2015-2016 EMPLOYEE BENEFITS GUIDEc8ca6e5e43a19f2300e1-04b090f30fff5ccebaaf0de9c3c9c18a.r54.cf… ·...

Transcript of 2015-2016 EMPLOYEE BENEFITS GUIDEc8ca6e5e43a19f2300e1-04b090f30fff5ccebaaf0de9c3c9c18a.r54.cf… ·...

1

EMPLOYEE BENEFITS GUIDE

2015-2016

2

WHY PUTTING THE BEST TEAM ON THE FIELD MATTERS

Our employees are our most valuable asset in furthering our Mission of College for All Children. For this very reason, IDEA Public Schools is committed to offering a comprehensive employee benefi ts program that helps our employees stay healthy, feel secure, and maintain a work/life balance.

Benefi ts offered through the workplace can help protect important things such as your income and your assets if you become sick or injured. Other benefi ts can help cover expenses that might not be covered in your medical plan such as day care, travel expenses, rent, mortgage, and every day cost of living expenses. These benefi ts are not only valuable, but also provide great protection for you and your family while reducing fi nancial exposure in your medical plan. For this very reason we at IDEA Public Schools work to ensure that the benefi ts we offer are best-in-class. The voluntary benefi ts program is something we also fi nd value in because these benefi ts work hand-in-hand with the medical plan in lowering fi nancial exposure for you and your family while providing benefi ts over and above what is covered by a traditional medical plan. Below is a brief snapshot of the benefi ts we offer at IDEA Public Schools. Thank you for all that you do!

Benefi ts Carrier Funding Description

Medical InsuranceTRS Active

Care

IDEA contributes a minimum of $341/month/ employee towards

monthly premiums

IDEA Public Schools provides you the opportunity to enroll in the TRS Active Care health plan, which offers you options of Aetna PPO, Scott and White HMO, and Allegian HMO plans.

Health Reimbursement

Arrangement Account

AmeriFlex

IDEA contributes $1,000/employee/year into an HRA account for full time employees enrolled in a medical plan (prorated contributions are made for

mid-year hires)

IDEA Public Schools provides $1,000 in a Health Reimbursement Arrangement Account to assist with your out-of-pocket cost for medical, dental, and vision prescription. You must participate in a medical plan through IDEA Public Schools in order to receive this benefi t.

Flexible Spending Account

AmeriFlex Employee Paid

This is a tax savings account that allows you to pay for eligible out-of-pocket medical, dental, and vision expenses with tax free dollars. In addition, it comes with a dependent day care account that assists with eligible day care expenses. DCA plan is a separate plan offered through Amerifl ex. It is not part of the FSA although they are both tax-sheltered. Employees have to actually enroll in a DCA plan.

Dental Guardian Employee PaidProvides benefi ts for preventive dental services, restorative care, periodontics, root canals, major services

Vision Guardian Employee Paid Provides benefi ts for eye exams, lenses, frames, and/or contacts.

Voluntary Group Term Life

Reliance Standard

Employee paidProvides a voluntary group term life benefi t for employees up to $200,000 in coverage, for a spouse up to $50,000 in coverage, and dependents up to $10,000 in coverage.

Short Term Disability Reliance Standard

Employee PaidBenefi t pays 60% of weekly salary up to $2,700 per week after a 7 day waiting period.

Long Term DisabilityReliance Standard

Employee PaidBenefi t pays 60% of monthly salary up to $15,000 per month after 90 day waiting period.

Cancer Insurance Trans America Employee PaidCovers Radiation/Chemotherapy, New and Experimental Treatment, and comes with a Wellness Benefi t.

Accident Insurance TrustMark Employee PaidProvides coverage for Emergency Accidents, Hospital Admission and comes with a Wellness Benefi t.

Critical Illness Allstate Employee PaidPays a lump sum up to $10,000 for Heart Attack, Stroke, and other major illness.

Universal Life with LTC

TrustMark Employee PaidProvides permanent life insurance coverage with long term care coverage.

Total Lifestyle Advantage Plan

Total Benefi ts Solution

Employee PaidProvides six benefi ts in one: Doctor by Phone, Roadside Assistance, Identity Theft, Vision Care, Chiropractic Care and Savings Guide.

Employee Assistance Program

Reliance Standard

No Cost

Provides professional counseling and referral service designated to help you with your personal, family and job issues.

ANNUAL BENEFITS OPEN ENROLLMENT OVERVIEW

We understand that life can be busy. But we encourage you to take the time to read the material inside this Benefits Guide to familiarize yourself with the benefits available to you. At this time of the year, you will have the opportunity to participate in open enrollment and make changes to your benefit elections.

What do you need to do during the Benefits Open Enrollment period?You must complete the enrollment process and either elect, change, or waive benefits. Even if you don’t wish to make any changes to your current benefit elections, you are still required to complete the enrollment process by August 26th.

NOTE: After the Open Enrollment Period ends on August 26th, you cannot make changes to your plan elections unless you experience a change in family status, such as: • Loss or gain of coverage through your spouse • Loss of eligibility of a covered dependent • Death of your covered spouse or child • Birth or adoption of a child • Marriage, divorce or legal separation

You have 30 days from a change in family status to make changes to your current coverage.

What benefits changed compared to last year?

MEDICALIDEA will continue to provide employees with an array of medical plans administered through TRS ActiveCare. There are a few changes this year which include: • Monthly premium rate increases ranged from 3.29% to 14.97% across all tiers and plan types. For the second year in a row, IDEA will absorb these increases to avoid increases to our staff. This means plan premium rates will remain the same for our staff in the 2015-2016 plan year. • Out of pocket maximums and deductible amounts have been slightly adjusted*.

*Please review the enclosed TRS ActiveCare Plan Highlight comparison for detailed information of specific plan changes.

HEALTH REIMBURSEMENT ARRANGEMENT (HRA)IDEA will continue to offer the Health Reimbursement Arrangement (HRA). An HRA is an employer-funded account that will assist employees with out-of-pocket medical expenses.

• IDEA will rollover unused HRA balances from the 2014-2015 plan year into the 2015-2016 plan year. • IDEA will continue to contribute $1,000 annually for every full time employee that enrolls in any of the PPO or HMO TRS ActiveCare medical plans offered through IDEA (pro-rated contributions will be made for mid-year enrollers). • Married IDEA staff members are each both eligible to receive $1000 if they are full time and enrolled in a medical plan.

DENTAL and VISIONThe dental and vision plan offered through Guardian provides a high level of benefits for you and your family. The monthly premium amounts for these plans are slightly increasing due to the high number of claims experienced last year.

We thank you for being a part of IDEA’s Team & Family and look forward to supporting you through this year’s annual open enrollment. If you have any questions or concerns, please feel free to reach out to us.

IDEA Benefits Team956-377-8000

07/15/15 to 08/26/16

4

TABLE OF CONTENTS

2015-2016 Open Enrollment Benefit Election Worksheet ..................................................................5

Benefit Enrollment Methods ................................................................................................................6

Open Enrollment Calendar of Events ..................................................................................................7

Medical Insurance – TRS Active Care PPO Plan Highlights by Aetna ..............................................8

Medical Insurance – Scott & White HMO Plan Highlights (Austin only) ............................................10

Medical Insurance – Allegian HMO Plan Highlights (RGV only) .........................................................11

2015-2016 Health Insurance Plans – Cost to Employee .....................................................................12

Health Reimbursement Account .........................................................................................................13

Flexible Spending Account And Dependent Care Account ...............................................................14

Dental Insurance Plan Highlights ........................................................................................................15

Vision Insurance Plan Highlights .........................................................................................................16

Voluntary Group Term Life Insurance .................................................................................................17

Short Term and Long Term Disability ..................................................................................................18

Cancer Insurance Benefit Plans ..........................................................................................................20

Accident Insurance Benefit Plan .........................................................................................................21

Critical Illness Benefit Plan ..................................................................................................................22

Universal Life with Long Term Care ....................................................................................................23

Total Lifestyle Advantage Plan ...........................................................................................................24

Employee Assistance Program ...........................................................................................................25

403(b) Plan ............................................................................................................................................26

Benefits FAQs .......................................................................................................................................27

Benefit Communication and Engagement Resources .......................................................................28

Benefits Contact Information .............................................................................................................29

Afforable Care Act Overview ...............................................................................................................30

Glossary of Benefit Terms ...................................................................................................................31

5

2015-2016 OPEN ENROLLMENT BENEFIT ELECTION WORKSHEET

Pre-Tax/ Post Tax Deduc on Deduc on Amount

EXAMPLE:Pre- Tax $125.00

Pre-Tax $

Pre-Tax $

Pre-Tax $

Pre-Tax $

Post - Tax $

Post - Tax $

Post - Tax $

Post - Tax $

Post - Tax $

Post - Tax $

Post - Tax $

Post - Tax $

$

$

*Add all items in the deduc on amount column to determine your total cost of premiums per month/biweekly. Please note these are es mated costs. Some plans are calculated on a pre-tax basis while others are calculated post-tax and may affect your paychecks.

