A Study on Micro Credit in Eastern Uttar- Pradesh with Reference to Cashpor

-

Upload

dwivedipgdm -

Category

Economy & Finance

-

view

1.454 -

download

3

description

Transcript of A Study on Micro Credit in Eastern Uttar- Pradesh with Reference to Cashpor

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

A Study on Micro Credit in Eastern Uttar-Pradesh with Reference to CashporDr. Amit Kumar Dwivedi, Dr. Punit Kumar Dwivedi,Ms. Nivedita Dwivedi

Introduction

“Microfinance is certainly not the silver bullet that will wipe awaypoverty, however it is undoubtedly making an impact on the socio-economicstatus of those who avail it and use it well.1”

The micro-credit sector in India is characterized by a variety of creditservice providers. These include various apex financial institutions like SmallIndustries Development Bank of India and NABARD financial institutions,Commercial Banks, Regional Rural Banks (RRBs), in accumulation tomember-based institutions like Cooperative, SHG, private sector companieslike specialized NBFCs, etc. Beside the existence of such a large number ofplayers in the organized/semi-organized sector, the rural credit market inIndia is still largely dominated by the all pervading network of indigenousmoney lenders.

There are a huge number of Non-Governmental Organizations (NGOs)which can be practically found in all villages and blocks of India. Most ofthese NGOs have compatible origin in that they started off as social serviceand welfare organizations with a focus on helping the poor and needy in

Journal of Commerce & Management Thought II - 3ISSN 0975-623X(print)0976-478X(online)

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

times of disaster, famine or any other social outbreak. The growingpopularity of micro-credit in India, these NGOs have also taken up micro-credit movement as a part of their overall service approach. While some haveadopted micro-credit as their core movement. A large number of suchinstitutions, have adopted multiple operations with a limited investment inmicro-credit (Planning Commission, Govt. of India).

Micro-credit is defined as the prerequisite of credit services to clientswho have otherwise been neglected by the majority credit/finance industry.These clients are excluded from mainstream financing primarily for reasonssuch as lack of education, living in a remote location, poverty, etc. Manykinds of Non-Government organizations participate in providing micro-creditof short-term financing services. These include non-profit regional andinternational both organizations, private companies, financial institutions andregistered banks. The micro-credit industry also includes other participants -such as state, local and national governments, independent rating agenciesand other third-party observers.

A significant amount of the underprivileged people in India is somehowable to tailor their financial resources in a way that they can realize theirambitions vis-à-vis their houses or other plans. However with theintroduction of micro finance in India, the standard of living of the poorsection of the population is expected to improve (Patil et al., 2008). From anobscure experiment in Bangladesh 30 years ago, microfinance has become aworldwide movement as a development activity, a way of helping poorpeople out of poverty (Ditcher, 2006). Singh, (2008) highlighted that,"Micro finance services are designed to help the underprivileged to increasetheir earning, consolidate their properties and even gain a decent financialstability in life. The advantage of availing the micro finance credit over themore traditional means is the unwillingness of the later to serve theunderprivileged people. In light of its prominent role in developmenteconomics, Buckley (1997) described it as the newest darling of the donorcommunity, while Karnani (2007) portrays it as the newest silver bullet foralleviating poverty and Greer (2008) and Gupta and Aubuchon (2008)claim that microfinance shines as a proven way to improve the lives of thepoor. Aguilar (2006), Ausburg (2008) argues that there is the need for a plus

A Study on Micro Credit... 339

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

component (training in financial management, marketing and managerialskills and market development) for microfinance to succeed.

In India in recent times, new types of Microfinance Institutions (MFIs)are being launched. They concentrate exclusively in the field of microfinanceand adopt products, policies and procedures which can enable them to deliverthese services in a profitable manner. The number of such MFIs is estimatedto be less than a hundred. These credit institutions have larger canvas andmicrocredit is one among their major activity. The MFIs adopt diversemethodologies in reaching the poor. Cashpor Financial and TechnicalServices Pvt. Ltd in Uttar-Pradesh is one of those which are adopting acombination of approaches.

Research Methodology

Cashpor Micro Credit (CMC) is a leading micro-credit institution ineastern Uttar-Pradesh region. It was observed that the CMC is increasing theoutreach in extensive manner. The data set of past 10 years have been usedfor this study and we obtained those from the annual report of CMC andMIX-market a database that compiles information on MFIs. Created in June2002 as a private non-profit organization, the MIX (MicrofinanceInformation Exchange) promotes the exchange of information within themicrofinance sector. The mission of the MIX is to help create a microfinancemarket by offering data collection services, performance tracking tools,sector comparisons and specialized information services. Micro-Soft (Excel)was used for data analysis and charts preparation.

