Amazon’s ecommerce Empire_FINAL [Autosaved]

-

Upload

rachelle-beckner-cfre -

Category

Documents

-

view

335 -

download

0

Transcript of Amazon’s ecommerce Empire_FINAL [Autosaved]

Amazons ecommerce empire

Amazons E-commerce EmpireTeam 4:Rachelle Beckner, Lisa Farmer, Joseph Tatta, Krista Toutant

1

Amazons HistoryFounder and CEO Jeff Bezos started Amazon.com's online store in July 1995.The company was incorporated in 1994 in the state of Washington and reincorporated in 1996 in Delaware. The Company's principal corporate offices are located in Seattle, Washington.In May 1997, Amazon.com became an IPO and listed on the Nasdaq under the symbol AMZN. The price of stock was $18, which became $1.50 after stock splits on June 2, 1998, Jan. 5, 1999 and Sept. 1, 1999.The company didnt turn a profit, though, until 2001.

2

Amazons Fun FactsBezos chose the name Amazon.com because website listings appear in alphabetical order.Amazons warehouses have more square footage than 700 Madison Square Gardens and could hold more water than 10,000 Olympic pools.Amazons logo was creatively designed to show a smile that goes from A to Z; this signifies that the company is willing to deliver everything to everyone, anywhere in the world.Amazons unique users are 5x more valuable thaneBays. Amazons average unique user brings in about $189, while eBays brings in just $39.

3

Amazons secret weaponsThere is one main focus for Amazon that is the foundation its success: operating as a customer-centric company.This secret is identified in their corporate mission statement: We seek to be the Earths most customer-centric company for our four primary customers sets: consumers, sellers, enterprises, and content creators.As an ecommerce site, Amazon dominates the marketplace. There are several reasons for how they became this ecommerce powerhouse.User experience is first priority. They individualize the experience for each shopper.Shoppers experiences are individualized with Items of Interest and Recommended Products, which are based on your past searched and purchases.Amazon Founder, Bezos, believes strongly in testing everything multiple times.User reviews provide consumers with word-of-mouth feedback and help them determine what purchases to make.

4

Business ModelsAmazon has a traditional Merchant Model business model based on Dr. Michael Rappas theory.Currently, Amazon.com exists as a virtual merchant selling in that it operates solely over the web. They have successfully gained a large market share because of their vast offerings, stellar customer service and generous return policy.However, Amazon is exploring other business models to grow their business, including the Click-And-Mortar, with a traditional brick and mortar business with a web storefront.

Click-and-MortarAmazon has adopted a new business model and will house its first brick-and-mortar establishment in New York City.The building is located on the same street as Macys in NYC and opened in time for the holiday shopping season.With this approach, Amazon hopes to capture more market by being accessible to consumers who like the in-store experience and as a site where people can purchase online and pick up their items at the store.This is a trial run with the new business model. Amazon will do a project analysis to determine the ROI of the project and whether it will be expanded to other locations.New York is giving Amazon a $5 million dollar tax credit to bring 500 jobs to the city.

6

Primary Business ModelsRetail The company started with e-books and quickly expanded to electronics and other goods.Amazon Marketplace allows merchants to offer goods through an online shopping mall.Amazon Web Services Cloud services, SQS, etc.

Retail Enterprise StrengthsCompetitive Prices Amazon typically offers the best prices for items.

Convenience -- With the Prime membership, customers can receive free two-day shipping and easy returns.

Expansive Selection Amazons selection of goods is unrivaled by their competitors.

8

Retail Competitors

9

Amazon MarketPlaceAmazon operates an online marketplace, where merchants can sell their goods much like you would see in a traditional shopping mall or eBay or another online auction site.

10

Amazon Web Services (AWS)Amazons Web Services are extensive from cloud storage to virtual desktops to computing and more.Amazon aims to be faster and cheaper than other cloud services and IT enterprise companies.

AWS: Competitors Microsoft is a big competitor for this service that Amazon offers.Google also is dabbling in the Cloud Service arena.Apple is also a rival for cloud services with the long-established iCloud.Salesforce.com is a leading provider in their respective markets of IaaS and SaaS.

12

Horizontal IntegrationAmazon continuously strives to have competitive advantage. Its latest trend is to integrate horizontally.A December 11, 2013 Wired article illustrates Amazons horizontal integration (and subsequent threat to UPS) by operating its own fleet of trucks.The trucks will deliver same-day groceries in major cities. This service is called Amazon Fresh.With its own private fleet of trucks, Amazon can reduce its shipping costs, further reduce delivery and return times and increase its marketing presence.

