2013 CO-OP Annual Report

-

Upload

co-op-financial-services -

Category

Documents

-

view

219 -

download

0

description

Transcript of 2013 CO-OP Annual Report

2 0 1 3

Message from Chairman and President/CEO 3

Year in Review 6

The Evolution is Now 8

THINK 14

CO-OP Miracle Match 15

Financials* Available via Extranet

* Note to readers: Financial Consolidated Statements are available in the version of this report that CO-OP member institutions may download by visiting www.co-opfs.org. Click on the “Login” menu at the extreme top right-hand corner of the home page and click on “Extranet.” After logging in, click on “Library,” then “Annual Report” and “2013 Annual Report (PDF).”

3

EVOLVE

Capitalizing on a Good Year, a Sound Strategic Plan

The year 2013 was a good one for the credit union system, with membership, loans and earnings all up in aggregate for the industry.

At CO-OP Financial Services we had record revenue and earnings, and we remained by far the nation’s largest credit union service organization in terms of clients and members served, according to Callahan & Associates. Perhaps even more importantly we had:

• Zero unscheduled or scheduled downtimes on our EFT switches for the second year in a row.

• In partnership with The Members Group (TMG), two top 10 credit union credit card-issuing wins along with many others.

• A record 2.8 billion transactions processed.

• 8.7+ customer satisfaction ratings in all of our businesses.

These and other 2013 accomplishments (see Year in Review) allowed us to again return a strong patronage to our nearly 1,200 shareholding institutions. We were able to capitalize on a good year, but we also capitalized on a sound strategic plan that focused on making sure that the investments and acquisitions of 2011-12 (FSCC, eCom and TMG) contributed in 2013 to a bright future for the credit union movement.

Evolution is Inevitable

At CUNA’s Governmental Affairs Conference (GAC) in February 2014, CO-OP used its space on the trade show floor to stage a true exhibit. We presented the history of payments in a display entitled “Evolution is Inevitable.” Through words and images we documented that the means of making payments has changed constantly throughout human history, driven by two key needs — safe access and convenience.

These are the very two needs that CO-OP, through its three principal business lines, is dedicated to meeting for our client credit unions and their members.

Meeting these needs calls for a continually evolving strategic plan. Building on our success in 2013, we are focusing on six key objectives moving forward.

4

BE THERE. BE MORE.Evolve network strategy with external developments in payment systems. Among these developments is the emerging EMV standard. Since the Target breach, both financial institutions and merchants are demanding the issues around EMV be resolved. CO-OP has been anticipating this and we have both the card issuer and ATM side of EMV in production.

Maximize return on investment from our mergers and acquisitions, and product development. Since November 2009, CO-OP has acquired CO-OP Member Center, SHARE SYSTEM (providing ATM and debit card program support), FSCC and eCom, and made strategic investments in TMG, Finivation and Alkami. These acquisitions and relationships have allowed us to be a comprehensive financial technology provider for credit unions.

Serve as an innovation partner to credit unions. During 2014, CO-OP will be rolling out or enhancing a wide variety of products in emerging technologies, including CardNav by CO-OP, our mobile card controls and alerts application; Sprig by CO-OP, our digital wallet; innovations in ATMs such as NextGen ATM by CO-OP; and branch transformation initiatives enabling greater self-service and in-branch help through CO-OP Member Center.

Fully realize the benefits of our investments in Finivation and Alkami. Among the most significant developments for CO-OP in 2013 and entering 2014 were our investments in Finivation and Alkami. Finivation’s primary role in CO-OP product development will be to maximize efficient connectivity to support emerging product lines and to build highly adaptive applications to serve our clients. CO-OP and Alkami are bundling CO-OP Bill Pay with the Alkami ORB Platform, enabling credit unions to offer members a fully-integrated online and mobile banking bill payment solution.

Build on our success in credit. CO-OP entered the “in-house” credit card processing business in December 2010, and “full-service” processing through our partnership with TMG in January 2012. Our TMG partnership led to significant contract wins in the past 12 months, in addition to in-house credit successes. We have been able to offer credit union transaction processing integration that allows full-service credit union clients of both CO-OP and TMG to have a single point of access to credit and debit reports, and a single view into credit and debit programs.

