2019 EDITORIAL CALENDAR - Business Travel News

Transcript of 2019 EDITORIAL CALENDAR - Business Travel News

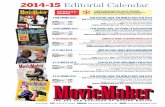

ISSUE DATE

AD CLOSING

MATERIAL DUE FEATURES EVENT

DISTRIBUTION

January 21 January 7 January 9• What to Watch in 2019• Business Travel Hall of Fame• SME Insiders *

February 18 February 4 February 6 • Premium Class Travel• Meetings Mavens **

March 18 March 4 March 6 • Expense Management Report • App Analysis *** • ACTE Global Summit (Chicago)

April 15 April 1 April 3• Best Practices in Traveler

Compliance & Engagement• SME Insiders *

May 13 April 29 May 1 • Women You Should Know• Meetings Mavens **

June 10 May 24 May 29• 5th Annual Car Rental Survey & Report• Meetings Management Report• App Analysis ***

July 1 June 17 June 19 • New Distribution Capability Update• SME Insiders *

August 5 July 17 July 19• 36th Annual Travel Manager Salary

Survey & Report • Meetings Mavens **

• GBTA Convention 2019

September 16 August 30 September 4• Travel Manager of the Year &

Best Practitioners• App Analysis ***

• ACTE Global Summit (London)

October 14 September 30 October 2 • 25th Annual Hotel Survey & Report• SME Insiders * • 6th Annual Innovate Conference (New York)

November 18 November 4 November 6 • 22nd Annual Airline Survey & Report

December 16 December 2 December 4 • 2019’s 25 Most Influential People in Business Travel

2019 EDITORIAL CALENDAR

Revised April 24, 2019

www.businesstravelnews.com August 13, 2018 | Business Travel News | 76 | Business Travel News | September 17, 2018 www.businesstravelnews.com

$1.7TRILLION

$1.3TRILLION

Global Business Travel Spend Will Reach $1.7T by 2022Global business travel spend grew 5.8 percent in 2017, an improvement on recent years’ moderate numbers, according to Rockport Analytics annual GBTA BTI Outlook, put together on behalf of the Global Business Travel Association. Rockport expects to mark 2018 growth at an even higher 7.1 percent. “The two-year period spanning 2017 and 2018 is projected to be the strongest two-year period for business travel since the initial recovery from the Great Recession in 2010 and 2011,” according to the report. Rockport does, however, expect growth to moderate again from 2019 through 2022, as the global economy is late in its current economic cycle. Still, growth is growth, and the industry is striding rather than inching toward the $2 trillion mark. Here’s more from the GBTA BTI Outlook.

Data Hub

HOW FAST WILL BUSINESS TRAVEL SPEND GROW?

2017 TO 2022 BUSINESS TRAVEL SPEND: FASTEST GROWTH VERSUS BIGGEST SPEND

India

China

Spain

Germany

U.K.

Russia

Canada

France

Italy

U.S.

Australia

The Netherlands

South Korea

Japan

Brazil

2017 2018 2019 2020 2021 2022

5.8%5%

7.1%

4.9% 4.7% 4.3%

BY AMANDA METCALF

71%

37%

30%

28%

26.3%

25.7%

25.6%

25%

22%

21%

19%

18%

16%

12%

9%

CHINA IN 2022

$475.6BCANADAIN 2022

$26.3B

RUSSIAIN 2022$24.1B

SPAININ 2022

$23.7B

U.K. IN 2022

$63.2B

GERMANY IN 2022

$92.3B

INDIA IN 2022

$63.5B

FRANCEIN 2022

$50BITALY

IN 2022

$41.3BAUSTRALIA

IN 2022$28B

NL IN 2022

$20.4B

JAPAN IN 2022

$71.4BBRAZILIN 2022

$33.5B

SOUTH KOREA IN

2022$41.8B

U.S. IN 2022

$354.6B

P007_BTN_0917 7 9/11/18 12:41 PM

7 | Data HubGlobal Business Travel Spend Forecast How fast will spend grow through 2022?

TOP STORY

VOLUME 35 | SEPTEMBER 17, 2018 WWW.BUSINESSTRAVELNEWS.COM

6 ON THE RECORD• HRS CEO Tobias Ragge on the value of transparency

18 SME INSIDERS• Buyer strategies in a newly fl exible market

22 TRANSPORTATION• Hertz invests in a turnaround• Air France-KLM hires new CEO

25 PAYMENT & EXPENSE• AppZen automates expense report approval

26 MANAGEMENT• BCD will turn on mobile air booking & adds Pana• Two new tools for lightly managed travel programs

36 PROCUREMENT• Southwest invests for corporate sales growth &

new distribution strategy• HRS Filter removes incorrect rates prior to point of sale

40 HEAD TO HEAD• Should fl ight disruption compensation from

airlines go to travelers or their employers?

Ariel Cohen, CEO of startup TripActions, on vying with mega travel management companies

What’s Inside 4 | On the Record

CONTINUED ON PAGE 30

“We’re never shy on the fact that we want to take the mar-ket, so our competitors are Amex GBT, BCD, Carlson, Egencia. And we are very capable and very successful on replacing them.”

Travel Manager of the Year & Best PractitionersKaren Hutchings has overhauled hotel procurement at one of the largest travel programs in the world: Her team put into play rate caps and dynamic rates, as well as price assurance technology, to slash the amount of time they spend on hotel RFPs. Turn inside to read all the wonky and wonderful details that moti-vated BTN to name Hutchings the 2018 Travel Manager of the Year. You’ll also � nd the stories of BTN’s 2018 Best Practitioners, three more travel buyers who similarly prefer bucking the system to riding the status quo.

ON THE HORIZON

The Transportation Security Administration plans to ex-periment with other ways to segment airport passengers for risk screening but plans to preserve the advantages travelers get from Precheck.

PAGE 3

TECHNOLOGY

The daunting job of data anlaytics looms large over corporate travel managers. Enter artifi cial intelligence and business intelligence tools from PredictX, Yapta & Carlson Wagonlit Travel.

PAGE 32

FULL STORY ON PAGE 8

LODGING

Marriott International CEO Arne Sorenson says the company doesn’t have much power to push hotel rates, plus what he has to say about meeting com-missions and home rentals.

PAGE 24

The timing of business travel’s biggest event, the GBTA Convention, doubt-less had something to do with it, but recent weeks have seen a notably high number of announced realign-ments, partnerships and expansions among travel management consul-tancies. Some may be coincidence. However, several people believe the changes symbolize expansion and repurposing in the consultancy mar-ket. In turn, those trends are driven by profound shifts within travel man-agement relating to new skill sets and strategic demands, technological advances, an exponentially growing supplier base, resource shortages and geographic coverage.

Areka Consulting managing partner for the Americas Louise Miller, who recently moved to the company from BCD Travel, singles out a group of travel management professionals aged

roughly 45 to 65 who are pioneering many of the changes. Her view is en-dorsed by Ann Dery, director of global travel for � nancial data, analytics and ratings company S&P Global. “I think there is a golden age of travel managers that are getting to the third act of our careers,” she said. “We look behind us and there aren’t many travel managers who have experienced what we have.” Dery’s argument is that travel manag-ers were operational specialists whose roles expanded and professionalized over the past decade by moving into procurement departments. That gave travel managers methodologies and tools to handle sourcing exercises with greater objectivity.

