A2A - 2017 Company Profile - Amazon S3 · • Capex for the period around 2.5 €Bn • Net Debt(2)...

Transcript of A2A - 2017 Company Profile - Amazon S3 · • Capex for the period around 2.5 €Bn • Net Debt(2)...

Our Results• Positive 2016 results were achieved: EBITDA up by

almost 18%, strong growth in Net Profit.Investments were up by 23%

• With respect to these external dynamics, the Groupreacted by continuing with the initiatives toimprove operational efficiency, which helped tosustain the profitability

• Debt optimization continued posting satisfactoryresults also in 2016

• A dividend of 0.0492 euros per share, up by 20%,was submitted to AGM approval

• A2A medium-term financial strategy is aimed atlengthening the average debt maturity,maintaining an adequate financial flexibility andlowering the cost of debt to support the Companyrating

• A2A adopts a prudent energy risk policy, part of itsEnterprise Risk Management model, whosepurpose is to further develop and integrate riskmanagement activities into the business process

Our Responsibilities• A high weight of green components

characterizes A2A asset portfolio. Large scalerenewable production (hydroelectric, WTE), highefficiency production (cogeneration with lowerCO2 emissions) and innovative technologies toincrease energy savings (LED lighting). A2A mayalso leverage on a large and loyal customer baseas a natural hedge for its energy portfolio.

• These mark the Company commitment tosustainability, further strengthened in 2016.

• The shift to a traditional governance model,occurred in June 2014, facilitates decisionmaking and emphasizes the central role of theBoard of Directors

• Milan and Brescia cities are the majorshareholders with a joint control

A2A - THE LEADING ITALIAN MULTI-UTILITY

Business units: top strengths

2

Environmentn. 1 for electricity produced by WTE plants

Energy Retailmarket leader for quality and customer satisfaction

Generation & Trading∼2 GW hydro installed capacity in Italy

This document has been prepared by A2A solely for investors and analysts. This document does not constitute an offer or invitation to purchase or subscribe any shares or other securities and neither it nor any part of it shall

form the basis of or be relied upon in connection with any contract or commitment whatsoever. Some information contained herein and other material discussed at the meetings may include forward-looking information based

on A2A’s current beliefs and expectations. These statements are based on current plans, estimates, projections, and projects and therefore you should not place undue reliance on them. Forward-looking statements involve

inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited

to changes in global economic business, changes in the price of certain commodities including electricity, gas and coal, the competitive market and regulatory factors. Moreover, forward-looking statements are current only at

the date on which they are made.

Networks and District Heatingincumbent in its 3 key gas areas first domestic operator in DH

Our World

• A2A is active in environment, energy retail,networks and district heating, generation andtrading – a business diversification which spansfrom regulated to market exposure thusconsiderably lowering its economic risk profile

• Born in 2008 from the merger of AEM, ASM andAMSA, A2A operates throughout Italy,predominantly in Lombardy. The activities inMontenegro were deconsolidated as of July 2017

• The business units of the company have a firstclass asset base - both plants and networks. Longterm concessions increase visibility

• A2A business model is very flexible. It allows foroptimizations both in the business units andacross them

• The current strategy has been set out in the2017-2021 Strategic Plan. The main lines of thePlan are the following:

- Relaunch: growth in environment, smartnetwork and energy services

- Regeneration: active role in the energy markettransformation

- Reshape: buying options in smart city and greeneconomy

- Discipline in operations and capital structure- Dialogue & engagement with key stakeholders- Digital & technological transformation

EBITDA expected to grow to around 1.3€ bn in2021, cumulated CAPEX of the period equal toaround 2.5 € bn.

A2A AT A GLANCE

Local

utilities

A2A in 2016

Italian utilities 2016 EBITDAA2A shareholding structure(3)

CURRENT CORPORATE CREDIT RATING

Standard & Poor’s

BBB/A-2 Outlook Stable

Moody’s

Baa3 Outlook Stable

Financial Highlights

(3) At December 31, 2016. Recent updates available at the following link.

3

0

20.000.000

40.000.000

60.000.000

80.000.000

0,70

0,80

0,90

1,00

1,10

1,20

1,30

1,40

Vo

lum

es

€/s

har

e

Volumes (right-hand scale) Price

A2A is the Blue Chip of the local utilities

0.8%

3.1%

25.0%

25.0%

46.1%

100.0%46.1%

53.9%

Free Float

Municipality of Milan

Municipality of Brescia

Norges Bank

A2A S.p.A. (treasury shares)

46.1%Total

(1) 2016 figures restated after the completion of the Purchase Price Allocation (PPA) process on LGH Group assets.(2) Group net income adjusted for the impact of extraordinary items: 2016 = 377 €M; 2015 = 278 €M; 2014 = 175€M; 2013 = 156€M

A2A BUSINESS PORTFOLIO

Ordinary EBITDA equal to 1,103 €M

(1) Equal to 1,132 €M, calculated as Reported EBITDA (1,231 €M) net of non recurring items (128 €M) and EBITDA from “Corporate” (-29 €M)(2) Infrastructure activities: electricity and gas networks, heating distribution and integrated water cycle. Energy efficiency activities: heat generation, recovery and sales, public lighting and other energy efficiency

services.

