Akhuwat Presentation

-

Upload

ahmedshuja -

Category

Documents

-

view

218 -

download

2

Transcript of Akhuwat Presentation

Microfinance is defined as financial services

for the poor and low income clients offered by different types of service providers

Microfinance

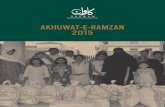

Akhuwat is Pakistan’s largest interest free

microfinance organization which envisions a poverty free society built on the principles of compassion and mutual support.

Akhuwat

In 2001 the idea of Akhuwat was presented before a

group of friends at the Lahore Gymkhana. During the conversation, charging of exorbitant interest rates on microfinance programs aimed at poverty alleviation was being criticized. The idea of initiating an interest free successful microfinance program was brought forth as a challenge and at that point, no one present foresaw the shape this experiment would eventually take. One of the friends pledged a donation of ten thousand rupees, while another friend, Dr. Amjad Saqib, took it upon himself to utilize that donation as an interest free loan.

History:

A poverty free society built on the principles

of compassion and equity.

About Akhuwat: Akhuwat was established in 2001 with the

objective of providing interest free microfinance to the poor so as to enhance their standard of living.

Vision:

Interest-free microcredit: Akhuwat provides

the economically poor with interest free loans so that they may acquire a self-sustaining livelihood. It also provides the skills and support they need to actualize their full potential and abilities

GUIDING PRINCIPLES OF AKHUWAT

The spirit of volunteerism that Akhuwat’s

management and its team members exhibit is indicative of the success Akhuwat achieved within a short span of time.

Spirit of volunteerism:

Since its inception Akhuwat has solely relied upon the philanthropists in extending its services to the community. However, in order to fulfill the increased credit needs of its ever-increasing clientele it is now willing to work with the international donors as well.

Reliance on philanthropy:

An important and novel idea associated with

individual loans is the use of the local mosque/church infrastructure as the center for loan disbursement and as an avenue for community participation.

Linkages with Mosque and Church:

Akhuwat has employed a credit plus approach

by introducing the idea of social guidance for its credit beneficiaries. The purpose of this approach is to help borrowers flourish their small enterprises so that they can lead socially healthier lives than before.

Credit Plus approach:

Akhuwat is governed by a Board of seventeen

members, consisting of philanthropists. The Board meets quarterly to review

operations and take policy decisions. Another salient responsibility of the board is to provide marketing services for Akhuwat and mobilize funds for loans. An Executive Committee consisting of three members meets every month for reviewing all administrative and operational issues of the organization.

Organizational Structure

Cost Structure

Interest : zero

Loan Processing Fee: zero

Profit : zero

Application Fee: Rs. 100 11

.

FAMILY ENTERPRISE LOAN LIBERATION LOAN EDUCATION LOAN HEALTH LOAN EMERGENCY LOAN HOUSING LOAN MARRIAGE LOAN SILVER LOAN

Akhuwat Microfinance Products