39416312 Central Bank

-

Upload

rahul-bidasaria -

Category

Documents

-

view

220 -

download

0

Transcript of 39416312 Central Bank

-

8/8/2019 39416312 Central Bank

1/33

CENTRAL BANK AND ITSFUNCTIONS

CREDIT POLICY AND ITS

IMPLICATIONS

SUBMITTED TO:

MRS. SONIA SINGH

-

8/8/2019 39416312 Central Bank

2/33

PRESENTED BY:

MBA (M & S) Sec A

Priyanka Mattoo 06

Ridhima Gupta 08 Prateek Sharma 13

Arneetbir Singh 33

Vipsa Mahipal 37

Ritika Pal 40

Eklavya Aatray 41

Sidhanshu Dhall 49

-

8/8/2019 39416312 Central Bank

3/33

PREFACE

The project on Central Bank and its functions, Credit policy and its implications is designed

to provide the reader with an insight into the various functions of the RBI and the credit

policy and its implications. The subject matter is very comprehensive and gives the idea of

the few aspects of central bank.

OBJECTIVE Since we all are MBA students and are aspiring to be managers,knowing about the various aspects of The Reserve Bank of India is an important part of our

studies. This project will help in understanding all the factors.

METHODOLOGY The project starts with giving an introduction of theCentral bank and its activities. Then it explains the functions of The RBI along with the

implications of the credit policy.

-

8/8/2019 39416312 Central Bank

4/33

INDEX

SR.

NO.

CONTENTS PAGE NO.

1. CENTRAL BANK AND ITS ACTIVITIES 05

2. THE CENTRAL BANK OF INDIA (RBI)

3. HISTORY

4. STRUCTURE

5. FUNCTIONS

6. CREDIT POLICY

-

8/8/2019 39416312 Central Bank

5/33

CENTRAL BANK

A central bank, reserve bank, or monetary authority is a banking institution granted the

exclusive privilege to lend a government its currency. However, a central bank is

distinguished from a normal commercial bank because it has a monopoly on creating the

currency of that nation, which is loaned to the government in the form of legal tender. It is a

bank that can lend money to other banks in times of need.

Its primary function is to provide the nation's money supply, but more active duties include

controlling subsidized-loaninterest rates, and acting as a lender of last resort to thebanking

sectorduring times of financial crisis (private banks often being integral to the national

financial system). It may also have supervisory powers, to ensure that banks and other

financial institutions do not behave recklessly or fraudulently.

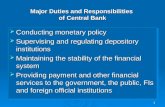

Activities and responsibilities

Functions of a central bank (not all functions are carried out by all banks):

implementing monetary policy

determining Interest rates

controlling the nation's entire money supply the Government's banker and the bankers' bank ("lender of last resort")

managing the country'sforeign exchange and gold reserves and the Government's

stock register

regulating and supervising the banking industry

setting the official interest rate used to manage bothinflationand the country's

exchange rate and ensuring that this rate takes effect via a variety of policy

mechanisms

http://en.wikipedia.org/wiki/Bankinghttp://en.wikipedia.org/wiki/Currencyhttp://en.wikipedia.org/wiki/Money_supplyhttp://en.wikipedia.org/wiki/Loanhttp://en.wikipedia.org/wiki/Interest_rateshttp://en.wikipedia.org/wiki/Lender_of_last_resorthttp://en.wikipedia.org/wiki/Bankhttp://en.wikipedia.org/wiki/Bankhttp://en.wikipedia.org/wiki/Foreign_exchange_markethttp://en.wikipedia.org/wiki/Foreign_exchange_markethttp://en.wikipedia.org/wiki/Gold_reserveshttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/Exchange_ratehttp://en.wikipedia.org/wiki/Exchange_ratehttp://en.wikipedia.org/wiki/Bankinghttp://en.wikipedia.org/wiki/Currencyhttp://en.wikipedia.org/wiki/Money_supplyhttp://en.wikipedia.org/wiki/Loanhttp://en.wikipedia.org/wiki/Interest_rateshttp://en.wikipedia.org/wiki/Lender_of_last_resorthttp://en.wikipedia.org/wiki/Bankhttp://en.wikipedia.org/wiki/Bankhttp://en.wikipedia.org/wiki/Foreign_exchange_markethttp://en.wikipedia.org/wiki/Gold_reserveshttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/Exchange_rate -

8/8/2019 39416312 Central Bank

6/33

CENTRAL BANK OF INDIA

Established in 1911, Central Bank of India was the first Indian commercial bank which was

wholly owned and managed by Indians. The establishment of the Bank was the ultimate

realisation of the dream of Sir Sorabji Pochkhanawala, founder of the Bank. Sir Pherozesha

Mehta was the first Chairman of a truly 'Swadeshi Bank'. In fact, such was the extent of pride

felt by Sir Sorabji Pochkhanawala that he proclaimed Central Bank of India as the 'property

of the nation and the country's asset'. He also added that 'Central Bank of India lives on

people's faith and regards itself as the people's own bank'. The central bank of the country is

the Reserve Bankof India (RBI). It was established in April 1935 with a share capital of Rs.

5 crores on the basis of the recommendations of the Hilton Young Commission. The share

capital was divided into shares of Rs. 100 each fully paid which was entirely owned by

private shareholders in the beginning. The Government held sharesof nominal value of Rs.

2,20,000.

Reserve Bank of India was nationalised in the year 1949. The general superintendence and

direction of the Bank is entrusted to Central Board of Directors of 20 members, the Governor

and four Deputy Governors, one Government official from the Ministry of Finance, ten

nominated Directors by the Government to give representation to important elements in the

economic life of the country, and four nominated Directors by the Central Government to

represent the four local Boards with the headquarters at Mumbai, Kolkata, Chennai and New

Delhi. Local Boards consist of five members each Central Government appointed for a term

of four years to represent territorial and economic interests and the interests of co-operativeand indigenous banks. During the past 99 years of history the Bank has weathered many

storms and faced many challenges. The Bank could successfully transform every threat into

business opportunity and excelled over its peers in the Banking industry. Further in line with

the guidelines from Reserve Bank of India as also the Government of India, Central Bank has

been playing an increasingly active role in promoting the key thrust areas of agriculture,

small scale industries as also medium and large industries. The Bank also introduced a

number of Self Employment Schemes to promote employment among the educated youth.

The RBI was first established in 1935 and is responsible for setting the overnight interbank

lending rate and creating financial stability in the country. This overnight rate is known as

the Mumbai Interbank Offer Rate (MIBOR) and it serves as the benchmark for interest rates

in India. Without the RBI, the credit markets would not function properly and the flow of

currency in the country would dry up.

http://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://www.mysmp.com/world-markets/bombay-stock-exchange.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://www.mysmp.com/world-markets/bombay-stock-exchange.html -

8/8/2019 39416312 Central Bank

7/33

Preamble

The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank

as:

"...to regulate the issue of Bank Notes and keeping of reserves with a view to securing

monetary stability in India and generally to operate the currency and credit system of the

country to its advantage."

Corporate vision

To emerge as a strong, vibrant and pro-active Bank/Financial Super Market and to positively

contribute to the emerging needs of the economy through consistent harmonization of human,

financial and technological resources and effective risk control systems.

Corporate mission

To transform the customer banking experience into a fruitful and enjoyable one.

To leverage technology for efficient and effective delivery of all banking services.

To have bouquet of product and services tailor-made to meet customers aspirations.

The pan-India spread of branches across all the state of the country will be utilized tofurther the socio economic objective of the Government of India with emphasis on

Financial Inclusion.

Central Bank of India, a government-owned bank, is one of the oldest and largest commercial

banks in India based in Mumbai. The bank currently has 3,563 branches and 270 extension

counters across 27 Indian states.

Mr S Sridhar has been appointed as the Chairman and Managing Director of state-run

Central Bank of India as on 2 March 2009.

