Almaden 2011 - World Without Jobs v2r12

-

Upload

doug-mcdavid -

Category

Documents

-

view

215 -

download

0

Transcript of Almaden 2011 - World Without Jobs v2r12

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

1/24

Vision of a World without Jobs

Doug McDavid

Submitted forCo-evolution of Future Technologies and Regional Skill-Job-Career Landscapes:

Connecting Frameworks, Theories, and ModelsIBM Almaden Research Center, September 27, 2011

AbstractThis paper calls attention to the changing nature of work in the 21st Century and proposesa services-based money system that is intended to release an enormous source of pent-upvalue creation into the economy at large. This paper also contains some cautionarythoughts about the dangers of corruption whenever economic interests are at stake.

JobsThe political mantra of the day is Jobs! Jobs! Jobs!. In the U.S. political media,Republicans and Democrats attack each other over the lack of progress on the job-creation agenda. But really, that is justsoooo 20th Century! I want to consider here aworld withoutjobs. Some may think that is less a vision than a nightmare. But such asituation represents change for the better in many important ways.

The end of the job as we know it

The typical job for most people over the last several decades involved a pre-defined,long-term, open-ended relationship between employer and employee. This prepackaged

work stream comes with a job title and qualifications, compensation range and worklocation. In most corporations and other enterprises this description and the use of it forhiring purposes are administered by some human resources department.

It seems rather obvious that the era of the job as we know it (JAWKI) is fast fadingaway. When I started my career at the end of the 1960s it was still expected that peoplewould most likely retire after a nice long career in the same field, and most often with thesame company or public sector employer. Since then the implied or expressed job-for-life pact has become very rare. Factors driving the trend toward obsolescence of thetraditional job are manifold and diverse. The instability of the financial universe haspenetrated through the fabric of human activity, to the point that everything seems

unstable, not least the comfortable old stable JAWKI. Globalization and the power ofcustomers combine to drive corporations to compete on price leads to a relentless need toreduce costs of employing people. Any way to increase productivity (which can be readas reduce labor expense) through information technology and/or robotics is veryattractive. At the same time, the world has shrunk to the point that corporations have theability to move work across the globe in a form of open-ended international arbitrage.This dual focus on cost often creates a race to the bottom, which makes things verydifficult for companies and even more damaging to the JAWKI.

Copyright 2011 DougMcDavid Enterprises 1

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

2/24

Technology is part of the problem and part of theanswer

Technology affects the JAWKI in various ways, in both detrimental and beneficial waysfor work and the wellbeing of workers. Robotics and webs of information technologyhave simply overtaken whole categories of jobs. This follows on the myriad ways that

technology has displaced previous generations of jobs for at least a couple of hundredyears. Where are the buggy-whip makers? Where are the radio vacuum tubemanufacturers? The nature of jobs keeps changing as value production migrates awayfrom physical production and towards information (e.g., 3D printing puts a premium onthe design rather than the resulting physical artifact).

At the same time, recently created jobs have been information-saturated like neverbefore. As the nature of work depends more and more on the brains and the knowledgeof workers, those workers themselves become more able to arbitrage opportunities tooptimize their interest level and compensatory regime. This puts technology and theknowledge worker in a potentially enhancing virtuous circle. This marks a glimmer of a

vision of an upward spiraling world, while the JAWKI continues to decline.

It is fair to say that were all living in the clouds. This includes cloud computing in thetechnical sense, with powerful computing resources at our fingertips. It also means thatwe increasingly inhabit clouds of information and relationships with people all over theglobe. Social networking technology abounds, making it possible to interact with anyoneelse on the planet, 24/7. The question this raises is whether anybody is really doinganything in those networks, or just talking? That social networking has been almosttotally monetized by loosely related advertising for goods and services calls in questionwhether a worthwhile business model lies behind all this chatter.

Service opportunities in abundanceUnder the conditions outlined above it is pretty clear that organizations need approachesthat combine both resilience and adaptability in order to achieve self-sustainment in theface of extreme uncertainty. Strangely enough these terms (resilience and adaptability)are often taken as synonyms. At least as used here resilience indicates the ability towithstand a shock and rebound, or snap back like a rubber band to a previous state.Adaptability, by contrast, confronts shocks and external changes by changing theorganization to better suit the new situation.

The dominance of the services paradigm in public and private sectors forms thefoundation of alternatives to the JAWKI. The services perspective supports bothresilience and adaptability. Its not that services cannot be performed by individuals intraditional job descriptions. But those quite structured descriptions make it hard fororganizations to change themselves, or adapt to changing circumstances in themarketplace, especially the more they have been optimized to a particular set ofcircumstances over the years. At the same time, even the desire to be resilient in the faceof business setbacks can be thwarted by rigid employment structures that make it hard toscale up or down as circumstances demand.

Copyright 2011 DougMcDavid Enterprises 2

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

3/24

According to Carlotta Perez we are in the second half of a fifth economic long-wavesince the late 18th Century. The current such cycle is based on information andcommunications technologies, which have already passed through the boom and bustphases of the cycle. In the boom phase there is growth of financial speculation narrowly

focused on the technology itself. This leads to a frenzied bubble (or in our case a seriesof them) based on the excitement generated by the promise of the technology.Unfortunately bubbles inevitably burst into crashes, which is no news to anyone who hasbeen paying attention over the last decade. Following the boom and bust, there typicallyemerges a prolonged period of incorporation of the technology into the fabric of society,thereby creating lasting, operational capital appreciation. This is a time of technology-based services that spawn widespread economic benefit so called golden ages. In ourcurrent case, the fifth known iteration of the long wave, the technology (information andcomputing technology) itself supports the growth of knowledge work, which isundeniably service-oriented. Thus the predominance of knowledge-saturated servicestends to break down the paradigm of the JAWKI.

The focus on services is highlighted by Frederic Bastiat, writing the mid-1800s: Thegreat economic law is this: Services are exchanged for services. It is trivial, verycommonplace; it is, nonetheless, the beginning, the middle, and the end of economicscience. (Bastiat, 1860) This seems to indicate that services-orientation is a matter ofperspective, with the pendulum of perception recently swinging strongly back to Bastiatsposition that the service is the fundamental building block of economic activity. Forinstance, the painter of a chassis in an automobile manufacturing plant can be classifiedas a service provider. That is true if the painters are subcontracting to the manufacturer,but it is also true if they are employees performing the service of painting. IBM Researchcan be seen as a service provider within IBM as a computer manufacturer and softwarevendor. Whole industries, such as the electronics industry, have been broken down intomultiple enterprises that provide specialized services to each other in complex supplynetworks. Even agriculture, where most work was clustered in the 19th Century, hasbeen largely industrialized, and as we see, industrialization lends itself to beingdecomposed into constituent services.

