38 chhavi sharma american international group

-

Upload

chhavisharma88 -

Category

Economy & Finance

-

view

484 -

download

0

description

Transcript of 38 chhavi sharma american international group

American International Group

American International Group, Inc. (AIG) is a leading global insurance company. Foundedin 1919, today we provide a wide range of property casualty insurance, life insurance, retirement products, mortgage insurance and other financial services to customers in more than 130 countries. Our diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

AIG’s Board of Directors include eminent personalities like: Arthur C. Martinez Chief Executive Officer Sears, Roebuck and Co. Morris W. Offit, Former Chief Executive Officer OFFITBANK, Suzzane Nora Johnson, Former Vice Chairman The Goldman Sachs Group, Inc. Douglas M. Steenland, Former President and Chief Executive Officer Northwest Airline

Corporation etc.

AIG’s key strengths include: World class insurance franchises that are leaders in their categories and are improving their

operating performance. A diverse mix of businesses with a presence in most international markets. Effective capital management of the largest shareholders’ equity of any insurance company in

the world, supported by enhanced risk management. Execution of strategic objectives, such as the recent divestiture of non-core businesses and

fulfillment of our commitment to repay the U.S. taxpayers. Improved profitability, as demonstrated by three consecutive years of full-year profit.

Management of AIG Nominating & Corporate Governance Committee: 1) Identifies individuals qualified to become

Board members, consistent with the criteria approved by the Board, and recommends individuals to the Board for nomination, election, or appointment as members of the Board and its committees. 2) Advises the Board on corporate governance matters. 3) Oversees the evaluation of the Board of AIG and its committees.

Compensation & Management Resources Committee: 1) oversees the administration of AIG’s compensation programs. 2) Approves the compensation of other senior executives under its purview. 3) Makes recommendations with respect to the compensation programs applicable to senior executives and other employee compensation.

Finance Committee: 1) assists the Board in its oversight responsibilities by reviewing and making recommendations to the Board with respect to AIG’s financial and investment policies. 2) Approves certain issuances, investments, dispositions and other transactions and matters

Audit Committee: 1) Assists the Board in its oversight of the integrity of AIG’s financial statements and AIG’s compliance with legal and regulatory requirements. 2) The qualifications, independence and performance of AIG’s independent auditors. 3) The performance of AIG’s internal audit function.

Public Policy & Social Responsibility Committee: Responsible for reviewing the position and policies of AIG that relate to current emerging corporate social responsibility and political and

1

public policy issues of significance to AIG, that may affect AIG’s business operations, performance or corporate reputation.

Regulatory, Compliance & Legal Committee: Assists the Board in its oversight of AIG’s handling of legal, regulatory and compliance matters.

AIG’s Commercial and Consumer products are

AIG Property Casualty operating segments are organized into Commercial Insurance and Consumer Insurance. Run-off lines of business and operations not attributable to these operating segments are included in other operations category.

Percent of 2012 Net premiums by operating segment.

2

Evolution of AIG:

3

1939: Mr. Starr moved his headquarters from Shanghai, China, to New York City.

Greenberg was ousted amid an accounting scandal in February 2005. Greenberg was succeeded as CEO by Martin J. Sullivan. 2008, after disclosure of financial losses and falling stock price, Sullivan resigned and was replaced by Robert B. Willumstad. He was forced by the US government to step down and was replaced by Edward M. Liddy on September 17, 2008. AIG's board of directors named Robert Benmosche CEO on August 3, 2009 to replace Mr. Liddy, who earlier in the year announced his retirement. Currently Bob Benmosche is the president and

chief executive officer of AIG.

Dimensions

1) Dimension of Management

Purpose: The primary purpose of any business is economic surplus.

AIG’s purpose of existence is to build a better future, whether for a growing company or for a family of four. For example, Tata AIG has developed innovative microinsurance programs to help farmers in rural India track 350,000 head of cattle – and protect their owners’ livelihoods.

We promise our customers that we will be there for the unexpected. When tornadoes destroyed schools in Kentucky in March 2012, we were there within days to give the Kentucky School Boards Insurance Trust a $5 million check to help schools start rebuilding.

Mission: Coupled with a refreshed logo and brand promise encouraging employees, clients, and partners to bring on the challenges of tomorrow, AIG is truly are looking to the future.

Bring on tomorrow As AIG’s brand promise, these words are more than window dressing to go along with their refreshed logo. They are a call to action, a rallying cry for their employees. AIG is revitalized, one team of approximately 63,000 people helping clients in more than 130 countries, with the drive and ambition to solve the problems and innovate for the future that their partners and customers will face.