Sources: A2A Strategic Plan, 2016 Results & Business Plan Update; Company Annual Reports

2016EBITDA(1)

4

GENERATION & TRADING

Fuel sourcing

Powergeneration

Whole-sale &Trading

352 €M 31%

ENERGY RETAIL

Electricity and Gas sales

free market regulated

market

ENVIRONMENT

120 €M 11%

Industrial Waste Treatment

Collection and street sweeping

Urban Waste Treatment

Material Recovery

Electricity and Heat production

EPCG(Montenegro)

Power generation

Electricity networks

69 €M 6%

NETWORKS & HEAT(2)

Integrated Water Cycle

Electricity networks

Gas networks

HeatDistribution

Cogeneration, heat recovery and

sales

Energy Efficiency Services

Public Lighting

SMART CITY

Telephony and Internet access

Data transmission

Video-surveillance

6 €M 1%

NETWORKS HEAT

69 €M 6%285 €M 25%231 €M 20%

SIGNIFICANT SYNERGIES ACROSS THE BUSINESS UNITS

Put option on EPCG was exercisedin July 2017

Deconsolidationas of H2 2017

Mostly Quasi-Regulated Merchant Low Volatility RegulatedMerchant High-Volatility

with Regulated itemsQuasi-RegulatedRisk

Profile

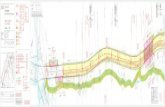

A2A GEOGRAPHICAL PRESENCE (AS OF H2 2017)

5

G

G

GG

G

G

PL

G

DHE G

W

G W

E G

E

DHG

G DH

DH

DH

DH

DH G

G

PL

PLPL

C

C

C

C

C

C

C

C

C

C

Italy Lombardy

Legenda

EnvironmentWaste collectionTreatment plantsBiogas/Biomass plantsWaste-to-Energy

Generation & TradingHydroelectricCCGT CoalFuel OilSolar

E

GW

PL

C

DH

Technological partnerships abroad on waste treatment plants (UK, Spain and Greece)

NetworksElectricityGasWaterPublic Lighting

HeatCogen. & thermal plantsThermal solar plantsDistrict Heating

A2A 2017-2021 STRATEGIC PLAN IN A NUTSHELL

STRATEGICFRAMEWORK

RELAUNCH

• Growth in environment, smart networks and energy services

• Focus on low-risk businesses

REGENERATION

• Active role in the energy market transformation

• Flexible fleet to serve shortening EU markets

• Re-alignment with EU Winter Package • Development by adjacencies

RESHAPE

• Buying options in smart city and green economy

• From pilot projects to market solutions

DISCIPLINE• Operational excellence project

adoption • Further deleveraging, with higher

Capex and DPS • Dividend target of 7.5 €cent in 2019

confirmed

DIALOGUE

• Extension of multi-stakeholder forum and territorial sustainability reports

• Sustainability target in management MBO • People: ageing policy, welfare, managerial

development, talent management, employer branding

DIGITAL

• Further Business Units process digitalization • New HR ERP

• Strong fiber development• New IT and digital services to municipality

• Strong investmentsin automation

STRATEGIC PLAN GUIDELINES

7

Key financial highlights

• Ordinary EBITDA(1) to grow from around 1.1 €Bn in 2016 to around 1.3 €Bn in 2021

• Capex for the period around 2.5 €Bn

• Net Debt(2) from 3.136 €Bn in 2016 to around 2.5 €Bn in 2021 (NFP/EBITDA from 2.5x to 1.8x at the end of the period)

• Ordinary Net Income(2) from 377 €Mn in 2016 to 470 €Mn in 2021

• Dividend policy: - dividend target of 7.5€cent in 2019 confirmed;- minimum 60% pay-out ratio at 2021.

NO LONGERA GEN.CO.

Growth mainly driven by non-generation

businesses

Higher option value from generation

assets and Winter Package

Strong CAPEX increase in regulated/

quasi-regulated markets

Annual investments 50% higher than past three

years’ average

Further optimization from operational

excellence

Local aggregations, M&A, RES/DER

and other projects to strengthen A2A

positioning and to mitigate risk

Updated Project Pot

BOOST IN BUSINESSES

WITH PROVEN TRACK RECORD

ROOM FORUPSIDES

A2A: what kind of company going forward?

OUR FUTURE IS SUSTAINABLE, GREEN, OPEN, SMART

(1) Reported EBITDA in 2016 = 1,231 €M. Includes non recurring items for 128 €M.(2) 2021 guidance on Net Debt and Net Income does not take into account the

effects of the put option exercised on EPCG.

Waste, Retail and Networks to lead the growth

More options for generation and a more conservative energy scenario

Resilience of net income growth to commodity prices

Dividend target of 7.5 €cent in 2019 confirmed

Positive free cash flow generation with increasing Capex and dividends

Key takeaways 2017-2021

A2A SUSTAINABILITY PLAN GOALS

8

CIRCULAR ECONOMY

DECARBONIZATION

SMART GRID AND SERVICES

PEOPLEINNOVATION

2016 results2020 goals

99.0%

67.0%

80.0%

56.2%

84%

98.86%Urban waste sent for recycling or energy recovery

Separated waste collection in the communities served

Impact of the recovery capacity of the material in the Group's plants on the urban waste collected

392.5

-234

1,260

Carbon intensity in electricitygeneration (gCO2/kWh)

CO2 avoided thanks to the extension of the district heating network (ktonnes/year)

Green electricity sold (GWh)

417

769

-161

The CSI Total in “multi-client of reference” surveys (CERVED DataBank) with a value never below

90%

customers with online A2A Energia services400,000

Million euro invested in the Smart City area10

268,818

1.9

92.4%

regional workshops with 30 actions to be implemented

inspections/year at the roadwork sites of the A2A Group

Target employees involved in SmartWorking projects

15

4,000

20%

2 workshop (11 actions)

1,406

5%

2020 goalalready achieved