This generation of travel managers make for ideal consultants, Dery be-lieves. What is more, she said, “the

Consulting’s Rising Role in Corporate Travel Management B Y A M O N C O H E N

BTN’S 2018

The state of California’s Bill Amaral, EY’s Karen Hutchings, Discovery Communications’ Yukari Tortorich & The Church of Jesus Christ of Latter-Day Saints’ Shawn Johnson

2018 2019 2020 2021 2022

5%

7.1%

4.9% 4.7% 4.3%

P001_BTN_0917 1 9/14/18 11:11 AM

BTN DEPARTMENTSOn The Horizon • On The Record • Data Hub • Voices • Transportation • Lodging • Payment & Expense • Meetings • Distribution • Management • Procurement • Global • Technology

BTN RECURRING FEATURES * SME Insiders: A panel of small and midsize travel

program managers discuss issues and strategies specific to the segment.

** Meetings Mavens: A panel of strategic meetings management experts talk shop and answer questions on the last frontier of unmanaged travel.

*** App Analysis: Apps or tech from multiple suppliers in a single category compared side by side, e.g., features, market reach, pricing and future plans.

LOUIS MAGLIAROSenior Vice President & Group PublisherThe BTN Group

[email protected] 973.769.0028

ANTHONY CARNEVALEPublisherThe BTN Group

[email protected] 201.902.1976

LINDSAY STRAUBBusiness Development DirectorThe BTN Group

[email protected] 646.380.6274

RICHARD MARKUSBusiness Development DirectorThe BTN Group

[email protected] 301.944.4324

TOP STORY

VOLUME 35 | AUGUST 13, 2018 WWW.BUSINESSTRAVELNEWS.COM

3 ON THE HORIZON• Facial recognition in hotels, plus IBM Watson & Travelport

8 DATA HUB• What will happen to travel prices in 2019?

28 MEETINGS• Cvent’s plans, plus a closer look at simple meetings

32 PAYMENT & EXPENSE• ARC enables Alipay & Certify acquires Abacus

33 TRANSPORTATION• Blacklane’s airport concierge services & airline JV updates

34 LODGING• IHG launches B2B program for small & midsize enterprises,

plus Airbnb for Work listings will fl ow into Concur

36 MANAGMENT• American Airlines gives travel management

companies a way to help travelers out of Basic Economy buyer’s remorse

40 PROCUREMENT• Airlines respond to rising fuel costs, plus

new Delta reporting metrics & what goes into fl ight disruption compensation

44 TECHNOLOGY• New Lola CEO, Tripbam launches benchmarking

tool & Deem enters the fray for small & midsize enterprises

48 APP ANALYSIS• Car rental company apps side by side

David Holyoke on acceptance of Airbnb for Work

Eric Bailey on the upshot of Microsoft’s Travel Manifesto

What’s Inside

4 | On the Record

CONTINUED ON PAGE 36

BTN’S 35TH ANNUAL SALARY SURVEY & REPORT

2018 Salaries Spring BackTravel manager salaries rebounded from last year’s salary survey, marking 15.6 percent year-over-year growth, after last year’s in� ux of early-career and small and midsize enterprise travel managers. Still, even among this year’s respondents, salaries leapt 6 percent over their own salaries a year prior. This year’s respondents also indicated changes in their programs’ focuses, whether to meetings, traveler experience or technology. Keep read-ing to see how salaries break down by gender, job title, travel program size and experience, plus travel managers’ perceptions about how their compa-nies value them, where they expect their careers and salaries to go and where they see opportunities for career advancement.

FULL STORY ON PAGE 12

2014

2015

2016

2017

2018

TRAVEL MANAGER SALARIES(based on BTN’s annual surveys)

MANAGEMENT

2014

2015

2017

2018

$1

08,33

1

$114

,769

$

118,4

79

$99,7

86

115

,306

Two of the world’s largest travel management companies have become one. American Express Global Business Travel com-pleted its 410 million British pound takeover of Hogg Robin-son Group last month to create a TMC that handles a combined $36 billion in annual transac-tion value. The mega of all megas now has mega integration work ahead. “The real work starts now,” Amex GBT CEO Doug An-derson said. “We’ve done a lot of planning, but planning is a desk-top exercise.”

The new company named Amex GBT EVP of traveler care Joanna Macleod as chief trans-formation of� cer “to facilitate

the successful integration of the companies,” according to Amex GBT. Meanwhile, HRG COO Bill Brindle joined Amex GBT’s executive ranks as COO. Already announced, former HRG CEO David Radcliffe has joined Amex GBT’s board.

“We’ll be working hard on three primary objectives around bring-ing together our complementary global footprint, our highly com-plementary tech stack and then the best of both in regards to our people,” said Anderson. “My prin-ciple around this from the begin-ning has been to � nd the best of both organizations and bring them

Amex GBT CEO Talks Next Steps Now That HRG Deal Is Done B Y J AY B O E H M E R

What do Alipay & Wechat Pay Mean for Corporate Payments?PAGE 20

The Geopolitics Driving Traveler RiskPAGE 22

Blockchain’s Early Travel Industry MoversPAGE 26

P001_BTN_0813 1 8/3/18 1:23 PM

• CORPORATE TRAVEL INDEX BTN’s annual compilation and analysis of per-diem business travel costs in 100 U.S. cities and 100 others around the world.

• MANAGED TRAVEL TECHNOLOGY HANDBOOK This resource will guide buyers through the research, decision-making and implementation of tech like desktop and mobile booking platforms, off-channel data aggregators, payment and expense and data visualization and business intelligence tools.

• SMALL & MIDSIZE ENTERPRISE REPORT An annual survey and analysis to help SME travel managers benchmark their own programs against peer programs.

• BUSINESS TRAVEL BUYER’S HANDBOOK An end-to-end guide to managed travel programs, including structure, policy, meetings management, travel management companies, payment systems, hotel companies, airlines, car rental firms, chauffeured providers and travel risk management.

• CORPORATE TRAVEL 100 BTN identifies the biggest corporate travel spenders in the U.S. and how they manage their programs.

• CORPORATE TRAVEL STAKEHOLDERS: WHAT THEY WANT TO KNOW Interviews with stakeholders from the C-suite to HR to department heads will reveal their priorities for managing travel, whether cost containment or investment in company growth. They’ll also dig in to employee safety, satisfaction and retention.

2019 EDITORIAL CALENDAR

Sponsored in part by

2018 CORPORATETRAVEL INDEX

BUSINESS TRAVEL PER DIEMS FOR 200 CITIES WORLDWIDE

March 26, 2018

ISSUE DATE AD CLOSING MATERIAL DUE TITLE

April 1 March 18 March 20 Corporate Travel Index

April 29 April 15 April 17 Managed Travel Technology Handbook

June 17 June 3 June 5 Business Travel Buyer’s Handbook

August 26 August 12 August 14 Small & Midsize Travel Management Report

September 30 September 16 September 18 Corporate Travel 100

November 4 October 21 October 23Corporate Travel Stakeholders: What They Want to Know

* Research and reference issues are standard magazine size

BTN RESEARCH & REFERENCE ISSUES*

Delivered in print and online, these special issues are effective reference tools for travel managers, as well as promotional vehicles for travel marketers. They help build a thought leadership position by associating your company in strategic editorial environments, offering extended shelf life for 12-month exposure.[

WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW RAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE O-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMAR-ET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME

BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR TRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST / INVESTORS FLOCK TO NEW SME CORPORATE TRETECH / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET

MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY HE MIDMARKET MATTERS / NEW ENTRANTS FIND SME NICHE / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL

MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST OR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE UL-IMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET NNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATE-

GIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW NTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC

WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMAR-ET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL

MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO ERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE

MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST OR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE UL-IMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET NNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGER / WHY THE MIDMARKET MATTERS / MIDMARKET BUYERS’ TMC THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRAT-

GIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST IS FOR NEW TRAVEL MANAGERS BUYERS’ TMC WISHLIST / MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW NTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC

WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMAR-ET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL

MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO ERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE

MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST OR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE UL-IMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET / HE NEW TRAVEL MANAGERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW RAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE O-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVA-ION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS /

MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES OR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS IND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHLIST NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’

NTRANTS FIND SME NICHE / AIR STWISHLIST / NEW ENTRANTS FIND SMET BUYERS’ TMC WISHLIST / NEW

MARKET / MIDMARKET BUYERS’ TMERVE THE SMALL MARKET / MIDMATHE RUSH TO SERVE THE SMALL M

MANAGERS / WHY THE MIDMO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE M

ION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGER/ MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW T

GIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-ERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BUYERS’ TMC W

MIDMARKET MATTERS / NEW ENTRANTS FIND SME NICHE / MIDMARKETNAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL M

R NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SEMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTENOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MMIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANA

S FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTRANTS FIND SME NICHE / AIR STRATEGIESHLIST / NEW ENTRANTS FIND SME NICHE / AI

UYERS’ TMC WISHLIST / NEW ENTRANTS FIND SET / MIDMARKET BUYERS’ TMC WISHLIST / NEW EN

HE SMALL MARKET / MIDMARKET BUYERS’ TMC WISHH TO SERVE THE SMALL MARKET / MIDMARKET BUYE

MATTEHY TH

ANAGERS / WHY THE MIDMARKET MATTERS / THE RUSHR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MA

E TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THHE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGE

KET INNOVATION / THE ULTIMATE TO-DO LIST IEGIES FOR SME BUYERS / MIDMARKET INN

E / AIR STRATEGIES FOR SME BUYERS / S FIND SME NICHE / AIR STRATEGIES F

T / NEW ENTRANTS FIND SME NICHE /ERS’ TMC WISHLIST / NEW ENTRANTS MIDMARKET BUYERS’ TMC WISHLIST

MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MARKET / MIDMARKET BMANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THE SMALL MAOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERHE NEW TRAVEL MANAGERS / THE RUSH TO SERVE THE SMALL MARKET / MI

AVEL MANAGERS / WHY THE MIDMARKET MATTERS / THE RUSH TO SERVE THDO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / T

/ THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL

ERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DSME BUYERS / MIDMARKET INNOVA

EW ENTRANTS FIND SME NICS’ TMC WISHLIST / NEW ENTIDMARKET BUYERS’ TMC WISE SMALL MARKET / MIDMAR

ARKET MATTERS / THE RUSH/ WHY THE MIDMARKET MAT

AVEL MANAGERS / WHY THE O LIST FOR NEW TRAVEL MATHE ULTIMATE TO-DO LIST FOT INNOVATION / THE ULTIMAUYERS / MIDMARKET INNOVSTRATEGIES FOR SME BUYERD SME NICHE / AIR STRATEGEW ENTRANTS FIND SME NICS’ TMC WISHLIST / NEW ENTRE / AIR STRATEGIES FOR SM

RANTS FIND SME NICHE / AISHLIST / NEW ENTRANTS FINARKET BUYERS’ TMC WISHL

ALL MARKET / MIDMARKET BTO SERVE THE SMALL MARK

ARKET BUYERS’ TMC WISHLIST / NALL MARKET / MIDMARKET BUYETO SERVE THE SMALL MARKET / M/ MIDMARKET BUYERS’ TMC TUYERS’ TMC WISHLIST / MIDST FOR NEW TRAVEL MANAGETIMATE TO-DO LIST FOR NEWNOVATION / THE ULTIMATE T

/ MIDMARKET INNOVATIOOR SME BUYERS / MIDM

AIR STRATEGIES FOR SNTS FIND SME NICHE /SHLIST / NEW ENTRANBUYERS’ TMC WISHLRKET / MIDMARKET

ENTRANTS FIND STMC WISHLIST / N

MARKET BUYERSMALL MARKERUSH TO SERVET MATTERS

THE SMALL MARKET / MIDMTHE RUSH TO SERVE THE SMARKET MATTERS / THE RUSHY THE MIDMARKET MATTERR NEW TRAVEL MANAGERSTION / THE ULTIMATE TO-DO

DMARKET INNOVATION / THESME BUYERS / MIDMARKETR STRATEGIES FOR SME BUD SME NICHE / AIR STRATEGEW ENTRANTS FIND SME NERS’ TMC WISHLIST / NEW ET / MIDMARKET BUYERS’ TTHE SMALL MARKET / MIDMTHE RUSH TO SERVE THE SMARKET BUYERS’ TMC WISHLISLL MARKET / MIDMARKET B

H TO SERVE THE SMALL MART MATTERS / THE RUSH TO WHY THE MIDMARKET MATTAVEL MANAGERS / WHY THE

MARKET BUYERS’ TMC WISHLIST / NEWALL MARKET / MIDMARKET BUYERS’ TSH TO SERVE THE SMALL MARKET / MCH / MIDMARKET INNOVATION / THEES FOR SME BUYERS / MIDMARKET INNOCHE / AIR STRATEGIES FOR SME BUYERTRANTS FIND SME NICHE / AIR STRATEGISHLIST / NEW ENTRANTS FIND SME NICRKET BUYERS’ TMC WISHLIST / NEW ENTMARKET / MIDMARKET BUYERS’ TMC WIS

TO SERVE THE SMALL MARKET / MIDMARATTERS / THE RUSH TO SERVE THE SMALLY THE MIDMARKET MATTERS / THE RUSH

EL MANAGERS / WHY THE MIDMARKET MATT FOR NEW TRAVEL MANAGERS / WHY THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MAINNOVATION / THE ULTIMATE TO-DO LIST FO

RS / MIDMARKET INNOVATION / THE ULTIMAGIES FOR SME BUYERS / MIDMARKET INNOV

ERS / THE RUSH TO SERVE THE SMALL MMIDMARKET MATTERS / THE RUSH TO SNAGERS / WHY THE MIDMARKET MATTE/ INVESTORS FLOCK TO NEW SME CORPOST / NEW ENTRANTS FIND SME NICHE / AIERS’ TMC WISHLIST / NEW ENTRANTS FINET / MIDMARKET BUYERS’ TMC WISHLIST THE SMALL MARKET / MIDMARKET BUYERTHE RUSH TO SERVE THE SMALL MARKET /ARKET MATTERS / THE RUSH TO SERVE THE/ WHY THE MIDMARKET MATTERS / THEW TRAVEL MANAGERS / WHY THE MIDMARE TO-DO LIST FOR NEW TRAVEL MANAGERS TION / THE ULTIMATE TO-DO LIST FOR NEW T

DMARKET INNOVATION / THE ULTIMATE TO-DOSME BUYERS / MIDMARKET INNOVATION / TR STRATEGIES FOR SME BUYERS / MIDMARKD SME NICHE / AIR STRATEGIES FOR SME BUYEW ENTRANTS FIND SME NICHE / AIR STRATE

TRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMAR-WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME

MARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR TIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKET TION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS / WHY MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL

FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE UL-NTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET ST / NEW ENTRANTS FIND SME NICHE /BUYERS’ TMC WISHLIST / NEW ENTRA

ARKET / MIDMARKET BUYERS’ TMC WISERVE THE SMALL MARKET / MIDMARRS / THE RUSH TO SERVE THE SMALL M

MARKET MATTERS / THE RUSH TO SERGERS / WHY THE MIDMARKET MATTEREW TRAVEL MANAGERS / WHY THE MIDMARKET MATTERS / THO-DO LIST FOR NEW TRAVEL MANAGERS / WHY THE MIDMARKETON / THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERS /

ST FOR NEIMATE T

/ AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATIONNTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SM

T BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / ASERVE THE SMALL MARKET / MIDMAR