Retail Technology IntegrationThis holiday season, Amazon released information about the extensive robotic system in their warehouses and makes order fulfilling process more efficient.

This concept was discussed in a TED Talk in Boston in July 2011 by Mike Mountz, owner of Kiva. https://www.youtube.com/watch?v=szU2-1infqc

In early 2012, Amazon purchased the Kiva Systems, a Massachusetts based startup that makes warehouse robots and software, to the tune of $775 million. This process automatizes the most mundane part of fulfilling orders. Amazon employees are still responsible for selecting the items and packaging them to fulfill the orders.

14

SWOT Analysis: Strengths

Price friendly Where Amazon is able to sell their products at a discounted rate, thus allowing them to be favored in the e-commerce market.Expanded Selection Where the various vendors demand for retail is increasing, therefore allowing multiple parties to promote items for sale.Convenience Where the ability and ease of use allows consumers to maneuver through the database for items.Lead Time Strategically placed warehouses located through the US, allows products to be shipped while alleviating longer lead times for purchased goods.

SWOT Analysis: WeaknessesNet Margins Amazon has become a worldwide leader in ecommerce, but proven records show that its no more profitable than brick and mortars averaging 3.425% margin from 2007-2010.Self Publication - Amazons self publishing facilities will provide an industry-wide enhancement, but most likely will allow others to profit.Ecommerce only storefront consumers cant try before you buy making some products difficult to sell online (i.e. mattresses, new electronic devices).

SWOT Analysis: Opportunities

Model Adaptability Amazon is structured to show a process for transitioning to cloud and third party services.Kindle Growth Amazons product line, the Kindle, has room to take over an increased portion of market share for E-Readers worldwide.Expanded Market Offerings Amazon FreshHorizontal Integration streamline shipping process and reduce costs as a result of purchasing their own trucking fleet.

SWOT Analysis: ThreatsForeign Competition E-Readers such as the Kindle are viewed as expensive, therefore foreign competitors will take market share.Domestic Competition The services offered by Amazon are also offered by market share leaders in the US.Large competitors are constantly innovating and gaining market share, taking customers away from Amazon.Emerging Tech Start-ups could pose a potential threat as it becomes easier to start an ecommerce business. New overhead costs associated with brick-and-mortar location in NY.

Business Strategy

Fixed Cost StrategyConstant process improvements to eliminate lead times for all items ordered. (i.e. Investment in distribution center expansions worldwide)Low shipping cost drive sales and increase revenue Will continue to expand until entire Market Share is capturedProfit for Amazon and quarterly losses on paper tend to be low at times, but the investment of expanding distribution centers worldwide explain these lossesFixed costs over time change losses on paper to profit, therefore allowing Amazon to show growth and increased revenue

Financial AnalysisAmazons strategy from the beginning has been to focus on long-term sustainability. As a result, they focus on, and have proven to be, very effective at growing revenue and market share in the long term which often comes at the cost of profit margins and paying dividends in the short term.Amazons operating margins are below the closest competitors such as eBay and Wal-Mart. However, investors continue to show confidence in the company and their strategy for the future.

Amazon re-invests its profits back into the business:Massive investments in technology, including a staff of thousands of engineering graduates from top schoolsPurchasing licensing rights for a video libraryBuilding warehouses in strategic locationsPackaging patent that reduces overall shipping costs

20

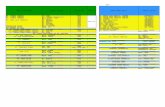

Financial Analysis: Income Statement

21

Financial Analysis: Balance Sheet

Financial Analysis: Cash Flow

Financial Analysis: OutlookOngoing focus on core revenue sectorOnline retailDifferentiated brandContinuous innovation will drive profitabilityExpanded product offeringsShipping & Delivery ServicesPartnership with USPS and othersAmazon Web Service (AWS)KindleAmazon App

Financial Analysis: Outlook

As evidenced by the strong stock price (currently around $313 per share), more investors are buying into Amazons business plan.

25

Summary

A look back through time shows just how quickly the virtual world changes. Just when you think we have seen it all, the next innovation arrives and it is bigger and better than that before it.