Central bank of India is one of 18 Public Sector banks in India to get recapitalisation

finance from the government over the next 24 months. The infusion of fund will

improve the financial health of the banks as their capital adequacy ratio (CAR) will be

raised more than desired level of 12 percent. The increase in CAR of the banks will

also enable them to lend more money.

The wholly-owned public sector bank, based in Mumbai, will convert an amount of

Rs. 800 crore out of its Rs. 1,124.14-crore total equity capital into perpetual non-

cumulative preference shares.

http://en.wikipedia.org/wiki/Indiahttp://en.wikipedia.org/wiki/Mumbaihttp://en.wikipedia.org/wiki/Indiahttp://en.wikipedia.org/wiki/Mumbai -

8/8/2019 39416312 Central Bank

8/33

-

8/8/2019 39416312 Central Bank

9/33

HISTORY

1935 - 1950

The central bank was founded in 1935 to respond to economic troubles after the First World

War. The Reserve Bank of India was set up on the recommendations of the Hilton Young

Commission. The commission submitted its report in the year 1926, though the bank was not

set up for another nine years. The Preamble of the Reserve Bank of India describes the basic

functions of the Reserve Bank as to regulate the issue of bank notes, to keep reserves with a

view to securing monetary stability in India and generally to operate the currency and credit

system in the best interests of the country. The Central Office of the Reserve Bank was

initially established in Kolkata, Bengal, but was permanently moved to Mumbai in 1937. The

Reserve Bank continued to act as the central bank forMyanmartill Japanese occupation of

Burma and later up to April 1947, though Burma seceded from the Indian Union in 1937.

After partition, the Reserve Bank served as the central bank forPakistan until June 1948

when the State Bank of Pakistan commenced operations. Though originally set up as a

shareholders bank, the RBI has been fully owned by the government of India since its

nationalization in 1949.

1950 - 1960

Between 1950 and 1960, the Indian government developed a centrally planned economic

policy and focused on the agricultural sector. The administration nationalized commercial

banksand established, based on the Banking Companies Act, 1949 (later called Banking

Regulation Act) a central bank regulation as part of the RBI. Furthermore, the central bank

was ordered to support the economic plan with loans.

1960 - 1969

As a result of bank crashes, the reserve bank was requested to establish and monitor a deposit

insurance system. It should restore the trust in the national bank system and was initialized on

7 December 1961. The Indian government founded funds to promote the economy and used

the slogan Developing Banking. The Gandhi administration and their successors restructured

the national bank market and nationalized a lot of institutes. As a result, the RBI had to play

the central part of control and support of this public banking sector.

http://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/Bengalhttp://en.wikipedia.org/wiki/Mumbaihttp://en.wikipedia.org/wiki/Myanmarhttp://en.wikipedia.org/wiki/Japanhttp://en.wikipedia.org/wiki/Burmahttp://en.wikipedia.org/wiki/Pakistanhttp://en.wikipedia.org/wiki/State_Bank_of_Pakistanhttp://en.wikipedia.org/wiki/Government_of_Indiahttp://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/Bengalhttp://en.wikipedia.org/wiki/Mumbaihttp://en.wikipedia.org/wiki/Myanmarhttp://en.wikipedia.org/wiki/Japanhttp://en.wikipedia.org/wiki/Burmahttp://en.wikipedia.org/wiki/Pakistanhttp://en.wikipedia.org/wiki/State_Bank_of_Pakistanhttp://en.wikipedia.org/wiki/Government_of_India -

8/8/2019 39416312 Central Bank

10/33

19691985

Between 1969 and 1980 the Indian government nationalized 20 banks. The regulation of the

economy and especially the financial sector was reinforced by the Gandhi administration and

their successors in the 1970s and 1980s. The central bank became the central player andincreased its policies for a lot of tasks like interests, reserve ratio and visible deposits. The

measures aimed at better economic development and had a huge effect on the company

policy of the institutes. The banks lent money in selected sectors, like agri-business and small

trade companies.

The branch was forced to establish two new offices in the country for every newly

established office in a town.The oil crises in 1973 resulted in increasing inflation, and the

RBI restricted monetary policy to reduce the effects.

19851991

A lot of committees analysed the Indian economy between 1985 and 1991. Their results had

an effect on the RBI. The Board for Industrial and Financial Reconstruction, the Indira

Gandhi Institute of Development Research and the Security & Exchange Board of India

investigated the national economy as a whole, and the security and exchange board proposed

better methods for more effective markets and the protection of investor interests. The Indian

financial market was a leading example for so-called "financial repression" (Mackinnon uand

Shaw). The Discount and Finance House of India began its operations on the monetary

market in April 1988; the National Housing Bank, founded in July 1988, was forced to invest

in the property market and a new financial law improved the versatility of direct deposit by

more security measures and liberalisation.

19912000

The national economy came down in July 1991 and the Indian rupee was devalued. The

currency lost 18% relative to the US dollar, and the Narsimahmam Committee advised

restructuring the financial sector by a temporal reduced reserve ratio as well as the statutory

liquidity ratio. New guidelines were published in 1993 to establish a private banking sector.

This turning point should reinforce the market and was often called neo-liberal. The central

bank deregulated bank interests and some sectors of the financial market like the trust and

property markets. This first phase was a success and the central government forced a

diversity liberalisation to diversify owner structures in 1998.

http://en.wikipedia.org/wiki/Oil_criseshttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/United_States_Dollarhttp://en.wikipedia.org/wiki/Oil_criseshttp://en.wikipedia.org/wiki/Inflationhttp://en.wikipedia.org/wiki/United_States_Dollar -

8/8/2019 39416312 Central Bank

11/33

TheNational Stock Exchange of India took the trade on in June 1994 and the RBI allowed

nationalized banks in July to interact with the capital market to reinforce their capital base.

The central bank founded a subsidiary companythe Bharatiya Reserve Bank Note Mudran

Limitedin February 1995 to produce banknotes.

Since 2000

The Foreign Exchange Management Act from 1999 came into force in June 2000. It should

improve the foreign exchange market, international investments in India and transactions.

The RBI promoted the development of the financial market in the last years, allowed online

banking in 2001 and established a new payment system in 2004 - 2005 (National Electronic

Fund Transfer). The Security Printing & Minting Corporation of India Ltd., a merger of nine

institutions, was founded in 2006 and produces banknotes and coins. The national economy's

growth rate came down to 5,8% in the last quarter of 2008 - 2009 and the central bank

promotes the economic development.

http://en.wikipedia.org/wiki/National_Stock_Exchange_of_Indiahttp://en.wikipedia.org/wiki/Online_bankinghttp://en.wikipedia.org/wiki/Online_bankinghttp://en.wikipedia.org/wiki/National_Electronic_Fund_Transferhttp://en.wikipedia.org/wiki/National_Electronic_Fund_Transferhttp://en.wikipedia.org/wiki/National_Stock_Exchange_of_Indiahttp://en.wikipedia.org/wiki/Online_bankinghttp://en.wikipedia.org/wiki/Online_bankinghttp://en.wikipedia.org/wiki/National_Electronic_Fund_Transferhttp://en.wikipedia.org/wiki/National_Electronic_Fund_Transfer -

8/8/2019 39416312 Central Bank

12/33

STRUCTURE

The Central Board of Directors is the main committee of the central bank and has not more

than 20 members. The government of the republic appoints the directors for a four year term.

Central Board of Directors

Name Position

Duvvuri Subbarao Governor

Shyamala Gopinath Deputy Governor

Usha Thorat Deputy Governor

K. C. Chakrabarty Deputy Governor

Subir Gokarn Deputy Governor

Y. H. Malegam Regional of the West

Suresh D. Tendulkar Regional of the East

U. R. Rao Regional of the North

Lakshmi Chand Regional of the South

H. P. Ranina Lawyer Supreme Court of India

Ashok S. GangulyChairman Firstsource Solutions

Limited

Azim Premji Chairman WIPRO Limited

Kumar Mangalam BirlaChairman Aditya Birla Group of

Companies

Shashi Rajagopalan Advisor

Suresh Neotia former Chairman Ambuja Cement Co.

