repair and

maintenance cost components per shawl constitutes a minor proportion of the

total cost accounting for 0 12 percent 013 percent and 006 percent on an

average respectively However these costs are seen to attain similar positions

as a proportion of variable and fixed costs respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

522 OutputReturns

Table 3 Category Wise Calculation of Gross and Net Returns of Handloom Units (Rs)

Investment (lacs)

Frequency

Annual Production of shawls (lac Nos)

Total Gross Returns

( Q x Price )

Total Annual cost

Net Returns (TGR-TC)

Average Cost

(per shawl)

Average Net Returns per Shawl (price-Average cost per

shawl)

1 2 3 4 = 3xPrice 5 6=4-5 7 8

Below 40 50 175 758272 401738 356537 230622 202678

40 ndash 90 56 224 970592 455866 514726 203506 229794

90 amp above 24 168 727944 212459 515485 164682 268618

All the three 130 567 24568108 1070063 1386748 199603 233696

Source field survey Q= quantity of shawls TGR= Total gross returns and TC= total cost

The prices of three categories of shawls is Rs 5312 Rs 4408 and Rs 3280 The average price was calculated by taking average of the three categories which amounts to Rs 4333 per shawl

Calculated by adding total fixed cost and total variable cost (table 1) refer to table 1

Table 3 gives us a clear picture of returns that are received from all the three categories of Handloom Units Returns are received by any firm against

the money invested It is evident from the table above that average cost per shawl decreases with the increase in the level of the investment It is

highest in case of small investment Unit Owners and lowest in case of large investment Unit Owners The above analysis shows that Handloom units

are subject to increasing returns to scale

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Table 4 Gross Returns per Rupee of Investment

Total fixed Investment (Rs

lacs)

Total cost

Gross returns Gross returns

per rupee of

investment

1 2 3 4=3divide2

Below 40 401738 758272 188

40 ndash 90 455866 970592 212

90 amp above 212459 727944 342

All the three 1070063 2456808 247

Source field survey

In terms of returns per rupee of investment the gross returns vary between Rs 188 to Rs 342 among

three categories which on average is calculated as Rs 247 for all the three categories Gross returns per

rupee of investment is lowest in case of the small investment Unit Owners ie below Rs 40 lacs

accounting for Rs 188 followed by medium investment Unit Owners with an investment between Rs 40-

90 accounting for Rs 212 and is highest in case of large investment Unit Owners with an investment

above Rs 90 lacs accounting for Rs 342

Table 5 Net Returns per Rupee of Investment

Total fixed

Investment

(Rs lacs)

Total cost

Gross returns

Net returns

Net returns per

rupee of

investment

1 2 3 4=3-2 5=4divide2

Below 40 401738 758272 356537 088

40-90 455866 970592 514726 112

90 amp above 212459 727944 515485 242

All the three 1070063 2456808 1386748 147

Source field survey

Published By Universal Multidisciplinary Research Institute Pvt Ltd

As evident from the table above it is seen that Net returns increase with the increase in the level of

investment from small sized Handloom units to large size Handloom units Net returns per rupee of

investment vary between Rs 088 to Rs 242 among all the three categories of Handloom units with an

average value accounting to Rs 147 Net returns per rupee of investment are high which implies that

shawl industry is a highly profitable business Every one rupee of investment fetches a profit of one and a

half rupee

53 Concluding Remarks

The findings of the study reveal that shawl industry of handicraft sector is highly profitable enterprise

Net returns per rupee of investment at an average account to Rs 147 which implies that every single

rupee of investment fetches a profit of one and a half rupee An important fact that is deduced from the

study is that due to the saturation of employment opportunities in governmenttraditional and

non-governmental sectors the need is to flourish handicraft sector which is not only employment oriented

but highly profitable Besides this sector not only provides employment opportunities to the educated as

well as uneducated people but also enables them to enhance their standard of living It is therefore

important to sustain this industry and create awareness for appreciation of the value of our tradition

among the future generations

References

Ahmad B (2004) ldquoAn Economic Study of JampK Staterdquo City Book Centre Budshah Chowk Srinagar

Ahmed N (1987) ldquoProblems and Management of Small Scale and Cottage Industriesrdquo Deep

publications

Ahmed P ldquoEconomy and Society of Kashmirrdquo Oriental publishing house 2007

Bamzi KNP ldquoSocio-Economic History of Kashmir (1846-1947)rdquo Gulshan books 1987

Barekh R K (2005) Importance and Potentiality of Small-Scale Industries in Nagaland Concept

Publication House New Delhi

Beyer John (1972) An Economic Framework for Project Analysis in India Ford Foundation New

Delhi

Emokaro C O et al (2010) ldquoProfitability and Viability of Cat Fish Farming in Kogi State Nigeriardquo

Research Journal of Agrcultural and Biological Sciences 6 (3) 215-219

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Mishra SN and Beyer John (1976) ldquoCost Benefit Analysis- A Case Study of Ratnagiri Fisheries

Projectrdquo Hindustan Publishing Corporation New Delhi

Darakshan (2011) ldquoA study of Handicraft Industry in JampK ldquo A journal of advances in management IT

and social sciences Vol 1 issue 4 pp 64-70

Hamid S and Haq I (2014) ldquoCost and Return Analysis of Handicraft Sector in JampK State Indiardquo Vol 1

Issue 1 p 22-27 Sai Om Publications

Hansohm D and Karl S M (1985) ldquoPromotion of Rural Handicrafts as a Means of Structural

Adjustment in Sudan with special reference to Darfur region

Mahendra et al (2008) ldquoEconomics of Handloom Weaving A field study of Andhra Pradeshrdquo EPW Vol

X LII No 21 May 24-30 pp43-51

Soundrapandian M (2002) Liberalisation in Small Scale Industries- Needs and Issues Third Concept

