43263932-MF0012-–-Taxation-Management(1)

-

Upload

tp00712212010 -

Category

Documents

-

view

215 -

download

0

Transcript of 43263932-MF0012-–-Taxation-Management(1)

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

1/15

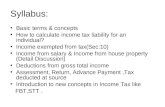

Master of Business Administration- MBA Semester 3MF0012 Taxation Management - 4 Credits

(Book ID: B1037)Assignment Set- 1

Q1. What are the incomes from house property which are exempted from tax?

ANS: Following incomes from house property is completely exempt from any tax liability:

i. Income from any farmhouse forming part of agricultural income;ii. Annual value of any one palace in the occupation of an ex-ruler;iii. Property Income of a local authority;iv. Property Income of an authority, constituted for the purpose of dealing with and satisfying the

need for housing accommodation or for the purposes of planning development or improvementof cities, towns and villages or for both. (The Finance Act, 2002, w.e.f. 1.4.2003 shall deletethis provision.);

v. Property income of any registered trade union;vi. Property income of a member of a Scheduled Tribe;

vii. Property income of a statutory corporation or an institution or association financed by theGovernment for promoting the interests of the members either of the Scheduled Castes orScheduled tribes or both;

viii. Property income of a corporation, established by the Central Govt. or any State Govt. forpromoting the interests of members of a minority group;

ix. Property income of a cooperative society, formed for promoting the interests of the memberseither of the Scheduled Castes or Scheduled tribes or both;

x. Property Income, derived from the letting of godowns or warehouses for storage, processing orfacilitating the marketing of commodities by an authority constituted under any law for themarketing of commodities;

xi. Property income of an institution for the development of Khadi and village Industries;'xii. Self-occupied house property of an assessee, which has not been rented throughout the

previous year;xiii. Income form house property held for any charitable purposes;xiv. Property Income of any political party.

Q2. Define the term tax holidays. What are the different tax incentives for new unitsestablished in SEZ?

ANS: A tax holiday is a temporary reduction or elimination of a tax. Governments usually create tax

holidays as incentives for business investment. The taxes that are most commonly reduced by national

and local governments are sales taxes. In developing countries, governments sometimes reduce or

eliminate corporate taxes for the purpose of attracting Foreign Direct Investment or stimulating

growth in selected industries. Tax holiday is given in respect of particular activities, and sometimes

also only in particular areas with a view to develop that area of business.

Or If an assessee is permitted or given exemption for not to pay tax for certain number of year/years then that particular year or years will be termed as Tax holiday. The following are the some ofprovisions mentioned by income tax department regarding tax holidays.

1. 100% export oriented units 10 year tax holiday is allowed for 100% of the income.2. For newly established industrial undertaking in Free trade zones , electronic hardware

technology park, software technology park or special economic zone- 10 year tax holiday isallowed for 100% of the profits(except for SEZ)

For SEZ the deduction is as followsa) For the first 5 years 100% of export profitb) For the next 2 years 50% of export profitc) For the next 3 years 50% of export profit

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

2/15

Tax incentives for new units established in SEZ:

In India, SEZs are the special zones created by the Government and run by Government-Private or

solely Private ownership, to provide special provisions to develop industrial growth in that particular

area. The government of India launched its first SEZ in 1965, in Kandla, Gujarat.

The incentives and facilities offered to the units in SEZs for attracting investments into the

SEZs, including foreign investment include:-

Duty free import/domestic procurement of goods for development, operation and maintenance

of SEZ units

100% Income Tax exemption on export income for SEZ units under Section 10AA of the Income

Tax Act for first 5 years, 50% for next 5 years thereafter and 50% of the ploughed back export

profit for next 5 years.

Exemption from minimum alternate tax under section 115JB of the Income Tax Act.

External Commercial Borrowing by SEZ units up to US $ 12500 billion in a year without any

maturity restriction through recognized banking channels.