A. Vaidyanathan Economist, Professor Madras Inst.

Man Mohan SharmaChemist, Professor Mumbai

University

D. JayavarthanaveluChairman Lakshmi Machine Works

Limited

Sanjay Labroo CEO Asahi India Glass Ltd.

http://en.wikipedia.org/wiki/Duvvuri_Subbaraohttp://en.wikipedia.org/wiki/Shyamala_Gopinathhttp://en.wikipedia.org/wiki/Usha_Thorathttp://en.wikipedia.org/w/index.php?title=K._C._Chakrabarty&action=edit&redlink=1http://en.wikipedia.org/wiki/Subir_Gokarnhttp://en.wikipedia.org/w/index.php?title=Y._H._Malegam&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Suresh_D._Tendulkar&action=edit&redlink=1http://en.wikipedia.org/wiki/U._R._Raohttp://en.wikipedia.org/w/index.php?title=Lakshmi_Chand&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=H._P._Ranina&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Ashok_S._Ganguly&action=edit&redlink=1http://en.wikipedia.org/wiki/Azim_Premjihttp://en.wikipedia.org/wiki/Kumar_Mangalam_Birlahttp://en.wikipedia.org/w/index.php?title=Shashi_Rajagopalan&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Suresh_Neotia&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=A._Vaidyanathan&action=edit&redlink=1http://en.wikipedia.org/wiki/Man_Mohan_Sharmahttp://en.wikipedia.org/w/index.php?title=D._Jayavarthanavelu&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Sanjay_Labroo&action=edit&redlink=1http://en.wikipedia.org/wiki/Duvvuri_Subbaraohttp://en.wikipedia.org/wiki/Shyamala_Gopinathhttp://en.wikipedia.org/wiki/Usha_Thorathttp://en.wikipedia.org/w/index.php?title=K._C._Chakrabarty&action=edit&redlink=1http://en.wikipedia.org/wiki/Subir_Gokarnhttp://en.wikipedia.org/w/index.php?title=Y._H._Malegam&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Suresh_D._Tendulkar&action=edit&redlink=1http://en.wikipedia.org/wiki/U._R._Raohttp://en.wikipedia.org/w/index.php?title=Lakshmi_Chand&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=H._P._Ranina&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Ashok_S._Ganguly&action=edit&redlink=1http://en.wikipedia.org/wiki/Azim_Premjihttp://en.wikipedia.org/wiki/Kumar_Mangalam_Birlahttp://en.wikipedia.org/w/index.php?title=Shashi_Rajagopalan&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Suresh_Neotia&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=A._Vaidyanathan&action=edit&redlink=1http://en.wikipedia.org/wiki/Man_Mohan_Sharmahttp://en.wikipedia.org/w/index.php?title=D._Jayavarthanavelu&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Sanjay_Labroo&action=edit&redlink=1 -

8/8/2019 39416312 Central Bank

13/33

Sunanda padmanabhan Government representative

Ashok Chawla Government representative

Offices and branches

The Reserve Bank of India has branch offices at most state capitals and at a few major cities

in India[total of 18 places] - viz. Ahmedabad, Bangalore,Bhopal, Bhubaneswar,Chandigarh,

Chennai, Delhi, Guwahati,Hyderabad, Jaipur,Jammu, Kanpur, Kolkata, Lucknow,Mumbai,

Nagpur, Patna, and Thiruvananthapuram. Besides it has sub-offices at Dehradun, Gangtok,

Kochi, Panaji, Raipur, Ranchi, Shimla and Srinagar.

The Bank has also two training colleges for its officers, viz. Reserve Bank Staff College atChennai and College of Agricultural Banking at Pune. There are also fourZonal Training

Centres at Belapur,Chennai,Kolkata andNew Delhi.

FUNCTIONS OF RESERVE BANK OF

INDIA

Bank of Issue

http://en.wikipedia.org/w/index.php?title=Sunanda_padmanabhan&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Ashok_Chawla&action=edit&redlink=1http://en.wikipedia.org/wiki/Ahmedabadhttp://en.wikipedia.org/wiki/Bangalorehttp://en.wikipedia.org/wiki/Bhopalhttp://en.wikipedia.org/wiki/Bhubaneswarhttp://en.wikipedia.org/wiki/Chandigarhhttp://en.wikipedia.org/wiki/Chennaihttp://en.wikipedia.org/wiki/Delhihttp://en.wikipedia.org/wiki/Guwahatihttp://en.wikipedia.org/wiki/Hyderabad,_Indiahttp://en.wikipedia.org/wiki/Jaipurhttp://en.wikipedia.org/wiki/Jammuhttp://en.wikipedia.org/wiki/Kanpurhttp://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/Lucknowhttp://en.wikipedia.org/wiki/Mumbaihttp://en.wikipedia.org/wiki/Nagpurhttp://en.wikipedia.org/wiki/Patnahttp://en.wikipedia.org/wiki/RBI_Thiruvananthapuramhttp://en.wikipedia.org/wiki/Dehradunhttp://en.wikipedia.org/wiki/Gangtokhttp://en.wikipedia.org/wiki/Kochihttp://en.wikipedia.org/wiki/Panajihttp://en.wikipedia.org/wiki/Raipurhttp://en.wikipedia.org/wiki/Ranchihttp://en.wikipedia.org/wiki/Shimlahttp://en.wikipedia.org/wiki/Srinagarhttp://en.wikipedia.org/wiki/Punehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Chennaihttp://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/New_Delhihttp://en.wikipedia.org/w/index.php?title=Sunanda_padmanabhan&action=edit&redlink=1http://en.wikipedia.org/w/index.php?title=Ashok_Chawla&action=edit&redlink=1http://en.wikipedia.org/wiki/Ahmedabadhttp://en.wikipedia.org/wiki/Bangalorehttp://en.wikipedia.org/wiki/Bhopalhttp://en.wikipedia.org/wiki/Bhubaneswarhttp://en.wikipedia.org/wiki/Chandigarhhttp://en.wikipedia.org/wiki/Chennaihttp://en.wikipedia.org/wiki/Delhihttp://en.wikipedia.org/wiki/Guwahatihttp://en.wikipedia.org/wiki/Hyderabad,_Indiahttp://en.wikipedia.org/wiki/Jaipurhttp://en.wikipedia.org/wiki/Jammuhttp://en.wikipedia.org/wiki/Kanpurhttp://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/Lucknowhttp://en.wikipedia.org/wiki/Mumbaihttp://en.wikipedia.org/wiki/Nagpurhttp://en.wikipedia.org/wiki/Patnahttp://en.wikipedia.org/wiki/RBI_Thiruvananthapuramhttp://en.wikipedia.org/wiki/Dehradunhttp://en.wikipedia.org/wiki/Gangtokhttp://en.wikipedia.org/wiki/Kochihttp://en.wikipedia.org/wiki/Panajihttp://en.wikipedia.org/wiki/Raipurhttp://en.wikipedia.org/wiki/Ranchihttp://en.wikipedia.org/wiki/Shimlahttp://en.wikipedia.org/wiki/Srinagarhttp://en.wikipedia.org/wiki/Punehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Zonal_Training_Centrehttp://en.wikipedia.org/wiki/Chennaihttp://en.wikipedia.org/wiki/Kolkatahttp://en.wikipedia.org/wiki/New_Delhi -

8/8/2019 39416312 Central Bank

14/33

Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank

notes of all denominations. The distribution of one rupee notes and coins and small coins all

over the country is undertaken by the Reserve Bank as agent of the Government. The Reserve

Bank has a separate Issue Department which is entrusted with the issue of currency notes.

The assets and liabilities of the Issue Department are kept separate from those of the BankingDepartment. Originally, the assets of the Issue Department were to consist of not less than

two-fifths of gold coin, gold bullion or sterling securities provided the amount of gold was

not less than Rs. 40 crores in value. The remaining three-fifths of the assets might be held in

rupee coins, Government of India rupee securities, eligible bills of exchange andpromissory

notes payable in India. Due to the exigencies of the Second World War and the post-war

period, these provisions were considerably modified. Since 1957, the Reserve Bank of India

is required to maintain gold and foreign exchange reserves of Ra. 200 crores, of which at

least Rs. 115 crores should be in gold. The system as it exists today is known as the minimum

reserve system.