Vol No 25

Sunita S (2010) ldquoRole of handicraft industry in production employment and export promotion A case

study of Jammu and Kashmir staterdquo Kashmir journal of Social Sciences Vol 4 2010 pp4361

Ted B and Marina Krivoshlykona (2006) ldquoGlobal market Assessment for Handicraftsrdquo Vol I P 23

WEBLIOGRAPHY

http wwwgooglecom

http wwwecostatjknicin

http wwwjkhandicraftscoorporationnicin

http wwwjkslbccomgoiSchemes

http wwwgeositescomhtml

http wwwministryoftextilesgovin

http wwwjkindustriescommercenicin

http wwwepworgin

http wwwwikipediaorgvikihandicraftsjk

http wwwjkslbccom

http wwwjandkplanningcomhandicrafts

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Appendix Tables

Table 1A Age Profile of the Unit Owners

Source Field survey

Table 1B Education Level of the Unit Owners

Education level Frequency Percentage

Illiterate 10 769

Elementary 34 2615

Secondary 54 4153

Higher secondary 21 1615

Graduate 11 846

Post Graduate Nil 000

Total 130 100

Source Field survey

Table 1C Nature of Ownership of the Unit Owners

Proprietorship Frequency Percentage

Single 110 8461

Joint 20 1538

Leased 0 000

Total 130 100

Source Field survey

Age (years) Number of Unit Owners Percentage

Below 18 0 00

18-60 110 846

60 and above 20 154

Total 130 100

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Table 1D Financial Source of the Respondents

Source Frequency Percentage

Banks 48 3692

Own Capital 77 5923

Others 05 384

Total 130 100

Source Field survey

Table 1E Time of Establishment of Units

Years Frequency Percentage

Less than 10 44 3384

Between 10-20 51 3923

20 and above 35 2692

Total 130 100

Source Field survey

Published By Universal Multidisciplinary Research Institute Pvt Ltd

152 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

of handicraft activities From the production point of view this sector occupies a prominent

place in the industrial scene of the state The handicraft production has gone up to an amount

of Rs 165030 crores at the end of the year 2012-13 The handicraft sector of Jammu and

Kashmir is important from the export point of view as well During 2012-13 handicraft goods

worth Rs 108080 crore were exported1

The range of crafts of Jammu and Kashmir is so vast which includes carpets shawls paper-

machie wood carving willow-work namdhas kandkari copper ware and lots more Shawl

making is one of the most important cottage industries of Kashmir valley Shawl

manufacturing is said to be as old as ldquoThe Hills of Kashmirrdquo2 Word Shawl has been derived

from Indo-Persian word ldquoShalrdquo which meant fine woven woolen fabric used as a drape

Statistics reveal that at present there are about 20000 artisans engaged in the industry turning

out shawls worth Rs 1500 crores annually3 The significance of handicraft sector should not

be judged only by its income generating capacity employment potential and contribution to

exports but its importance for promotion of tourism and maintenance of ecological balance of

the state It is therefore necessary to determine the profitability and viability of shawl making

industry of handicraft sector with the aim of evolving strategies for development of this

sector

2 Objectives of the Study

1 To carry out socio-economic analysis of handloom unit holders

2 To assess the viability of Shawl making units

3 To ascertain that shawl making units are economically profitable enterprises

3 Review of Related Literature

Dirk Hansohm and Karl Wohlmuth4 (1985) in their combined study aimed to identify the

handicraft sector and the investments made in this sector which are less risky and expected to

bear profits more quickly as well as constraints faced by this sector Ted Barber and Dr M

1 Digest of Statistics 2012-2013 Directorate of Economics and Statistics JampK p 67 2 Bakshi RS ldquoHistory of Economic Development in Kashmirrdquo Gulshan publishers 2002 3 Digest of Statistics 2012-2013 Directorate of Economics and Statistics JampK p 66 4 Dirk Hansohm and karl mohlmuth (1985) ldquoPromotion of Rural handicrafts as a means of structural adjustment in Sudan with special reference to Darfur region

Published By Universal Multidisciplinary Research Institute Pvt Ltd

153 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Soundarapandian5 (2002) reveal in his study that handloom sector continues to remain a

dominant industrial segment of the country inspite of using traditional methods of production

The study further reveals that the protection policies of government have led the weavers to

become dependent entrepreneurs Marina Krivoshlykova6 (2006) conducting an extensive

study on analysis of the global market for handicrafts and the key trends that affect producers

in developing countries and offers recommendations for handicraft sector Emokaro C O et

al (2010) in their combined study have shown that catfish farming is not only profitable but

equally viable in Kogi sate of Nigeria The study reveals that the said trade fetches average

annual gross revenue of $5723 and an average net profit margin of $ 2576 with a net profit

margin of 5146 Sunita Sharma7 (2010) in her study studied ldquoRole of handicraft industry

in the production employment and export promotion The author further says that the state

leans heavily towards the small-scale sector However the small scale industry has shown a

continuous growth in number from 2203 in 1973-74 to 49426 in 2006-07 Also that

handicraft industry occupies important place in the economy of JampK state

4 Data and Research Methodology

Data was obtained from both primary and secondary sources for the present study The main

sources of secondary data are Books and Journals official records of various departments

The primary data was gathered through a field study in district Srinagar by administering a

well designed questionnaire For this purpose stratified random sampling technique has been

brought into operation As per the official records (2008-09) of the Directorate of Handloom

Development there are 3663 handloom units scattered over the entire range of district

Srinagar So two areas with maximum concentration and two areas with minimum

concentration have been purposively chosen in handloom sector This way total number of