RS / THE RUSH TO SERVE THE SMALL MMARKET MATTERS / THE RUSH TO SER

GERS / WHY THE MIDMARKET MATTEREW TRAVEL MANAGERS / WHY THE MIO-DO LIST FOR NEW TRAVEL MANAGERON / THE ULTIMATE TO-DO LIST FOR NMIDMARKET INNOVATION / THE ULTI

FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE UL-TS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET / UYERS / MIDMARKET INNOVATION / THE ULTIMATE TO-DO LIST FOR NEW

TRATEGIES FOR SME BUYERS / MIDMARKET INNOVATION / THE ULTIMATE SME NICHE / AIR STRATEGIES FOR SME BUYERS / MIDMARKET INNOVA-/ NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES FOR SME BUYERS / ERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE / AIR STRATEGIES / MIDMARKET BUYERS’ TMC WISHLIST / NEW ENTRANTS FIND SME NICHE

May 21, 2018

SPONSOREDIN PART BY

DDDMMMEEEEEEHEE MMMMMIIIDIDMAMAMAARKKRKRKEETET MMMMATATTATTTETERSRSRSRSRS //// TTHEHEHEHEHE RRRUSH TOTOTOTOTO SSSSERVEE TTTTHEHEHE DDD SSSSMEMEME NNNICCCCHEHHEHEHE / AAAAAIRIRIRIRIR SSTRATATTEGGEGEGMMMC CC WIWIWISSHSHLIISTSTST / NNNNEWEWEWEWEW EENTNTNTRRRARANTNTNTSS FINNNEEEETTTT T //// MIMIMIDMDMDMMARARARARARKEKEKET TTTT BBBUBUBUYERSSSS TTTTTTTT

FOFOFOFOFORR SMSMSME UUUBUYEYEYEYEYERSRS /// MMMMIIDMAMAMARKET IINNNNNNNNNNOOOOV TATATATATIIOIOION /// TTTHEEEE ULULULULULTTTTTIS M A L L & M I D S I Z E E N T E R P R I S E R E P O R T 2 0 1 8HST

EEEEEE EEEEEEEEE MMMMM DDDDDDDDHEEEEEEE MMMMMMMMMMMIIIIIDIDIDIDIDDDMMAMAMAMAMAMAMAMAMAAM RKRKRKRKRKRKRKRKRKRKEEEETETETETETT MMMMMMMMMMATATATATATATATATATATATA TETETETETETEETERSRSRSRSRSRSRSRSRSRSRR ///////// TTTTTTTTTTHEHEHEHEHEHEHEHEHEHEHEH RRRRRRUSHHHHHH TOTOTOTOTOTOTOTOTOTOTT SSSSSSSSSSEERVEEEEEEEE TTTTTTTTTHHHHHEHEHEHEHEHE EEEEEEEEEETTTTTTTTTT ////////// MMIMIMIMIMIMIMIMIMM DMDMDMDMDMDMDMMMMMMDMAARARARARARARARARARARKEKEKEKEKEEEEKETTTTTTTTTTTT BBBBBBBBUBUBUBUUUUYERRSRSSSSSSSSSSS TTTTTTTTMTMTMMMMMCCCCCCCCCCC IWIWIWIWIWIWIWIWIWIW SSSSSSSSSSHSHHLILILIIIIIISSSSTSTSTSTSTSTSTT // NNNNNNNNNNNNNEWEWEWEWEWEWEWEWEWWWWEW EEEEEEEEENTNTNTNTNTNTNTNTNTNTRRRRRRARARARARAAANTNTNTNTNTNTNTNTNTNTN SSSSS FIIINDNDNDNDNDNDNDNDNDNN SSSSSSSSSSMEMEMEMEMEEEEEEM NNNNNNICICICCCCCCCCCI HHHEHEHEHEHEHEHEHEHEE //// AAAAAAAAAAAAAIRIRIRIRIRIRIRIRIRIRR SSSTRAATATATATATATATATATTTEGEGGGEGEGEGEGEGEGEGSTSTSTSTSTSTSTSSSS

FOFOFOFOFOFOFOFOFOFOOORRRRR SSSSMSMSMSMSMSMSMSMMEE BUBUUUUUUUUUUUB YEYEYEYEYEYYEYEYEYEYEERSRSRSRSRSRSRSRS ///////// MMMMMMMMMMMIIIDMAMAMAMAMAMAMAMAMAMAM RRRKET IIIIIIIINNNNNNNNNNNNNNNNNNNNNNN OOOVOVOVOVOVVATTATATATATATATATATATAAA IIIIOIOIOIIOIOOOONN ////////// TTTHTHTHTHTTHEEEEEEEEEEEE UULULULULULULULULULULLLTTTTTS M A L L & M I D S I Z E E N T E R P R I S E R E P O R T 2 0 1 8RT

RVE E THT E SMSMALALL MAMARKETET / MMIDI MARKETT BBUYERERRRRRRSS //// TTHHHHEE RURURUUSHSH TTTOOOO SEEEERRRVVVE TTTHHEEE SMALLLL MMMMAARKETTTHHH

GMEGIIESES FORR SSMEE BBUYU ERRS / / MIM DMMARARKET ININNON VMMMEEE NNNIICHCHHHEE //// AIIRRR SSTTTS RRAAATTTTEGGGGIESSSE FFOOOROR SSSME BBBBUYYYYEER

EEW ENE TRTRANANTSS FFINI D SMMEE NIN CHCHE / / AIAIRR STS RARATETEEEERRSSSS’’ TTTMMMMMCC WWWWWWISISSSHLHLIISST / NNNNNEWWWWW EEENNTRTRANANANANNTTS FFFINNNNDD SSSSM

ONO // TTHE UULTLTIMATATE E TOO DDO O LIST FFORO NEWEW TRAAVEV L MAMMIMMIIDMDMMMMARARRKKEKETTT INNNNNONONOVVAVAVATTTTI NNNON / THHEEE UUULLLTIIMMMMAAAATTTE TOTOTOO DDOOOO LLLIISTTRRRRSS //// THHHHHEEE RURURURUUSHSH TTTOOOO SEEERRVVVE TTTHHEEE SMALLLLL MMMMAARKETT

HHHE T MEEERRSSSS’’ TTTMMMMMC WWWWWWWISISSSHLHLIISST / NNNNNEWWWWW EEEENNNTRTRANANANANNTTS FFFINNNNNDD SSMSMSMMEEE NNNIIICHCHHHEE //// AAIIRRR SSSTTTRRAAATTTTETEGGGGIEESSS FFOOOROR SSSME BBBBUYYYYEEER MIMMIIDMDMMMMARARARKKEKETTTT INNNNNONOVVAVAVAV TTTTIONNN / THHEEE UUULLLTIIMMMMAAAATTTE TOTOTOO DDOOOO LLLLIIISEEEEE MMM DDDD

TTTHH

RRRRSS ////// TTHHHHHEEEE RURURURUURUSHSHSH TTTOOOOOO SEEEERRVVVVR E TTTTHHHEEEE SMALLLLLLL MMMAMAAAM RKETTTTTHEHEHEEEEEEEEHEH MMMMMMIIIIIIIDDDDDDDDMMMMMAMAMAMAMAMAAMMMM RKRKRKRKRKRKKEEEEEETETETETTT MMMMMMMMATATATATATATATATATTETETETETEEEETETERSRSRSRSRSRSRR ///////// TTTTTTTTTTTTHEHHEHEHEHEHE RRRRRRUSHHHHHHHHHH TOOTOTOTOTT SSSSSSSSSSSEERVEEEEEEEEEEE TTTTTTHHHHHHH