Exemption from Central Sales Tax.

Exemption from Service Tax.

Single window clearance for Central and State level approvals.

Exemption from State sales tax and other levies as extended by the respective State

Governments.

The major incentives and facilities available to SEZ developers include:-

Exemption from customs/excise duties for development of SEZs for authorized operations

approved by the BOA.

Income Tax exemption on income derived from the business of development of the SEZ in a

block of 10 years in 15 years under Section 80-IAB of the Income Tax Act.

Exemption from minimum alternate tax under Section 115 JB of the Income Tax Act.

Exemption from dividend distribution tax under Section 115O of the Income Tax Act.

Exemption from Central Sales Tax (CST).

Exemption from Service Tax (Section 7, 26 and Second Schedule of the SEZ Act).

Currently there are 114(as on Oct 2010) SEZs operating throughout India in the following states.

Karnataka - 18; Kerala - 6; Chandigarh - 1; Gujarat - 8; Haryana - 3; Maharashtra - 14; Rajastan - 1;

Orissa - 1 TamilNadu - 16; Utter Pradesh - 4; West Bengal - 2.

Additionally, more than 500 SEZs are formally approved (as on Oct 2010) by the Govt of India in

the following states. Andhra Pradesh - 109; Chandigarh - 2; Chattisgarh - 2; Dadra Nagar Haveli - 4;

Delhi- 3; Goa - 7; Gujarath - 45; Haryana - 45; Jharkand - 1; Karnataka - 56; Kerala - 28; Madhya

Pradesh - 14; Mahrashtra - 105; Nagaland - 1; Orissa - 11; Pondicherry - 1; Punjab - 8; Rajasthan - 8;

TamilNadu - 70; Uttarankhand - 3; Utter Pradesh - 33; West Bengal - 22;

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

3/15

Q3. What are the key steps to calculate the tax liability of an individual ?

ANS: Steps to calculate the tax liability of an individual are:

Determine residential status- First of all to determine the residential status of the assessee.The incomes are taxed according to residential status i.e. Resident in India, Not Ordinarilyresident, or Non resident.

Calculation of gross total income- For the calculation of the gross total income we shouldhave to calculate the income of five heads according to the provisions of Income Tax Act.

Exempted Incomes- While calculating the incomes of the different heads, the incomes whichare exempted will not be included.

Income of other persons to be included in the income of assessee - Few incomes of otherpersons (Sec. 64) includes in the income of assessee.

Set-off of losses- If there is negative income in a particular head then it is to be set offaccording to the provisions of Income Tax Act.

Deductions u/s 80- After the above steps, the aggregate amount of income is known as GrossTotal Income. From the gross total income few deductions which are provided under section 80of income tax act will be deducted. After deductions, the balance of income is known as Total

Income or Taxable Income. The list of deductions available to an individual are as follows:1. Investments and deposits (sec 80C)2. Contribution to certain pension funds (sec 80CCC)3. Contribution of new pension scheme (sec 80CCD)4. Payment to medical insurance premium (sec 80D)5. Medical treatment of handicapped dependents and amount deposited for maintenance of

handicapped dependents (sec 80DD)6. Expenditure on medical treatment of certain diseases (sec 80DDB)7. Repayment of loan and interest thereon taken for higher education (sec 80E)8. Donations to certain funds/charitable institutions etc. (sec 80G)9. Deductions in respect of rent paid (sec 80GG)10. Donations for scientific research and rural development (sec 80GGA)

11.Contribution to political parties (80GGC)12. Profit and gain of new industrial undertaking set up for infrastructure development (sec 80IA)13. Profit and gains of new industrial undertakings (sec 80IB)14. profit and specific industrial undertakings establish in specific states (sec 80IC)15. Deduction in respect of profits and gains from business of collecting and processing of bio

gradable waste (sec 80JJA)16. Deduction in respect of certain incomes of offshore banking unit (sec 80LA)17. Deduction in respect of royalty income to authors (80QQB)18. Deduction in respect of royalty on patent (sec 80RRB)19. Deduction in case of person with disability (sec 80U)

Total Income rounded off in the multiple of`10 The total income calculated will roundedoff in multiple of Rs. 10. For this rupee five or more than Rs. 5 will be treated as Rs. 10 and

less than Rs. 5 will be deleted.

