2017 Display Industry Key words - Markit© 2016 IHS Markit. All Rights Reserved. 2017 keyword for...

-

Upload

nguyenduong -

Category

Documents

-

view

218 -

download

0

Transcript of 2017 Display Industry Key words - Markit© 2016 IHS Markit. All Rights Reserved. 2017 keyword for...

© 2016 IHS Markit. All Rights Reserved. © 2016 IHS Markit. All Rights Reserved.

2017 Display Industry Key words

November 2016

© 2016 IHS Markit. All Rights Reserved.

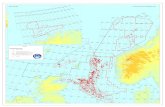

Large area Supply/demand forecast

2

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0

10,000

20,000

30,000

40,000

50,000

60,000

Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18

Yielded Glass Area Capacity Demand Total Seasonal Glut Level

Previous Large Area Supply/Demand Forecast

Notes: ALL TFT includes AMOLED

Source: IHS © 2016 IHS

Dem

an

d\C

ap

acity(0

00

m^2

/Qu

art

er)

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0

10,000

20,000

30,000

40,000

50,000

60,000

Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18

Chart Title

Yielded Glass Area Capacity Demand Total Seasonal Glut Level

Latest Large Area Supply/Demand Forecast

Notes: ALL TFT includes AMOLED

Source: IHS © 2016 IHS

Dem

an

d\C

ap

acity(0

00

m^2

/Qu

art

er)

© 2016 IHS Markit. All Rights Reserved.

<32 32 39-43 45 46-48 49 50 55 58 60 65+

2016(F) 18 78 68 2 9 18 14 33 2 4 10

2017(F) 21 67 66 2 2 25 17 39 4 5 14

0

10

20

30

40

50

60

70

80

90

Millio

n U

nit

s

Chart Title LCD TV Panel shipment forecasting by size

Notes: LCD TV only

Source: IHS © 2016 IHS

2017 keyword for TV panels

• Unit shipment has less changes: 257M 260M(1%) but key size zones have constraint.

• China looks “less aggressive in volume”

3

12%

-14% -4%

-19%

-79%

38%

15%

18%

106% 8%

43%

© 2016 IHS Markit. All Rights Reserved.

2017 keyword for notebook PC panels

4

• China has ambition, 21%(’16) 29%(‘17)

• Overall sup/dem in 2017 looks similar to 2016 but China IPS yield rate is concern point.

Korea 43%

Taiwan 42%

China 14%

Japan

1%

Notebook PC panel shipment forecast by region(Preliminary)

© 2016 IHS

Notes: TFT-LCD only

Source: IHS

2016(F) 2017(F)

IPS/PLS 26% 39%

TN 74% 61%

Chart Title LC mode forecasting in Notebook PC

panel(Preliminary)

Notes: Source: IHS © 2016 IHS

2015 2016(F) 2017(F)

180M 155M 154M Set (177M) Set (164M) Set (162M)

© 2016 IHS Markit. All Rights Reserved.

2017 keyword for Monitor panels

5

Monitor panel shipment forecast by region(Preliminary)

© 2016 IHS

Notes: TFT-LCD only

Source: IHS

2015 2016(F) 2017(F)

140M 137M 131M

• Again, Chinese ambition, 23%(’16) 31%(‘17)

• Overall Sup/Dem in 2017 looks similar to 2016.

• However, consider IPS/PLS yield and quality, actual supply might lower.

2016(F) 2017(F)

TN 54% 41%

IPS 38% 47%

VA 8% 13%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Chart Title LC mode forecasting in Monitor

panel(Preliminary)

© 2016 IHS

Source: IHS

Set (139M) Set (136M) Set (133M)

© 2016 IHS Markit. All Rights Reserved.

Korean finds Exit with Business Optimization

• All applications expect big drop in volume shipment in 2017.

• Korean focusing “Exit & Optimize”

- Exit strategy: IT panels, double digit decline for Unit and Area shipment

- Optimize strategy: TV panels, focusing on large size and high-end. IT panels, only high-end.

6

0 20 40 60 80 100 120

NoteBook PC

Monitor

LCD TV

NoteBook PC Monitor LCD TV

2016(F) 51 55 99

2017(F) 32 49 90

Chart Title Korean panel makers' BP forecasting by application(Preliminary)

© 2016 IHS

Notes: TFT-LCD only

Source: IHS

Millio

ns U

nit

s

-9%

-11%

-37%

© 2016 IHS Markit. All Rights Reserved.

China Ambition – Prepare 2017, Invasion 2018

7

• 2017 for China, year of internal stability.

• Build up healthy product line up, various and valancing Portfolio.

• Less drive TV volume, expanding IT business while Korean makers retreat.

• Take #1 within 2018.

- China Gen10.5 starts 2H2018.