Monthly (12 Pay):

Biweekly (24 Pay):Biweekly Premiums deducted twice a month to IDEA Staff that are paid on a biweekly basis year-round (example: Clerical Hourly Staff and Custodians).

Manual Trade Biweekly (20 Pay):This is a special Biweekly Premium deducted twice a month to hourly IDEA Staff that are paid on a biweekly basis but only work 10 months out of theyear (Bus Drivers and Cafeteria staff only).

Voluntary Group Term Life

TBS Lifestyle Advantage

Short-Term Disability

Long-Term Disability

Universal Life with LTC

Accident

Total Monthly Cost

Use this worksheet to help facilitate your enrollment process through self-enrollment or assisted-enrollment. As you review the various plans available, fill in the plan type, note the er you would like to par cipate in (i.e. employee only, employee and spouse, employee and children, family), and add the cost of each plan you elected.

IDEA Public Schools2015-2016 Open Enrollment Benefit Elec on Worksheet

Medical

Vision

Cancer

Total Biweekly Cost

Medical

Plan Name Coverage Tier

Ac veCare Select Employee Only

Flexible Spending Account

Dental

Cri cal Illness

Pre - Tax $403B

EXPLANATION OF THE PREMIUM CALCULATIONS BY PAY FREQUENCYAny staff member who enrolls in any of the plans offered by IDEA will have the corresponding deduction according to their pay frequency

Monthly (12 Pay):Monthly premiums deducted once a month to IDEA Staff who are salary and paid on a monthly basis (All salary staff).

Biweekly (24 Pay):Biweekly premiums deducted twice a month to IDEA Staff who are hourly and paid on an annualized biweekly basis (All hourly staff with exception

of bus drivers and hourly cafeteria staff).

Biweekly (20 Pay):Biweekly Premium deducted twice a month for hourly IDEA Staff that are paid on a biweekly basis but only work 10 months out of the

year (Hourly Bus Drivers and Cafeteria Staff Only).

6

BENEFIT ENROLLMENT METHODS…EASY AS 1, 2, 3!It is required that every employee go through the enrollment process to either elect or waive benefi ts.

1. ONE-ON-ONE ENROLLMENT METHOD

Employees have the option to enroll in benefi ts one-on-one with a benefi ts counselor at their convenience. Benefi ts counselors will be available by appointment at designated times during the annual open enrollment period. To set up your appointment, login to www.meetme.so/IDEABenefi ts to look for appointment times available at your campusand region.

2. CALL CENTER ENROLLMENT METHOD

In the event you don’t have the time to meet with a Benefi ts Counselor one-on-one, IDEA’s benefi ts enrollment call center is available to you from 8 a.m. to 4:30 p.m. CST Monday through Friday. The design of the call center is the same as a one-on-one session but facilitated over the telephone. Please contact Total Benefi t Solutions at 1-888-783-9653 to speak with a benefi ts counselor who can assist you with your benefi ts enrollment needs.

3. WEB SELF-ENROLLMENT METHOD

In the event you don’t have time to meet with a benefi ts counselor or contact IDEA’s benefi ts call center, you can conduct your enrollment by going online. It’s easy! Below is a snapshot of what the site portal looks like. Simply go to https://www.benselect.com/Enroll/Login.aspx to start your enrollment today!

Username: Social Security Number

PIN: Last 4 of social followed by year of

birth (ex. 555584)

Enrollment Guide: Once you enter into the

site you will be prompted to change your pin

and set up a security pass code. In the event

you forgot your PIN, go to FORGOT PIN to

reset for future use.Forgot PIN

7

BENEFITS OPEN ENROLLMENT METHOD SCHEDULEDay Date

Self-Enrollment

Call Center Enrollment

One-on-One Enrollment

IDEA’s Benefit Counselor

Wednesday July 15

Thursday July 16

Friday July 17

Saturday July 18

Sunday July 19

Monday July 20

Tuesday July 21

Wednesday July 22

Thursday July 23

Friday July 24

Saturday July 25

Sunday July 26

Monday July 27

Tuesday July 28

Wednesday July 29

Thursday July 30

Friday July 31

Saturday August 1

Sunday August 2

Monday August 3

Tuesday August 4

Wednesday August 5

Thursday August 6

Friday August 7

Saturday August 8

Sunday August 9

Monday August 10

Tuesday August 11

Wednesday August 12

Thursday August 13

Friday August 14

Saturday August 15

Sunday August 16

Monday August 17

Tuesday August 18

Wednesday August 19

Thursday August 20

Friday August 21

Saturday August 22

Sunday August 23

Monday August 24

Tuesday August 25

Wednesday August 26

Self-Enrollment (Online Portal)Available 24/7

One-on-One EnrollmentBy Appointment Only

Call Center EnrollmentAvailable 8:00am-4:30pm

IDEA’s Benefit Counselor At HQ - By Appointment Only

METHOD AVAILABILITY

IDEA Staff will now have an improved 24/7 online benefit presentation throughout Open Enrollment. The link to watch this online benefit presentation will be available on July 15th at The Hub. The IDEA Benefits Team will ensure communication is sent to all IDEA Staff in advance. For Auxiliary Departments, IDEA Benefits Team will have a Face-to-Face Benefits Presentation during the Summer Trainings already scheduled by HQ leaders to participate. Benefits counselors will also be present during the assigned 3-days scheduled trainings:

Facilities Staff: July 14th & 17th | Transportation Staff: July 23rd – July 24th | Child Nutrition Program Staff: July 31st

Group Benefits Presentation

8

TRS ACTIVE CARE PPO PLAN HIGHLIGHTS

Type of Service ActiveCare 1-HD

ActiveCare Select or ActiveCare Select – Aetna Whole Health (Baptist Health System and HealthTexas Medical

Group; Baylor Scott & White Quality Alliance; Memorial Hermann Accountable Care Network; Seton

Health Alliance)

ActiveCare 2

Deductible (per plan year)

$2,500 employee only$5,000 employee and spouse; employee and child(ren); employee and family

$1,200 individual$3,600 family

$1,000 individual$3,000 family

Out-of-Pocket Maximum (per plan year; does include medical deductible/any medical copays/coinsurance/any prescription drug deductible and applicable copays/coinsurance)

$6,350 employee only**$9,200 employee and spouse; employee and child(ren); employee and family**

$6,600 individual$13,200 family

$6,600 individual$13,200 family

CoinsurancePlan pays (up to allowable amount)Participant pays (after deductible)

80%20%

80%20%

80%20%

Office Visit CopayParticipant pays

20% after deductible $30 copay for primary$60 copay for specialist

$30 copay for primary$50 copay for specialist

Diagnostic LabParticipant pays

20% after deductible Plan pays 100% (deductible waived) if performed at the Quest facility; 20% after deductible at other facility

Plan pays 100% (deductible waived) if performed at the Quest facility; 20% after deductible at other facility

Preventative CareSee next page for list of services

Plan pays 100% Plan pays 100% Plan pays 100%

Teladoc® Physician Services $40 consultation fee (applies to deductible and out-of-pocket maximum)

Plan pays 100% Plan pays 100%

High-Tech Radiology(CT Scan, MRI, nuclear medicine) Participant Pays

20% after deductible $100 copay plus 20% after deductible $100 copay plus 20% after deductible

Inpatient Hospital (preauthorization required)(facility charges)Participant pays

20% after deductible $150 copay per day plus 20% after deductible ($750 maximum copay per admission)

$150 copay per day plus 20% after deductible ($750 maximum copay per admission; $2,250 maximum copay per plan year)

Emergency Room(true emergency use)Participant pays

20% after deductible $150 copay per visit plus 20% after deductible (copay waived if admitted)

$150 copay per visit plus 20% after deductible (copay waived if admitted)

Outpatient SurgeryParticipant pays

20% after deductible $150 copay per visit plus 20% after deductible

$150 copay per visit plus 20% after deductible

Bariatric SurgeryPhysician charges (only covered if performed at an IOQ facility)Participant pays

$5,000 copay plus 20% after deductible Not covered $5,000 copay (does not apply to out-of-pocket maximum) plus 20% after deductible

Prescription DrugsDrug deductible (per plan year)

Subject to plan year deductible $0 for generic drugs$200 per person for brand-name drugs

