Ahmedabad Chartered Accountants Journalcaa-ahm.org/Pdf/Journal/Journal-29.pdf · Ahmedabad...

Transcript of Ahmedabad Chartered Accountants Journalcaa-ahm.org/Pdf/Journal/Journal-29.pdf · Ahmedabad...

Ahmedabad Chartered Accountants Journal August, 2013 253

Journal CommitteeCA. Rajni M. Shah CA. Ashok C. Kataria

Chairman ConvenorMembers

CA. Bharat C. Mehta CA. Hemant N. Shah CA. Jayesh C. SharedalalCA. Shailesh C. Shah CA. Yogi K. Upadhyaya

CA. Prakash B. Sheth [President (Ex-Officio)] CA. Chintan M. Doshi [Hon. Secretary (Ex-Officio)]

Volume : 37 Part : 05 August, 2013

In this issue

E-mail : [email protected] Website : www.caa-ahm.org

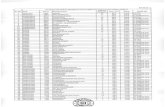

Contents Author's Name Page No.Editor's Views CA. Rajni M. Shah 255

President's Message CA. Prakash B. Sheth 257

Art ic les :Corporate Debt Restructuring CA. Nesal H. Shah 258

Estate Planning and Procedure CA. Helly Parikh 263

Controversies and Issues in Business Deductions under CA. Sunil H. Talati 267Chapter IV (Sections 30 to 36)

Columns :More Unknown Than Known CA. Jayraj Pandya & 276

Aatman Shah,Final C.A.Student

Procedures - Formation of Private Limited Company CA. Ajit C. Shah 279

Glimpses of Supreme Court Rulings Advocate Samir N. Divatia 281

From the Courts CA. C. R. Sharedalal & 283CA. J. C. Sharedalal

Tribunal News CA. Yogesh G. Shah & 286CA. Aparna Parelkar

FEMA & NRI Taxation CA. Rajesh H. Dhruva 290

Controversies CA. Kaushik D. Shah 293

Judicial Analysis Advocate Tushar P. Hemani 294

Sta t u te Up date(a) Service Tax Judgements CA. Ashwin H. Shah 299(b) Fema Update CA. Savan A. Godiawala 300(c) Value Added Tax CA. Bihari B. Shah 301(d) Corporate Laws CA. Naveen Mandovara 303(e) Circulars & Notifications CA. Kunal A. Shah 304

From Published Accounts CA. Pamil H. Shah 305

News Lounge CA. Arpit Shah 308

Association News CA. Chintan M. Doshi & 310CA. Abhishek J. Jain

Report on the 40th Residential Refresher Court at Banglore CA. Chandrakant Pamnani 311Interactive Session with CPC, Bangalore CA. Jignesh J. Shah 312Updates from ICAI CA. Uday I. Shah 278On the Website of CAA 266

Ahmedabad Chartered Accountants Journal

Ahmedabad Chartered Accountants Journal August, 2013254

AttentionMembers / Subscribers / Authors / Contributors

1. Journals are carefully posted. If not received, you are requested to write to the Association's Office withinone month. A copy of the Journal would be sent, if extra copies are available.

2. You are requested to intimate change of address to the Association's Office.

3. Subscription for the Financial Year 2013-14 is ` 400/-. Single Copy (if available) ` 40/-.

4. Please mention your membership number / journal subscription number in all your correspondence.

5. While sending Articles for this Journal, please confirm that the same are not published / not even meantfor publishing elsewhere. No correspondence will be made in respect of Articles not accepted forpublication, nor will they be sent back.

6. The opinions, views, statements, results published in this Journal are of the respective authors / contributorsand Chartered Accountants Association, Ahmedabad is neither responsible for the same nor does itnecessarily concur with the authors / contributors.

7. Membership Fees (For ICAI Members)

Life Membership ` 7500/-

Entrance Fees ` 500/-

Ordinary Membership Fees for the year 2013-14 ` 600/- / ` 750/-

Financial Year : April to March

Published ByCA. Rajni M. Shah,on behalf of Chartered Accountants Association, Ahmedabad, 1st Floor, C. U. Shah Chambers, Near GujaratVidhyapith, Ashram Road, Ahmedabad - 380 014.Phone : 91 79 27544232Fax : 91 79 27545442

No part of this Publication shall be reproduced or transmitted in any form or by any means without thepermission in writing from the Chartered Accountants Association, Ahmedabad.

While every effort has been made to ensure accuracy of information contained in this Journal, the Publisheris not responsible for any error that may have arisen.

Professional AwardsThe best articles published in this Journal in the categories of 'Direct Taxes', 'Company Law and Auditing' and'Allied Laws and Others' will be awarded the Trophies/ Certificates of Appreciation after being vetted byexperts in the profession.

Articles and reading literatures are invited from members as well as from other professional colleagues.

Printed : Pratiksha PrinterM-2 Hasubhai Chambers, Near Town Hall, Ellisbridge, Ahmedabad - 380 006.

Mobile : 98252 62512 E-mail : [email protected]

Ahmedabad Chartered Accountants Journal August, 2013 255

Objection, Your Honour!The two recent judgments delivered by the Supreme Court of India, one relating to the disqualification of tainted MPsand MLAs in contesting elections and the other relating to the ban of caste based rallies has caught many eyeballs.Many instances have been noticed in the recent times whereby the Apex Court or the High Court tried to step into theshoes of the executive and legislature, which include the CBI being called a ‘Caged Parrot’ or the ban on sale of Acidor the Supreme Court deciding the residence of ‘Lions’ or the High Court on its own motion instructing the CBDT toresolve the critical issues faced by the tax payers to name a few.

On a closer scrutiny of all the above judgments, a common thread that emerges in most of above cases is that the Courthas acted on its own motion. There are many evidences where the judiciary is commenting and passing strictureswhich may be many a times considered unwarranted.

The outgoing Chief Justice of India, Mr. Altamas Kabir recently opined that the SC steps in only when the legislaturefails to do the job. When someone does not work, the court has the power to tell him what to do and there happens tobe no case of overreaching.

Another botheration that is affecting India’s Judiciary system is the backlog of the cases. As per the website of theSupreme Court of India, there were 69,446 pending cases as on 30th June 2013 out of which 52,100 matters are morethan one year old. Vacationing may help to give a new life to oneself and give our sagging spirit a boost. However, itis still prima facie unreasonable for their Lordships of the Indian Judiciary to go on long vacations even as the numberof pending cases are rocket high.

The 230th Law Commission of India Report of Judicial Reforms, remarks that if the working hours are extended even byhalf – an – hour, a real impact could be seen on the rates of pending cases.

The words of Frank Tyger are worth noting in the Indian Scenario, “When you like your work, everyday is a holiday”.If everyone in the judiciary take Tyger’s words by heart, then surely the number of pending cases can be reduced to agreat extent.

The continual shifting of the judges of the Courts also adds to the backlog of cases. Even though the retiring judgesoften have a habit of wrapping up the cases and delivering judgments that may have been on their plate for a while,clearing the mountain and the handover period can add up to an administrative nightmare.

Every second phrase that we hear from a lawyer/advocate is that “Justice delayed is justice denied”. But the milliondollar question is whether the said phrase has religiously been followed by the judiciary? A trip through the Indian CourtSystem, is as close as experiencing eternity as a living soul can get.

Even if there are potholes, the commonality takes the matter to the Court and the judges entertain such cases. Inaddition they also make strong comments about the poor quality of administration. In the process, knowingly orunknowingly, the judiciary is causing a great damage to the reputation of the government and reducing the reverenceof the persons holding high and responsible positions, in the eyes of the citizens, even if the same are truth.

Even today, every Monday and Friday are called as ‘Miscellaneous Days’ or the days on which all the judges hear freshcases and decide which to admit for waiting in a queue or which ones should be dismissed forthright.

Many times it has been observed that the judgments delivered by the courts have a far reaching impact which mighthave not been taken into consideration at the time of delivering the judgments. Recently, the Delhi HC held in the caseof DLF Constructions Limited that trading in derivatives by companies is a speculative transaction in view of Explanationto Section 73 of the Act. The court overlooked the provisions of Section 43(5)(d) which has been inserted much afterexplanation to Section 73. As a result of the judgment, many AOs may rely upon the same, and take the matter to thecourt resulting in pending litigation for several years and in case of multiple tax payers. Intellectual arrogance orintellectual dishonesty is obvious when their Honours decide without being bound by principles of ‘stare decisis’ orprecedent.

