African Review Dec Jan 2016

-

Upload

alain-charles-publishing -

Category

Documents

-

view

249 -

download

1

description

Transcript of African Review Dec Jan 2016

-

Europe 10, Ghana C1.8, Kenya Ksh200, Nigeria N330, South Africa R25, UK 7, USA $12www.africanreview.com

Finance:H E Ilyas Moussa Dawaleh, Minister ofEconomy and Finance of Djibouti P30

Power:Technology enables ruralaccess to energy P36

Mining:Project managementfor cost control P48

African Review

of

Europe 10, Ghana C1.8, Kenya Ksh200, Nigeria N330, South Africa R25, UK 7, USA $12

December/January 2016

www.africanreview.com

Finance:H E Ilyas Moussa Dawaleh, Minister ofEconomy and Finance of Djibouti P30

Power:Technology enables ruralaccess to energy P36

Mining:Project managementfor cost control P48

African Review

of Business and TechnologyD

ecember/January 2016

Volume 51 N

umber 5

ww

w.africanreview

.com

Ghanaian

investorguidance

P22

RebuildingSouth African

healthcare

P44

ATR Dec_Jan 2016 Cover_Layout 1 15/12/2015 09:53 Page 1

-

Flying to the Surf City Three times weekly from December 2015

www.ethiopianairlines.com

DURBAN

10/16/2015 2:52:12 PMS01 ATR Dec 15_Jan 16 - Start_Layout 1 16/12/2015 06:42 Page 2

-

Editor: Andrew [email protected]

Editorial and Design team: Bob AdamsPrashant AP, Hiriyti Bairu, Sindhuja Balaji Miriam Brtkova, Ranganath GS, Rhonita Patnaik Prasad Shankarappa, Zsa Tebbit, Nicky Valsamaki Louise Waters and Ben Watts

Publisher: Nick Fordham

Publishing Director: Pallavi Pandey

Advertising Sales Manager: Roman ZincenkoTel: +44 114 262 1523 Fax: +44 7976 232791 Email: [email protected]

China: Ying MathiesonTel: +86 10 8472 1899 Fax: +86 10 8472 1900Email: [email protected]

India: Tanmay Mishra Tel: +91 80 65684483 Fax: +91 80 40600791Email: [email protected]

Nigeria: Bola OlowoTel: +234 80 34349299Email: [email protected]

UAE: Graham BrownTel: +971 4 448 9260 Fax: +971 4 448 9261Email: [email protected]: Steve ThomasTel: +44 20 7834 7676 Fax: +44 20 7973 0076Email: [email protected]: Michael TomashefskyTel: +1 203 226 2882 Fax: +1 203 226 7447Email: [email protected]

Head Oce: Alain Charles Publishing Ltd, University House,11-13 Lower Grosvenor Place,London SW1W 0EX, United KingdomTel: +44 20 7834 7676, Fax: +44 (0)20 7973 0076 Middle East Regional Oce: Alain Charles Middle East FZ-LLC, Oce 215,Loft No 2/A, PO Box 502207, Dubai Media City,UAE, Tel: +971 4 448 9260, Fax: +971 4 448 9261Production:Priyanka Chakraborty, Nikitha JainNathanielle Kumar, Nelly MendesDonatella Moranelli, and Sophia PintoE-mail: [email protected]

Subscriptions: [email protected]: Derek FordhamPrinted by: Buxton PressPrinted in: December 2015US Mailing Agent: African Review of Business & Technology, USPS. No. 390-890 is published 11 times a year for US$140 per year byAlain Charles Publishing, University House, 11-13 LowerGrosvenor Place, London SW1W 0EX, UK. Peridicals postage paidat Rahway, New Jersey. Postmaster:send address corrections to AlainCharles Publishing Ltd, c/o MercuryAirfreight International Ltd, 365Blair Rd, Avenel, NJ 07001.

ISSN: 0954 6782

UP FRONT

3

REGULARS

FEATURES20 Business and Finance

How food security aects Nigerias public and private sectors; HR management tools for theNigerian market; how the GIPC governs Ghanas investment framework; Infosys Finacle bankingtechnoology to transform a financial institution in Mauritius; how Chinese investment impactsAfrican economies; and methods to modernise Nigerian inland revenue

32 SecurityWhat is needed for an eective information governance; robust IT service provision; and theNigerian Communications Commission strengthens its surveillance system

36 PowerSolar power boxes in South Africa; grid electricity for remote communities; and FG Wilsons fivedecades of enabling energy production

40 ConstructionThe prospects for precast concrete; smart building for secure storage; how African constructorscan gain from Elkon concrete batching plants; integrating energy into architecture; improvinghealthcare facilities for South Africas cape communities; and safe scaolding practices

48 MiningProject management for mineral extraction; sustainable gold mining in Ghana; software tooptimise mine planning; and training to improve health and safety

04 Agenda:Corporate initiatives andmarket developments

14 Bulletin:Investment initiativesacross the continent

52 Solutions:Equipment for buildinginfrastructure

Contents

Europe 10, Ghana C1.8, Kenya Ksh200, Nigeria N330, South Africa R25, UK 7, USA $12www.africanreview.com

Finance:H E Ilyas Moussa Dawaleh, Minister ofEconomy and Finance of Djibouti P30

Power:Technology enables ruralaccess to energy P36

Mining:Project managementfor cost control P48

Europe 10, Ghana C1.8, Kenya Ksh200, Nigeria N330, South Africa R25, UK 7, USA $12

December/January 2016

www.africanreview.com

Finance:H E Ilyas Moussa Dawaleh, Minister ofEconomy and Finance of Djibouti P30

Power:Technology enables ruralaccess to energy P36

Mining:Project managementfor cost control P48

Ghanaian

investorguidance

P22

RebuildingSouth African

healthcare

P44

Editors Note

Cover picture: DW artInset, bottom left: Government of Djibouti

P35

P46

This issue of African Review of Business and Technology oers insights into business andfinance, security, power, manufacturing and construction, and mining. From page 18 to page23, this issue analyses Nigerias food security situation, appraises HR tools for the Nigerianbusinesses, and reports on the governance of Ghanaian investment. Included also, from pages 24to 31, are articles on Chinese investment into African economies, including specific analysis fromDjiboutis Minister of Finance, and analysis of Nigerian accounting. Pages 32 to 35 include featureson information governance and IT service provision, and on surveillance. From page 36 to page39, this issue reports on solar power boxes in South Africa, on grid electricity for remotecommunities, and on the five decades of standby power support delivered by F G Wilson. Pages40 through to 46 report on the marketability of precast concrete, block and brick-making for'smart' buildings, concrete batching plants, the relationship between energy and architecture, therecent improvements made to a healthcare facilities on South Africas Western Cape, and guidanceon safe scaolding. From page 48 to page 51, there are overviews of project management formineral extraction, sustainable gold mining in Ghana, software for mine planning, and training formine health and safety.

Andrew Croft, Editor

African Review of Business and Technology - Dec 15/Jan 16

Audit Bureau ofCirculations -BusinessMagazines

www.africanreview.com

Serving the world of business

2:52:12 PMS01 ATR Dec 15_Jan 16 - Start_Layout 1 16/12/2015 10:39 Page 3

-

Engineered to give optimum bucket ll,

t

An optimised powertrain and Eco-pedal function contribute to outstanding

f

T

World Bank Groupmember institutionIFC is investing in a 20 per cent equitystake in Egypt-based Sphinx Glass, to boost

the glass manufacturing sector in the region,support the companys expansion, and spurjob creation and growth.

Sphinx Glass is a subsidiary of Saudi-basedConstruction Products Holding Company(CPC).The IFC investment enables SphinxGlass to optimise production, improve itsenergy eciency and create more jobs, as wellas boost the development of Egypts industrialinfrastructure. The company is a key supplier offloat glass to Egypts construction sector, and asignificant regional and international exporter.

Mu'taz Sawwaf, vice chairman of CPC said,IFC will play a strong role as an equity partnerhelping a regional player in its expansion plansin Egypt. We aim to build a long termrelationship with IFC, as we continue toexecute on our international expansionstrategy, capitalizing on increasing demand forbuilding materials and glass in Egypt and Africa.

The investment is part of World Bank Groupstrategy in Egypt to boost job creation throughthe manufacturing sector and promote energyeciency improvement initiatives. It will alsostrengthen regional integration through aSouth-South investment, a key pillar of IFC'sstrategy in the Middle East and North Africa.

Nada Shousha, IFC country manager forEgypt, Libya and Yemen, said, Creating newjobs and strengthening the manufacturingsector, particularly in an area that can boostexports, is vital in this period of transition forEgypt. We hope this investment will also helprestore investor confidence in the country, andsend a positive message to international anddomestic investors.