$0 for generic drugs$200 per person for brand-name drugs

Retail Short-Term(up to a 31-day supply)Participant pays• Generic copay• Brand copay (preferred list)• Brand copay (non-preferred list)

20% after deductible

$20$40***50% coinsurance

$20$40***$65***

Retail Maintenance(after first fill; up to a 31-day supply)Participant pays• Generic copay• Brand copay (preferred list)• Brand copay (non-preferred list)

20% after deductible

$25$50***50% coinsurance

$25$50***$80***

Mail Order and Retail-Plus(up to a 90-day supply)Participant pays• Generic copay• Brand copay (preferred list)• Brand copay (non-preferred list)

20% after deductible

$45$105***50% coinsurance

$45$105***$180***

Specialty DrugsParticipant pays

20% after deductible 20% coinsurance per fill $200 per fill (up to 31-day supply)

$450 per fill (up to 90-day supply)

A specialist is any phsyician other than family practitioner, internist, OG/GYN or pediatrician. *Illustrates benefits when network providers are sued. For some plans non-network benefits are also available; see Enrollment Guide for more information. Non-contracting providers may bill for amounts exceeding the allowable amount for covered services. Participants will be responsible for this balance bill amount, which may be considerable. **Includes perscription drug coinsurance ***if the patient obtains a brand-name drug when a generic equivalent is available, the patient will be responsible for the generic copayment plus the cost difference between the brand-name drug and the generic drug.

9

TRS ACTIVE CARE PPO PLAN HIGHLIGHTS

TRS-ActiveCare Plans - Preventative Care

Preventative Care Services

Network BenefitsWhen Using Network Providers

(Provider must bill services as “preventative care”)

ActiveCare 1-HD ActiveCare Select orActiveCare Select - AetnaWhole Health

(Baptist Health System and HealthTexas Medical Group; Baylor & White Quality

Alliance; Memorial Hermann Accountable Care Network; Seton Health Alliance)

ActiveCare 2 Network

Evidence−based items or services that have in effect a rating of “A” or “B” in the current recommendations of the United States Preventive Services Task Force (USPSTF)

Immunizations recommended by the Advisory Committee on Immunization Practices of the Centers for Disease Control and Prevention (CDC) with respect to the individual involved

Evidence−informed preventive care and screenings provided for in the comprehensive guidelines supported by the Health Resources and Services Administration (HRSA) for infants, children and adolescents. Additional preventive care and screenings for women, not described above, as provided for in comprehensive guidelines supported by the HRSA.

For purposes of this benefit, the current recommendations of the USPSTF regarding breast cancer screening and mammography and prevention will be considered the most current (other than those issued in or around November 2009).

The preventive care services described above may change as USPSTF, CDC and HRSA guidelines are modified.

Examples of covered services included are routine annualphysicals (one per year); immunizations; well-child care;breastfeeding support, services and supplies; cancer screening mammograms; bone density test; screening for prostate cancer and colorectal cancer (including routine colonoscopies); smoking cessation counseling services and healthy diet counseling; and obesity screening/counseling.

Examples of covered services for women with reproductivecapacity are female sterilization procedures and specifiedFDA-approved contraception methods with a written prescription by a health care practitioner, including cervical caps, diaphragms, implantable contraceptives, intra-uterine devices, injectables, transdermal contraceptives and vaginal contraceptive devices. Prescription contraceptives for women are covered under the pharmacy benefits administered by Caremark. To determine if a specific contraceptive drug or device is included in this benefit, contact Customer Service at 1-800-222-9205. The list may change as FDA guidelines are modified.

Plan pays 100% (deductible waived)

Plan pays 100% (deductible waived; no copay required)

Plan pays 100% (deductible waived; no copay required)

Annual Vision Examination(one per plan year; performed by an opthalmologist or optometrist using calibrated instruments)Participant pays

After deductible, plan pays 80%; participant pays 20% $60 copay for specialist $50 copay for specialist

Annual Hearing ExaminationParticipant pays

After deductible, plan pays 80%; participant pays 20%

$30 copay for primary$60 copay for specialist

$30 copay for primary$50 copay for specialist

TRS-ActiveCare is administered by Aetna Life Insurance Company. Aetna provides claims payment services only and does not assume any financial risk or obligation with respect to claims. Prescription drug benefits are administered by Caremark.

! Note: Covered services under this benefit must be billed by the provider as “preventive care.” If you receive preventive services from a non-network provider, you will be responsible for any applicable deductible and coinsurance under the ActiveCare 1-HD and ActiveCare 2. There is no coverage for non-network services under the ActiveCare Select plan or ActiveCare Select – Aetna Whole Health.

10

SCOTT-WHITE HMO PLANHIGHLIGHTS (AUSTIN REGION ONLY)

Plan Provisions Co-Payment

Annual Deductible $1,000 Individual/$3,000 Family

Annual out-of-pocketmaximum including medical co-paysand co-insurance

$3,000 Individual/$6,000 Family

(excludes deductible)

Lifetime Paid Benefi t Maximum None

Fully Covered Health Care Services Co-PaymentPreventive Services No Charge

Standard Lab and X-ray No Charge

VitalCare Condition Guidanceand Wellness Programs No Charge

Well Child Care Annual Physicals No Charge

Immunizations (age appropriate) No Charge

Outpatient Services Co-PaymentPrimary Care $20 co-pay

Specialty Care $50 co-pay

Other Outpatient Services 20% after deductible1

Diagnostic/RadiologyProcedures 20% after deductible

Eye Exam (one annually) No Charge

Allergy Serum & Injections 20% after deductible

Outpatient Surgery$150 co-pay and

20% of charges after deductible

Maternity Care Co-PaymentPre-Natal Care No Charge

Inpatient Delivery$150 per day2

and 20% of chargesafter deductible

Inpatient Services Co-PaymentOvernight hospital stay: includesall medical services includingsemi-private room or intensive care

$150 per day2 and 20% of charges

after deductible

Diagnostic & Therapeutic Services Co-Payment

Physical and Speech Therapy $50 co-pay

Equipment and Supplies Co-Payment

Diabetic Supplies and Equipment Same as DME or Rx,as appropriate

Durable Medical Equipment/ Prosthetics $1,000 maximum annual benefi t 50% after deductible

Home Health Services Co-PaymentHome Health Care Visit $50 co-pay

Worldwide Emergency Care Co-PaymentVitalCare Nurse On Call 1-877-505-7947

VitalCare Online Services No Charge — go towww.swhp.org

After Hours Primary Care Clinics $20 co-pay

Ambulance and Helicopter $40 co-pay and 20% ofcharges after deductible

Emergency Room $150 co-pay and 20% ofcharges after deductible

Urgent Care Facility $55 co-pay

Ask a SWHPPharmacyrepresentative howto save money onyour prescriptions.

Retail Quantity(Up to a 34-day supply)

Maintenance QuantitySWHP Pharmacies Only(Up to a 90-day supply)

Preferred Generic4 $3 co-pay 1-877-505-7947

Preferred Brand 30% after deductible No Charge — go towww.swhp.org

Non-preferred 50% after deductible $20 co-pay

Non-formulary Greater of $50 or50% after deductible

$40 co-pay and 20% ofcharges after deductible

Mail Order 1-800-707-3477

Online Refi lls http://www.swhp.org/homepage/trs

Prescription DrugsAnnual Benefi t Maximum Unlimited

DeductibleDoes not apply to generic drugs $100

Specialty Medications Co-Payment

Level 1 10% after deductible

Level 2 (Preferred) 20% after deductible

Level 3 (Premium preferred) 30% after deductible

Level 4 (Non-preferred) 50% after deductible3

1 Includes other services, treatments, or procedures received at time of offi ce visit.2 $750 maximum co-payment per admission and 20% after deductible.3 Level 4 co-payment does not count toward out-of-pocket maximum.4 If a brand name drug is dispensed when a generic is available, 50% co-pay applies.

