ACC620 15 and 16 Ref..xlsx

Transcript of ACC620 15 and 16 Ref..xlsx

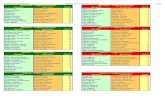

15-18Preferred Stock11%100parAuthorized10000Issued2120212000Common Stock5ParAuthorized118050Issued23610118050Additional Paid-in Capital126100Retained Earnings473700Total9298501)Paid Preferred11per share23320Common4per share944402)Purchased1600sharesCommon39per share624001164503)Reissued690TreasuryLand316502270022704)Issued510Preferred108per share55080Net Income3472005)Declared10%DividendCommon Stock46per shareOutstanding6)Issued Stock DividendPreferred2630263000Common249701294007)Declared Annual 11Per SharePreferredTresasury Stock354904Per ShareCommonAdd Paid227990Payable in next yearRetained Earnings587670Journal Entries1)Dividends Payable - Preferred23320Dividends Payable - Common94440 Cash1177602)Treasury Stock62400 Cash624003) Land31650 Treasury Stock26910 Paid-in Capital from Treasury Stock47404)Cash55080 Preferred Stock51000 Paid-In Captial in Excess of Par - Preferred Stock40805)Retained Earnings104420 Common Stock Dividend Distributable11350 Paid-In Capital in Excess of Par - Common Stock930706)Common Stock Dividend Distributable11350 Common Stock113507)Retained Earnings128810 Dividends Payable - Preferred Stock28930 Dividends Payable - Common Stock99880Stockholder Equity Captial Stock Preferred263000 Common129400Total Capital Stock392400Additional Paid-IN227990Total Paid-IN Capital620390Retained Earnings587670Total Paid-IN Cap & RE1208060less: Treasury Stock35490Total Stockholders' Equ.1172570

15-2Preferred StockAuthorized10580SharesPreferredCommon8%71par10580535000Common Stock561080510Authorized5350001810240402per sharenopar3160RM80510OS74201058010-JanIssued80510Common Stock6per share10580328780RM1-MarIssued5610Preferred Stock113per shareOS206220

1-AprIssued24040Common Stockfor landAsking90810FV805101-MayIssued80510Common Stock8per share1-Augissued10580Common Stockfor attorneysbill503601-SepIssued10580Common Stock10per share1-NovIssued1810Perferred Stock115per shareGeneral Journal10-JanCash483060 Common Stock161020 Paid-In Capital in Excess of Stated Value - Common Stock3220401-MarCash633930 Preferred Stock398310 Paid-in Capital in Excess of Par - Preferred Stock2356201-AprLand80510 Common Stock48080 Paid-In Capital in Excess of Stated Value - Common Stock324301-MayCash644080 Common Stock161020 Paid-in Capital in Excess of Stated Value - Common Stock4830601-AugOrganiation Expense50360 Common Stock21160 Paid-in Capital in Excess of Stated Value - Common Stock292001-SepCash105800 Common Stock21160 Paid-in Capital in Excess of Stated Value - Common Stock846401-NovCash208150 Preferred Stock128510 Paid-in Capital in Excess of Par - Preferred Stock79640

15-5500Shares10Par ValueCommon Stock100Shares107Par ValuePreferred StockLump Sum of 109000a) Prepare the jounral entry for the issuance when the Market Price of the Common Share is 168each and Market price of the Preferred is213each.b) Prepare the jounral entry for the issance when only the market price of the common stock is known and it is 186.6per shareLump Sum109000Lump-sum Receipt109000Par- Common5000Allocated to Common93300Par- Preferred10700Balance Allocated to Preferred1570015700Paid in Capital in Excess of Par- Common Stock88300FV of Common84000Paid-in Capital in Excess of Par- Preferred Stock5000FV of Preferred21300105300Allocated to Common86952Allocated to Preferred22048109000a)Cash109000 Common Stock5000 Paid-in Capital in Excess of Par- Common Stock81952 Preferred Stock10700 Paid-in Capital in Excess of Par- Preferred Stock11348b)Cash109000 Common Stock5000 Paid-in Capital in Excess of Par- Common Stock88300 Preferred Stock10700 Paid-in Capital in Excess of Par- Preferred Stock5000