Between fiscal years 2011 and 2015, IFCsinvestments in Egypt totaled close toUS$1.2bn, including mobilization. Thoseinvestments covered 18 projects across a hostof sectors, including financial markets,infrastructure, oil and gas, agribusiness,manufacturing, and health care.

A project is currently under way to construct anew, larger fishing port in Casablanca, Morocco.For dredging operations, subcontractor Somit isusing a dredger carrying an excavator equippedwith an Atlas CopcoHB 7000 hydraulic breaker.To ensure reliable operation of the attachmentunderwater, Atlas Copco has supplied acomprehensive package comprising thebreaker, a compressor, and an underwaterconnector kit.

The construction of the new fishing portinvolves extensive dredging of the channel andthe basins and the main contractor hassubcontracted the dredging and marine worksto Somit, an Italian company. The primaryequipment used by Somit is Bucephalus, a self-propelled backhoe dredger equipped with aLiebherr R 984.

Underwater breakingSeeking a suitable breaker to mount on the

Liebherr excavator, Somit consulted AtlasCopco. Taking into account the working depthof 518m, Atlas Copco recommended an HB7000 hydraulic breaker with an underwater kit.Compressed air is provided by an XAHS 347 Cdcompressor, also mounted on the dredger.

The equipment was supplied as a completepackage and the installation of compressed airlines for the underwater kit on the Liebherrexcavator was tested successfully and went intooperation.

Atlas Copco Marocco sales engineerMustapha El Idrissi explained, Underwaterbreaking requires a special installation. The

compressor and kit are mandatory to avoidserious damages.

The underwater connector kit, withprotective equipment, feeds compressed airfrom the compressor to the breaker'spercussion chamber. This prevents waterentering the attachment and avoids problemsof water hammer. An automatic switchprevents the breaker from being started upwithout ventilation.

Morocco's national ports authority (ANP)appointed Dumez Maroc, part of VINCIConstruction, as the main contractor for theconstruction of Casablanca's new fishing port.Begun in February 2015 with completionscheduled for January 2017, the new port willprovide more than twice the surface areacompared to the existing facility.

In addition to the dredging, the projectinvolves building a main breakwater (715lm), asecondary breakwater (500lm), two quays(325m and 145m), 11 hectares of quaysidesurfaces, a slipway (70m), and 240m of floatinglanding stages.

4

NEWS

Renewable energy enterprise Lekela Power has signed a memorandum of understanding(MoU) with the Egyptian Electricity Transmission Company for a 250MW wind power stationin Egypts Gulf of Suez area. Lekela Power is owned 60 per cent by the investment firm Actisand 40 per cent by the wind and solar company Mainstream Renewable Power. This latestpower station is Lekela Powers third project in Egypt following two power stations signedearlier this year (one 50MW solar power station and one 50MW wind power station). It will besituated in the Gulf of Suez area to capitalise on Egypts unique wind resources and will bemanaged with a build, own and operate (BOO) framework.

Sphinx Glass investmentboosts Egypts industry

Casablanca Harbour

African Review of Business and Technology - Dec 15/Jan 16

Agenda / NorthLekela Power signs MoU forEgypitna wind power station

Equipping Somits dredgingoperations in Casabanca

www.africanreview.com

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 4

-

volvoce.com

ALGERIA SMT Algeria+ 213 560 078 851

ANGOLAAuto Maquinaria+ 244 9 2782 4434

BENINSMT Benin+ 229 21 35 14 02

BOTSWANABabcock International Group+ 267 316 3200

BURKINA FASOSMT Burkina Faso+ 226 66 77 01 01

BURUNDISMT Burundi+ 32 10 47 61 20

CAMEROONSMT Cameroun+ 237 99 41 40 30

CONGOSMT Congo+ 242 06 508 27 13

CTE DIVOIRESMT Cte dIvoire+ 225 21 75 16 27

DEM. REP. OF CONGOSMT D. R. Congo+ 243 815 656 565

EGYPTGhabbour+ 20 242 107 794

ETHIOPIAEquatorial Business Group+ 251 11 442 4955

GABONSMT Gabon+ 241 07 515 008

GHANASMT Ghana+ 233 30 268 33 51

KENYA Auto Sueco Ltd+ 254 727 534 593

LIBERIASMT Liberia+ 231 888 071 000

LIBYAUnited Group+ 218 21 7313310

MADAGASCARMaterauto+ 261 20 22 233 39

MALISMT Mali+ 32 10 47 61 20

MAURITANIASMT Mauritania+ 32 10 47 61 20

MAURITIUSLeal Equipements Compagnie+ 230 207 2100

MOROCCOVolvo Maroc S.A.+ 212 522 764 800

MOZAMBIQUEBabcock International Group+ 258 84 2652397

NAMIBIABabcock International Group+ 264 81 6937473

NIGERIASMT Nigeria+ 234 802 3747678

RWANDASMT Rwanda+ 32 10 47 61 24

SENEGALSMT Senegal+ 32 10 47 61 20

SEYCHELLESLeal Equipements Compagnie+ 230 207 2100

SIERRA LEONEA. Yazbeck and Sons Ltd+ 232 7730 3042

SOUTH AFRICABabcock International Group+ 27 11 230 7300

SUDANAlbarajoub Engineering Co.+ 249 183 77 84 13

TANZANIAAuto Sueco Ltd+ 255 222 866 333

TOGOSMT Togo+ 228 99 99 92 15

TUNISIANordic Machinery+ 216 71 409 260

UGANDA Auto Sueco Ltd+ 256 791 500 400

ZAMBIABabcock International Group+ 260 212 216 200

ZIMBABWEConquip+ 263 4 485 543

The new L120G with z-bar linkage gives you loads more: more productivity,

more fuel efciency and more uptime. Engineered to give optimum bucket ll,

the L120Gz-bar delivers superior productivity, with the z-bar lifting arm system

working in perfect harmony with load sensing hydraulics and the Volvo attachment

range. An optimised powertrain and Eco-pedal function contribute to outstanding

fuel efciency, coupled with easy service access, for lower operating costs.

The new L120G z-bar maximum productivity and optimum efciency.

Building Tomorrow.Munich 11-17 April

Hall C4:327Outdoors: FM510

THE NEW L120G with z-bar linkage

LOADS MORE... and faster

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 5

-

Nairobi can now boast a new MANand VW heavy commercial vehicleservicing facility, situated on the oldMombasa Road that connects the Kenyancapital to the nation's primary port ofMombasa. Owned by industrialist RajinderSingh Baryan, managing director of R TEast Africa Limited (RTEAL), the 9,000square-metre facility has been built at acost of over KES250mn (US$2.45mn) andhas been custom-designed to allowoptimum flexibility for vehicle servicing. Itis equipped with two inspection pits, anengine and pump room, a large partswarehouse and expansive oce space.

Mr Baryan said, "the facility will bringRTEAL's client service functions together topromote collaboration and address clientissues quickly and eciently. The newfacility will also oer after-sales service forMAN trucks with a capability of 12 truckservice bays, and carry an extensiveinventory of MAN parts."

Robert Clough, head of MAN Sub-Equatorial Africa, added, "MAN has beenenjoying steady market share growth inEast Africa which is a reflection of theorganisation's innovative engines,transmissions, braking systems, remotediagnostic and fuel economytechnologies. We believe this new facility isably equipped to support our East Africanmarkets for MAN and VW trucks and buses.With its strategic location, RTEAL's newservice centre will undoubtedly assist MANin maintaining its strong competitiveadvantage in East Africa."

Under contemporary constraints, themechanisms for achieving improvements inthe lives of smallholder farmers through greenpolicies are unclear. Both policy rationale andthe means of governing agriculturalinnovation are crucial for pro-poor impacts.Researchers at the University of East Anglia(UEA) in the UK have set out to criticallyanalyse Rwandas Green Revolution policiesand impacts from a local perspective, a mixedmethods, multidimensional wellbeingapproach is applied in rural areas inmountainous western Rwanda.

The British researchers, led by ed by Dr NeilDawson, a senior research associate in theSchool of International Development at UEA,established that the policies involve asubstantial transformation for rural farmers froma traditional polyculture system supportingsubsistence and local trade to the adoption ofmodern seed varieties, inputs, and credit inorder to specialise in marketable crops andachieve increased production and income.Although policies have been deemed successfulin raising yields and conventionally measuredpoverty rates have fallen over the same period,such trends were found to be quite incongruouswith local experiences. Research reveals thatonly a relatively wealthy minority were able toadhere to the enforced modernisation andpolicies appear to be exacerbatinglandlessness and inequality for poorer ruralinhabitants. Negative impacts were evidentfor the majority of households as subsistence

practices were disrupted, povertyexacerbated, local systems of knowledge,trade, and labour were impaired, and landtenure security and autonomy were curtailed.

