A Risky Propositions3.amazonaws.com/zanran_storage/ · vi A RISKY PROPOSITION: THE FINANCIAL...

Transcript of A Risky Propositions3.amazonaws.com/zanran_storage/ · vi A RISKY PROPOSITION: THE FINANCIAL...

A Risky Proposition

The Financial Hazards of New Investments in Coal Plants

Barbara Freese

Steve Clemmer

Claudio Martinez

Alan Nogee

Union of Concerned Scientists

M A R C H 2 0 1 1

A Risky Proposition

The Financial Hazards of New Investments in Coal Plants

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S ii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S iiiii U N I O N O F C O N C E R N E D S C I E N T I S T S

© 2011 Union of Concerned Scientists All rights reserved

Barbara Freese is a senior policy analyst/advocate with the UCS Climate and Energy Program.

Steve Clemmer is director of energy research and analysis for the UCS Climate and Energy Program.

Claudio Martinez is a risk analyst with the UCS Climate and Energy Program.

Alan Nogee is the director of climate and energy strategy and policy for the UCS Climate and Energy Program.

The Union of Concerned Scientists (UCS) is the leading science-based nonprofit working for a healthy environment and a safer world.

More information about UCS and the Climate and Energy Program is available on the UCS website at www.ucsusa.org.

This report is available on the UCS website (www.ucsusa.org/publications) or may be obtained from:

UCS Publications2 Brattle SquareCambridge, MA 02138-3780

Or, email [email protected] or call (617) 547-5552.

Printed on recycled paper

Design: Mary ZyskowskiFront cover photo: ©iStockphoto.com/mbbirdyBack cover photo: ©Zen Sutherland Photography

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S ii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S iii

Contents

v FIGURES AND TABLES

vi ACKNOWLEDGMENTS

vii EXECUTIVE SUMMARY

PART ONE

1 Background: The Changing Outlook for Coal

1 TheNeedforUrgentActiontoAddressClimateChangeIsNowIndisputable”

2 DeepEmissionsCutsAreRequiredfromtheCoalSector

2 FederalProjectionsofNewCoalPlantsPlummet

3 WidespreadRetirementsExpectedamongExistingPlants

6 ExcessGeneratingCapacityFacilitatesCoalPlantRetirements

7 GrowingOppositiontoCoal

PART TWO

8 Eroding Markets for Coal Power: The Impacts of Energy Efficiency, Renewable Power, and Natural Gas

8 EnergyEfficiency

9 RenewablePower

11 CompetitionfromNaturalGas

PART THREE

13 Fuel Prices at Risk

13 TheThreattoU.S.CoalPricesfromVolatileGlobalMarkets

15 NewDoubtsabouttheSizesofU.S.andGlobalCoalReserves

18 OtherProduction-CostIncreasesAhead

PART FOUR

19 Carbon Risk: A Costly Problem in a Warming World

19 TheImpactofaCarbonCostonCoalGeneration

20 CarbonPricesStillontheHorizon

22 UncertaintiesaroundCarbon-CaptureRetrofits

“

iv U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S iv A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S v

PART FIVE

25 Coal’s Damages—to Air, Water, Land, and Public Health—and the Costs of Reducing Them

25 TransportRule:PreventingThousandsofDeathsfromPollution-RelatedDiseases

26 AirToxicsRule:ProtectingChildren’sBrainDevelopment

28 AshRule:KeepingToxicContaminantsOutofGroundwaterandSurfaceWater

30 CoolingWaterRule:ReducingFishKillsandOtherStrainsonWaterBodies

31 RegulationofGlobalWarmingEmissions:TheEPA’sClimateProtectionMandate

32 NeedforLong-RangePlanningandRegulatoryOversightPriortoAnyRetrofits

PART SIX

33 Construction Costs: High and Volatile

33 SteepCostIncreases

34 PulverizedCoalPlantCosts

34 IGCCPlantCosts

36 PlantCostswithCCS

PART SEVEN

37 Harder-to-Get Financing

37 MajorBanksTryingtoLimitCarbonRisks,PressuredtoDoMore

37 DowngradedDebtRatingsfromExposuretoCoalRisk

38 CooperativeFundingDryingUp,MunicipalFundingQuestioned

PART EIGHT

39 Bottom Line: The Wrong Investment for a Changing World

39 TheHighCostofEnergyfromNewCoalPlants

40 NewCoalCostsMorethanManyCleanerOptions

41 CoalCompetingforDispatchintheMarket

42 TheDisappearingBaseloadAdvantage

42 ACleanerPathForward

45 Conclusion

47 REFERENCES

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S iv A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S v

FIGURES

viii FigureES.1.U.S.CO2EmissionsfromEnergyUsebySource,2009

x FigureES.2.DecliningFederalProjectionsofNewCoalPlantsthrough2030

xi FigureES.3.WindPowerGrowingatRecordPace

xii FigureES.4.AverageWeeklyCoalSpotPrices

xiv FigureES.5.LevelizedCostofElectricityforVariousTechnologies

3 Figure1.U.S.CO2EmissionsfromEnergyUsebySource,2009

4 Figure2.DecliningFederalProjectionsofNewCoalPlantsthrough2030

5 Figure3.U.S.ElectricGeneratingCapacitybyIn-ServiceYear

10 Figure4.WindPowerGrowingatRecordPace

14 Figure5.AverageWeeklyCoalSpotPrices

15 Figure6.U.S.CoalProduction

17 Figure7.ChangesinU.S.CoalMineLaborProductivity

22 Figure8.CO2AllowancePriceForecastsComparedwithPreviouslyModeledScenarios

23 Figure9.RelativeCostIncreasesfromAddingCarbonCapturetoCoal-FiredPowerPlants

34 Figure10.PowerPlantConstructionCosts

35 Figure11.PulverizedCoalPlantCapitalCosts:ActualProjectsvs.Studies

40 Figure12.IncreasingLevelizedCostofElectricityfromNewPulverizedCoalin2015

41 Figure13.LevelizedCostofElectricityforVariousTechnologies

43 Figure14.FuturePowerGenerationunderUCSBlueprint

44 Figure15.FuturePowerGenerationunderEPRIModel

TABLES

6 Table1.CoalPlantRetirementProjections

27 Table2.SelectedAirPollutionControlCosts

vi U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S vi A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S vii

ThisreportwasmadepossibleinpartthroughthegeneroussupportofOakFoundation.

Wewouldliketothankthefollowingindividualsfortheirinsightfulcommentsonourdraftreport:AbigailDillen,LisaEvans,LeslieGlustrom,LisaHamilton,RichardHeinberg,LucyJohnston,NancyLange,BruceNilles,CarlPope,DavidSchlissel,ReedSuper,andRobertUkeiley.

TheauthorswouldalsoliketothankUCSstaffmembersfortheirhelpfulcontributionstothereport,includingRachelCleetus,JeffDeyette,BrendaEkwurzel,ElizabethMartin,LonPeters,JulieRinger,JohnRogers,andLexiSchultz.WegivespecialthankstoEthanDavisforhisworkonthereports’quantitativecostanalysesandfigures.

WethankStevenMarcusformakingthereportmorereadable,MaryZyskowskifortheattractivedesignandlayout,andBryanWadsworthandHeatherTuttleforoverseeingthereport’sproduction.

Theopinionsandinformationexpressedhereinarethesoleresponsibilityoftheauthors.

Acknowledgments

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S vi A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S vii

children’sbraindevelopment;theycreatevastquantitiesoftoxicash,whichrequirecarefulhandlinginordertopreventleakage;andtheirhugecooling-waterwithdrawalsstrainourincreasinglyvulnerablewaterbodies.Expectedregulationswouldreducemanyofthesecostlyharms,butasseveralrecentfinancialanalysespointout,muchofthenation’scoalfleetisalreadyold,inefficient,andripeforretirement.Ratherthanretrofitthem,itmakesgreatereconomicsensetoclosethem. Finally,thereistheunavoidablefinancialriskassociatedwithcoal’scriticalroleindestabilizingtheglobalclimate.Giventheincreasinglydirenatureofglobalwarming,climatelegislationisstillwidelyexpectedintheyearsahead,withinevitablecostimplicationsforcoalplants. Combined,thesetrendsanddevelopmentscreaterisksthatnooneconsideringalong-terminvestmentinneworexistingcoalplantscanaffordtoignore.Theyalsocreateuniqueoppor-tunitiestoinvestinsteadinthecleanertechnologiesthatwillbeingrowingdemandaswetransitiontowardamoremodern,flexible,diversified,andsustainableenergysystem.

“The need for urgent action to address climate change is now indisputable.” Thiswarningwaspartofa2009jointstatementbytheU.S.NationalAcademyofSciencesanditscounterpartacademiesfrom12othernations,urgingworldleaderstotakeactiontoslowglobalwarming(NAS2009).Already,thecli-mateischanging,bothfasterandinmoredangerouswaysthancomputermodelshadprojected,andmuchworseliesaheadifwefailtomakedeepcutsinourglobalwarmingemissions(NRC2010a).

Deep emissions cuts are needed from coal plants. Coalpoweristhenation’slargestsourceofCO2,emittingmorethanallofourcars,trucks,andothermodesofsurfacetransportationcombined(FigureES.1,p.viii).Asthesourceofone-thirdofenergy-relatedCO2emissions,coalplantsmustbeaprimarysourceofthereductionsweneedtoprotecttheclimate.Indeed,reducingemis-sionsfromcoalplantsisaparticularlycost-effectiveapproachtoclimateprotection(Cleetus,Clemmer,andFriedman2010).