Q4. Define the treatment of remuneration paid to partners under income tax act.

ANS:In all most all the partnership, provision for salary has been included and decided with mutual

consent .But as per Income Tax Act, full amount of salary is not allowed as expenses in profit & loss

account but salary is restricted to % of profit before salary to the partner. There are some conditions

also which are to be complied to claim deduction of salary as expense in P & L account of partnership

firm.

Conditions are defined in section 40(b) of the income tax act.

1. Salary should be paid to working partner.

2. Salary must be written/authorized by the Partnership deed

3. Salary should be related to the period after the partnership deed date.

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

4/15

4. Salary must be with in limit of % of Book profit.

Salary here means: salary, commission, remuneration (or any name whatever name called)

Now detail of each condition.

1. Working partner: salary to sleeping partner is not allowed .and working partner definition has been

given in explanation 4 of the section 40(b)

working partner means an individual who is actively engaged in conducting the affairs of the

business or profession of the firm of which he is a partner

From above definition it is clear that " full time" attendance to any or all of the tasks of the

partnership .

2. Salary must be written/authorized by the Partnership deed: To claim the expense of salary of

partner in p& L salary should be authorized by the partnership deed and it should also be according to

the conditions/terms defined in the partnership deed.

Clause in partnership should be clear and amount should be defined.

Board has issued a circular also related to clause in partnership deed for salary to partners

Whether for assessment years subsequent to assessment year 1996-97, no deduction under section

40(b)(v) will be admissible unless partnership deed either specifies amount of remuneration payable to

each individual working partner or lays down manner of quantifying such remuneration

1. The Board have received representations seeking clarification regarding this allowance of

remuneration paid to the working partners as provided under section 40(b)(v) of the Income-tax Act.

In particular, the representations have referred to two types of clauses which are generally

incorporated in the partnership deeds. These are :

(i) The partners have agreed that the remuneration to a working partner will be the amount ofremuneration allowable under the provisions of section 40(b)(v) of the Income-tax Act; and

(ii) The amount of remuneration to working partner will be as may be mutually agreed upon between

partners at the end of the year.

It has been represented that the Assessing Officers are not allowing deduction on the basis of these

and similar clauses in the course of scrutiny assessments for the reason that they neither specify the

amount of remuneration to each individual nor lay down the manner of quantifying such

remuneration.

2. The Board has considered the representations. Since the amended provisions of section 40(b) have

been introduced only with effect from the assessment year 1993-94 and these may not have been

understood correctly the Board are of the view that liberal approach may be taken for the initial

years. It has been decided that for the assessment years 1993-94 to 1996-97 deduction for

remuneration to a working partner may be allowed on the basis of the clauses of the type mentioned

at 1(i) above.

3. In cases where neither the amount has been quantified nor even the limit of total remuneration has

been specified but the same has been left to be determined by the partners at the end of the

accounting period, in such cases payment of remuneration to partners cannot be allowed as deduction

in the computation of the firms income.

4. It is clarified that for the assessment years subsequent to the assessment year 1996-97, no

deduction under section 40(b)(v) will be admissible unless the partnership deed either specifies the

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

5/15

amount of remuneration payable to each individual working partner or lays down the manner of

quantifying such remuneration.

Circular: No. 739, dated 25-3-1996.

The above circular is very clear so, from ay 1996-97 onwards amount should be defined in the

partnership deed.

3. Salary should be related to the period after the partnership deed date: The salary as per

partnership deed should be after the partnership deed. If payment is related to period earlier than the

date of partnership deed, then it will be disallowed as exp.