Banker to Government

The second important function of the Reserve Bank of India is to act as Government banker,

agent and adviser. The Reserve Bank is agent of Central Government and of all State

Governments in India excepting that of Jammu and Kashmir. The Reserve Bank has the

obligation to transact Government business, via. to keep the cash balances as deposits free of

interest, to receive and to make payments on behalf of the Government and to carry out their

exchange remittances and other banking operations. The Reserve Bank of India helps the

Government - both the Union and the States to float new loans and to manage public debt.

The Bank makes ways and means advances to the Governments for 90 days. It makes loans

and advances to the States and local authorities. It acts as adviser to the Government on all

monetary andbankingmatters.

Bankers' Bank and Lender of the Last Resort

The Reserve Bank of India acts as the bankers' bank. According to the provisions of the

Banking Companies Act of 1949, every scheduled bank was required to maintain with the

Reserve Bank a cash balance equivalent to 5% of its demand liabilites and 2 per cent of its

time liabilities in India. By an amendment of 1962, the distinction between demand and time

liabilities was abolished and banks have been asked to keep cash reserves equal to 3 per cent

of their aggregate deposit liabilities. The minimum cash requirements can be changed by the

Reserve Bank of India.

The scheduled banks can borrow from the Reserve Bank of India on the basis of eligible

securities or get financial accommodation in times of need or stringency by rediscountingbills of exchange. Since commercial banks can always expect the Reserve Bank of India to

http://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.htmlhttp://finance.indiamart.com/investment_in_india/rbi.html -

8/8/2019 39416312 Central Bank

15/33

come to their help in times of banking crisis the Reserve Bank becomes not only the banker's

bank but also the lender of the last resort.

Controller of Credit

The Reserve Bank of India is the controller of credit i.e. it has the power to influence the

volume of credit created by banks in India. It can do so through changing the Bank rate or

through open market operations. According to the Banking Regulation Act of 1949, the

Reserve Bank of India can ask any particular bank or the whole banking system not to lend to

particular groups or persons on the basis of certain types of securities. Since 1956, selective

controls of credit are increasingly being used by the Reserve Bank.

The Reserve Bank of India is armed with many more powers to control the Indian moneymarket. Every bank has to get a licence from the Reserve Bank of India to do banking

business within India, the licence can be cancelled by the Reserve Bank of certain stipulated

conditions are not fulfilled. Every bank will have to get the permission of the Reserve Bank

before it can open a new branch. Each scheduled bank must send a weekly return to the

Reserve Bank showing, in detail, its assets and liabilities. This power of the Bank to call for

information is also intended to give it effective control of the credit system. The Reserve

Bank has also the power to inspect the accounts of any commercial bank.

As supreme banking authority in the country, the Reserve Bank of India, therefore, has the

following powers:

(a) It holds the cash reserves of all the scheduled banks.

(b) It controls the credit operations of banks through quantitative and qualitative controls.

(c) It controls the banking system through the system of licensing, inspection and calling for

information.

(d) It acts as the lender of the last resort by providing rediscount facilities to scheduled banks.

Custodian of Foreign Reserves

The Reserve Bank of India has the responsibility to maintain the official rate of exchange.

According to the Reserve Bank of India Act of 1934, the Bank was required to buy and sell at

fixed rates any amount of sterling in lots of not less than Rs. 10,000. Though there were

periods of extreme pressure in favour of or against the rupee. After India became a member

of the International Monetary Fund in 1946, the Reserve Bank has the responsibility of

maintaining fixed exchange rates with all other member countries of the I.M.F maintainingthe rate of exchange of the rupee, the Reserve Bank has to act as the custodian of India's

-

8/8/2019 39416312 Central Bank

16/33

reserve of international currencies. The vast sterling balances were acquired and managed by

the Bank. Further, the RBI has the responsibility of administering the exchange controls of

the country.

Supervisory functions

In addition to its traditional central banking functions, the Reserve bank has certain non-

monetary functions of the nature of supervision of banks and promotion of sound banking in

India. The Reserve Bank Act, 1934, and the Banking Regulation Act, 1949 have given the

RBI wide powers of supervision and control over commercial and co-operative banks,

relating to licensing and establishments, branch expansion, liquidity of their assets,

management and methods of working, amalgamation, reconstruction, and liquidation. The

RBI is authorised to carry out periodical inspections of the banks and to call for returns andnecessary information from them. The nationalisation of 14 major Indian scheduled banks in

July 1969 has imposed new responsibilities on the RBI for directing the growth of banking

and credit policies towards more rapid development of the economy and realisation of certain

desired social objectives. The supervisory functions of the RBI have helped a great deal in

improving the standard of banking in India to develop on sound lines and to improve the

methods of their operation.

Promotional functions

With economic growth assuming a new urgency since Independence, the range of the

Reserve Bank's functions has steadily widened. The Bank now performs a variety of

developmental and promotional functions, which, at one time, were regarded as outside the

normal scope of central banking. The Reserve Bank was asked to promote banking habit,

extend banking facilities to rural and semi-urban areas, and establish and promote new

specialised financing agencies. Accordingly, the Reserve Bank has helped in the setting up of

the IFCI and the SFC; it set up the Deposit Insurance Corporation in 1962, the Unit Trust of

India in 1964, the Industrial Development Bank of India also in 1964, the Agricultural

Refinance Corporation of India in 1963 and the Industrial Reconstruction Corporation of

India in 1972. These institutions were set up directly or indirectly by the Reserve Bank to

promote saving habit and to mobilise savings, and to provide industrial finance as well as

agricultural finance. As far back as 1935, the Reserve Bank of India set up the Agricultural

Credit Department to provide agricultural credit. But only since 1951 the Bank's role in this

field has become extremely important. The Bank has developed the co-operative credit

movement to encourage saving, to eliminate moneylenders from the villages and to route its

short term credit to agriculture. The RBI has set up the Agricultural Refinance and

Development Corporation to provide long-term finance to farmers.

-

8/8/2019 39416312 Central Bank

17/33

Monetary Authority

The Reserve Bank of India is the main monetary authority of the country and beside that the

central bank acts as the bank of the national and state governments. It formulates, implements

and monitors the monetary policy as well as it has to ensure an adequate flow of credit to

productive sectors. Objectives are maintaining price stability and ensuring adequate flow of

credit to productive sectors. The national economy depends on the public sector and the

central bank promotes an expensive monetary policy to push the private sector since the

financial market reforms of the 1990s.

The institution is also the regulator and supervisor of the financial system and prescribes

broad parameters of banking operations within which the country's banking and financialsystem functions. Objectives are to maintain public confidence in the system, protect

depositors' interest and provide cost-effective banking services to the public.

Developmental role

The central bank has to perform a wide range of promotional functions to support national

objectives and industries. The RBI faces a lot of inter-sectoral and local inflation-related

problems. Some of these problems are results of the dominant part of the public sector.

Related functionsThe RBI is also a banker tot the government and performs merchant banking function for the

central and the state government. It also acts as their banker. The National Housing Bank

(NHB) was established in 1988 to promote private real estate acquisition. The institution

maintains banking accounts of all scheduled banks, too. There is now an international

consensus about the need to focus the tasks of a central bank upon central banking. RBI is far

out of touch with such a principle, owing to the sprawling mandate described above. The

recent financial turmoil world-over, has however, vindicated the Reserve Bank's role in

maintaining financial stability in India.