In my concerned opinion, the legislature should make the Judiciary highly accountable and make them equipped withresources to discharge their functions and exercise their power.

Editor's Views

Ahmedabad Chartered Accountants Journal August, 2013256

Editor's Views

The paradoxical situation is that a layman undergoes stress when receiving a routine government notice and the VIPsand celebrities get away with notices involving serious charges. One can not discuss the legal matters or any issuesrelated to judiciary saying it is sub judice or under threat of ‘Contempt of Court’.

Further, the cases of VIPs take almost 15-20 years to get disposed off. While one of the celebrities went behind the barsrecently, other has been convicted just while this piece is being penned down. No one knows when he would finallysuffer the punishment, if found guilty. Facts which illustrate the view are many, the ‘Chara Ghotala’, ‘Hansie Cronje –Match Fixing scandal’ are the ones to name a few.

To illustrate this, if we consider the case of Late LN Mishra, former CM of Bihar, murdered in 1975, the 27 year old manwho was accused of murder is now ailing at 65. Out of the 39 witnesses, 31 have already died. More than 20 differentjudges have heard the matter over years. And to top it all, the court declared that 38 years was by no means too long!Now if this happens to be the fate of a VIP case, we can imagine the plight of the mango people in this situation.

The long delayed judgments results in crushing of the honorable and the law abiding by those with muscle and money.The present Indian scenario is rightly described by the following phrase: “If law breakers are not in jail, they will be inthe legislature”

The new Chief Justice of India who joined the office thought it fit to give interview to the Television Media. Those whoare of the opinion that judges should keep themselves away from glare of the media would disappoint themselves.Those days seem to be fading away when the sitting judges at the lower courts scrupulously avoided such interaction sothat their personal views would not be made public and would not become a matter of debate. Judges should not onlyappear to be neutral but also have to be so. Judges today use the guest house of private companies or accept the landallocated from the discretionary quota of the Chief Minister. There is nothing which could tarnish the credibility of ajudge more than perception that he is close to certain parties or individuals.

The political system in India cannot be reformed until and unless the judicial system is amended or re-built. Even theSupreme Court has tried to promote faster justice by computerizing the cases, Lok Adalats and so on but Alas! The fateremains the same.

In other words, the need of the hour is a proactive and integrated approach to problem-solving, as against the currentstand-alone measures. What the nation needs today in addition to the electoral reforms is the judicial reforms. Theprocess needs to be more transparent.

Not only the judiciary, it is high time the legislature starts doing its job in an effective and transparent manner. Shouldthese complex and burdensome laws be simplified, we could reduce the pending litigation to a great extent. It is theinterpretation bubble that leads to all the legal battles. Every time, it has been observed that when the Apex Courtdecides something which might favour the ‘aam janta’, the unscrupulous law maker tend to amend the law and thattoo with a retrospective effect and thus leading the entire judicial process irrelevant and meaningless.

At the same time, the public at large can’t escape from its responsibility for turning ”a blind eye” on such criticalissues. Thanks to social media, we know what is happening in the Antarctic or Azerbaijan, but the irony is, we simplydon’t know what is happening next door. Whether one calls it blind eyes, escapism or intentional blindness, the factremains that it is making the victory of vices over virtues easy.

Further, we as the citizens of this nation should start accepting the system by developing a society where there areminimal disputes so that legal disputes are reduced and time of the courts are not wasted.

Afterthought: With so many wise men in the executive, the legislature and the bureaucracy, why do the simplest andmost obvious of solutions escape away or is it, once again, a question of political will – the lack thereof?

The blind–eyed approach of our politicians and bureaucrats, reminds me of famous lines in the Mahabharata narratedby Dhrutrashtra:

I know what dharma (virtue) is, yet I can’t follow it;

I know what is adharma (vice) and yet, I can’t leave it.

We are unsure, whether those who are in power are blindly following Dhrutrashtra’s but what is happening forces us toaccept this bitter truth.

CA. Rajni M. [email protected]

❉ ❉ ❉

Ahmedabad Chartered Accountants Journal August, 2013 257

Dear Professional Colleague,

As we will celebrate 67th Independence Day on 15th

August 2013, India has not been able to make itselffree from the clutches of the problems of anunderdeveloped country like poverty,unemployment, illiteracy and corruption. The social-economic backwardness with which this great Nationis f ighting is raising doubts on the electedgovernments as to the way they have functioned overthe years. The governance of various governmentsincluding major share of the period enjoyed by theCongress government, that played a major role inIndian Independence, has failed to ensure basicamenities to the citizens of this country. Last 9 yearsof the UPA government in the total span of 66 yearshave been the worst amongst all. The functionalparalysis of the government is visible from the utterindecisiveness in governance. The Prime Minister ofthe Nation who has proved himself as one of thefinest Economist in the past is failing miserably tocarry the nation forward economically.

The central government has been generally morereactive than being proactive in its approach. Afterthe Delhi gang rape case, the government went intothe statute books to make amendments for morestringent provisions rather than ensuring that everygirl on every street of the nation is ensured andempowered to walk freely with dignity and withouta slightest hesitation that any harm can be done toher.

Legislation is one of the most important functionsof the government but this government seems tofind the answers of all the socio-economic problemsincluding food security by enacting laws. The morereason for the concern has been the manner in whichthe Food Security law is being brought in by way ofan ordinance without routing it through thedemocratic process of discussion in the parliament.The times when the nation’s fiscal deficit is more than5% of the GDP, the government has not been ableto come out with any answer as to how the foodsecurity will be funded. As a concerned citizen onecould only hope that the government one dayconsiders financial implications over any policydecision made just to woo the voters.

President's Message CA. Prakash B. [email protected]

The activities at the Association are in full swing withregard to the preparations of RRC are concerned.By the time you receive the copy of journal for themonth of August 2013, the Association would havebeen through with one of the most important eventsduring the tenure of any president. If I can share myexperience, the first and the foremost thought thatarises after being appointed as the Vice President ofthe Association is, where would I arrange the RRCduring my tenure as a President? The RRC has beenthe most challenging job for any president of theAssociation but I would say that things have not beenso difficult for me because I have been fortunate tohave a dedicated team in the RRC committee, ledwith an example by the chairman of the committeeand with all the administrative assistance providedto me by the Convenor and Hon. Secretaries, Gettingthe paper book ready 15 days prior to the date ofRRC and ensuring its timely delivery to all thedelegates is just one example showing the dedicationof the entire team. I can say such a big event is notpossible without the team work. The way the thingsare in process, we are sure that we would be able toprovide the best of time to all the participants, atthe RRC amidst a fine blend on study and recreation.

Then we all wait for the entertainment evening ofthe Association. The event is scheduled on 14 th

August’2013. This year the form and the substanceof the talent evening have been changed in principleto involve maximum participation from the membersand their family members and make it more livelyand entertaining. The Institute has come out with anew guidance note on Tax Audits. As we begin thehectic schedule of Tax Audits assignments, 2nd BrainTrust meeting is arranged on the topic on 23rd August2013. The second knowledge clinic was held where4 queries were replied by the panelists of the clinic.It is hearting to note that members are taking goodadvantage of this new activity at the Association.

Results of Final CA have been announced.Congratulations to all the students who have beenable to taste the success. I invite newly passed CAs tobecome the members of this prestigious Association.

With best regards,CA. Prakash B. ShethPresident01.08.2013

❉ ❉ ❉

Ahmedabad Chartered Accountants Journal August, 2013258

Introduction

During the recent past one has observed continuinginflation, high interest rates, volatile forex markets andbearish capital markets affecting the Indian Industry. Ineffect, incidence of corporate failures to achieve theirgrowth endeavor has increased and hence manycompanies especially those with highly leveraged balancesheet are required to restructure their business and aligncapital employed to their business. However, in thehindsight one of the fundamental reasons for performancefailures is lack of financial discipline which, has distortedfinancial results of various companies and now lookingfor options to reorganize or say restructure theirobligations.

Restructuring

The reorganization of a company’s outstanding financialobligations is generally achieved by reducing the burdenof the debts on the company, by reducing the rate ofinterest payable and increasing the time duration withinwhich the company is required to repay its debt. Thisallows a company to improve its ability to meet theobligations.

Also, some of the debt is sometimes foregone by thecreditors in exchange for an equity position in thecompany which is more commonly known as debt-equityswap.

The option of one time settlement (OTS) broadly dependson the quality of security and its realizable value,available to the lender which also is explored inrestructuring overall obligations.