5

BE THERE. BE MORE.Promote the brand — and the industry. In 2013 we took the step of rebranding the two best-known consumer services in the credit union industry, our nationwide network of 30,000 ATMs and 5,000 shared branches, including more than 2,000 self-service locations. CO-OP ATM and CO-OP Shared Branch enable credit unions to present these key services side-by-side with brand consistency and clear communication of benefit. In 2014 CO-OP-branded mobile/virtual products (CardNav, Sprig) will be unveiled and enhanced. We will also continue to promote the credit union movement through our THINK and CO-OP Miracle Match programs (see separate articles) as well as support the industry system as a whole.

Whatever the Challenge, Be There. Be More

What do all of these six strategic objectives add up to for credit unions? We answer this in

detail on pages 8-13, but it boils down to five things. CO-OP exists to help your credit union be:

• Resilient in a rapidly changing regulatory environment.

• Operationally sound and strong.

• Capable of sustained growth.

• Relevant in an intensively competitive field.

• A source of an enhanced member experience, every time.

CO-OP makes sure that you are providing your members with safe access and convenient

means for transacting payments. But we also help you move beyond that to something greater

as a primary financial institution. You can Be There. Be More for your members.

Thank you for your partnership and business.

Stanley C. Hollen President/CEO

Terry Laudick Chairman of the Board

6

In April CO-OP Financial Services announced the rebranding of its shared branching and ATM networks.

March

May

April

2014

In April CO-OP Financial Services announced the rebranding of its shared branching and ATM networks.

February

March

May

August

December

January

February

April

2013The Members Group (TMG) and CO-OP Financial Services announce the companies will offer their members MasterPass, a digital service introduced by MasterCard.

The number of credit union “live teller” branch locations available through the nationwide CO-OP Shared Branching network reached 5,000, just over three years after reaching 4,000 in February 2010.

CO-OP announces a patronage (shareholder dividend) pool of $25.9 million for fiscal year 2012, a 73 percent increase in patronage compared to the 2011 figure of $15.0 million. This brings the total shareholder patronage amount for CO-OP to $254.2 million since becoming a credit union-owned cooperative in 1996.

CO-OP announces that CU Service Centers and its “swirl” logo and signage at participating credit unions will be replaced by CO-OP Shared Branch in a multi-year rebranding process. Migration to the new logo will be done in a phased approach for the benefit of current shared branch users, as well as participating credit unions and state networks. CO-OP Network is also being rebranded to CO-OP ATM.

Chuck Purvis, President/CEO of Coastal FCU, Raleigh, N.C., is elected to a three-year term on the Board of Directors of CO-OP.

CO-OP becomes a minority owner of Finivation, strengthening an existing technical partnership for Web and mobile application development and the related middleware to efficiently connect hosts and acquirers for emerging CO-OP products.

In recognition of her commitment to the credit union philosophy, the National Credit Union Foundation (NCUF) announces that Sarah Canepa Bang of CO-OP Shared Branching is the winner of the 2014 Herb Wegner Memorial Award for Individual Achievement.

Sprig by CO-OP, introduced in January specifically for credit union members, is upgraded to enable out-of-network, pay-anyone payments.

CO-OP announced a new annual record, processing 2.8 billion electronic funds transfer (EFT) and shared branch transactions by credit union members in 2013, an increase of 10 percent compared to 2012. The annual record was augmented by a new single day record of more than 9 million transactions recorded on December 21.

CO-OP and Alkami Technology, Inc., announced their partnership to bundle CO-OP Bill Pay with the Alkami ORB Platform, enabling credit unions to offer members a fully-integrated online and mobile banking bill payment solution. CO-OP is also making a strategic investment in Alkami as part of its program of maximizing efficient connectivity to emerging product lines and building highly adaptive applications that serve CO-OP’s credit unions and their members.

7

RESILIENCY

Let the evolution begin 8

A New Year of Change and Opportunity

But this isn’t change for the sake of change. We’re evolving. And within that evolution is a series of driving forces that shape our purpose. Following are five themes we’ve identified as critical to the growth and evolution of credit unions — and, in turn, to our own growth and evolution. Though each theme represents a specific challenge, each one also entails new opportunities.

Evolution is inevitable.

On every front and at every level, this is the era of change. We are expanding and diversifying our products and services, to deliver more effectively on our core offerings and turn up the volume on innovations. We’re fine tuning our systems, so you have access to the features and the data you need — and so you have the capacity to grow. We’re thinking strategically. We’re looking toward the future. We’re wearing our running shoes.