15-6533004per shareCommon StockAuthorized to Issue1)547054per shareless79802)1420for land53300~55per share3)Purchased53042per sharewere issued at 38per sharea)Cash287400 Common Stock21880 Paid-in Capital in Excess of Par- Common Stock265520b)Land78100 Common Stock5680 Paid-in Capital in Excess of Par- Common Stock72420c)Treasury Stock22260 Cash22260

15-Q1Preferred11170100par6%8Common521009par10667020201060NOT REPORTEDPreferred Stock3700003700266400 Common266400 Pain-in Excess of Par- Common103600370000103600Paid-In Capital1184020111700067020Preferred Stock1117000468900Paid-In Capital in Excess of Par- Preferred67020

15-Q25-JanCumulativenonparticipatingPreferred Stock5300104Par7%Common Stock5400011Par11-JanCash372640 Common Stock24112011-JanIssued21920Common Stock17per share Paid-In Capital in Excess-Common Stock1315202411203726401-FebEquipment593201-FebIssued4700PreferredBuildings172800EquipmentFV5932044080Land325800FactoryFV172800 Preferred Stock488800LandApprised Value325800 Paid-in Capital in Excess- Preferred Stock6912048880055792029-JulTreasury Stock3534029-JulPurchased1860Common19per share Cash353403534098643421610-AugCash2418010-Augsold1860treasury13per shareRetained Earnings1116024180 Treasury Stock35340

31-Decdeclared0.45common dividend31-DecRetained Earnings44080preferred dividend38584 Dividends Payable44080

31-DecClosed Income Summary31-DecIncome Summary180440Net Income180440 Retained Earnings180440

Capital Stock Preferred Stock488800 Common Stock241120 Total Capital Stock729920Additional Paid-in Capital Paid-in Capital in Excess- Preferred Stock69120 Paid-in Capital in Excess- Common Stock131520200640Total Paid-in Capital930560 Retained Earnings125200 Total Stockholders' Equity1055760

15-Q3Preferred208%Capital StockCommon5 Preferred Stock3886000 Common Stock10734500Preferred Stock1563003126000250080 Total Capital Stock14620500Common Stock208800010440000Additional Paid-in CapitalPaid-In Capital in Excess of Par- Preferred Stock207500 Paid-in Capital in Excess- Preferred321500Paid-In Capital in Excess of Par- Common Stock27790000 Paid-in Capital in Excess- Common28732400Retained Earnings4539000 Paid-in Capital from Treasury20800290747001-JanPreferred 3800023 Total Paid-in Capital436952001-FebCommon5890021Retained Earnings44930251-JunSplit2-for-1Par 2.5Total Paid-in Capital and Retained Earnings481882251-JulCommon35100Treasury10per shareLess: Treasury Stock24700015-Sep10400Treasury12per share Total Stockholders' Equity4794122531-DecPreferred 250080Common0.4593960031-DecNet Income2186000Preferred StockExcess31260002075007600001140003886000321500

CommonExcess10440000277900002945009424001073450028732400

Retained4539000-310880-192109521860004493025

TreasuryExcess35100020800-10400024700020800

15-Q4AssetsCurrent Assets$48,900Equity InvestmentsABC Stock10,710Shares @cost$42,840$4Equipment (net)$255,100Intangibles$60,730 Total Assets$407,570Liabilities and Stockholders' EquityCurrent and Long Term Liabilites$103,800Stockholders' Equity Common Stock $5Par$22,8004560 Paid-in Capitial in Excess of Par$113,900 Retained Earnings$167,070$303,770 Total Liabilites and Stockholders' Equity$407,570