Knowledge is at the heart of the effective services approach. The knowledge of the workof producing, say, consumer electronics products, divides among multiple players, whointegrate and reintegrate for every product or client service offered and created. Thisrequires knowledge of the various specialized steps, for one thing. It also requires theknowledge of how to orchestrate these various steps to achieve the desired result.

This knowledge saturation is further emphasized by something that I choose to call theOxygen Rule of Services. This rule goes beyond the so called Golden Rule, whichpresents the proposition that a person should treat others the way he or she would want tobe treated. My reformulation states that the most successful service providers will beable to treat their clients as those clients would prefer to be treated. This implies thatservice providers should know their clients so well that they can perceive and evenpredict how their clients will want to be treated. I call this the oxygen rule because it

Copyright 2011 DougMcDavid Enterprises 3

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

4/24

breathes the breath of life into the services relationship. Of course, it also implies achallenging degree of knowledge of the client, and a strong relationship built on trust.

People are the source of value

Perhaps the most hopeful aspect of our current global system lies in the abundance of

work to be done. Problems proliferate, and therefore some commensurate level ofopportunity, as well. The key ingredients in a regime of plenitude include problems thatcreate value as they are addressed, on the one hand, and the problem-solvers themselves,on the other. Problem-identifiers and problem-solvers are all people, and there is noimmediate scarcity of people on the planet. Abundance resonates more than scarcity in aworld where the JAWKI is quickly becoming obsolete. As (Baker 2008) states, Peopleare not assets, inventory, or resources; they are individuals entitled to a sense of missionand purpose in their lives, who congregate in organizations to make a difference in thelives of others. The universal need of every worker is to perform meaningful work, in acommunity with others of like mind to make a difference in the world.

The ideas in this paper stem directly from the belief that people, with their talent,knowledge, skills, and experience constitute the ultimate source of value. The highestforms of value arise from problem-solving services. My definition of problem isextremely broad, encompassing any and every situation that creates a desire for change,through some form of service (which we have seen is also defined very broadly). Wemerely lack a direct means to turn that rather ubiquitous value-producing activity intowealth that can be monetized.

Services supportWellbeing at work is part of the spirit that informs this paper. The ability of people towork together within a technology-rich environment that supports their interactions forms

the basis for workplace wellbeing.

Services always embody a public or front office aspect and a private, back office aspect.Front and back office support structures provide capabilities to deal with issues ofubiquity of service and the level of knowledge saturation required. The kind of supportneeded to provide any particular service depends on the nature of the service in question.Physical services that require in-person interaction have different support needs thansoftware-intensive services that can be delivered remotely. My own professionalexperience with consulting-style services in recent decades supplies my primary lens forexamples and perspective, keeping in mind the ubiquity and variation of services acrossindustries and geographies

Both the accounting and investment communities desire to value companies largely basedon their knowledge capital as a future indicator of potential success. There has beenmuch discussion over the years about the value of intangibles, such as brand, customerrelationships, and intellectual capital. The accounting category of goodwill roughlycorresponds to the market valuation of the firm after subtracting the value of tangibleassets, such as plant and fleet. Some people are trying to expand that discussion to amore rigorous accounting for the intangible value of firms. Mary Adams and Mike

Copyright 2011 DougMcDavid Enterprises 4

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

5/24

Oleksak have a book, Intangible Capital, and a web site called the Intellectual CapitalKnowledge Center (ICKC http://www.icknowledgecenter.com/) They present the ideaof a Knowledge Factory inside a firm or other organization, which operates on the factorsof structural capital, relationship capital and human capital. These combine in variousways to create the product and service offerings of the enterprise. In their view of the

Knowledge Factory, these factors become building blocks from which are built theknowledge assets of the firm or organization.

I can think of other analogies that might cover the same factors, but in a manner morepalatable for folks in different fields. A Knowledge Garden might convey the organicnature of these assets, and the nurturing approach required in gardening. Or perhaps theidea of a Knowledge Lab might appeal to people of a scientific bent, as a place whereexperimentation occurs and knowledge is recorded as it is generated. Or some peoplemay want to think in terms of a Knowledge Studio, which gives emphasis to the creative,and even artistic, nature of knowledge design and creation.

The franchise business model epitomizes this approach, where whats being franchised isthe knowledge of the firm. Think of H&R Block a franchise built around knowledge-based services that guide effective and efficient tax return preparation. But also think ofMcDonalds, whose end-user product is surely tangible, but what the franchisees pay theparent for, aside the obvious brand advantage, is the process (frozen knowledge) for allthe preparations required to produce (manufacture) the product that is consumed by theconsumer.

Whether we think of back room support for services as factory, garden, lab, or studio, theability to rehearse service performance provides a critical success factor. In some fields,work without rehearsal would be unthinkable. An orchestra would never assemble in apublic performance the first time they met each other. Likewise theater and sportsperformances are the products of endless rounds of practice and rehearsal. This alsoapplies to a military, who rehearse in order to prepare to face predictable andunpredictable circumstances. By extension, all services could be enhanced byconsciously adding rehearsal to their services support structure. Franchises providetraining and rehearsal for their franchisees whenever they roll out new services. So, forthose who are already rehearsal-oriented, as well as for those that are not, improvementsin the techniques for running rehearsals can enhance almost any business model and itsexecution.

Communities of practice and passion

All of the services support that I have just covered can be found or built into communitiesof practice inside larger organizations. Additionally, within cyberspace (Ning, Facebook,LinkedIn, etc.) instances of communities of passion independent from, or spanning,corporations and other formal organizations, have flourished over the past several years.An example of the latter is the ICKC community that I mentioned, which currently existsas a discussion-oriented electronic community on the Ning network.

Copyright 2011 DougMcDavid Enterprises 5

http://www.icknowledgecenter.com/http://www.icknowledgecenter.com/http://www.icknowledgecenter.com/ -

7/29/2019 Almaden 2011 - World Without Jobs v2r12

6/24

What I propose is that the community (a form of human social system) can serve as acontainment vessel to incubate monetization of internal and external services, but onlywhen such communities of interest, practice or passion are equipped with the properinstitutional and technological capabilities. Individuals will identify and hone theirvalue-capturing abilities through the supporting framework and capabilities provided by

such communities.

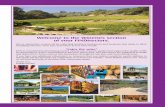

The graphic below provides one view of a consulting-type services practice, to illustrate,at a high level of abstraction, a portion of its primary work and its support structure.