As we embark on a new year of extraordinary change and opportunity at CO-OP Financial Services, this is what we say and how we are living:

RESILIENCYA New Year of Change and Opportunity

9

Regulatory Resilience

Rise to the Regulatory Challenge

Solutions from CO-OP such as the ones below help you operate more efficiently, so you can deal with an increasingly cumbersome regulatory environment, and find new revenue streams, to offset potential income loss due to new regulations.

• CO-OP ATM• Debit and Credit Processing• CO-OP Shared Branch• Sprig by CO-OP• NextGen ATM by CO-OP• CardNav by CO-OP• Mobile Banking• CO-OP Revelation

Adaptation Is the Advantage

While credit unions aren’t new to the notion of regulatory changes, the past few years have seen many challenges. Credit unions have navigated rough seas in relationship to everything from interchange income to tax exemption, from the emergence of the Consumer Finance Protection Bureau to the debate over business lending caps.

What have we learned?

Change is inevitable — and so is the need to adapt. In fact, adaptability has become a leading advantage for credit unions looking to cultivate regulatory resilience. Though no one can predict exactly what future changes in the regulatory environment will require, certain advantages suggest a sure edge:

• Maximizing and growing transaction volume.• Seeking diversity in sources of both income

and growth.• Creating efficient systems for reporting

and analysis.• Promoting flexibility.• Uncovering opportunity in the face of

regulatory changes.

Without question, the future belongs to financial institutions that can surf the regulatory tides. CO-OP is here to help. With the nation’s largest credit union ATM network, industry-leading debit and credit processing solutions, CO-OP Shared Branch and its mobile counterpart, Sprig by CO-OP — along with a growing complement of user-friendly products and solutions — CO-OP drives transaction volume as no other credit union service organization can.

Our data analysis and reporting help credit unions divine smart strategies to create new revenue and growth. Our wide-ranging solutions enable our members to stay ahead of the pitfalls and opportunities that changing regulation can create. Where one door closes, others inevitably open. CO-OP’s driving mission is to uncover these emerging opportunities, and to provide the tools credit unions need in order to capitalize on them.

Our complex regulatory environment is here to stay. Finding the right systems and tools — and, equally, the right partners — to thrive within that environment is a key challenge. As we enter a new year of innovation and growth, we look forward to meeting that challenge.

10

GROWTH

STRENGTH

Operational Strength

Compound Your Operations

CO-OP solutions such as these compound your existing operational assets by reducing resource strain, streamlining product integration and saving on personnel expenses.

• CO-OP Member Center• CO-OP Connect • Full-Service Credit Processing• In-House Processing (ATM, Debit, Credit)• CO-OP ATM Managed Services

Survival of the Fittest

Here again, evolutionary advantage goes hand in hand with complexity. Credit union operations have become more intricate and sophisticated. Yet, never has operational strength been more imperative.

Thus, we find the tension between complexity and simplicity.

On the one side lies complexity, the straight volume and variety of systems, tools, procedures, resources, personnel, equipment, gadgets, suppliers and partners required to do a day’s business. If you’re hoping to grow or improve, expect your diversity quotient to explode.

On the other hand is simplicity. Focus. The singularity that enables strength. When you’re stretched, you aren’t operationally strong — and that’s a huge evolutionary disadvantage.

CO-OP’s business begins and ends at the intersection of complexity and simplicity. Our business lines are devised to bring innovation and cooperative strength to our members. That means giving you access to the complicated world of new technology, a kaleidoscopic array of channels, the strategy and insights you need to see your way forward with confidence.

It also means lifting the operational burdens of fast innovation, rapid expansion and change. So not only can you offer your members 24/7 call center access and the debit, credit and ATM services they require, but you can do so without sacrificing your operational focus.

Possibilities are endless. Resources are not. The solutions you need in these changing times don’t make these truths into opposing forces, but rather combine them into a single formula for success.

GROWTH

11

Growth and Sustainability

Opportunity Catchers

Solutions from CO-OP lead to credit union growth by opening new channels to member products and enables you to offer the latest technology, contributing to an enhanced member experience.

• CO-OP ATM Network• CO-OP Bill Pay• CO-OP Member Center• Check Imaging at the ATM• Signature and PIN Debit• In-House and Full-Service Credit• CO-OP Mobile• CO-OP My Deposit Mobile• NextGen ATM by CO-OP• CO-OP Shared Branch• Sprig by CO-OP• CO-OP Connect

The Evolving Door of Opportunity

Opportunity has arrived. According to a March 2014 economic forecast by CUNA, credit union loan growth is estimated at 7.5 percent for 2014 and 8 percent for 2015. Consumer spending and borrowing are on the rise — as is the quality of credit. Add in a consumer population that is still disenchanted with banks and the potential for growth is clear at last.