Declares and Pays$0.58per shareDividenda)ChangeAmount Total AssetsDecrease$2,645 Common Stock No Effect Paid-in Capitial in Excess of ParNo Effect Retained EarningsDecrease$2,645Total Stockholders' EquityDecrease$2,645

Declares and Issues a10%Stock Dividend when the Market Price is $14per shareb)ChangeAmount Total AssetsNo Effect Common Stock Increase$2,280 Paid-in Capitial in Excess of ParIncrease$4,104 Retained EarningsDecrease$6,384Total Stockholders' EquityNo EffectDeclares and Issues a 30%Stock Dividend when the market Price is$15per sharec)ChangeAmount Total AssetsNo Effect Common Stock Increase$6,840 Paid-in Capitial in Excess of ParNo Effect Retained EarningsDecrease$6,840Total Stockholders' EquityNo EffectDeclares and Distributes a Property Dividend. 1Shareof its equity (ABC Stock) for every 2of its own.ABC is selling for 10per shared)ChangeAmount Total AssetsDecrease$9,120 Common Stock No Effect Paid-in Capitial in Excess of ParNo Effect Retained EarningsDecrease$9,120Total Stockholders' EquityDecrease$9,120Declares a 3for 1Stock Split and issues New Sharese)ChangeAmount Total AssetsNo Effect Common Stock No Effect Paid-in Capitial in Excess of ParNo Effect Retained EarningsNo EffectTotal Stockholders' EquityNo Effect

16-11)Issued20323000par value12%convertible bonds at98if not convertible95Expenses of issusing750002)Issued20323000par value12%bonds at971detachable stock warrant was issued with each100par valueat time, warrants were selling for 53)Called convertible debt13%10149000par value bonds were convertied into1014900shares of 1par value common stock59000unamortized discount applicable to bondspaid an additional82700using book value methodCalculations1)199165402)Value of Bonds Plus Warrants19713310Value of Warrants1016150Value of Bonds186971603)90751001)Cash19916540Discount on Bonds Payable406460TRUE Bonds Payable20323000Unamortized Bond Issue Costs75000 Cash750002)Cash19713310Discount on Bonds Payable1625840TRUE Bonds payable20323000 Paid-in Capital-Stock Warrants10161503)Debt Conversion Expense82700Bonds Payable10149000 Discount on Bonds Payable59000TRUE Common Stock1014900 Paid-In Capital in Excess of Par - Common Stock9075100 Cash82700

16-11Jan 1 201529000Shares12Parat21per shareexercisable in5yearsperiod for this award is 2yearsFV optiontotal compensation406400April 1 20162900options were terminated because of resigning employeesMarket Value per share was36March 31 201717400Options were exercised when the market price of the common stock was42per share12/31/15Paid-in Capital- Stock Options2032004/1/16Compensation Expense2032012/31/16Paid-in Capital- Stock Options1828803/31/17Cash365400Paid-in Capital- Stock Options243840Unexerciesed Options87001/1/15No Entry0 No Entry012/31/15Compensation Expense203200 Paid-In Capital- Stock Options2032004/1/16Paid-In Cpaital- Stock Options20320 Compensation Expense2032012/31/16Compensation Expense182880 Paid-In Capital-Stock Options1828803/31/17Cash365400Paid-In Capital-Stock Options243840 Common Stock208800 Paid-in Capital in Excess of Par- Common Stock400440

16-244604009%10yearConvertible Bondson6/1/1499plus accrued interest2007181512discount per monthIssue PriceMonths RemainingBonds Dated:4/1/1437844604118Interest Payable1-Aprand1-OctG1 Month6B4 Month44/1/151672650bonds were converted into 39600shares of18par value common stockAccrued interest was paid in cash at the time of conversion.a)Prepare the entry to record interest expenses at10/1/14assume that accrued interest payable was credited when the bonds were issued.b)Prepare the entry to record the conversion on 4/1/15(Book Value Method is Used).Assume that the entry to record amortization of the bond discount and interest paymenthas been made.a) Interest Payable66906Interest Expense135324TRUE Discount on Bonds Payable1512 Cash200718b)Bonds Payable1672650TRUE Discount on Bonds Payable15309 Common Stock712800 Paid-in Capital in Excess of Par - Common Stock944541