Figure 1

In this simplified partial architecture I emphasize the platform for collaboration thatsupports both front office and back office activities. Practitioners and clients cometogether within the domain of performance to collaborate on engagements of variouskinds. Practitioners also prepare through rehearsal of the particular services to bedelivered to clients. Out of engagement experiences come knowledge assets that arecaptured by a back office function that feeds into a refinement process that I am callingfranchising. The refined (franchised) knowledge is available to be reused insubsequent engagements by downstream practitioners, who rehearse and engage withclients based on this refined material. This captured knowledge also feeds into patternrecognition between the knowledge of what can be offered by the community and therecognized and characterized problems that embody what is known about the clients

needs and desires. In Figure 1 monetization of the performance is shown, withoutfurther details. This is a point that I will return to shortly.

Mystery of capital

On several occasions during my IBM career I was able to explore the relevance of thework of Hernando De Soto (2000) to the discussion of the care and feeding of businessand technical services practitioners. Practices, in IBM parlance, constitute organizationsthat engage with clients in large, expensive projects. Each practice has certain

Copyright 2011 DougMcDavid Enterprises 6

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

7/24

specialized services work that it performs (e.g. security and privacy services, disasterrecovery services, enterprise architecture services, etc.) Each has some responsibility formaintaining its methods and information assets of various kinds. Practitionersthemselves are responsible for the work of capturing lessons learned and maintainingmethods in a kind of knowledge factory, garden, lab, or studio, as mentioned earlier.

IBMs aspirational slogan for years was asset-based services, and the company had afair amount of success in this regard. I know, however, as a practitioner deeply involvedin these activities, it was most frequently extra work, over and above billable client work.The so-called green dollar work with paying clients tended strongly to take precedenceover the blue dollar work of investing in offerings and practices.

The lack of a proper reward structure based on ownership stake for the problem-solversprovides an incentive to take a tick-box approach, which leads to doing the minimalamount of community knowledge development work, in order to maximize billable time.This results in a kind of degradation of the meme-pool. The more successful practicesfind ways to reward knowledge capture and preparation in ways that are meaningful for

the practitioner. On the other hand, the dinner-out with the boss scenario has proved tobe a not-so-effective reward system, when many practitioners most value time at homewith their families.

Such reward systems, or lack thereof, appeared to me and some colleagues to be quiteanalogous to the situations described by DeSoto as he pondered the reasons why somecultures create wealth and others languish in that regard. He uncovered a pattern amongnations that the wealth creators enjoy institutions that support clear title to property, andthe documentation that could be relied upon to validate such ownership, as precursors toleveraging property in various ways in the commercial marketplace. By extension, itseems useful to consider title to intellectual property at the practitioner level, which couldbe leveraged in various ways within internal corporate marketplaces.

An IBM Academy of Technology study made the point that if a market like eBay couldtransform a latent source of value (the dormant stuff in peoples attics and basements)into a worldwide marketplace of monetizable assets, then surely it would be possible,and more powerful, to monetize an intrinsically more valuable latent asset (peoplestalent and knowledge). This was the germ of an idea that has continued to develop alongmore general lines, and which forms the basis of many of the ideas presented here.

Service-based moneyAt this point, I would like to introduce the concept of service-based moneys. This class

of money supports the idea of making a living through performance of service as opposedto making a killing through domination of markets and the life choices of others.Service-money is created at the time services are performed. Let me repeat: Service-money is created at the time services are performed. Yes, created. I will explain howsuch creation can be accomplished later in this paper. Hint: Its hard work.

Copyright 2011 DougMcDavid Enterprises 7

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

8/24

Money in general

At first, lets review a few aspects about money in general. The three classical functionsof money are well-known as medium of exchange, unit of account, and store of value.Another way of classifying money is in terms of commodity money vs. fiat money, wherecommodity money consists of something tangible (such as gold and other metals, but also

cigarettes, goats, etc.), and where fiat money is issued by a jurisdiction and is required tobe accepted (by fiat). Fiat money manifests itself as currency (the physical legal tender greenbacks) or as so-called bank money. There are many other characteristics ofmoneys, such as whether they are reserve currencies, have a sovereign issuing authority,short-term credit-based, political money, equity sharing, private currencies, social money,etc. Greco (2009)

Alternative currencies

Alternative currencies are not new. Often called local currencies, such mechanisms havebeen called upon to supplement or actually replace fiat money in times of stress. One ofthe longest running instances of an alternative monetary scheme is the WIR Bank, a

complementary system in Switzerland that was created in response to the 1929 stockmarket crash. The WIR Bank exists today, circulating the equivalent of roughly a billionSwiss francs. Another longstanding system, the Labour Banks of Japan (Rokin), wasestablished in 1950, initially to help labor and local communities in their post-warrecovery. More recently a number of local currencies and barter systems helped cushionArgentina somewhat from a major collapse of its currency. A number of geographicallylocal currency systems are classified as "Local Exchange Trading Systems" (LETS),whose local currency unit is often equivalent to the dollar. An early currency is IthacaHours, where the unit is set at $10, or one hour of work. Not all alternative currencies aregeography based. A commonly cited example is the airline frequent flyer miles program.A point that emerges from a review of alternative currencies is that the reward, or

denominator of a money consists of the set of things that can be purchased by the money,and from whom such things can be bought.

The phenomenon I call attention-focused saliency applies here. Just as when you buy anew car, all of a sudden it seems that you see that make or model everywhere you go, soit is that once you have become sensitized to the idea of alternative currencies, you arelikely to begin seeing examples in more places than you ever would have expected.

Personal money

A key step in the development of a form of value capture (currency, or money) isconsideration of the four conceptual forms of exchange characterized below:

Things buy things Symmetrical barter

Money buys things typical of moderneconomies

Things buy money goods and services buyanything

Money buys money AKA foreign exchange

Copyright 2011 DougMcDavid Enterprises 8

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

9/24

Table 1

The upper left-hand quadrant represents the classical trading scenario where Ihave some beads and want corn, and you have corn and want beads, so we tradedirectly. This symmetry of haves and wants is what characterizes barter systems.

When money typically comes into the picture is in the scenario where anintermediate value-carrying mechanism is introduced, so that I can buy corn fromsomeone whether or not they want beads, enabled by the fact that I can sell beadsto someone else for the money that I turn around and use for your corn.

In recent years the volume of foreign exchange, where some fiat money is tradedfor some other fiat money (dollars for euros, yen for pounds sterling, etc.) hasbecome astonishingly huge, on electronic exchanges.

This leaves the lower left quadrant where I propose that things (goods andservices) can buy money. We normally do not think of it this way, but when Itake my skills and experience into the marketplace, I am offering to use them tobuy traditional fiat money, in the form of salary or contract fees.