Section 391 of Companies Act

The legal framework which provides support to a“Corporate Entity” in such difficult times is covered bySection 391 of the Companies Act, 1956. Here a schemeof Compromise or Arrangement having widest character,ranging from a simple composition or moratorium to anamalgamation of various companies with completereorganization of their share capital and loan capital ispossible.

Corporate DebtRestructuring CA. Nesal H. Shah

In fact, Section 391 is a complete code in itself, whereinSection 391(2) provides that if majority in numberrepresenting three fourths in value of the creditors orclass of creditors or members or class of members as thecase may be present and voting either in person or proxyat the meeting agree to a compromise or arrangementshall, if sanctioned by the Court, be binding on all thecreditors, all the creditors of the class, all the members,or all the members of the class, as the case may be, andalso on the company, or, in the case of a company whichis being wound up, on the liquidator and contributoriesof the company. The prerequisite of course is the Courtis satisfied that the company or any other person bywhom an application has been made has disclosed tothe Court, by affidavit or otherwise, all material factsrelating to the company, such as the latest financialposition of the company, the latest auditor’s report onthe accounts of the company, the pendency of anyinvestigation proceedings in relation to the companyunder sections 235 to 251, and the like.

Hence the dissenting creditors or class of creditors havingequal to or less than 25% exposure in value shall haveto accept the terms and conditions of the scheme ofarrangement vote in favor by majority of the creditors orclass of creditors, if it is proved, not to be prejudicial topublic interest.

Corporate Debt Restructuring Mechanism

A simpler mechanism of Corporate Debt Restructuring(CDR) is an option enunciated in a Scheme evolved byReserve Bank of India for a corporate entity which wantsto reorganize its loan capital only with banks and financialinstitutions. The CDR Mechanism is a voluntary non-statutory system based on Debtor-Creditor Agreement(DCA) and Inter-Creditor Agreement (ICA) and theprinciple of approvals by super-majority of 75% creditors(by value) which makes it binding on the remaining 25%creditors by value to fall in line with the majority decision.

Eligibility Criteria for CDR

The CDR Mechanism covers only multiple bankingaccounts, syndication/consortium accounts, where allbanks and institutions together have an outstandingaggregate exposure of Rs.10 crores and above. It covers

Ahmedabad Chartered Accountants Journal August, 2013 259

Corporate Debt Restructuring

all categories of assets in the books of member-creditorsclassified in terms of RBI’s prudential asset classificationstandards. Even cases filed in Debt Recovery Tribunals/Board of Industrial and Financial Reconstruction/and othersuit-filed cases are eligible for restructuring under CDR.

In case of loan capital with a single bank or multiplebanking accounts with exposure of less than Rs.10crores,for corporate or non-corporate entity including a smalland medium enterprise, bilateral restructuring with theindividual bank or multiple banks is possible based onguidelines prescribed by Reserve Bank of India (RBI),which are based on CDR restructuring framework exceptapplicability of prudential norms and the manner in whichthe diminution in value of the loan is computed andprovided for.

Reference to CDR Mechanism may be filed by any oneor more of the creditors having minimum 20% share ineither working capital or term finance (referred to asreferring institution), or by the concerned corporate, ifsupported by a bank/FI having minimum 20% share asabove.

The requests of any corporate indulging in fraud ormisfeasance, even in a single bank, cannot beconsidered for restructuring under CDR Mechanism.However, Core Group (part of the standing forum i.e.the top tier in CDR Mechanism), after reviewing thereasons for classification of the borrower as willfuldefaulter, may consider admission of exceptional casesfor restructuring after satisfying it-self that the borrowerwould be in a position to rectify the willful default providedhe is granted an opportunity under CDR. Willful defaulteris defined under the guidelines pronounced by RBI.

Admission of Reference

At the time of filing reference with CDR Cell, a FlashReport in prescribed format has to be filed with the Celland the Nodal Officers of all participating lenders at least10 days before the meeting of CDR Empowered Group(EG). Participating lenders would mean lending banks orfinancial institutions which are members to the CDRMechanism and have an exposure with the corporateapplying for restructuring under CDR mechanism.

The Flash Report provides the background details of theorganization, historical financial results, the reasons andjustification for restructuring and the broad contours ofrestructuring and the financial projections. Based on theFlash Report, the EG decides that restructuring of acompany’s debts is prima facie feasible and the concerned

enterprise is potentially viable in terms of the policiesand guidelines evolved by Standing Forum, the finalrestructuring package is worked out by the referringinstitution in conjunction with the CDR Cell.

The decision on admission of reference shall be takenby super majority vote of the lenders of the corporateentity who are members of CDR Cell. Hence the vote ofa lender to the corporate entity who is not the memberof the CDR cell is not considered for admission of thereference to the CDR Cell.

[“Super-Majority Vote” shall mean votes cast infavour of a proposal by not less than sixty percent (60%)of number of Lenders and holding not less than seventy-five percent (75%) of the aggregate Principal OutstandingFinancial Assistance.]

Time Lines for Processing of Package

The Final Package which provide relief and concessionsto the corporate entity is generally approved within aperiod of 60 days from the date of admission of referenceexcept for large and complicated cases which would bedecided by CDR EG, within 90 days. If the final decisionon a particular case is not taken within the stipulatedtime frame i.e. 60/90 days, as the case may be, therestructuring proposal would automatically be treated asclosed unless extension of time beyond 60/90 days isspecially sought by the Referring lending Institution (upto a maximum limit of 180 days) and the same ispermitted by the CDR Core Group. Such closed caseswould be considered for re-entry in the CDR system onlywith the permission of the Core Group. As per RBIguidelines the approved CDR package should beimplemented within 120 days from the date of approvalby CDR EG.

The restructuring package is formalized by signing aMaster Restructuring Agreement (MRA) by allparticipating lender with the borrower. Secondly, thebanking operations of the corporate entity need to becarried out from a common account known as TrustRetention Account (TRA) generally is opened with theMonitoring Institution (MI), post admission of referencewith CDR Cell. The MI shall transfer the necessary creditsto all the participating lenders as per the sanctionedpackage during the entire period of package.

Package and Viability Criteria

Generally before drafting the final package, a technoeconomic viability study (TEV) study from an independent

Ahmedabad Chartered Accountants Journal August, 2013260

agency is conducted prima-facie to check the viability ofthe unit. Also, for working capital loans, an independentStock & Receivables Audit is conducted to verify theavailable drawing power based on the quality ofReceivables and value and quantity of Stocks. Theirregularity needs to be converted into Working CapitalTerm Loan (WCTL) because the security of current assetsfor that part of the loan is not available to the lenders.Wherever, necessary and especially in case of diversionof funds, forensic audit /special investigative audit mayalso be carried out under the supervision of the LeadBank/MI.

The final package should consider the following:

1. Determine the cut-off date for carving out theirregularity in working capital loans and convertingthem into WCTL and also for the tenure ofrescheduling loans.

2. Banks may reduce interest rates however rate ofinterest on all facilities including Funded Interest TermLoan (FITL) and WCTL should not be less than theBase Rate. Hence generally all interest rates chargedare linked to base rate of the bank having highestbase rate.

3. Banks may reschedule the loans and providemoratorium as per the needs and requirements ofthe unit. However, repayment period of therestructured advance including moratorium period,if any, should not exceed 15 years in the case ofinfrastructure advances and 10 years in the case ofother advances.

4. The unit should become viable in a time span of 5years in case of non-infrastructure projects and 8years for units engaged in infrastructure projects.

5. Reduction in the rate of interest and / or reschedulingof the repayment of loan, as part of the restructuring,will result in diminution in the fair value of theadvance. Such diminution in value is an economicloss for the bank and will have impact on its profits.It is termed as Bank’s Sacrifice. The benchmark forPromoter’s to bring in funds to make the unit viablehas to be at least 25% of Bank’s Sacrifice and needsto be brought up front. Previously it was 15% andcould partially be brought up front and balance aftersix months.

6. The RBI guidelines mention that conversion of debtinto preference shares is not desirable and shouldbe the last option. Instead instruments such as

convertible bonds having security may be acceptedas part of the package. When conversion is necessaryit should be in equity with a view to attainingmajority shareholding which can trigger change ofmanagement.

7. If the unit has non-core assets, the same should bemonetized in a time bound manner, and accordinglyincluded in the package.

8. The package would involve waivers, concessions andsacrifices on part of the lenders. These waivers andsacrifices need to be recouped whether fully orpartially, which is termed as “Right to Compense”.For the Right to Compense clause, the recompenseamount should be estimated and incorporated inthe package.