4. Salary must be with in limit of % of Book profit. As per section following % has been defined with

in which salary can be claimed for partners.% chart is given below:

THE ABOVE RATES HAS BEEN PROPOSED TO BE CHANGED FROM 01.04.2010 means fromAssessment year 2010-11 or financial year 2009-10 AS UNDER

Common rate for both type of Firm whether covered under 44AA or not.

New Rates proposed in Budget 2009

On the First three lakh of the Profit or In case of Loss: 150000 or 90 % of profit which ever is more.

On balance profit:60% of the profit

Profession notified under section 44AA.

legal, medical, engineering or architectural profession or the profession of accountancy or

technical consultancy or interior decoration ,profession of authorized representative, the

profession of film artist (actor, cameraman, director, music director, art director, dance director,

editor, singer, lyricist, story writer, screen play writer, dialogue writer and dress

designer),Profession of Company Secretary, Profession of Information Technology.

Calculation Of book Profit.

1. Take profit as per P& L account.

2. Add back salary given to partners if debited in p& L earlier.

3. Make adjustment for expenses allowed/disallowed as per section 28- 44D.

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

6/15

4. If expenses /Income of other head like house property or income from other sorcse, capital

gain has been debited /credit then reverse backs the amount from profit & loss account.

5. As the depreciation b/f is covered under section 32(2) ,so adjustment should be made for b/f

depreciation to calculate the book profit but adjustment can be done only upto maximum of

profit of current year before depreciation minus b/f loss of the previous years .

suppose

Profit as per P & L = 220850

Depreciation =111474.00

Net profit after depreciation =109376

salary of partner given =108000

Now salary allowed as per section 40(b) is given below

Book profit=109376

If firm is covered under 44AA(profession prescribed):

1. On first 100000=90% of 100000=90000

2. On balance 9376 @ 60%=5626

Total allowed=90000+5626=95626

if firm is not covered under above: any other firm

1. On first 75000=90% of 100000=67500

2. On (109376-75000=34376) @ 60%=20986

Q5. Describe in brief the provisions for set off and carry forward of losses.

ANS:

Income Head Nature of LossSet off in Same

Assessment Year

Carried forward to

Subsequent Assessment

Year

No of Years for which it

can be carried forward

Income fromHouseProperty

House Property

Let Out Property

Self Occupied Property

Income fromAny Head ofIncome.

Only againstIncome from HouseProperty.

8

Speculation

Business

Speculation Loss Only against

SpeculationProfit.

Only against

Speculation Profit. 4

OtherBusiness orProfession

Any Loss from Business orProfession other thanSpeculation Loss andUnabsorbed Depreciation

Any Incomeexcept Salary.

Only against Profitor Gains frombusiness orProfession.

8

Capital Gains Long Term Capital Gains Only againstLong term

Only against Longterm Capital Gains.

8

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

7/15

Capital Gains.

Capital Gains Short Term Capital Gains Only againstCapital Gains

(Both ShortTerm & Long

Term).

Only against CapitalGains (Both Short

Term & LongTerm).

8

Other Sources Income from owning and

maintaining Race Horses

Only against

Income fromowning andmaintainingRace Horses.

Only against

Income fromowning andmaintaining RaceHorses.

4

Other Sources Income from Other Sources Any Income. No Carry Forward NA

Profit or Gainsfrom Businessor Profession

Unabsorbed Depreciation Any Head ofIncome exceptSalary.

Any Head ofIncome exceptSalary.

No time limit.

Shall be carriedforward to

Subsequentassessment year

and shall be

deemed to be theDepreciation of that

year.

Profit or Gainsfrom Businessor Profession

Scientific and ResearchExpenditure

Any Income Shall be carriedforward toSubsequentassessment yearand shall bedeemed to be theScientific ansResearchExpenditure of that

year.