16-2410year46300008%1/2/14Current Conversion Ratio15/1par value1000in2years20/1sold at982014Net Income7500000straightline basiseffective tax35%andcompany had2390000shares outstanding during the entire yearBasic Earnings Per Share$3.14Diluted Earnings Per Share$3.12Maturity value4630000Stated Rate8%Cash Interest370400Net Income For Year7500000Discount Amort:9260AddAdj. Net Tax246779Interest Expense37966077467791-Tax Rate65%After-Tax Interest2467794630debentures2092600shares

16-7issuing183700Face Value of Bonds with coupon rate of12%Warrants 133440issued1for each 100soldvalue without warrants33360bonds sold in market at issuance for 146000a)Basic Formulas

Value Assigned to bonds133440*146000=116800133440+33360Value Assigned to Warrants33360*146000=29200133440+33360Total146000Discount on Bonds Payable66900a)Cash146000Discount on Bonds Payable66900 Bonds Payable183700 Paid-in Capital- Stock Warrants29200b)Cash146000Discount on Bonds Payable37700 Bonds Payable183700

16-Q-15/1/14issued31701000bondsat102each was issued with 1detachable stock warrant.After issuance the bonds were selling at98but fair vaule of the warrants cannot be determineda)Prepare the entry to record the issance of the bonds and the warrants

Cash$3,233,400Discount on Bonds Payable$63,400TRUE Bonds Payable$3,170,000 Paid-in Capital-Stock Warrant$126,800

b)Assume the same facts as (a), except the Fair Value is 22Prepare the entry.

Cash$3,233,400Discount on Bonds Payable$7,593TRUE Bonds Payable$3,170,000 Paid-in Capital- Stock Warrant$70,993

Market Value of Bonds without warrants3106600Market Value of Warrants69740Total Market Value3176340

Value Assigned to Bonds3162407.185628743106600*32334003176340Value Assigned to Warrants7099369740*323340031763403233400

16-Q-2Issued2940000Convertible10year Bondson7/1/14Bond Provided for14%Interest PayableSemiannuallyon1-Janand1-JulThe discount in Connection with the issue was 39600Amortized monthly with Straight-lineThe Bonds are Convertible after 1year into 8share of 100par valueCommon Stockfor each 1200of bonds8/1/15294000of bonds were turned in for converstion into Common StockInterest has been accrued monthlyAt the time of conversion, the accrued interest on bonds being converted is paid in CASHPrepare the Journal enteries to record the conversion, amortization, and interest in connection with the bonds.a)8/1/15(Book Value method is used)b)8/31/15c)12/31/15(including closing entries for end-of-year)a)Discount on Bonds Payable3531Common Stock196000Paid-in Capital in Excess of Par- Common Stock94469Cash3430

a)Bonds Payable294000 Discount on Bonds Payable3531 Common Stock196000 Paid-in Capital in Excess- Co. Stk.94469

Interest Payable3430 Cash3430b)Interest Expense297Interest Payable30870Schedule 1full amount to be Amortized39600Monthly amount330months used13.20134290Balance on day before35310Debenture converted 10%(3531)Balance on Day of31779Remaining Monthly 297Schedule 2Amortization of bond discount charged to bond interest in year:Month in A/8First part of year 733023108end of year52971485Total3795

Interest on Bonds:Beg411600Monthly34300Denbenture percent370440Denbenture monthly30870