AcrosstheUnitedStates,theelectricpowersectorisplacingnewbetsonanoldtechnology—coal-firedpowerplants.Utilitiesandotherelectricityproduc-ersarepoisedtoinvestheavilyinretrofittingtheir

oldplantsorinbuildingnewones.Eachmajorretrofitornewplantrepresentsanenormouslong-termfinancialcommitmenttocoalpower.Butasdiscussedinthisreport,currenteconomic,technological,andpolicytrendsmakesuchcommitmentsexceedinglyrisky. Demandforcoalpowerisbeingsteadilyerodedbycompe-titionfromenergyefficiencyandrenewableenergy,whicharebenefitingfromrisingpolicysupport,growingpublicinvest-ment,advancingtechnologies,andoften-fallingprices.Coalpoweralsofacesmuchstrongercompetitionbothfromnewandexisting(thoughunderutilized)naturalgasplants,whichcantakeadvantageoftoday’srelativelylowgasprices. Coalprices,bycontrast,areontherise.Havingspikedin2008inresponsetoglobalcoaldemand,theyareclimb-ingagainwiththeglobaleconomicrecovery.Thereisgrowingconcern,moreover,thattheycouldbedrivenmuchhigherbysoaringdemandfromChinaandIndia,aswellasbyfallingproductivityacrossallU.S.coalfieldsandbyshrinkingreserveestimates.Constructioncostsforcoalplants,whichskyrocketedintheyearspriorto2008,remainhigh,andalltheserisksmakethefinancingoflong-termcoalinvestmentsbothharderandcostlier.Coalplants,newandold,arelosingthecostadvantagestheyoncehad,andtheylacktheoperationalflexibilitythatwillbeincreasinglyvaluableasthepowergridevolvestointegratemoresourcesofcleanbutvariablerenewablepower. Inadditiontotheseongoingstructuralchanges,whicharemakingcoalpowerincreasinglycostlyandlesscompetitive,coalpowerfacesthefinancialrisksposedbyitsmanyenvironmentalimpacts.Thecontinuingdamagesthatcoalpowerposestoourair,land,andwater—andourhealth—areamajorfinancialliabilitythatremainsunresolved.Coalplantsemitairpollutantsthatstillkillthousandsofpeopleyearly,costingsocietyover$100billionperyear,byoneestimate(CATF2010).Theseplantsarealsoaleadingsourceofmercury,whichthreatens

Executive Summary

viii U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S viii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S ix

arestillnocoal-firedpowerplantsusingCCSonacommercialscale.DesignestimatesindicatethatCCScouldincreasethecostofenergyfromanewpulverizedcoalplantby78percent,andcostswouldbeevengreaterifCCSwereaddedasaretrofit(ITFCCS2010).ItisalwayspossiblethatfutureadvancesinCCStechnologywilldrivesuchcostsdownsubstantially,buttheCCSprojectsunderdevelopmenttodayhavefacedseriouscostoverrunsanddelays.Moreover,thefallinnaturalgasprices,concernoverfuturecoalsuppliesandprices,andthefailureofthe111thCongresstopassclimatelegislation—whichwouldhaveputapriceoncarbonandestablishedmas-sivesubsidiesforCCS—mayfurtherdelayCCSdevelopment.

Many of the nation’s coal plants are old, inefficient, and ripe for retirement. Seventy-twopercentofpresentU.S.coalcapac-ityisalreadyolderthan30years—theoperatinglifetimeforwhichcoalplantsweretypicallydesigned—and34percentofthenation’scoalcapacityismorethan40yearsold(Bradleyetal.2010).Olderplantsbecomeincreasinglyinefficientandunreliable,andtheyfacehighmaintenanceandcapitalcostsiftheyaretocontinueoperatingeconomically.Andbecausetheywerebuiltbeforemodernpollutioncontrolswererequiredandoverthedecadesmanyhaveavoidedaddingthosecontrols,

A future price on carbon still threatens coal investments. The111thCongressfailedtopassacomprehensiveclimatebill,andthe112thCongressisevenmoredeeplydividedontheissue,therebyperpetuatinguncertaintyoverthetimingandnatureoffutureclimatepoliciesandtheirimpactsoncoalplants.However,thegrowingurgencyofglobalwarmingmeansthatCongresswillfacesustainedpressuretotackletheprob-lemagain,perhapsrepeatedlyovertheyears,untilthenationisoffthedangerouspathitiscurrentlytraveling(unlessotherfactors,suchasasteepdeclineincoalusedrivenbytheotherrisksdiscussedinthisreport,succeedinslashingourcarbonemissions).Becauseapriceoncarbonwouldhelptostimulateprivate-sectorinnovation,itremainsalikelyelementofsuchfutureclimatepolicies;andasthesourceofpowerthathasthehighestcarbonemissions,coalwouldtherebybedisadvantagedcomparedwithcleanertechnologies.

Carbon-capture retrofits cannot be counted on to cut emis-sions affordably. Whileprojectstodemonstratethepotentialofcarboncaptureandstorage(CCS)areimportant,itwouldbefinanciallyrecklesstomakecoal-plantinvestmentsbasedontheassumptionthatCCSretrofitswillprovideanaffordablewayforthoseplantstoavoidafuturepriceonCO2emissions.There

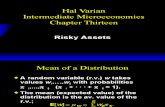

Figure ES.1. U.S. CO 2 EMISSIONS FROM ENERGY USE BY SOURCE, 2009

Coal Plants33.2%

Other Electricity Generation 5. 0%

Residential 6.2%

Commercial 3.9%

Industrial 15.4%

Surface Transportation 32.9%

Aviation 3.3%

More CO2 is emitted from coal plants than from any other technology or sector, including all modes of surface transportation combined (EIA 2011a). (Power plant emissions are presented under coal plants and other electricity generation, rather than under the residential, commercial, and industrial sectors where the power is consumed.)

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S viii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S ix

costs,butitisstartingtoreflecttheeconomicrealitiesthathavealreadyledtotherecentcancellationorrejectionofabout150coalplantproposalsnationwideandthatthreatentheremainingcoalplantproposalsaswell.

Demand for coal power will continue to fall as the nation turns to cleaner options. Coalprovidedalmost53percentofU.S.powerdemandin1997,butmarketsharedroppedtolessthan46per-centinthefirsthalfof2010.Giventhestronggrowthofcompet-ingcleanertechnologies,thisdecreaseislikelytocontinue.

• Energy efficiency hasenormouspotentialtocutpower demand—by23percentbelowprojectedlevelsby2020and byevenmoreifthetechnologyisassumedtoadvance (Goldstein2010;Granadeetal.2009).Thatpotentialis beginningtoberealized,as27statesatpresent—double thenumberin2006—haveadoptedorhavependingenergy efficiencyresourcestandardsthatovertimecangreatly reduceelectricdemand(ACEEE2010a).Statespendingon ratepayer-fundedelectricity-andgas-efficiencyprograms nearlydoubledbetween2007and2009,risingfrom $2.5billionto$4.3billion(ACEEE2010a).Andnewfederal appliancestandardsformorethan20consumerproducts willhelpreduceconsumerdemandforyearstocome.

• Renewable poweriscapturingagrowingshareofthe marketfromcoal,andithasthepotentialtogomuch further.Whilenon-hydrorenewablepowerprovided 3.6percentofU.S.generationin2009,theEIAprojects thatitwillincreaseto11.7percentby2030,primarily becauseofexistingstatepoliciesandfederalincentives(EIA 2010a).Federalresearchalsoconcludesthatwecouldmeet nearlyaquarterofourpowerneedswithrenewablepower by2025withnosignificantimpactonconsumerprices atthenationallevel(Sullivanetal.2009).Windalone couldmeet20percentofdemandby2030(EERE2008),

olderplantsaregenerallyfarmorepollutingthannewonesandfacesignificantretrofitcostsasaresult. Coalplantoperatorsinvariouspartsofthecountry—includingColorado,Delaware,Georgia,Illinois,Indiana,Minnesota,NorthCarolina,Ohio,andPennsylvania—havealreadyannouncedtheretirementofdozensoftheiroldestplants(Bradleyetal.2010).ByDecember2010,12gigawatts(GW)ofcoalplantretirementshadalreadybeenannounced(Salisburyetal.2010).Financialandindustryanalystsexpectthewaveofretirementstogrow.InthewordsofaCreditSuisseanalyst,“alargechunkoftheU.S.coalfleetisvulner-abletoclosuresimplyduetocrummyeconomics”(Eggersetal.2010).Inannouncingtheclosureofthreeofitsoldercoalunits,ExelonCorp.noted,“theseagingunitsarenolongerefficientenoughtocompetewithnewresources”(Power-GenWorldwide2009).

Excess generating capacity in the United States will facilitate coal retirements. Thenationcurrentlyhasamplegenerat-ingcapacity,whichcanhelpitaccommodatetheprojectedcoalplantretirementsandstillmaintainthereliabilityofthepowersystem(Bradleyetal.2010;ShavelandGibbs2010).Onerecentanalysisfoundthatthepowersector“isexpectedtohaveover100GWofsurplusgeneratingcapacityin2013”(Bradleyetal.2010).

New coal plants are not economic, even under current policies. Theeconomicoutlookfornewcoalplantsisverydifferentfromwhatitwasjustafewyearsago.1Whenmostnewplantprojectsinthepipelinetodaywereannounced,theU.S.EnergyInformationAdministration(EIA)computermodelpredictedalargeamountofnewcoalplantconstructionintheyearsahead(FigureES.2,p.x).ButnowthesamemodelnolongerprojectsanynewcoalplantswithoutCCScomingonlinethrough2030(apartfrom11.5GWofnewcoalplantsthattheEIAcountsasalreadyunderconstructionandassumeswillbecompleted).TheEIA’smodelinghashistoricallyunderestimatedcoalplant

1 While many of the new coal plants announced over the last few years were subsequently cancelled or blocked (largely as a result of the economic and policy trends discussed in this report), dozens of proposals are still on the table. The Sierra Club maintains a database of coal-fired power plant proposals around the country. As of January 2011, it lists 149 coal projects as recently cancelled or rejected, 50 plants as active or upcoming, 26 plants as progressing (some of which have been completed), and 18 plants with uncertain status (Sierra Club 2011).

Coal is no longer a reliably low-cost fuel, in

part because it is increasingly vulnerable to

volatile global markets.

x U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S x A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xi

gascombined-cycleplants,manybuiltinjustthelast decade.Theseplantsarestillgreatlyunderused,operating at42percentofcapacityin2007(Kaplan2010)andat only33percentin2008(Bradleyetal.2010).Moreover, gasprices—andpriceprojections—havefallensignificantly, partlyasaresultoftechnologicalbreakthroughsin drillingthathavethepotentialtodramaticallyincrease domesticgasproductionforyears(aslongastheindustry canresolvegrowingconcernsoverimpactsonwaterand newquestionsaboutmethaneleakageduringproduction). Rampinguptheuseofexistinggasplantscouldallowthe nationtosubstantiallycutitscoal-basedelectricity generation(Casten2010;Kaplan2010).Moreover,new

andindeedwindcapacityhasbeenaddedtothegridat aremarkablepaceoverthelastfewyears(FigureES.3). Bothphotovoltaic(PV)andconcentratingsolarpower (CSP)areseeingdramaticgrowthintheirmarketsharesas well,withmajornewprojectsmovingforwardandprices forsolarpanelsfallingmarkedly.Newrenewablecapacity willcontinuetoenterthesystem,evenwithoutfurther policychanges,asaresultoftherenewableenergy standardsalreadyadoptedby30statesandadvancesin renewabletechnology.