NA

Profit or Gainsfrom Business

or Profession

ProspectingExpenditure(Installment)

NA Shall be carriedforward to

Subsequentassessment year

and shall bedeemed to be the

Installment of thatyear.

Can be carriedforward upto the10th assessment

year reckoned fromthe year ofcommercialproduction.

Profit or Gainsfrom Businessor Profession

Family Planning Expenditure NA Shall be carriedforward toSubsequent

assessment yearand shall bedeemed to be theFamily PlanningExpenditure of thatyear.

NA

Q6. Compute the net wealth and wealth tax liability of Golden Jewelers ltd. as on 31-3-11. Thecompany is engaged in the jewellery business export and domestic sales

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

8/15

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

9/15

Q1) Write a short note on:

a) Cost of acquisition

b) Cost of improvement

c) Expenditure on transfer

d) Transfer

ANS:a) Cost of acquisition:Acquisition cost is the pretax amount of money it costs to gain title to anyproperty. Acquisition cost usually applies to fixed assets. The acquisition cost accounting amount isalways calculated at the amount after all discounts, closing costs, transfer costs, and otheradjustments are made. Used in accounting, acquisition cost is also a term applied to IRA withdrawalsfor any tax penalty free amount applied to buy a first home. Acquisition cost of a first home would,then, be the post-closing cost including any repairs. Acquisition cost adjustments also includefinancing costs, so the IRA-eligible withdrawal amounts could include some of the mortgage fees

required to close. Acquisition cost of a computer purchased for business use is a common question forIRS expense rules: "The entire acquisition cost of a computer purchased for business use can beexpensed under Code section 179 in the first year if qualified, or depreciated over a 5-year recoveryperiod." Acquisition cost is a required accounting line item and calculation for any MACRS expensesdeducted. Acquisition cost often appears in summaries of a company's cost to acquire customers.Acquisition cost of a customer is really a sales expense in a customer acquisition context.

b) Cost of improvement: is capital expenditure incurred by an assessee in making any

additions/improvement to the capital asset. It also includes any expenditure incurred to protect or

complete the title to the capital assets or to cure such title. To put it differently, any expenditure

incurred to increase the value of the capital asset is treated as cost of improvement. Special

provisions under the Income-tax Act in respect of cost of improvement should be noted as under:

Expenditure incurred before April 1, 1981 not considered - Any cost of improvement incurred

before April 1, 1981 is not taken into consideration for calculating capital gain chargeable to

tax. This rule does not have any exception. In other words, cost of improvement includes only

expenditure on improvement incurred on or after April 1, 1981. Expenditure incurred on

improvement of a capital asset before April 1, 1981 is always taken as equal to zero.

Double deduction not permitted - Cost of improvement does not include any expenditure

which is deductible in computing the income chargeable under the heads Interest on

securities, Income from house property, Profits and gains of business or profession and

Income from other sources.

c) Expenditure on Transfer: Expenditure incurred wholly and exclusively in connection with the

transfer of a capital asset is deductible from full value of consideration. The expression expenditure

incurred wholly and exclusively in connection with such transfer means expenditure incurred which is

necessary to effect the transfer. Examples of such expenses are brokerage or commission paid for

securing a purchaser, cost of stamp, registration fees borne by the vendor, traveling expenses

incurred in connection with transfer, litigation expenditure for claiming enhancement of

compensation awarded in the case of compulsory acquisition of assets. One should also keep in view

the following propositions:

Vague claim for expenses is not allowable Expenditure in connection with transfer need not necessarily have been incurred prior to

passing of title.

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

10/15

If a sum has already been subject-matter of deduction under other heads, the same cannot be

allowed as deduction under section 48.