9. If necessary, the lenders should examine thepossibility of change of management where it hasbeen found that the unit was adversely affected dueto incompetent management or diversion/misuse offunds have taken place.

10. The lead bank/MI may if desire, nominate a directoron the Board of the company.

11. In case additional finance is required by the borrowerunit, firstly the end use of funds vis-à-vis source offinance needs to be ascertained. The TEV studywould generally throw light on the subject. Further,the amount which has to be shared by the lendersshall always be on pro-rata basis of the outstandingamount of the lenders. In case of lenders providingneed based working capital, they shall be givenpriority in the scheme to recover equivalent to FITL/WCTL as compared to TL.

12. The existing security sharing pattern among lendersshould not be altered as far as possible and theunsecured lenders, if any, should be given secondor subservient charge.

The Bench Marks financial viability parameters for thefinal package include the following:

1. Return on Capital Employed (ROCE): MinimumROCE equivalent to 5 year G-Sec plus 2% may beconsidered as adequate.

2. Debt Service Coverage Ratio (DSCR):. Since the unitis being restructured, adjusted DSCR as explainedbelow should be >1.25 within the 7 years period inwhich the unit should become viable and on year-to-year basis DSCR to be above 1. The normal DSCR

Corporate Debt Restructuring

Ahmedabad Chartered Accountants Journal August, 2013 261

for 10 years repayment period should be around1.33:1.

Adjusted DSCR:

ACF + total interest excluding interest on WCL +lease rentals

Repayment of loans + interest excluding interest onWCL + lease rentals

*ACF means Actual Cash Flows and WCL meansWorking Capital Loans.

ACF will be net cash position during the year (totalgross profit plus outside funds if any available lesstotal requirement including build-up of inventory/debtor/normal capital expenditure etc. & repaymentof public deposits

3. Gap between Internal Rate of Return (IRR) and Costof Funds should be at least one percent.

4. Loan life ratio (LLR) is a concept, which is usedinternationally in project financing activity. The ratiois based on the available cash flow and present valueprinciple.

Present value of total ACF during the loan life period (including int.+ prin.)LLR = ————————————————————

Maximum amount of loan

The discounting factor may be the average yieldexpected by the lenders on the total liabilities, oralternatively, the benchmark ROCE. This ratio issimilar to the DSCR based on the modified method(Actual Cash Flow method). In project financing,sometimes LLR is used to arrive at the amount ofloan that could be given to a corporate. On the sameanalogy, LLR can be used to arrive at sustainabledebt in a restructuring exercise as also the yield. Abenchmark LLR of 1.4, which would give a cushionof 40% to the amount of loan to be serviced, maybe considered adequate.

The above financial viability benchmarks levels canbe modified by the CDR-EG on a case to case basis.

Decision Making Process

CDR Empowered Group’s decision relating to prima faciefeasibility and/or final approval of a Restructuring Schemeshall be taken by a Super-Majority Vote at a dulyconvened meeting, after giving reasonable notice, to theLenders and to the Eligible Borrower. In case of anychange/alteration/modification to the ApprovedRestructuring Scheme is required, the Referring Lender/

CDR Cell shall refer the same to the CDR EmpoweredGroup and the decision of the CDR Empowered Grouprelating to such changes/alteration/modification shall betaken by a Super-Majority Vote at a duly convenedmeeting, after giving reasonable notice, to the Lendersand to the Eligible Borrower.

The lenders not having mandate at the time of CDR EGmeeting could furnish their stand shortly after the meetingbut not later than the next meeting and their stand ifreceived by then should be taken into account for voting,and Lenders not furnishing their stand before the nextCDR EG meeting shall be excluded from voting.

In cases, where additional funding is to be provided tothe restructured unit, once the MI presents therestructuring proposal and has established the need foradditional exposure and has been approved by CDR EG,the same must be accepted by all the participating lendersas per their share in lending without any deviation. Anymandate which is conditional or if mandates does notagree for need based additional exposures would betreated as negative votes in respect of approval of finalpackages. Hence it is important for the borrower unit,before finalizing the package to check with the lendingbanks/institutions on their agreement to providingadditional funds and also to the package before goingfor the super majority vote to ensure that the package isaccepted and Letter of Approval (LOA) is issued by CDREG.

Holding on Operations

The Holding on Operations (HOO) is basically a short termmeasure to accommodate the genuine and legitimatebusiness needs of potentially viable units from the dateof filing of reference till the implementation of schemeor opening of Pre-TRA Account.

Since the cash credit account or overdraft account of theborrower would be overdrawn with the lending bank, itwould adjust any credits received in the account and theborrower shall not be able to utilize such credits for itsbusiness operations. During HOO, the outstanding levelFund Based plus Non Fund Based Limits (FB+NFB) as onthe date of filing of reference would be maintained andall credits received after the date of filing shall be allowedto be withdrawn by the borrower for business operations.In many cases lenders also allow interchangeabilitybetween FB and NFB limits to the extent of theoutstanding level as on the date of reference.

Corporate Debt Restructuring

Ahmedabad Chartered Accountants Journal August, 2013262

Pre-Trust Retention Account (Pre-TRA)

On admission of the Flash Report the borrower needs to

open a current account with the MI to be designated“Pre-TRA” All credits thereafter shall be routed through

this account only. All operational accounts of the borrower

such as cash credit account / overdraft account are

immediately frozen for the purpose of credits. The lender

operating the pre-TRA account shall not have the right

of general or specific lien on account balances. Suchlender may only recover pre-determined charges for

operating such an account. The Pre-TRA account shall

be a credit account with no stipulation of minimum

balance.

Every lender while obtaining sanction for admission of

flash report shall also seek sanction to authorise opening

of Pre-TRA account with MI. Any debit on account of

critical payments required to maintain asset classificationas on date of reference may be paid through this account,

provided the same is clearly mentioned in the flash report.

After date of reference, all forced debits like interest,

instalments, devolved LCs and invoked BGs shall be

accounted for with respective lenders only. No amount

shall be debited to the new account and the borrowershall be allowed to carry out business operations smoothly.

The Pre-TRA account will be governed by way of a

common document to be executed by all the lenders.

The waterfall mechanism for a pre-TRA account would

be on similar lines as prescribed for regular TRA accounts.

In case restructuring is not approved by CDR EG, thebalance o/s in the Pre-TRA account shall be distributed

amongst all the lenders on pro rata basis. Waterfall

mechanism would mean that the payments to lenders

would be prioritized in which high tiered lenders receive

interest and principal payments while lower tiered lendersonly interest payments, if at all any payments are to be

made to the lenders during the interim period.

Monitoring Mechanism

A monitoring mechanism has been evolved as part of

CDR System. The Mechanism comprises Monitoring

Institution (MI), Monitoring Committee (MC) and externalagencies of repute to complement monitoring efforts and

also to carry out work of Lenders’ Engineer, Concurrent

Audit, Special Audit and Asset Valuations. MI isappointed by CDR EG for effective monitoring of

sanctioned scheme. MC is formed to oversee the

implementation of the approved Restructuring Scheme.

The MC shall generally comprise one term lender, one

working capital bank, one minority lender and the CDRCell. MC is a recommendatory body and does not have

authorization to accord any approval. All outstanding

matters should be brought by the Monitoring Institutions

to MC meetings for discussion/resolution so that at the

EG meetings, a final view/consensus may be arrived at

expeditiously. Further, in case of any difficulty inimplementation of the approved Restructuring Scheme,

MC may approach the CDR EG for necessary direction

and/or guidance. In case of any dispute between the

lenders, the MC and the Borrower in respect of

implementation of the approved Restructuring Scheme,

the decision of the CDR EG shall be final and binding onthe parties to that dispute. MC also is assigned the task

to reviews regularly, and examine the necessity of

continuing the concessions granted.

Finally, the CDR package could be treated as

implemented by a lender if the following conditions are

fulfilled:

1. The package was sanctioned by the lender(s)

concerned and effect had been given in the books

of account of the lender(s);

2. Promoters’ contribution to the extent envisaged in

the package had been brought in; and

3. MRA was executed binding the lender(s) and the

company for compliance of all terms and conditions

of the approved package.

4. There should not be any additional or irrelevant

conditions at the time signing MRA by the lenders,

apart from the conditions mentioned in the approved

CDR package.