Research Objectives

The aim of this Paper to show that a micro-credit facility can change lifestyle of poor as well as strengthen the rural economy. This paper discussedthe CMC’s performance in region as major micro-credit institution. The focuspoints of the paper are as follows:1) To evaluate the business policy and systems of CMC.2) To analyse the Efficiency, Productivity and Profitability in CMC.3) To analyse the relationship between the financial results and other non

financial issues.

Journal of Commerce and Management Thought II - 3340

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

Importance of Study

In this study an attempt has been made to focus on financial as well asnon-financial factors of Cashpor Micro-Credit. It also examines businesspolicy, plans followed by CMC to maximize the outreach of the firm. In thestudy the past 10 year-data have been analyzed. It has also analysed financialand non-financial factors of micro-credit business.

Cashpor Micro Credit (CMC) : Management of Operations

The Cashpor Financial & Technical Services Pvt. Ltd (CFTS) has startedoperations in Mirzapur District in September 1997, as an experimental fast-track, commercial approach to establishing a Grameen Bank-type institution.In the first six months of establishment and field operation only 100 womenhave chosen this as credit institution and by that time CFTS has opened sixbranches in the area2. The second six month period was more challengingbecause there was no addition in the clients and at the end of the year thenumber was only 100. In February, 1998 CFTS called 10 selected clients3(Centre Chiefs) for a formal meeting at Mirzapur, CFTS paid them all thetransport charges and arranged formal Lunch with their families. In meeting,officials of CFTS discussed the objectives of the firm to the clients that CFTSwants to provide micro-credit facility to them with continual, timely andhonest access to service for as long as they needed."4After this meetingCFTS started its journey to success which has become remarkable.

The Objective of the CMC is reduction in poverty through thesustainable financial services to poor women. The task is taken byindentifying at the village level poor households that are CMC’s potentialclients. CMC begins its work in village that has a sufficient number of poorhousehold to make it possible to establish a full center that is one with 15 to20 women each. The Housing Index (HI) has only two indicators:

1. Height of the wall and material used Points• More than 5 feet and made of brick 4• More than 8 feet and made of mud 2• More than 4 feet but less than 8 feet and made of mud 1

A Study on Micro Credit... 341

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

2. Material of the roof• Concrete/new tiles 2• Old tiles/GI sheet 1• Thatch/Straw/Plastic/leaves 0

Maximum Score 6

The Poverty Status is decided on Housing Index. The classification is madeas under : • Very Poor - 2 or less • Moderate Poor - 3 • Non Poor - 4 or more

The Housing Index is used to identify households with less than 4 score.The second step is to take brief interview with occupants that scored lessthan 4 on the HI. It determines the poverty status of household from sourcesof income/ no. of earners and ownership of productive assets.

Business System in CMC

The Cashpor Micro Credit (CMC) has developed Centre Manager (CM)as chief player in the organization. CM has to attend centre meetings in thevillages, ensuring about collection, taking new-loan proposals from existingborrowers and also do some exercises for new clients. He has to check thedeployment of loan funds by borrowers and about timely loan disbursementalso. CMC has a unique system of "Mini Branch System"6. There are 4supervisors at the bottom level and they are responsible for Branch and Arealevel operations. The Branch Manager supervises four Centre Managers withrequirement of surprise visiting at least once in a day, and the Area managersupervise four branches in the same way of surprise visiting for whole week.The district manager has to visit 12 branches on monthly basis and if thenumber of branches is more than 12, then the Deputy District Manager willcover rest of it. In CMC the Zonal manager is at the pinnacle of the fieldsupervisory structure. He has to coordinate in 3-4 districts and has to reportto managing Director of CMC.

CMC has special type of funds for branch management. In the branchoffices they are providing residential and food facilities for Branch Managerand Area Manager. Similarly District Manager and Dy. District Managerhave to live at District office. The CMC’s objective for this provision is,

Journal of Commerce and Management Thought II - 3342

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

(i) to motivate new prospective borrowers, (ii) To recovery of given loans,and (iii) to achieve their targeted business plan timely.