Q2) Write a short note on deductions under section:

a) 80 DD

b) 80 G

c) 80 GG

d) 80lb

e) 80 U

ANS:

a) Medical Treatment of Handicapped Dependant [SEC 80DD]Expenditure incurred for the medical treatment, training and rehabilitation of a handicapped

dependant, or the assessee has paid or deposited under any scheme framed in this behalf by the LIC orUTI for maintenance of handicapped dependant.

b)Donation [SEC 80G]Donations are classified into a) no limit donation , b ) with limit donation. Each of these can

again be classified into two. 1) Deduction allowed @ 100 % of qualifying amount and 2) deductionallowed @ 50 % of qualifying amount.

c) Rent Paid [Sec 80GG].Self employed persons or a salaried employee who is not in receipt of any house rent

allowance, are eligible for the deduction. Adjusted total income for this section means gross total

income minus LTCG and all deduction u/s 80 other than Sec 80GG.

d) Profit from industrial undertakings other than infrastructure and building projects [Sec 80IB]This deduction is available to an assessee, whose gross total income includes profits from

specific business.

e) Income of handicapped resident individual [Sec 80U]This deduction is available only if it is certified by a physician, surgeon or psychiatrist as the

case may be working in a govt. hospital. Such certificate has to be produced before I.T.O in respect ofthe first AY for which deduction is claimed.

In short:

Section Eligible assessee Eligibility Quantum of deductiona) 80DD Individual& HUF Treatment of handicapped

dependantRs.50000 (for more than 80%disability Rs.75000)

b) 80G All assessee Approved donation 100% in some case and 50% in othercase

c) 80GG Individual & HUF Rent paid #Rs.2000p.m#Rent paid in excess of 10% of ATI

d) 80U Individual residentin India

Disability Rs.50000(disability is over 80% ,Rs75000)

Q3) Explain the tax provisions for dividend , interest and royalty.

ANS: Dividend:

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

11/15

It means any amount paid by a company, out of divisible profits, whether taxable or nottaxable, to its share holders in proportion to his share holding in the company. Dividend also includesdeemed dividend.

The following payments are deemed as dividend.a) any distribution entailing the release of companys assetsb) any distribution of debentures, debenture stock, deposit certificatesc) distribution on liquidation of companyd) distribution on reduction of capital

e) any payment by way of loan or advance by a closely held company

Dividend distributed or paid by a domestic company after 31-3-2003 is not taxable in the handsof the shareholder under sec10 (34). On such dividend, the dividend declaring company has to pay tax.But deemed dividend under sec2 (22) is taxable in the hand of the share holders.

Interest on securities:Interest on securities is charged to tax under this head if the securities are held by the

assessee as fixed assets. If the securities are held as stock in trade then the interest is taxable underthe head profit and gains of business or profession. The gross interest (net interest plus tax deductedat source) is taxable. If net interest is given, it should be grossed up in the hands of recipient if tax isdeducted at source by the payer.

Net interest X 100100- Rate of TDS

No Particulars TDS Rate1 Interest on any security of central or state government No TDS2 Interest on debentures listed in a recognized stock exchange,

statutory bodies and local authority10%

3 Any other interest on security[unlisted] 20%4 Winnings from lottery, crossword puzzles, card games, horse race etc 30%

For the purpose of income tax purpose, the securities can be classified into

1. Government securities:a. Tax-free securities

i. Interest fully exemptedii. Not included in the total income

b. Less- tax securitiesi. Issued by central govt. or state govt.ii. Non TDSiii. Taxable securitiesiv. Interest received should not be grossed up

2. Commercial securitiesa. Tax-free securities

i. Local authority, statutory corporation and company issues in the from of

debentures and bondii. Tax is paid by the issueriii. Since tax is paid by the issuer it is termed as tax-free securitiesiv. Interest should be grossed up

b. Less tax commercial securitiesi. Taxable securitiesii. TDS is collectediii. Interest should be grossed up if net amount is given

Royalties:(Sometimes, running royalties, or private sector taxes) are usage-based payments made by one

party (the "licensee") and another (the "licensor") for ongoing use of an asset, sometimes

an intellectual property (IP). Royalties are typically agreed upon as a percentage of gross or netrevenues derived from the use of an asset or a fixed price per unit sold of an item of such.