Based on Table 1 I can begin to envision money that has quite different characteristicsfrom sovereign fiat currency that is based on debt. The money class proposed here, i.e.service-money, is based, not on a commodity like gold, nor on debt such as interest-bearing instruments, but rather on performance of talented and educated people. This islikely to be quite controversial, since it is actually a major paradigm shift in our way ofthinking about money.

The simplest form of service-money, intrinsic personal currency, inheres in each of usinnately, simply as human beings. I like to introduce this concept by saying: Youautomatically have money. You contain your personal money already. You generate

additional amounts with your deeds. You control what you put forward to buy what youwant. What you offer is what you are willing to do. The personal money I speak ofarises from talent, experience, subject knowledge, personal relationships and the like.These attributes we each already have, but we dont generally think of them as money.But in point of fact, it is exactly those characteristics and attributes that we each goforward into the market with, literally trying to buy the main thing we are enabled tobuy with them fiat money in the form of salaries, generally via, the JAWKI that we alsosee now are inexorably dwindling.

The next section of this paper explores an example of a scheme that allows this service-based money to come into being. Service-based money, starting with personal money, is

related to knowledge, but not so much in terms of evidence of the knowledge that youhave acquired. It has less to do with what you may have published, and more to do withwhat you can perform in various problem-solving roles. Service-based money appears asa form of capital at the personal level, the community level, and beyond. This contrastswith the whole mechanism of creation of fiat money, which is more correctlycharacterized as debt-based money.

Copyright 2011 DougMcDavid Enterprises 9

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

10/24

The reason I mention debt-based money is to contrast the business as usual creation ofmoney with a different way of creating money that is bringing money into theeconomy. Debt-based money is the normal way that money comes into existence.Central banks make huge loans in the form of selling T-bills and such. This actionprecipitates down through the banking system in the form of re-lending that generates a

money multiplier effect (Griffin 2010). The table below lists some key characteristics ofthe two alternative schemes to bring money into existence.

Debt-Based Money Service-Based Money

Obligation Opportunity

Fosters Competition Fosters Cooperation

Trust Performance

Pay Back Pay forward

Start behind the 8-ball Start ahead of the game

Credit Capital

Compounding interest Compounding the interesting

Money makes money People make moneyPower concentration Power dispersion

Money fosters control Money fosters doing

Fiat Consent

Plutocratic Democratic

Monolithic Diverse

Created by stroke of the pen Created by stoking human effort

War-mongering Peace-mongering

Empowering bankers Empowering problem solvers

Apex consolidation Broad diffusion

Jurisdictional Community of passion

Table 2

So, the first difference with our service-money scheme is that debt-money starts out withan obligation millions of loans have been made, and must be paid back. Service-money, on the other hand is born in the cradle of opportunity, as human beings addressissues of interest to them in a way that causes money to emerge as a result. I am notgoing to write all the sentences that can be written about all the contrasting pairs ofperspective points in the table above. They seem pretty self-explanatory to me, but I amhappy to expound upon them all in the future, on demand.

Communities as money incubatorsI mentioned earlier that communities of practice and passion function as containmentvessels for incubating services capital. I also mentioned that problem-solving peoplecreate much of the value in our economic systems. So, why not base our wealth capturesystem on that foundation? The monetary and monetization system proposed herecaptures the value of people as they perform in service relationships from innovation toinstantiation. Rather than a loan that cascades down through the banking system, this

Copyright 2011 DougMcDavid Enterprises 10

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

11/24

alternative money starts out life as a form of capital. This capital is created incommunities (of practice, etc.) from the valued services performed by and within eachcommunity.

When I talk about local currencies in this context I am talking about a form of local that

goes beyond the geographical or jurisdictional. I am more generally referring to alocality of domain of interest, concept, or field of study. This is not to say that thedomain of interest never includes physical or jurisdictional locale, as in, say, the greenentrepreneurs of Sacramento, or the medical technology experts in Zurich.

What follows constitutes a simplified architecture of the kind of monetization schemethat I am suggesting can be installed into communities of interest, passion, and practice.

Turning personal money into community money

The key to this idea is the process of turning personal money into community money thatcan perform the kinds of functions that support knowledge and services development.

The diagram below shows that a community has a store of capital (community money(CM)) while each member has a store of declared personal money (PM) and a store ofCM. Members each bring some estimated amount of their own PM to the performancearena, from which emerges CM to both the community and the participants, as capital(not debt).

Figure 2

I start from a framework that provides for a cycle between capture of useful informationand performance of useful work. Within this framework, persons have the ability toreveal to the community what talents and skills they bring to the situation. These talents

and skills, offered for exchange within the community, constitute manifestations ofpersonal money. The key action here is the declaration of members capability toperform certain activities, and their personal estimate of the value of those capabilities.This is a choice for members, who may be able to do many more things than they arewilling to perform within the context of this particular community. This initialdeclaration can change over time, as members acquire new skills, or withdraw offers theyno longer wish to perform if and when requested.

Copyright 2011 DougMcDavid Enterprises 11

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

12/24

Personal money transforms into community money through performance of projects thatproduce validated value as viewed by the community. An example would be thedevelopment of a service offering of, say, bovine veterinary practice, by a community,complete with methods, case studies, and rehearsal scenarios. Another example would bea piece of client work, such as introducing a coordinated feeding and inoculation regime

on a dairy farm in Illinois. Each person who wants to participate in such work makes abid. The team itself agrees to the initial value profile of the work in other words, whatthey anticipate value of this project to the community, once successfully completed. Theteam also estimates the value anticipated as part of this project by each participant. Oncethis is agreed to, the work can commence.

As the project progresses there are likely to be points where both the profile of the workand the concomitant value profile, need to be adjusted. At the end of the work, all thepersons involved negotiate a final evaluation of the value produced by the project, andeach persons contribution. This value is added to the community store of its internalmoney, with proportional allocations into each participants account. As these projects

accumulate, so do these community and personal stores of value (capital). Communitymembers then are able to use their respective shares of community money to buy thingsof value in the context of the community. These things include personal rewards ormentoring by other members of the community.

The rewards mentioned above consist of whatever people value in the community and areagreed on by the leadership. Such valued items as reputation, discourse, assignments,travel, cash bonus, etc., can form the basis (denominators) of the reward structure. Acommunity of practice within a consulting-type enterprise can be denominated inutilization credits, where practitioners can bargain for each others time with utilizationoffsets. Community money may be based on discounts of various types. An examplewould be a club of motorcycle aficionados that arranges for its members to offer eachother 20% discounts on each others products and services in their day jobs. Thatdiscount is a form of money, which rewards participation in the community.