EEE / MM SSEEEEETTTTT /////////// MMMMMIMIMIMIMIMMMIMM DMDMDMDMDMDMDDMMMMMMMD AARARARRRRRARRKEKEKEKEKKEEEEEEETTTTTTTT BBBBBBBUUUUUUUUYERRRRRSSSSSSSSSSS TTTTTMMMMMMMMT CCCCCCCCCCC WIWIWIWIWIIWWWWW SSSSSSSSSSSHHHHLLLLIIIIIIIISSSSSSTSTTTTTTTT //// NNNNNNNNNEEWEWEWEWWWWWWWWWWW EEEEEEEEEENTNTTNTNTNTNTRRRRRRRARARAAAAARAANTNTNTNTNTNTNTNTNNTNTNTSSSSSSS FIFIIINNNDNDNDNDNDNNDN SSSSSSSSSMMMMMMEEEEEEEMM NNNNNNIIIICICCCCCCCCCCI HEHHEHEHEEEEEE //// AAAAAAAAAAIRIRIRIRIRRRRR SSSTRAAAAAAAATATATATTTAATEGEGGEGEGEGEGGEERERRREE SSSSS’’ TTTTMMMMMMCCC WWWWWWWWISISISSSHLHLHLIISISSSI T / NNNNENEWWWWWW EEEENNNTRTTRTRANANANAANTSTSTS FFFFFINININNNNDD SMSMSMSMMSS EEE NINIIIN CHCHCHCHHEE //// AAIAIIRRR SSTSTTTTS RRAAAATTTETETEGGGGGIGIESESSSSE FFFOOROROR SSSSME BBBBBUYYYUYEEERE MMMMIIIDMMMMDMARARARARRKKEKETTTTT ININNNNNONONOVVVAVAVAVV TTTTTII NNNONO // THHEEEE UUUULLLTLTL IIIMMMMMAATATTTTA EE TOTOTOTOTO DDDOOOOO LLLIIIL SSSSSSSSSSSSSSSS

FFOFOFOOOOOOOORRRR SSSSMSMSMSMSMMMMMMMEEEE BBBUUUUUUUUUUBBBB YEYEYEEEEYEYERSRSRSRSRSRSRSRSRSRSRSS ////// MMMMMMMMMIIIDDMAMAMAMAMAMAMAMAMAMAMAMAMAMM RRRKETT IIIIIIINNNNNNNNNNNNNOVOVOVOVOVOVOVOVOVOVVATATATATATAAAAAAAA IIIIOOOOOOIOOONN ////////// TTHTHTHTHTHTHTHTHHEEEEEEEEEE UUUUUUURRRRRRSSSSSSSSSSSSSSSSSSSSSSSSSDDDDDDDDDDDDDDDDDMMSSSSSSEEEEEEEEEEEEEEEEEEEEEEEEE

EEEEEEEEEEEEEEEMMMMMMMT ////////////////////HHHHHHHHHHSSSSSSSSSSSS MMMMMMMMMMM AAAAAAAAAAAAA LLLLLLLLLLLLLLL LLLLLLLLLLLLLLL &&&&&&&&&&&& MMMMMMMMMMMMSSSSSSS MMMMMMM AAAAAA LLLLLLL LLLLLLL &&&&&&&& MMMMSSSSSSSSSS ////////////// / TTTHTHTHTHTHTHTHTTTTTT EEEEE E E E E E E E RURURUURURURURURURURURURURURUR SHSHSHSHSHSHSHSHSHSSHSSSSSSS TTTTTTTTTTTOOOOOOOOOOOOOOO SSESESESESESSSSSSSSSSS RVRVVVVRVRVRVRVRVRVRVRVVVVEEEE EEEEEEEEEE TTTTHHHHHHHHEEEEEEEEEEEE E E E E SMSSSSSSSSS ALLLLLLLL L L MAMAMAAAAAMAMAMAMAMAMAMAMAMAMM RKRRRRRRRR EETTTTTT ////////SSSSSSSSS ///////// / // THTHTHT EEE E E E E E E E E UUUUURURURURURURURURUSSSSSSSSSSSSS TTTTTTTTTOOOOOOOOOOOOOO SS RVRVVVVRVRVRVRVRVRVVVV HHHHHHHEEEEEEEEEEEEEE LL MAMAMAAMAMAMAMAMAMAMAMM ////////SSS /// / // T E E EE UURURUUR SS TTTOOOOOOO S RVRVRVVVVR HHHEEEEEE L L MMMAMAMAAAM RK ///SSS /// / // T E E EE UURURUUR SS TTTOOOOOOO S RVRVRVVVVR HHHEEEEEE L L MMMAMAMAAAM RK ///

HEEEEEEEEEEHEHHH MMMMIIIIIDDDDDDDDMMMMMMMMMAMAMAMAAAMMM RKRKRKRKRKKEEEEEEETETETTT MMMMMMAATATATATATTTTTTTTETETETETEEEEEEETET RSRSRSRSRSRSSSSSSS ///////// TTTTTTTTTTTTTHEHHEHEHEEEEEEEEE RRRRRRUSSSHHHHHHHHHHHHHH TOTOT SSSSSSSSSSSERERVVEVEVEVEEEEEEEEEE TTTTTHHHHEEEEEEEE MMMMM MMMAMAMAMAMAMAMAMAMAMMM RRRKRKRKRRRR TTTTT MMMMAAATATATATATAAA EEEEEEEEEEERSRRRSRSSSSSSSSRS TTTTTTTTTTTTHHHEHEHEHEHEEEEEEHE HHHHHHHH TOTOTOTO EEEEEEEEEEE TTTTTTTTHHHHHHEEEEEE MMMMM MAMAMAMARRRKRK TTTTT MMMMMAAAAAT EEEEEERRRSRSRSRS TTTTTTHHHHHEHE R HHHHH TTTOTOTOTO S EEEE TTTTHHHEEEEEE MMMMM MAMAMAMARRRKRK TTTTT MMMMMAAAAAT EEEEEERRRSRSRSRS TTTTTTHHHHHEHE R HHHHH TTTOTOTOTO S EEEE TTTTHHHMMMMMMMMMMMM RRRRRRRRR IIIIIIIII SSSSSSSSSSSSS EEEEEEEEEEE RRRRRRRRRRRRRRRRRR IIIIII SSSSSSS EEEEEEE RRRRRRRSTTTTTTSTSTSTSTSTSTSTSTSTSTRRRRARARARARARARARARRRRR TETETETEETETETETETETETETETETEGGGGGIGIGIIIIIIESSSSESESESESESESESESESESES FFFFFFFFFFFFOOORORORORORRRRRRRR SSSSSSSSSSSSSSSSMMEMMMMMMMMM BBBBBUYYUYUYUYUYUYUYUYUYUYUYUYERERERERRERERERERERERERERERERERERSTTTSTSTSTSTSTSTSTSTST ARARARARARR TTTTTTTTTTTTT GGIIIIIIIESSSSESESESESESESESESE ORORORORRRRRRR SSSSSSSSSSSS UYYUYUYUYUYUYUYUYUYUYEEEEEEEEEEESTSTTTTTS RAAATTTTTT GGIGIESESSSSS RORO SSSME UYUYYUYEEEEESTSTTTTTS RAAATTTTTT GGIGIESESSSSS RORO SSSME UYUYYUYEEEEE