❉ ❉ ❉

Corporate Debt Restructuring

Ahmedabad Chartered Accountants Journal August, 2013 263

Estate planning forms an essential part in the process of

financial planning. Making a will and creation of trust

are few of the widely used tools for the purpose as the

preparation and execution of these tools is relativelysimple, easy and practical. A deeper understanding into

these matters is very much required and is discussed

hereunder.

The Role of Financial Planner is not limited to planning

finances for individuals and helping them meet their needs

and requirements during their lifetime but it also includes

managing and disposing the funds after the death of an

individual. ESTATE PLANNING is helpful in achieving this

objective.

The whole issue of estate management has become

complex mostly due to lack of clarity and peculiar internal

family equations. Such issues should be handled withspecial soft skills as it involves sensitive and legal matters.

It is very important for one to be clear about the exactmeaning and definition of Estate before carrying out

Estate planning. “Estate means the whole of one’s

possession, especially all the property and debt

by one at death.”

Objective of Financial Planning is to develop and

implement a series of financial plans in order to achieve

financial success. Estate planning plays a vital role in the

process. Main goal of estate planning is to ensure the

proper and smooth disposal of property after the deathof the person.

Estate Planning and ProcedureCA. Helly [email protected]

Estate Planning includes:

1) Estate Management

2) Estate Preservation

3) Estate Legacy

Estate Planning can be carried out taking any of thefollowing routes

A. Through a Will

B. Through setting up a trust

Majority of people have not put enough thoughts on thematters relating to management of estate. So, the first

step in Estate planning is to gather information and their

preferences regarding ways and choices of disposal of

the estate. Once a Planner is clear about what the person

wants relating the disposal of property after death, thevery next step is to prepare a Will. Making a will is a

great tool in Estate Planning.

A. Will:

Person making a Will is called Testator . The

intention of the testator with respect to his propertyto be effective is known as Will.

For a person to make a valid Will, he must be:

1) Mentally capable ( Sound mind)

2) 18 years or older in age

Normally, Wills are made for disposing of property afterthe death of testator. But it can also be used as a tool for

appointing the executor for creating a trust.

Ahmedabad Chartered Accountants Journal August, 2013264

Estate Planning and Procedure

If a person dies without writing a Will, he is calledintestate. His property will be inherited by his legal heir/s as per the law of Inheritance.

Types of Will:

- Conditional Will - Will that is expressed to takeplace in the event of happening of some conditionis called as Conditional Will.

- Joint Will - Two or more persons make the willjointly. Joint Wills can be revoked at anytime byeither of the person during their lives.

- Holograph Wi l l - Such Wills are entirelyhandwritten by the testator himself.

- Concurrent Will - Normally testator should leaveonly one Will at the time of his death. However, forthe sake of convenience a testator may dispose ofproperties in one country by one will and otherproperties in another country by a separate will.

- Pr i v i leged Wil l and Unpr iv i leged Wi l l -Privileged Will is generally pronounced by the soldier,airman or a mariner as they are not in a position towrite the will. Such pronounced Will has legalrecognition. All other Wills prepared by individualsare called unprivileged Wills.

Testator may make Will in duplicate, keeping one withhimself and other with someone else or at some otherplace. If an original Will is destroyed by the testator, it isrevocation of both.

Certain Terms used in Will:

Bequest or Legacy: Act of giving property by Will. Infact it is a gift of personal property by Will.

Codicil: An instrument made in relation to Will andexplaining, altering or adding to its disposition and shallbe deemed to form part of Will. A codicil unlike a will isnot an independent document but it is appendage tomain document.

Probate: It signifies that copy of the will is given to theexecutor together with the certificate granted under theseal of the court and signed by one of the registrarscertifying that the will has been approved. On the deathof the testator, the executor of the Will or heir ofdeceased testator can apply for probate. The court will

ask the other heirs of the deceased if they have anyobjections to the Will. If there are no objections, thecourt will grant probate. A probate is a copy of a Willcertified by the court. A probate is to be treated as aconclusive evidence of genuineness of a Will. In case, ifany objections are raised by any of the heirs, a citationhas to be served calling upon them to consent. Thereafter,if no objection is received, the probate is granted.

Registration of a Will:

Though it is not mandatory but is advisable to registerWill. It should be registered at the office of sub-registrar.No stamp duty is payable on registration of the Will.

Revocation of Will:

A will is always revocable during the lifetime of thetestator, even when the will is stated to be irrevocable.If the testator wants to revoke the will, he can do so byburning or tearing or destroying it completely. It must bedone with the intention to revoke the will and meresymbolic destruction is not sufficient. There should be aclause that ‘the present will is the last Will of the testatorand any Will prior to this would stand revoked.’ Thetestator cannot revoke the Will by just striking off. Hemust sign it and have it attested by at least two witnesses.

Nomination v/s Will:

Normally, Will and Nomination are used interchangeably.However, here it must be clarified that nomination is nota will. The nominee merely acts as trustee. In someinstances, the nominee and beneficiary of the will is thesame person. However, at all times provisions of Willprevail over Nomination. It is advisable to have the sameperson as the nominee and beneficiary of the will in orderto prevent future disputes.

GENERAL DRAFT OF THE WILL

I ,…………. Aged……..Son/wife/daughter of………..Residing at……….Do hereby declare that this is my lastWill. I am holding a disposal power of all estate, propertymentioned below and I am making this Will with anintention of smooth succession of my all movable as wellas immovable property among all Beneficiaries as below.I also declare that I am making this Will without anypressure, being a sound health. I understand that in eventof my death there should not be any dispute among mylegal heirs mentioned below to succeed my property

Ahmedabad Chartered Accountants Journal August, 2013 265

Sr. No Name Age Relationship, if any

I own the following Moveable properties

Sr No Particular of property Registration No Remarks

On the basis of the above lists, I bequeath my propertyas below:

Sr No Property Details Type of property Beneficiary Name

In witness whereof , I the said ……have put my signatureto each sheet of this Will on the day……of……year…..

Signature of testator

Name and Signature of Witness

Conclusion:

Will is generally perceived to be only for wealthyindividuals who have enough valuables, cash and propertyto be left behind for their loved ones. But the fact is thatWill is essential for all individuals regardless of theireconomic standing. It is important for financial plannersto help their clients secure a peace of mind that theirfamilies would get their inheritance as per the wish ofthe clients. It is also important that the Will may beupdated periodically.

B. Trust:

A trust is an Estate planning solution that allows anindividual or a married couple to structure their wealtheffectively for the benefit of both current and futuregenerations and the same is governed by a trustdeed. Trust deed is a deed that sets out the terms oftrust agreed between the Settler and Trustees.

The law relating to private trusts is governed by theIndian Trusts Act (“Trust law”). A trust is basically a

vehicle under which property is transferred from theoriginal owner and held by the person to whom it istransferred for the benefit of another. The “authorof the trust”, the “trustee”, the “beneficiary”, the“trust-property”, the “beneficial interest” and the“instrument of trust” are the integral elements of atrust. A trust can be created for any lawful purpose.

A trust, in relation to an immovable property, mustbe in writing and registered. A trust is created whenthe author of the trust indicates an intention to createa trust along with its purpose, beneficiary and thetrust-property, and transfers the property to thetrustee. A trust is different from a gift.

A Trust comes with certain inherent advantages. Itprovides the flexibility to be set up in more than oneform or in hybrid forms as per the requirement. Atrust can be either private or public. As opposed toa public trust, a private trust is a trust generally forconvenience and support of individuals of families.Trust can be structured as revocable or irrevocable.

A revocable trust can enable the settler to exercisecontrol over the property but can be prone toclubbing provisions under the tax laws. An irrevocabletrust can provide safeguard against future creditorclaims on the assets in case of bankruptcy, sincethe settler ceases to have the title to the trustproperty, yet at the same time enable indirect controlover the property through terms of the trust deed.This is one of the prime benefits of a trust structurewhich allows ring fencing of wealth, the downside,however, being the settler losing ownership.

Further, while settling equity stake of a loss makingcompany in a trust to ensure asset protection, onemay need to be careful of tax provisions due to whichlosses could lapse in case of a substantial change instake. A trust can be further set up either asdiscretionary, where trustees can have the discretionas regards to distribution of benefits to one or morebeneficiaries and extent thereof which may beespecially useful if the settler is the trustee, or asdeterminate, where entitlement of beneficiaries isfixed by the settler through the trust deed.

Trusts can be set up inter vivo or by will. Both havetheir own characteristic advantages and purposesto serve. Multiple trusts can be set up to suit multiplepurposes or even hybrid trusts combining variousforms, thus, obviating the need to have multipletrusts.