Handloom units came to 1299 out of which a 10 random sample from each area

constituting 130 handloom units have finally been chosen for the study All unit holders were

interviewed personally by present investigator at their respective work places

5 Soundarapandian M (2002) ldquoGrowth and Prospects of Handloom Sector in Indiardquo Lal Publications New Delhi 6 Ted Barber and Marina Krivoshlykona (2006) ldquoGlobal market Assessment for Handicraftsrdquo Vol-I P 23 7 Sunita Sharma (2010) ldquoRole of handicraft industry in production employment and export promotion A case study of Jammu and Kashmir staterdquo Kashmir journal of Social Sciences Vol 4 2010 pp4361

Published By Universal Multidisciplinary Research Institute Pvt Ltd

154 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

To workout the profitability of Shawl making units in Handicraft industry following

analytical tools have been used

GR= Q times P NP = GRndash TC

TC = TFC + TVC NPM = x 100

WhereGR = Gross RevenueQ = Quantity of Output P = Price per Unit of Output

NP = Net Profit TPC = Total Cost TFC = Total Fixed Cost TVC = Total Variable Cost

GM = Gross Margin and TR = Total Revenue

5 Results and Discussions

Present study has been discussed under the following two headings

i) Socio-economic profile

ii) Economic Analysis

51 Socio-Economic Profile of Shawl making (Handloom) Unit Owners

511 Age of Unit Owners

Age is an important socio economic factor There is a positive relation between young age

and efficiency in production Young people are more energetic to adopt new ideas and

innovations easily and quickly which in turn leads to high productivity Figure below shows

age profile of Unit Owners in the study area

Figure 1 Age of Unit Owners

It is evident from the above pie chart that majority of the Unit Owners fall in the working age

group of 18-60 ie about 85 percent followed by 15 per cent of Unit Owners who lie in the

age group of more than 60 years and no unit holder was found in the age group of below 18

0

85

15

Age in yearsBelow 18 18-60 60 and above

Published By Universal Multidisciplinary Research Institute Pvt Ltd

155 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

512 Education of Handloom Unit Owners

Education is the most powerful weapon which you can use to change the world (Nelson

Mandela) It is a tool that provides individuals with better understanding and capabilities of

laying productive units which leads to social and economic development Fig 2 shows the

level of education of the Unit Owners

Figure 2 Level of Education of Unit Owners

It is clear from the above diagram that out of the total Unit Owners surveyed about 8 per cent

of Unit Owners are illiterate 26 per cent have received elementary education 42 per cent

have attained education up to the secondary level 16 per cent of Unit Owners are educated up

to higher secondary level and 8 per cent Unit Owners fall in the category of higher levels of

education The study reveals that more than 50 per cent of the Unit Owners are well educated

which shows that Handicraft industry has an immense potential to generate employment for

educated people

513 Nature of Ownership

Ownership pattern is an important factor that determines the growth and development of

small units Different types of ownership of Unit Owners in the study area are presented in the

fig 3 below

8

26

42

168 0

EducationIlliterate Elementary

Secondary Higher secondary

Graduate Post Graduate

Published By Universal Multidisciplinary Research Institute Pvt Ltd

156 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Figure 3 Type of Ownership of Unit Owners

The fig above shows that about 85 percent of the enterprise owners are sole proprietors while

as 15 percent of enterprises have partnership No enterprise was reported operating on

leasehold arrangement

514 Financial Sources

Finance is the life blood of any economic activity Finance plays an important role for the

growth and development of any type of industry The following pie diagram gives

information regarding the sources of finance of the sample Unit Owners

Figure 4 Sources of Finance

The above diagram reveals that a huge percentage of respondents ie 59 per cent have their

own capital about 36 per cent of the Unit Owners take assistance from the banks while as

only a small percentage of Unit Owners figuring 4 per cent borrow (from their relatives and

friends) without any interest

515 Establishment of the Units

85

150

OwnershipSingle Joint Leased

37

59

4

Financebanks own capital others

Published By Universal Multidisciplinary Research Institute Pvt Ltd

157 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the establishment of the units is concerned information from the Unit Owners was

collected through a questionnaire regarding for how long they are involved in the business

The response provided by the respondents is given below

Figure 5 Experience of Unit Owners

As seen in fig 5 majority of the Unit Owners ie 39 per cent (51 units) were involved in the

business between 10 to 20 years followed by 33 per cent (44 units) of the Unit Owners who

have been in the business from less than 10 years and rest 26 per cent of Unit Owners have an

experience of handling the business for more than 20 years (35 units) This shows that from

last twenty years this sector has been able to attract more individuals to set up their own

Handloom units

52 Economic Analysis

The study is designed to make an analysis of the cost structure and return to investment of the

Shawl industry

521 Cost Structure

The input costs as already mentioned are categorized as fixed and variable costs The fixed

costs include machinery land and building insurance charges depreciation etc while as

variable costs include human labor raw material energy charges (power and fuel) repair and

maintenance charges etc The analysis of the data for the empirical estimation of the above

mentioned variables has been done in the context with the level of investment For this

Less than 10

Between 10-20

20 and above

4451

35

0

Time of Establishment Years

Frequency

Published By Universal Multidisciplinary Research Institute Pvt Ltd

158 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

purpose the industrial units have been categorized into three classes as units with an

investment of below Rs 40 lacs between Rs 40 and Rs 90 lacs and above Rs 90 lacs

Published By Universal Multidisciplinary Research Institute Pvt Ltd

159 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 1 Aggregation of Category Wise Cost Structure per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs

Salary to

managerial

staff

Rental

value

Capital Insurance Other

costs

Total Fixed

Cost

Raw

material

Labor cost Energy

Cost

Repair and

maintenance

Other

costs

Total

Variable

Cost

Cost Per

Shawl (Rs)