The value of the work of articulating the problem or opportunity behind the project,whether the beneficiary is the community itself or some client of some kind cannot beoverstated. The people who perform the work of problem-articulation (problem finders)should be appropriately recognized. People involved in problem recognition anddescription work should be eligible to participate in the value generated for thecommunity by the project, along with the problem-solving members of the team.

A key factor in the success of any community monetization program is the extent towhich it encourages membership retention and participation. As rewards of local capitalaccumulate in the accounts of people in the community, this recognition and tangiblevalue provide positive feedback that is increasingly hard to walk away from.

Ill suggest that this deserves another application of the idea of attention-focused saliency once you understand about local moneys, you start to see them everywhere.

Copyright 2011 DougMcDavid Enterprises 12

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

13/24

Turning community money into fiat money

Although it starts as capital that is retained by the community as well as its individualmembers, service-money needs liquidity features to make it possible to do variouspragmatic things in the marketplace. The mechanism I have described so far does notautomatically create dollars (or euros, yen, rubles, etc.). Other processes are needed in

order to externalize community money from the community into the wider monetarydomain.

Figure 3

The first way to introduce fiat money into a community is by including a client, whoreaps some benefit from the community and its members. This may be in any form thatis acceptable to the community. Perhaps this is in the form of dollars or other fiat money,

or perhaps it is in the form of community money.

Another way to liberate community service-money into the wider world is throughmerchants of goods and services who have enough of an interest to accept thecommunitys money. Consider a community of enthusiasm for the sport of skiing. Sucha community might assume for itself problems such as advocacy of lift-safetyinspections, equipment improvement, ski instructor and ski patrol certifications, etc.These activities might provide enough value to skiing-oriented merchants that themerchants agree to offer discounts in return for community cash. For the merchant this isa good promotion mechanism, at least, and it may be that merchants can find otherrelationships in the skiing marketplace to spend that cash in return (manufacturers,

perhaps, where the merchant access to community service-money helps give themcredibility among skiing-oriented folk). As the value of the community currency growsover time, we might expect to see such relationships spread from equipment vendors, toall sorts of winter gear, to all-terrain vehicles, and even to real estate in ski resorts, allbeing transacted via some combination of fiat and local money.

As practice or passion communities develop good merchant and client relationships, theyhave the potential to evolve into multi-sided enterprises in their own right. The Catalyst

Copyright 2011 DougMcDavid Enterprises 13

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

14/24

Code (Evans and Schmalensee 2007) explores this business model, which is essentiallyan attractor of like-minded people who come to a physical or virtual place do businesswith each other. Think of an on-line stock broker, a speed-dating service provider, orswap meet host. In each of these cases the multi-sided business attracts counterpartieswho do business with each other using the platform provided the business in question.

The skiing-oriented example shows the community playing the role of such a multi-sidedenterprise.

Markets and investments based on community money

We anticipate that this new institutional complex will not really take off and have theimpact it can on society until robust market clearing services emerge. Once that happens,community currencies can be freely exchanged with each other, and with fiat moneys.Once there is a critical mass of communities using service-money schemes, there can betrading among these communities, including buying each others services using their ownand each others currencies.

Figure 4

We can envision further elaboration of this theme as communities of monetized serviceprovision become more deeply entrenched in the economy. As communities and theirsurrounding ecosystems of clients and merchants become more prosperous, investorsmay wish to participate in that prosperity, either because of their interest in communitysubject matter, or simply because of the prosperity. This is likely to stimulate somemechanisms for creating investment instruments for participation by community insidersand outsiders.

Lest this raise eyebrows because of recent experience with exotic derivative(collateralized debt obligations, credit default swaps, etc.), there are safeguards that canbe built into the scheme. One safeguard is automatic, since the performance of humanbeings underlies such derivatives. This is a stronger base than many other derivatives,

Copyright 2011 DougMcDavid Enterprises 14

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

15/24

such as default swaps and tranches of aggregated sub-prime mortgage loans.Additionally, the scheme would benefit from a strict rule that enforces transparency oncommunities that participate in such investment schemes. That is, while communitiesmay start out with work done behind the scenes, such private work is ineligible forinclusion in investment vehicles. To be included in investment instruments and

portfolios, communities must disclose their performance records, including participants,algorithms, negotiation histories and outcome evaluations. Finally, none of this involvesloans and debt, but rather capital formation, so the emphasis is not on risk, but ratherappreciation in the value of communities themselves.

Institution buildingAt this point I should mention that service-money serves as an engine for institutionbuilding. To be clear, this use of the term institutions is not the more commonly usedorganizational meaning. The organizational meaning refers to entities like banks,hospitals, universities, prisons, the Smithsonian, IBM, or the Institute for the Future.Rather, the sense used here denotes importantfeatures of organizations or societies.

This meaning is closer to the way the term is used by institutional economics (North2005), which studies the complex interaction of various economic entities (e.g.individuals, firms, states) whose interactions are mediated and governed by social norms,forms and rules that shape the way things are done. This kind of institution includesmarkets, auctions, generally accepted accounting practices, Sarbanes Oxley, etc. Money-related institutions include such things as interest-bearing loans, fractional reserves,demurrage, free coinage, etc. The ability to create and use service-money integrates anumber of institutional forms, such as capital formation, structured negotiation, andservice to clients.

To unstick our thinking about the nature of needed institutions in this second half of

Perezs long wave, it helps to turn to What We Learned in the Rainforest(Kiuchi &Shireman 2002). The authors, a corporate CEO and a dedicated environmentalist visitedand studied the rain forest of Costa Rica in search of just such a metaphor. They write:From our birds-eye view [parachuting in], the rainforest looked rich in resources. But this first impression was wrong. The Costa Rican rainforest in fact, nearly everytropical rainforest has thin soil virtually devoid of minerals. The forest floor isgenerally starved of sunlight and often of water, which is blocked and diverted by theforest canopy. And fallen vegetation seldom accumulates on the ground long enough tocreate humus to enrich the soil. It is immediately captured by fungi that tear it apart anddeliver its nutrients straight to living things. Out of necessity, rainforests deliverresources to their populations just in time. How can this be? How can a region facing

such immediate resource limits produce [such] diverse abundance? The answer islimits and the feedback and adaptation triggered by limits. In this counterintuitiveperception, scarcity of resources gives rise to a rich proliferation of life forms andinteractions. Service-money imposes similar limits compared to the era of easy credit,but unlimited potential to create diversity of services in idiosyncratic niches.