Recent Reserve Bank of India News Events

The RBI has recently been battling inflation in the country and has held the

benchmark interest rate to 7.75 percent

The rupee has gained 9.5 percent in '08 and is the best performing of the 10 most-

traded Asian currencies

http://en.wikipedia.org/wiki/National_Housing_Bankhttp://en.wikipedia.org/wiki/National_Housing_Bank -

8/8/2019 39416312 Central Bank

18/33

Recent capital inflows as a result of the Indian bull market have lead to a number of

asset bubbles

CREDIT POLICY

Clear, written guidelines that set (1) the terms and conditions for supplying goods on credit,

(2) customerqualificationcriteria, (3)procedure for making collections, and (3) steps to be

taken in case of customerdelinquency. Also called collection policy.

Guidelines that spell out how to decide which customers are sold on open account, the exact

payment terms, the limits set on outstanding balances and how to deal with delinquent

accounts.

THE POLICY changes in the banking system initiated by the RBI (Reserve Bank of India) inits latest credit policy announcements all point to one fact: interest rates in the economy are

http://www.businessdictionary.com/definition/guideline.htmlhttp://www.businessdictionary.com/definition/terms-and-conditions.htmlhttp://www.businessdictionary.com/definition/goods.htmlhttp://www.businessdictionary.com/definition/credit.htmlhttp://www.businessdictionary.com/definition/customer.htmlhttp://www.businessdictionary.com/definition/qualification.htmlhttp://www.businessdictionary.com/definition/criteria.htmlhttp://www.businessdictionary.com/definition/procedure.htmlhttp://www.businessdictionary.com/definition/collection.htmlhttp://www.businessdictionary.com/definition/delinquency.htmlhttp://www.businessdictionary.com/definition/collection-policy.htmlhttp://www.businessdictionary.com/definition/guideline.htmlhttp://www.businessdictionary.com/definition/terms-and-conditions.htmlhttp://www.businessdictionary.com/definition/goods.htmlhttp://www.businessdictionary.com/definition/credit.htmlhttp://www.businessdictionary.com/definition/customer.htmlhttp://www.businessdictionary.com/definition/qualification.htmlhttp://www.businessdictionary.com/definition/criteria.htmlhttp://www.businessdictionary.com/definition/procedure.htmlhttp://www.businessdictionary.com/definition/collection.htmlhttp://www.businessdictionary.com/definition/delinquency.htmlhttp://www.businessdictionary.com/definition/collection-policy.html -

8/8/2019 39416312 Central Bank

19/33

set to drop further. Last month, the RBI set the stage for another round of interest rate cuts by

reducing the Bank Ratethe rate at which banks borrow from the RBIby half a percentage

point to 6.5 per cent and the cash reserve ratio (CRR)the percentage of deposits banks have

to maintain with the RBIby 2 percentage points to 5.5 per cent.

At a primary level, the two steps lower the cost of funds for banks and increase liquidity in

the system, respectively. At a secondary level, they have significant implications for your

personal finances.

Debt investments. Brace yourself for another round of cuts in interest rates on fixed-income

instruments like bank deposits, corporate bonds and deposits, and government securities.

Expect lower returns from new investments in these instruments. Although the inverse

relationship between interest rates and prices of fixed-income securities saw debt funds notch

up smart gains in their NAVs (net asset value) in the wake of the RBI move, this appreciation

is a one-off rise.

Loans. With the cost of funds coming down, lenders are likely to pass on the rate cuts to

customers. Banks are expected to take the lead. Housing finance companies, on the other

hand, will probably wait for NHB (National Housing Board) to drop refinance rates before

doing the same. The general expectation is of a cut of half a percentage pointthe exact

amount will vary with the loan tenure. So, if you are planning to take a loan, wait for a

revisioncredit is likely to come cheaper.

Equity investments. Softer interest rates will also improve the bottomlines of high-rated

companies who are in a position to negotiate better credit terms with lenders. Banks are the

biggest gainers from the RBI steps. The fall in CRR requirements means they can deploy

more funds at market rates. CRR investments currently earn 6.5 per cent interest (hiked from

6 per cent in this credit policy). Even if banks put this money in government securities, they

stand to earn an additional 2 percentage points. With yields on debt paper coming down,

banks will also see some appreciation in their investment portfolio. Even after factoring in the

lower lending rates, banks do gain at the net level.

As you create your policy, consider the link between credit and sales. Easy credit terms can

be an excellent way to boost sales, but they can also increase losses if customers default. Atypical credit policy will address the following points:

Credit limits. You'll establish dollar figures for the amount of credit you're willing to

extend and define the parameters or circumstances.

Credit terms. If you agree to bill a customer, you need to decide when the payment

will be due. Your terms may also include early-payment discounts and late-payment

penalties.

Deposits. You may require customers to pay a portion of the amount due in advance.

Credit cards and personal checks. Yourbankis a good resource for credit card

merchant status and for setting policies regarding the acceptance of personal checks.

http://www.entrepreneur.com/encyclopedia/term/82124.htmlhttp://www.entrepreneur.com/encyclopedia/term/82124.html -

8/8/2019 39416312 Central Bank

20/33

Customer information. This section should outline what you want to know about a

customer before making a credit decision. Typical points include years in business,

length of time at present location, financial data, credit rating with othervendors and

credit reporting agencies, information about the individual principals of the company,

and how much they expect to purchase from you. Documentation. This includes credit applications, sales agreements, contracts,

purchase orders, bills of lading, delivery receipts, invoices, correspondence, and so

on.

Reserve Bank of India (RBI) Annual Credit

Policy (2009-2010)

Keynote Capitals presents key highlights of the

credit policy of Reserve Bank of India

Estimates for 2009-10 (FY10)

Growth Projection : Real GDP growth forecasted at 6%

Date: 22 April 2009

http://www.entrepreneur.com/encyclopedia/term/82124.htmlhttp://www.entrepreneur.com/encyclopedia/term/82124.htmlhttp://www.entrepreneur.com/encyclopedia/term/82124.html -

8/8/2019 39416312 Central Bank

21/33

Credit growth and aggregate deposits growth projected at 20% and 18% respectively.

Money Supply (M3) growth projected at 17%.

WPI inflation projected at 4.0% by FY10

Presently, WPI-based inflation is reaching close to zero and is expected to be in the negative

territory in the early part of the current year. This expected negative inflation in India has

only statistical significance and is not a reflection of demand contraction as is the case in

advanced economies. Prices of manufactured products fell sharply, while that of the fuel

group contracted, though inflation in case of food articles still remains high. Keeping in view

the global trend in commodity prices and domestic demand-supply balance, WPI inflation is

projected at 4% during the current year.

CPI-based inflation expected to moderate

CPI-based inflation is expected to moderate from its present high level but would continue to

remain in positive territory throughout FY10.

Repo and Reverse Repo rates cut by 25bps each

With this, the effective repo rate is 4.75% vis-a-vis 5% earlier and effective Reverse repo rate

is 3.25% vis-a-vis 3.5%earlier. However, CRR and bank rate remain unchanged at 5% and

6% respectively.

Extension of ECB relaxation for all-in-cost limit to December

As per existing ECB policy, all-in-cost ceilings for ECBs are: LIBOR + 300bps for ECBs

with average maturity period of 3 years and up to 5 years; and LIBOR + 500bps for ECBs

with average maturity of more than 5 years. However, these all-in-cost ceilings have been

dispensed with up to June 30, 2009. Subject to ECB proposals above prescribed all-in-cost

ceilings, irrespective of amount of the borrowing will come under the approval route. Due to

continuing tightness of credit spreads in the international markets, it is proposed to extend

relaxation in all-in-cost ceilings to December 31, 2009.

Relaxing the FCCB buyback policy for companies

Companies can now buy back out of internal accruals $100mn of redemption as against

$50mn earlier. Under the existing norms, RBI has been considering, under the approval route,

proposals from Indian companies for buyback of FCCBs, out of internal accruals, up to

US$50mn redemption value per company, at a minimum discount of 25% on the book value.

Keeping in view the benefits accruing to Indian companies, it is proposed to increase the total

amount of permissible buyback, out of internal accruals, from $50mn of the redemption value

per company to $100mn, by linking the higher amount of buyback to larger discounts.

-

8/8/2019 39416312 Central Bank

22/33

Domestic financing conditions have improved whereas external financing conditions are

expected to remain tight. Therefore, private investment demand is expected to remain

subdued.