In order to mitigate the eects, the universityteam recommends that inventive pro-poorforms of tenure and cooperation (none of whichpreclude improvements to input availability,market linkages, and infrastructure) mayprovide positive outcomes for rural people, andimportantly in Rwanda, for those who havebecome landless in recent years. Applyinganalysis to a pan-continental perspective, theresearchers conclude that policies promoting aGreen Revolution in Sub-Saharan Africa shouldnot all be considered to be pro- poor, but rathershould be the subject of rigorous impactassessment including localised impacts on landtenure, agricultural practices, and the well-beingof dierent communities.

6

NEWS

Helios Investment Partners (HIP) has reached agreement with the Orange Group onthe sale of Orange's entire 70 per cent stake in Telkom Kenya. The finalisation of thetransaction is subject to approval from the relevant authorities.

Telkom Kenya is the countrys incumbent fixed-line operator and is the third player inthe mobile market. The company, which operates a high-quality mobile data network,had four million mobile customers (as at end-June 2015).

MAN opens centre forservice in Kenya

Rwanda c. (Photo: Neil Dawson_UEA)

The new R T East Africa premises

African Review of Business and Technology - Dec 15/Jan 16

Agenda / East

Orange agrees to sell stake in Telkom Kenya to HIP

Green revolution means innovationfor rural Rwandan shareholders

www.africanreview.com

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 6

-

The new SUVs from Mercedes-Benz. Make the best of every ground.Find out more on: www.mercedes-benz-africa.com

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 7

-

Zimbabwean Minister of Finance andEconomic Development Patrick Chinamasahas received an US$87mn credit line fromIndias Export Import Bank (EXIM Bank) forthe renovation and upgrading of Bulawayothermal power station.

The facility is one of the fruits of ouraccelerated re-engagement with the BRICScountries and pursuance of our Look EastPolicy, Mr Chinamasa said.

EXIM Bank credit lines extended to dateinclude: upgrading of the Deka pumpingstation and river water intake system tosupport cooling at Hwange thermal powerstation, at US$28.6mn; purchase of vehiclesand spares for the Ministry of Tourism andHospitality Management, at US$49,9mn; andthe purchase of mining equipment and spareparts for Hwange Colliery, at US$13.03mn.

Mr Chinamasa said that the upgradingproject of the Bulawayo thermal powerstation is expected to be completed by 2018.It is also expected to contribute an additional70MW to the countrys national grid from thecurrent 30MW.

The project will consequently assist inreducing the current power deficit, which

currently stands at 1,500MW incircumstances of depressed demand, MrChinamasa said.

The plant will now replace the existingworn-out and inecient facility and willintroduce more advanced technology to cutdown on additional costs. It is also expectedto create downstream employment in thecoal and transport industry.

Wallace Mawire

Lifting solutions enterprise Konecraneshas received an order for six rubber tiredgantry (RTG) cranes from DP World Maputoin Mozambique. The cranes will be deliveredat the end of 2016.

Located on the south-eastern coast ofAfrica, DP World Maputo is a containershipping gateway to southern Africas vasteconomic hinterland. The port plays a majorrole in linking regional production, miningand commercial hubs to the markets ofsouth-east Asia. The port, which is almostentirely focused on origin and destinationthroughput, serves as the main shippingterminus for land-locked regions of southernAfrica such as Gauteng province, Zimbabwe,Swaziland and Botswana.

The six RTGs on order are 16-wheel RTGswith a lifting capacity of 40 tons, stackingone-over-five containers high and six rowsplus truck lane wide. They will be equippedwith auto-steering, a driver-assisting featurewhich keeps the crane on a pre-programmed, straight path, and stackcollision prevention, truck anti-lifting and atruck positioning system. The cranes will alsobe equipped with TruConnect, a remoteservice that provides 24/7 access to a globalnetwork of support centres, oeringexpertise to help solve problems and reduce downtime.

Mr Junaid Zamir, CEO of DP World Maputo,said, Container handling equipment is key tooperations across our network includingMaputo, and we strongly emphasize reliabilityand eciency. Local support on the ground isalso important for maintaining our assets sothat we meet customer expectations. TheseRTG cranes will add to our capability in thismajor market.

Our business continues to grow in Africa.With this RTG delivery to DP World Maputo,we will add southern Africa to our growingpresence in Africa. I look forward to forging along-term, mutually beneficial relationshipwith DP World Maputo, said Antoine Bosquet,sales director, port cranes, Konecranes.

8

NEWS

Building materials manufacturer Cheetah Cement plans to establish a US$30mnmanufacturing plant at Otjiwarongo in Namibia's Erongo region. The cement factory, apartnership between Whale Rock Cement Company and Chinese partners, would bethe second cement producer after Ohorongo Cement.

Cheetah Cement spokesperson Manfred Uxamb said that the company plans toproduce 1.5mn tonnes of cement per annum. He said, "Together with our partners, wehave performed a comprehensive investigation of the plot, limestone, clay, wasted ironore, and gypsum which are necessary for this cement plant. And we found that all theseresources meet our requirements. However, there are still some issues such as the supplyof electricity and water."

In 2005, Whale Rock Cement attempted to enter the Namibian market by sellingCheetah brand cement imported from Brazil. However, this attempt was short-lived inthe face of stiff competition from South Africa's Holcim Cement (now AfriSam).

Konecranes delivers RTGcranes to Maputo

EXIM Bank chairman & managing director YaduvendraMathur (right) concluding line of credit agreement forUS$87 mn with HE Mr Patrick Anthony Chinamasa [MP],Minister of Finance and Economic Development ofGovernment of Republic of Zimbabwe, in the presenceof Piyush Goyal, Hon Minister for Power, Coal, New &Renewable Energy, Government of India

African Review of Business and Technology - Dec 15/Jan 16

Agenda / SouthIndia's EXIM Bank supportsBulawayo power station upgrade

Cheetah Cement to set up Namibian operation

www.africanreview.com

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 8

-

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 9

-

S outh African oil and gas companySacOilhas committted to woring withinthe consortium of Taleveras Group, GunvorGroup and the Strategic Fuel Fund indeveloping the Bioko Oil Terminal tank farmin Equatorial Guinea into a massive oil andpetroleum products storage facility.

The project, which is spearheaded by thecountry's Ministry of Mines, Industry andEnergy, is central to the Government'sattempts at making Equatorial Guinea thepremier storage location in West and CentralAfrica, and a major transit point for global oiland gas deliveries.

SacOil is active in upstream, midstreamand downstream projects across Africa -including Egypt, the DRC, Malawi,Mozambique, and Botswana.

The entry of a fourth partner companyinto the Bioko Oil Terminal project signalsthe international interest in this facility,which will serve the huge demand forpetroleum storage in the Gulf of Guinearegion, said Minister of Mines, Industry andEnergy HE Gabriel Mbaga Obiang Lima.Projects such as the Bioko Oil Terminalfurther reinforce Equatorial Guineas status asa major African oil and gas actor and a highlyattractive investment destination.

SacOil Holdings chief executive ocer DrThabo Kgogo said, The project fits well withthe companys overall strategy of diversifyingthe business into midstream anddownstream activities.

10

NEWS

In light of the current economic challenges facing businesses in emerging markets, MainOneand Microsoft have called for the adoption of data centre colocation and enterprise cloudsolutions, stressing benefits that include cost savings and high availability.

Speaking during a presentation at the MainOne/Microsoft Enterprise seminar on deploying'innovative business models' to achieve improved eciency with data centre services,MainOne chief executive ocer Funke Opeke urged CIOs and other IT decision-makers to takeadvantage of MDX-is services, utilising Microsoft's cloud expertise on the Azure platform andthe high availability of the MDX-i data centre, owned by MainOne. She noted that Tier III ratedMDX-i is the only data centre colocation facility in Nigeria that has received the PCI DSS andISO 9001 and 27001 certifications, which are critical to ensuring data security for customers.

Ms Opeke said, Our Cloud Infrastructure as a Services ensures quick provisioning of ICTsolutions for businesses, thus improving their time to deploy new applications and services.This aords our customers lower deployment costs and streamlined expenses to enable themfocus more on their core business.