Estate Planning and Procedure

Ahmedabad Chartered Accountants Journal August, 2013266

Estate Planning and Procedure

Except for necessary governing provisions, the trustlaw provides enough flexibility in creating andmanaging a trust. Any person competent to contractcan create a trust and any person capable of holdingproperty can be a beneficiary including a minor. Anyperson capable of holding property can be a trustee.A trust can be an efficient tool for successionplanning without the need for probate processthrough Court, thereby protecting privacy bypreventing public disclosure.

Being governed largely by the terms of the trust deed,a trust structure can afford the necessary flexibilityto capture commercial or family arrangements andat the same time enable imposition of necessaryconditions by the settler for the entitlement tobenefits. Investment of trust moneys, apart fromsecurities prescribed under trust law, can also bemade in securities expressly authorised by trust deed.

The settler, even though not the legal owner, canthereby specify an investment mandate in respectof trust property and exercise implicit control throughthe various covenants. The settler can himself bethe trustee, thereby exercising a greater control. Atrust, therefore, can enable the settler to exercisevarious degrees of control over the property evenwhen divested of the legal title.

Further, it is feasible to transfer beneficial interestsin the property from generation to generation asalso realign family holdings inter-se, as perrequirements. A trust enables segregation ofownership and control. Management of propertiesthrough a trust creates a legal framework withinwhich assets can be protected and maintained

effectively while safeguarding the interests of familymembers.

Taxation of Revocable/ Irrevocable Trust:

When a person looks at options of Irrevocable Trustcreating a revocable or an irrevocable Trust it is importantto understand how income generated by these Trustswould be taxed

1) In case of a revocable trust, the income of the trustis taxed in the hands of the creator of the trust i.e.the Settler. The tax imposed would be at the ratesapplicable to the Settler.

2) In case of an irrevocable trust, the income of thetrust is taxed in the hands of the beneficiaries. Thetax imposed would be at the rates applicable to thebeneficiaries. However, if the beneficiaries are notdetermined at the time of executing the Trust Deedthen the Trust would become a discretionary trustand any income of such a Trust would be taxed atmaximum marginal rate.

How much does it cost?

If you have to just make a Will, it might cost you anythingbetween Rs 6,000 and Rs 10,000. Making of a Will,registration, other processes like safe-keeping andexecution will work out to about Rs 25,000.

If you are taking your bank’s help in setting up of a Trust,its management and execution, the bank will chargeyou 0.5-3% of total assets under management (AUM)as the estate planning fee. If you seek an independentprofessional the charges vary depending upon the service.The setting up of a trust, will work to a one time cost ofRs 2-3 lakh.

❉ ❉ ❉

Following latest information / judgements are availableon the website of the Association www.caa-ahm.org

High Court Judgements

1 . CIT v. Milton Laminates Ltd. (Guj.)

As per CBDT’s circular No.549 dated 31.10.1989,assessee’s assessed income cannot be less that thereturn income. This Circular was held not to beapplicable, in Gujarat Gas Co. Ltd v. JointCommissioner of Income tax reported in 245 ITR84. Similarly held by Gujarat High Court in Milton

On the Website of CAALaminates Ltd. Department’s SLP dismissed. [354ITR St. Pg. 101]

2 . Manoharlal Agarwal v. CIT (Guj)

When return was e-filed (beyond due date)and TDS was left to be claimed, but wasclaimed through revised return, credit wasto be given for TDS.

The July-2013 issue of ACA Journal is also available onthe website.

❉ ❉ ❉

Ahmedabad Chartered Accountants Journal August, 2013 267

What is Business?

The word ‘Business’ is defined in section 2(13) to includeany trade, commerce or manufacture or any adventureor concern in the nature of trade, commerce ormanufacture.

The expression ‘business’, though extensively used in tax-statutes, is a word of indefinite import. In tax statutes, itis used in the sense of occupation or profession whichoccupies the time, attention and labour of a person,normally with the object of making profit. To regard anactivity as a business, there must be a course of dealings,either actually continued or contemplated to be continuedwith a profit motive and not for sport or pleasure.

Essential characteristics of business:

1) Continuous and systematic exercise of activity.

2) Profit Motive

3) Transaction between two persons

4) Involves a twin activity

5) Business includes trade or commerce

6) Business includes manufacture

7) Business includes any adventure or concern in thenature of trade, commerce or manufacture

- Section 28 of the Income Tax Act deals with aninclusive definition so as to charge Income tax underthe head “Profits and gains of business orprofession”. This includes seven items so as to covercertain types of receipts to be specifically taxed underthis head.

- Thereafter section 29 deals with the provision so asto clarify as to how income referred to in section 28shall be computed in accordance with the provisionscontained in section 30 to 43D. It can be a book byitself if all the aspects dealing with these areconsidered in this presentation in this elite gatheringin this limited time period. However, it is importantto appreciate that on the basis of the provisions madein section 30 to 36 following expenses are allowable.I am making an attempt to deal with some of thecontroversies and issues arising during the course ofpracticing profession or conducting business as under:

Section 30: Rent, Rates, Taxes, Repairs &Insurance of Buildings used for the purposeof the Business

Controversies and Issues in BusinessDeductions under Chapter IV(Sections 30 to 36)

CA. Sunil [email protected]

Controversies :

i. Rent of the premises is allowed as deduction.However, notional rent paid by proprietor is notallowed as deduction. But rent paid by him tohis partner for using his premises is allowed asdeduction.

i. Current repairs if the assessee bears the cost ofrepairs are allowed as deduction. However,Capital repairs incurred by the assessee arenever allowed as deduction whether premisesis occupied as a tenant or as a owner. Insteadthe capital repairs incurred shall be deemed tobe a building and depreciation shall be claimed.

i. Any sum on account of Land Revenue, LocalTaxes or Municipal Taxes subject to section 43B.as per section 43B deduction shall be allowedonly if such sum is actually paid on or beforethe due date of furnishing or return ; and

i. Insurance charges against the risk of damageor destruction of building is allowed asdeduction

Issues :

Assessee-company was carrying on its businessin a building taken on rent - Consequently, anagreement was entered into between owners,tenant, other occupants and a developer, underwhich developer was to repair and reconstructbuilding at its own cost, and, after that certainarea was to be handed over to co-owners -Assessee was also given its equivalent portionon condition that it would contribute towardscost incurred on repair and reconstruction -Assessee’s share of cost was arrived at Rs. 1.50crores; said agreement also provided that therewould be no increase in rent payable by assessee- On above facts, Assessing Officer held thatassessee had secured rights over portion ofbuilding on payment of Rs. 1.50 crores whichconstituted deemed ownership of building -Accordingly, Assessing Officer held expenditureof Rs. 1.50 crores to be capital in nature anddisallowed it - Commissioner (Appeals) andTribunal reversed order of Assessing Officer -Whether since there was no acquisition of acapital asset and occupation of assesseecontinued in character of a tenancy,expenditure of Rs. 1.50 crores could not be

Ahmedabad Chartered Accountants Journal August, 2013268

Controversies and Issues in Business Deductions under Chapter IV (Sections 30 to 36)

regarded as capital in nature but revenue to beallowable by way of deduction - Held, yes [CIT Vs. Talathi an[In favour of assessee]dPanthaky Associated (P.) Ltd. [2012] 18taxmann.com 367 (Bom. H.C.) ]

The expenditure on designing, layout and othertemporary constructions, to make officefunctional, was allowable as repairs andmaintenance, and was not capital in nature.[CIT Vs. Armour Consultants (P.) Ltd.[2013] 32 taxmann.com 172 (MadrasH.C.)] [In favour of assessee]

Section

31: Repairs & Insurance of Plant, Machinery& Furniture

Controversies :

i. Current repairs to the plant, machinery andfurniture is allowed as deduction. However,capital repairs incurred by the assessee arenever allowed as deduction whether plant isleased or is purchased. Instead the capitalrepairs incurred shall be deemed to be an asseteligible for depreciation.

i. Premium paid for insurance against the risk ofdamage or destruction of plant, machinery orfurniture is allowed as deduction.