During 1st half of 2009-10, planned Open market operation purchases and MSS

unwinding to add primary liquidity of about Rs1,20,000Cr which, by way of monetary

impact, is equivalent to CRR reduction of 3.0%. This would leave adequate resources with

banks to expand credit.

Further Relaxations in Branch Authorization Policy

The current branch authorization policy requires banks to have a medium term plan in respect

of branch expansion. The request to open off-site ATMs was a part of such plans. Now, it is

proposed to allow scheduled commercial banks to set up offsite ATMs without prior approval

subject to reporting. RBI will constitute a Group to review the extant framework of branch

authorization policy with a view to providing greater flexibility, enhanced penetration and

competitive efficiency consistent with financial stability.

Presence of Foreign Banks in India

In 2005, the Government of India and RBI laid out a 2-track approach aimed at increasing the

efficiency and stability of the Indian banking sector. One track was consolidation of the

domestic banking system, both in private and public sectors, and second one was gradual

enhancement of the presence of foreign banks in a synchronized manner. The roadmap was

divided into 2 phases, with the 1st phase spanning the period March 2005 - March 2009, and

2nd phase beginning April 2009 after a review of the experience gained in the first phase.

Amid the current global financial market turmoil, the RBI will continue with the current

policy and procedures governing the presence of foreign banks in India. The RBI has decided

not to allow entry of new foreign banks into the country or allow foreign banks to acquire

stake in private banks. The proposed review will be taken up after due consultation once there

is greater clarity regarding stability and recovery of the global financial system.

Credit Rating AgenciesThe RBI accorded accreditation to 4 SEBI registered credit rating agencies for the limited

-

8/8/2019 39416312 Central Bank

23/33

purpose of using their ratings for assigning risk weights within framework of the Basel II

Accord.

RBI Credit Policy 2009 2010

January 29th, 2010 by V

No Comments

Advertisements

I. The State of the Economy

Global Economy

2. The global economy is showing increasing signs of stabilisation. The growth outlook in

virtually all economies is being revised upwards steadily, with the Asian region experiencing

a relatively stronger rebound. Global trade is gradually picking up, but other indicators of

economic activity, particularly capital flows and asset and commodity prices are more

buoyant. However, even as most of the forecasts on recovery are generally optimistic,

significant risks remain. The recovery in many economies is driven largely by governmentspending, with the private sector yet to begin playing a significant part. There are signs that

high levels of global liquidity are contributing to rising asset prices as well as rising

commodity prices. Emerging market economies (EMEs) are generally recovering faster than

advanced economies. But they are also likely to face increased inflationary pressures due to

easy liquidity conditions resulting from large capital inflows.

3. While conditions in the beginning of 2010 are significantly better than they were at the

beginning of 2009, a different set of policy challenges has emerged for both advanced

economies and EMEs. In 2009, while advanced economies were focused on dealing with thefinancial crisis, especially reviving the credit market and restoring the health of the financial

http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.htmlhttp://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#commentshttp://buzz7.com/wp-content/uploads/2010/01/RBI.jpghttp://indihot.com/indihot-news/rbi-credit-policy-2009-2010.htmlhttp://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#comments -

8/8/2019 39416312 Central Bank

24/33

sector, EMEs were engaged in mitigating the adverse impact of the global financial crisis on

their real economies. In 2010, the effort in advanced economies will be to further improve the

financing conditions and strengthen the growth impulses, while the endeavour in the EMEs

will be to strengthen the recovery process without compromising on price stability and to

contain asset price inflation stemming from large capital inflows.

Domestic Economy

4. As stated in the Second Quarter Review of October 2009, Indias macroeconomic context

is different from that of advanced and other EMEs in at least four respects. One, India is

facing rising inflationary pressures, albeit largely due to supply side factors. Two,

households, firms and financial institutions in India continue to have strong balance sheets,

although there is a need to encourage domestic consumption and investment demand. Three,

since the Indian economy is supply-constrained, pick-up in demand could exacerbate

inflationary pressures. Four, India is one of the few large EMEs with twin deficits fiscaldeficit and current account deficit.

5. Growth during Q2 of 2009-10, at 7.9 per cent, reveals a degree of resilience that surprised

many. Subsequent data releases, whether on industrial production, infrastructure or exports,

confirm the assessment that the economy is steadily gaining momentum. Based on this better-

than-expected performance, growth forecasts for 2009-10 have generally been revised

upwards. As reassuring as this recovery is, it is still unbalanced. Public expenditure continues

to play a dominant role and performance across sectors is uneven, suggesting that recovery is

yet to become sufficiently broad-based.

6. For several months, rapidly rising food inflation has been a cause for concern. More

recently, there are indications that the sustained increase in food prices is beginning to spill

over into other commodities and services as well. The increases in the prices of manufactured

goods have accelerated over the past two months. While food products, understandably,

contribute significantly to this, pressures in other sectors are also visible. Further, prices of

non-administered fuel items have increased significantly in line with rising international

prices. With growth accelerating in the second half of 2009-10 and expected to gain

momentum over the next year, capacity constraints could potentially reinforce supply-side

inflationary pressures.

7. The inflation risk looms larger when viewed in the context of global price movements. As

already indicated, global commodity prices are showing signs of firming up, driven both by

the recovery in demand and the asset motive. Significantly, prices of important food items are

also firming up. Going by the Food and Agriculture Organisation (FAO) data, the global rates

of increase in the prices of sugar, cereals and edible oils are now appreciably higher than

domestic rates. The opportunity to use imports as a way to contain domestic food prices is,

therefore, quite limited.

-

8/8/2019 39416312 Central Bank

25/33

8. Monetary aggregates during 2009-10 have so far moved broadly in line with their

projections. However, non-food bank credit growth decelerated significantly from its peak of

over 29 per cent in October 2008 to a little over 10 per cent in October 2009. Thereafter, it

recovered to over 14 per cent by mid-January 2010. This credit performance should be seen

in the context of improved access of corporates to non-bank sources of funds this year. Roughcalculations show that the total flow of financial resources from banks, domestic non-bank

and external sources to the commercial sector during 2009-10 (up to January 15, 2010) at

Rs.5,89,000 crore was only marginally lower than Rs.5,95,000 crore in the corresponding

period of the previous year. These numbers suggest that non-bank sources of finance have, to

a large extent, mitigated the impact of the slow down in bank credit growth.

9. Our previous Reviews have commented on the monetary transmission during the crisis

period. While the changes in the Reserve Banks policy rates were quickly transmitted to the

money and government securities markets, transmission to the credit market was slower.

Evidently, the transmission is still in progress. The effective average lending rate ofscheduled commercial banks declined from 12.3 per cent in March 2008 to 11.1 per cent in

March 2009. Although relevant information for the subsequent period is not available, the

effective average lending rates may have declined further as banks benchmark prime lending

rates (BPLRs) softened by 25-100 basis points during this period.

10. Financial markets have remained orderly. Overnight money market rates remained below

or close to the lower bound of the liquidity adjustment facility (LAF) corridor. Liquidity

conditions remained comfortable with the Reserve Bank absorbing about Rs.1,09,000 crore

on a daily average basis during the current financial year. Yields on government securitiescould potentially have increased sharply because of the abrupt increase in government

borrowings. However, the upward pressure on yields was contained by lower commercial

credit demand, open market operation (OMO) purchases and active liquidity management by

the Reserve Bank. Equity markets are behaving in a manner consistent with global patterns.

Real estate prices have firmed up as has been the trend in several other EMEs. Increasing

optimism about the recovery and high levels of liquidity are driving up real estate prices

although they are still some distance away from the pre-crisis peaks.

11. On the fiscal front, the stimulus by the government in the second half of 2008-09 has

clearly contributed significantly to the recovery. It may be recalled that the crisis-drivenstimulus by way of reduction in excise levies, interest rate subventions and additional capital

expenditure came on top of structural measures already built into the budget such as the Sixth

Pay Commission Award and farm debt waiver.