0 20 40 60 80 100

NoteBook PC

Monitor

LCD TV

NoteBook PC Monitor LCD TV

2016(F) 32 32 79

2017(F) 45 40 82

Chart Title China panel makers' BP forecasting by application(Preliminary)

© 2016 IHS

Notes: TFT-LCD only

Source: IHS

Millio

ns U

nit

4%

26%

40%

© 2016 IHS Markit. All Rights Reserved.

LCD TV panel price trend in 2017 • Recent Price trend close to “1 year cycle”, Basically it is expected “上高下低” in 2017.

• But there are couple of factors can influence typical trend.

- Supply shrinkage, TV brands still aggressive on volumes.

8

H2 2008 H2 2009 H2 2010 2H 2011 2H 2012 2H 2013 2H 2014 H2 2015 H2 2016 (F)

32" -44% 4% -24% -16% 2% -15% 14% -35% 33%

40" -36% -1% -20% -9% 3% -13% 2% -29% 53%

42"/43" -34% 2% -22% -10% 4% -20% 2% -29% 50%

46"/48"/49"

UHD-28% -4% -18% -11% 0% -13% 1% -34% 24%

55" UHD -27% -11% -16% -6% -1% -13% -1% -26% 9%

-60%

-40%

-20%

0%

20%

40%

60%

Pri

ce C

han

ge %

(D

ecem

ber

vs J

un

e)

Panel price changes during H2, 2008-2015 (HD/FHD, open cell), October 2016 update

Notes: 1) 2H price erosion of historical years is based on the price change between June and December. Q1 2016, Q2 2016 and Q3 2016 price erosion is based on the price change in the corresponding

quarter. 2) From January 2016, prices of 49" and 55" are with the resolution of UHD.

Source: IHS © 2016 IHS

© 2016 IHS Markit. All Rights Reserved.

Supply constraint continues

Coming More Fabs shut down

New fabs coming but needs more ramp up time

Size migration Continues

End market demand

is uncertain

LCD Fab Capacity up

in 2017

Brands’ profitability

Effects from Innolux OEM

partners strategy

9

2017 – Bull or Bear?

9

© 2016 IHS Markit. All Rights Reserved.

New TV size war and INX OEM Partners strategy

10

Gen 8/8.5

Gen 8.6

Korea(SDC, LGD) China(BOE, CSOT, CEC-

Panda) Taiwan(AUO, INX) Japan(Panasonic, Sharp)

Capacity 1874K

Main Products - 32”/49”/55”/65”(MMG) - Trying 43” by MMG

Taiwan(INX) China(CEC-Panda, CEC-

IRICO, HKC) Capacity 420K(Future) Main Products - 45”/50”/58”/65”/58”

Gen 10.5

China(BOE, CSOT) Global total Capacity 180K(Future) Main products - 43”/49”/65”/75”

V.S

© 2016 IHS Markit. All Rights Reserved.

Power shift happening in TFT-LCD industry

11

• Korean leads TFT-LCD industry past 15 years.

• Looks like “No any longer”, Power shift is on going.

• Samsung defocus TFT-LCD business. Who will take leadership here?

• Korean needs to find a way to keep their position in this industry. That’s AMOLED.

SDC

Taiwan Makers

LGD

China Makers

LGD

Foxconn

BOE

Korean leads TFT-LCD industry so far Competition among 3 parties

© 2016 IHS Markit. All Rights Reserved.

Status of AMOLED panel suppliers • Small and medium AMOLED industry

> Only Samsung Display reached mass production of Quad HD & flexible AMOLED, placing it ahead of others for more than three years. To overcome the lack of core technology and experience, suppliers should avoid the exclusive patent of Samsung.

• Large AMOLED industry

> Only LG Display reached mass production of Ultra HD larger than 65 inches, but it is suffering from low yield rate and high cost. To overcome these issues, suppliers should develop innovative manufacturing processes.

AMOLED Panel Supplier’s Development Status

© 2016 IHS

Source: IHS

Improve Technology

(need more core tech.)

Improve Yield Rate

(need more experience)

Application Target

(Monitor, Wearables)

Increase Capacity

(Flexible, TV panel)

SDC, LGD AUO, Sony BOE, Tianma, EDO, GVO INX, Truly, CPT

JOLED, JDI, CSOT

Move to flexible AMOLED

by 2018

Differentiate

with flexible / large OLED

Reduce

manufacturing cost Secure

core technology

R&D Pilot run Small MP

(Niche market) MP

12

12

© 2016 IHS Markit. All Rights Reserved.

China Maker’s high-end OLED technology R&D alliance

© 2016 IHS Source: IHS

• China makers also working on high-end OLED technologies such as printing OLED, QD OLED.

• China is rising market, equipment & material suppliers have interest in.

China targets high-end OLED technologies