• Natural gasrepresentsanothermajorthreattocoalpower. Thenationhasmorethan220GWofefficientnatural

Figure ES.2. DECLINING FEDERAL PROJEC TIONS OF NEW COAL PLANTS THROUGH 2030

In its Annual Energy Outlooks (AEOs), the EIA’s projections of unplanned coal capacity coming into service by 2020, 2025, and 2030 have dropped dramatically. In 2006 the EIA projected 145 GW of new coal by 2030 (the equivalent of about 240 new plants of 600 megawatts). But the agency now projects only 2 GW by 2030, consisting entirely of advanced plants with CCS technology that are inputs to the model based on the assumed response to federal subsidies. Planned capacity additions—plants that the EIA understands to be under construction already—are not reflected (EIA 2006, 2007, 2008a, 2009a, 2010a, 2011a).

160

140

120

100

80

60

40

20

0

CU

MU

LA

TIV

E N

EW

CO

AL

CA

PA

CIT

Y (

GW

)

AEO 06 AEO 07 AEO 08 AEO 09 AEO 10 AEO 11(ER)

n 2020n 2025n 2030

E I A P R O J E C T I O N S B Y Y E A R

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S x A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xi

arecurrentlylessexposedtoglobalmarkets,butthepriceforaone-monthcontractforPowderRiverBasincoalstillrose67percentbetweenOctober2009andOctober2010(Jaffe2010).Moreover,PowderRiverBasincoalproducersareseek-ingtobuildtransportationinfrastructuretoexpandtheirreachtoAsianmarkets,potentiallysubjectingWesterncoaltopricespikessimilartothoseexperiencedintheeasternUnitedStates.Chineseofficialshaveannouncedplanstocaptheirowncoalproduction,puttingevengreaterupwardpressureonglobalandU.S.coalprices(Reuters2010a). Newquestionsarealsobeingraisedaboutjusthowmucheconomicallyrecoverablecoalexists,bothintheUnitedStatesandelsewhere.Officialreserveestimatesarebasedondecades-olddataandmethods.Moremodernassessmentsarefindinglesseconomicallyrecoverablecoalthanwascommonlythought,includinginWyoming’simportantGillettecoalfield(Luppensetal.2008).ThefactthatproductivityatU.S.mineshasbeendroppingforyears,notonlyinthemorematureanddepletedeasterncoalfieldsbutalsointhenewerminesofthe

gasplantscouldbebuiltatarelativelylowcostandexisting coalplantscouldberepoweredtoburnnaturalgas.While environmentalconcernsorotherfactorsmaydrivegas pricesbackup,would-becoalinvestorscannotignorethe competitivethreatfromgas.“Coalislosingitsadvantage incrementallytogas,”agasanalystwithBarclaysCapital recentlytoldtheNew York Times,andanenergyanalyst withCreditSuissesaidthattheshiftfromcoaltogas“has thepotentialtoreshapeenergyconsumptionintheUnited Statessignificantlyandpermanently”(Krauss2010).

U.S. coal prices are rising and could be driven much higher by soaring global demand and shrinking reserves. Coalisnolongerareliablylow-costfuel,inpartbecauseitisincreasinglyvulnerabletovolatileglobalmarkets.EasternU.S.coalspotpricesspikedin2008(FigureES.4,p.xii),mainlyinresponsetotherisingpriceofcoalininternationaltrade,andpricesareclimbingagainasrapidlyrisingcoaldemandinChinapushesglobalcoalpriceshigher.WesternU.S.coalproducers

Figure ES.3. WIND POWER GROWING AT RECORD PACE

U.S. wind power capacity expanded by over 50 percent in 2008 alone and continued to expand in 2009 despite the recession (Wiser and Bolinger 2010).

40

35

30

25

20

15

10

5

0

AN

NU

AL

CA

PA

CIT

Y (

GW

)

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

CU

MU

LA

TIV

E C

AP

AC

ITY

(G

W)

12

10

8

6

4

2

0

Annual U.S. CapacityCumulative U.S. Capacity

xii U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xiii

courtordersrequiringittoimplementexistingstatutorystan-dards).Plantsfacecostsassociatedwith:

• Preventing thousands of deaths from heart and lung disease. Coalpowerisamajorsourceofsulfurdioxide(SO2)and nitrogenoxide(NOX)emissions,whicharetransported downwindandcauseozoneandparticulatepollutionthat shortenthelivesofthousandsofAmericansyearly;these emissionshavebeenestimatedtoimposeannualcostson societyofmorethan$100billion(CATF2010).TheEPA’s proposedCleanAirTransportRulewouldpreventmanyof theseprematuredeaths,asoldanduncontrolledplants wouldfinallyberequiredtoinstallcontrolsonSO2andNOX.

• Protecting children’s brains from impairment.Coalpower isthesourceofatleasthalfofU.S.emissionsofmercury,a

west,pointstolikelyhighercoalproductioncostsahead—incontrasttothelowerproductioncostsexpectedfornaturalgas.Newstudiesthatprojectfuturecoalproduction,includ-ingsomethatmakeprojectionsbyfittingabellcurvetopastproductionlevels(ananalyticmethodthatremainscontrover-sial),predictthatwearemuchnearertopeakcoalproductionthantraditionalreserveestimatessuggest(HeinbergandFridley2010;PatzekandCroft2010;Rutledge2010;EWG2007).Coalpricesinsomemarketsmayalsoriseinresponsetoeffortstoreducethedamagecausedbymountaintop-removalmining.

Coal plants also face costs associated with reducing their non-climate environmental impacts. Becausecoalplants,especiallyolderones,causegraveharmtotheenvironmentandpublichealth,theU.S.EnvironmentalProtectionAgency(EPA)isdevelopingmoreprotectiveregulations(largelyinresponseto

Figure ES.4. AVERAGE WEEKLY COAL SPOT PRICES

Coal prices spiked dramatically in 2008, largely in response to the influence of global coal demand on U.S. coal markets, particularly in Appalachia (EIA 2010e). Prices in most basins are rising again with the economic recovery.

$160

$150

$140

$130

$120

$110

$100

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

DO

LL

AR

S P

ER

SH

OR

T T

ON

30 M

ar 0

7

10 Ju

n 07

21 A

ug 0

7

1 N

ov 0

7

12 Ja

n 08

24 M

ar 0

8

4 Ju

n 08

15 A

ug 0

8

6 Ja

n 09

19 M

ar 0

9

30 M

ay 0

9

10 A

ug 0

9

21 O

ct 0

9

1 Ja

n 10

14 M

ar 1

0

25 M

ay 1

0

5 Au

g 10

15 O

ct 1

0

27 D

ec 1

0

n Central Appalachian Northern Appalachian Illinois Basinn Powder River Basinn Uinta Basin

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xii A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S xiii

reboundedquickly,andexpertsprojectthattheywillremainhighbyhistoricalstandards(IMF2010).

Coal project financing may be harder to obtain and may cost more. Thetrendsdiscussedaboveincreasetheriskthatcoalinvestmentprojectswillfailtoobtainthefinancingtheyneedorthattheywillhavetopaymoreforitthanplanned.Thefinancialcommunityisbecomingincreasinglywaryoftherisksassociatedwithnewinvestmentsincoal.Aseriesofutilitiesandotherpowerproducershaveseentheircreditratingsandoutlooksdowngraded,inpartbecauseoftheratingsagencies’concernsaboutcoalconstructionorretrofitcosts.

New coal plants cost more than cleaner options. Thetradi-tionalcostadvantagethatcoalpowerenjoyedovercleanerenergyhaslargelydisappearedwithrespecttonewplants.FigureES.5(p.xiv)comparesthelevelizedcostsofelectric-ity2fromnewcoalplantstothoseofothernewsourcesofpower,bothwithandwithoutincentivesandusingarangeofassumptionsdescribedinPart8(andinAppendixA,whichisavailableonline).Powerfromnewcoalplantsclearlycostsmorethanpowerfromnewgasplants,windfacilities,andthebestgeothermalsites,andmuchmorethaninvestinginenergyefficiency.Wheneithercarbonpricesorincentivesarefactoredin,powerfromnewcoalplants(withorwith-outCCS)becomesevenlesscompetitive,costingmorethanpowerfrombiomassfacilitiesorfromthebestsolarthermalandsolarphotovoltaicsites.Thesecomparisonsreflectarangeofcoalprices(butdonotfullyrepresenttheriskthatcoalpricescouldrisesteeplyduetovolatileglobalmarketsandothercauses)andtheyincorporateconservativeassumptionsaboutfallingpricesofrenewabletechnology. Inadditiontolosingtheircostadvantage,coalplants’rela-tivelackofoperationalflexibilitymakesthempoorlysuitedforthegridoftomorrow,whichwillsurelyincludegreaterquanti-tiesofvariablesources—windandsolarpower,forexample—andplaceapremiumonotherpowersources,suchasnaturalgas,thatcanrampupordownquicklyasneeded.

potentneurotoxinthatthreatensfetalandinfantbrain development.TheEPA’sforthcomingAirToxicsRule, limitingmercuryandothertoxicemissions,wouldrequire uncontrolledplantstoinstallcontrolsonthesepollutants.

• Keeping toxic coal ash from contaminating the water. Coal ashcontainsmanytoxiccomponentsandiscurrentlystored inwaysthatcanresultbothincatastrophicreleases(such astheKingston,TN,ashspillof2008)andinslowleakage intogroundandsurfacewaters.ProposedEPAruleswould requiresaferashhandlingandpotentiallyobligemany plantstoconvertfrom“wet”handlinginsurfaceimpound- mentsto“dry”handlinginlinedlandfills;plantscouldalso berequiredtoaddnewwatertreatmentsystemsinorderto keeptoxinsoutofourwatersuppliesandecosystems.