26

Recommendation; Look to the futureDrone Service Amazon Prime AirService will deliver customer orders via flying robotsQuick one hour delivery timeCan handle items up to 5 lbs. and travel within a 10 mile radiusIssues to work out yet (weather, FAA, people shooting at them)

Focus on historically sound business techniquesFocus on growth (acquisitions and organic)Continue to be a customer-focused organizationIntroduce anew tag line coaxing buyers automatically go to Amazon.com firstSeek exclusivity rights to popular productsSold exclusively at Amazon and Amazon.com

27

ConclusionBy continuously finding ways to innovate Amazons strong hold on the market will be difficult to compete with. Patience and careful planning, reinvesting earnings back into the company for growth and opportunity, Amazon is arming itself to take the retail game to higher ground.

28

References:Wall Street Journal, December, 5, 2014, Amazon to Open First Brick and Mortar Site, http://online.wsj.com/articles/amazon-to-open-first-store-1412879124Amazon.com, December 5, 2014, FAQ, http://phx.corporate-ir.net/phoenix.zhtml?c=97664&p=irol-faq#6986Wired Magazine Online, December 2, 2014, Amazon Reveals the Robots at the Heart of its Epic Cyber Monday Operation, http://www.wired.com/2014/12/amazon-reveals-robots-heart-epic-cyber-monday-operation/Wired Magazine Online, December 2, 2014, Amazon Drones Are Useless. But Its Trucks Could Crush UPS, http://www.wired.com/2013/12/amazon-fresh-trucks/Wikibon, November 15, 2014, Cloud Computing 2013: The Amazon Gorilla Invades the Enterprise, http://wikibon.org/wiki/v/Cloud_Computing_2013:_The_Amazon_Gorilla_Invades_the_EnterpriseForbes.com, November 15, 2014, 6 Things Online Retailers Can Learn from Amazon, http://www.forbes.com/sites/groupthink/2013/09/24/6-things-online-retailers-can-learn-from-amazon/Funding Universe, December 2, 2014, Amazon.Com, Inc. History http://www.fundinguniverse.com/company-histories/amazon-com-inc-history/Ecommerce Digest: Amazon Case Study, December 2, 2014, http://www.ecommerce-digest.com/amazon-case-study.htmlJuly 2011 Ted Talk by Mike Mountz, https://www.youtube.com/watch?v=szU2-1infqcWei, Eugene. October 25, 2013. Blog Post Amazon and the Profitless Business Model Fallacyhttp://www.eugenewei.com/blog/2013/10/25/amazon-and-the-profitless-business-model-narrativeAmazon.com Inc (AMZN: NASDAQ GS) http://investing.businessweek.com/research/stocks/financials/financials.asp?ticker=AMZNAmazon: Telling The Story Through Financial Statement Analysis http://seekingalpha.com/article/1847022-amazon-telling-the-story-through-financial-statement-analysisNo Stores? No Salesmen? No Profit? No Problem for Amazon. http://www.technologyreview.com/news/520801/no-stores-no-salesmen-no-profit-no-problem-for-amazon/Be afraid, Amazon competitors: Retail giants critics misunderstand the brilliant business model http://www.salon.com/2013/11/05/be_afraid_amazon_competitors_retail_giants_critics_misunderstand_the_brilliant_business_model/Amazon Gets $5 Million From N.Y. to Bring 500 Jobs to Manhattan http://www.businessweek.com/news/2014-12-05/amazon-gets-5-million-from-n-dot-y-dot-to-bring-500-jobs-to-manhattan10 Mind Blowing Facts About Amazon.com http://www.businessinsider.com/10-mind-blowing-facts-about-amazoncom-2013-3?op=1

![Udara Sekeliling Kita [Autosaved] [Autosaved]](https://static.fdocuments.net/doc/165x107/5572026e4979599169a37d85/udara-sekeliling-kita-autosaved-autosaved.jpg)

![Base isolation.ppt [Autosaved] [Autosaved]](https://static.fdocuments.net/doc/165x107/587319861a28ab673e8b5ddd/base-isolationppt-autosaved-autosaved.jpg)

![Arc therapy [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/55a758ab1a28ab67458b4586/arc-therapy-autosaved-autosaved.jpg)

![Man of steel [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/5551d154b4c905922b8b51a1/man-of-steel-autosaved-autosaved.jpg)

![Presentation3 [Autosaved] [Autosaved]](https://static.fdocuments.net/doc/165x107/577d2e691a28ab4e1eaef4b4/presentation3-autosaved-autosaved.jpg)

![ATC ppt [autosaved] [autosaved] [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/558ca444d8b42a27548b465c/atc-ppt-autosaved-autosaved-autosaved-autosaved.jpg)