12. We will have to await the forthcoming budget in end-February 2010 for the

Governments decision on phasing out the transitory components of the stimulus. As regards

the structural components, even though they were one-off, some of their impact is expected to

continue over the next couple of years, as state governments and public sector enterprises

align their compensation structures with the recommendations of the Sixth Pay Commission.

-

8/8/2019 39416312 Central Bank

26/33

13. Managing the government borrowing programme to finance the large fiscal deficit posed

a major challenge for the Reserve Bank. In order to address this, the Reserve Bank front-

loaded the government borrowing programme, unwound MSS securities and undertook OMO

purchases.

14. On the external front, exports have begun responding to the revival in global demand.

Right through the difficulties of 2008-09 and the early months of the current financial year,

there was never any pressure on the current account. However, capital outflows in the third

quarter of 2008-09 led to some stress on the balance of payments, but we rode this out on the

strength of our forex reserves. The Reserve Bank, however, had to initiate some conventional

and non-conventional measures to ease the pressure on forex and rupee liquidity. In the space

of a year, the situation has clearly stabilised.

15. The current account deficit during April-September 2009 was US$ 18.6 billion, up from

US$ 15.8 billion during April-September 2008. Over the first half of 2009-10, capital inflowsresumed, but were not significantly in excess of the current account deficit. Indias improving

growth prospects, combined with persistently high levels of global liquidity, may result in a

significant increase in net inflows over the coming months. Depending on how these are

handled, there will be implications in terms of a combination of exchange rate appreciation,

larger systemic liquidity and the fiscal costs of sterilisation.

II. Outlook and Projections

Global Outlook

Global Growth

16. Global economic performance improved during the third and fourth quarters of 2009,

prompting the IMF to reduce the projected rate of economic contraction in 2009 from 1.1 per

cent made in October 2009 to 0.8 per cent in its latest World Economic Outlook (WEO)

Update released on January 26, 2010. The IMF has also revised the projection of global

growth for 2010 to 3.9 per cent, up from 3.1 per cent (Table 1). The IMF expects the growth

performance, which will be led by major Asian economies, to vary considerably across

countries and regions, reflecting different initial conditions, external shocks, and policyresponses.

Table 1: Projected Global GDP Growth (%)*

Country/Region 2009 2010

US (-) 2.5 2.7

UK (-) 4.8 1.3

Euro Area (-) 3.9 1.0

Japan (-) 5.3 1.7

http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#T1http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#T1 -

8/8/2019 39416312 Central Bank

27/33

China 8.7 10.0

India 5.6 7.7

Emerging and Developing Economies 2.1 6.0

World (-)0.8 3.9

Source: World Economic Outlook Update, IMF, January 26. 2010

17. The IMF has also revised upwards its projection of the real GDP growth of emerging and

developing economies for 2009 to 2.1 per cent from its earlier number of 1.7 per cent. The

estimates are even more optimistic for 2010. The growth of emerging and developing

economies is now projected at 6.0 per cent, up from 5.1 per cent earlier. The growth in EMEs

such as China and India and other emerging Asian economies is expected to be robust.

Commodity-producing countries are likely to recover quickly in 2010 on the back of a

rebound in commodity prices.

Global Inflation

18. The IMF expects that the high levels of slack in resource utilisation and stable inflation

expectations will contain global inflationary pressures in 2010. In the advanced economies,

headline inflation is expected to increase from zero in 2009 to 1.3 per cent in 2010, as rising

energy prices may more than offset deceleration in wage levels. In emerging and developing

economies, inflation is expected to rise to 6.2 per cent in 2010 from 5.2 per cent in 2009 due

to low slack in resource utilisation and increased capital inflows.

Domestic Outlook

Growth

19. During 2009-10, real GDP growth accelerated from 6.1 per cent in Q1 to 7.9 per cent in

Q2 driven by revival in industrial growth, and pick-up in services sector growth, aided by

payment of arrears arising out of the Sixth Pay Commission Award. It is expected that Q3

growth, which will reflect the full impact of the deficient south-west monsoon rainfall on

kharif crops, would be lower than that of Q2. As rabi prospects appear to be better, on thewhole, agricultural GDP growth in 2009-10 is expected to be near zero.

20. As a result of the improvement in the global economic situation since the Second Quarter

Review in October 2009, exports expanded in November 2009, after contracting for 13

straight months. This positive trend is expected to persist. The industrial sector recovery,

some signs of which were noted in the Second Quarter Review, is now consolidating. The

performance of the corporate sector has picked up. Increased business optimism also reflects

brighter prospects for the industrial sector. Services sector activities have improved.

Domestic and international financing conditions have eased considerably, and this too should

support domestic demand.

-

8/8/2019 39416312 Central Bank

28/33

21. In the Second Quarter Review of October 2009, we had placed the baseline projection for

GDP growth for 2009-10 at 6.0 per cent with an upside bias. The movements in the latest

indicators of real sector activity indicate that the upside bias has materialised. Assuming a

near zero growth in agricultural production and continued recovery in industrial production

and services sector activity, the baseline projection for GDP growth for 2009-10 is nowraised to 7.5 per cent (Chart 1).

22. Looking ahead to 2010-11, our preliminary assessment of the baseline scenario is that the

current growth will be sustained. This is a tentative assessment. We shall formally indicate

our growth projection for 2010-11 in our Monetary Policy in April 2010.

Inflation

23. Headline wholesale price index (WPI) inflation was 1.2 per cent in March 2009. It

continued to decline and became negative during June-August 2009 due to the large

statistical base effect. It turned positive in September 2009, accelerated to 4.8 per cent in

November 2009 and further to 7.3 per cent in December 2009. On a financial year basis,between April-December 2009, WPI moved up by 8 per cent.

24. The deficient monsoon rainfall and drought conditions in several parts of the country

have accentuated the pressure on food prices, pushing up the overall inflation rate both of

the WPI and consumer price indices (CPIs). Going forward, the rabi crop prospects are

assessed to be better. The large stock of foodgrains with public agencies should help supply

management. On the other hand, there is a risk that inflationary pressures may emanate from

the rebound in global commodity prices.

http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#C1http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#C1 -

8/8/2019 39416312 Central Bank

29/33

25. Assessment of inflationary pressures has become increasingly complex in the recent

period as the WPI and CPI inflation rates have shown significant divergence. All the four

CPIs have remained elevated since March 2008 due to the sharp increase in essential

commodity prices. The Reserve Bank monitors an array of measures of inflation, both overall

and disaggregated components, in conjunction with other economic and financial indicatorsto assess the underlying inflationary pressures for formulating its monetary policy stance.

26. The Second Quarter Review of October 2009 projected WPI inflation of 6.5 per cent with

an upside bias for end-March 2010. The upside risks in terms of higher food prices reflecting

poor monsoon have clearly materialised. However, some additional factors have also exerted

upward pressure on WPI inflation. One, the expected seasonal moderation has not taken

place, other than in vegetables. Two, prices of the non-administered component of the fuel

group, tracking the movement in global crude prices, have also risen significantly. Three,

there have also been some signs of demand side pressures. The Reserve Banks quarterly

inflation expectations survey for households indicates that inflation expectations are on therise. Keeping in view the global trend in commodity prices and the domestic demand-supply

balance, the baseline projection for WPI inflation for end-March 2010 is now raised to 8.5

per cent (Chart 2).

27. As with growth, we shall formally announce our inflation projection for 2010-11 in our

Monetary Policy in April 2010. However, on the assumption of a normal monsoon and global

oil prices remaining around the current level, it is expected that inflation will moderate from

July 2010. This moderation in inflation will depend upon several factors, including the

measures taken and to be taken by the Reserve Bank as a part of the normalisation process.

28. As always, the Reserve Bank will endeavour to ensure price stability and anchor inflationexpectations. The conduct of monetary policy will continue to condition and contain

http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#C2http://indihot.com/indihot-news/rbi-credit-policy-2009-2010.html#C2 -

8/8/2019 39416312 Central Bank

30/33

perception of inflation in the range of 4.0-4.5 per cent. This will be in line with the medium-

term objective of 3.0 per cent inflation consistent with Indias broader integration with the

global economy.