Interest would beTotal InterestFirst part of year 2401003795end of year154350394450total394450398245

b)Interest Expense297 Discount on Bonds Payable297

Interest Expense30870 Interest Payable30870

c)Income Summary398245 Interest Expense398245

16-Q-3Determine the Basic and Diluted Earnings Per share1)Authorized to Issue7228800shares10par value Common StockAs of 12/31/141807200shares had been issued and were outstanding2)The per share market prices of the common stock on selected dates were as follows:7/1/14201/1/15214/1/15257/1/15118/1/1510.511/1/15912/31/15103)A total of 699600shares of an authorized1386000shares of convertible preferred stock had been issued on 7/1/142098800Par25Cum. Dividend of 3per shareConversion1preferred to1commonadjusted for splits and dividendsDividends are quarterly30-Sep31-Dec31-Mar30-Jun4)Subject to a 40%income tax rate5)the after-tax net income for the year ended 12/31/15was12500000the following took place during the year1)1-Jan5%common stock dividend was issued.903600declared on 12/1/14for all stockholders as of 12/29/142)1-Apr411600shares of the 3convertible was convertednew common was issued and old preferred was retired.3)1-Jula 2 for 1 split of common stock became effective on this date. was authorized on 1-Jun4)1-Aug285600shares of common stock were issued to acquire a factory building5)1-Nov30800shares of common stock were purchased on the open markert at9per shareto be treasury stock, still held in treasury as of12/31/156)Common stock Cash Dividends declared and paid as follows15-Apr0.3per share15-Oct0.2per share7)Preferred stock cash dividendscash dividends were decalred and paid as scheduled.a)EventDates (outstanding)Shares (outstanding)RestatementFraction of yearWeighted SharesBeg, Balanace(include5%Stock Dividend)1-Jan1-Apr189756021/4$948,780Conversion of Preferred stock1-Apr1-Jul232974021/4$1,164,870Stock Split(2 for 1)1-Jul1-Aug46594801/12$388,290Issued Shares for building1-Aug1-Nov49450801/4$1,236,270Purchase of Treasury Stock1-Nov1-Dec49142801/6$819,047 Total number of Common Shares to Compute Basic4557257b)Number of Share to Compute Basic Earnings Per Share4557257Convertible Preferred Stock - Still Outstanding604800Convertible Preferred stock - Converted216090Number of shares to compute diluted earnings per share5378147c)After-tax net income12500000Preferred Stock Dividends March 31524700 June 30216000 Sept 30216000 Dec 312160006480001172700Adjusted Net Income11327300

16-Q-4Issued 333000010year8%Convertible at104interest paid semiannually30-Junand31-Deceach 1000debenture can be convered into 9shares of 104par value common stock after31-Dec-151-Jan-16333000of debentures are converted into common stockwhich is then selling at114and additional 333000are converted on31-Mar-16Market of the common stock is then117Accrued interest at will be paid on the next interest date

12/31/15Interest Expense127206Premium on Bonds Payable5994 Cash133200

1/1/16Bonds Payable333000Premium on Bonds Payable8525 Common Stock311688 Paid-In Capital in Excess - Common Stock29837

3/31/16Interest Expense6423Premium on Bonds Payable237 Interest Payable6660

3/31/16Bonds Payable333000Premium on Bonds Payable8288 Common Stock311688 Paid-In Capital in Excess- Common Stock29600

6/30/16Interest Expense101765Premium on Bonds Payable4795Interest Payable6660 Cash113220

![[MS-XLSX]: Excel (.xlsx) Extensions to the Office Open XML ...interoperability.blob.core.windows.net/files/MS-XLSX/[MS-XLSX].pdf · [MS-XLSX]: Excel (.xlsx) Extensions to the Office](https://static.fdocuments.net/doc/165x107/5e14a2c69b6a8672683323c2/ms-xlsx-excel-xlsx-extensions-to-the-office-open-xml-ms-xlsxpdf-ms-xlsx.jpg)