Service-money supports the institution of legitimate peripheral participation inorganizations. New members enter into a community by involving themselves in non-

Copyright 2011 DougMcDavid Enterprises 15

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

16/24

critical community activities, where they learn about how things are done in thatcommunity, and then graduate into richer and more complex interactions. This serves asa form of apprenticeship, and creates a technology-enabled alternative to the formallearning of pre-packaged subject matter in colleges and universities.

Another institutional benefit of this scheme, as it penetrates society at large, is as a way tohedge the fiat economy. Debt-based moneys bring obligations that invite default, in thelimit. A monetary scheme, marketplace, and economy based on human performance,rather than debt, is immune to default. Either you perform or not. If you do, new capitalis created. If not, not. This provides a kind of performance-based stability and safety netindependent of high flyers, fat cats, and bubble-to-bust scenarios.

From a management perspective it appears that institutions encouraged by service moneyand communities of practice may help to address the issue raised in The Puritan Gift(Hopper & Hopper 2007). The Hopper brothers contrast the era that they call the GoldenAge of American Management (1920-1970) with the age of management by the cult of

so-called experts. Once upon a time, managers were produced by growing up throughtheir whole career within the enterprises they came to lead. This was lost as businessschools began to train and credential the general-purpose manager, supported byconsultant experts in this general-purpose field of study. This pathological detachment iscombatted in our scheme by the need to perform services within communities of servicein order to realize any value proposition. This realigns all participants, even leaders andmanagers, with the underlying purposes and projects of the community, rather thanstanding aside as general-purpose managers, aloof from the reason for being of thecommunity.

Finally, as the service-money economy proposed here grows and thrives, it shouldprovide a kind of venture capital playground, where investors can turn for opportunitiesto find and support up-and-coming socially focused entrepreneurs. This will require adifferent mindset for venture capitalists, as they probe for the most effective communitiesin the management of the service-money they themselves create. The issue will involvenurturing such communities into greater transparency and public exposure, which willallow their currencies to attain liquidity in ever larger market domains.

Institutional dangers

Because this entire systemic proposal has the potential to catalyze pervasive socialchange, it should be designed with precautions, to avoid managerial (or institution-designer) malpractice. We need a set of tests to assure that we are not walking blindly

into ethical quagmires or irreconcilable inconsistencies.

I mentioned earlier the problem of fouling the meme pool by gaming the system that issupposed to care for intellectual capital. There is a specific moral hazard that afflicts thecapture of valuable knowledge within a community of practice. It takes significant effortto create and deliver services innovations. There are often anti-rewards for give back,which is supposed to be an altruistic act of doing work on behalf of the community, whenby far the greater reward comes to work that is paid for by clients. In the typical

Copyright 2011 DougMcDavid Enterprises 16

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

17/24

voluntary knowledge capture regime, a hardworking but powerless person on the frontlines is required (coerced by compensation or promotional retardation) to share or giveback to the practice in the form of experience captured in methods and other informationassets. This creates temptation to hold back knowledge for personal advantage, whilegaming the system with tick-box responses. As we will see, this should raise red flags as

an ethical hybrid enforced largesse provided by those that can least afford to begenerous. I propose that ownership provides an antidote to the moral hazard ofshortchanging the community.

Moral hazards have to do with asymmetrical information that gives unfair advantage toone party in an agreement. This information advantage allows one party to shift risksinappropriately onto other parties. Insurance is intrinsically in the business of moralhazard, by shifting the burden of taking risk onto some other parties. It is clear, forinstance, how this drives up the whole health care system, when no one feelsresponsibility to keep costs to the procedures that truly serve the needs of patients. Arsonresults from temptations engendered by excessive property insurance. Bailouts,

sometimes with the special operative condition of too big to fail, open opportunities forrisky bets, where losses can be laid off on someone elses doorstep.

Once again we have a situation of attention-focused saliency once you start thinkingabout moral hazards, you begin to see moral hazards everywhere. Debt money in generalpresents the moral hazard of borrowing and spending now, while creating a financialburden for someone in the future. This leads to the canonical bailout hazard. Cost-pluspricing schemes lead to the hazard of driving excess cost into the business, because thisincreases both revenue and profit. The institution of endowing companies with the abilityto limit individual liability is a moral hazard on its face. The billable hour in servicesengagements encourages the fraudulent practice of padding time billed, at the expense offocus on the best interests of the client.

Antidotes

Jane Jacobs (1992) provides a fascinating set of moral precepts in herSystems ofSurvival, which, if followed go a long way to immunize commercial behavior. Theseethical systems arise from the two major ways of getting by in the world for humanbeings the takers and the traders. Jacobs claims that the moral precepts in these twosystems were discovered and refined through in an extensive literature scan that reviewedterms and concepts that people regard as moral or ethical behavior. The two, ratherincompatible, systems emerged after removal of seemingly universal precepts (courage,common sense, judgment, competence, perseverance, etc.).

Copyright 2011 DougMcDavid Enterprises 17

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

18/24

Table 3

The two sets of precepts are summarized in Table 3. The key to the bifurcation here istrade. Animals and plants do not trade for a living, and neither do all humans. Manyhumans and all other living systems fall into the taker, or guardian mode. The guardianregime is based on occupying and defending territory (intellectual as well as physical),from which a living is gathered (not traded). The guardian syndrome encompassespolitics and government, the military, religion, academia, etc. Its precepts include theexpectation that the military and civil service are expected to adhere to tradition (whereas

commerce puts a premium on inventiveness). The government guardians dispenselargesse, which is to say redistribution of wealth from some parts of society to otherparts.

Humans are the only ones who have the second survival system commerce, or trade.The basic mindset of the commercial syndrome is to promote comfort and convenienceon the part of customers and clients. Key to that orientation is to keep an optimisticattitude that encourages win/win behavior. The mechanism of accomplishing theprovision of items of comfort is to come to voluntary agreements. This requires honestyby parties to agreements and respect for the contracts that ensue. Commercial endeavorsrequire participants to compete among themselves for business, but when commercial

relations break down and require some force between parties, this should come fromguardians. The relationships in commerce require parties to collaborate easily withstrangers and aliens, although an honest attitude and binding contracts encouragecommercial participants to sometimes dissent for the sake of the task. On the one hand, aprecept for commerce is pursuit of efficiency in an industrious and thrifty manner. Onthe other hand business needs to be open to inventiveness and novelty in enterprisinginitiatives, which in turn requires investment for productive purposes.