Money and Credit Aggregates

29. During the current financial year, the year-on-year growth in money supply (M3)

moderated from over 20.0 per cent at the beginning of the financial year to 16.5 per cent on

January 15, 2010, reflecting deceleration in bank credit growth during 2009-10. Year-on-year

increase in non-food bank credit to the commercial sector, at 14.4 per cent as on January 15,

2010, was significantly lower than the 22.0 per cent growth a year ago. Consequently, the

more important source of M3 expansion this year has been bank credit to the government,

reflecting the enlarged support to the market borrowing of the government and unwinding of

MSS securities.

30. Aided by the measures initiated by the Reserve Bank (see para 13), over 98 per cent of

the net market borrowing programme of the Central Government for 2009-10 has already

been completed by January 28, 2010. The anticipated increase in credit demand by the

commercial sector in the remaining period of 2009-10 can, therefore, be easily met from the

market as adequate liquidity is available in the system. In view of the increased availability of

funds from domestic non-bank and external sources (see para 8), the 18 per cent growth in

adjusted non-food credit growth projected earlier is unlikely to be realised. Accordingly, the

indicative adjusted non-food credit growth projection for 2009-10 is now reduced to 16 per

cent. Based on this projected credit growth and the remaining very marginal market

borrowing of the government, the projected M3 growth in 2009-10 has been reduced to 16.5

per cent for policy purposes. Consistent with this, aggregate deposits of scheduled

commercial banks are projected to grow by 17 per cent. These numbers, as before, are

provided as indicative projections and not as targets.

Risk Factors

31. While the baseline scenario is comforting, a number of downside risks to growth and

upside risks to inflation need to be recognised.

(i) There is still uncertainty about the pace and shape of global recovery. There are concerns

that it is too dependent on public spending and will unravel if governments around the world

withdraw their fiscal stimuli prematurely. As the world discovered during the recent crisis,

the global economy is heavily inter-linked through the business cycle. A downturn in global

sentiment will affect not only our external sector but also our domestic investment.

(ii) Oil prices have been range-bound in the recent period. However, if the global recovery

turns out to be stronger than expected, oil prices may increase sharply, driven both by

prospects of demand recovery and the return of the investment motive, which will affect all

commodities. This could stoke inflationary pressures even as growth remains below potential.

-

8/8/2019 39416312 Central Bank

31/33

(iii) Expectations of softening domestic inflation are contingent on food prices moderating.

This, in turn, depends significantly on the performance of the south-west monsoon in 2010. If

rainfall is inadequate, high food prices will continue to intensify inflationary pressures.

(iv) So far, capital inflows have been absorbed by the current account deficit. However, sharp

increase in capital inflows, above the absorptive capacity of the economy, may complicate

exchange rate and monetary management.

(v) As growth accelerates and the output gap closes, excess liquidity, if allowed to persist,

may exacerbate inflation expectations.

32. Beyond the above risk factors, by far a bigger risk to both short-term economic

management and to medium-term economic prospects emanates from the large fiscal deficit.

The counter-cyclical public finance measures taken by the government as part of the crisis

management were necessary; indeed they were critical to maintaining demand when otherdrivers of demand had weakened. But as the recovery gains momentum, it is important that

there is co-ordination in the fiscal and monetary exits. The reversal of monetary

accommodation cannot be effective unless there is also a roll back of government borrowing.

As indicated earlier (para 13), even as the government borrowing had increased abruptly

during 2008-09 and 2009-10, it could be managed through a host of measures that bolstered

liquidity. Those liquidity infusion options will not be available to the same extent next year.

On top of that, there will be additional constraints. Inflation pressures will remain and private

credit demand will be stronger with the threat of crowding out becoming quite real.

33. There are standard, well-known and well-founded reasons for fiscal consolidation. For

both short-term economic management and medium-term fiscal sustainability reasons, it is

imperative, therefore, that the government returns to a path of fiscal consolidation. The

consolidation can begin with a phased roll back of the transitory components. Beyond that, in

the interest of transparency and predictability, the government should ideally do two things:

first, indicate a roadmap for fiscal consolidation; and second, spell out the broad contours of

tax policies and expenditure compression that will define this roadmap.

III. The Policy Stance

34. The Reserve Bank has pursued an accommodative monetary policy beginning mid-

September 2008 in order to mitigate the adverse impact of the global financial crisis on the

Indian economy. The measures taken instilled confidence in market participants and helped

cushion the spillover of the global financial crisis on to our economy. However, in view of

rising food inflation and the risk of it impinging on inflationary expectations, the Reserve

Bank announced the first phase of exit from the expansionary monetary policy by terminating

some sector-specific facilities and restoring the statutory liquidity ratio (SLR) of scheduled

commercial banks to its pre-crisis level in the Second Quarter Review of October 2009.

-

8/8/2019 39416312 Central Bank

32/33

35. Against the above backdrop of global and domestic macroeconomic conditions, outlook

and risks, our policy stance in this Quarter is shaped by three important considerations:

(i) A consolidating recovery should encourage us to clearly and explicitly shift our stance

from managing the crisis to managing the recovery. We articulated this change in our

stance in the October quarterly review, but the growing confidence in the recovery justifies

our moving further in reversing the crisis-driven expansionary stance. Our main policy

instruments are all currently at levels that are more consistent with a crisis situation than with

a fast-recovering economy. It is, therefore, necessary to carry forward the process of exit

further.

(ii) Though the inflationary pressures in the domestic economy stem predominantly from the

supply side, the consolidating recovery increases the risks of these pressures spilling over into

a wider inflationary process. Looking ahead into 2010-11, if the growth momentum turns out

to be as expected, pressures on capacities in an increasing number of sectors are likely tostrengthen the transmission of higher input and wage costs into product prices.

(iii) Even amidst concerns about rising inflation, we must remember that the recovery is yet

to fully take hold. Strong anti-inflationary measures, while addressing one problem, may

precipitate another by undermining the recovery, particularly by deterring private investment

and consumer spending.

36. Against this backdrop, the stance of monetary policy of the Reserve Bank for the

remaining period of 2009-10 will be as follows:

Anchor inflation expectations and keep a vigil on the trends in inflation and be prepared to

respond swiftly and effectively through policy adjustments as warranted.

Actively manage liquidity to ensure that credit demands of productive sectors are adequately

met consistent with price stability.

Maintain an interest rate environment consistent with price stability and financial stability,

and in support of the growth process.

IV. Monetary Measures

37. On the basis of the current assessment and in line with the policy stance as outlined in

Section III, the Reserve Bank announces the following policy measures:

Bank Rate

38. The Bank Rate has been retained at 6.0 per cent.

Repo Rate

39. The repo rate under the Liquidity Adjustment Facility (LAF) has been retained at 4.75 per

cent.

-

8/8/2019 39416312 Central Bank

33/33

Reverse Repo Rate

40. The reverse repo rate under the LAF has been retained at 3.25 per cent.

Cash Reserve Ratio

41. It has been decided to:

increase the cash reserve ratio (CRR) of scheduled banks by 75 basis points from 5.0 per cent

to 5.75 per cent of their net demand and time liabilities (NDTL) in two stages; the first stage

of increase of 50 basis points will be effective the fortnight beginning February 13, 2010,

followed by the next stage of increase of 25 basis points effective the fortnight beginning

February 27, 2010.

42. As a result of the increase in the CRR, about Rs. 36,000 crore of excess liquidity will be

absorbed from the system.

43. The Reserve Bank will continue to monitor macroeconomic conditions, particularly the

price situation closely and take further action as warranted.

Expected Outcomes

44. The expected outcomes of the actions are:

(i) Reduction in excess liquidity will help anchor inflationary expectations.

(ii) The recovery process will be supported without compromising price stability.

(iii) The calibrated exit will align policy instruments with the current and evolving state of

the economy.