Below 40 50 2742 1714 362 314 144 5278 219828 3949 265 125 1177 225344 230622

40-90 56 2400 1607 364 279 110 4760 192500 4628 254 116 1250 198748 203506

90 amp above 24 1371 1000 226 164 058 2819 157738 6171 213 115 1190 161863 164682

Average 130 2171 1440 317 252 104 4286 190022 4916 244 119 1206 195318 199603

Source field survey Interest Payments Peeco Dying poly cover etc

To find an estimate of the total cost of Shawl production through Handloom units both the fixed costs as well as the variable costs have been clubbed

together in the table above From table 1 it is evident that with the increase in the size of the investment total cost component per shawl decreases

The cost of manufacturing per shawl is found to be highest for small size Unit Owners accounting for an amount of Rs 230622 followed by medium

size Unit Owners accounting for an amount of Rs 203506 and lowest for large size Unit Owners ie Rs 164682 The inference drawn from the above

analysis is that increasing returns to scale is seen to exist in the Handloom Units involved in the manufacture of shawls

Published By Universal Multidisciplinary Research Institute Pvt Ltd

160 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 2 Category Wise Cost Composition per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs Total Cost per Shawl

(Rs)

Salary to managerial staff

Rental value

Capital Insurance Other Costs

Total Fixed Cost

Raw material Labor cost

Energy Charges

Repair and Maintenance

Other cost Total Variable Cost

Below 40 50 2742

(119)

5195

1714

(074)

3247

362

(016)

685

314

(014)

595

144

(006)

273

5278

(229)

100

219828

(953)

9755

3949

(171)

175

265

(012)

012

125

(005)

006

1177

(051)

052

225344

(9771)

100

230622

(100)

-

40-90 56 2400

(118)

5042

1607

(071)

3376

364

(018)

765

279

(014)

586

110

(005)

231

4760

(234)

100

192500

(9459)

9685

4628

(227)

233

254

(012)

013

116

(006)

006

1250

(061)

063

198748

(9766)

100

203506

(100)

-

90 and above 24 1371

(083)

4863

1000

(061)

3547

226

(014)

802

164

(010)

582

058

(004)

206

2819

(171)

100

157738

(9578)

9745

6171

(375)

381

213

(013)

013

115

(007)

007

1190

(072)

074

161863

(9829)

100

164682

(100)

-

Average 130 2171

(109)

5065

1440

(072)

3360

317

(016)

740

252

(013)

588

104

(005)

243

4286

(215)

100

190022

(9519)

9729

4916

(246)

251

244

(012)

012

119

(006)

006

1206

(060)

062

195318

(9785)

100

199603

(100)

-

Source field survey

Interest Payments Peeco Dying poly cover etc

Figures in Parentheses indicate percentage share out of total cost

Figures in curly Parentheses indicate percentage share out of fixed costvariable cost respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

161 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the cost structure of Handloom units is concerned raw material is the

most expensive item in the production process of Handloom units On an

average raw material constitutes about 95 percent of the total cost Also it can

be seen that as a proportion of variable cost it still constitutes the highest level

of cost component constituting about 97 percent on an average

Human labor cost component appears only next to the cost of raw

material constituting about 251 percent of the total cost on an average This

cost component is found to be high for large investment Unit Owners followed

by medium investment Unit Owners and lowest for small size investment

holders ie 375 percent 227 percent and 171 percent respectively of the total

cost Also on an average for all the three categories it constitutes about 3

percent of the total variable cost

Annual salary cost component is the third major input used in the

Handloom units accounting for 109 percent for all the three units on an

average

Rental value of land is the fourth major component accounting for 072

percent of the total cost on an average As a component of fixed cost rental

value of land is seen to attain second position

Other costs (including expenditure on peeco dying and packaging) is

another major input next to rental value of land As a proportion of the variable

cost this cost component is seen to constitute 062 percent of the total variable

cost on an average

Energy cost component insurance cost component and repair and

maintenance cost components per shawl constitutes a minor proportion of the

total cost accounting for 0 12 percent 013 percent and 006 percent on an

average respectively However these costs are seen to attain similar positions

as a proportion of variable and fixed costs respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

522 OutputReturns

Table 3 Category Wise Calculation of Gross and Net Returns of Handloom Units (Rs)

Investment (lacs)

Frequency

Annual Production of shawls (lac Nos)

Total Gross Returns

( Q x Price )

Total Annual cost

Net Returns (TGR-TC)

Average Cost

(per shawl)

Average Net Returns per Shawl (price-Average cost per

shawl)

1 2 3 4 = 3xPrice 5 6=4-5 7 8

Below 40 50 175 758272 401738 356537 230622 202678

40 ndash 90 56 224 970592 455866 514726 203506 229794

90 amp above 24 168 727944 212459 515485 164682 268618

All the three 130 567 24568108 1070063 1386748 199603 233696

Source field survey Q= quantity of shawls TGR= Total gross returns and TC= total cost

The prices of three categories of shawls is Rs 5312 Rs 4408 and Rs 3280 The average price was calculated by taking average of the three categories which amounts to Rs 4333 per shawl

Calculated by adding total fixed cost and total variable cost (table 1) refer to table 1

Table 3 gives us a clear picture of returns that are received from all the three categories of Handloom Units Returns are received by any firm against

the money invested It is evident from the table above that average cost per shawl decreases with the increase in the level of the investment It is

highest in case of small investment Unit Owners and lowest in case of large investment Unit Owners The above analysis shows that Handloom units

are subject to increasing returns to scale

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Table 4 Gross Returns per Rupee of Investment

Total fixed Investment (Rs

lacs)