Royalty income of authors [u/s Sec 80 QQB]This deduction is allowable up to maximum Rs. 3.00,000 for a resident individual. Assessee

should furnish a certificate in Form 10CCD from the person responsible for paying the person

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

12/15

responsible for paying the income. The book authored by him/her is a work of literary, artistic orscientific nature and it does not include guides, textbook of schools and other similar publication.

Royalty on Patents [Sec 80 RRB] This deduction is allowable up to, Rs.300000 or actual amount (which ever is less) for a

resident individual. The assessee should furnish a certificate in Form 10 CCE duly signed by controllerof Patents Act along with the return of income. If it is received from outside India the income shouldbrought into India in convertible foreign exchange within 6 months from the end of the relevant PY.

Q4) Company A is proposed to be merged with company B . the following are the particularsof the former company

Unabsorbed depreciation Rs. 45600000.00Unabsorbed business loss Rs. 145000.00

Consider which of the benefit can be availed of by the company and advice the latter on theconditions to be fulfilled to claim each such benefit.

ANS:

Q5) Discuss the provisions relating to set off of losses in the following cases:

i) Speculation lossii) Short term capital lossiii) Long term capital lossiv) Losses from horse race, gambling and cross word puzzles

ANS:

i) Speculation Loss: Any loss from speculation business can only be set off from another speculation

business income, not from general business income. Although general business can be set off againstthe income from general business as well as from speculation business. Further, loss incurred from

speculation loss (e.g. from shares or commodities) cannot be set off against any other income. Also, it

is unlikely that the benefit of set off of loss under an activity or source will be available, where the

income from an activity or source is exempt from taxation.

ii) Short term capital loss: These losses can only be set off against the Capital Gains (Both Short

Term & Long Term).

iii) Long term capital loss:LTCL can only be set off against Long Term Capital Gains and cannot be

set off against Short Term Capital Gains.

iv) Losses from horse race, gambling and cross word puzzles: Ifthere is a loss from horse race thenit cannot be set off from other horse income.

And also, No loss can be set-off against casual income i.e. Income from lotteries, cross wordpuzzles, betting gamblingand other similar games.

Q6) what are the deductions available from gross salary income?

ANS: These deduction are as follows:

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

13/15

1. Entertainment Allowance2. Tax On Employment3. Deduction U/S 80c Out Of Gross Total Income

4. Deduction Of Tax From The Salary

1. Entertainment Allowance [ U/s 16(ii)]Some employees are required to incur expenditure on the entertainment ( tea etc.) of customers,

clients etc. who came to meet them in connection with their official or business work. In caseemployee is given a fixed amount every month to meet this type of expenditure then it is fully addedin salary and out of Gross total Salary , a deduction u/s 16(ii) shall be allowed only to Govt.employees.This means that in case this allowance is given to employee working in private sector, it is fullytaxable.But in case any amount is reimbursed against any expenditure incurred by employer, it shall be fullyexempted.Deduction u/s 16(ii) admission to govt. employee shall be an amount equal to least of following:

1. Statutory Limit of Rs.5,000 p.a.2. 1/5 th of Basic Salary3. Actual amount of entertainment allowance received during the previous year.

2. Tax on Employment u/s 16(iii)In case any amount of professional tax is paid by the employee or by his employer on his behalf it isfully allowed as deduction.

3. Deduction U/S 80c Out Of Gross Total Income

Savings play a vital role in the fast economic development of nay country. To encourage savings, anincentive in the form of a deduction out of ones taxable income has been allowed. To channelisethose savings, various schemes have been framed and if the assessee deposits those savings in theseapproved saving schemes, a deduction shall be allowed.

Section 80C has been inserted from the assessment year 2006-2007 onwards. Section 80C providesdeduction i8n respect of specified qualifying amounts paid deposited by the assessee in the previousyear.