Bring on one AIG Bring on One AIG

AIG has reunited their businesses under the AIG name because AIG believe that together they re stronger. They are one AIG, and working together across company and partners. AIG’s network of unparalleled data and experience around the globe mean that they can offer their customers solutions that no one else can.

Bring on teamwork We know that even when the odds are against you, when the right people come together, with the right Values and a lot of hard work, even the toughest challenges can be overcome. We found these values echoed in the tenacity, integrity, and international community surrounding rugby. Now we’re partnering with USA Rugby to sponsor the Junior and Collegiate All-American teams, and we’re sponsoring the New Zealand Rugby Union and its legendary All Blacks – one of the most successful teams in sporting history.

4

1919: Vander Starr established a general insurance agency, American Asiatic Underwriters (AAU), in Shanghai

1952: Mr. Starr acquired Globe & Rutgers Fire Insurance Company and its subsidiary, American Home Fire Assurance Company. 1960, C.V. Starr hired Maurice R. Greenberg to develop an international accident and health business. Greenberg promoted selling insurance through independent brokers rather than agents to eliminate agent salaries

1967, American International Group, Inc. (AIG) was incorporated as a unifying umbrella organization for most of C.V. Starr’s general and life insurance businesses.

The company went public in 1969. 1984 AIG listed its shares on the New York Stock Exchange (NYSE).

1990s, AIG developed new sources of income through diverse investments, including the acquisition of International Lease Finance Corporation (ILFC), a provider of leased aircraft to the airline industry.

1992, AIG received the first foreign insurance license granted in over 40 years by the Chinese government. AIG acquired Sun America Inc. a retirement savings company, in 1999

Early 2000’s saw a marked period of growth as AIG acquired American General Corporation, a leading domestic life insurance and annuities provider, and AIG entered new markets including India.

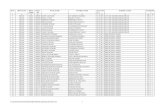

Financial statements of last 3 years: AIG balance sheet had a strong result in 2012 because of the issuance of unsecured notes and

monetization of non-core assets –including our agreement to sell our largest non-core asset, International Lease Finance Corporation, our leading aircraft leasing business, and the sale of our remaining shares of AIA Group Limited.

A good Board of Directors should empower people to stretch and expand the limits of what is possible, and AIG has continued to work hard to help AIG reach its full potential.

5

6

2) People Dimension/ Work Dimension/ Achievement Dimension

AIG believes that only by reenergizing and empowering the people of AIG will they be able to envision a future worth working toward.

AIG has adhered to comprehensive pay for-performance processes and standards for three years – ensuring that their people are motivated and appropriately rewarded for their efforts to properly balance profit, growth, and risk.

AIG’s new Volunteer Time Off program encourages employees to take their talents out of the office and into the community.

AIG employees are passionate people– passionate about their work but also about their communities. AIG want to help their people give to causes and organizations that matter – to them. To assist employees in supporting the causes they care most about, AIG launched a bigger and better Matching Grants Program in 2012.

AIG is investing in its employees through a competitive benefits program as well as training and development

AIG is providing employee diversity training to increase awareness of the benefits of a diverseworking environment. We are also increasing the products that serve diverse communities as well as the diversity of suppliers.

7

Robert S. Miller, Non Executive Chairman of the board said: We have a past, we have a present, and – with thanks to AIG’s employees and America’s support – now we have a future.

3) Social Dimension AIG’s new Volunteer Time Off program encourages employees to take their talents out of the

office and into the community. AIG employees are passionate people– passionate about their work but also about their

communities. AIG want to help their people give to causes and organizations that matter – to them. To assist employees in supporting the causes they care most about, AIG launched a bigger and better Matching Grants Program in 2012.

For the past 24 years, AIG has held its Winter Summit, combining business sessions led by AIG Property Casualty with ski and snowboarding races. Since 2011, the event has also raised more than $1.5 million for Disabled Sports USA,

AIG’s operations around the world are subjected to regulation by many different types of regulatory authorities, including banking, insurance, securities and investment advisory regulators in the United States and abroad. The insurance and financial services industries generally have been subject to heightened regulatory scrutiny and supervision in recent years.AIG adhere to all these regulations.

AIG develop new insurance products that address client needs related to alternative energy and limiting carbon emissions, as well as products that support the growing carbon market. AIG was the first U.S. insurance organization to issue a policy statement that publicly recognizes the impact of climate change, and to call for federal legislation to reduce greenhouse gas emissions.

AIG Investments is building on its robust due diligence process to integrate environmental, social and governance considerations into investment analysis.