Total cost

Gross returns Gross returns

per rupee of

investment

1 2 3 4=3divide2

Below 40 401738 758272 188

40 ndash 90 455866 970592 212

90 amp above 212459 727944 342

All the three 1070063 2456808 247

Source field survey

In terms of returns per rupee of investment the gross returns vary between Rs 188 to Rs 342 among

three categories which on average is calculated as Rs 247 for all the three categories Gross returns per

rupee of investment is lowest in case of the small investment Unit Owners ie below Rs 40 lacs

accounting for Rs 188 followed by medium investment Unit Owners with an investment between Rs 40-

90 accounting for Rs 212 and is highest in case of large investment Unit Owners with an investment

above Rs 90 lacs accounting for Rs 342

Table 5 Net Returns per Rupee of Investment

Total fixed

Investment

(Rs lacs)

Total cost

Gross returns

Net returns

Net returns per

rupee of

investment

1 2 3 4=3-2 5=4divide2

Below 40 401738 758272 356537 088

40-90 455866 970592 514726 112

90 amp above 212459 727944 515485 242

All the three 1070063 2456808 1386748 147

Source field survey

Published By Universal Multidisciplinary Research Institute Pvt Ltd

As evident from the table above it is seen that Net returns increase with the increase in the level of

investment from small sized Handloom units to large size Handloom units Net returns per rupee of

investment vary between Rs 088 to Rs 242 among all the three categories of Handloom units with an

average value accounting to Rs 147 Net returns per rupee of investment are high which implies that

shawl industry is a highly profitable business Every one rupee of investment fetches a profit of one and a

half rupee

53 Concluding Remarks

The findings of the study reveal that shawl industry of handicraft sector is highly profitable enterprise

Net returns per rupee of investment at an average account to Rs 147 which implies that every single

rupee of investment fetches a profit of one and a half rupee An important fact that is deduced from the

study is that due to the saturation of employment opportunities in governmenttraditional and

non-governmental sectors the need is to flourish handicraft sector which is not only employment oriented

but highly profitable Besides this sector not only provides employment opportunities to the educated as

well as uneducated people but also enables them to enhance their standard of living It is therefore

important to sustain this industry and create awareness for appreciation of the value of our tradition

among the future generations

References

Ahmad B (2004) ldquoAn Economic Study of JampK Staterdquo City Book Centre Budshah Chowk Srinagar

Ahmed N (1987) ldquoProblems and Management of Small Scale and Cottage Industriesrdquo Deep

publications

Ahmed P ldquoEconomy and Society of Kashmirrdquo Oriental publishing house 2007

Bamzi KNP ldquoSocio-Economic History of Kashmir (1846-1947)rdquo Gulshan books 1987

Barekh R K (2005) Importance and Potentiality of Small-Scale Industries in Nagaland Concept

Publication House New Delhi

Beyer John (1972) An Economic Framework for Project Analysis in India Ford Foundation New

Delhi

Emokaro C O et al (2010) ldquoProfitability and Viability of Cat Fish Farming in Kogi State Nigeriardquo

Research Journal of Agrcultural and Biological Sciences 6 (3) 215-219

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Mishra SN and Beyer John (1976) ldquoCost Benefit Analysis- A Case Study of Ratnagiri Fisheries

Projectrdquo Hindustan Publishing Corporation New Delhi

Darakshan (2011) ldquoA study of Handicraft Industry in JampK ldquo A journal of advances in management IT

and social sciences Vol 1 issue 4 pp 64-70

Hamid S and Haq I (2014) ldquoCost and Return Analysis of Handicraft Sector in JampK State Indiardquo Vol 1

Issue 1 p 22-27 Sai Om Publications

Hansohm D and Karl S M (1985) ldquoPromotion of Rural Handicrafts as a Means of Structural

Adjustment in Sudan with special reference to Darfur region

Mahendra et al (2008) ldquoEconomics of Handloom Weaving A field study of Andhra Pradeshrdquo EPW Vol

X LII No 21 May 24-30 pp43-51

Soundrapandian M (2002) Liberalisation in Small Scale Industries- Needs and Issues Third Concept

Vol No 25

Sunita S (2010) ldquoRole of handicraft industry in production employment and export promotion A case

study of Jammu and Kashmir staterdquo Kashmir journal of Social Sciences Vol 4 2010 pp4361

Ted B and Marina Krivoshlykona (2006) ldquoGlobal market Assessment for Handicraftsrdquo Vol I P 23

WEBLIOGRAPHY

http wwwgooglecom

http wwwecostatjknicin

http wwwjkhandicraftscoorporationnicin

http wwwjkslbccomgoiSchemes

http wwwgeositescomhtml

http wwwministryoftextilesgovin

http wwwjkindustriescommercenicin

http wwwepworgin

http wwwwikipediaorgvikihandicraftsjk

http wwwjkslbccom

http wwwjandkplanningcomhandicrafts

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Appendix Tables

Table 1A Age Profile of the Unit Owners

Source Field survey

Table 1B Education Level of the Unit Owners

Education level Frequency Percentage

Illiterate 10 769

Elementary 34 2615

Secondary 54 4153

Higher secondary 21 1615

Graduate 11 846

Post Graduate Nil 000

Total 130 100

Source Field survey

Table 1C Nature of Ownership of the Unit Owners

Proprietorship Frequency Percentage

Single 110 8461

Joint 20 1538

Leased 0 000

Total 130 100

Source Field survey

Age (years) Number of Unit Owners Percentage

Below 18 0 00

18-60 110 846

60 and above 20 154

Total 130 100

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Table 1D Financial Source of the Respondents

Source Frequency Percentage

Banks 48 3692

Own Capital 77 5923

Others 05 384

Total 130 100

Source Field survey

Table 1E Time of Establishment of Units

Years Frequency Percentage

Less than 10 44 3384

Between 10-20 51 3923

20 and above 35 2692

Total 130 100

Source Field survey

Published By Universal Multidisciplinary Research Institute Pvt Ltd

153 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Soundarapandian5 (2002) reveal in his study that handloom sector continues to remain a

dominant industrial segment of the country inspite of using traditional methods of production