Issues :

(A) Expenditure incurred by assessee towardscost of replacement of machinery couldnot be regarded as amount paid on accountof current repairs allowable under section31. [CIT VS. Sree Ayyanar Spinning& Weaving Mil ls L td. [2012] 28taxmann.com 106 (SC) ] [In favourof Revenue]

(B) Whether section 31(i) limits scope ofallowability of expenditure as deduction inrespect of repairs made to machinery, plantor furniture by restricting it to concept ofcurrent repairs and all repairs are notcurrent repairs - Held, yes - Whether todecide applicability of section 31(i) test isnot whether expenditure is revenue orcapital in nature, but whether expenditureis current repairs - Held, yes - Whetherbasic test to find out as to what wouldconstitute current repairs is that expendituremust have been incurred to preserve andmaintain an already existing asset, andobject of expenditure must not be to bringa new asset into existence or to obtain a

new advantage - Held, yes - Whether allrepairs do not attract section 31(i) eventhough expenditure is revenue in nature -Held, yes- Assessee manufacturer of yarnreplaced old 3 ring frames by new onesand claimed expenditure incurred in saidactivity as current repairs contending thatwhole textile mill was a ‘Plant’ and ringframes were one of 25 machines whichconstituted one single process…….

(C) Replacement of frames be treated asreplacement of part of plant/totalmachinery and not replacement of amachine - Assessing Officer held that eachmachine including ring frame was anindependent and separate machinecapable of independent and specificfunction and, therefore, expenditureincurred for replacement of entire machinewould not come within meaning of words‘current repairs’ - Whether AssessingOfficer was justified in holding so - Held,yes [Saravana Spg. Mills (P.) Ltd. Vs.CIT [2007] 163 TAXMAN 201 (SC) ][In favour of Revenue]

(D) Section 31 of the Income-tax Act, 1961 -Repair and insurance of machinery, plantand furniture - Assessment year 1995-96 -Whether each machine in a textile millshould be treated independently as suchand not as a mere part of entire compositemachinery of spinning mill - Held, yes -Whether, therefore, replacement of suchan old machine with a new one wouldconstitute bringing into existence a newasset in place of old one and not repair ofold and existing machine to be allowed asdeduction under section 31 - Held, yes [CIT Vs. Sri Mangayarkarasi Mills (P.)Ltd. [2009] 182 TAXMAN 141 (SC) ][In favour of Revenue]

(E) Assessee claimed expenditure of Rs.1,80,85,276 on account of repairs of40MVA transformer - Assessing Officerfound that book value of transformer hadbeen completely exhausted, and therefore,he held that it was a case of making newtransformer - He, therefore, held thatexpenditure was of capital nature andmade disallowance therefor - On appeal,Tribunal found that expenses were incurredon extensive repairs, consequent to severedamage to an existing business asset and,therefore, it was case of restoration of its

Ahmedabad Chartered Accountants Journal August, 2013 269

existing capabilities and not a case ofacquisition of new asset or obtaining anyadvantage of enduring nature - Tribunal,accordingly, allowed assessee’s claim -Whether findings recorded by Tribunalwere findings of fact and, therefore, noquestion of law did arise therefrom - Held,yes [ CIT Vs. Sunflag Iron & SteelCo. Ltd.* [2011] 15 taxmann.com124 (Bom. H.C.) ] [ In f avour ofassessee]

Section 32: Depreciation

(i) know-how, patents, copyrights, trademarks,licences, franchises or any other business orcommercial rights of similar nature, beingintangible assets acquired on or after the 1stday of April, 1998, owned, wholly or partly, bythe assessee and used for the purposes of thebusiness or profession the following deductionsshall be allowed.

Issues :

(A) Goodwill is an asset under Explanation 3(b)to section 32(1) and, thus, it is eligible fordepreciation & Stock exchangemembership card is an asset eligible fordepreciation under section 32 of the Act..[CIT Vs. Smifs Securities Ltd. [2012] 24taxmann.com 222 (SC)] [In favour ofassessee]

(B) Whether right of membership conferredupon a member under BSE membershipcard in terms of rules and Bye-laws of BSE,as they stood during relevant assessmentyears, was a ‘business or commercial right’which gave a non-defaulting continuingmember a right to access exchange andto participate therein and, in that sense, itwas a licence or akin to a licence in termsof section 32(1)(ii) - Held, yes - Whether,therefore, for relevant assessment years,depreciation was allowable on cost of BSEmembership card under section 32(1)(ii) -Held, yes. [Techno Shares & StocksLtd. vs. CIT [2010] 193TAXMAN 248(SC) ] [In favour of assessee

(C) Assessee was engaged in business of hire-purchase and leasing finance - It leasedout positive film rolls purchased by it to afirm and claimed depreciation on those filmrolls - Assessing Officer allowed such claim- Subsequently, on account of strike in filmindustry, lessee returned film rolls toassessee and requested for cancellation of

lease agreement - Assessee accounted forlease rent as income but same being notrecovered were claimed as bad debt -Assessing Officer reopened assessmentand disallowed depreciation originallyallowed to assessee on ground thatassessee had claimed lease rent as baddebt in subsequent assessment year andthat assessment had become final -Whether film rolls which were kept underforced idleness, were to be deemed to bein use during entire period of year and,therefore, assessee, even though a passiveuser, was to be deemed to be an activeuser within meaning of word ‘used’, as filmrolls were kept ready for use - Held, yes -Whether, therefore, assessee was entitledto claim depreciation on said film rolls -Held, yes [ CIT vs. Heera FinancialServices Ltd. [2008] 169 TAXMAN192 (MAD. H.C.) ] [ In f avour ofassessee]

(D) Assessee-company claimed depreciationon Tetrapack machine - Assessing Officerdisallowed its claim on ground that saidmachine was lying idle - Commissioner(Appeals) upheld order of Assessing Officer- However, Tribunal accepted assessee’sclaim on ground that machine was not sold,discarded or demolished and was keptready for use - Whether since keeping ofmachine in readiness was a finding of fact,machine would be deemed to have beenused within meaning of expressioncontained in section 32 and, therefore,Tribunal was justified in allowing assessee’sclaim - Held, yes [ CIT Vs. PremierIndustr ies ( India ) Ltd.2008] 170TAXMAN 407 (MP H.C.) ] [In favourof assessee]

(E) Non-registration of asset in assessee’sname is no bar for allowing depreciation.Whether even in absence of registered saledeed in respect of car parking space,assessee is entitled to claim depreciationon same - Held, yes.[CIT VS. IndianSugar Exim Corpn. Ltd. [2012] 26taxmann.com 323 (Delhi H.C.) ] [Infavour of assessee]

(F) Trial run of plant constitutes ‘use’ thereofentitling assessee for depreciation inrelevant assessment year. The trial run ofthe plant by the assessee constitutes ‘use’thereof entitling the assessee for

Controversies and Issues in Business Deductions under Chapter IV (Sections 30 to 36)

Ahmedabad Chartered Accountants Journal August, 2013270

depreciation in the relevant assessmentyear. [C IT Vs. Mentha & Al l i edProducts [2010] 326 ITR 297 (ALL.H.C.)] [In favour of assessee]

(G) Allowance/Rate of - Non-compete fee -Assessment year 2001-02 - Whether sincein case of non-competition agreement,advantage is a restricted one in point oftime and it does not confer any exclusiveright to carry on primary business activity,amount paid as non-compete fee does notquality for depreciation under section32(1)(ii) - Held, yes [Sharp BusinessSys tem Vs. C IT [2012] 27taxmann.com 50 (Delhi H.C.) ] [Infavour of revenue]

Section 36(1)(i) : Insurance of Stock

Controversies :

• The amount of any Insurance premium paid inrespect of insurance against risk of damage ordestruction of stocks or stores used for the purposesof the business is allowed as discount.

Section 36(1)(ib) Insurance premium on thehealth of employees

Controversies :

It is allowed as deduction if following conditionsare satisfied :

a) The Premium is paid by Cheque by the employer;and

b) Premium is paid under the Scheme framed in thisbehalf by the General Insurance Corporation ofIndia and approved by the Central Government.

Issues :

Section 36(1)(i) of the Income-tax Act, 1961 -Insurance premium qua insurance of stocks orstores - Assessee, a partnership firm, insuredthe lives of its partners to provide for liquid cashto pay off outgoing partner or legal heirs ofdeceased partner to enable surviving partnersto continue business without interruption -Assessee paid insurance premia and was entitledto sum assured on maturity of policy or in eventof death of partner - Whether it could be saidlife insurance policies were taken out againstrisk of damage or destruction to the stocks sothat insurance premium paid could be allowedunder section 36(1)(i) -Held, on facts, No.[Khodidas Mot iram Pancha l VS . CIT[1986] 27 TAXMAN 208 (GUJ. H.C.) ][In favour of revenue

Section 36(1)(ii) Bonus or commission paid toemployees

Controversies :

• Bonus or Commission paid to an employee isallowable as deduction subject to certain conditions:

1 ) Admissible only if not payable as profitor dividend : One of the conditions is thatthe amount payable to employees as Bonus orCommission should not otherwise have beenpayable to them as profit or dividend. This isprovided to check an employer from avoidingtax by distributing his / its profit by way of bonusamong the member employees of his/itsconcern, instead of distributing the sum asdividend or profits.