Microsoft Nigeria business group director (cloud & enterprise) Oluyomi Alarape said,MainOne is a member of an elite list of Cloud OS Network partners who deliver Microsoft-validated solutions and geographic specialization. Together, Microsoft and MainOne havepartnered to implement an Enterprise ready infrastructure platform in Nigeria that includesAzure-enabled scenarios. You gain the peace of mind knowing that solutions deployed withMainOne are supported by Microsoft, thus minimizing risk and simplifying your move to thecloud with data domiciliation in Nigeria. As trusted advisors, the partners are also availablelocally to lend their technology expertise to you while providing other services such asconnectivity that improve the quality of your solution.

SacOil supports oil inEquatorial Guinea

L-R: Ernst & Young IT transformation director Dapo Adewole, MainOne head of technical solutions Damola Solanke,Microsoft Nigeria business group director (cloud & enterprise) Oluyomi Alarape, and Accenture Nigeria MD Niyi Tayo,during the joint business session between the MainOnes data centre subsidiary MDX-i and Microsoft on 'InnovativeBusiness Models' in Lagos

African Review of Business and Technology - Dec 15/Jan 16

Agenda / WestMainOne and Microsoft present data centre solutions

www.africanreview.com

Projects such asthe Bioko Oil

Terminal furtherreinforce EquatorialGuineas status as a

major African oil andgas actor and a highlyattractive investment

destination. HE Gabriel Mbaga Obiang Lima, Minister of

Mines, Industry and Energy, Equatorial Guinea

S02 ATR Dec 15_ Jan16 - Agenda_Layout 1 16/12/2015 06:48 Page 10

-

BH67

195

The most capable SUV with innovations like the Terrain Management Systems Rock mode.

INTRODUCING THE FORD EVEREST

ssa.ford.com

S03 ATR Dec 15_ Jan16 - Bulletin_Layout 1 15/12/2015 10:08 Page 11

-

12

NEWS

February8-11Investing In African Mining IndabaCape Town, South Africawww.miningindaba.com

9-11Water Africa and West AfricaBuilding & ConstructionAbuja, Nigeriawww.aceevents.com

11-12Africa Air Expansion SummitAccra, Ghanaafrica.airportexpansionsummit.com

15-16Drilling AfricaCape Town, South Africawww.iadc.org

16-17Africa Energy IndabaJohannesburg, South Africawww.africaenergyindaba.com

16-18AfricaBuildLagos, Nigeriawww.africabuildlagos.com

17-18eCommerce AfricaCape Town,, South Africawww.ecommerceafrica.com

18-20Metal & Steel MECairo, Egyptwww.metalsteelegy.com

23-25SolaireCasablanca, Moroccosolaireexpomaroc.com

March1-2 Cards & Payments AfricaJohannesburgwww.terrapinn.com

1-3 Securex West AfricaLagos www.securexwestafrica.com

3-5 CIBEX East AfricaNairobi www.cibexeastafrica.com

15-16 Power & Electricity World AfricaJohannesburg www.terrapinn.com

15-18 Propak AfricaJohannesburg www.propakafrica.co.za

18-20 PlastPrintPackPaperDar es Salaam www.mxmexhibitions.com

21-22 Africa CEO ForumAbidjan www.theafricaceoforum.com

Events / 2016

Organised by Lnoppen, taking place 11-12 February 2016 in Accra,Ghana, the fourth Africa Airport Expansion Summit represents the bestopportunities and innovations around the continents air transporthubs. Over the past few years business activities at African airportshave grown from 45 per cent to 80 per cent, and passenger and cargotrac volumes are growing at a never seen rate. To accommodate this increase many airports are upgrading; moreover,there are plans to construct at least 40 new airports across the continent.Opportunities for airport contractors, airport equipment suppliers,management services and other products and services are unprecedented.At the 4th Africa Airport Expansion Summit; government ocials,investors, civil aviation authorities and airport management groupswill discuss with consultants, architects, construction companies,equipment providers and service groups, in order to better explorethe market and support the project development. The events confirmedspeakers include Alexanfer Herring, managing director, SafegateGermany, chairman of the summit; Bruno Boucher, associate partner,Luftansa Consulting; Flora Wakola, chief air trac control ocer,Kenya Civil Aviation Authority, and Jean Francois Guitard, directorinternational development, Aeroports de la Cote dAzur, France.

Sponsors of the 4th Africa Airport Expansion Summit include CycloneTechnology, Avlite, and IATAS. Topics to be addressed at the eventinclude:

African Open Sky Policies. Optimising airport planning & design to drive revenue, improve

security and cost eciency. Airport expansion and development projects from around Africa. Promoting public-private partnerships (PPPs) to finance airport

expansion and development. Achieving low carbon sustainable solutions for airport expansion

projects. Insights in the future of airport technology. A few of the event sponsors' bear particular significance in the

market: Avlite Systems recently introduced a new ICAO Type A and Type B

medium intensity obstruction light (MIOL). Cyclone Technology specialises in hard surface cleaning solutions. IATAS oers the platforms, solutions, tools and professional services

for tomorrow's ATM challenges.

Boosting business with improved aviation

African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

S03 ATR Dec 15_ Jan16 - Bulletin_Layout 1 15/12/2015 10:08 Page 12

-

13African Review of Business and Technology - Dec 15/Jan 16www.africanreview.com

WEB SELECTION

Mercedes Benz is to begin theassembly of mini buses andambulances in Nigeria in anattempt to draw benefits fromthe countrys automotive policy. The companys managingdirector in Nigeria, BensonUwatse, said the country couldbenefit greatly from its currentautomotive policy. Uwatsestressed, however, that thereremains much to accomplish with the policy, as Nigeria lacks theinfrastructure and the ancillary industries required for vehicleassembly.www.africanreview.com/manufacturing

Mercedes Benz latest firm to capitaliseon Nigerian auto policy

Orange and Engie have signed twodeals to expand the electricity gridand optimise the power supply forthe telecom infrastructure acrossAfrica. For the additional supply ofpower, solar kits and small-scaleelectricity networks will be set up.The service would be billed tocustomers through mobilenetworks, explained ocials from Orange.Engies expertise in renewable energy production, aggregation andmaintenance, in addition to Oranges dominance in the telecomsector, could result in domestic power supply solutions for ruralpopulations. Trials will be conducted that will help companiesvalidate technical solutions, sales and distribution models, as well asthe economic feasibility of the project.www.africanreview.com/energy-a-power

Japanese multinational Toshiba Corporation has concluded an MoUwith the Tanzania Geothermal Development Company Limited (TGDC)to develop geothermal power in the East African nation.TDGC is the only organisation in Tanzania with geothermalexploitation rights, according to Toshiba, whose business ranges fromgeothermal resource development to power plant construction. Through TDGCs expertise, Toshiba will be expected to develop andprovide major equipment, create guidelines for plant operation andmanagement, as well as handle personnel training.www.africanreview.com/energy-a-power

Air Seychelles is set to launchnon-stop flights between Maheand Beijing by January 2016.According to the Seychellesgovernment, this would be thefirst direct air link between thetwo countries, following regulatory approvals.Air Seychelles chairman Jol Morgan said, The start of this servicenext year is especially fitting as Seychelles and China will celebratethe 40th anniversary of diplomatic relations established in 1976,and I am confident our friendship will continue to strengthen withthis important new air bridge.www.africanreview.com/transport-a-logistics

Orange and Engie set to boost Africantelecom network

Mercedes Benz will assemble mini busesand ambulances in Nigeria (Photo:Technik Museum Sinsheim und Speyer)

Small scale electricity networks willbe set up across Africa, according toEngie ocials (Photo: Tony Webster)

African Review/On the WebA selection of product innovations and recent service developments for African businessFull information can be found on www.africanreview.com

Toshiba signs MoU geothermal powergeneration deal with TGDC

Air Seychelles to launch non-stopflights to Beijing

France has revealed its plans to spend billions of euros on renewableenergy and environmental projects in Africa over the next five years. At the 2015 Paris Climate Conference COP21, French PresidentFranois Hollande said that his government was planning to double itsinvestments in clean energy production, which could include windfarms, solar power and hydro projects. Though Africa produces considerably lesser number of greenhousegases, the continent at large is vulnerable to the devastating eects ofclimate change.www.africanreview.com/manufacturing

France to invest in clean energy projects in Africa

Caterpillar has launched the pilot phase of the Technicians for Africaproject, which aims to train those who aspire to become technicians inthe heavy equipment sector.The project is applicable for those living in Nigeria, Mozambique andDR Congo, said Caterpillar. It entails a website that engagesparticipants in virtual training sessions. There are 18 modules thatprovide technical insights into safety and basic fundamental systemslike electrical, hydraulics and powertrain. The website will be availablein English, French and Portuguese.www.africanreview.com/ict

Caterpillar launches virtual trainingwebsite for technicians

Air Seychelles will fly directly from Maheto Beijing (Photo: Edwin Ieong)

S03 ATR Dec 15_ Jan16 - Bulletin_Layout 1 15/12/2015 10:08 Page 13

-

Zambia governments most significant outreachto UK investorsOn 4th November, the Government of Zambia came to London, for

the 2015 UK-Zambia Trade & Investment Forum: the Zambian

governments most significant overseas investment outreach in

recent years. Organised by DMA and led by Her Honour Madam

Inonge Wina, Vice President of the Republic of Zambia & Minister of

National Planning, provided a unique opportunity for investors and

business leaders to gain in-depth knowledge of Zambia, one of

Africas fastest growing and most stable economies.

