3rd Quarter 2011 Commercial Newsletter

-

Upload

david-bloodworth -

Category

Documents

-

view

218 -

download

2

description

Transcript of 3rd Quarter 2011 Commercial Newsletter

K W Commercial Lubbock

Industrial - Land - Multifamily - Office - Retail

www.kwcommercial-lubbock.com

3rd Quarter 2011

Serving West Texas

Industrial - Land - Multifamily - Office - Retail

Cost Segregation: Benefits to a Commercial Property Owner

Tremendous Income Tax Savings Available To Commercial and Multi Family Building Owners With Engineered Cost Segregation Studies Commercial building and multi-family property owners are pocketing significant cash by using a popular asset depreciation technique called cost segregation.The tremendous income tax savings created by a engineered cost segregation study generates an average of $25,000 to $50,000 of income tax savings or refunds per half million dollars in building cost. Cost segregation can be applied retroactively on buildings built, purchased, or improved since January 1, 1987. These savings can be applied to the current tax year or prior tax year (if extension was filed) with-out amending the returns. How Did Cost Segregation Come About? Cost segregation came about in 1997 with the landmark tax court case Hospital Corporation of America (HCA) vs. IRS. Prior to the tax court's ruling, buildings had to be depreciated over 39 years. With the favorable HCA decision, qualified building components can now be depreciated over five, seven, and fifteen years. The result of this faster depreciation is tremendous tax savings and increased cash flow. How Does The IRS View Cost Segregation? According to a recent article published by the nationally recognized Texas A @ M Real Estate Center: “Favorable court decisions as well as recent tax law revisions and IRS pronouncements have completely blessed cost seg” What Does The Texas Society of CPA’s Say About cost Segregation? According to a article published in the Texas Society of CPA’s magazine Today’s CPA: “Cost Segregation is one of the most valuable tax planning strategies available to commercial building owners today” Can Cost Segregation Studies Be Performed On Existing Properties Purchased In Prior Years? According to an article published by the Texas A @ M Real Estate Center: “Even better, cost segregation (cost seg) can provide a large immediate cash flow for currently owned properties acquired in prior years. Re-cent changes in the tax law and cost seg techniques make this immediate benefit possible.” What Is The American Institute of Certified Public Accountants Opinion Of Cost Segregation? The following comments were published by the American Institute of Certified Public Accountants in a white paper on cost segregation: “Instead, due to the time value of money, the advantage of these front loaded deductions will be quantifiably greater than had the deductions been spread over longer periods of time using slower depreciation methods” and “CPA’s should routinely recommend that their clients or employers use cost segregation” Continued next page

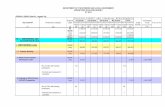

Why Hasn't My CPA Recommended Cost Segregation? Many CPAs are aware of cost segregation but have not recommended it to their clients because a cost segregation study requires engineering exper-tise. CPA’s in the past have not had a qualified engineering firm with which to work to get the studies done for their clients. Furthermore, in the past, studies have been prohibitively expensive. But Cost Segregation Services Inc. has made it cost effective for taxpayers with buildings as low as $150,000 in building cost to pay the study fee and receive the income tax benefits. Typical Savings Overview for a Commercial Building Faculty placed in service: 2008 Original depreciation method: 39-year life, straight line method

Who Qualifies for a Cost Segregation Study? Any commercial property that has been purchased, constructed, or had leasehold improvements since January 1, 1987 qualifies for cost segregation. Continued next page

Building Cost $ 2,150,000

Date Acquired April 2008

Tax Year: 2011 2012 2015

Current Method Accumulated Depreciation Reported 39 year straight line method $ 204,487 $ 259,613 $ 424,991

Alternative Method Cost Segregation Study Accumulated Depreciation 5 yr. $ 302,342 $ 344,447 $ 365,500 15 yr. $ 39,661 $ 48,596 $ 71,871 39 yr. $ 157,455 $ 199,902 $ 327,243 Total $ 499,457 $ 592,944 $ 764,614

Results for Tax Year: 2011 2012 2015 Increased Accumulated Depreciation Expense $ 294,971 $ 333,332 $ 339,623 Tax Rate (Estimated) 36.0% 36.0% 36.0%