If you need additional information regarding Employee Benefi ts, please contact our

Benefi ts Team at IDEA Public Schools Headquarters at 956-377-8000 or email us at

11

ALLEGIAN HMO HIGHLIGHTS (RGV REGION ONLY)

Medical Plan Year Deductible $500 Individual $1,000 Family

Out-of-Pocket Maximum (includes deductible and copays) $4,500 Individual $9,000 Family

Annual Maximum UnlimitedPrimary Care Provider (PCP) Office Visit• Includes lab/X-ray services, injectables, and supplies• Other services provided in a physician’s office are subject to additional deductible and copayments/coinsurance

$25 copayment

Specialist Office Visit• Includes lab/X-ray services• Other services provided in a physician’s office are subject to additional deductible and copayments/coinsurance

$60 copayment

Preventive CareWell-woman exam, immunizations, physicals, mammograms, colorectal cancer screening No copayment

Surgical Procedures Performed in the Physician’s Office 20% copayment*

Minor Emergency/Urgency Care Visit $75 copayment

Emergency Room 20% copayment*

AmbulanceAir/Ground 20% copayment*

Inpatient ServicesFacility charges, physician services, surgical procedures, pre-admission testing,operating/recovery room, newborn delivery and nursery, ICU/coronary care units, laboratorytests/X-rays, rehabilitation facility

20% copayment*

Outpatient ServicesFacility charges, physician services, surgical procedures, observation unit 20% copayment*

Diagnostic TestsMRI, CT scan, sleep study, stress test, PET scan, ultrasound, cardiac imaging, genetic testing,colonoscopy (non-preventive)

20% copayment*

Behavioral HealthMental Health/Chemical Dependency 20% copayment*

Home Health Care Limited to 30 visits per plan year 20% copayment*

Hospice Care 20% copayment*

Skilled Nursing Facility Limited to 60 days per plan year 20% copayment*

Accidental Dental CareLimited to $3,000 per plan year 20% copayment*

Prosthetics Lifetime Maximum $10,000 per device 20% copayment*

Orthotics Lifetime Maximum $10,000 20% copayment*

Spinal Manipulation Limited to 10 visits per plan year 20% copayment*

Durable Medical Equipment Limited to $3,000 per plan year 20% copayment*

All Other Covered Services 20% copayment*

Pharmacy Plan Year Deductible $100 per Member

Annual Maximum Unlimited

Participating Retail PharmacyStandard Drugs/30-day supply Tier 1: GenericTier 2: Preferred Brand NameTier 3: Non-Preferred Brand NameTier 4: Specialty/High Cost Drugs

$10 per prescription$40 per prescription$65 per prescription20% per prescription

out-of-pocket maximum of $4,000

Participating Mail Order PharmacyMaintenance Drugs/90-day supply Tier 1: GenericTier 2: Preferred Brand NameTier 3: Non-Preferred Brand NameTier 4: Specialty/High Cost DrugsParticipating Mail Order Pharmacy and Local Participating Pharmacies

$30 per prescription$120 per prescription$195 per prescription

Not Covered

* Subject to deductible

12

2015-2016 HEALTH INSURANCE PLANS MONTHLY EMPLOYEE PREMIUMS

Full-time employees at IDEA Public Schools receive standard deductions including Federal Withholding, Medicare

and TRS (Teacher Retirement System of Texas). IDEA Public Schools participates in the TRS Active Care health plan,

which offers three PPO plans, and region specific HMO plans. Note: The San Antonio region does not have an HMO

plan available. IDEA contributes a minimum of $341 per month per employee towards health care premiums. The totals

represented below are the monthly cost to the employee for each plan. In addition IDEA contributes $1000/annually into

an HRA account for each full time employee enrolled in a health care plan (annual contributions will be prorated for mid-

year hires). These funds are available to be used toward out of pocket medical expenses. Please refer to next page for

additional information.

Services

ActiveCare 1-HD

(PPO)AVAILABLE IN ALL

REGIONS

ActiveCare Select

(PPO) AVAILABLE IN ALL

REGIONS

ActiveCare 2

(PPO)AVAILABLE IN ALL

REGIONS

Allegian

(HMO)AVAILABLE IN RGV

REGION ONLY

Scott & White

(HMO)AVAILABLE IN AUSTIN

REGION ONLY

Deductible Employee $2,500

Family$5,000

Employee $1,200

Family$3,600

Individual$1,000

Family$3,000

Individual$500

Family$1,000

Individual$1,000

Family$3,000

Out-of-Pocket Maximum(individual/family;includes deductibles)

$6,450 $12,900 $6,600 $13,200 $6,000 $12,000 $4,500 $9,000 $4,000 $9,000

Coinsurance(Plan pays/participant pays)

80% / 20% 80% / 20% 80% / 20% 80% / 20% 80% / 20%

Office Visit Copay 20% after deductible$30 for primary

$60 for specialist$30 for primary

$50 for specialist$25 for primary

$60 for specialist$20 for primary

$50 for specialist

Preventive Care Plan pays 100% Plan pays 100% Plan pays 100% Plan pays 100% Plan pays 100%

Prescription Drug Deductibles

Subject to plan year deductible

$0 for Generic$200 for Brand Name

$0 for Generic$200 for Brand Name

$100$0 for Generic

$100 for Brand Name

Cost to Eligible Employees

EmployeeOnly

$0.00Employee

Only$125.00

EmployeeOnly

$204.00Employee

Only$62.06

EmployeeOnly

$93.42

Employee and Spouse

$469.00Employee

and Spouse$719.00

Employee and Spouse

$878.00Employee

and Spouse$616.04

Employee and Spouse

$620.10

Employee and Children

$247.00Employee

and Children$384.00

Employee and Children

$516.00Employee

and Children$282.86

Employee and Children

$339.00

Employee and Family

$735.00Employee and Family

$913.00Employee and Family

$998.00Employee and Family

$635.14Employee and Family

$723.54

True Out-Of-Pocket Cost (TROOP)True Out-Of-Pocket Cost is just that, your actual total out-of-pocket cost. HealthCare Reform has brought on many changes and TROOP is one of

them. TRS ActiveCare has complied with the ACA guidelines and all plans are now subject to TROOP. This means is that your deductible and co-

pays are included into to the total amount you spend on healthcare, period.

HMO vs. PPO (Open Access Network)Health Maintenance Organizations commonly referred to as HMO are considered network steerage programs meaning that you must see only the

providers that are listed within the HMO network. An HMO tends to have slightly richer benefits at a comparable rate vs. an Open Access Network

Plan. Open Access Network allows an individual to see a doctor of choice but rewards those with deeper discounts by seeing a preferred provider.

If your providers are in the HMO network or you don’t mind having a limited list of providers then think about the HMO route. If you like the freedom

to see whom you wish, then think about going the Open Access Network route.

13

HEALTH REIMBURSEMENT ARRANGEMENT ACCOUNT

Health Reimbursement Arrangement Account (HRA), is an employer-funded account that is designed to assist employees in paying for qualifi ed out-of-pocket expenses related to medical, dental and vision care costs.

Benefi ts: • IDEA Public Schools will contribute $1000/annually for every full time employee who participates in a medical plan offered through IDEA Public Schools. (prorated contributions will be made for mid-year enrollers)

• Contributions made by IDEA Public Schools can be excluded from your gross income.

• Any un-used amounts in the HRA will be carried forward for use in later years.

Enrollment: • No action is needed by the employee to enroll for this specifi c benefi t. Employees enrolled in a medical plan will automatically have an HRA account set up on their behalf and will receive an AmeriFlex Debit MasterCard mailed to their home address within two weeks from the date of enrollment.

• Married IDEA staff members are each both eligible to receive $1000 if they are full time and enrolled in a medical plan.

Usage: • You and your eligible dependents may use the Amerifl ex Debit MasterCard funds on any qualifi ed medical expenses such as co-pays, deductibles, dental, vision, prescription, over-the-counter medications (prescription required).

• Once funds are utilized, keep the receipt as you will need this for substantiation.

• All funds will be forfeited upon separation of employment.

Online Balance Access: • Login to www.� ex125.com to register your card, look at a list of all medical expenses covered, check your balance and upload receipts used.

• AFC Portal Mobile Application

NOTE: If you were enrolled in the HRA for 2014-2015 benefi t plan year you will not be reissued anew card. If you need a replacement card please contact Amerifl ex directly.!

Download the AFC Mobile Application

CARRIER: AmeriFlex

14

FLEXIBLE SPENDING ACCOUNT Flexible Spending Accounts (FSAs), were developed as part of Internal Revenue Code Section 125 to provide employees with tax relief for their out-of-pocket medical and dependent daycare costs. FSAs enable employees to utilize pre-tax dollars and save federal, FICA, and, in most cases, state taxes.

There are two types of Flexible Spending Accounts:

1) Medical Reimbursement Accounts: Accounts used to pay for eligible medical expenses such as co-pays, deductibles, dental, vision, prescription, over-the-counter medications (prescription required), and more.

ü Annual Minimum Contribution: $600.00 ($50 per month) ü Annual Maximum Contribution: $2, 550.00 ($206 per month)

2) Dependent Day-Care Reimbursement Accounts: Accounts used to pay for the daily care of an eligible child or adult dependent (as defined by law).

ü Annual Maximum Contribution: $5,000; $2,550 if married and filing separately

NOTE: An Ameriflex Debit MasterCard is provided for any of these plans, however if you are enrolled in HRA, you will use the same card that was previously issued to you.