With a real GDP growth averaging roughly 6.7 per cent per annum, a

rich resource endowment and business-friendly environment, Zambia

continues to attract international investors and to entice firms

looking to build their African presence through the countrys

excellent access to markets across Southern Africa. Through the

Forum, the Government of Zambia set out its ambitious programme

for developing the economy beyond its strong extractives base and

for exploiting opportunities in new growth sectors such as

agriculture, hydro-power and tourism.

Supported by The Zambian Embassy in London, Zambia

Investment Development Agency, FCO, UKTI, BCA, RSA & British

Expertise, the forum was comprised of both plenary and more

targeted sessions. It was specifically designed to highlight the large

investment opportunities in Zambia, the rapidly improving

infrastructure, the attractive fiscal incentives, the supportive FDI legal

framework and the competitive workforce ability. DMA also arranged

1-2-1 meetings to take place in the margins.

Our government will play its part to create an enabling

environment; in which doing business can be made easier and

where benefits and incentives can help the private sector to take

root and flourish, noted Her Honour Madam Inonge Wina. We now

look to the international community to play an important part to

bring new investment, skills and resources, and to share in the

rewards and opportunities for growth.

To initiate vigorous, constructive dialogue between would-be

investors and government, Her Honour Madam Inonge Wina, was

accompanied by Hon Margaret Mwanakatwe, Minister of Commerce,

Trade and Industry as well as the most senior delegation of ministers

and ocials. Speaking alongside the delegation, CEOs and directors

from leading international businesses presented their own

investment plans in Zambia, a number of which were translated into

deals by the end of the day.

Letshego gains majoity interest in Advans BankTanzaniaFinancial institution Letshego Holdings Limited, which runs

consumer, micro lending and deposit-taking subsidiaries across

Southern and East Africa, has acquired a 75 per cent stake in Advans

Bank Tanzania by way of a subscription for new shares; the

subscription of Tanzania Shillings 15.5bn (approximately US$7mn) is

positioned alongside existing shareholders Advans SA and FMO,

which will continue to provide on-going governance and oversight.

Angola's new airport to be operational in 2017A new international airport in Luanda, Angola, is expected to become

operational in the first half of 2017, according to Angolan Minister of

Transport Augusto Toms, ultimately serving some 15mn passengers

per year; construction of the airport, costing US$3.8bn, has been

contracted to China International Fund Limited (CI).

Sandvik expands Zambian support centreMining equipment company Sandvik has invested in additional

support facilities in Zambia that include administrative oces,

workshops, parts distribution and logistics centres, with advanced

equipment and tooling, along with globally accepted management

systems, are also in place to ensure services and support that is

comparable to other Sandvik centres across the globe; Steve

Chambers, Sandvik technical and workshop manager for central

Africa, said, With a significant amount of stock and spares parts and a

complement of specially trained sta able to maintain and support

our full range of machines there is no need to look elsewhere.

14

NEWS

Bulletin / Investment

African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

DMA Zambia Forum

Assembling of a DANA CL9000torque converter used in the Sandvik

TH540 dump truck for a customer

S03 ATR Dec 15_ Jan16 - Bulletin_Layout 1 15/12/2015 10:08 Page 14

-

15

Bulletin / InvestmentNEWS

Experience trends, innovations and enthusiasm up close at the industrys most important international exhibition. This is where the world comes together, so you cant miss out! Prepare your business success and look forward to: 3,400 exhibitors More than half a million visitors 605,000 m of space

The world speaks bauma.Join the conversation!

Get your ticket now:

www.bauma.de/tickets/en

Connecting Global Competence

April 1117, Munich

31st Edition of the Worlds Leading Trade Fair for Construction Machinery, Building Material Machines, Mining Machines, Construction Vehicles and Construction Equipment

www.bauma.deContact: Trade and Fairs Consulting GmbH | [email protected] | Tel. +49 (0) 6003 826892

bauma Official

African Review of Business and Technology - Dec 15/Jan 16www.africanreview.com

CIF endorses Ugandan renewable energy plansThe Government of Uganda

has welcomed endorsement of

its renewable energy investment

plans under the dedicated fund

for Scaling Up Renewable

Energy in Low Income Countries

Program (SREP) established by the Climate Investment Funds (CIF),

with SREP funding of US$50mn now available to help advance

geothermal exploration, solar photovoltaic net metering, the building

of mini-grids and the development of wind power in the East African

country; James Baanabe, Ugandas Commissioner of the Energy

Eciency and Conservation Department in the Ministry of Energy

and Mineral Development, said, Energy is the driver of social

economic development so adequate and reliable renewable energy is

vital to our vision of becoming a prosperous country within 30 years."

Dutch funding for Mozambican water project The Government of The Netherlands has approved a grant for more

than 20mn (US$21.4mn) has been signed for the execution of the

project plan developed by Mozambique water supply company

FIPAG, engineering and project management consultancy Royal

HaskoningDHV and water utility partner Vitens Evides

International, to supply clean drinking water to 650,000 people in

Maputo; FIPAG CEO Pedro Paulino said, "The new sustainable water

supply system will provide good quality drinking water via public

infrastructure to 650,000 inhabitants in northern Maputo.

The Netherlands Deputy Director-General for International Cooperation, Mrs ReinaBuijs, and the Minister of Public Works, Housing and Water Resources of Mozambique,His Excellency Mr Carlos Bonete Martinho, have signed a grant arrangement for theimplementation, operation and maintenance of the Greater Maputo Water SupplyExpansion Project (Photo: Netherlands Water Partnership)

S03 ATR Dec 15_ Jan16 - Bulletin_Layout 1 15/12/2015 10:08 Page 15

-

At ECAir, we opted to negotiatewith our peers and were able toconclude inter-airline agreementswith TAC, Asky, Ethiopian, SouthAfrican Airways, Air Algrie andagreed to operate theBrazzaville-Beirut route incollaboration with Trans AirCongo." - Fatima Beyina-Moussa,chief executive officer,

Equatorial Congo Airlines (ECAir)Fatima Beyina-Moussa, chief executiveocer, Equatorial Congo Airlines (ECAir)

Trade between countries andregional cooperation are of theutmost importance when itcomes to building a strong andsustainable African economy. -Dr Ibrahim Mayaki, CEO,

NEPAD Agency

The entrepreneurial spirit inAfrica and the creativity to comeup with out-of-the-box solutionsare simply amazing. In a worldthat is increasingly shaped bydigital solutions, this innovativespirit is enabling Africa tospearhead technologicalsolutions in areas such as e-

health, mobile banking orcommunity information. - StefanOschmann, CEO-elect,

Merck

Conditions in mining industriesaround the world remainchallenging as the fall incommodity prices has far-rangingimpacts that will continue toweaken the unit sales of newmining pumps. However, there areopportunities for growth with thedemand for replacement pumps, a bigger focus on recycling andreusing water, and investmentsmade towards productivityimprovements. - Nez Guevera,senior mining analyst,

Timetric

If we are to engage inenvisioning and co-designing asustainable future for Africancities, we need to envisage asustainable, low carbon futureusing the best minds availableand plan to realise that vision." -Jeff Robinson, sustainablebuildings group leader

Aurecon

"One of the greatest economicchallenges Nigeria faces is howto economically empower theyouth. The answer to this issupport for entrepreneurship.Nigerian youths have beenactively engaged in businesscreation. They control theentertainment industry and areexpressing themselves in thetechnology sector. If wemanaged to unlock funding for

these and other sectors, thedoldrums that a recessionsymbolises would become a possibility far-fetched forNigeria." - Roberts Orya,managing director/chiefexecutive officer,

Nigerian ExportImport Bank (NEXIMBank)

Sustainable agriculture in SouthAfrica and mitigating the impactof climate change is going torequire significant collaborationbetween a multitude ofstakeholders, including:government, private sectorplayers, the farming communityand environmentalists. - MarkBeaumont, project director,

Global Forum for Innovations inAgriculture (GFIA Africa)

The mobile wave forinternational remittance growth isjust beginning. An increasingnumber of mobile walletproviders are now ready to opennetworks and make low-valueinternational payments anintegral part of their businesses.