2 ) Deductible on payment basis : Bonus orCommission is allowed as deduction only wherepayment is made during the previous year oron or before the due date of furnishing returnof income u/s 139.

Issues :

(A) Assessee-company was a share broker - Duringrelevant assessment year, it had paidcommission to tune of Rs. 40 lakhs each to threeworking directors who were only shareholdersof company and owned entire share capital ofRs. 6.5 crores of company - Assessing Officerheld that such payment of commission was inlieu of dividend and was not eligible fordeduction under section 36(1)(ii) - Assesseeclaimed that payment of commission was notin lieu of profit or dividend as payment hadbeen made to directors for hard work they hadput in improving profits of company - However,facts revealed that steady rise in performanceof company was due to improved marketconditions and not because of any extra servicerendered by directors as no evidence had beenproduced for rendering of extra services -Assessee had not given any convincing reasonfor not declaring dividend in spite of substantialprofit - Moreover, no commission was paid toany employee other than three shareholderdirectors who were also family members -Whether, on facts, payment of commission ofRs. 1.20 crores to three working directors wasin lieu of dividend and same was not allowableas deduction under section 36(1)(ii) - Held, yes.[ Dalal Broacha Stock Broking (P.) Ltd.vs. ACIT [2011] 11 taxmann.com 426(Mum. ITAT) (SB) ] [In favour of revenue]

Controversies and Issues in Business Deductions under Chapter IV (Sections 30 to 36)

Ahmedabad Chartered Accountants Journal August, 2013 271

(B) Whether ex gratia payment made by assessee-company to its employees over and above limitof 8.33 per cent prescribed under Payment ofBonus Act was allowable as deduction undersection 36(1)(ii) - Held, yes. [CIT VS. MainaOre Transport (P . ) Ltd . [2008] 175TAXMAN 494 (BOM. H.C.) ] [In favourof Assessee]

(C) Bonus or commission - Assessment years 1979-80 and 1980-81 - Assessing Officer disallowedcertain sum claimed by assessee-companytowards bonus paid to senior staff members -Whether in view of decision of Allahabad HighCourt in CIT v. Champaran Sugar Co. Ltd. [ITReference No. 20 of 1990, dated 14-2-2005],Tribunal was correct in holding that paymentto senior members of employees who were notentitled to receive bonus under Payment ofBonus Act, was an admissible expenditure -Held, no [ CIT VS. Champaran Sugar Co.Ltd. (2006) 154 TAXMAN 177 (H.C.ALL.)] [In favour of revenue]

(D) Assessee paid certain amounts as bonus toemployees, who were also shareholders andpromoters of company. The bonus was mainlypaid for services rendered by working Directors,who happened to hold a few shares in company- Whether in view of aforesaid legal position,assessee’s claim for bonus could not bedisallowed by invoking provisions of section36(1)(ii) - Held, yes [ACIT VS. MandoviMotors (P.) Ltd [2010] 8 taxmann.com225 (Bang. ITAT) ] [In favour of Assessee]

(E) Bonus or Commission - Tribunal allowed claimof assessee for deduction of ex gratia paymentas additional bonus on ground that saidpayment was made on account of agreementbetween mills owner’s association andemployee’s union - Whether in absence of anyevidence to show that agreement was bindingon assessee or to show that ex gratia paymentwas reasonable or in accordance with anypractice prevailing at relevant time, assesseewas not entitled to deduction of bonus, whichwas paid over and above bonus payable underPayment of Bonus Act - Held, yes [CIT VS.Mafat lal F ine Spg. & Mfg. Co. Ltd. [[2004] 138 TAXMAN 143 (BOM. H.C.) ][In favour of revenue]

(F) Section 36 (1)(ii) of the Income-tax Act, 1961 -Bonus or commission - Assessment year 1977-78 - Assessee paid certain sum to its executivestaff as commission over and above salarypayable to them - Assessing Officer disallowed

said commission - On appeal, Tribunal deletedaddition holding that payment was clearly forcommercial expediency - Whether on facts,Tribunal was justified in its action - Held, yes .[Porri tts & Spencer (Asia) Ltd. VS CIT[2008] 175 TAXMAN 533 (PUNJ. & HAR.H.C.) ] [In favour of Assessee]

Sect ion 36(1)( i i i ) Interest pa id on borrowedcapital for the purpose of business or profession

Controversies :

CONDITIONS :

As per Supreme Court judgment :

1. The sum of money should be borrowed from anotherassessee. The loan may be borrowed from any Bank,Financial Institution, Govt., Public, friends or relatives.Loan may be in the form of debentures or depositsetc. Interest on capital or loan to proprietor is notallowed as deduction since the loan is not borrowedfrom another person. However, interest paid by firmto its partner on their capital contribution is allowedas deduction.

2. Such borrowed money should be used for the purposeof business or profession. But where the amount ofloan is used for personal purpose it is not allowed asdeduction. E.g. the loan is borrowed for the paymentof income tax not allowed as deduction. However,loan is borrowed for payment of dividend or salestax is allowed as deduction

3. The Interest has accrued during the relevant previousyear. However, where the interest falls u/s 43B, i.e.where interest is payable to banks or financialinstitutions, then for claiming deduction such interestshould actually be paid on or before the due date offurnishing of return.

Controversies :

PROVISO 1 TO 36 (1)( i i i ) . INTEREST ON BORROWING FOR ACQUIRING NEW ASSETS :

1. Interest accrued before the commencement ofbusiness not allowed ad deduction but has to becapitalized and added to the actual cost of fixedassets acquired out of borrowed capital.

2. Similarly interest accrued after the commencementof business but before the asset is put to use is notallowed as deduction but has to be capitalized andadded to the actual cost of the fixed assets acquiredout of borrowed capital.

3. Interest accrued after the asset is put to use isallowed as deduction u/s 36(1)(iii) irrespective of thetreatment in books of account.

Controversies and Issues in Business Deductions under Chapter IV (Sections 30 to 36)

Ahmedabad Chartered Accountants Journal August, 2013272

Other Points :

Where interest is paid outside India without deduction oftax at source can not be allowed as deduction.

1. Income tax department cannot question the needfor borrowing and the rate of interest.

2. Interest other than interest on borrowing is allowedas deduction u/s 37 and not under this clause. E.g.Interest on late payment of sales tax etc.

Issues :

(A) Interest paid on borrowed fund for mereextension of existing business, is allowable asdeduction under section 36(1)(iii). [CIT Vs.Monnet Indust r ies L td. [2012] 25taxmann.com 236 (SC) ] [In favour ofAssessee]

(B) Interest paid in respect of borrowings on capitalassets not put to use in concerned financial yearis allowable as deduction under section36(1)(iii ). [ ACIT VS. Arvind Polycot Ltd.(2008] 299 ITR 12 (SC)] [In favour ofAssessee]

(C) Assessee had a running business ofmanufacturing and selling of intravenoussolutions - It installed new machineries on whichproduction was not started during relevant year- Assessee claimed deduction of interest onborrowings made for purchasing thesemachineries - Whether assessee’s claim was tobe allowed u/s 36 (I)(iii)- Held, yes. [ DCITVS. Core Health Care Ltd. [2008] 167TAXMAN 206 (SC) ] [ In f avour ofAssessee]

(D) Interest paid in respect of borrowings foracquisition of capital assets not put to use inconcerned financial year can, be allowed asdeduction under section 36(1)(iii). [VardhmanPolytex Ltd. vs. CIT [2012] 25taxmann.com 281 (SC) ] [In favour ofAssessee]

(E) Section 36(1)(iii) of the Income-tax Act, 1961,read with Article 7 of DTAA between India andBelgium (Business Profit) - Interest on borrowedcapital - Assessee-non-resident company hadborrowed money from its shareholders in sameratio as equity shareholding resulting in abnormaldebt-equity ratio of 248:1 - Revenue’s case wasthat debt was to be re-characterised as equityand interest payment thereon disallowed -Whether since there are no thin capitalizationrules in force, interest payment on debt capitalto shareholders could not be disallowed - Held,