The following table is for illustrations purposes only, consult your tax accountant for all tax advice.

!Without FSA With FSA

Gross Income $30,000 $30,000

FSA Contributions $0 $5,000

Gross Income – FSA contributions $30,000 $25,000

Estimated Taxes

Federal -$2,500* -$1,776*

State -$900** -$750**

FICA -$2,295 -$1,913

After Tax Earnings $24,255 $20,561

Eligible expenses $5,000 $0

Remaining Income $19,255 $20,561

Income increase $0 $1,306

*It assumes standard deductions and four exemptions **Varies, assumes 3%

Premiums are paid by annual contributions divided by number of deductions, for example:PREMIUM ILLUSTRATION:

Monthly (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Based on $5,000 Annual Contribution

Premiums $416.67 $208.33 $250.00

Based on $2,500 Annual Contribution

Premiums $208.33 $104.17 $125.00

CARRIER: AmeriFlex

15

DENTAL INSURANCE PLAN HIGHLIGHTS IDEA’s Dental Plan provides a high level of benefits for you and your family. Dental benefits include preventative care visits and discounts on services offered by dentists who are members of Guardian’s network.

There are two types of Dental Choice Plans: 1. Network Access Plan: The Network Access Plan (NAP) allows you to see any dentist of your choice and you receive 100% coverage for preventive services, 80% coverage for basic service, and 50% coverage for major services (all subject to deductible).

2. Value Plan: The Value Plan requires you to see an in-network Guardian provider and if you choose this plan you will receive richer benefits for basic care (100% vs. 80%) and major care (60% vs. 50%) reducing your financial exposure.

To look up a dental provider go to www.guardiananytime.com

Summary of Dental Plans Coverage

BenefitGuardian Choice Plans

Network Access Plan Value Plan

Deductibles & Maximums

Calendar year deductible

Individual $100 per person $100 per person

Family Up to 3x family maximum or $300 Up to 3x family maximum or $300

Annual Benefit Maximum

Individual $1,250 $1,250

Family $1,250 per person $1,250 per person

Covered Services

Preventive care (cleaning, x-rays, fluoride

treatments, sealants)

100%

After deductible has been met

100%

After deductible has been met

Basic services (fillings, simple extractions,

root canal, endodontics, oral surgery)80% 100%

Major services (crowns, inlays, onlays,

veneers, bridges, dentures50% 60%

Orthodontia50% coverage up to $1,000 lifetime max;

dependents to age 19 only eligible50% coverage up to $1,000 lifetime max;

dependents to age 19 only eligible

PREMIUMS:

Coverage Tiers Monthly (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Employee Only $25.63 $12.82 $15.38

Employee + 1 $49.87 $24.94 $29.92

Employee + 2 or more $92.06 $46.03 $55.24

CARRIER: Guardian

16

VISION BENEFITS PLAN HIGHLIGHTS

IDEA’s Vision Plan provides personalized eye care for yourself and your entire family. It will help you achieve the quality care you deserve with yearly exams all the way to purchasing the frames and lenses you want.

To look up a vision provider go to www.guardiananytime.com

Summary of Vision Plan Benefi ts

Benefi ts In-Network

Eye examination $10 co-pay; covered in full every 12 months

Prescription LensesSingle vision lenses $25 co-pay; covered in full every 12 months

Lined bifocal vision lenses $25 co-pay; covered in full every 12 months

Lined trifocal vision lenses $25 co-pay; covered in full every 12 months

Lenticular lenses $25 co-pay; covered in full every 12 months

Frames or Contacts (in lieuof glasses)

$25 co-pay; up to $130 allowance with a 20% discounton the difference every 24 months

Medical Necessity $25 co-pay; covered in full every 12 months

Elective Up to $130 allowance

PREMIUMS:

* Benefi ts for exams and lenses are provided every 12 months and every 24 months for frames.

CARRIER: Guardian

Coverage Tiers Monthly (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Employee Only $8.29 $4.15 $4.97

Employee + 1 $17.11 $8.56 $10.27

Employee + 2 or more $24.08 $12.04 $14.45

17

PREMIUMS:

VOLUNTARY GROUP TERM LIFE BENEFITSThis plan is term life insurance and provides no cash value. However, it provides you the benefit you need for a low cost so you are financially secure during your working career.

IDEA Employees are offered this benefit in increments of $10,000 and can get coverage on dependents as well.

New Hire Guarantee Issue Benefit:Employee age 18-59: $10,000 to $200,000Employee age 60-69: $10,000Spouse up to age 60: $10,000 to $50,000 Children: $10,000

Age Reduction: Reduces by 60% of the amount in force at age 74 at age 75, 35% at age 80, 27.5% at age 85, 20% at age 90, 7.5% at age 95 and 5% at age 100.

AGE $10,000 $20,000 $30,000 $50,000 $100,000 $200,000

0-24 $.65 $1.30 $1.95 $3.25 $6.50 $13.00

25-29 $.65 $1.30 $1.95 $3.25 $6.50 $13.00

30-34 $.65 $1.30 $1.95 $3.25 $6.50 $13.00

35-39 $.95 $1.90 $2.85 $4.75 $9.50 $19.00

40-44 $1.56 $3.12 $4.68 $7.80 $15.60 $31.20

45-49 $2.39 $4.78 $7.17 $11.95 $23.90 $47.80

50-54 $3.64 $7.28 $10.92 $18.20 $36.40 $72.80

55-59 $5.72 $11.44 $17.16 $28.60 $57.20 $114.40

60-64 $9.56 $19.12 $28.68 $47.80 $95.60 $191.20

65-69 $15.73 $31.46 $47.19 $78.65 $157.30 $314.60

!IMPORTANT: You may elect one $10,000 level up to the Guarantee Issue on the Voluntary Life VG-184426. If you

were previously declined or declined coverage in the past, you will have to go through medical underwriting for any

amount of coverage.

CARRIER: Reliance Standard

*AVAILABLE IN $10,000 INCREMENTS UP TO $200,000 *SPOUSE RATE IS BASED ON THE SPOUSE’S AGE*CHILD COVERAGE IS UP TO AGE 26 AS LONG AS HE/SHE IS A FULL-TIME STUDENT

Rates shown on table below, are monthly premiums if you are a 24 pay or 20 pay staff member, you will be deducted according to your pay frequency.

18

SHORT TERM AND LONG TERM DISABILITY

Voluntary Short Term Disability Benefits

Elimination Period (Benefits Start): 7th day

Benefit Duration: 12 Weeks

Gross Income Protection:60% up to $2,700 a Week(not taxed, and paid depending on nature of disability)

Pre-existing Conditions:

3/6 Any injury/sickness occurring 3 months prior to the effective date will not be covered under the plan for 6 months after the effective date. If you are new to the plan your coverage is Guaranteed Issue but you are subject to the Pre-Existing Conditions clause.

Premium Contribution Rate: 48 cents per $10

Voluntary Long Term Disability Benefits

Elimination Period (Benefits Start): 90 days

Benefit Duration: Social Security Normal Retirement Age

Gross Income Protection:60% up to $15,000 a Month(not taxed, and paid on a monthly basis)

Pre-existing Conditions

12/12 Any injury/sickness occurring 12 months prior to effective date will not be covered under plan for 12 months after effective date.) If you are new to the plan your coverage is Guaranteed Issue, but you are subject to the Pre-Existing Conditions clause

Premium Contribution Rate: From 6 – 83 cents per $100 of coverage

These disabilities plans are a way for IDEA Staff to have protected income either short term or long term due to an accident, long term medical leave, maternity leave, etc.

There are important clauses and benefits depending on the type of plan, read carefully below:

! IMPORTANT: Both Short Term and Long Term Disability are guarantee issue regardless if you are new or current but

do have pre-existing condition clauses. Detail information about these plans are available at The Hub. Note: Rates

will increase based on your salary increasing, your age in the long term disability plan, or a combination of both.

CARRIER: Reliance Standard

19

SHORT TERM AND LONGTERM DISABILITY (CONT.)