But in order to realize that potential, credit unions need the tools to attract and engage new members. That means omnichannel access to meet member expectations, insightful data gathering and analytics to pinpoint opportunity and shape strategy, continual technology upgrades to keep up with a rapidly evolving marketplace, and more. Although credit unions have already seen a booming demand for mobility and transactional technology, that demand is only expected to increase. And though marketing outward — with an eye toward new membership — makes good business sense, consumer expectations have never been higher.

How can credit unions capture the opportunity that’s out there without exceeding their capacity and resources?

CO-OP’s commitment to growth and innovation has increased its value to members exponentially. Our core solutions are stronger than ever. CO-OP ATM leads the movement with the largest surcharge-free network available to credit unions and ATM innova-tions that make the self-service experience more productive, faster and better for credit unions and their members alike. CO-OP Shared Branch enables our members to connect to a growing nationwide network of locations unique to the credit union movement — and then to leverage that connection to provide cost-effective mobile banking and payment solutions via Sprig by CO-OP.

CO-OP innovates, with products ranging from NextGen ATM by CO-OP to CO-OP Bill Pay, now available bundled with the Alkami ORB Platform for a fully-integrated online and mobile banking bill payment solution. Each product is designed to elevate the member experience, and the credit union experience as well. Because — forgive the pun — as opportunity becomes a bit of an “evolving” door, credit unions must move fast and keep moving with direction and speed. Now that it’s arrived, opportunity is not to be wasted.

12EXPERIENCE

RELEVANCYDifferentiators in the New Wild West

We offer a differentiated product set for a differentiated member experience, to differentiate you from your competitors.

• CardNav by CO-OP• Sprig by CO-OP• Merchant-Funded Rewards• NextGen ATM by CO-OP• CO-OP Shared Branch• CO-OP Member Center• CO-OP Connect

Competitive Relevance

It’s a Darwin Thing

Following fast on the heels of opportunity is competition. Not only do credit unions face their usual rivals — big banks, community banks and other credit unions — but new players also vie for consumer loyalty. Among financial institutions, online banks serve up a new brand of electronic service. And in the payments space, retailers, electronic payments companies and all kinds of innovators are creating the equivalent of the wild west.

How do credit unions compete and win? Differentiate. Differentiate. Differentiate.

Beyond CO-OP’s precedent-setting ATM and shared branch networks are unique products that set your credit union — and your brand — apart from the pack. To be launched in 2014: CardNav by CO-OP, which brings mobile remote control technology to your members’ card accounts. Using your branded iPhone or Android app, members can turn their card accounts on and off, set spending and usage limits, receive fraud and account alerts and more. CardNav by CO-OP is engaging and different, placing your credit union ahead of the competition in both timeliness and function.

Are you worried about payments innovations disrupting your business? Starting soon, credit unions can provide their members with pay-anyone P2P using Sprig by CO-OP. Best of all: Sprig by CO-OP is available to participating credit unions of CO-OP Shared Branch at no additional cost.

Even with the furious pace of innovation CO-OP has undertaken in recent years, we have never lost sight of our purpose. We serve credit unions. As such, we are keenly aware that innovations credit unions can’t afford or implement don’t serve credit unions at all.

CO-OP’s ongoing mission is to provide current products and services that differentiate our member credit unions from their competition. But it’s not just access to cool products that sets us apart competitively. We’re innovating for the future, so that the systems and relationships you develop now evolve seamlessly with a changing market. Your partnership with CO-OP positions you for competitive relevance today and for a world of potential in the future.

13EXPERIENCE

Evolving Your Member Experience

Services like CO-OP Revelation and Member Marketing provides visibility into member behavior, while many other CO-OP services provide a truly enhanced member experience.

• CO-OP Revelation• Member Marketing• Digital/Virtual Sprig by CO-OP CardNav by CO-OP• NextGen ATM by CO-OP• CO-OP Member Center

Enhanced Member Experience

Transcending the Transaction

Imagine that you’re on a quest to find the perfect chair. You launch a Google search on your home computer. You visit home decorating websites, create a Pinterest board, read social media reviews and compare pricing. You bring a tablet to the store, so you can check inventory against your online options. You receive special offers in-store on your tablet. You pay for your purchase with the mobile version of PayPal and avoid standing in the checkout line.

Are you a time traveler? Is this nirvana?

