Accounting McGraw Hills Chap1

Transcript of Accounting McGraw Hills Chap1

Learning ObjectivesLearning ObjectivesAfter studying this chapter, you should After studying this chapter, you should

be able to:be able to: Explain how accounting information assists Explain how accounting information assists

in making decisions.in making decisions. Describe the components of the balance Describe the components of the balance

sheet.sheet. Analyze business transactions and relate Analyze business transactions and relate

them to changes in the balance sheet.them to changes in the balance sheet. Compare features of proprietorships, Compare features of proprietorships,

partnerships, and corporations.partnerships, and corporations.

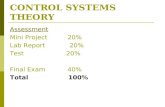

IntroductionIntroduction AccountingAccounting - a process of identifying, - a process of identifying,

recording, summarizing, and reporting recording, summarizing, and reporting economic information to decision makers economic information to decision makers in the form of in the form of financial statementsfinancial statements

Financial accountingFinancial accounting - focuses on the - focuses on the specific needs of decision makers external specific needs of decision makers external to the organization, such as stockholders, to the organization, such as stockholders, suppliers, banks, and government agenciessuppliers, banks, and government agencies

The Nature of The Nature of AccountingAccounting

The The accounting systemaccounting system is a series of is a series of steps performed to analyze, record, steps performed to analyze, record, quantify, accumulate, summarize, quantify, accumulate, summarize, classify, report, and interpret classify, report, and interpret economic events and their effects on economic events and their effects on an organization and to prepare the an organization and to prepare the financial statements.financial statements.

The Nature of The Nature of AccountingAccounting

Accounting systems are designed to Accounting systems are designed to meet the needs of the decisions makers meet the needs of the decisions makers who use the financial information.who use the financial information.

Every business has some sort of Every business has some sort of accounting system.accounting system. These accounting systems may be very These accounting systems may be very

complex or very simple, but the real value complex or very simple, but the real value of any accounting system lies in the of any accounting system lies in the information that the system provides.information that the system provides.

Accounting as an Aid toAccounting as an Aid toDecision MakingDecision Making

Accounting information is useful to Accounting information is useful to anyone who makes decisions that have anyone who makes decisions that have economic results.economic results.• Managers want to know if a new product will be Managers want to know if a new product will be

profitable.profitable.• Owners want to know which employees are Owners want to know which employees are

productive.productive.• Investors want to know if a company is a good Investors want to know if a company is a good

investment.investment.• Creditors want to know if they should extend Creditors want to know if they should extend

credit, how much to extend, and for how long.credit, how much to extend, and for how long.• Government regulators want to know if financial Government regulators want to know if financial

statements conform to requirements.statements conform to requirements.

Accounting as an Aid toAccounting as an Aid toDecision MakingDecision Making

Fundamental relationships in the Fundamental relationships in the decision-making process:decision-making process:

EventAccountant’s

analysis &recording

FinancialStatements

Users

Financial and Financial and Management AccountingManagement Accounting

The major distinction between financial The major distinction between financial and management accounting is the and management accounting is the users of the information.users of the information. Financial accountingFinancial accounting serves external users. serves external users. Management accountingManagement accounting serves internal serves internal

users, such as top executives, management,users, such as top executives, management, and administrators and administrators

within within organizations.organizations.

Financial and Financial and Management AccountingManagement Accounting

The primary questions about an The primary questions about an organization’s success that decision organization’s success that decision makers want to know are:makers want to know are:

What is the financial picture of the What is the financial picture of the organization on a given day?organization on a given day?

How well did the organization do during How well did the organization do during a given period?a given period?

Financial and Financial and Management AccountingManagement AccountingAccountants answer these primary questions Accountants answer these primary questions with three major financial statements.with three major financial statements.

Balance SheetBalance Sheet - financial picture on a given - financial picture on a given dayday

Income StatementIncome Statement - performance over a - performance over a given periodgiven period

Statement of Cash FlowsStatement of Cash Flows - performance over - performance over a given perioda given period

Financial and Financial and Management AccountingManagement Accounting

Annual reportAnnual report - a document prepared - a document prepared by management and distributed to by management and distributed to current and potential investors to current and potential investors to inform them about the company’s past inform them about the company’s past performance and future prospects.performance and future prospects. The annual report is one of the most The annual report is one of the most

common sources of financial information common sources of financial information used by investors and managers.used by investors and managers.