Ambar Sur, founder and CEO,Terra

16 African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

QUOTES

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:16 Page 16

-

17

#BeACarmixMan

African Review of Business and Technology - Dec 15/Jan 16www.africanreview.com

QUOTES

Its the role of intellectualproperty organisations in Africato push African leaders tounderstand that there is an entireedifice to build that will allow ouryouth to cross the Rubicon - tobreak the glass ceiling andpartake in the excitement of theinventor, to dare to become thefirst in their country, in the regionand even the first in the world topropose a solution to a social ill.- Martial De-Paul Ikounga,Commissioner for humanresources, science andtechnology,

African Union

Agribusiness is strategicallyplaced to drive Africas futureeconomic development. Theneed to transform the Africanagri-business sector is adevelopment challenge as itinvolves small-scale and familyfarmers who are the largestprivate investors into Africanagriculture. Promoting innovativebusiness models in Africancountries opens up new businessopportunities, helps raiseefficiency and advances nationaleconomic development. - MarkBeaumont, project director,

GFIA Africa

There is growing recognition ofthe importance of appropriateaccounting and financialmanagement in the public sectoras a key means of achievingsustainable public finances. -Shirley Machaba, public sectorleader,

PwC Southern AfricaShirley Machaba, public sector leader, PwCSouthern Africa

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:16 Page 17

-

18 African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

Nigeria is Africas most populousnation with more than one hundredand sixty million people. It is thelargest market on the continent and is alsoAfricas biggest economy. President of theAfrican Development Bank (AfDB) andNigerias former minister of agriculture,Akinwumi Adesina, says that out of a totallandmass of 923,768 sq km, about 840,000sq km is arable and only 40 per cent hasbeen used for agricultural purposes.

Notable for its vast oil and natural gasreserves, Nigeria is seen by many to possessgreat economic potential. Ironically, in thelast few years, it has been unable todiversify from its over-dependence on oiland gas exports.

The hunger for solutionsData on global food security from the non-governmental organisation Oxfam says thatover seventy million Nigerians go to bedhungry every day. A prestigious school oftechnology based in Nigeria, Yaba College ofTechnology in Lagos, estimates that thefigure falls in the range of fifty to sixty million.

This clearly shows that Nigeria has beenunable to tap into its vast arable land forfarming.

Nigerias National Bureau of Statistics inits Q2 2015 export report reveals that atotal of 2,879.2bn (US$14,453,584,000)was received from exports. This is an 8 percent increase from its Q1 export receiptsbut ironically, is a 38.5 per cent decreasefrom the corresponding value in Q2 2014.

Earnings from crude oil exports continueto dominate Nigerias gross domesticproduct (GDP). In Q2 2015, oil receiptsaccounted for 73.7 per cent or 2.121trillion of total exports. Liquefied naturalgas (LNG) had the second highest exportvalue, recording 9.1 per cent or 260.7bnof the total export value during the period.

Vegetable Products recorded 1.3 per centor 36.7bn while prepared foodstuffs,beverages, spirits, vinegar and tobaccorecorded 0.9 per cent or 24.6bnrespectively.

These statistics reveal a worrisome trendand further disclose the impact that Nigeriasagricultural exports have on the economy.

Improving industry performanceMany believe that agriculture in the WestAfrican nation has performed poorly in the

past few years, thus making food security a mirage. While Nigeria continues to boast ofbeing the largest economy in Africa,economists believe there are great potentialsfor its agricultural sector if it is modernisedand that it can produce enough food for theone-third of its citizens who are in dire needof food.

A 2007 research states that Nigeriasagricultural sectors contribution to its GDPhas remained stable between 30 per centand 42 per cent, and the sector employs 65

NigeriaBUSINESS

Industry, economyand opportunityFood security is a serious socio-economic concern,but it can be addressed by private sector enterpriseand public sector administration

1.819

2.06

Onions, dry

Tomatoes

0

1.281

5.837

3.313

8.452

32.319

0.287

8.695

50.95

5.433

0.287

0.185

0.65

0.995

10 20 30 40 50 60

Million Metric Tonnes

Millet

Sorghum

Groundnuts, with shell

Cottonseed

Maize

Cassava

Rice, paddy

Melonseed

Cocoyam

Soybeans

Sesame seed

Yams

Beans, dry

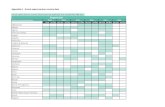

Agriculture production data for 2012, taken from Nigerias National Bureau of Statistics

Nigerian Commodities Production

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:17 Page 18

-

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:17 Page 19

-

20 African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

per cent of its total labour force.In the 1960s, agriculture accounted for

65-70 per cent of total exports; it fell toabout 40 per cent in the 1970s and fellfurther to less than 2 per cent in the late1990s. The decline in the agricultural sectorwas largely due to rise in crude oil revenuesin the early 1970s.

Nigerias agricultural workforce iscomprised of smallholder and traditionalfarmers, mainly women, children andelderly men who use rudimentary tools andproduction techniques to cultivatefarmlands with resultant low yields. Thesmallholder farmers are constrained bymany problems including poor access tomodern inputs and credit facilities, poorinfrastructure, inadequate access tomarkets, environmental degradation, and inadequate research and extension services.

Susana Godwin, a female farmer inNigerias North Central Nasarawa state, sayswomen also face challenges as they do nothave access to lands and credit facilitiesbecause of cultural practices. The inabilityof farmers to access credit facilities isworrisome as this leads to low and pooragricultural output which has a negativeeffect on the countrys economy.

Several other factors such as education,poor infrastructure and inflation have alsobeen identified as factors retarding growthof the agricultural sector.

Agricultural activities in Nigeria areusually concentrated in the less-developedrural areas where there is a critical need forrural transformation, improvedinfrastructure, social development andpoverty alleviation.

Nigerias wide range of climatic variationsallows it to produce a variety of food andcash crops.

Crop production continues to dominateagricultural production. The majoragricultural crops in Nigeria include guineacorn, millet, cocoa, sorghum, groundnut,beans, yam, cottonseed, maize, cassava,paddy rice, melon seed, cocoyam, soyabeans, sesame seed, onions and tomatoes.

Some of the crops like guinea corn, millet,sorghum, groundnut, bean, cotton seed,sesame seed, onions and tomatoes arefound in the north of the country, whileother products like maize, yam, cassava andpaddy rice are not specific to regions.Cocoa is grown in the western region ofNigeria.

Nigerias National Bureau of Statisticsstates that in 2012, cassava toppedagricultural yields followed by yams. Melonseed and cotton seed had the lowest yields.

Agricultural imperativesLivestock production in Nigeria comes withits own set of challenges. Yakubu Ago ofNigerias National Livestock Training Centresays that feeding and disease challenges aretwo major areas aecting the livestockindustry.

Nigerias National Bureau of Statisticsclaims that this sector contributed less thanthree per cent to Nigerias GDP. The sectorgrew slightly due to lower demand forwood products and depletion of existingresources. Nigerias Forestry ResearchInstitute worked towards increasing woodproduction in the country, includingsupplying improved breeder seedlings toreplace harvested tree stocks.

Fish investor, Yashpal Jain of Triton AquaAfrica, says Nigeria has a local demand ofabout 2.7mn tonnes of fish which can beestimated at more than 130bn. This showsthat there is a thriving market for domesticfish production.

Investment can be made in twelve areasin Nigerias agricultural sector. These are: Input production and supply Staple food crop production Fisheries Industrial crop production Livestock production Forestry Commodity processing Storage enterprises Agricultural commodity marketing Agro-industry and manufacturing Agricultural commodity export Agricultural support services

Available research reveals that foreigninvestors are usually attracted toenterprises that are capital-intensive andthat add value to primary output. Foreigninvestors prefer input production andsupply enterprises, commodity processingand agro-industry and manufacturingenterprises. These can be regarded asdownstream activities and are highlycapital intensive. Primary enterprises andagro-services are more attractive to localinvestors. Activities that are infrastructure

related are not favoured by privateinvestors because they are seen asbelonging in the governments domain.Domestic investors will be willing to investin input production and supply, agriculturalproduction enterprises, commodityprocessing, commodity marketing, andindustry enterprises.