The study further reveals that the protection policies of government have led the weavers to

become dependent entrepreneurs Marina Krivoshlykova6 (2006) conducting an extensive

study on analysis of the global market for handicrafts and the key trends that affect producers

in developing countries and offers recommendations for handicraft sector Emokaro C O et

al (2010) in their combined study have shown that catfish farming is not only profitable but

equally viable in Kogi sate of Nigeria The study reveals that the said trade fetches average

annual gross revenue of $5723 and an average net profit margin of $ 2576 with a net profit

margin of 5146 Sunita Sharma7 (2010) in her study studied ldquoRole of handicraft industry

in the production employment and export promotion The author further says that the state

leans heavily towards the small-scale sector However the small scale industry has shown a

continuous growth in number from 2203 in 1973-74 to 49426 in 2006-07 Also that

handicraft industry occupies important place in the economy of JampK state

4 Data and Research Methodology

Data was obtained from both primary and secondary sources for the present study The main

sources of secondary data are Books and Journals official records of various departments

The primary data was gathered through a field study in district Srinagar by administering a

well designed questionnaire For this purpose stratified random sampling technique has been

brought into operation As per the official records (2008-09) of the Directorate of Handloom

Development there are 3663 handloom units scattered over the entire range of district

Srinagar So two areas with maximum concentration and two areas with minimum

concentration have been purposively chosen in handloom sector This way total number of

Handloom units came to 1299 out of which a 10 random sample from each area

constituting 130 handloom units have finally been chosen for the study All unit holders were

interviewed personally by present investigator at their respective work places

5 Soundarapandian M (2002) ldquoGrowth and Prospects of Handloom Sector in Indiardquo Lal Publications New Delhi 6 Ted Barber and Marina Krivoshlykona (2006) ldquoGlobal market Assessment for Handicraftsrdquo Vol-I P 23 7 Sunita Sharma (2010) ldquoRole of handicraft industry in production employment and export promotion A case study of Jammu and Kashmir staterdquo Kashmir journal of Social Sciences Vol 4 2010 pp4361

Published By Universal Multidisciplinary Research Institute Pvt Ltd

154 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

To workout the profitability of Shawl making units in Handicraft industry following

analytical tools have been used

GR= Q times P NP = GRndash TC

TC = TFC + TVC NPM = x 100

WhereGR = Gross RevenueQ = Quantity of Output P = Price per Unit of Output

NP = Net Profit TPC = Total Cost TFC = Total Fixed Cost TVC = Total Variable Cost

GM = Gross Margin and TR = Total Revenue

5 Results and Discussions

Present study has been discussed under the following two headings

i) Socio-economic profile

ii) Economic Analysis

51 Socio-Economic Profile of Shawl making (Handloom) Unit Owners

511 Age of Unit Owners

Age is an important socio economic factor There is a positive relation between young age

and efficiency in production Young people are more energetic to adopt new ideas and

innovations easily and quickly which in turn leads to high productivity Figure below shows

age profile of Unit Owners in the study area

Figure 1 Age of Unit Owners

It is evident from the above pie chart that majority of the Unit Owners fall in the working age

group of 18-60 ie about 85 percent followed by 15 per cent of Unit Owners who lie in the

age group of more than 60 years and no unit holder was found in the age group of below 18

0

85

15

Age in yearsBelow 18 18-60 60 and above

Published By Universal Multidisciplinary Research Institute Pvt Ltd

155 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

512 Education of Handloom Unit Owners

Education is the most powerful weapon which you can use to change the world (Nelson

Mandela) It is a tool that provides individuals with better understanding and capabilities of

laying productive units which leads to social and economic development Fig 2 shows the

level of education of the Unit Owners

Figure 2 Level of Education of Unit Owners

It is clear from the above diagram that out of the total Unit Owners surveyed about 8 per cent

of Unit Owners are illiterate 26 per cent have received elementary education 42 per cent

have attained education up to the secondary level 16 per cent of Unit Owners are educated up

to higher secondary level and 8 per cent Unit Owners fall in the category of higher levels of

education The study reveals that more than 50 per cent of the Unit Owners are well educated

which shows that Handicraft industry has an immense potential to generate employment for

educated people

513 Nature of Ownership

Ownership pattern is an important factor that determines the growth and development of

small units Different types of ownership of Unit Owners in the study area are presented in the

fig 3 below

8

26

42

168 0

EducationIlliterate Elementary

Secondary Higher secondary

Graduate Post Graduate

Published By Universal Multidisciplinary Research Institute Pvt Ltd

156 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Figure 3 Type of Ownership of Unit Owners

The fig above shows that about 85 percent of the enterprise owners are sole proprietors while

as 15 percent of enterprises have partnership No enterprise was reported operating on

leasehold arrangement

514 Financial Sources

Finance is the life blood of any economic activity Finance plays an important role for the

growth and development of any type of industry The following pie diagram gives

information regarding the sources of finance of the sample Unit Owners

Figure 4 Sources of Finance

The above diagram reveals that a huge percentage of respondents ie 59 per cent have their

own capital about 36 per cent of the Unit Owners take assistance from the banks while as

only a small percentage of Unit Owners figuring 4 per cent borrow (from their relatives and

friends) without any interest

515 Establishment of the Units

85

150

OwnershipSingle Joint Leased

37

59

4

Financebanks own capital others

Published By Universal Multidisciplinary Research Institute Pvt Ltd

157 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the establishment of the units is concerned information from the Unit Owners was

collected through a questionnaire regarding for how long they are involved in the business