• Reducing fish kills and protecting water bodies. Coalplants usevastquantitiesofwaterfromadjacentrivers,lakes,and bays,takingaheavytollonaquaticlifeasaresult.TheEPA isconsideringnewrulesthatwouldrequiremorecoal(and otherthermalpower)plantstoinstallcoolingtowersthat wouldgreatlyreducetheamountofwatertheywithdraw andthethermalpollutiontheydischarge.

Retrofittingcoalplantswithpollutioncontrolsandothertechnologiescouldgreatlyreducetheseenvironmentalandhealthdamages,andtheretrofitswouldcostmuchlessthanwhatthedamagescurrentlycostsociety.However,theretrofitcostswouldbesubstantialformanyplants,particularlytheoldestanddirtiest.Thelimitedremainingusefullifeofmanyoldercoalplantswouldmakesuchinvestmentsdifficult,ifnotimpossible,torecover,makingretirementthebetterfinancialoption.

Major coal projects face high and unpredictable construc-tion costs. Coalplantconstructioncostsroseatarapidrateintheyearsleadingupto2008,contributingtothecancellationofmanyproposedfacilities.Despitethesubsequentrecession,constructioncostshaveremainedhigh(IHSCERA2010),andsomecoalplantprojectswerestillannouncingsubstantialcostincreasesin2010.Muchoftheconstruction-costincreasewasdrivenbyrisingglobalcommoditycosts.Whilethesecommod-itypriceswentbackdownwiththeglobaleconomiccrisis,they

2 Levelized cost of electricity (LCOE) is an economic assessment of the cost of energy generation of a particular system. LCOE includes all of the costs over the system’s lifetime, such as capital expenditures, operations and maintenance, fuel cost, and cost of capital, discounted to a net present value. The LCOE is the price at which energy must be sold for the project to break even.

xiv U N I O N O F CO N C E R N E D S C I E N T I S T S

A costly history threatens to repeat itself. Whenconsideringlong-terminvestmentsincoaltoday,itishelpfultorememberanearliereraofpower-sectorinvestmentsthatdidnotendwell.Inthe1970s,utilitiesinvestedmassivelyinbothcoalandnuclearplantswhileignoringthesweepingchangesthatwereincreasingthecostsof,anddecreasingthedemandfor,suchplants.Theresultwasstaggeringfinanciallossesaroundthecountryasscoresofplantswerecancelledafteryearsofspend-ing.Wecanavoidrepeatingthatcostlyhistorybyrecognizingthatchangesunderwaytodayaremakinglong-terminvest-mentsincoalpoweranunacceptablyriskyproposition.

We can dramatically reduce our dependence on coal power.Long-terminvestmentsincoalwouldbelessriskyifthenationhadnochoicebuttocontinuewithitscurrentlevelofcoaluse,nomatterhowhighthecosts.Butthatisnotthecase.StudiesbytheUnionofConcernedScientistsandothersshowthatwecouldinfactreplacemostofourcoalpowerusingrenewableenergy,demandreduction,andnaturalgaswithinthenext15to20years,withadditionalreductionsincoalpowerafter-ward(Keithetal.2010;Specker2010;Cleetus,Clemmer,andFriedman2009).Andtheoverallbenefitsoftransitioningtoacleanerenergysystem—savinglives,protectingairandwater,andhelpingusavoidsevereclimatechangeswhilestimulatingtechnologicalinnovationandbuildingnewclean-energyindus-tries—wouldbetremendous.

Figure ES.5. LEVELIZED COST OF ELEC TRICIT Y FOR VARIOUS TECHNOLOGIES

All projections assume newly built installations coming online in 2015 and represent levelized costs over a 20-year period. A range of capital costs is assumed for all technologies; a range of fuel costs is assumed for coal, natural gas, and biomass; and a range of capacity factors is assumed for wind, solar, natural gas, and nuclear power. A range of CO2 prices is taken from Synapse projections (discussed in Part 4). Current tax incentives for wind and biomass are assumed to be extended to 2015.

n Total Costs with Incentivesn Total Costs without Incentivesn Low CO2 Costsn Mid CO2 Costsn High CO2 Costs

Coal IGCC-CCS

Nuclear

Coal IGCC

Pulverized Coal

Solar Thermal

Large Solar PV

Biomass

Geothermal

Wind (Onshore)

Natural Gas CC

Efficiency

0 50 100 150 200 250 300 350

$ / M W h

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 1

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 1

P A R T O N E

BackgroundThe Changing Outlook for Coal

Scientificconcernoverglobalwarmingcontinuestogrow,andtheneedforsteepreductionsincarbonemissionsisnowwidelyrecognizedwithinthesciencecommunity.Whilethe111thCongressfailedtopassalawlimiting

heat-trappingemissions,thefactthattheclimatethreatisbothgraveandgrowingmeansthatCongresswillbeundersustainedpressuretotackletheproblemagain,perhapsseveraltimes,dur-ingtheoperatinglifetimeofalong-terminvestmentincoal.Coalplants,asthenation’slargestsourceofglobalwarmingemissions,wouldsurelybetargetedbyanyfutureclimatelaws. Meanwhile,evenwithoutapriceoncarbon,theeconomicoutlookfornewcoalplantshasalreadychangeddramaticallyunderU.S.EnergyInformationAdministrationprojections.Asforexistingcoalplants,manyareseveraldecadesold,highlypolluting,andfacingtheprospectoffinallyhavingtoinstalltechnologiestoreducethesubstantialdamagetheydototheair,water,land,andpublichealth.Industryanalystsarethereforeprojectingawaveofcoalplantretirementsahead—indeed,suchawavehasalreadybegun—madepossiblebythefactthatthenation’selectricgridhassubstantialsurplusgeneratingcapacity.

“The Need for Urgent Action to Address Climate Change Is Now Indisputable”Nooneplanningalong-terminvestmentincoalcanaffordtobeunawareofthescientificevidencethatshowshowurgentlyanddeeplyweneedtoreduceourcarbonemissions.Basedonitsmostcomprehensivesurveyofclimateresearchtodate,theNationalAcademyofSciences(NAS)releasedinMay2010aseriesofcongressionallyrequestedreportsthatconcludedyetagainthattheearthiswarming,thatemissionsfromtheburn-

ingoffossilfuelsarelargelytoblame,thatthiswarmingposesawiderangeofseriousriskstosocietyandnaturalsystems,andthat“thereisanurgentneedforU.S.actiontoreduce[greenhousegas]emissions”(NRC2010aand2010b).3ThisconclusionreaffirmedtheNationalAcademy’s2009jointstatement,withitscounterpartscientificacademiesof12othernations,bluntlystating,“theneedforurgentactiontoaddressclimatechangeisnowindisputable”(NAS2009).Inthisspirit,theNAShasspecificallyrecommendedthattheUnitedStates“acceleratetheretirement,retrofitting,orreplacementof[greenhousegas]emission-intensiveinfrastruc-ture”(NRC2010b). Ourclimateisalreadychangingindangerousways,withmorefrequentandseveredroughts,heatwaves,anddown-pours,amongothermanifestations.Andclimatechangeposesbothdirectandindirectthreatstopublichealth,suchasthroughheat-andweather-relatedstresses,respiratoryill-nesses,insect-bornediseases,andcontaminationoffoodandwater(APHA2010;NIH2010;EPA2009e).Inrecognitionofthesethreats,thenation’sleadingpublichealthgroupshaverecentlyaddedtheirvoicestothecallforlawsthatwouldlimit

3 In 2009, allegations of scientific misconduct were made against certain U.S. and U.K. climate scientists, based on stolen and misinterpreted email correspondence. These allegations, which were given broad media coverage, created confusion in some nonscientific circles about the certainty of the science behind researchers’ global warming conclusions. Subsequent investigations that exonerated these scientists of misconduct, and reaffirmed the strength of the underlying climate science, received far less coverage (Oxburgh et al. 2010; Penn State 2010; Russell et al. 2010). In actuality, the fundamental science underlying climate concerns, based on multiple independent lines of evidence and the work of thousands of scientists, is robust and was never in doubt.

2 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 2 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 3

heat-trappingemissions(APHA2010).Manyofthechangestotheworldaroundusareunfoldingfasterthanscientistsprojectedjustafewyearsago(NAS2009;Rosenzweigetal.2008;Rahmstorfetal.2007;Stroeveetal.2007).Inaddi-tion,thedatashowthatmuchworseliesaheadifwedonotchangecourse(Meinshausenetal.2009;Solomonetal.2009).Indeed,wemaybeveryclosealreadytotriggeringnaturalamplificationmechanismsthatcouldcauseirreversiblechangeswithcatastrophicconsequences(NRC2010a).

Deep Emissions Cuts Are Required from the Coal SectorMostclimateexpertsagreethatinordertohaveareasonablechanceofavoidingthemostsevereimpactsofglobalwarm-ing,wemustpreventaverageglobaltemperaturesfromrisingmorethantwodegreesCelsius4abovepreindustriallevels(UCS2008;ClimateChangeResearchCentre2007).TheCopenha-genAccord,negotiatedatameetingofworldleadersinDecem-ber2009,formallyembodiesthisgoal(UNFCCC2009).However,thereisnoguaranteethatatwo-degreewarmingwouldbesafe,andsomeprominentscientistsnowthinkthatallowingeventhatmuchwarmingwouldbea“recipeforglobaldisaster”(Hansen2008).TheCopenhagenAccordexplicitlycallsforreassessmentofthetwo-degreetargetandconsiderationofa1.5-degreetargetby2015(UNFCCC2009). Eventhetwo-degreelimitwouldrequireambitiousreductionsinheat-trappingemissionsby2020andbeyond.Theabove-mentionedNationalAcademyofSciencesjointstatementnotesthat,“limitingglobalwarmingto2degreesCwouldrequireaveryrapidworldwideimplementationofallcurrentlyavailablelow-carbontechnologies”(NAS2009).Tohaveareasonablechanceofachievingthatlimit,industrializednationstakencollectivelywouldhavetoreduceemissionsto25to40percentbelow1990levels(or35to48percentbelow2005levels)inthenext10years(IPCC2007).TheUnionofConcernedScientistsrecommendsthattheUnitedStatesreduceemissionsbyat least35percentbelow2005levelsby2020,basedontheworkoftheIntergovernmentalPanelonClimateChange(IPCC)andotherstudies(Baeretal.2008;denElzenetal.2008).UndertheCopenhagenAccordtheObamaadministrationsetalesserbutstillambitioustargetofreducingU.S.emissions“intherangeof17percent”by2020(pendinglegislativeaction)(Stern2010).