Area of Operation

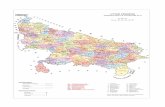

Eastern-Uttar Pradesh is also known as Poorvanchal, it is bounded byNepal in north and Bihar state of India to the east, Vindhya hills to the southand Awadh region to the west. Poorvanchal consists mainly of threedivisions; (i) the eastern Awadh region in west, (ii) the western Bhojpuriregion in the east, and (iii) Northern Vindhya region in the south.

It lies on the Indo-Gangetic plain, together with western Bihar, which isthe most densely populated area in the world. The rich quality of soil and thehigh earthworm density in the soil than adjoining districts of U.P. isfavourable for agriculture. Cashpor Micro-Credit spread out in few districtsof Eastern Uttar-Pradesh as well as Western Bihar. The districts which aregetting facilitated by CMC are Varanasi, Chandoli, Ghazipur, Jaunpur,Mirzapur, Deoria, Gorakhpur, Kushinagar, Azamgarh, Ballia, Sonbhadra ofEastern U.P and Buxar, Bhabua-Rohtas, Siwan and Saran of Western Bihar.Currently CMC has operation in 15 districts of India. The total number ofactive clients in these districts are 4,17,039 (cumulative) as on March 2010.7

Fig. 1 : Area of Operation of Cashpor Micro Credit

Head-Office(Varanasi)

BCJS BMV BGSS ADGK(ZONE) (ZO NE) (ZONE) (ZONE)

Districts Districts Districts DistrictsBhabua Rohtas Buxar Ballia AzamgarhChandauli Mirzapur Gazipur DeoriaJaunpur Varanasi Siwan GorakhpurSonbhadra Saran Kushinagar

A Study on Micro Credit... 343

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

CMC has weekly reporting system by Branch Manager at district officeand upto head office through information media as well as documented form.The Managing Director (MD) and Chairman have to read the weekly reportsand their remarks make new-targets for subordinates. Every month, CMCofficials have to sit together and assess theirs achievements in the month. Inthe same meeting they have to finalize the next month business planaccording to need. The whole system is equipped with mobile phones andinternet facility.

The Zonal Manager (ZM) has to prepare action plan for proposed target ofcoming month, and also secure its approval by the coordinator of theOperations whose action plan is approved by MD, at the end of each month.The action plan is assessed by MD and provides proper feedback to Z.M.Similarly district offices have also to prepare the action plans for theirtargets.8 CMC has quarterly, half-yearly & annually monitoring andevaluation process in their business system. The system of monitoring isquite sound and foolproof.

Data Analysis

In the year 2010 the Cashpor Micro-Credit (CMC) achieved Rs. 43Crore (US$ 1 million) after paying all losses. From this surplus CMC is goingto build-up their own capital fund. This surplus will help to improve outreachof the firm. The successful business plans of the previous year have made thisfruitful surplus to the firm. CMC targeted to increase their portfolio by Rs.219 Crore but in actual they achieved Rs. 267.3 Crore (about US$ 58 million)i.e.122% of the targeted amount. In this section of the paper, the majorfinancial data has been analysed and presented in tables and figures.

A) Efficiency and Productivity Analysis :

Efficiency and productivity indicators are performance measures thatshow how well the institution is streamlining its operations. Productivityindicators reflect the amount of output per unit of input, while efficiencyindicators also take into account the cost of input and /or the price of outputs.In micro-credit institution, administrative cost may be Rs. 15, to 30 for each

Journal of Commerce and Management Thought II - 3344

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

hundred rupees loan portfolio, so the efficiency ratio is 15% to 30%.9Operating Expenses Ratio, Cost of borrowers is the major analysis forassessment of efficiency and productivity of a firm.

Operating Expenses Ratio (OER):

This ratio provides the best indicator of the overall efficiency of amicro-credit institution for this reason it is also known as efficiency ratio. Incase of CMC operating expenses ratio appeared very high around 23 per centbut slowly its came down when portfolio of lending increased year by year.In the Fig. 2.1 it is shown that the management of CMC controlled OER andafter 2008 it is very close to 10 percent, which is showing remarkableefficiency in CMC.

Fig. 2.1 : Operating Expenses Ratio (OER)

Cost per borrower

Cost per borrower is calculated by dividing operating expenses byaverage no. of active borrowers. This ratio is also a component ofmeasurement of efficiency by focusing the average cost of maintaining activeborrowers. In CMC cost per borrower was quite high at the beginning aroundRs. 5,600 because of less no of borrowers and high-per borrowers operatingcost, but with incremental effect in no. of borrowers it reduces very quicklyand in previous year it was observed that per borrowers cost is around Rs.700, that is good signal for CMC.