Financial and Financial and Management AccountingManagement Accounting

The annual report usually includes:The annual report usually includes: a letter from corporate managementa letter from corporate management a discussion and analysis of recent a discussion and analysis of recent

economic events by managementeconomic events by management footnotes that explain many elements of the footnotes that explain many elements of the

financial statements in more detailfinancial statements in more detail the report of the independent auditorsthe report of the independent auditors a statement of management’s responsibility a statement of management’s responsibility

for preparation of the financial statementsfor preparation of the financial statements other corporate informationother corporate information

The Balance SheetThe Balance Sheet What are the different sections What are the different sections

of the Balance Sheet?of the Balance Sheet?

The Balance SheetThe Balance SheetSections of the balance sheet:Sections of the balance sheet: AssetsAssets - resources of the firm that are expected - resources of the firm that are expected

to increase or cause future cash flows to increase or cause future cash flows (everything the firm owns)(everything the firm owns)

LiabilitiesLiabilities - obligations of the firm to outsiders - obligations of the firm to outsiders or claims against its assets by outsiders (debts or claims against its assets by outsiders (debts of the firm)of the firm)

Owners’ EquityOwners’ Equity - the residual interest in, or - the residual interest in, or remaining claims against, the firm’s assets remaining claims against, the firm’s assets after deducting liabilities (rights of the owners)after deducting liabilities (rights of the owners)

The Balance SheetThe Balance SheetThe balance sheet equation:The balance sheet equation:

Assets = Liabilities + Owners’ Assets = Liabilities + Owners’ EquityEquity

oror

Owners’ Equity = Assets - Owners’ Equity = Assets - LiabilitiesLiabilities

The Balance SheetThe Balance SheetHAMILTON COMPANYHAMILTON COMPANY

Balance SheetBalance SheetDecember 31, 1997December 31, 1997

AssetsAssets LiabilitiesLiabilitiesCurrent assets:Current assets: Current liabilities:Current liabilities: CashCash $ 4,525 $ 4,525 Accounts payable Accounts payable $ $

9,8009,800 Accounts receivable Accounts receivable 2,040 2,040 Wages payable Wages payable

3,765 3,765 Total current assets $ 6,565Total current assets $ 6,565 Total liabilitiesTotal liabilities

$13,565 $13,565Plant assets:Plant assets: LandLand $ 9,755 $ 9,755 EquipmentEquipment 6,500 6,500 Owners’ EquityOwners’ Equity Total plant assetsTotal plant assets 16,255 16,255 Hamilton, capitalHamilton, capital

9,255 9,255Total liabilities andTotal liabilities and

Total assetsTotal assets $22,820$22,820 Owners’ equity Owners’ equity $22,820 $22,820

========================== ============= =============

Balance Sheet Balance Sheet TransactionsTransactions

The balance sheet is affected by every The balance sheet is affected by every transaction that an entity encounters.transaction that an entity encounters.

Each transaction has counterbalancing Each transaction has counterbalancing entries that keep total assets equal to entries that keep total assets equal to total liabilities and owners’ equity, i.e., total liabilities and owners’ equity, i.e., the balance sheet equation the balance sheet equation must must alwaysalways be balanced.be balanced.

Balance Sheet Balance Sheet TransactionsTransactions

Just as the balance sheet equation must Just as the balance sheet equation must always balance, the balance sheet always balance, the balance sheet must also always must also always balance.balance.

A balance sheet could be prepared after A balance sheet could be prepared after every transaction, but this practice every transaction, but this practice would be awkward and unnecessary.would be awkward and unnecessary. Therefore, balance sheets are usually Therefore, balance sheets are usually

prepared monthly or on some other prepared monthly or on some other periodic schedule.periodic schedule.

Transaction AnalysisTransaction Analysis Transactions are recorded in Transactions are recorded in

accountsaccounts, which are summary , which are summary records of the changes in particular records of the changes in particular assets, liabilities, or owners’ equity.assets, liabilities, or owners’ equity.

The The account balanceaccount balance is the total of is the total of all entries to the account.all entries to the account.

Transaction AnalysisTransaction Analysis For each transaction, the accountant For each transaction, the accountant

must determine:must determine: which specific accounts are affectedwhich specific accounts are affected whether the account balances are whether the account balances are

increased or decreasedincreased or decreased the amount of the change the amount of the change

in each account in each account

Types of OwnershipTypes of Ownership Three basic forms of ownership:Three basic forms of ownership:

Sole proprietorshipsSole proprietorships PartnershipsPartnerships CorporationsCorporations

Types of OwnershipTypes of Ownership

Sole ProprietorshipSole Proprietorship A separate organization with a A separate organization with a singlesingle

ownerowner Tend to be small retail establishments Tend to be small retail establishments

and individual professional or service and individual professional or service business - for example, a single dentist, business - for example, a single dentist, attorney, or public accountantattorney, or public accountant

The sole proprietorship is an individual The sole proprietorship is an individual entity that is separate and distinct from entity that is separate and distinct from the owner.the owner.