Evendeeperemissionscutsbeyond35percentareneededintheyearsfollowing2020—intherangeofatleast80percentby2050(NRC2010b;Luersetal.2007).TheUnitedStatesandotherdevelopedeconomiesagreedforthefirsttime,atthe2009G8Summit,thatdevelopedcountriesshouldcuttheirheat-trappingemissionsby80percentormorefrom1990levelsby2050(G82009). Theselonger-termreductionsarepossiblebutrequireanimmediateandsustainednationalcampaigntomoveawayfromhigh-carbon-emittingenergy.BecausecoalplantsaloneaccountformorethanathirdofallU.S.CO2emissionsfromenergyuse—theyemitmorethanallofthenation’scars,trucks,andtrainscombined(Figure1)—wecannotachievethereductionsweneedwithoutslashingcarbonemissionsfromcoalpowerintheyearsahead.Evenifthecoalpowersectoronlymadeitspro-portionalshareofreductions,itwouldfacereductionsofatleast17percentinthenextdecadeandmorethan80percentoverfourdecades.Butasmanystudieshaveshown(someofwhicharediscussedinParts4and8),ifsocietyfollowsanythingresem-blingaleast-costpath,adisproportionateshareoftheemissionsreductionswillbeachievedbyshiftingawayfromcoalpower. Thesescientificrealities,whicharedrivingpolicyresponseselsewhereintheworld,willkeepfuelingdemandsforstrongerpoliciesintheUnitedStatesaswell—includingalawthatputsapriceoncarbon,whichwouldhavefinancialimplicationsforcoalthatwediscussinPart4.Butevenwithoutsuchapriceinplace,theeconomicprospectsbothofoldcoalplantsandproposednewplantshavealreadychangedprofoundly.

Federal Projections of New Coal Plants PlummetOneofthemostcommonlycitedsourcesofinformationaboutthenation’senergysectoristheEnergyInformation

4 This is equivalent to about 3.6 degrees Fahrenheit. We have already warmed by 1.7 degrees Fahrenheit above preindustrial levels (Arndt, Baringer, and Johnson 2009).

Apart from plants already under construction,

the EIA’s model no longer projects the

construction of any new coal plants through

2030 without carbon capture and storage (CCS).

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 2 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 3

Administration(EIA)—anindependentagency,withintheU.S.DepartmentofEnergy,thatisthesourceofofficialfederalenergystatisticsandanalyses.TheEIApublishesanAnnualEnergyOutlook(AEO)thatmakeslong-termforecasts,basedonhighlydetailedcomputer-basedeconometricmodeling,aboutU.S.energymarkets.Asamatterofmethodology,theAEOreference-caseforecastassumesimplementationofexist-inglawsandregulationsonly.Theseannualforecaststhereforedonotfactorinafuturepriceoncarbon(discussedinPart4),nordotheyreflectmanyofthepollutioncontrolupgradesthatexistingplantsface(discussedinPart5). Justafewyearsago,whenmanyplantsinthepipelinetodaywerefirstannounced,theEIAforesawarobustfuturefornewcoalplants.IntheAEO2006,theEIA’smodelpro-jectedtheconstructionof145gigawatts(GW)of“unplanned”newcoalcapacityby2030,ortheequivalentofabout240newcoalplantsof600MWinsize(inadditiontothe9.3GWof“planned”capacity,whichtheEIAputintothemodeltoreflectnewcoalprojectsthatitunderstoodtobeunderconstructionandthatitassumedwouldbecompleted)(EIA2006).Whilecritics,includingtheUnionofConcernedScientists,pointedoutthattheseforecastswerebasedoninap-propriatelylowcoal-plantconstruction-costassumptions,and

thattheydidnotreflectcarbonregulatoryrisk,backersofnewcoalplantspointedtothesefederalprojectionsasevidenceoftheeconomicwisdomofbuildingmorecoalcapacity. ButintheEIA’sAEO2011(EarlyRelease),thosehundredsofprojectedcoalplantshavevanished,areflectionoftheprofoundeconomicchangesthathaveoccurredsince2006.Apartfrom11.5GWofplantsalreadyunderconstruction,theEIA’smodelnolongerprojectstheconstructionofany newcoalplantsthrough2030withoutcarboncaptureandstorage(CCS)(EIA2011a)(seeFigure2,p.4).Only2GWofcoalpowerwithCCSareprojectedby2030,whichreflectnewplantsthattheEIAassumedwouldbestimulatedbyexistinggovernmentsubsidies(EIA2011a).

Widespread Retirements Expected among Existing PlantsAlargepercentageofU.S.coalplantcapacityhasreachedorexceededitsoriginallyassumedusefullifetime.Seventy-twopercentofU.S.coalplants(bycapacity)areolderthan30years,34percentareolderthan40years,and14percentareolderthan50years(Bradleyetal.2010).Only1percentare10yearsoldorless,andonlyafewnewplantsarenowinthepipeline.AsFigure3(p.5)shows,however,thenationdoeshavesubstantialnewlybuilt

Figure 1. U.S. CO 2 EMISSIONS FROM ENERGY USE BY SOURCE, 2009

More CO2 is emitted from coal plants than from any other technology or sector, including all modes of surface transportation combined. (Power plant emissions are presented under coal plants and other electricity generation, rather than under the residential, commercial, and industrial sectors where the power is consumed.)

Coal Plants33.2%

Other Electricity Generation 5. 0%

Residential 6.2%

Commercial 3.9%

Industrial 15.4%

Surface Transportation 32.9%

Aviation 3.3%

Source: EIA 2011a

4 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 4 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 5

energycapacityintheformofnaturalgasplants(whichhavebeengreatlyunderutilizedinrecentyears,asdiscussedinPart2)and,increasingly,windpowerandotherrenewablesources. Theadvancedageofsomanycoalplantspresentstwoprob-lems.First,theyrequireadditionalinvestmentsjusttokeeprun-ning.After30yearsofoperation,theavailabilityofacoal-firedboilerdeclinessharplyandtheplantfaceshigherratesofforcedoutages;largecapital-improvementprojects,whichoverhaulorreplacekeyplantcomponents,aretypicallyneededtoextendtheplant’soperatinglife.5Suchprojectsarenotonlycostlybutcanalsorequireextendedplantshutdowns(Slat2010). Second,manyolderplantslackmodernpollutioncontroltechnologies,sotheytypicallyposemuchgreaterthreatstoair,

water,land,andpublichealth(andsomewhatgreaterclimateimpacts,giventheirlesserfuelefficiency)thandonewplants.Thesehighlypollutingplantsfacetheprospectofnewandmoreprotectiveregulatorystandards(discussedinPart5),whichwouldforcetheirownerstodecidewhethertoretirethemorfinallyinvestinpollutionreductiontechnologies.Severalclosuresofoldcoalplantsaroundthecountryhave

Figure 2. DECLINING FEDERAL PROJEC TIONS OF NEW COAL PLANTS THROUGH 2030

In its Annual Energy Outlooks (AEOs), the EIA’s projections of unplanned coal capacity coming into service by 2020, 2025, and 2030 have dropped dramatically. In 2006 the EIA projected 145 GW of new coal by 2030 (the equivalent of about 240 new plants of 600 megawatts). But the agency now projects only 2 GW by 2030, consisting entirely of advanced plants with CCS technology that are inputs to the model based on the assumed response to federal subsidies. Planned capacity additions—plants that the EIA understands to be under construction already—are not reflected.

5 Much of the litigation under the Clean Air Act’s New Source Review program has involved coal plant operators that failed to obtain preconstruction permits before replacing major plant components. Among the plant components that required upgrading have been economizers, reheaters, primary and secondary superheaters, waterwalls, cold end air heaters, and boiler floors. See U.S. v. Ohio Edison Co., 276 F. Supp. 2d. 829 (S.D. OH 2003).

160

140

120

100

80

60

40

20

0

CU

MU

LA

TIV

E N

EW

CO

AL

CA

PA

CIT

Y (

GW

)

AEO 06 AEO 07 AEO 08 AEO 09 AEO 10 AEO 11(ER)

n 2020n 2025n 2030

E I A P R O J E C T I O N S B Y Y E A R

Sources: EIA 2006, 2007, 2008a, 2009a, 2010a, 2011a

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 4 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 5

alreadybeenannouncedbyProgressEnergy,Xcel,Duke,TVA,andExelon,amongothers(Bradleyetal.2010).Xcel’sanalysisoftwoagingcoalunitsinMinnesotashowedthatmakingtheneededlife-extensionandpollutioncontrolinvestmentswouldcostmorethanrepoweringthemwithnaturalgasundereachofthe10scenariosexamined,includingahighgaspricescenario(XcelEnergy2010). Thescaleandimplicationsoftheforthcomingwaveofcoalplantretirementsarethesubjectofintensespeculation,witharesultingflurryofnewscenariosandestimates—someofwhicharelistedinTable1(p.6)—fromconsultingfirms,investmenthouses,andothers.TheseestimatesallreflecttheimpactoftheU.S.EnvironmentalProtectionAgency’s(EPA’s)forthcomingairregulationsonthenation’sagingcoalfleet,andsomealsoincludeexpectedashandcooling-waterregula-tions(allofwhichisfurtherdiscussedinPart5).Thecurrentandprojectedlownaturalgasprices(discussedinPart2)arealsoamajorfactorintheseobservers’analyses. Thegigawattsofcoalplantcapacityexpectedtoberetiredinthenextfewyearsvariessubstantiallyfromoneanalysisto

another,withnotablecongregationintheneighborhoodof40to60GW.(Bywayofcomparison,thesizeoftheexistingfleetofcoalplantsisabout313GWofnetsummercapacityand337GWofnameplatecapacity(EIA2010d).6)However,someoftheanalysesconcludethatamuchlargershareofthefleetpotentiallyfacesretirement.TheDeutscheBankanalysis,forexample,projectsthat60GWofcoalplantswillretireby2020,butitalsonotesthatanadditional92GWofcoalplantsare“ripeforretirement”(Mellquistetal.2010). Thedecliningeconomiccompetitivenessoftheagingcoalfleetisanimportantfactorinmostoftheanalyses.Accord-ingtoinvestmentbankCreditSuisse,“alargechunkoftheU.S.coalfleetisvulnerabletoclosuresimplyduetocrummyeconomics,whereweseecoalpricingatapremiumtonatural

Figure 3. U.S. ELEC TRIC GENERATING CAPACIT Y BY IN-SERVICE YEAR

Most of the nation’s coal plants are decades old, with many at or well beyond their expected operating lifetimes. However, the United States has added a large amount of new natural gas generating capacity in the last decade (much of which is currently underused), and the country has growing renewable power capacity as well.