DDDDD SSSSSSSSSSMMMMMMEEEEMMMM NNNNNNNNIIIICCCCCCIII HEHEHEEEEE //////// AAAAAAAIRIRRRRRRRR SSSTRRRRAAAAAAAAAATATATTTAAAA EGEGEGEGEGGGGDDDDDDDDDD SSSSMMMMMMMEEEEM NIIICCCCICHHEHEHH /////// AAAAAAAIRIRIRIRRR S AAAAAATATATATTTAAA EEGEGEGEGEGEEEEGDDDD SMEMMME NICICICICICCHHHHE ////// AAAAAAIIIRIR S ATATATATATEEEEGEGDDDD SMEMMME NICICICICICCHHHHE ////// AAAAAAIIIRIR S ATATATATATEEEEGEGNNNNNNNNNNN TTTTTTTTTTTTTT EEEEEEEEEEE RRRRRRRRRRR PPPPPPPPPPP RRRRRRRRRRRRNNNNNNN TTTTTT EEEEEEE RRRRRRR PPPPPPP RRRRREEEENENENENENENENNNTRTTRTRTRTRTRTRTRTRTRTRTRTRTRANANANANANANANANANANANAAAAAA TTTSTSTTSTSTSTTSTSSSTS FFFFFFFFFFFFFFFININININININININININIIII DDDDDDDDDD SMSMSMSMMMSMSMSMSMSMSMSMSMSMSS EEE E E E NIIINININININININININININ CHCHCHCHCHCHCHCHCHCHCHCHCHCCCC EEEEEEEEE /////////// / AIAAAIAIAIAIAIAIAAAAAAAA RRR R R R R SSSSSSSSSSSSNNNNNNNTRTRTRTRTRTRTRTRTRTRTRTRAAAAAAAAAAAAAA TTSTSTSTTSTSTTSTSSS FFFFFFFFFFFFIIIIIIIIII DDDDDDDD SMSMSMSMSMMSMSMSMSMSMSSS EE E NIIINININININININININ CCCCCCCCC EEEEEEE ////// / / / // AAAAAAAAAA RR R R R SSSSSSSSSSNNNNTRTTRTRTRAAAA TSTSTSSTSTS FFFFI DD SSSSME E NNIIIIN CCC EEE ///// / / AA R R SSNNNNTRTTRTRTRAAAA TSTSTSSTSTS FFFFI DD SSSSME E NNIIIIN CCC EEE ///// / / AA R R SSMMMMMMMMCCCCCCCCCCC WIWIWIWWWWWW SSSSSSSSSSHHHSHLLLLLIIIIIIILLL SSSSSSTTTTTTTTTT //////// NNNNNEEWEWWWWWWWWWWWWW EEEEEEEEEEENTNTNTNTNTRRRRRARARARARARARAAAAANTNTNTNTNTNTNTNTNTNTNTSSSSSSSSSSSSS IFIFIFIFIFIFIF NNNNNNNNNNCCCCCCCCCC WIWIWIWIWWWWWW LLLIIIIILIL SSSS ////// NNNNNEEWEWEWEWW EEEEEEEEEEENTNTNTNTNTNTNTTTRRARARAAAAAAANNNNNNNNN IIIIIINNNNNNNNNCCCC WWWWIWI LLILILIS ////// NNNNNNEEEEW EEEENTNNTNTNTRAAAANNN S IIIIINNNNCCCC WWWWIWI LLILILIS ////// NNNNNNEEEEW EEEENTNNTNTNTRAAAANNN S IIIIINNNNSSSSSSSSS IIIIIIIII ZZZZZZZZZZZZZ EEEEEEEEEEE EEEEEEEEEEESSSSSSS IIIIII ZZZZZZZZ EEEEEEE EEEEEEEERERERRRRRERERERERERERERERERERE SSSSS’S’SSS TTTTTTTTTTTTTTTMMMMMCMCMCMCMCMCMCMCMCC WWWWWWWWWWWWWWWWISISISISISISISISISISIIIII HLHLHLHLHLHLHLHLLLLLISISSSSISISISISISISISISISISISI T TT TTTTTTTT / NNNNNNENEEEEEEEEEWWWWWWWWWWWWW W WWERERERREREREREREREREREE TTTTTTTTTTTTT CCCCCCCCC WWWWWWWWWWWWWW LHLHLHLHLHLHLHLLLLISISISSSISISISISISISISI / NENEEEEEEEEWWWWWWWWWW W WWWEEERERRRE TTT CCCCC WWWWWWWW LHLLH IIISST / NEEWWWWWWW EEERERRRE TTT CCCCC WWWWWWWW LHLLH IIISST / NEEWWWWWWW

EETTT ///////////// MMMMMIMIMIMIMMMMM DMDMDMDMDMMMMMMMDMDDD AARARARARRRRRRRRA KEKEKEEEEEEEEEKEEKK TTTT BBBBBBUUUUUUUUB YEYERRRRRRRSSSSSSSSSRSR ’’ TTTTTEEEETTTTT MMMMMMMMMMMMM MMMMMMMMMMMAAAARARARARARARARRR EEEEEEEEEEEETTTTT BBBBBB RRRRRSRSSSSSSSSSR ’’’’ TTTTTTEEEEETTT MMMM MMMMMMAAAAAR EEEEEETTTTTT BB RSRSRSRSRSRS’’’’ TTTEEEEETTT MMMM MMMMMMAAAAAR EEEEEETTTTTT BB RSRSRSRSRSRS’’’’ TTT EEEEEEE PPPPPPPPPPP OOOOOOOOOOOOO RRRRRRRRRRRR TTTTTTTTTTTTTT 22222222222 000000000000 111111111111 888888888888EEEEE PPPPPPP OOOOOOO RRRRRRR TTTTTT 22222222 0000000 111111 8888888MMMMIMIMIMMIMMMMMMMM DMMMDMDMDMDMDMDMDMDMDMMMARARARAARARARARARAARAAAAAA KKEKEKEKEKEKEKEKEKEKEKETTTTTTT T T T TT ININININININININININININININIII NNONONONONONONONOOOOOVAVAVAVAVAAAVAVAVAVAVAVAVAVAVAVATTTITITITITITT ONONNNONONONONONONONONON /////////////// TTHHEEEEEE UUUUUUUUUUULTLTLTLTLTTLTLTLTLTLTLTLTLTLTLTLTIIIMIMIMIMIMIMIMMMMMMMMATATTTTTATATATATATATATATATATEEEEEEEEE E EEEEEEE TOTOTOTOTOTOTOTOOOOOOTO DDDD-D-D-D-D-D-D-D-D-D-D-D-- OOOO O O O O LILIIIILILILILILILILILILILILISSSSSSSSSSSSSSSSSMMMMMMMMMMMM DMMMDMDMDMDMDMDMDMDMMAAAAAAAAAAA KKEKEKEKEKEKEKEKEKET T TTTTTTTT IIIII NONONONONONONOOOOVAVAVVVAVAVAVAVAVAVAV IIIONONNNONONONONONONON T EEE UUUUUUUUUULTLLTLTLTLTLTLTLTLTL MMMMMMMMMMATATTATATATATATATATATEEEE OTOTOTOTOTOTOOOOOO---- O O O O LILIIILILILILILILILILIL SSSSSSMM DMDMDMDMMMDMAAA KEKEKEKEKET T T T II NONONOVVVVVAVAV IIIIIOONONNNONN / T EE UUUUULLLTLT MMMMAATATATTTTE TOTOTOTO--- O LLLLIIISSMM DMDMDMDMMMDMAAA KEKEKEKEKET T T T II NONONOVVVVVAVAV IIIIIOONONNNONN / T EE UUUUULLLTLT MMMMAATATATTTTE TOTOTOTO--- O LLLLIIISSFFOFOOOOOOOORRRRRRR SMSMSMSMSMSMSMMMMMMMEEEEEEEEEEE BBBBBBBUBUBUBUUUUBBBBB YEYEYEYEYYEYERSRSRSRSRSRSRSRSRSRSRSRSRSS ///// MMMMMMMMMMMIIDIDIDDDMAMAMAMAMAMAMAMAMAMAMAMAMAMAM RRRRKETETTTT IIIIIINNNNNNNNNNNNNNOVOVOVOVOVOVOVOVOVVVVOVOVOVATATATATATAAA IOIIOOOOOOOOOOONNNNNN ///////// THTHTHTHTHTHTHTHTHTHHEEEEEE UUUFFOFOFOFOORRRRR SSSS BBUBUBUBUBUBUBUUUYYYYYYYEYEE SSSSSSSS //////// MMMMMM MMMMMMMMMMMMM RK IIIII NNNNNNNNNNNNNN VVVVVVVVVVATAAATATATATATI /////// HHHHHHHEEEEEE UUUUFFFFORRRR SS BUBUBUBUBUUYYYYE SSSSS ///// MM MMMM RK IIIIIINNNNNNNN VVVVVAAATATATATIO /// HHHHHEEEEEE UUFFFFORRRR SS BUBUBUBUBUUYYYYE SSSSS ///// MM MMMM RK IIIIIINNNNNNNN VVVVVAAATATATATIO /// HHHHHEEEEEE UUMMMMMMMMMMMMMMMM IIIIIIIIIIIIII DDDDDDDDDDDDDDD SSSSSSSSSSSSSSSS RRRRRRRRRR EEEEEEEEEEEEEEEMMMMMMMM IIIIIII DDDDDDD SSSSSSSS RRRRRR EEEEEEEES M A L L & M I D S I Z E E N T E R P R I S E R E P O R T 2 0 1 8