Short Term Disability Rates and Benefi t Calculation

Short Term Disability Rate: $0.48 per $10 in coverage

Benefi t Calculation: $30,000 (gross salary) x 60% protection = $18,000/52 weeks = $346.15 weekly benefi t

Rate Calculation: $346.15 weekly benefi t/$10 increments = $34.62 x $.48 = $16.62 per month premium

Long Term Disability Rates and Benefi t Calculation

Age Rate per $100 in coverage

18-24 $.06

25-29 $.09

30-34 $.17

35-39 $.27

40-44 $.40

45-49 $.52

50-54 $.65

55-59 $.82

60-64 $.83

65-69 $.58

70+ $.42

Benefi t Calculation: $30,000 (gross salary) x 60% protection = $18,000/12 months = $1,500 monthly benefi t

Rate Calculation: $30,000 (gross salary)/12/100 x your rate based on your age = monthly premium

Example at 32 yrs. old: $30,000 (gross salary)/12/100 x $.17 (32 year old rate) = $4.25 monthly premium

Rates and Benefi t Calculations:

CARRIER: Reliance Standard

20

CANCER INSURANCE BENEFIT PLANS

Transamerica Basic Cancer PlanInitial Diagnosis Benefit A $1,000 lump sum benefit

Wellness Benefit A $50 lump sum (each insured on the plan)

Inpatient/Outpatient Benefits $200 per day for 90 days, $400 for each day after

Radiation/Chemotherapy Benefits Up to $15,000 of actual incurred charges

New/Experimental Treatment Benefit Up to $15,000 per calendar year

Surgery Benefit Up to $3,000 in-patient, up to $4,500 for out-patient

Anesthesia for Surgery A 25% of covered surgery benefit

Bone Marrow Transplant Benefit Up to $15,000 of actual incurred charges

Prosthesis Benefit Up to $1,500 per device

Stem Cell Transplant Benefit Up to $15,000 of actual incurred charges

Transamerica Enhanced Cancer PlanInitial Diagnosis Benefit A $2,000 lump sum benefit

Wellness Benefit A $100 lump sum (each insured on the plan)

Inpatient/Outpatient Benefits $300 per day for 90 days, $600 for each day after

Radiation/Chemotherapy Benefits Up to $20,000 of actual incurred charges

New/Experimental Treatment Benefit Up to $20,000 per calendar year

Surgery Benefit Up to $2,000 in-patient, up to $3,000 for out-patient

Anesthesia for Surgery A 25% of covered surgery benefit

Bone Marrow Transplant Benefit Up to $20,000 of actual incurred charges

Prosthesis Benefit Up to $1,000 per device

Stem Cell Transplant Benefit Up to $20,000 of actual incurred charges

The Cancer Insurance Benefit Plan is offered to all IDEA Employees who would like peace of mind should they have a cancer diagnosis or treatment needed unexpectedly. There are two types of cancer plans:

PREMIUMS:

Coverage Tiers Monthly Premium (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Basic Plan

Employee Only $23.56 $11.78 $14.14

1 Parent Family $26.45 $13.23 $15.87

Family $42.29 $21.15 $25.37

Enhanced Plan

Employee Only $33.30 $16.65 $19.98

1 Parent Family $37.68 $18.84 $22.61

Family $60.06 $30.04 $36.04

CARRIER: Reliance Standard

IF YOU ARE A NEW EMPLOYEE THIS BENEFIT IS GUARANTEE ISSUE FOR YOU ONLY. YOU WILL BE SUBJECT TO A 12/12 PRE-EXISTING

CONDITIONS CLAUSE WHICH MEANS THAT ANY PRIOR CANCER DIAGNOSIS OR TREATMENT WITHIN THE PAST 12 MONTHS WILL BE

EXCLUDED THE FIRST 12 MONTHS OF THE POLICY. IN THE EVENT YOU ARE A CURRENT EMPLOYEE AND DO NOT HAVE THIS COVERAGE

THEN YOU WILL BE SUBJECT TO MEDICAL EVIDENCE, THE 12/12 PRE-EXISTING CLAUSE AND POSSIBLE DECLINATION.

21

Coverage Tiers Monthly Premium (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Employee Only $13.52 $6.76 $8.11

Employee / Spouse $19.85 $9.93 $11.91

Employee and Child(ren) $26.04 $13.02 $15.62

Family $32.32 $16.16 $19.39

ACCIDENT INSURANCE BENEFIT PLANThough most people do not like to think about it, accidents can happen at any place at any time and can be devastating. You could have an accident while driving to work, exercising, doing chores around the house, enjoying outdoor activities such as sports and hunting or just playing with your kids.

After an accident you may have expenses you’ve never thought about before. Can your finances handle them? It’s reassuring to know that an accident policy can be there for you through the many stages of recovery, from the initial emergency treatment or hospitalization, to follow up treatments or physical therapy.

Did you know?

• In 2007, more than 34 million people sought medical attention for an injury.* • In 2006, more than 42 million visits to hospital emergency departments were due to injuries.* • Falls are the leading cause of unintentional injuries that are treated in hospital emergency departments.*

*Injury Facts, 2010 Edition, National Safety Council.

The Accident Insurance Benefit Plan offered to IDEA Employees is a reassuring policy that can be there for you through the many stages of recovery, from the initial emergency treatment or hospitalization, to follow up treatments or physical therapy. This benefit plan is provided by Trustmark Solutions.

PREMIUMS:

Benefits:

What is Covered by Trustmark’s Accident Insurance Plan?

Accidental Death Benefit(with common carrier)

Up to $25,000 Employee BenefitUp to $10,000 Spouse

Up to $5,000 Child(ren) Benefit

Catastrophic Accident BenefitUp to $100,000 Employee Benefit

Up to $50,000 Spouse or Child(ren) Benefit

Health Screening Benefit Benefit of $50 for routine health screener tests

To get the full disclaimer of this benefit plan and summary details please visit the Hub.

CARRIER: Trustmark

22

CRITICAL ILLNESS BENEFIT PLAN

Allstate Critical Illness Plan BenefitsHeart Attack $10,000/$5,000

Stroke $10,000/$5,000

End Stage Renal Disease $10,000/$5,000

Quadriplegia Benefit $10,000/$5,000

Major Organ Transplant $10,000/$5,000

Bypass Surgery Benefit $10,000/$5,000

Balloon, Angioplasty, or Stent Benefit $10,000/$5,000

Although medical insurance and other insurance coverage’s you may have are essential, they won’t cover everything. Medical treatment has never been better, but it is expensive. People today can experience financial hardship because of the expenses their insurance plan does not cover. Critical illness insurance could be a strong supplement to other health insurances.

Did you know?

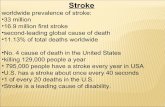

• 1 in 5 men suffer a critical illness before their normal retirement age.* • 1 in 6 women suffer a critical illness before their normal retirement age.* • The probability of surviving a critical illness before age 65 is almost twice as great as dying.* • Approximately 1.5 million Americans suffer a heart attack each year, of those 1.1 million will survive at least 3 years.* * Munich Reinsurance Co. 2000.

Monthly Premiums-Non-Tobacco Age: 18-35 36-50 51-60 61-63 63+

Employee $2.73 $6.93 $14.73 $24.53 $38.82

Employee/Spouse $3.55 $9.88 $21.58 $36.27 $57.72

Employee/Child $2.73 $6.93 $14.73 $24.53 $38.82

Family $3.55 $9.88 $21.58 $36.27 $57.72

Monthly Premiums-Tobacco Age: 18-35 36-50 51-60 61-63 63+

Employee $4.12 $11.61 $25.00 $38.61 $61.53

Employee/Spouse $5.68 $16.90 $37.01 $57.42 $91.78

Employee/Child $4.12 $11.61 $25.00 $38.61 $61.53

Family $5.68 $16.90 $37.01 $57.42 $91.78

PREMIUMS:

CARRIER: Allstate

Rates shown on table below, are monthly premiums if you are a 24 pay or 20 pay staff member, you will be deducted according to your pay frequency.

!Note: Critical Illness is guarantee issue for new employees however the employee will be subject to the pre-existing

condition clause. Current employees who did not participate do not receive the guarantee issue underwriting and

will have to answer medical questions being subject to the pre-existing clause and possible declination.

23

PREMIUMS:

UNIVERSAL LIFE INSURANCEWITH LONG TERM CAREMany people don’t think about Long Term Care (LTC) when they are young because they feel it won’t affect them until they are old. That’s not always the case. In fact, 40 percent of people currently receiving LTC are between the ages of 18 and 64.

Unfortunately, when people finally realize they need LTC, most don’t get coverage because they either can’t afford it or can’t qualify for it anymore, which is why it’s important to purchase it as early as possible — before the need occurs. Young, working adults qualify easily and have lower premiums. Inflation protection is also available, just like with traditional LTC policies. Benefit increases are automatic, guaranteed and fully portable for both employees and spouses.

People purchase life insurance for many reasons, like taking care of their family should something happen. But having the option to wrap in LTC coverage is invaluable.

How Does It Work?If the life insurance benefit amount is $100,000, LifeEvents advances 4 percent of that — or $4,000 a month — to help pay for care.