The response provided by the respondents is given below

Figure 5 Experience of Unit Owners

As seen in fig 5 majority of the Unit Owners ie 39 per cent (51 units) were involved in the

business between 10 to 20 years followed by 33 per cent (44 units) of the Unit Owners who

have been in the business from less than 10 years and rest 26 per cent of Unit Owners have an

experience of handling the business for more than 20 years (35 units) This shows that from

last twenty years this sector has been able to attract more individuals to set up their own

Handloom units

52 Economic Analysis

The study is designed to make an analysis of the cost structure and return to investment of the

Shawl industry

521 Cost Structure

The input costs as already mentioned are categorized as fixed and variable costs The fixed

costs include machinery land and building insurance charges depreciation etc while as

variable costs include human labor raw material energy charges (power and fuel) repair and

maintenance charges etc The analysis of the data for the empirical estimation of the above

mentioned variables has been done in the context with the level of investment For this

Less than 10

Between 10-20

20 and above

4451

35

0

Time of Establishment Years

Frequency

Published By Universal Multidisciplinary Research Institute Pvt Ltd

158 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

purpose the industrial units have been categorized into three classes as units with an

investment of below Rs 40 lacs between Rs 40 and Rs 90 lacs and above Rs 90 lacs

Published By Universal Multidisciplinary Research Institute Pvt Ltd

159 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 1 Aggregation of Category Wise Cost Structure per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs

Salary to

managerial

staff

Rental

value

Capital Insurance Other

costs

Total Fixed

Cost

Raw

material

Labor cost Energy

Cost

Repair and

maintenance

Other

costs

Total

Variable

Cost

Cost Per

Shawl (Rs)

Below 40 50 2742 1714 362 314 144 5278 219828 3949 265 125 1177 225344 230622

40-90 56 2400 1607 364 279 110 4760 192500 4628 254 116 1250 198748 203506

90 amp above 24 1371 1000 226 164 058 2819 157738 6171 213 115 1190 161863 164682

Average 130 2171 1440 317 252 104 4286 190022 4916 244 119 1206 195318 199603

Source field survey Interest Payments Peeco Dying poly cover etc

To find an estimate of the total cost of Shawl production through Handloom units both the fixed costs as well as the variable costs have been clubbed

together in the table above From table 1 it is evident that with the increase in the size of the investment total cost component per shawl decreases

The cost of manufacturing per shawl is found to be highest for small size Unit Owners accounting for an amount of Rs 230622 followed by medium

size Unit Owners accounting for an amount of Rs 203506 and lowest for large size Unit Owners ie Rs 164682 The inference drawn from the above

analysis is that increasing returns to scale is seen to exist in the Handloom Units involved in the manufacture of shawls

Published By Universal Multidisciplinary Research Institute Pvt Ltd

160 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

Table 2 Category Wise Cost Composition per Shawl (Rs)

Investment

Level (lacs)

Frequency Fixed Costs Variable Costs Total Cost per Shawl

(Rs)

Salary to managerial staff

Rental value

Capital Insurance Other Costs

Total Fixed Cost

Raw material Labor cost

Energy Charges

Repair and Maintenance

Other cost Total Variable Cost

Below 40 50 2742

(119)

5195

1714

(074)

3247

362

(016)

685

314

(014)

595

144

(006)

273

5278

(229)

100

219828

(953)

9755

3949

(171)

175

265

(012)

012

125

(005)

006

1177

(051)

052

225344

(9771)

100

230622

(100)

-

40-90 56 2400

(118)

5042

1607

(071)

3376

364

(018)

765

279

(014)

586

110

(005)

231

4760

(234)

100

192500

(9459)

9685

4628

(227)

233

254

(012)

013

116

(006)

006

1250

(061)

063

198748

(9766)

100

203506

(100)

-

90 and above 24 1371

(083)

4863

1000

(061)

3547

226

(014)

802

164

(010)

582

058

(004)

206

2819

(171)

100

157738

(9578)

9745

6171

(375)

381

213

(013)

013

115

(007)

007

1190

(072)

074

161863

(9829)

100

164682

(100)

-

Average 130 2171

(109)

5065

1440

(072)

3360

317

(016)

740

252

(013)

588

104

(005)

243

4286

(215)

100

190022

(9519)

9729

4916

(246)

251

244

(012)

012

119

(006)

006

1206

(060)

062

195318

(9785)

100

199603

(100)

-

Source field survey

Interest Payments Peeco Dying poly cover etc

Figures in Parentheses indicate percentage share out of total cost

Figures in curly Parentheses indicate percentage share out of fixed costvariable cost respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

161 South -Asian Journal of Multidisciplinary Studies ISSN2349-7858 Volume 2 Issue 4 (SJIF2246)

As far as the cost structure of Handloom units is concerned raw material is the

most expensive item in the production process of Handloom units On an

average raw material constitutes about 95 percent of the total cost Also it can

be seen that as a proportion of variable cost it still constitutes the highest level

of cost component constituting about 97 percent on an average

Human labor cost component appears only next to the cost of raw

material constituting about 251 percent of the total cost on an average This

cost component is found to be high for large investment Unit Owners followed

by medium investment Unit Owners and lowest for small size investment

holders ie 375 percent 227 percent and 171 percent respectively of the total

cost Also on an average for all the three categories it constitutes about 3

percent of the total variable cost

Annual salary cost component is the third major input used in the

Handloom units accounting for 109 percent for all the three units on an

average

Rental value of land is the fourth major component accounting for 072

percent of the total cost on an average As a component of fixed cost rental

value of land is seen to attain second position

Other costs (including expenditure on peeco dying and packaging) is

another major input next to rental value of land As a proportion of the variable

cost this cost component is seen to constitute 062 percent of the total variable

cost on an average

Energy cost component insurance cost component and repair and

maintenance cost components per shawl constitutes a minor proportion of the

total cost accounting for 0 12 percent 013 percent and 006 percent on an

average respectively However these costs are seen to attain similar positions

as a proportion of variable and fixed costs respectively

Published By Universal Multidisciplinary Research Institute Pvt Ltd

522 OutputReturns

Table 3 Category Wise Calculation of Gross and Net Returns of Handloom Units (Rs)