A Study on Micro Credit... 345

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

Fig. 2.2: Cost per Borrower and No. of Active Borrowers

B) Profitability Analysis

Profitability measures, such as return on equity and return on assets,tend to summarise performance in all areas of the firm.

Return on Assets and Equity (ROA & E)

ROA is an overall measure of profitability that reflects both profit aswell as loss margin and the efficiency of the institution. It is calculated bydividing net income (after tax and excluding nay grant or donation) byaverage assets. In beginning days ROA was in negative10 in CMC but it wasimproved year by year after that now it is 4.94 per cent.

Fig. 2.3: Return on Assets and Equity

Journal of Commerce and Management Thought II - 3346

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

C) Portfolio Yield:

Portfolio Yield is the initial indicator of an institution’s ability togenerate revenue with which to cover its financial and operating obligations.Credit Institutions tend to disguise their interest rates, but portfolio yield isan easy way to calculate the actual rate obtained by the institution.11 PortfolioYield is calculated by dividing total cash financial revenue (all incomegenerated by the loan portfolio, but not accrued interest) by the periodaverage gross portfolio. It measures how much Cash interest actuallyinstitution is receiving from its clients. Portfolio Yield in CMC is constantfrom year 2006 till previous year in between 15 to 20 percent. Withappositive growing rate in no. of active borrowers and competition it has agood pace of growing.

Fig 2.4 Portfolio Yield and No. of Active Borrowers

Results and Discussion

1. Capital Cost to Assets Ratio (CCAR): It is calculated by dividingOperating Expenses (Rent, Depreciation, office, other) by Total Assetsof the institution. From starting it was observed very high in CMC dueto expansion cost and establishment of new offices but after reaching upto optimum level of clients it came down and currently it is showingstandard rate in CMC.

A Study on Micro Credit... 347

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

2. Loan to Assets Ratio (LAR): Loan to Total Assets Ratio is calculated bydividing loan portfolio by total assets of the firm. In beginning days ofCMC also LAR was in good position i.e. 55.56 percent in 2001. Itmeans that from very beginning CMC has got optimum no. of clientsand it has a better policy regarding asset management due to this onlyCMC has maintained standards of this ratio and currently it is on 72.3percent.

3. Return on Assets (Adjusted) Ratio (ROAR): ROAR is a percentage,which measures the net income earned on the assets of a MFI. It’s anoverall measure of profitability that reflect profit and loss margins. Itindicates financial performance of the institution. In CMC it isnegatively correlated to Cost of Capital to Assets Ratio (CCAR). andpositively correlated with Operating Self-Sufficiency Ratio (OSSR) andPortfolio Yield (PY). These relations show positive because the firmhas been growing at right path and it had got a proper level of self-sufficiency. In the very beginning it was negatively high but withbusiness growth it became positive and now following the businessstandards.

4. Operating Self-sufficiency Ratio (OSSR): Operating Self-SufficiencyRatio is a percentage, which indicates whether or not enough revenuehas been earned to cover the MFI’s total costs-operating expenses, loanloss provisions and financial costs. It is an important measurement ofsustainability of the credit operation. If credit-institution does not reachoperational self-sufficiency, eventually its equity (loan fund capital) willbe reduced by losses (unless additional grants can be raised to coveroperating shortfalls). CMC shows negative relationship with CapitalCost to Assets Ratio (CCAR), whereas it is having a positive strongrelationship with Return on Assets ratio (ROAR).

5. Portfolio at Risk > 30 Days (PAR): PAR is calculated by dividing theoutstanding balance of all loans with arrears over 30 days, plus all

Journal of Commerce and Management Thought II - 3348

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

refinanced loans12 by the outstanding gross portfolio as of a certaindate. Since the ratio is often used to measure loans affected by arrearsof more than 30 days. In CMC, PAR>30 days has positively relationshipwith Portfolio Yield.

Table : Corrélation Matrix (CCAR, LAR, ROAR, OSSR, PAR, PY)

CCAR LAR ROAR OSSR PAR

LAR -0.440933398 1

ROAR -0.993325703 0.413826348 1

OSSR -0.832844087 0.393051201 0.861195018 1

PAR -0.167529282 0.395828629 0.145300162 0.1254385 1

PY -0.593445491 0.385241488 0.578362157 0.6827013 0.50816165

From the above analysis it can be observed that CMC has controlled itsmajor costs and now able to generate its funds for self-sufficiency. It wasfound that for any micro-credit institution costs at the beginning are veryhigh, but if that institution maintained the optimum level of borrowers withless number of loan losses that can turn into a positive position.