Some LTC policies limit benefits to a type of care or daily benefit. LifeEvents doesn’t. It pays benefits directly to the policy owner and enables a choice of care facilities: home care, assisted living, adult daycare and nursing home. If a policyholder never uses the money in the policy for LTC, it just goes backto the family as a death benefit.

Why It’s ValuableGuarantee Issue: As an employee you can elect up to $200,000 or $8.00 per week

Portability: It is 100% completely portable, regardless of job changes or retirement

Family Coverage: Coverage is available for spouses even if the employee does not participate

Benefit Restoration: Restores the death benefit that is reduced to pay for LTC

Extension of LTC: Extends LTC benefit an additional 25 months

Accidental Death: Doubles the death benefit if death occurs by accident

Child Coverage: Covers children, from newborn to 23 years old

EZ Value: Guaranteed automatic increases to Death Benefit and all Living Benefits

Living Benefits: Helps supplement the cost of home healthcare, assisted living, adult day

care and nursing home care

CARRIER: Trustmark

Age Monthly Premium (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Based on $50,000 life example

25 $16.81 $8.41 $10.09

35 $24.53 $12.27 $14.72

45 $47.15 $23.56 $28.29

55 $88.01 $44.01 $52.81

24

TOTAL LIFESTYLE ADVANTAGETotal Lifestyle Advantage Plan by Total Benefi ts Solution provides services that are essential for you and your family needs like Doctors by Phone, Safe Identity and Roadside Assistance, Vision Care, Chiropractic Care and SaversGuide. Learn more about these services below, and receive them all for only one monthly premium cost.

Doctors By PhoneDoctors by Phone services are available to you at home, work, or wherever you may be. Benefi ts include: • On-demand healthcare-wherever and whenever you need it • Access to a physician from anywhere via telephone or online, 24/7 • Physicians discuss symptoms, recommend treatment options, diagnose many common conditions, and prescribe medications when appropriate • Prescriptions phoned into your local pharmacy for pickup

Safe IdentitySafe Identity protects members from identity theft. A detection system scans thousands of databases to fi nd attempts to steal your ID. Members are told by phone if suspicious activity is found. Benefi ts include: • Creates a risk score from 0-999 that shows the likelihood of becoming a victim of identity theft. • Early detection and warning: scans billions of records to fi nd attempts to steal a member’s identity. • $1,000,000 coverage guarantee. • Child Protect- enhanced detection of whether your child’s social security number is being used

Roadside AssistanceRoadside Assistance is available 24/7/365. It helps members when owned or leased vehicles are disabled due to unavoidable circumstances. The following benefi ts are provided under the Roadside Assistance service: • Towing Assistance • Flat Tire Assistance • Lock-out Assistance • Fuel, Oil, Fluid and Water Delivery Service • Battery Assistance • Collision Assistance • Up to 15 miles towing per occurrence maximum for covered charges (up $80 retail value)

Vision Care • Coast to Coast Vision (CTC) has over 12,000 eye care locations nationwide. The CTC provider network includes ophthalmologists, optometrists, independent optical centers and national chain locations. • Discounts on prescription eyewear, contact lenses, soft contact lenses, frames, eye exams and LASIK Surgery. • No limit to the number of times you can use your card.

Chiropractic Care • Members save 30% to 50% at over 3,000 participating chiropractors nationwide. • Free initial consultation. • 50% off diagnostic services, 50% off X-rays performed on-site and 30% off treatment or other services. • No limit to the number of times you can use your card.

ServicesGuide®SaversGuide® is an interactive, online discount program that gives members access to over 235,000 discounts/locations from Entertainment’s® exclusive database of merchant offers. Members will be able to select relevant, high-value discounts by searching where they live, work, or travel.

Limit one service within 72 hours and fi ve services per year.To get the full disclaimer of this benefi t plan and summary details, please visit The Hub.

CARRIER: Total Benefi ts Solution

Coverage Tiers Monthly Premium (12 Pay) Biweekly Premium (24 pay) Biweekly Premium (20 pay)

Employee and Dependents $21.62 $10.81 $12.97

PREMIUMS:

25

EMPLOYEE ASSISTANCE PROGRAM

Life can be challenging. We’re constantly trying to balance our careers, families, leisure activities, health and wellness. It’s not easy…and every now and then we all can use a little help.

The Employee Assistance Program (EAP) is a professional counseling and referral service designed to help you with your personal, family and job issues. It’s free, voluntary and strictly confidential!

Your EAP can help with the following issues and concerns:

Emotional & Mental Health• Stress, Anxiety and Depression • Anger Management • Grief and Loss• Life Transitions • Illness and Disability

Family •Parent-Child Conflicts • Coping with Serious Illnesses • Elder Care Issues• Single Parenting • Child Care Issues

Relationships and Marriage• Separation and Divorce • Communication Problems • Conflict Resolution• Domestic Violence

Workplace• Reorganizations • Workplace Conflicts • Harassment• Team Building

Substance Abuse/Addictions• Alcohol and Drug Problems • Prescription Drug Misuse

Financial• Problem Gambling • Household Budgeting • Credit Counseling• Retirement Planning

Legal• Civil and Consumer Issues • Criminal Legal Issues

What to expect?An EAP counselor will: ü Help you assess the problem ü Provide short-term counseling, when appropriate ü Assist you in selecting a local resource, when necessary ü Provide supportive follow-up

CALL 1-800-767-5320Any time, 24 hours a day, 7 days a week!

26

403(B) RETIREMENT SAVINGS PLAN

The key to enjoying your retirement is to begin contributing to your retirement savings plan now and continue to contribute on a regular basis.

Your retirement years will be here before you know it and you want to enjoy them. You will be living longer and your needs will be greater than they are at present. The assets in your retirement savings plan are tax-sheltered; any income earned within the plan is not taxable until you withdraw the funds. Leaving the assets in the plan allows the funds to compound, meaning you earn interest on the interest. A 403(b) Retirement Savings Plan will do just that and all IDEA employees are elgibile to participate. JEM Resource Partners is IDEA’s third party administrator who will assist you.

Why contribute to a 403B Plan?Fill in the Gap: Your pension to TRS will likely not provide members with a full salary upon retirement. You need to make up this gap in salary by contributing to a separate retirement plan.

Lower your Taxes: Immediate savings on current taxes as well as tax deferred growth and earnings.

Ease of Savings: Once you have enrolled in your 403(b), the funds come directly out of your paycheck on a regular basis.

How much can I tax shelter per year?For 2015 the limits are $18,000 for age 49 or less and $24,000 for age 50 or over. There is no minimum amount you may contribute and you can choose to opt in and out at any time.

THE KEY TO A SUCCESSFUL RETIREMENT IS TO START EARLY!

CARRIER: JEM Resources Partners

27

BENEFITS FAQS1. Who is IDEA’s medical insurance carrier?

ü RGV Region: Aetna (PPO) & Allegian (HMO)

ü Austin Region: Aetna (PPO) & Scott & White (HMO)

ü San Antonio Region: Aetna (PPO)

2. Will I receive new cards for this plan year?If you are not making any changes to your plans, you will not receive a new card. If you are making changes, like adding dependents or changing plans, you will receive a new card for all plans.

3. I lost or have not received my medical ID cards after enrollment. Who do I call?

ü Aetna-You can log in online https://www.trsactivecareaetna.com/need-id-card/ and print out a temporary card or call 1-800-222-9205.

ü Allegian- You can call 1-800-829-6440

ü Scott & White-You can call 855-463-7264

4. I lost or have not received my HRA card after enrollment. Who do I call?Call Ameriflex at 888-868-3539 ext. 255 and they can help verify your address and request another card to be sent to you.

5. I lost or have not received my dental/vision ID cards after enrollment. Who do I call?You can register yourself at https://www.guardiananytime.com/gafd/wps/portal/fdhome and print out a paper copy as well as request a new card. IDEA Group# - 00487503.

6. Can I enroll in benefits at any time?No, IDEA Employees can only enroll in benefits if: a) They are a New Hire- within their 30 days of their start date or b) They have a Qualifying life event- birth of child, death, marriage, divorce, gain or loss of other coverage or court order. or c) Open Enrollment

7. If I am a new hire and I just enrolled, when do my benefits start?Your Choice between 2 options: 1) The first day of the month following start date 2) The actively-at-work start date

8. If I have the Flexible Spending Account (FSA) how will the HRA benefit me? And how will they work together?AmeriFlex administers both the FSA and the HRA for IDEA Public Schools through the convenience Debit Card provided after you enroll. If you are participating in the FSA and are eligible to receive the employer HRA contribution, funds for both accounts will be available on the same AmeriFlex Debit Card. When utilizing these funds, the FSA funds will pay first and the HRA will pay second.