Estimated Accumulated Tax Savings Benefit $ 106,189 $ 119,999 $ 122,264

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

Does the Taxpayer Have to Amend Their Returns to Apply Cost Segregation? The taxpayer does not have to amend their returns to apply the results of a cost segregation study. The taxpayers CPA files a 3115 change of account-ing form with the tax return and according to a American Institute of Certified Public Accountants whitepaper on engineered cost segregation the 3115 is “granted automatically” by the IRS. What Percentage of My Building's Construction Costs Can Be Reclassified? According to a June 2009 article published by the Texas Society of CPAs, 10-60% of a buildings construction costs can be reclassified from 39 year real property to 5, 7, or 15-year property. What are Some of the Components that Can Be Reclassified to 5, 7, and 15-year Depreciation? A partial list of components typically seen in an engineered cost segregation study includes: 5-year: cabinets and millwork, communication/electrical equipment, drive-up windows, wall finishings, glass window walls, interior partitions and walls, moldings, misc steel products 7-year: pneumatic tube systems, projection screens,

What Do I Look for When Selecting a Cost Segregation Firm? When selecting a company to hire for the cost segregation, ask for case studies of previous properties they have completed and the amount saved. Building owners should also insist on a preliminary estimate of the income tax benefit, dollar amounts of depreciation reclassified, and the cost of the study before deciding to proceed with the actual study.

About the author: David DeLamar is an senior consultant and manager for Cost Segregation Services Inc. , a engineering firm specializing in cost seg-regation studies nationwide. David can be reached at 806.773.6382 or emailed at [email protected]. David provides all of his clients with a no cost conservative estimate on the income tax benefit as well as the cost of a study.

15-year: site preparation and drainage, sidewalks and curbs, landscaping, exterior signage, parking lot, temporary power, driveways, misc foundations

Cost segregation is gaining momentum among building owners and purchasers nationwide as a way to produce significant income tax savings and posi-tive cash flow. Those same building owners can use those tax savings for other real estate purchases, pay down debt, make improvements or invest as they see fit. Astute building owners across the country are giving serious consideration to the application of engineered cost segregation and its positiveoutcomes.

Industrial - Land - Multifamily - Office - Retail

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

Congratulations!!!

We want to congratulate SERVPRO of South-west Lubbock and The Ben E. Keith Company on their new office space. SERVPRO is located at 6101 43rd Street and Ben E. Keith’s new location is 411 E. 66th Street. Happy Anniversary to The Exchange! Kristen Miranda and Alyssa Villanueva opened this high end resale boutique at 5412 Slide Road, #500 last August and have had a very good first year in business. We wish continued success for all three of these businesses. KW Commercial represented all three businesses in their lease transactions.

Industrial - Land - Multifamily - Office - Retail

Featured Retail Properties 3442 West Loop 289

7455 West 19th Street

7455 West 19th Street

The building is an approximately 9,500 square foot building currently used as a furniture showroom and warehouse. It was built in 2004 using engineered foam panels that provide superior energy efficiency. There is one overhead door with dock high access in the back of the building. This property is located between Lubbock and Reese Center on the south side of west 19th Street. There is easy access from Loop 289 as well as from Wolfforth and Levelland.

3442 West Loop 289

This is a 2332 square foot retail space that is part of a 13,000 square foot center on the West Loop. The space has a large carpeted showroom area, three private offices and an ADA compliant restroom. The center’s current tenants in-clude Down Memory Lane Scrapbook Store and The Kid’s Connection children’s consignment store. This property is on the West Loop access road between 34th Street and Marsha Sharp Freeway.

Lubbock Commercial Real Estate at KW “Like” us on Facebook at Lubbock Commercial Real Estate at KW. Watch us on YouTube at

lbkcomreatkw. Join us on LinkedIn. Check out our listings on Craigslist. Learn more at www.lubbockcommercialrealestateatkw.com