1940

1950

1960

1970

1980

1990

2000

2008

NA

ME

PL

AT

E C

AP

AC

ITY

(M

W) 80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

n Other Renewablesn Hydron Nuclearn Other Gasesn Oiln Natural Gasn Coal

6 Nameplate capacity is the maximum output of a generator under specific conditions designated by the manufacturer (and is usually indicated by an actual nameplate attached to the generator). Net summer capacity is the expected maximum output of the coal fleet during summer peak demand after subtracting electricity use for station service or auxiliaries.

Sources: Ceres et al. 2010; EIA 2008d

6 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 6 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 7

gas…whenadjustingonanelectricityequivalentbasis.…Awfulenergymarginssuggesttousthatownersshouldbereevaluatingtheircoalfleetsduetopureenergyeconomicsbeforeeventakingontheburdenofa[capitalexpenditure]forenvironmentalcontrolequipment”(Eggersetal.2010).Coalplantretirementsareprojectedtohaveapositiveeconomiceffectonmanypowerproducers.TheCreditSuisseanalysis,entitled“GrowthfromSubtraction,”predictsthatamongtheseproducersthenewEPAregulationswillproduce“mostlywinnersandbiggerwinners”andhavetheeffectof“cullingtheherdofbadplants”(Eggersetal.2010).

Excess Generating Capacity Facilitates Coal Plant RetirementsFortunately,withprojectionsofextrageneratingcapacityonthegridforyearstocome,theUnitedStatesisnowinarela-tivelygoodpositiontohandleawaveofcoalplantretirements. Eachregionofthecountrymustmaintainenoughelectricgeneratingcapacitytomeetexpecteddemand,plusanaddi-tional“reservemargin”todealwithplantoutages,transmis-

sionfailures,unexpecteddemand,andotherfactors.Inmostregions,theminimumtargetreservemarginis15percentorless,butinrecentyearsactualreservemarginsaroundthecountryhavebeenwellabovethatthreshold,andin2013reservemarginsareexpectedtorangefrom22to46percent,dependingontheregion.AccordingtoarecentanalysisbyM.J.BradleyandAssociates,inaggregate“theelectricsectorisexpectedtohaveover100GWofsurplusgeneratingcapacityin2013”(Bradleyetal.2010). TheNorthAmericanElectricReliabilityCorporation(NERC)issuedanassessmentinlate2010oftheimpactoffourdifferentforthcomingEPAregulationsonreliability;itfoundpotentialforanimpact,dependingon“whethersuf-ficientreplacementcapacitycanbeaddedinatimelymanner”

Table 1. COAL PLANT RE TIREMENT PROJEC TIONS

A recent series of reports and presentations has attempted to predict the scale of coal plant retirements over the next few years. The reports vary in the factors they considered and the type of analysis, but all agreed that the aging U.S. coal fleet faces significant retirements ahead.

S O U R C E O F A N A L Y S I S

Black and Veatch (Griffith 2010)

Brattle Group (Celebi et al. 2010)

Charles River Associates (Shavel and Gibbs 2010)

Credit Suisse (Eggers et al. 2010)

Deutsche Bank Climate Change Advisors(Mellquist et al. 2010)

FBR Capital Markets (Salisbury et al. 2010)

ICF International (Fine Maron 2011)

Wood Mackenzie (Snyder 2010)

P R O J E C T I O N S

54 GW (in response to “pending” environmental regulations)

50–66 GW “vulnerable to retirement” by 2020

39 GW retired by 2015

60 GW assumed retired in base case by 2017 35 GW and 103 GW retirements considered on other scenarios

60 GW “expected” to retire by 2020 92 additional GW “inefficient and ripe for retirement”

45 GW retired in base case by 2018(30–70 GW range)

20% decline in coal fleet by 202012% decline in coal generation by 2020

“Nearly 50” GW by 2020

A large chunk of the U.S. coal fleet is vulnerable

to closure simply due to crummy economics.

— C R E D I T S U I S S E

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 6 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 7

BankshowsapathwaythatwouldreducepowersectorCO2

emissionsby44percentby2030. Inthelongerterm,theUnitedStatescanretireafarlargershareofitscoalfleetthanthoseprojectedintheseanalyses;indeed,doingsowouldbeacentralfeatureofmakingthedeepcutsinglobalwarmingemissionsthatweneed.Forexample,inamultiyearmodelinganalysisreleasedin2009,theUnionofConcernedScientistsshowedhowwecouldreducecoaluseby84percentby2030,replacingitmainlywithefficiencysav-ingsandmorerenewablepowerwhilesavingenergyconsumersmoney(Cleetus,Clemmer,andFriedman2009).WediscussthisstudyfurtherinPart8,alongwithotherresearchshowingthattheUnitedStatescouldretireitsoldcoalplantsatarapidpaceandstillmeetitsenergyneeds(Keithetal.2010;Specker2010).

Growing Opposition to CoalAmongtheveryrealbuthard-to-quantifyrisksfacedbythoseinvestingincoalisthelikelihoodthatpublicoppositiontocoalwillkeepbuilding,particularlyastemperaturesclimbintheyearsahead.Manynewcoalplantproposalshavealreadybeenstoppedbypublicopposition,drivenatleastinpartbyclimateconcerns.Andbecauseslashingthecarbonemissionsofexistingplantsiscriticaltoclimateprotection,activists—alreadymobilizedtoopposenewplants—canbeexpectedtoincreasinglyturntheirattentiontoclosingexistingplants.Thefailuretopassacomprehensiveclimatebillduringthe111thCongressmayjustsharpenclimateactivists’focusoncoalplants,giventhattheyarethebiggestcarbonpollutersandthemostobvioustargets. Butrisingoppositiontocoaluseisbasednotjustonclimateconcerns.Mountaintop-removalminingincreasinglydrawsprotestsandactsofcivildisobedience,includingattheWhiteHouseinSeptember2010,when1,000protestorsdem-onstratedand100werearrested(Reis2010).Andthethreatsposedbycoalash,madeevidentbythe2008ashspillinKingston,TN,havealsopromptedprotestsandheavycitizenturnoutatEPAhearingsaroundthecountrytocallforstricterashregulation. Inshort,thoseplanningtomakelong-terminvestmentsincoalpowershouldexpectgreaterscrutiny,morecontroversy,andstrongerlegalandpoliticaloppositionintheyearsahead.Thisoppositionposestheriskthatprojectsmaybedelayedorstoppedaltogether.

(NERC2010).TheNERCanalysisassumed33to70GWofplantretirements,butthesefiguresincluded30GWofsmall,oldoilandgasunitsretiredinresponsetotheEPA’sas-yet-unproposedcooling-waterrule.However,asthesubsequentCharlesRiverAssociates(CRAInternational)analysispointedout,thenumberofprojectedcoalplantretirementsnationwideissmallcomparedwiththerateatwhichtheUnitedStateshasaddedgeneratingcapacityinthepast.CRAInternationalalsofoundthatafterthe39GWofcoalretirementsitprojected,alloftheregionaltransmissionorganizationswouldstillhavesufficientresourcestomeetreservemarginrequirementsevenifnewadditionsintheplanningandsitepreparationstageswerenotincludedintheanalysis(ShavelandGibbs2010). Theseamplereservemarginsresultinnosmallpartfromthemanynewnaturalgasplantsthatcameonlineinthelastdecade(Figure3)butthathavebeenoperatingatjustafractionoftheircapacity.Theseplantscouldreplacethepowerlostfromsubstan-tialnumbersofretiringcoalplants,andlowerprojectednaturalgaspricesmakethisprospectevenmorelikely(seePart2).Inaddition,demanddroppedsubstantiallywiththerecession,withpowersalesin2009about5percentbelowtheir2007levels(EIA2010h).Whilethedemandforpowerbegantoreboundin2010,surplusgenerationcapacityisstilllikelytopersistforlongerthanwasexpectedbeforetherecession.AccordingtotheDeutscheBank’sanalysis,“thereisamplecapacity,strandedfromthe1998–2003‘dashtogas’overbuild[,]andtherecessionhasincreasedreservemargins,reducingpressureonaddingnewplantsinmanyregions”(Mellquistetal.2010).Theseanalystsassumethatatleasttwo-thirdsofthecoal-to-gasswitchtheyprojectcouldoccurbyincreasingtheuseofexistinggasplants;combinedwithgrowingrelianceonrenewablepower,Deutsche

©Ze

n Su

ther

land

Pho

togr

aphy

8 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 8 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 9

P A R T T W O

Eroding Markets for Coal Power The Impacts of Energy Efficiency, Renewable Power, and Natural Gas

Proposedandexistingcoalplantsarealsothreatenedbyincreasingcompetitionfromenergyefficiency,renew-ableenergy,andnaturalgas,whicharecuttingintothelong-termdemandforcoalpower.Coal’sshare

oftheU.S.electricitymarkethasalreadydroppedsignificantlysince1997,whenitaccountedfor53percentofthepowermix.Inthefirsthalfof2010,coalprovidedonly46percentofU.S.generation(and45percentin2009)(EIA2010c;EIA2010d).Giventhepolicysupportforcleanercompetingtechnologies,theirgrowth,andtheircostandperformanceimprovements,coal’smarketsharewilllikelycontinuetodecline.