Investment (lacs)

Frequency

Annual Production of shawls (lac Nos)

Total Gross Returns

( Q x Price )

Total Annual cost

Net Returns (TGR-TC)

Average Cost

(per shawl)

Average Net Returns per Shawl (price-Average cost per

shawl)

1 2 3 4 = 3xPrice 5 6=4-5 7 8

Below 40 50 175 758272 401738 356537 230622 202678

40 ndash 90 56 224 970592 455866 514726 203506 229794

90 amp above 24 168 727944 212459 515485 164682 268618

All the three 130 567 24568108 1070063 1386748 199603 233696

Source field survey Q= quantity of shawls TGR= Total gross returns and TC= total cost

The prices of three categories of shawls is Rs 5312 Rs 4408 and Rs 3280 The average price was calculated by taking average of the three categories which amounts to Rs 4333 per shawl

Calculated by adding total fixed cost and total variable cost (table 1) refer to table 1

Table 3 gives us a clear picture of returns that are received from all the three categories of Handloom Units Returns are received by any firm against

the money invested It is evident from the table above that average cost per shawl decreases with the increase in the level of the investment It is

highest in case of small investment Unit Owners and lowest in case of large investment Unit Owners The above analysis shows that Handloom units

are subject to increasing returns to scale

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Table 4 Gross Returns per Rupee of Investment

Total fixed Investment (Rs

lacs)

Total cost

Gross returns Gross returns

per rupee of

investment

1 2 3 4=3divide2

Below 40 401738 758272 188

40 ndash 90 455866 970592 212

90 amp above 212459 727944 342

All the three 1070063 2456808 247

Source field survey

In terms of returns per rupee of investment the gross returns vary between Rs 188 to Rs 342 among

three categories which on average is calculated as Rs 247 for all the three categories Gross returns per

rupee of investment is lowest in case of the small investment Unit Owners ie below Rs 40 lacs

accounting for Rs 188 followed by medium investment Unit Owners with an investment between Rs 40-

90 accounting for Rs 212 and is highest in case of large investment Unit Owners with an investment

above Rs 90 lacs accounting for Rs 342

Table 5 Net Returns per Rupee of Investment

Total fixed

Investment

(Rs lacs)

Total cost

Gross returns

Net returns

Net returns per

rupee of

investment

1 2 3 4=3-2 5=4divide2

Below 40 401738 758272 356537 088

40-90 455866 970592 514726 112

90 amp above 212459 727944 515485 242

All the three 1070063 2456808 1386748 147

Source field survey

Published By Universal Multidisciplinary Research Institute Pvt Ltd

As evident from the table above it is seen that Net returns increase with the increase in the level of

investment from small sized Handloom units to large size Handloom units Net returns per rupee of

investment vary between Rs 088 to Rs 242 among all the three categories of Handloom units with an

average value accounting to Rs 147 Net returns per rupee of investment are high which implies that

shawl industry is a highly profitable business Every one rupee of investment fetches a profit of one and a

half rupee

53 Concluding Remarks

The findings of the study reveal that shawl industry of handicraft sector is highly profitable enterprise

Net returns per rupee of investment at an average account to Rs 147 which implies that every single

rupee of investment fetches a profit of one and a half rupee An important fact that is deduced from the

study is that due to the saturation of employment opportunities in governmenttraditional and

non-governmental sectors the need is to flourish handicraft sector which is not only employment oriented

but highly profitable Besides this sector not only provides employment opportunities to the educated as

well as uneducated people but also enables them to enhance their standard of living It is therefore

important to sustain this industry and create awareness for appreciation of the value of our tradition

among the future generations

References

Ahmad B (2004) ldquoAn Economic Study of JampK Staterdquo City Book Centre Budshah Chowk Srinagar

Ahmed N (1987) ldquoProblems and Management of Small Scale and Cottage Industriesrdquo Deep

publications

Ahmed P ldquoEconomy and Society of Kashmirrdquo Oriental publishing house 2007

Bamzi KNP ldquoSocio-Economic History of Kashmir (1846-1947)rdquo Gulshan books 1987

Barekh R K (2005) Importance and Potentiality of Small-Scale Industries in Nagaland Concept

Publication House New Delhi

Beyer John (1972) An Economic Framework for Project Analysis in India Ford Foundation New

Delhi

Emokaro C O et al (2010) ldquoProfitability and Viability of Cat Fish Farming in Kogi State Nigeriardquo

Research Journal of Agrcultural and Biological Sciences 6 (3) 215-219

Published By Universal Multidisciplinary Research Institute Pvt Ltd

Mishra SN and Beyer John (1976) ldquoCost Benefit Analysis- A Case Study of Ratnagiri Fisheries

Projectrdquo Hindustan Publishing Corporation New Delhi

Darakshan (2011) ldquoA study of Handicraft Industry in JampK ldquo A journal of advances in management IT

and social sciences Vol 1 issue 4 pp 64-70

Hamid S and Haq I (2014) ldquoCost and Return Analysis of Handicraft Sector in JampK State Indiardquo Vol 1

Issue 1 p 22-27 Sai Om Publications

Hansohm D and Karl S M (1985) ldquoPromotion of Rural Handicrafts as a Means of Structural

Adjustment in Sudan with special reference to Darfur region

Mahendra et al (2008) ldquoEconomics of Handloom Weaving A field study of Andhra Pradeshrdquo EPW Vol