THE RUSH TO SERVE THE SMALL MARKET

WHY THE MIDMARKET MATTERS

AIR STRATEGIES FOR SME BUYERS

THE ULTIMATE TO-DO LIST FOR NEW TRAVEL MANAGERSMIDMARKET INNOVATION

NEW ENTRANTS FIND SME NICHE

MIDMARKET BUYERS’ TMC WISHLIST

Structuring a Managed Travel ProgramEstablishing a T&E Policy

Selecting a Travel Management CompanyGetting Started with Meetings Management

Setting Up a Corporate Lodging ProgramWorking with Airlines

Working with Car Rental FirmsWorking with Chauff eured Car Providers

Selecting a Corporate Payment SystemCore Technology & Data Reporting

Taking On Travel Risk Management

517 2733 3952 5965 687680

BusinessTravel Buyer’s

Handbook

June 25, 2018

S P O N S O R E D I N PA R T B Y

2018

2018 CORPORATE TRAVEL

BTN’S 31ST ANNUAL LIST OF THE BIGGEST CORPORATE TRAVEL SPENDERS IN THE U.S.

October 1, 2018

S P O N S O R E D I N PA R T B Y

LOUIS MAGLIAROSenior Vice President & Group PublisherThe BTN Group

[email protected] 973.769.0028

ANTHONY CARNEVALEPublisherThe BTN Group

[email protected] 201.902.1976

LINDSAY STRAUBBusiness Development DirectorThe BTN Group

[email protected] 646.380.6274

RICHARD MARKUSBusiness Development DirectorThe BTN Group

[email protected] 301.944.4324

2019 EDITORIAL CALENDAR

ISSUE DATE AD CLOSING MATERIAL DUE EVENT DISTRIBUTION

March February 8 February 13

May April 26 May 1

July June 20 June 25• GBTA Convention• 6th Annual Innovate Conference (New York)

December November 7 November 12

TRAVEL PROCUREMENT DEPARTMENTSNews • Business Travel by the Numbers • Case Study • Q&A • Opinion

MIDDLE EAST & AFRICA

MIDDLE EAST & AFRICA

EUROPE

EUROPE

ASIA/PACIFIC

ASIA/PACIFIC

North American hotel outlook for January to December 2018; year-over-year changes in average daily rate and occupancy across the globe in October, November & December; projected 2018 meetings budget outlook; plus corporate air travel metrics compiled & analyzed by tClara managing partner Scott Gillespie.

FORECASTING ADR2018 YOY CHANGE

North America business transient isUP 2.5%

North America group is UP 1.8%

FORECASTINGBOOKINGS2018 YOY CHANGENorth America business transient is

DOWN 0.7%North America group is

UP 1.9%

BUSINESS TRAVEL BY THE NUMBERS

LOOKING BACK AT ADR: YOY CHANGE AMERICAS

AMERICAS

OctoberNovemberDecember

OctoberNovemberDecember

OctoberNovemberDecember

OctoberNovemberDecember

OctoberNovemberDecember

OctoberNovemberDecember October

NovemberDecember

OctoberNovemberDecember

2.9%4%

2.3%-0.1%

1.9%1.7%

0.7%

5.1%

2.6%3.8%

2.8%-3.2%

1.8%1.9%

3.9%2.5%

2.5%2.2%

2.1%-0.8%

2.3%2.9%

1.9%

4.5%

Source: TravelClick North American Hospitality Distribution Review of hotel stays booked by Jan. 1 in the 25 major markets

Source: STR

LOOKING BACK AT OCCUPANCY: YOY CHANGE

H O T E L

CARRENTAL

8 / T R AV E L P R O C U R E M E N T

www.businesstravelnews.com/procurement

Americas OverallUnited States

CanadaMexico

BrazilChile

Argentina

+1%+1%

+2.3%+0.5%+0.5%+0.5%

AMERICAS 2018 RENTAL CAR FORECAST +0.5%

September 2018

WHAT IT’S LIKE TO WORK WITH

Airbnb for Work page 20A VAT company page 21

TWO AIRLINES COURTING CORPORATE BUSINESS

Air Canada page 23Air Italy page 24

American’s corporate bundles & United’s

midmarket discount page 22

SeSeSeSSe tptptptememembbebeerrr 20202018181811

A NEW AIR KPICost per mile, segment, traveler ... Now there’s quality cost per mile, developed by The Church of Jesus Christ of Latter-Day Saints’ Shawn Johnson & team. page 14

February 2018

Major MergerAmex GBT

& HRG Ready to Tie the Knot

page 5

BCD Creates a Tech Marketplace

page 15

Scott Gillespie Confronts Procurement’s

False God: Savingspage 18

WHYNOTTHINKBIG?Olive Kavanagh brought big-program sophistication to Kerry Group’s midsize travel program. She brought suppliers along for the ride. Here’s how she did it. page 12

100% (411

billion) 98%

109%

121%

108%

100% 96.3%

112.3%

114.6%

114.6%

($89)

10.9%

8.2%

16.7%

13.8%

9.0%

105%

95%

35%

30%

Q42016

Q12017 Q2 Q3 Q4

Q42016

Q12017 Q2 Q3 Q4

130%

90%

120%

95%

25%

15%

20%

5% 20.0%

18.5%

19.1%

17.2%

21.2%

100%

101%

102%

101%

99% (2.59)

33.5%

31.8%

33.5%

32.7% 31.7%

U.S. AVAILABLE SEAT MILES1 PRICE PAID PER FLIGHT HOUR4

BIG 4 PROFIT MARGIN2 CORPORATES THAT BEAT MARKETPRICES BY 2%5

AIRLINES PER CITY PAIR3 LONG HAUL’S SHARE OFCORPORATE MILES6

SUPPLY METRICS DEMAND METRICS

1Diio Mi data, tClara analysis; airline seat miles in both directions for all non-stop scheduled passenger airline service originating or terminating at a U.S. airport2Google Finance data, tClara analysis; operating margin defined as the sum of American Airlines, Delta, Southwest and United’s operating income divided by the sum of their gross revenues3Diio Mi, tClara analysis; average number of marketing carriers for the 500 nonstop U.S. city pairs with the most scheduled available seat miles

4ARC data, tClara analysis; original-sale corporate tickets, excluding taxes & fees, bought within 45 days of travel for flights taking off within the U.S., based on scheduled nonstop travel time or, for city pairs that don’t have nonstop service, expected nonstop travel time 5ARC data, tClara analysis Air Clarity benchmarks; share of the about 1,900 ARC branch IDs that beat the same-citypair & same-booking class prices by at least 2 percent6ARC, tClara analysis; share of total revenue passenger miles from the about 1,900 ARC branch IDs that are on flights longer than 2,700 miles and cross an international border

AIR ANALYSIS BY TCLARA

www.businesstravelnews.com/procurement J U N E 2 0 1 8 / 9

PACIFIC WEST 1. West Covina, Calif.2. Huntington Beach, Calif.3. Downey, Calif.4. Irvine, Calif.5. Burbank, Calif.