Energy Efficiency Energyefficiencyhasenormouspotentialtoreduceelectric-itydemand.ArecentanalysisbytheMcKinseyCorp.foundthattheUnitedStatescouldreduceannualnon-transportationenergyconsumptionby23percentbelowprojectedlevelsby2020,usingonlymeasuresthatpaidforthemselvesandwithoutassumingapriceoncarbon(Granadeetal.2009).ANationalAcademyofSciencesstudyconcludedthatdeployingcur-rentlyavailabletechnologycouldreduceprojectedelectricityconsumptionfromcommercialandresidentialbuildingsby26percentby2020,andatcostswellbelowretailelectricityprices(NRC2009).Otherstudieshavemadesimilarfindings(Cooper2010;Cleetus,Clemmer,andFriedman,2009;Jamesetal.2009;Ehrhardt-MartinezandLaitner2008;Creytsetal.2007).Withmoreoptimisticassumptionsabouttechnologyimprovements,onerecentstudyconcludedthattheUnitedStatescouldcutenergyuseinallofitsformsby30percentby2020and88percentby2050(Goldstein2010).

TheUnitedStateshasnotyettakenadvantageofsuchpotentialsavingsfromefficiencybecausemarketbarriershavepreventedtheassociatedinvestmentsfrombeingmade.Butthesebarrierscanbeovercomebythekindsofpolicychangesincreasinglybeingadoptedbystateandfederalgovernments.7Theproliferationofnewstateenergyefficiencypoliciesoverthepastseveralyears“suggeststhatthenextdecademayseeadramaticandsustainedincreaseinoverallfundinglevels,andafundamentalredrawingoftheenergyefficiencymap,”concludeda2009LawrenceBerkeleyNationalLaboratoryreviewofstatepolicies(Barbose,Goldman,andSchlegel2009).Theseanalystsfoundupcomingincreasesinefficiencyinvestmentsnotonlyamongstatesthathavesupporteditforyearsbutalsoamongpopulousstates—includingIllinois,Maryland,Michigan,NorthCarolina,Ohio,andPennsylvania—thatuntilrecentlyinvestedlittlebuthavenowenactedaggressivenewpolicies. OneofthemoreeffectiveandpopularpolicymechanismsfordeployingenergyefficienttechnologiesistheEnergyEffi-ciencyResourceStandard(EERS),whichrequiresutilitiestoimplementprogramstoreduceenergydemandbyaspecifiedpercentageovertime.Currently,27stateshaveenactedanEERSorhaveonepending,abouttwiceasmanyasjustfouryearsago;severalstates,includingArizona,Illinois,Indiana,Massachusetts,Ohio,andVermont,requireannualsavingsthatrampupto2percentorhigher(ACEEE2010a).Overall

7 For a broader discussion of the barriers to energy efficiency and policy solutions, see the Union of Concerned Scientists report Climate 2030 (Cleetus, Clemmer, and Friedman 2009).

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 8 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 9

ingavoidedfuturecarboncosts)(EERE2008).Despiteitsvariableoutput,severalU.S.andEuropeanutilitystudieshaveshownthatwindpowercouldprovideupto25percentoftotalgenerationonutilityandregionalsystemsatmodestintegra-tioncosts(oflessthan$10/MWh,orroughly5to10percentofwindpower’swholesalecost)(WiserandBolinger2009;Holttinenetal.2007). Theinstallationofwindandsolarenergytechnologieshasexpandedatastrikingpace,withwindgrowingatanaver-ageannualrateof39percentbetween2004and2009andsolargrowingatanannualaveragerateof41percentoverthatperiod.In2007,forthefirsttime,theUnitedStatesaddedmorerenewablecapacity,mainlywind,thanitdidnonrenew-ablecapacity(EIA2009c).From2008to2009,morewindcapacitywasaddedtotheU.S.powersupplythaninthepreviousthreedecadescombined(Figure4,p.10)(WiserandBolinger2009).In2010,however,windinstallationsdroppedoffconsiderablyfromtherecentrecordpace,dueinlargeparttotherecessionaswellastoincreasedcompetitionfromlow-pricednaturalgas(AWEA2010a;AWEA2010b). Themarketshareofsolarphotovoltaic(PV)powerisalsogrowingrapidly,andthisoptionhasthepotentialtotransformtheenergygridassolarpanelpricescontinuetofall.PVinstal-lationsduringthefirsthalfof2010were55percenthigherthanin2009onanannualizedbasis(SEIA2010b).Californianowhas600MWofPVcapacityonline,aspartofapushtoinstall3,000MW(CPUC2010),andNewJerseyhas120MWunderdevelopment(Belson2009).Unlikemostother

spendingonratepayer-fundedgasandelectricefficiencyprogramsnearlydoubledbetween2007and2009,risingfrom$2.5billionto$4.3billion(ACEEE2010a).Suchaggressiveandsustainedinvestmentsinenergyefficiencycouldnotonlygreatlyreducetheneedfornewsourcesofgeneration(includ-ingcoal)butalsocutdemandforexistingpowerplants. Arenewedcommitmenttoenergyefficiencyatthefederallevelwillhelptodrivedemandreductionsnationwide.Forexample,theAmericanRecoveryandReinvestmentActof2009(ARRA)providedapproximately$17billioninincentivesforhomesandbusinessestoinvestinenergyefficiency(ACEEE2010b).Moreover,sinceJanuary2009theU.S.DepartmentofEnergyhasfinalizednewefficiencystandards,formorethan20householdandcommercialproducts,estimatedtocumulativelysaveconsumers$250billionto$300billionby2030(DOE2010).Thesearebillionsofdollarsthatwillnolongerneedtobespentoncoalpoweroranyotherkindofelectricitysupply.

Renewable PowerThepotentialofrenewablesourcestomeetafargreatershareofourelectricityneedsiswelldocumented.Themajorrenewableenergytechnologies—wind,solar,geothermal,bioenergy,andsmall-scalehydropower—havethepotentialtoproducemanytimesthecurrentU.S.powerdemand(Cleetus,Clemmer,andFriedman2009).Ofcourse,notallofthatpotentialispracti-callyrealizable,butnumerousstudieshaveconsistentlyfoundthattheUnitedStatescouldsignificantlyincreaserenewableenergygenerationinanaffordableandreliableway(ASES2007;Nogee,Deyette,andClemmer2007).ANationalRenewableEnergyLaboratory(NREL)studyrecentlyconcludedthatby2025theUnitedStatescouldmeet22percentofitselectric-ityneedsusingnon-hydrorenewablepower—upfromabout3.6percentin2009—withnosignificantimpactonconsumerpricesatthenationallevel(EIA2010b;Sullivanetal.2009).8Inaddition,a2009EIAstudyprojectedthatincreasingtheshareofrenewableelectricityto25percentnationallyby2025wouldlowerconsumernaturalgasbillsslightlycomparedwithbusinessasusual,therebyoffsettingslightlyhigherelectricitybills(EIA2009g). Accordingtoalandmark2008analysisbytheU.S.Depart-mentofEnergy,windpoweralonecouldmeet20percentofourelectricityneedsby2030withoutcompromisingreliabilityorraisingelectricratesbymorethan2percent(notconsider-

The next decade may see a dramatic and

sustained increase in overall [energy

efficiency] funding levels, and a fundamental

redrawing of the energy efficiency map.

— L A W R E N C E B E R K E L E Y N A T I O N A L L A B O R A T O R Y

8 The NREL analysis examined three proposed renewable energy standards, the most stringent of which would require 25 percent of retail power sales to derive from renewable power by 2025. However, because smaller utilities were exempted from this standard, the effective renewable requirement was only 22 percent by 2025.

10 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 10 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 11

50percentinthelasttwoyears,partlyduetonewlow-costmanufacturingfacilitiesinChina(Bradsher2010).AnalystsatDeutscheBankreport,“lookingatlearningcurves,weexpectmanyrenewabletechnologieswilllikelybeascheapasfossilfuel-firedpowergenerationon[alevelizedcostofelectric-ity]basiswithinthenext5–10years”(Mellquistetal.2010).WhiletheseanalystsfocusparticularlyonrapidlyfallingsolarPVprices,theynotethateventherelativelymatureonshorewindindustrysawturbinepricesfallin2010andthatpricesareprojectedtobe20percentlowerin2011thanin2009(Mellquistetal.2010). Evenwithoutsuchfallingprices,renewablepowerwouldseecontinuinggrowthdrivenbyfederaltaxcreditsandstate-levelrenewableelectricitystandards,whichrequireelectricitysupplierstoprovideaminimumpercentageoftheirelectricityfromrenewablesources.Already,29statesandtheDistrictofColumbiahaveenactedsuchstandards,anumberthathasmorethandoubledsince2004.Arecentanalysisprojectedthatiffullcompliancewiththesestatestandardswereachieved,it

powersources,onsitesolarPVprojectsbecomecompetitivewhencostsfallbelowretailratherthanwholesalepowerprices.Netmeteringpoliciesandinnovativefinancingmechanisms(suchasproperty-assessedcleanenergy,orPACE,financing),whichhelpreducethebarrierstowideruseofPV,arespreadingquickly(Rose2010;SEIA2010a). Otherrenewabletechnologiesarealsoseeingimpressivegrowth.Concentratedsolarpower(CSP)canfunctionaroundtheclockwhenpairedwithnewheat-storagetechnologies.ThisoptionistakingoffparticularlyinCalifornia,wherestateregu-latorsapprovedninenewprojectstotalingover4,000MWoverafour-monthperiodinlate2010(Kraemer2010).Onesuchproject,at1,000MW,willbethelargestintheworld(Hsu2010).Onanotherfront,in2009geothermalpowergrew26percentinnewprojectsunderdevelopment,with7,875MWofprojectsunderwayin15states(GEA2010). Renewablepowercontinuestobecomemorecompetitivewithfossilfuelsbecauseoftechnologicaladvances,economiesofscale,andotherfactors.Solarpanelpriceshavedroppedby

Figure 4. WIND POWER GROWING AT RECORD PACE

U.S. wind power capacity expanded by over 50 percent in 2008 alone and continued to expand in 2009 despite the recession.