28

BENEFITS COMMUNICATION & ENGAGEMENT RESOURCESTo stay educated and engaged on information pertaining to your benefits and how to use them to their fullest extent, IDEA’s Benefits Team will provide you with communication and resources during the school year such as:

Monthly Benefits NewslettersThese Newsletters are designed to keep you aware of health events around your local community, important benefit updates happening during the year and most importantly benefit plan utilization. It is emailed to all active IDEA Staff on a monthly basis and you may find archives of past newsletter at the HR site of The Hub. Main 3 topics are:

• Important Benefit Updates • Plan Utilization • Awareness Month

Annual Open Enrollment CampaignOn an annual basis during theend of July and August, all IDEA Staff are required to enroll or waive their benefit elections according to new rates, deductions and benefits offered. In order to keep IDEA educated on the important decisions to come during this time of year, we start a campaign full of educational resources 5 months ahead. It is important to be in the lookout for the following communication methods:

• Posters all over IDEA Campuses and Headquarters • Mailing (make sure you mailing address is always updated in Skyward) • Email Blasts • Benefits Presentations • Benefits Counselors available by appointment and during Summer Trainings for Auxiliary Staff. • Robocalls (calls made to your IDEA work phone) • Annual Benefits Guide printed delivered to your home and also available at The Hub.

The HubThe Hub’s HR Site - Benefits is available 24/7/365. It helps all IDEA Staff to have a one-stop place to navigate at their own time and look through the resources available to make the best out of your benefits plans. You may simply login to The Hub -> Team Sites -> Human Resources -> Employee Benefits. The following sub sites are just some of the most commonly visited and used:

• Insurance Cards – Provider Directory • Benefit Claim Forms • Benefit Coverage Summaries • FSA and HRA Eligible Expenses Lists

29

BENEFITS CONTACT INFORMATION

Beatrice ValenciaAssistant Director of Human Resources956-373-6844

Chelsi RodarteBenefits Counselor501-580-2127

Tonie Castaneda Benefits Analyst956-337-8000

• HR General Inquiries and Requests• Benefits Communication and Engagement Management • New Hire Process Management• Substitute Teacher Program Management

• Customer Service of Benefits Inquiries and Claims• 403B Administration • New Hires Benefits Enroller • Qualifying Events Inquiries and Entries.

• Workers Compensation Administration• Administrator of Reconciliations for all plans

Benefit Carrier Contact Information

Medical Plan TRS ActiveCare-Aetna800.222.2905 (customer service/claims)www.trsactivecareaetna.com (website)

HMO Medical Plan TRS ActiveCare-Scott and White800.321.7947 (customer service/claims)www.trs.swhp.org (website)

HMO Medical Plan TRS ActiveCare-Allegian800.829.6440 (customer service/claims)www.valleybaptisthealthplans.com (website)

HRA/FSA Administration AmeriFlex888.868.3539 (customer service/claims)www.flex125.com (website)

Dental and Vision Guardian212.598.8000 (customer service/claims)www.guardiananytime.com (website)

Voluntary Group Term LifeShort Term DisabilityLong Term Disability

Reliance Standard800.351.7500 (customer service/claims)www.reliancestandard.com (website)

Accident and Universal Life Trustmark800.918.8877 (customer service/claims)www.trustmarksolutions.com (website)

Critical Illness Allstate800.521.3535 (customer service)800.348.4489 (claims)www.allstate.com/mybenefits (website)

Cancer Plan Transamerica 888.763.7474 (customer service/claims)www.transamericaemployeebenefits.com (website)

Total Benefits Solution Lifestyle Advantage Program888.783.9653 (customer service/claims)www.tbsins.net (website)

Employee Assistant Program (EAP) Reliance Standard 800.767.5320 (24/7 counselors)

403(b) Retirement JEM Resource Partners800.943.9179 (customer service)www.region10rams.org (website)

Norma CruzBenefits Manager956-373-0780

• Benefits Inquiries, Compliance and Claims• HRA Administration • Benefits System Administrator• Workers Compensation and Reconciliations Management

30

New Health Insurance Marketplace Coverage Options and Your Health Coverage

PART A: General Information When key parts of the health care law take effect in 2014, there will be a new way to buy health insurance: the Health

Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic

information about the new Marketplace.

What is the Health Insurance Marketplace?

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The

Marketplace offers "one-stop shopping" to find and compare private health insurance options. You may also be eligible

for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance

coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014.

Can I Save Money on my Health Insurance Premiums in the Marketplace?

You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or

offers coverage that doesn't meet certain standards. The savings on your premium that you're eligible for depends on

your household income.

Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace?

Yes. If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible

for a tax credit through the Marketplace and may wish to enroll in your employer's health plan. However, you may be

eligible for a tax credit that lowers your monthly premium, or a reduction in certain cost-sharing if your employer does

not offer coverage to you at all or does not offer coverage that meets certain standards. If the cost of a plan from your

employer that would cover you (and not any other members of your family) is more than 9.5% of your household

income for the year, or if the coverage your employer provides does not meet the "minimum value" standard set by the

Affordable Care Act, you may be eligible for a tax credit.1

Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your

employer, then you may lose the employer contribution (if any) to the employer-offered coverage. Also, this employer

contribution -as well as your employee contribution to employer-offered coverage- is often excluded from income for

Federal and State income tax purposes. Your payments for coverage through the Marketplace are made on an after-

tax basis.

How Can I Get More Information?

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the

Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health

insurance coverage and contact information for a Health Insurance Marketplace in your area.

1 An employer-sponsored health plan meets the "minimum value standard" if the plan's share of the total allowed benefit costs covered

by the plan is no less than 60 percent of such costs.

Form Approved OMB No. 1210-0149 (expires 1-31-2017)

31

GLOSSARY OF BENEFIT TERMSBenefit CarrierA benefit carrier is the agency responsible for administrating your plan. Example Aetna or Allegian are medical plan carriers. Guardian is the visions

and dental plan carrier.

Co-InsuranceThe amount the insurance company covers after deductible is reached.

Co-PayThe amount the Employee will pay for a standard or regular doctor consultation.

DeductibleThe amount an Employee pays before your co-insurance takes place.

High Deductible vs. Traditional PlansHigh Deductible Health Plans (HDHP) are attractive due to the cost vs. the more traditional plan which comes with co-pays. When comparing the

two understand the HDHP program is really designed for those who are not heavy consumers because everything is subject to the deductible

in which correlates into lower premiums. The more traditional plan comes with typically a lower deductible, co-pays, but a higher premium.

The traditional route is for someone who tends to utilize the plan more frequent or is fearful of paying the actual cost of care. Please take into

consideration the premium savings vs. the out-of-pocket exposure you might have when choosing each plans.

HMO vs. PPO (Open Access Network)Health Maintenance Organizations commonly referred to as HMO are considered network steerage programs meaning that you must see only the

providers that are listed within the HMO network. An HMO tends to have slightly richer benefits at a comparable rate vs. an Open Access Network

Plan. Open Access Network allows an individual to see a doctor of choice but rewards those with deeper discounts by seeing a preferred provider.

If your providers are in the HMO network or you don’t mind having a limited list of providers then think about the HMO route. If you like the freedom

to see whom you wish, then think about going the Open Access Network route.

Preventative CarePreventative Care services are those services that are provided within a plan’s network that are regulated by Health Care Reform prohibiting any

cost-sharing such as co-pays or co-insurances. These services are at no-cost to you so long as you follow specific guidelines provided by your

medical plan.

Qualifying Life EventA change in your life that can can make you eligible for a special enrollment period to enroll in health coverage. Examples of qualifying life events

include birth or adoption of a child, lost or gain of coverage, marriage, divorce, etc.

TRS Active CarePPO (Preferred Provider Organization) health insurance plans offered through TRS.

TRS – Teacher Retirement SystemTRS is a public pension plan of the State of Texas. Established in 1937, TRS provides retirement and related benefits for those employed by the

public schools, colleges, and universities supported by the State of Texas.

True Out-Of-Pocket Cost (TROOP)True Out-Of-Pocket Cost is just that, your actual total out-of-pocket cost. HealthCare Reform has brought on many changes and TROOP is one of

them. TRS ActiveCare has complied with the ACA guidelines and all plans are now subject to TROOP. This means is that your deductible and co-

pays are included into to the total amount you spend on healthcare, period.

Benefit Guide Disclosure Notice

Please note, this guide is for illustration purposes only. Regions Insurance Group and its affiliates recommend that you review your contract in detail

and any carrier illustration information made available to you via The Hub and IDEA Enroll. Any illustration in this guide is designed to provide you

with a brief summary of the plan and not take place of the carrier contract or benefits illustration. Please contact IDEA’s Benefits Team if you

have any questions.