In order to ensure adequate food securityin Nigeria, there are several interventionsthat must be made to ensure problems inAgriculture in Nigeria are adequatelytackled. Some of these are:

Education of farmers - Many farmers inNigeria have very little knowledge ofimproved and modern agriculturaltechniques, many of them need to betrained on how to use modern techniquesto boost their production.

Electricity - The Civil Society Coalition forPoverty Eradication in Nigeria claims thatmore than 40 per cent of perishable goodsproduced get spoilt after harvest due to thelack of electricity needed for their storageand processing.

Bad road network - Of Nigerias 200,000km road network, many roads remainuntarred and poorly managed. Most farmsin Nigeria are located more than a kilometre and a half away from the mainroads, and the only entrance to these farmsare mostly through bush paths. It is virtuallyimpossible to transport harvested producethrough these roads because of theirproximity to farms and also due to the badcondition of the roads.

Lack of funds - Funds are usually neededto run a farm, construct farm houses andadequate storage system. Farmers areuneducated and poor, and do not haveadequate requirements to obtain loansfrom banks.

Nigerias growth initiativeIn the last four years, Nigerias governmenthas initiated the Growth EnhancementSupport Scheme. Its aim was to put localfarmers at the centre of the governmentsinterventions by making fertiliser, improvedseedlings, direct access to available marketsand other critical components available tofarmers through a variety ofunconventional means.

Nigeria has what it takes to multiply itsGDP through agriculture and ensureguaranteed food security for the entirety ofits population. If the government willintervene in solving the problems faced bymany farmers, it is believed that as early as2020, the import of food stuffs andlivestock will witness a gross decrease.

Amadin Uyi

e wide range ofvariations in Nigeriasclimate allows for theproduction of a large

variety of food andcash crops, providing

the potential forensuring food security

NigeriaBUSINESS

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:17 Page 20

-

BUSINESSNigeria

21African Review of Business and Technology - Dec 15/Jan 16www.africanreview.com

Sage recently launched new human resources management(HRM) tools in the Nigerian market, bringing mid-size and largeenterprises a powerful, simple and flexible solution to gaineciency in HR processes. It is available either as a standalone productor as a module that integrates with Sage X3, empowering HRmanagers to improve overall business performance by gaining bettercontrol over their workforce costs and creating stronger engagementwith employees.

Sage HRM automates processes such as payroll, hiring, on-boardingand talent retention. The solution ensures legal compliance as well ashigher employee retention and engagement, with easy self-service HRservices. It also helps manage employee development by providingfaster and simpler access to skills and performance information. SageHRM contains all settings, features, statutory calculations and parametersfor payroll and global legislations compliance for the Nigerian market.

Accurate and informedSage HRM provides a global and accurate view of the HR budget andin real-time. With Sage HRM, HR managers are able to accuratelyestimate workforce costs and performance and make data-drivenpersonnel decisions which translates into more informed decisionmaking. Plus, it includes flexible mobile features that enable

employees to access HR services anywhere from any device, thusproviding HR managers access to live key performance indicators.

The solution is aimed at companies in the manufacturing,distribution, services and healthcare industries that are keen tointegrate HR with finance, thereby improving eciency and cost controlthrough back oce automation. Sage HRM enables HR departments toimprove administrative eciency and compliance management.

Functional and collaborativeIvan Epstein, president of Sage International, said, With more than93mn Internet users in Nigeria (according to the NigerianCommunications Commission), Sage HRMs rich cloud and mobilefunctionality makes it a perfect match for the market. If you want toprofit from modern technology thats not only future-proof, but alsohelps increase visibility and collaboration in your business, you are ingood hands with Sage HRM.

Jeremy Waterman, managing director, Sage Northern Africa &Middle East, added, Sage HRM, together with Sage X3, gives yourorganisation more accurate and exhaustive data over your dierentbusiness units and locations. It supports best practices and can giveyou an integrated view of HR and financial data to help you keep yourcosts under control.

Sage's HR solutions

S04 ATR Dec 15_ Jan16 - Quotes_Layout 1 15/12/2015 10:17 Page 21

-

With a severe downturn in its economy, attracting foreigndirect investment continues to be a priority for thegovernment of Ghana, given the urgent need to restore thecountrys economic momentum and overcome an annualinfrastructure funding gap of at least $1.5 billion.

Investment will continue to be critical, even though an IMF creditfacility approved in April 2015 is expected to bring some relief fromthe current macroeconomic imbalances high fiscal and currentaccount deficits. The current administration fully recognises thatforeign investment requires an enabling legal environment and isopen to discussing issues that hinder foreign investment.

The 2013 Ghana Investment Promotion Centre (GIPC) Act governsinvestment in all sectors of the economy and outlines thegovernments investment framework, but the implementation of thelegislation could end up increasing the burden on domestic andinternational investors.

With a stable and predictable political environment, Ghana oersinvestors a forward leaning, business-enabling environment. There isno discrimination against foreign-owned businesses. Thegovernment has instituted a free-flowing exchange rate regime andguarantees repatriation of profits out of the country. There are alsoinvestment laws that protect investors against expropriation andnationalisation. And in a region perceived to be riven by corruption,the practice is comparatively less prevalent than in other countries.

The government has made great strides in fostering a conduciveenvironment for investment, but some bottlenecks still remain.Although the existing legal framework recognises and provides waysto enforce property rights, the procedure to obtain a clear title overland is often dicult, complicated, and lengthy. There is also a lack ofprotection towards intellectual property rights, including computersoftware and pharmaceuticals. In addition, the process to establish abusiness in Ghana is lengthy, complex, and requires compliance withregulations and procedures of at least five government agencies.

Overall, the investment climate in Ghana is welcoming to foreigninvestment, especially relative to others in the sub-region.Nevertheless, analysts believe the passage of stringent local contentregulations in the petroleum sector could serve as a signal of futureeorts to legislate restrictions on how international capital can beused within Ghana. If these regulations become overly restrictive,they could stifle foreign investment, impacting domestic growth. AsGhana transitions to an established middle income country, weexpect the investment climate to continue to improve, but thegovernment will determine the rate at which those improvementsoccur,said a western diplomat in Accra.

The government passed laws to encourage foreign investment andreplaced regulations perceived as unfriendly to investors. The 2013

GIPC Act regulates investments in almost every sector, exceptminerals and mining, oil and gas, and the industries within free zones.Sector-specific laws further regulate banking, non-banking financialinstitutions, insurance, fishing, securities, telecommunications,energy, and real estate. In oil and gas specifically, these laws includespecific local content requirements that could discourageinternational investment. Foreign investors are required to satisfy theprovisions of the investment act as well as the provisions of sector-specific laws. In general, GIPC has streamlined procedures andreduced delays.

The GIPC Act specifies areas of investment reserved for locals,which include small-scale trading, operation of taxi and car rentalservices with fleets of fewer than 25 vehicles, lotteries (excludingsoccer pools), operation of beauty salons and barber shops, printingof recharge scratch cards for subscribers of telecommunicationservices, production of exercise books and stationery, retail offinished pharmaceutical products, and the production, supply, andretail of sachet water. The law further delineates incentives andguarantees that relate to taxation, transfer of capital, profits anddividends, and guarantees against expropriation.

GIPC registers investments and provides assistance to enableinvestors to take advantage of relevant incentives. The governmenthas no overall economic or industrial strategy that discriminatesagainst foreign-owned businesses. In some cases a foreigninvestment may enjoy additional incentives if the project is deemedcritical to the country's development. Foreign firms are able toparticipate in government-financed and/or research anddevelopment programmes on a national treatment basis.

Once all necessary documents are submitted, GIPC states that newinvestments will be registered within five working days. However, theactual time required for registration can be significantly higher -sometimes up to one month.

Although registering a business is a relatively easy procedure, itappears that the process involved in establishing a business can belengthy, complex, and requires compliance with regulations andprocedures of at least five dierent government agencies includingGIPC, Registrar General Department, Ghana Revenue Authority (GRA),Ghana Immigration Service, and Social Security and NationalInsurance Trust (SSNIT).

The World Bank's 2015 Doing Business report states that theaverage time to start a business in Ghana is 14 business days. Thisplaces Ghana 96th out of 189 down from 93rd the previous year.

Capital conditionsGIPC requires foreign investors to satisfy a minimum capitalrequirement. The minimum capital required for foreign investors is

GhanaBUSINESS

22

Seeking a stableand reliable settingHow the GIPC governs Ghana's investment framework, to ensure a robustentrepreneurial environment in the West African state

African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com

S05 ATR Dec 15_ Jan16 - Advertorial GIPC_Layout 1 15/12/2015 10:17 Page 22

-

BUSINESSGhana

23

$200,000 if they do a joint venture with local partners or $500,000 forenterprises that are wholly owned by foreign investors. Tradingcompanies either entirely or partly-owned by foreigners require aminimum capital contribution of $1 million and are required toemploy at minimum 20 skilled locals. Capital contributions may besatisfied by remitting convertible foreign currency to a bank in Ghanaor by importing goods valued in this amount. This minimum capitalrequirement does not apply to portfolio investments, enterprises setup for export trading or their branch oces.