Copyright 2011 DougMcDavid Enterprises 18

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

19/24

The main point of Jacobss analysis of the guardian and commerce syndromes is thatwhen they get mixed up and confused, big societal problems emerge. She goes so far asto label such mix-ups as monstrous moral hybrids. This is a form of systemiccorruption, and any significant breach of a syndromes integrity causes some normalvirtues to convert to vices when they are transplanted to the opposite culture. In a

general sense, there is systemic corruption whenever government gets into the business ofbusiness. Likewise, when business essentially buys government officials, there is moresystem corruption from the transplantation of incompatible values. Business practicesthat have come to seem normal in various eras we can now see as transplants of guardianaggrandizement ethics into situations such as mergers and acquisitions, monopolies,conglomerates, leveraged buyouts, and hostile takeovers. With respect to the earlierpoint that insurance in general inhabits the universe of moral hazard, Jacobs ... sooner orlater insurance in guardian hands converts to largesse, which now has become sopervasive that much of our global economic system depends upon.

Applying the antidotes

We are now in a position to consider the issue of how service-money applies Jacobsscommercial precepts as antidotes to moral hazards.

Commercial interests exist to promote comfort and convenience on the part of customersand clients. The way we think about that in service-money communities is that problemfinders and problem solvers continually dwell on the problems of the community itself orits clients, in order to turn problems into wealth-creating solution projects. Whenprojects are seen as abundant opportunities, it is easy to keep an optimistic attitude thatencourages win/win behavior.

Jacobs stresses the need to honor voluntary agreements. The voluntary agreement

institution thoroughly permeates the community structures that will be spawned by ourscheme. Because the processes for turning personal money into community money andthen into fiat money or other exchanges requires transparency, voluntary agreements willbe thoroughly scrutinized with benign intent.

Commercial endeavors require participants to compete among themselves for business,but the participants themselves should leave forceful intermediation to guardians. Thescheme proposed here partially avoids this issue because it is so oriented to cooperationrather than competition. More importantly, the wealth accumulated by communities andtheir participants is in the form of capital held within the community structure. This doesnot present a temptation for theft, since it is not easily separated from its rightful owners

by force or guile.

The relationships in commerce require parties to collaborate easily with strangers andaliens, although an honest attitude and binding contracts encourage commercialparticipants to sometimes dissent for the sake of the task. Our scheme encouragesnegotiation and renegotiations throughout the process of setting up and performing theperformances within projects that give rise to the monetary resources generated by

Copyright 2011 DougMcDavid Enterprises 19

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

20/24

communities. This provides a platform for easy collaboration, as well as ready-madeavenues for expressing creative dissent throughout the process.

Jacobs presents two sets of precepts that represent an essential dynamic tension a yin-yang dichotomy. These two sets are basically efficiency and inventiveness. On the one

hand, the precept to pursue efficiency relates strongly to her statements that businessshould be conducted in an industrious and thrifty manner. In practice, communities willfail to generate their desired results if they take the opposite path of slothful, profligateinefficiency. At the same time, Jacobs tells us that commercial endeavors need to beopen to inventiveness and novelty. This is intrinsic to service-money generators, sincenovel knowledge and uses of knowledge to solve problems constitutes the core of theirvalue proposition. This in turn requires investment for productive purposes, which isexactly what the members of communities of practice and passion do they invest theirtime in activities that they regard as worthwhile. With service-money they generaterewards for this behavior as a matter of course.

FeasibilityWhile I have called this world the without job as we know it a vision, I do believe thisis eminently practical and possible. As we discussed earlier, the need is here now. Thetechnology is generally already in existence to provide the support that is needed forcollaboration platforms, including monetization. The issue is primarily twofold: systemsintegration and social system evolution.

Systems integration

When I say a systems integration project, I have in mind that the IT industry is pretty faralong into the era of the mash-up, so that a whole generation of developers takesintegration fully in stride. At the same time, technologies that can be integrated (mashed

up) continue to proliferate. Ill just mention a few points here, without going into majortechnology architecture discussions.

General purpose computing and communication technologies form the foundation for thevirtualization of the service-money support system. Cloud computing is quicklybecoming the development and hosting environment of choice, and puts powerfulcomputing resources within the reach of everyone via products like Amazon WebServices and Microsoft Azure. Communications capabilities including Skype,GoToMeeting, and new ones every day, are so cheap as to be miniscule considerationsfor services support platforms. Everyone can at least talk to each other, and also see eachother, share screens and videos, etc.

Social networking sites such as Facebook, Ning. LinkedIn, Plaxo are also ubiquitous, andalready provide some primitive support for communities of interest and practice. A keyfactor in mash-ups involving some of these established players (a plug-in app for Ning,for instance) is that they are already rather viral in nature, so that add-on service-moneysoftware can spread painlessly and widely through established channels.

Copyright 2011 DougMcDavid Enterprises 20

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

21/24

Earlier I complained about the seeming superficiality in social networking sites information conveyed, but no work being actually being done. From another perspectivewe do see some very big things being done, as exemplified by the Arab Spring andOccupy everything. Still, when you look at their Facebook pages and Twitter hashtags,there are announcements and pictures and commentary, but not so much of the robust

collaboration required to bring people together for sustained problem-solving efforts.Crowdsourcing services like Kickstarter and Innocentive combine reward structures withproblem-solving, but are not particularly supportive of deep collaboration.

Avatar-based virtual world technologies provide a special kind of platform that exists byvirtue of bundling various features of computing and communications in attractive andcompelling 3-dimensional rendering environments. Various virtual workspaces havebeen around for several years, beginning with all-purpose environments like Second Life,but also more businesslike products like ProtoSphere and Avaya web.alive.Technology-based alternative money schemes already exist, such as PayPal, Bitcoin and

others. Coupon redemption services such as Groupon are currently enjoying a surge ofpopularity. Within the virtual world environments a whole variety of moneys andexchanges have come and gone, including such enterprising endeavors as gold farmingfor virtual world gaming platforms.

Truly semantic technologies have gained traction in various specialized fields, in theform of ontologies, controlled vocabularies, and process standards. Mashing suchcapabilities, including advanced text analytics, will provide service communities withpowerful tools to support pattern matching between problem descriptions and capabilitiesoffered by practitioners within communities of practice.

All of this is still further empowered through the ability to be connected to and throughvarious mobile hardware devices, such as smart phones, smart cards, RFIDs, etc.

As far as I know, even with all of this capability and activity, there is not currentlyanywhere to go to find the package of service-supporting capabilities discussed here. Ifthere is such a source, I would appreciate being informed, because I think I know somethings that can be done with it!

Social system evolution

In addition to the affordances touched on above, there will be endless challenges from asocial system perspective, to bootstrap service-money into existence. For purposes of

stimulating imagination, I thought I would mention a few possible steps in the evolutionof social systems, based on the social innovations weve been discussing.