40

35

30

25

20

15

10

5

0

AN

NU

AL

CA

PA

CIT

Y (

GW

)

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

CU

MU

LA

TIV

E C

AP

AC

ITY

(G

W)

12

10

8

6

4

2

0

Annual U.S. CapacityCumulative U.S. Capacity

Source: Wiser and Bolinger 2010

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 10 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 11

ensstandardsforthesepollutants,aswellasunderanyfuturecarbon-costscenario.Naturalgasplantsalsohavethecapabilitytoincreaseorreducetheiroutputasmarketdemandfluctuates,whichcoalplantscannotefficientlydo.Thisflexibilitymakesgasplantsinherentlybetteradaptedtoagridontowhichagrowingnumberofvariablerenewableenergysourcesarebeingadded,pursuanttostatepoliciesandshiftingeconomics. Theprospectsforallpowersources,includingcoal,aregreatlyaffectedbynaturalgasprices.Whenpriceswerelow,inthe1990sandearly2000s,thepowersectorbuiltagreatmanyefficientnaturalgascombined-cyclepowerplantsdesignedtooperateasaround-the-clockbaseloadcapacity.10Whengas

wouldresultinsome76GWofnewrenewableenergycapacityby2025—orasmuchas97GWifthenewlyenhancedCalifor-niastandardandthevoluntarygoalsadoptedinsevenaddi-tionalstateswereincluded(Wiser2010).Federalsupporthasalsobeenimportant,withextendedtaxcreditsforrenewablegenerationextendedthrough2012aspartofthe2009ARRAlegislation.TheEIAprojectsthatthesetaxcredits,combinedwithexistingstate-levelstandards,willincreaserenewableenergy’sshareofelectricitygenerationto12.3percentby2020(EIA2010a). Inshort,whilecoalpowerisshrinkingandfacesnewregulatoryhurdlesandrisingcosts,renewablepowerisexpand-ingwithgrowingpolicysupport;moreover,costsarefallingformanyofthesetechnologies.Renewablepower’smarketsharewillthuscontinuetoincreasetoasubstantialfractionoftheU.S.powermarket,meetingelectricitydemandthatmightotherwisebefilledbycoal.

Competition from Natural GasNaturalgasplantsholdimportantadvantagesovercoalplants.Theyburncleaner,producinglessthanhalfthecarbonemis-sions,aboutone-tenththenitrogenoxides,andnegligibleamountsofsulfurdioxide,mercury,andparticulates.9ThusnaturalgaswillhaveanaddededgeovercoalastheEPAtight-

9 A federal analysis of power plant performance found that a new natural gas combined-cycle plant emitted 58 percent less CO2 per megawatt-hour than a new coal plant using subcritical technology and 55 percent less CO2 than a new coal plant using the more efficient supercritical technology (NETL 2007). 10 Baseload power is the term used for those sources of electricity that are run most of the time and at a steady rate. This is in contrast to peaking or interme-diate plants, which are turned on when demand reaches a certain point and ramped up and down as demand shifts, and in contrast with intermittent sources such as wind, which provide power only when available. Traditionally, coal, nuclear, hydroelectric (except in drought years), biomass, and geothermal plants have provided the baseload power, though lately natural gas combined-cycle plants have also been a source of significant amounts of baseload power in some parts of the country.

©M

artin

D. V

onka

, Shu

tter

stoc

k.co

m

Source: Wiser and Bolinger 2010

12 U N I O N O F CO N C E R N E D S C I E N T I S T S A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 12 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 13

priceslaterincreased,muchofthenewnaturalgascapacitywasleftunderutilizedandthepowersectorlaunchedacoalplantbuildingspree,withannouncementsofover150proposednewcoalplantsatitsheight.Sincethen,naturalgaspriceshavefallen,contributingtothecancellationofsomeofthosenewcoalplantsandpromptingtheownersofseveraloldcoalplantstoannounceplanstoreplacethemwithnaturalgasunits(Smith2010). Naturalgaspricesareparticularlyhardtoforecast,butitisworthnotingthatwhileestimatedcoalreservesarebeingreducedandcoalpricesarerising(seePart3),theoppositeishappeningwithnaturalgas.IndustryexpertsrecentlyexpandedtheirestimatesofU.S.domesticgasresourcesbyadramatic39percentsincethelastestimatein2006,announcing“anexcep-tionallystrongandoptimisticgassupplypictureforthenation”(PotentialGasCommittee2009).Thisconfidenceresultedfromadvancesindrillingtechnology—horizontaldrillingandhydraulicfracturing—thatletdrillersreachtheformerlyinac-cessibleshalegassupplieslocatedinmanystates. Therearemanyunresolvedconcernsovertheimpactthathydraulicfracturingcanhaveonwaterqualityandsupply,however.Andtherearequestionsastowhethertheglobalwarmingimpactofmethaneleakedduringtheproductionofnaturalgasmoregenerallyhasbeenfullycounted(LustgartenandProPublica2011).Theseissues,andthepublicoppositiontoexpandeddrillinginsomeareas,coulddampenexpectationsaboutfuturegasproduction.Still,shalegasisviewedbymanyascausingadramaticimprovementintheoutlookfordomesticnaturalgasproduction.Thisincreaseinnaturalgasavailabilitycouldhavesignificantimplicationsforcoalpower,especiallywhencombinedwithclimate-protectionpolicies.A2010

The threat to coal from natural gas is particularly

great at present, given the many natural gas

plants built in the last decade that have been

operating at far below capacity.

analysisbyResourcesfortheFuturefoundthatexpandedpro-ductionofshalegas,combinedwithacap-and-tradeprogram,wouldreducecoalgenerationin2030bymorethanhalfcomparedwithbusiness-as-usuallevels(BrownandKrupnick2010). Thethreattocoalfromnaturalgasisparticularlygreatatpresent,giventhemanynaturalgasplantsbuiltinthelastdecadethathavebeenoperatingatfarbelowcapacity.Forexample,combined-cyclenaturalgasplantswereoperatingat42percentin2007(Kaplan2010)andatonly33percentin2008(Bradleyetal.2010).ACongressionalResearchServicereportestimatedthatbringingutilizationofthoseplantsto85percent,asistechnicallyfeasible,wouldbesufficienttocutcoalgenerationbynearlyathirdandreduceCO2emissionsby19percent(Kaplan2010).Anotherassessmentconcludedthatalmost70percentofthecoalfleetcouldbeidledbyfullyutiliz-ingthenaturalgascombined-cyclepotential(Casten2009).Theseandotherreportshaveacknowledgedthemanypracti-calbarrierstoawidespreadsubstitutionofgasforcoal(AspenEnvironmentalGroup2010).Still,theexistenceofsomanyunderusedgasplantswhengaspricesareprojectedtoremainrelativelylowrepresentsyetanotherpotentiallysignificantthreattocoalpower’smarketshare.

A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 12 A R I S K Y P R O P O S I T I O N : T H E F I N A N C I A L H A Z A R D S O F N E W I N V E S T M E N T S I N COA L P L A N T S 13

P A R T T H R E E

Fuel Prices at Risk

Coalhastraditionallybeenconsideredareliablylow-costfuel,butthepricevolatilityofthelastfewyearsshowsthatthisdistinctionhasalreadybeenerodedandthatmuchgreaterchangesmay

lieahead.Inpredictingfuturecoalprices,investorsmustconsidertherisksthatpricescouldbepushedfarhigherbyincreasedexposuretotheglobalmarket(particularly,risingcoaldemandfromAsia),bynewuncertaintiesaboutthesizeofcoalreserves(bothintheUnitedStatesandglobally),andbynewconstraintsonmining.

The Threat to U.S. Coal Prices from Volatile Global Markets SpotcoalpricesintheeasternUnitedStatesrosedramaticallyin2008(Figure5,p.14).11Thisshiftoccurredlargelyinresponsetotheriseintheglobaltradeincoal,towhichtheeasternU.S.marketswereparticularlyexposed(Freme2009;Victor2008).Globalcoalpricesalsorosesteeplyin2008—becauseofgrow-ingdemand,especiallyfromAsia,andofsupplyproblemsinothercountries(MufsonandHarden2008).Afterspikingin2008,spotpricesdroppedwiththerecession,largelybecauseofdecliningdemandforpowerdomesticallyandfallingsteelproductionglobally(EIA2009e). Asnations’economiesrecoverfromthewoesofthepasttwoyears,thesamekindsofglobalforcesaredrivingcoalpricesupwardagain.Chinaistheworld’slargestcoalconsumerandproducerbyfar,miningandburningaboutthreetimesasmuchastheUnitedStates(insecondplace)in2009(EIA2011b;EIA2010f).Chinaalsoswitchedfrombeinganetcoalexportertoanetimporterin2009(Rosenthal2010).China’scoaluse

hasrisenabout10percentannuallyforthelastdecade,anditnowaccountsforalmosthalfofglobalconsumption(Rudolf2010).Indiaaswellisincreasinglyrelyingonimportedcoaltomeetitsgrowingdemand,andCitigrouppredictsthatin2011ChinaandIndiacombinedwillincreasetheircoalimportsby78percent(SethuramanandSharples2010).SomeindustryanalystsdescribethecoaldemandintheAsia-Pacificregionasexperiencing“absolutelystupendous,fantasticgrowth,”whichtheyexpectwillbringabouta“seismicshift”intheglobalcoalmarkets(Gronewold2010). ThatseismicshiftcouldbeevenstrongergiventherecentannouncementbyChineseofficialsthattheyplantocaptheirnation’sdomesticcoalproductionat3.6billionto3.8billiontonnes(comparedwiththe2009productionof3.2billiontonnes),inparttopreventChinesereservesfromrunningdowntooquickly(Reuters2010a;Winning2010).Thismove,com-binedwithstill-soaringdemandforcoalinChina,couldhaveprofoundimplicationsforglobalcoalprices—whichinDecem-ber2010reachedtheirhighestpointintwoyears(SethuramanandSharples2010)—andforU.S.coalprices. U.S.coalpricesarealreadyrising,atleastpartlyinresponsetoglobalprices.Appalachianspotpriceshavebeenonan

11 Given long-term contracts (of one year or longer), most U.S. coal plants are buffered from the immediate effects of short-term spot price volatility, but they still feel the coal price trend. On a national-average basis, delivered prices of coal to electric utilities in 2009 were 43 percent higher than in 2005 (EIA 2009h). Delivered coal prices in 2009 were 8 percent higher than in the year before, even though 2009 demand for coal dropped by 10 percent in the power sector. The EIA attributes this rise mainly to the new contracts signed during the 2008 spike in spot prices. And notably, despite the global economic slowdown, the average price per ton of U.S. steam coal exports rose by 28 percent in 2009 (EIA 2009h).