The principal law regulating investment in minerals and mining isthe Minerals and Mining Act, 2006 (Act 703). This law addressesdierent types of mineral rights, issues relating to incentives andguarantees, and land ownership. The 2006 law provides for a stabilityagreement, which protects the holder of a mining lease for a periodof 15 years from future changes in law that may impose a financialburden on the license holder. When investment exceeds $500 million,lease holders can negotiate a development agreement whichcontains elements of a stability agreement and more favorable fiscalterms. The Minerals Commission is the government agency thatimplements the law. Small-scale (artisanal) mining is reserved forGhanaian investment.

Compared with its BB rated peers, Ghana has a strong businessenvironment, underpinned by foreign investment totaling $3.2 billionin 2014, second only to Nigeria. Ghana was 70th out of 189 countriesin the World Banks Doing Business Survey, scoring highly onobtaining credit, protecting investors and enforcing contracts. Whileforeign direct investment (FDI) has slid in recent years as someinvestors take a Wait and See attitude as economic growth hasslowed, Ghanas reputation as a reliable partner allows the country tocontinue to attract foreign investment at a higher rate than similarlypositioned neighbours in sub-Saharan Africa.

The countrys short-term fiscal and external risks have moderatedfollowing an IMF Extended Credit Facility worth $918 million. The IMFprogramme focuses on addressing Ghanas key credit weaknessesthrough prioritising fiscal consolidation, raising revenue andimproving central bank policies. Analyst are confident that over time,commitment to the programme should result in a recovery of donorinflows, foreign investment in the domestic bond market, and easingof domestic funding costs.

Ghana's investment laws guarantee that investors can transfer thefollowing in convertible currency out of Ghana: dividends or netprofits attributable to an investment, loan service payments where aforeign loan has been obtained, fees and charges with respect totechnology transfer agreements registered under the GIPC Act, andthe remittance of proceeds from the sale or liquidation of an

enterprise or any interest attributable to the investment. So far,companies have not reported challenges or delays in remittinginvestment returns.

There is a single formal system for transferring currency out of thecountry through the banking system. The Foreign Exchange Act,passed in November 2006, provides the legal framework for themanagement of foreign exchange transactions in Ghana. It has fullyliberalised capital account transactions, including allowing foreignersto buy certain securities in Ghana - those with a three-year tenor andhigher. It has also removed the requirement for the Bank of Ghana(the central bank) to approve oshore loans. Payments or transfer offoreign currency can only be made through institutions such as banksor persons licensed to do money transfer. There is no limit on capitaltransfer as long as the transferee can identify the source of capital.

In February 2014, the government announced limits to foreignexchange withdrawals in an eort to stem the deterioration of thecedi and prevent the dollarisation of the currency. By June, theselimits had been lifted, making it clear that this technique will only beused as a short term measure to deal with urgent economic concerns.

Legitimate considerations The Ghanaian Constitution sets out some exceptions and a clearprocedure for the payment of compensation in allowable cases ofexpropriation or nationalisation. Additionally, Ghana's investmentlaws protect investors against expropriation and nationalisation. Thegovernment may expropriate when the property follows one of thefollowing: national defence, public safety, public order, publicmorality, public health, town and country planning, or thedevelopment or utilisation of property in a manner to promote publicbenefit. It must provide prompt payment of fair and adequatecompensation. The government guarantees due process by allowingaccess to the high court by any person who has an interest or rightover the property.

Investors are generally not subject to dierential or discriminatorytreatment in Ghana, and there have been no ocial governmentexpropriations in recent times. Since 2001, four foreign investors havefiled for international arbitration against the Ghanaian government.Two of these cases were resolved when the government agreed topurchase the investments. In both cases the investors agreed to theterms of the government purchase as an exit strategy,notwithstanding perceived inequitable terms. There have been noreported instances of indirect expropriation or any governmentaction equivalent to expropriation.

Jon Oei-Ansah

African Review of Business and Technology - Dec 15/Jan 16www.africanreview.com

S SouOne S

eceecee urcmany so

l olutions

many solutions

.flsmidth.comwww el no. +27 (0)10 210 4000 [email protected] no. +27 (0)10 210 4000 [email protected]

e information contact usFor mor

S05 ATR Dec 15_ Jan16 - Advertorial GIPC_Layout 1 15/12/2015 10:17 Page 23

-

Sunil Dabeesingh, CEO of Mauritius CivilService Mutual Aid Association (MCS) isvery proud of the history of the companyand has big ambitions for the years ahead.Above all, Dabeesingh said MCS aims toprovide happiness to customers, and apartnership with Finacle is playing an importantrole in meeting this aim in the long term.

From humble beginningsMCS is one of the oldest financial institutionsin Mauritius, it was started in 1893 by a group ofcivil servants the underlying philosophy ismutuality and this is still in practice today, hesaid.Indeed, the very foundations of MCS were

built on a need to help people in a time oftrouble. The 175 civil servants pioneered theassociation by pooling resources in a fund togrant loans to members needing financialassistance. At the time, Mauritius was stillrecovering from a devastating cyclone whichstruck the island nation in 1892. At the time,loan facilities from banks were not widelyavailable and MCS was able to offer aresponsible alternative to unscrupulous moneylenders. By 1894, an ordinance was passed,which constituted MCS into a limited liabilitysociety.The Associations mission is to provide the

best services to make the customers happy.When asked how MCS stands out from other

financial institutions, Dabeesingh gave anintriguing response: We are different but alsoalike.He then elaborated: We have loan facilities,

we take deposits, we are licensed by theCentral Bank of Mauritius, we have the samebasic functions as other financial institutions,but we are different because as an association,we have evolved. The relationships between the association

and its members is crucial, it is the basis of thesuccess of the association we have lastedalready for 122 years.Dabeesingh described the mutual trust

between MCS and its customers as a win-winsituation.Our culture is an alignment of the needs and

expectations of our customers.

A major IT project for MCS with FinacleNow MCS has plans for expansion, andDabeesingh said the extensive overhaul of thecompanys IT systems is an important part offulfilling this mission. He said the company has fully replaced all IT

infrastructure, moving to an IBM platform in apartnership with Finacle, a multi-nationalbanking IT solutions company, which is awholly owned subsidiary of Infosys. Thereplacement project supports all-newhardware, software, network resources and

virtualisation technology rolled out across allfront- and back-end services for the entirecompany.When MCS decided to pair up with Finacle

for the IT project, Dabeesingh said thecompany was at a juncture. A decision hadto be made as to whether to upgrade theprevious system, fully replace the system orsimply contract it out. It was decided that a full replacement was

required and Dabeesingh said the decision touse Finacle as the partner for the project wasthe result of market research.We went for Finacle because of their state-

of-the-art solutions, said Dabeesingh. Theymet our specific requirements and we werealso quite satisfied with their pricing policy.The testimonials of other satisfied Finacle

clients, in Mauritius and abroad, meant thatMCS could move forward with confidence.The result was, according to Dabeesingh, a

very good partnership with Finacle.Finacles people are very professional in

their attitude to their work, said Dabeesingh.Each time we had a problem, people with theright competencies came to help.Additionally, Dabeesingh was impressed

with Finacles project management capabilitiesand said the replacement work was completedon time and within budget.

Looking to the futureThe IT replacement project with Finacle hasbeen completed and MCS is now preparing forthe next phase in its drive towards more digitalservices for customers. We are settling down now. The next stage is

to prepare to enhance the technology platformfor ease of doing business for customers, saidDabeesingh. Customer convenience is the mainpriority and MCS plans to move quickly with itslatest digital plans. The new systems set up inpartnership with Finacle form a solid foundationfor future expansion. Digital technology will play a crucial role in

the next three to five years and to be on the

Digital technology will play a crucial role in the next

three to five years and to be onthe competitive edge, we need

an increased level ofpreparedness

Modernising African bankingPROFILE

24

Technology to drivegrowth for MCSMauritius Civil Service Mutual Aid Association, one of the countrys oldest financialinstitutions, is on a drive towards a digital future with Infosys Finacle as a partner.

Sunil Dabeesingh, CEO of MCS says customer happiness is paramount

African Review of Business and Technology - Dec 15/Jan 16 www.africanreview.com