Conclusion

Cashpor Micro Credit promoted by Cashpor Financial TechnicalServices Pvt. Ltd. (CFTS) is working with a mission to alleviate the povertyin eastern-U.P. region has made positive impact on the clients. The financialmanagement of CMC shows that it achieved self sufficiency level. Businesspolicy being followed in CMC is more client oriented and Institution isgetting benefited because of pro-poor plans; specially like CHI HousingIndex. The Efficiency, Productivity and Profitability levels show optimumposition and are equivalent to business standards. The growing ROAR anddecreasing CCAR show the effectiveness and improvement in businessactivities.

A Study on Micro Credit... 349

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

Endnotes

Appendix-1 : Cashpor Micro-Credit : Ratios

Journal of Commerce and Management Thought II - 3350

1. Annual-Reports (2009, 2010) CashporMicro-Credit, Varanasi India

2. Aguilar, V. G. (2006). Is Micro-financereaching the Poor? An Overview ofPoverty Targeting Methods.www.globalnet.org (accessed on01/08/09)

3. Augsburg, B. (2008) Microfinance Plus– Impact of the ‘plus’ on customers’income in Rural University Maastricht,the Netherlands

4. Buckley, G. (1997). Microfinance inAfrica? Is it Either the Problem or theSolution? World Development, 25(7):1081-1091.

5. Dichter, T. W. (2006) "Hype and Hope:The Worrisome State of the Microcredit.http://conservationfinance.wordpress.com (Accessed on 30/08/09)

6. Greer, P. (2008). Hitting its Mark:Microfinance and the Alleviation ofPoverty.

7. Gupta, S. and Aubuchon, C. (2008). The

Microfinance Revolution: An Overview.Federal Reserve Bank of St. LouisReview, 90(1), 9- 30.

8. Karnani, A. (2007). MicrofinanceMisses its Mark. Stanford SocialInnovation Review Summer 2007.

9. Pati, A.P. (2008), .Subsidised MicroFinancing and Financial Sustainabilityof SHGs., The Indian Journal ofCommerce, Vol.61, No.4, pp.137-149.

10. Patil, Ganesh, Govind, P.S. andBhamare, Priyanka D. (2008), .MicroFinance: A Combat Against Poverty,The Indian Journal of Commerce,Vol.61, No.4, p.169.

11. Singh, Lakshmeshwar Pd. (2008),.Micro Finance. The Emerging Horizonsfor Poor and weaker Section, The IndianJournal of Commerce, Vol.61, No.4,p.173.

12. Technical Note on MicrofinanceInstitution: Performance Indicators forMFI-Micro Rate, Washington, D.C.

ww

w.In

dia

nJo

urn

als.

com

Mem

ber

s C

op

y, N

ot

for

Co

mm

erci

al S

ale

Do

wn

load

ed F

rom

IP -

203

.200

.225

.151

on

dat

ed 1

6-A

pr-

2012

Appendix - 2 : Variables definedVariable Name Proxy Definition/Description

Variable

Capital Cost to Asset Ratio CCAR Operating Expenses/ Total AssetsLoan to Asset Ratio LAR Loan Portfolio / Total AssetsReturn on Assets(adjusted) Ratio ROAR Net operating Income / TotalAssetsOperating Self Sufficiency Ratio OSSR Net Operating Revenue /

(Financial Expenses + loan lossportfolio + operating expenses)

Operating Expenses Ratio OER Operating Expenses / Gross Loan Portfolio

Portfolio-Yield PY Total cash financial revenue (all income generated) / Loan portfolio

Portfolio at Risk > 30 days PAR The percent of the total loan portfolio that has at least one payment overdue by more than 30 days, by methodology.

The AuthorsDr. Amit Kumar Dwivedi is a Faculty in the Entrepreneurship DevelopmentInstitute of India, Gandhinagar, Gujrat. He also worked in IIM-A as AcademicAssociate (F&A Area).

Dr. Punit Kumar Dwivedi is Reader-Head of the Faculty of Management Studies inModern Institute of Professional Studies, Indore (M.P.)

Ms. Nivedita Dwivedi is a Lecturer in College of Home Science Narendra DevUniversity of Agriculture & Technology, Kumargunj, Faizabad (U.P.)

Email : [email protected] ● Received on : Jan. 20, 2011

A Study on Micro Credit... 351