In fact, you are having what is fast becoming an ordinary consumer experience. Right now, your members’ expectations are changing — drastically and at a blinding speed.

Members expect more — from retailers, financial institutions and life. With a full appreciation for the immensity of this challenge, CO-OP sees several necessities in store for credit unions that hope to join the evolution:

• Change the channel — the omnichannel experience is upon us and credit unions must gear up to compete.

• Improve efficiencies — invest now in systems that will free up the resources and capacity you need to continuously expand.

• Gain insight — not only do members expect you to gather data, but they also want you to use data-based insights to maintain their security, deliver customized products and services and strategize for the future.

CO-OP delivers the products and services you need to meet and exceed member expectations. Our rapidly-evolving mobile and online technology blows the doors off of your existing channels. Our solutions are built with an eye toward both current and future integration. And our CO-OP Revelation data analytics tool not only shows you the numbers, but also helps you visualize trends, zero in on opportunities, stop fraud in its tracks, and create the promotions and products your members actually want.

What we’re seeing in member experience mirrors the larger universe in which credit unions now must live. This is an intricate world, in which technology and intelligence are apparent but not intrusive, innovations are revelatory without being frustrating, and the interface between credit unions and their members is evolving — empowered, genuine, multilayered, dynamic.

These are exciting times indeed. Welcome to the evolution.

129231_CF_14_23_2013 AR_5_2_14_r05_CX.indd 15 5/9/14 12:37 PM

THINK is an innovation content platform inspiring the evolution of the credit union movement.

THINK is the future for credit unions. It’s not just a renowned conference, an app, a prize or a website. THINK is a year-round platform for collaborative power, generating the impetus for credit unions to provide today’s member with a superior financial services experience. Contributors include some of the best known thought-leaders in the world, key leaders of the credit union movement and, perhaps most important of all, the members we seek to serve better.

Visit co-opthink.org regularly for new thought leadership content.

Daria Musk, Google+ Music Star.

Robert Baron of Technicolor Federal Credit Union, Burbank, Calif., was the winner of the CO-OP THINK Prize 13.

Daymond John, Shark Tank Star/FUBU Founder.

13

THINK

14

“ The more creative you are, the more you desperately want to escape the doldrums that accompany the development process and come up with a new idea.” — Scott Belsky, Startup Guru/Realist

MIRACLE MATCH

15

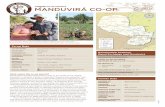

174 Events matched

Miracle Match by CO-OP multiplies the power of credit unions

to help hospitalized children in their local communities.

Together we raised

$3,020,830

98 Hospitals

benefitted in 34 states

154 Participating Credit Unions

67 First time

Credit Union participants

$3 Million Raised in 2013

More Than $3 Million Raised For CMN Hospitals In 2013 Through CO-OP Miracle Match

More than 150 credit unions participating in CO-OP Miracle Match in 2013 raised $3 million for Children’s Miracle Network Hospitals, $1 million of which was matching funds provided under the CO-OP Financial Services program.

CO-OP established CO-OP Miracle Match on behalf of its member credit unions in 2008 as a way to encourage Credit Unions for Kids fundraisers. This marks the third year in a row that the combined totals of CO-OP and participating credit unions surpassed the $3 million mark in donations.

In addition to the $1 million CO-OP Miracle Match program, CO-OP made donations totaling $164,500 to CMN Hospitals in 2013. These donations were made through event sponsorships, such as credit union-hosted golf tournaments, and at the THINK conference, held in Chicago, Ill.

Charitable Contributions at the ATM

In December 2013, CO-OP also announced that it is teaming up with Credit Unions for Kids to introduce a new way to help CMN Hospitals. Credit union members can now opt for an add-on transaction that will allow them to make a charitable contribution when they visit their CO-OP ATM.

In this new program, credit union debit cardholders may contribute to CMN Hospitals while they conduct their business at participating CO-OP ATM locations.

All ATMs directly “driven” (controlled) by CO-OP for its clients are eligible for this feature. Credit unions interested in taking advantage of this opportunity can begin their participation by opening a work order through the client-only Extranet area of CO-OP’s website at co-opfs.org.

For more information on CO-OP Miracle Match, visit co-opfs.org/miracle-match.

129231_CF_14_23_2013 AR_5_2_14_r05_CX.indd 17 5/9/14 12:38 PM

CO-OPFS.ORG

CO-OP Financial Services | 9692 Haven Avenue | Rancho Cucamonga, CA 91730