AFIF 2012 Session I - Part1 - Michael Hamp - IFAD

-

Upload

emrc -

Category

Economy & Finance

-

view

526 -

download

1

Transcript of AFIF 2012 Session I - Part1 - Michael Hamp - IFAD

Michael Hamp Senior Rural Finance Adviser – IFAD

(International Fund for Agricultural

Development)

Italy

Africa Finance & Investment Forum -AFIF2012

Financial Inclusion through SMEs & Cooperatives, Rabobank Headquarters – Utrecht, NL, 17-19 June 2012

Michael Hamp Senior Rural Finance Advisor

Sustainable Approaches to Financial Deepening and Rural Outreach

Overview:

Financial access in rural areas

Rural microfinance -Terminology

Rural Finance as part of IFAD’s operations

IFAD’s Rural Finance Policy - key principles

Partner financial service providers

33 years experience in rural microfinance

a) focusing on agricultural lending challenges

b) focusing on IFAD’s competencies

Sustainable outreach and deepening – country cases

Emerging lessons in rural microfinance

Discussion

• 2.7 billion people around the world have no access to formal financial services

• Over 90% of people in rural areas lack access to financial services

Financial access in rural areas

Terminology

• Rural finance: Financial

services used in rural

areas by people of all

income levels

• Agricultural finance:

Financing agriculture-

related activities, from

production to the market

• Microfinance: Financial

services for poor and low-

income people

FINANCIAL MARKET

MICRO FINANCE

RURAL FINANCE

AGRICULTURAL

FINANCE

Rural Finance as Part of IFAD’s Operations

Programme Management Department

Policy and Technical Advisory Division

Financial Assets, Markets and Enterprises - FAME - Unit

Rural Finance

Core Business

Rural Economic Development

(VCD, Private Sector)

Rural Finance Special Facilities

(FFR and WRMF)

Economic & Financial Analysis

IFAD’s Rural Finance Policy

- key principles

• Support access to a wide variety of financial

services, including savings, credit, insurance,

leasing, remittances and payment systems

• Promote a wide range of financial institutions,

models and delivery channels

• Support demand-driven, market-based

approaches in collaboration with the private sector

• Develop and support long-term strategies

focusing on sustainability and poverty outreach

• Promote an enabling environment for rural

finance

Partner Financial Service Providers

Public, Private,

Cooperative

Banks

Non-Bank

Financial

Institutions

NGOs

MFIs

Community

Based

Financial

Organizations

Slide courtesy CGAP

FORMAL INFORMAL

33 Years Experience in Rural Microfinance

Facing the challenges of

financing small-scale

agriculture

30 m borrowers

from IFAD assisted MFIs

US$ 200 average loan size

15 m voluntary savers

US$ 127 average savings

women account for 83% (24 m pax)

• Operating a self-sustaining

rural MFI

• High information &

transaction costs

• Private sector approaches

crowded-out by subsidized

& targeted lending

• Dispersed populations

• Poor infrastructure

• Seasonality of agricultural

activities

• Few collateral assets

• Risks of farming (price,

production, …)

33 Years Experience in Rural Microfinance

a) focusing on agricultural lending challenges

• Taking banking services to the people via ICT

applications

• building loan analysis & repayment schedules on

revenue flows from all farm, labour and business

activities, incl. remittances

• using specific methodologies for micro-level index

insurance applications

• securing loans by contractual agribusiness

payments (VCF), WRS, etc.

• Overcoming poor lending practices and improving

repayment culture

• Developing technical capacity at the local level

33 Years Experience in Rural Microfinance b)

focusing on IFAD’s competencies

• Banking beyond branches

• Replicating Targeting Ultra Poor

• Managing price risks (commodity exchange, warehouse

receipt system)

• Enhancing the value chain financing methodology

• Promoting & consolidating decentralized

community-based financial systems & linkages • Flexible disbursement & repayment schedules (seasonality)

• R&D in weather and yield index insurance (WRMF) and

productive use of payment services and rural remittances

(FFR)

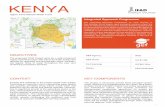

Sustainable Outreach and Deepening

Ethiopia

Ghana

Sierra Leone

The Gambia

• RUFIP targets > 6 m households through RUSACCOs

• RAFIP supports formal rural community banks and

ARB Apex Bank and credit union association

• RFCIP supports community banks and Financial

Services Associations (FSAs)

• RFCIP supports some 80 semi formal Village-based

Savings and Credit Associations (VISACAs) of

130,000 members

Emerging Lessons in Rural Microfinance

• Member-based MFIs can facilitate rural outreach and financial deepening:

“Cooperative financial institutions and mutuals are often well positioned and

effective in providing financial services for agriculture, and other financial

institutions can draw valuable lessons from their experiences.”

Johannesburg Findings

Johannesburg 1-3 April, 2009

Agricultural Finance in Africa