1602 Texas Avenue 9,425 SF Office Building

For Sale $150,000

OFFICE BUILDING

RETAIL CENTER

RETAIL SPACE

LUBBOCK COMMONS 6319 82nd Street

12,102 SF Sold

ULOFTS 1001 University Ave

1,050 SF For Lease $14.50 PSF NNN

FREE STANDING RETAIL BUILDING 2513 82nd St

6,656 SF For Lease $15.00 PSF NNN

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

RETAIL BUILDING

SOLD

SOLD

OFFICE BUILDING

OFFICE WAREHOUSE

OFFICE BUILDING 2124 15th Street

1860 SF For Lease $ 8.00 PSF

OFFICE WAREHOUSE 2212 Clovis Highway

Over 11,000 SF Available For Lease

Industrial - Land - Multifamily - Office - Retail

LAND

LAKE ALAN HENRY LAND

4,000 SF For Sale $480,000.00

ENCLAVE OFFICE BUILDING 5012 50th Street

3,400 SF For Lease $14.00 PSF Full Service

OFFICE BUILDING

LEASED

OFFICE LAND

MULTI FAMILY

OFFICE LAND 8240 Boston Avenue

45,133 SF For Sale $121,390 $ 2.69 psf

ULOFTS 1001 University Ave

1,420 SF For Lease $12.50 PSF NNN

VILLA APARTMENTS 2301 51st Street

36 Units For sale $1,000,000

RETAIL SPACE

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

LAKE STORE

LAKE ALAN HENRY STORE Justiceburg, TX

4,000 SF For Sale $320,000.00

LEASED WAREHOUSE UNITS 8602 Ashe

28 units For Sale $1,200,000

WAREHOUSE

RETAIL SPACE LAND

MULTI FAMILY

HICKORY TREE APARTMENTS 1629 16TH

90 Units For Sale $999,000

ULOFTS 1001 University Ave

3,000 SF For Lease $12.50 PSF NNN

DEVELOPMENT LAND 6420 4th Street

296,712 SF For Sale $1,483,560 $5.00 psf

Industrial - Land - Multifamily - Office - Retail

2218 BROADWAY 2,858 SF Office Building

For Sale $241,000

OFFICE BUILDING

LAND OFFICE WAREHOUSE

RETAIL SPACE

DEVELOPMENT LAND 82nd and Alcove

164,657 SF For Sale $975,484 $5.92 psf

RETAIL SPACE 57th and Slide

2,788 SF Leased

1725 E. 50th St 4,393 SF Office/Warehouse

For Sale $100,000

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

Subject Property SOLD

LEASED

LAND RETAIL BUILDING

RURAL LAND MULTI FAMILY

TOLEDO COURTS APARTMENTS 306 Toledo Avenue 70 Units For Sale

$2,000,000

DEVELOPMENT LAND 5902 4th Street

152,600 SF For Sale $604,633 3.96 psf

RURAL LAND CR6300 AND FM 2378 159.7 Acres For Sale

$320,000

FREESTANDING RETAIL BUILDING 2531 82ND Street

6,656 SF For Sale $850,000

Industrial - Land - Multifamily - Office - Retail

Reese Redevelopment

SUBJ EC T

SUBJECT

FM2378

Hwy 114

LAND OFFICE BUILDING

RANCH LAND MULTI FAMILY

LYNNWOOD TOWNHOMES 306 Toledo Avenue

314 Units For Sale $63,000,000

DEVELOPMENT LAND Shallowater, TX

18.46 Acres For Sale $185,000

MULESHOE HUNTING RANCH South of Muleshoe-West of HWY 84

2600 acres For Sale $ 1,947,675 $750 per acre

ENCLAVE OFFICE BUILDING 5012 50th Street

For Sale Call Agent for Price

Subject

High School

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

LAND

Commercial Hard Corner Northwest Corner 4th and Alcove

2 Acres For Sale $495,000

Commercial Development Land 19th and Milwaukee Ave. 3.97 Acres For Sale

$997,825 LAND

OFFICE BUILDING

DOWNTOWN REDEVELOPMENT

OFFICE BUILDING 4913 S Loop 289

17,928 SF For Sale $1,695,000

Green/Cobb Building 1215 Avenue J

70,430 SF For Sale $750,000

Industrial - Land - Multifamily - Office - Retail

4747 S. Loop 289 Suite 110, Lubbock, TX 79424 - office 806.771.7701 www.lubbockcommercialrealestateatkw.com

2156 50th Street 4,850 SF Retail Building

Leased

RETAIL BUILDING

LEASED Leasing Brokerage Investments Land Development Tenant Representation Lease vs. Buy Analysis

RETAIL CENTER

LUBBOCK COMMONS 6319 82nd Street

2256 SF Retail Space Leased

Leased

COMMERCIAL REAL ESTATE QUESTIONS ?

David Bloodworth, CCIM Managing Director/Commercial Brokerage and Leasing - Retail and Office Specialization 806.771.7701 office 806.632.3244 cell 806.771.7700 fax [email protected]

Julie Childs Commercial Brokerage and Leasing - Retail and Office Specialization 806.771.7701 office 806.441.1481 cell 806.771.7700 fax [email protected]

KW Commercial = Answers

Retail Office Land Industrial Multi-Family Hospitality Shopping Centers Net Investment Properties Special Purpose

Industrial - Land - Multifamily - Office - Retail