Types of OwnershipTypes of Ownership

PartnershipPartnership An organization that joins two or more An organization that joins two or more

individuals who act as co-ownersindividuals who act as co-owners Dentists, doctors, attorneys, and accountants Dentists, doctors, attorneys, and accountants

tend to conduct their activities as tend to conduct their activities as partnerships. Some can be large international partnerships. Some can be large international firms.firms.

The partnership is an individual entity that is The partnership is an individual entity that is separate and distinct from each of the separate and distinct from each of the partners. partners.

Types of OwnershipTypes of Ownership

CorporationCorporation An “artificial entity” created under state An “artificial entity” created under state

lawslaws Corporations have Corporations have limited liabilitylimited liability - -

corporate creditors have claims against corporate creditors have claims against corporate assets only.corporate assets only. Individual investors are at risk only up to Individual investors are at risk only up to

the amount they have invested in the the amount they have invested in the corporation. Creditors cannot hold corporation. Creditors cannot hold investors liable for the corporation’s debts.investors liable for the corporation’s debts.

Types of OwnershipTypes of OwnershipCorporationCorporation

Owners are called Owners are called shareholdersshareholders or or stockholdersstockholders..

Publicly owned vs. privately owned Publicly owned vs. privately owned corporationscorporations PublicPublic - Shares in the ownership are sold to the - Shares in the ownership are sold to the

public on a stock exchange; the corporation can public on a stock exchange; the corporation can have many thousands of shareholders.have many thousands of shareholders.

PrivatePrivate - Shares in the ownership are owned by - Shares in the ownership are owned by families, small groups of shareholders, and shares families, small groups of shareholders, and shares are not sold to the public.are not sold to the public.

Types of OwnershipTypes of OwnershipManagement by the owners:Management by the owners: Sole proprietorshipSole proprietorship - The owner is an active - The owner is an active

manager in day-to-day operation of the manager in day-to-day operation of the business.business.

PartnershipPartnership - Partners are usually active - Partners are usually active managers in day-to-day operations of the managers in day-to-day operations of the business.business.

CorporationCorporation - Shareholders usually do not - Shareholders usually do not participate in the day-to-day operations of participate in the day-to-day operations of the business.the business.

Advantages and Advantages and Disadvantages of Forms Disadvantages of Forms

of Ownershipof OwnershipCorporationsCorporations AdvantagesAdvantages

limited liabilitylimited liability easy transfer of ownership - shares of stock easy transfer of ownership - shares of stock

can be bought and sold easily (stock can be bought and sold easily (stock exchanges)exchanges)

ease of raising ownership capital - many ease of raising ownership capital - many potential stockholderspotential stockholders

continuity of existence - life of the corporation continuity of existence - life of the corporation continues even if its ownership changescontinues even if its ownership changes

Advantages and Advantages and Disadvantages of Forms Disadvantages of Forms

of Ownershipof Ownership

CorporationsCorporations DisadvantagesDisadvantages

possibility of double taxation - possibility of double taxation - corporation pays tax at the entity level corporation pays tax at the entity level and its owners pay taxes on and its owners pay taxes on distributions of earnings to themdistributions of earnings to them

Advantages and Advantages and Disadvantages of Forms Disadvantages of Forms

of Ownershipof Ownership

Proprietorships and PartnershipsProprietorships and Partnerships AdvantagesAdvantages

no taxation at the entity level - income no taxation at the entity level - income of sole proprietorship and partnership of sole proprietorship and partnership is attributed to the owners as individual is attributed to the owners as individual taxpayerstaxpayers

Advantages and Advantages and Disadvantages of Forms Disadvantages of Forms

of Ownershipof OwnershipProprietorships and PartnershipsProprietorships and Partnerships DisadvantagesDisadvantages

unlimited liability - creditors of the business can unlimited liability - creditors of the business can look to the owners’ personal assets for repaymentlook to the owners’ personal assets for repayment

not easy to transfer ownershipnot easy to transfer ownership not easy to raise ownership capital - few, if any not easy to raise ownership capital - few, if any

individuals interested in a particular individuals interested in a particular proprietorship or partnershipproprietorship or partnership

no continuity of existence - changes in ownership no continuity of existence - changes in ownership terminate the proprietorship or partnershipterminate the proprietorship or partnership