SOUTH ATLANTIC 1. Savannah, Ga.2. Sandy Springs, Ga.3. Fort Lauderdale, Fla.4. Greensboro, N.C.5. Hialeah, Fla.

Source: RewardExpert’s 2018 Best Midsized Cities for Business Meetings report ranking U.S. cities of between 10,000 and 300,000 residents based on weighted average scores covering aff ord-ability, safety, climate, commute, business atmosphere/economic development, events & the pres-ence of restaurants, bars, hotels & shopping; cost of living formed 50 percent of each city’s score

SOUTH CENTRAL1. Irving, Texas2. Pasadena, Texas3. Richardson, Texas4. Mesquite, Texas5. Baton Rouge, La.

June 2018

page 16

page 18

page 20

THENEED FORSPEEDWorld Bank’s meeting owners often design topic-driven programs in multiple countries. Sabrina Capannola took a portfolio approach to meetings globalization and dashed to the finish line.page 10

page 16

page 18

Europe’s Airline M&A Climate Intensifies

Incentivization Tech Finds Funding but Faces Skepticism

Inside Meetings Commissions Cuts

LOUIS MAGLIAROSenior Vice President & Group PublisherThe BTN Group

[email protected] 973.769.0028

ANTHONY CARNEVALEPublisherThe BTN Group

[email protected] 201.902.1976

LINDSAY STRAUBBusiness Development DirectorThe BTN Group

[email protected] 646.380.6274

RICHARD MARKUSBusiness Development DirectorThe BTN Group

[email protected] 301.944.4324

1X 4X 8X 12X 18X Tabloid Ad Sizes

Tabloid Page $36,825 $35,720 $34,650 $33,590 $32,610

Tabloid Spread $72,215 $70,050 $67,960 $65,915 $63,930 1/2 Page Tabloid $22,830 $21,470 $20,840 $20,840 $20,215 1/3 Page Tabloid $15,460 $15,005 $14,560 $14,135 $13,710 1/4 Page Tabloid $12,515 $12,155 $11,790 $11,435 $11,085

Junior Page Ad Sizes

Junior Page $33,035 $32,040 $31,070 $30,135 $29,475 Junior Spread $64,640 $62,700 $60,815 $58,980 $57,215 1/2 Junior Page $21,505 $20,860 $20,235 $19,625 $19,050 1/3 Junior Page $13,880 $13,455 $13,050 $12,660 $12,285 1/4 Junior Page $12,700 $12,305 $11,950 $10,345 $11,170

Covers 2, 3 or 4 $44,565 $43,255 $41,970 $40,675 $39,470

Front Page Box $12,680 $12,045 $11,445 $10,880 $10,330

1X 4X 8X 12X 18X

Full Page $22,590 $21,910 $21,265 $20,620 $20,020

Spread $45,200 $43,800 $42,535 $41,245 $40,020 1/2 Page $13,945 $13,530 $13,115 $12,730 $12,350

Covers 2, 3 or 4 $28,960 $28,280 $27,630 $26,985 $26,385 BLEEDS, PREFERRED POSITIONS, SHORT RATES A. Bleed or oversized ads—subject to 10% surcharge on space rate.

Exceptions: (1) covers, (2) spread which may bleed into gutter without surcharge.

B. Preferred positions — Page 5, 7, 9, 11 and Centerspread +10%; Covers 2, 3, 4 +20%

C. Guaranteed positioning — +10%

D. Short rates will be billed upon cancellation of contract or failure to fulfill minimum requirements.

2019 ADVERTISING RATES

LOUIS MAGLIAROSenior Vice President & Group PublisherThe BTN Group

[email protected] 973.769.0028

ANTHONY CARNEVALEPublisherThe BTN Group

[email protected] 201.902.1976

LINDSAY STRAUBBusiness Development DirectorThe BTN Group

[email protected] 646.380.6274

RICHARD MARKUSBusiness Development DirectorThe BTN Group

[email protected] 301.944.4324

(All rates are quoted gross and include 4/color charge. Effective January 1, 2019)

E-NEWSLETTERS

SOCIAL MEDIA ADVERTISING

E-BLASTS

BTN DAILY (published 5x/week)

Horizontal Banner (600x100): Top or Bottom position $11,845/week

Rectangle (300x250): Top or Bottom position $11,845/week

TRAVEL PROCUREMENT (published monthly)

Horizontal Banner (600x100): Top or Bottom position $9,060/month

Rectangle (300x250): Top or Bottom position $9,060/month

BTN TRAVEL MANAGEMENT SPONSORSHIP (includes e-newsletter and website) E-Newsletter : One 600x100 or 300x250 banner ad in each of the two issuesWebsite: Rotating top and lower 728x90 Leaderboard banner ad and rotating top and lower 300x250 banner ad in the Travel Management content section of the BTN website for one month corresponding with the e-newsletter.

$17,420/month

BTN GLOBAL SPONSORSHIP (includes e-newsletter and website) E-Newsletter: One 600x100 or 300x250 banner ad in each of the two issuesWebsite: Rotating top and lower 728x90 Leaderboard banner ad and rotating top and lower 300x250 banner ad in The Global content section of the BTN website for one month corresponding with the e-newsletter.

$17,420/month

Leaderboard (728x90): ROS rotating upper and lower positions

$4,180/month

Pushdown (970x90) $6,960/weekRectangle (300x250) $4,180/month

2019 ADVERTISING RATES

CONTENT SECTION

Leaderboard (728x90): ROS rotating upper and lower positions

$9,055/month

Rectangle (300x250): ROS rotating upper and lower positions

$9,055/month

Facebook: 100% SOV on sponsored ads sent directly to our qualified audience. Includes 5,000 impressions/week.

Send your customized email message to BTN’s qualified subscribers. 100% SOV and all client-supplied creative. Target by BTN’s audience and available attributes. Rates starting at $800 CPM with 10,000 minimum audience size.

Image Ad $2,000/week

Video Ad $3,000/weekCarousel $4,000/week

LOUIS MAGLIAROSenior Vice President & Group PublisherThe BTN Group

[email protected] 973.769.0028

ANTHONY CARNEVALEPublisherThe BTN Group

[email protected] 201.902.1976

LINDSAY STRAUBBusiness Development DirectorThe BTN Group

[email protected] 646.380.6274

RICHARD MARKUSBusiness Development DirectorThe BTN Group

[email protected] 301.944.4324

Homepage Takeover: Includes dedicated (1) 970x90 Pushdown, (2) 728x90, (3) 300x250 $13,925/weekPushdown (970x90): one advertiser appears in the top position on all non-sponsored pages $17,410/week

Leaderboard (728x90): ROS rotating upper and lower positions $10,455/month

Rectangle (300x250): ROS rotating upper and lower positions $10,455/monthMobile (300x50): ROS rotating upper position $4,400/monthNEW Corporate Travel Index Calculator Sponsorship: An interactive tool to gauge corporate travel rates in 200 benchmark cities, both in the United States and Internationally. Includes logo sponsorship on site.

$9,955/month

WEBSITES