The following are the main provisions of the newly inserted Section 80C. :

1. Under Section 80C , deduction would be available from Gross Total Income.

2. Deduction under section 80C is available only to individual or HUF.3. Deduction is available on the basis of specified qualifying investments / contributions /deposits / payments made by the taxpayer during the previous year.

4. The maximum amount deduction under section 80C , 80CCC, and 80CCD can not exceed Rs.1lakh.

Deduction u/s 80C shall be allowed only to the following assessee :

1. An Individual2. A Hindu Undivided Family (HUF)

The Deduction is calculated as per the following steps

Step-1: Gross qualifying Amount which is the aggregate of the following

1. Life Insurance Premium2. Payment in respect of non-commutable deferred annuity.

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

14/15

3. Any sum deducted form salary payable to Govt. employee for the purpose of securinghim a deferred annuity.

4. Contribution towards Statutory Provident Fund and Recognised Provident Fund.5. Contribution towards 15-year Public Provident Fund6. Contribution towards an Approved Superannuation Fund.7. Subscription to National Saving Certificates, VIII Issue.8. Contribution for participating in the Unit-linked Insurance Plan (ULIP) of UTI.9. Contribution for participating in the Unit-linked Insurance Plan (ULIP) of LIC Mutual

Fund.

10. Payment to notified annuity plan of LIC11. Subscription towards notified Units of Mutual Fund or UTI.12. Contribution to notified Pension Fund set up by Mutual Fund or UTI.13. Any sum paid as subscription to Home Loan Account Scheme of the National Housing

Bank.14. Any sum paid as Tuition Fees for full time education of any 2 children of an individual.15. Any payment towards the cost of purchase / construction of a residential Property.16. Amount invested in approved Debenture of , and equity shares in, public company

engaged in infrastructure.17. Amount deposited in as Term Deposit for a period of 5 years or more in accordance

with a scheme framed by the Government.18. Subscription to any notified Bonds of National Bank for Agriculture and Rural

Development ( NABARD)19. Amount deposited under Senior Citizens Saving Scheme.20. Amount deposited in 5 Year Time Deposit in Post Office.

Step-2: Net Qualifying Amount :

Deduction u/s 80C is available on the basis of Net Qualifying Amount which is determined as under

1. Gross Qualifying Amount ; or2. Rs. 1,00,000

Whichever is LESS.

Step-3: Amount of Deduction:

Amount Deduction u/s 80C is computed as under:

1. Net Qualifying Amount ; or2. Rs. 1,00,000

Whichever is LESS.

The aggregate deduction u/s 80C, 80CCC, and 80 CCD can not exceed Rs. 1,00,000.

4. DEDUCTION OF TAX FROM THE SALARY [SECTION-192]The summarized provisions of Sec. 192 are given below :

Who is the taxpayer Employer

Who is the recipient Employee

Payment covered Taxable salary of the employee

At what time tax has to be deducted atsource

At the time of payment

Maximum amount which can be paidwithout Tax Deduction

The amount of exemption limit ( i.e.Rs.1,80,000 / Rs.2,25,000/Rs.1,50,000 for theassessment year 2009-10.)

Rate of tax deducted at source Normal Rates applicable to an individual

-

7/31/2019 43263932-MF0012--Taxation-Management(1)

15/15

Is it possible to get the payment without taxdeduction or with lower tax deduction

The employee can make an application inForm No.-13 to the Assessing Officer to get acertificate of lower tax deduction or no taxdeduction.

Note: - Rs. 1,80,000 is for Resident Women below 65 years

- Rs. 2,25,000 is for Senior Citizen 65 years or more.

RELIEF IN RESPECT OF SALARY IN ARREARS, ADVANCE, ETC.If an individual receives any portion of his salary in arrears or in advance or receives profit in lieu ofsalary, he can claim relief in terms of Sec.89