In the beginning (now), a promising environment leads to some tentativeexperimentation. One or a handful of friendly communities adopt early forms of service-money. Initially they stay within themselves, as local monetization addresses localcommunity needs for service support, such as franchising service methods andperformance platforms. These start with robust reputation systems that feature the

Copyright 2011 DougMcDavid Enterprises 21

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

22/24

strengths and abilities of performers and practitioners. There is some adoption oftangible rewards that are life-enhancing, if not especially life-changing.

As the reputation of service-money spreads, more and more communities adopt (andadapt) service-money systems for their own purposes. Artist colonies and writer

programs (both physically local as well as virtual) adopt programs, which then quicklyspread to museums and theater companies that have been increasingly cash-strapped anddependent on volunteer labor for years. Other volunteer charities and local jurisdictionsstart to get on board, at the same time as consultancies and other for-profit servicesorganizations pick up the beat.

The tax authorities sniff around the edges of a few organizations as more serious volumeof value production begin to cause more serious buzz in the press and the blogosphere.Tax compliance will need to be incorporate, in order to placate these authorities.

Merchants become local currency exchange (LokEx?) centers, exchanging various

currencies, and competing to be the most accommodating to various forms of businessthat are attracted to do business in the vivid marketplaces thus provided.

In a somewhat dubious move, given what we know about moral hazards and monstroushybrids, political campaign workers form communities of issue wonks where they beginto generate Politicos, the currency of grass roots movements. Lobbying groups fundthemselves through local currencies (lokal?), which become quite well-funded, sincelobbying is awash in money looking for ways to make an impact that puts their clients ina good light. This parallels attempts to bolster corporate social responsibility programsthrough enhanced reward structures.

ConclusionsIm afraid that I have forced you readers through a long journey to get to this point. Ionly hope that this proves to be a helpful and meaningful contribution to the discussionabout how it might be possible to create upward spirals of wellbeing and wealth inregional localities as well as within the virtual localities that are now possible with thenear-ubiquitous distance-erasing technologies that we have at our disposal.

To begin, I outlined some rather obvious points about the changing nature of work, in anera when the job as we know it has lost its place of primacy in so many parts of theeconomy. I touched briefly on a variety of forces and economic conditions that aredriving this trend in the workplace.

I claim that there is an enormous, relatively untapped value pool of knowledge-basedactivities that indisputably create value but languish for lack of a market to capture thatvalue. The quantity and quality of this value source dwarfs in comparison the success ofeBay and its ilk as markets for marginal commodities. This situation sets up a vastuniverse of opportunities for monetization via service-money.

Copyright 2011 DougMcDavid Enterprises 22

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

23/24

We have seen that service-oriented communities of practice and passion enable backoffice activities to achieve effective offering development, fully support the front officeinstances of engagement with customers, clients, and eventually merchants and a wholepotential ecosystem of value exchangers. I characterized the back office services supportoperation as largely a knowledge factory (garden, lab, studio) where collaboration can

occur, and the contributions of community members are rewarded for intellectualperformances of problem solving on behalf of the community and its related partners ofall types.

A new form of money service-money performs the role of catalyst in this servicesecosystem. I positioned service-money as a form of capital that problem finders andsolvers literally create in the crucible of service performance by communities. Service-money exhibits various levels of intensity and seriousness, with the ability to evolvealong with communities and their members as they mature and become increasinglyadept at performing to the potential of their talent, knowledge, relationships, andexperience.

In order for this concept to reach its potential, it needs to achieve a significant level ofintegration with other economic systems and structures. This paper touched on that issuebriefly, leaving many details to be filled in.

We began to foresee that the basic service-money system described here could lead toserious institution building and evolution. This, in turn, led to consideration of thepotential dangers involved as such social innovations gather strength. In an attempt todeal with these dangers head-on, this paper took some halting first steps toward aframework for antidotes, leaning heavily on the work of Jane Jacobs on the moralsyndrome of commerce as the trade-oriented system of human survival. Further tentativethoughts applied the antidote framework to the system of creating service-money.

Finally, this paper took a glancing look at the feasibility of service communitiescapitalized via service-money, drawing on examples of existing technologicalaffordances and a gauzy futuristic scenario to invoke images of how it might emerge overthe coming months and years. I expect that as society evolves in the 21st century, we willsee a reversal of Greshams Law, which states that bad money drives out good money. Inthis case I believe that good money will drive out bad, as service-money based ontalented people performing services will put debt-money out of business. But only with atremendous amount of work. Not jobs. Work.

ReferencesAdams, M & M Oleksak. (2010) Intangible Capital: Putting knowledge to work in the 21 st-centureorganization. ABS-CLIO, LLC, Santa Barbara, CA, USA.

Baker, RJ. (2008) Mind over matter: Why intellectual capital is the chief source of wealth. John Wiley &Sons, Hoboken, NJ, USA.

Copyright 2011 DougMcDavid Enterprises 23

-

7/29/2019 Almaden 2011 - World Without Jobs v2r12

24/24

Bastiat. (1860) Cited in: Vargo SL & RF Lusch. (January 2004) Evolving to a New Dominant Logic forMarketing, Journal of Marketing, Vol. 68, 117

DeSoto, H (2000) The mystery of capital: Why capitalism triumphs in the West and fails everywhere else,Basic Books, New York, NY, USA

Evans, D & Schmalensee, R. (2007) Catalyst code: The strategies behind the worlds most dynamiccompanies. Harvard Business School Publishing, Boston, MA, USA.

Greco, TH. (2009) The end of money and the future of civilization. Chelsea Green Publishing Company,White River Junction, VT, USA.

Griffin, GE. (2010) The creature from Jekyll Island: A second look at the Federal Reserve. AmericanMedia, Westlake Village, CA, USA.

Hopper, K. & Hopper, W. (2007) The Puritan gift: Reclaiming the American dream amidst global financialcrisis. I. B. Taurisz & Co Ltd, London, U.K.

Jacobs, J. (1992) Systems of survival: A dialogue on the moral foundations of commerce and politics.Random House, Inc., New York, NY, USA.

Kiuchi, T. & B Shireman (2002) What we learned in the rainforest: Business lessons from nature, BerrettKoehler Publishers, Inc., San Francisco, CA, USA

North DC. (2005) Understanding the process of economic change. Princeton University Press, Princeton,NJ, USA.

Perez, C. (2002) Technological revolutions and financial capital: The dynamics of bubbles and golden ages.Edward Elgar Publishing Ltd, The Lypiatts, Cheltenham, UK.