5 stage digital maturity to improve customer on boarding

-

Upload

abhishek-chatterjee -

Category

Sales

-

view

113 -

download

0

Transcript of 5 stage digital maturity to improve customer on boarding

5 stage Digital Maturity to improve Customer On-boarding

New account opening and subsequent customer on-boarding process is going

through seismic shift due to change in customer's behaviour and rapid

technology adoption. Customers are entering into anytime- anywhere service

paradigm, where they expect Banks to know about them and provide

transparent, real-time interactive services. Banks also need to be very sensitive

to the cost of operation and time to market, to stay ahead of the competition.

Banks also should be aware of the rapid rise of alternate banking models (P2P

lending, Crowd sourcing, eBanking, Digital Wallets like Apple pay, crypto

currency models) and enforce continuous innovation culture across Business,

Operations and IT to stay in business.

Following are the potential areas of focus, when banks start to embark upon a

journey to improve customer on-boarding:-

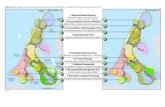

Digital Maturity stage -1: E2E transaction capability in each channel

key challenges:-

Inability to attract customer traffic and attention in each channels

High digital sales abandonment in products like commercial lending,

cards due to inconsistent and immature process

High customer on-boarding time & cost.

Focus area to improve maturity:-

Continuous Monitoring and improvement of marketing and sales effort

in each channel etc

Build capabilities in each channel to engagement customer i.e.

Communities, Chats, social, Call Center, IVR, Mobile, web, Social etc

Simplification of Business Process & IT landscape.

Market leaders initiatives:-

Banks across the globe are embarking upon Simplifications initiatives to

reduce number of applications, process and Infrastructure.

Digital Maturity stage -2: Consistent Cx across all channels

key challenges:-

Variable Customer Experience across channels due to lack of process

standards

High customer on-boarding time and cost due to lack of IT

Standardization.

Focus areas to improve maturity:-

Standardization of Back Office soiled process - KYC, AML, Payments

reconciliation, error handling etc in each channel using products like

Pega, IBM BPM etc

Build an Unified Content Management (Creation, organization and

publishing) capability with implementation of products like ADOBE,

IBM, SDL, SiteCore etc

Introduce Design and development standards i.e. Ux (HTML5, CSS3,

Angular JS, PhoneGap, JQuery etc); Business process modelling, &

business rules (BPMN, BPEL, IFW, DMN etc) and application, data

architectures (BAIN, IFX etc), security (mobile and CLOUD security)

Introduce right SOA and API management (i.e. WSO2, Layer7,

MuleSoft, IBM, TIBCO etc) to improve reusable assets and augment

B2B and B2C transaction capabilities, also fuel innovation through App

store.

Market leaders initiatives:-

Banks across the globe are embarking upon Global standards initiatives

to standardize process and IT services.

Digital Maturity stage -3: Multi-Channel Cx - ability to complete a

transaction using multiple channels

key challenges:-

Lack of customer centric user experience design enablement

Lack of mobile banking capabilities

High customer On-boarding time & cost due to lack of Infra and IT

Agility & automation.

Focus areas to improve maturity:-

Change design philosophy to enable persona user experience

management

Enable process standardization across channels

Creating Digital innovation labs to fuel rapid prototyping and

innovation

Introduce capabilities like Payments, transaction history, query

management, approval, digital wallet using Mobile channel

Enable Infra and IT agility and automation through rapid environment

provisioning using CLOUD and virtualization (CLOUDFundry,

IBMBlueMix etc); Lack of automation in SDLC - continuous integration

(Jenkins, Hudson etc); build (Maven); coding standards (sonar); SCM

(SVN); Unit testing tools (Mokito); ALM (IBM Rational etc); deploy

(Udepoy); automated integration testing (LISA) etc

Manage IT vendor's SLA and risk to align timely fix and releases.

Market leaders initiatives:-

Banks across the globe are embarking upon agile & automated

infrastructure and development process through rapid adoption of

CLOUD and DevOps and model driven testing.

Digital Maturity stage -4: Personalized customer lifecycle

management through single customer view, real time decision

making and next best action

key challenges:-

Lack of Cross-channel measurement

Lack of Cross-channel Campaign Management to improve conversion

Cross channel analytics & targeting for greater customer experience and

conversion

Anytime-Anywhere on-boarding enabled by customer centric Business

process management.

Focus areas to improve maturity:-

build unified analytic capabilities across social, mobile and web

channels using products like Adobe, IBM, Attensity, Brandwatch etc

Build Business activity monitoring and Complex event processing using

IBM, Oracle, TIBCO products

Build a multichannel Campaign management capability using Adobe,

IBM, SDL etc

Build a single customer view using standard CRM solutions;

Enable real time marketing and sales through next best actions using

Big data, BI, analytics platforms (i.e. Hadoop, Cassandra, Sparks,

Splunk, IBM, TIBCO etc).

Customer centric process automation & e-commerce capabilities using

mobile, social and Web Channels using products like Adobe, IBM, Kony,

Pega, SAP etc.

Market leaders initiatives:-

Banks across the globe are incubating small scale pilots through sales

and marketing channel improvement initiaitves using Big data, analytics

initiatives.

Digital Maturity stage -5: Personalized brand experience through

optimization of channel experience to reflect the brand promise

and cultivate influencers

key challenges:-

Lack of Cross-Channel Optimization to increase 1-2-1 personalization

and to improve conversion

Lack of Marketing optimization to increase revenue realization

Advocacy & Influence management to improve brand loyalty and value.

Focus areas to improve maturity:-

Provide optimization capabilities using A/B testing, Multivariate testing

with products like Adobe, IBM etc

Marketing & Media attribution mix modelling to achieve desired

revenues and profitability

Detailed segmentation to identify the brand champions and advocates

using products like IBM, Adobe etc.

Market leaders initiatives:-

Banks will start to experiment using in-memory computing, predictive

analytics and cognitive intelligence initiatives to improve advanced

Sales and marketing initiatives.

Note: Banks can initiate the initiatives in one go. also the tools recommended

are indicative in nature.