Environmental Responsibility: AIG is focusing on the environment by increasing our energy efficiency, advocating for climate change legislation and helping clients improve their environmental stewardship.

AIG is investing in its employees through a competitive benefits program as well as training and development.

AIG provides property, casualty and marine insurance to a wide range of operations— including hydro, solar, geothermal, wind, waste-to-energy, biomass, landfill gas, IGCC, and biofuel facilities worldwide. Our products can support facilities from construction through operation.

8

4) Time Dimension

AIG’s Business strategy is to: Business Mix Shift: Grow in higher value lines of business and geographies. Underwriting Excellence: Enhance pricing and risk-selection tools through

investments in data mining, science and technology. Claims Best Practices : Reduce loss costs through new claims technology, a more

efficient and effective operating model and the use of data tools to bettermanage the economic drivers of losses.

Operating Expense Discipline: Decrease recurring operating expenses by leveraging AIG’s scale and driving increased standardization.

Capital Management: Efficiently allocate capital through the use of risk adjusted profit metrics, optimization of reinsurance and legal entity restructuring.

AIG is putting its global strength in insurance and financial services behind ensuring the long-term sustainability of its business. For doing so, they are allocating resources to effectively manage the risks and capture the opportunities presented by emerging social, environmental and governance concerns. AIG believe that sustainability initiatives will help grow their business and produce strong financial results well into the future.

9

5) AdministrationAdministration is all about managing effectiveness and efficiency across different departments. Effectiveness is the measure of are we doing the right thing whereas efficiency is “Are we doing the things right?”.

Marketing Department

Effectiveness Efficiency1) AIG is coming up with new policies and new products for the right customers

1) Because of sensitivity to customer needs the market cap of AIG is $68.71B.

2) AIG has direct agents and right distribution channels. In India it has a Joint venture with TATA AIG(76:24).

2) Efficiency of distribution channel is measured by channel to direct sales.

3) AIG invests a considerable amount on its advertisement.

3) Their share of advertisement as percentage of sales is low.

Finance DepartmentEffectiveness Efficiency

1) AIG has a strong backup from American govt, right investors and sources of funds.

1) With Net Income of US $3438 million and featuring in Fortune 500 companies, AIG is going strong on its financial aspects. Profit, ROI and ROA aspects of AIG are pretty strong for this insurance company.

HR DepartmentEffectiveness Efficiency

1) AIG is focusing on employee diversity so as to retain the best talent.

1) Because of this right mix attrition rate is not as high as in other companies in Tata AIG..

2) AIG believes in investing in its employees through a competitive benefits program as well as training and development

2) Because of a good training model in place for AIG no of training days/year is pretty good for AIG

3) AIG has an effective appraisal policy and transparency in place.

3) Because of transperancy in appraisal policy job satisfaction index is high in AIG

10

6) EntrepreneurshipAIG is providing a valuable opportunity for local entrepreneurs.

In an effort to promote entrepreneurship in Oman, the American International Group (AIG) will provided 12 scholarships to Omani citizens in AMIDEAST's 'Starting a Business' course, being offered in partnership with Cisco Entrepreneur Institute in May 2013.

AIG is putting its global strength in insurance and financial services behind ensuring the long-term sustainability of its business. For doing so, they are allocating resources to effectively manage the risks and capture the opportunities presented by emerging social, environmental and governance concerns. AIG believe that sustainability initiatives will help grow their business and produce strong financial results well into the future.

AIG develop new insurance products that address client needs related to alternative energy and limiting carbon emissions, as well as products that support the growing carbon market. AIG was the first U.S. insurance organization to issue a policy statement that publicly recognizes the impact of climate change, and to call for federal legislation to reduce greenhouse gas emissions.

In 2007, AIG developed a new strategy of investing in institutions that make microloans to small business owners. These initiatives will help build wealth in the communities where we do business, and facilitate our expansion in key emerging markets as microentrepreneurs grow local economies

AIG is building a diverse workforce, client base and supply chain so as to foster innovation. It enhances the ability to attract and retain top talent and maximize opportunities to expand customer base and utilize certified diverse suppliers.

Business Mix Shift: Grow in higher value lines of business and geographies.

11

Bibliography

Wikipedia http://www.aig.com/management-leadership_3171_437905.html http://www.aig.com/Chartis/internet/US/en/2012%20AIG%20Annual%20Report

%20(lower)_tcm3171-484181.pdf http://www.4psbusinessandmarketing.com/25102007/storyd.asp?sid=735&pageno=1

Submitted By:Chhavi SharmaPGDM04Div A

12